For the longest time, India’s pharmaceutical sector has been a steady friend investors could count on. Dependable, low-risk, and always delivering. With inelastic demand, a strong manufacturing backbone, and tough regulations keeping things in check, the industry has enjoyed a reputation for stability.

But things may be changing. Trump’s “Liberation Day” tariffs have already disrupted global trade, and India is clearly in his line of fire. After slapping a 50% tariff on Indian goods, the U.S. is now looking at drug imports, a move that matters hugely for India’s pharma industry, where the American market plays a central role.

In times like these, it’s natural for investors to feel on edge. That’s why this is the moment to step back, cut through the noise, and examine the macroeconomic fundamentals, which is exactly what we’ll do in this blog.

Sector Overview

India is known as the “Pharmacy of the World” and rightly so. By volume, we are the third-largest producer of pharmaceuticals, and by value, we rank 13th globally. This reflects India’s focus on high-volume, low-cost generic drugs, rather than expensive patented medicines.

As the fifth-largest contributor to manufacturing GVA, the sector not only draws in 4% of the country’s total FDI, but also powers a healthy $19 billion trade surplus and supports 2.7 million livelihoods, either directly or indirectly.

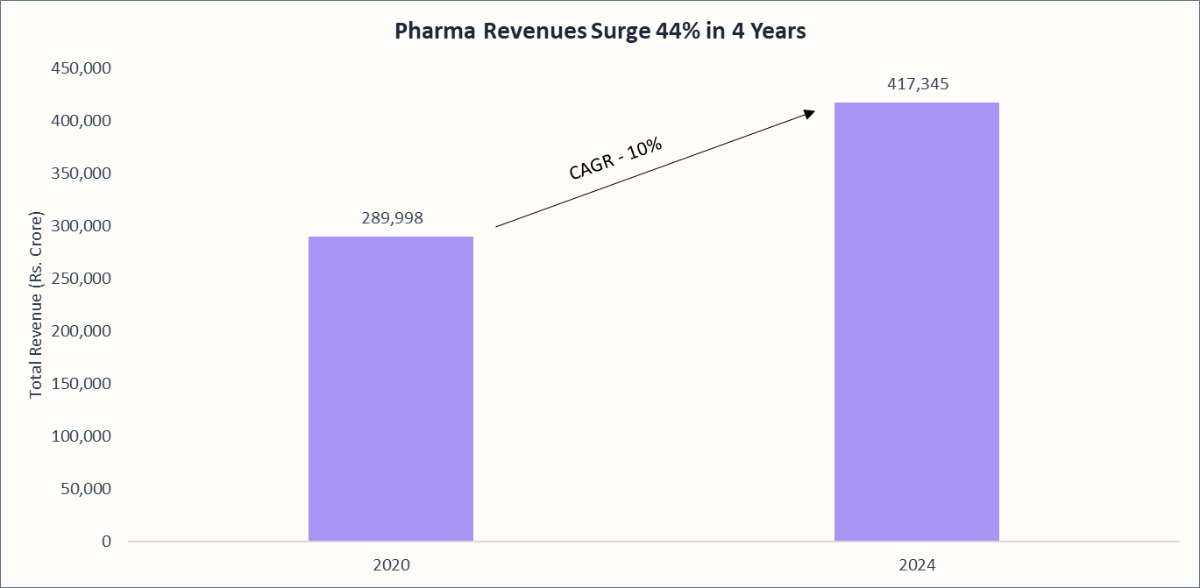

Since the pandemic, the pharma sector has consistently grown by a 10% CAGR in revenues, driven by robust domestic demand, expanding exports, and increasing global reliance on India as a supplier of affordable generics and vaccines.

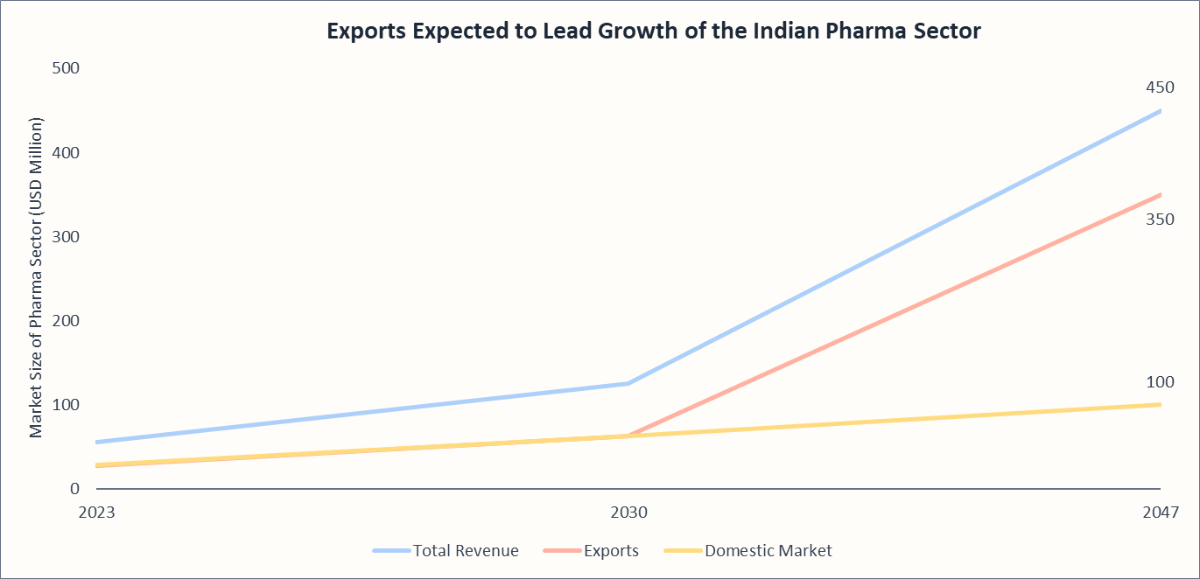

According to Bain & Company, India’s pharmaceutical sector could be about eight times larger by 2047, with exports driving most of the growth. And it won’t just be more low-cost generics—momentum will also come from specialty generics, APIs (active pharmaceutical ingredients), biosimilars, vaccines, and outsourced services via CDMOs (contract development & manufacturing) and CROs (contract research).

Recommended for you

Readers also explored

India's IT Sector Outlook for FY2026

Nifty 50 Companies List 2025 : Top 50 Stocks in India

Pharma Value Chain

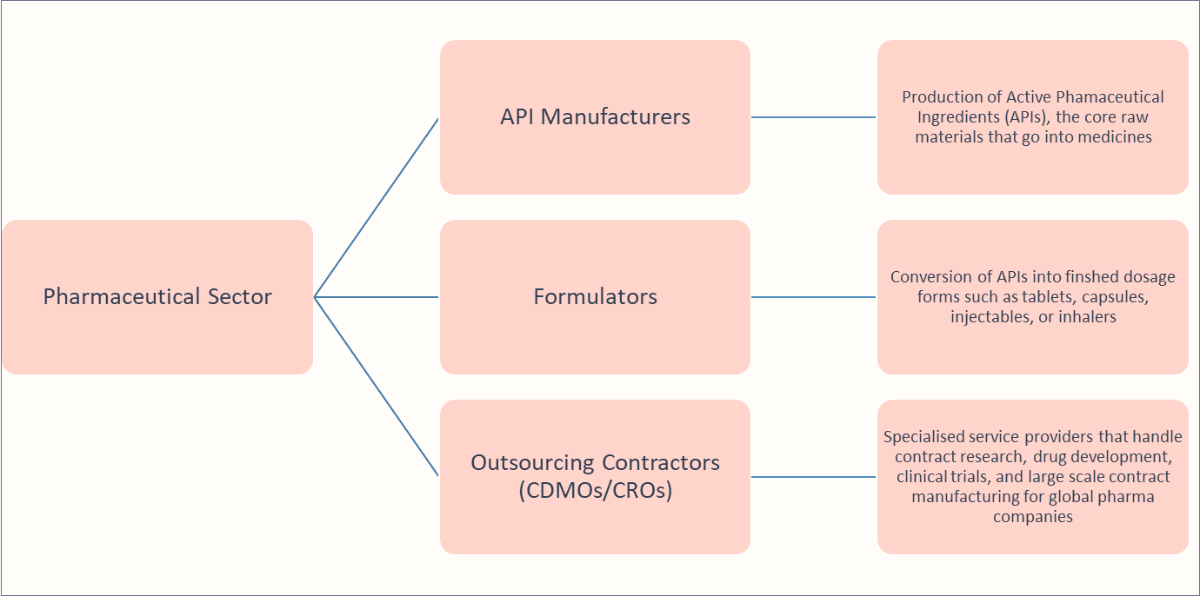

One of the most important aspects of understanding the pharmaceutical sector is its value chain. At a high level, it resembles other manufacturing industries, which procure raw materials, process them, and deliver finished products. But pharma is more complex, with layers of regulation, specialised science, and highly fragmented players.

Broadly, the value chain can be broken into three distinct processes; you can also think of these as three sub-sectors. Very few companies operate across all three:

Financial Performance of Nifty Pharma Companies

| Name | NIFTY Pharma Weightage | P/E | P/B | Sales Growth 10 Years % | Profit Growth 10 Years % | ROE % |

|---|---|---|---|---|---|---|

| API Manufacturing | 15.0% | 57.2 | 7.4 | 12.8 | 14.4 | 12.4 |

| Divi's Laboratories | 9.4% | 69.2 | 10.7 | 11.6 | 9.8 | 15.4 |

| Laurus Labs | 2.9% | 95.6 | 10.9 | 15.4 | 16.7 | 7.5 |

| Ipca Laboratories | 2.0% | 37.4 | 4.8 | 11 | 13 | 12.8 |

| Granules India | 0.7% | 26.6 | 3.4 | 13.3 | 18.1 | 13.9 |

| Outsourcing Contractors | 4.7% | 87.9 | 2.7 | 16.7 | 3.5 | 6.3 |

| Biocon | 2.9% | 134.7 | 2 | 17.3 | 9.1 | 4.8 |

| Gland Pharma* | 1.9% | 41.1 | 3.5 | 16 | -2 | 7.8 |

| Formulations | 80.3% | 32.8 | 4.7 | 8 | 12.9 | 17.3 |

| Sun Pharmaceutical Industries | 22.5% | 33.4 | 5.3 | 6.7 | 9.6 | 16.9 |

| Cipla | 7.4% | 23.3 | 4 | 9.3 | 16.2 | 17.8 |

| Torrent Pharmaceuticals | 7.2% | 61 | 16.2 | 9.5 | 10 | 26.5 |

| Dr Reddy's Laboratories | 6.4% | 19 | 3.2 | 8.1 | 9.3 | 18 |

| Mankind Pharma | 6.3% | 56.6 | 7.5 | 13.9 | 14.8 | 14.7 |

| Zydus Lifesciences | 6.1% | 22.4 | 4.4 | 10.4 | 14.9 | 21.2 |

| Lupin | 5.3% | 24.3 | 5.2 | 5.9 | 3 | 20.6 |

| Abbott India | 3.8% | 44.8 | 15.4 | 10.8 | 20 | 35.7 |

| Alkem Laboratories | 3.8% | 28.1 | 5.3 | 13.4 | 19.5 | 19.4 |

| Aurobindo Pharma | 3.6% | 18 | 1.9 | 10.1 | 8.1 | 11.1 |

| Glenmark Pharmaceuticals | 3.5% | 44.7 | 6.7 | 7.3 | 17.5 | 15.8 |

| Ajanta Pharma | 1.9% | 34.6 | 8.5 | 12.2 | 11.3 | 24.9 |

| J B Chemicals & Pharmaceuticals | 1.6% | 39.6 | 7.9 | 13.1 | 21.1 | 20.1 |

| Natco Pharma | 0.9% | 8.9 | 2 | 18.3 | 29.2 | 28 |

*Data for Gland Pharma Ltd is for 5 years

- Sales Growth Driven by Exports:

On the sales front, Nifty Pharma has delivered an impressive performance. Over the last decade, most companies have recorded double-digit revenue growth, reflecting the sector’s strong demand base and robust supply side. Much of this momentum has come from exports, which have grown at an 11% CAGR, with the U.S. market standing out at an even stronger 13% CAGR. This highlights how India’s role as the world’s low-cost generic hub has anchored the sector’s growth story. - Valuations Split Between APIs and Formulations:

The pharma sector’s defensive nature and steady growth in revenues have made it one of the more expensive spaces in the market. With an industry P/E of 33.4, among the highest across sectors, it clearly carries the safe-haven appeal. Within the industry, a few patterns stand out: API manufacturers trade at a premium, supported by the China+1 supply chain shift, while formulation companies are priced closer to the sector average, offering relatively more attractive entry points for investors. - Profitability Anchored in Formulations:

On profitability, the sector shows healthy but uneven performance. Over the last decade, most pharma names have delivered a 12–15% profit with an average 17% ROE, though the spread is wide.- Formulation companies lead the way, consistently converting scale into stronger margins and shareholder returns.

- API makers, while posting faster sales growth, settle for lower profitability.

- Outsourcing contractors, despite strong sales traction, show weaker profit growth and muted ROEs, a result of their business model, where long-term contracts ensure steady revenues but limit pricing power, keeping margins thin and sensitive to utilisation.

Macroeconomic Factors Impacting the Pharmaceutical Industry

🟢Export Growth Steady Despite Tariff Threats:

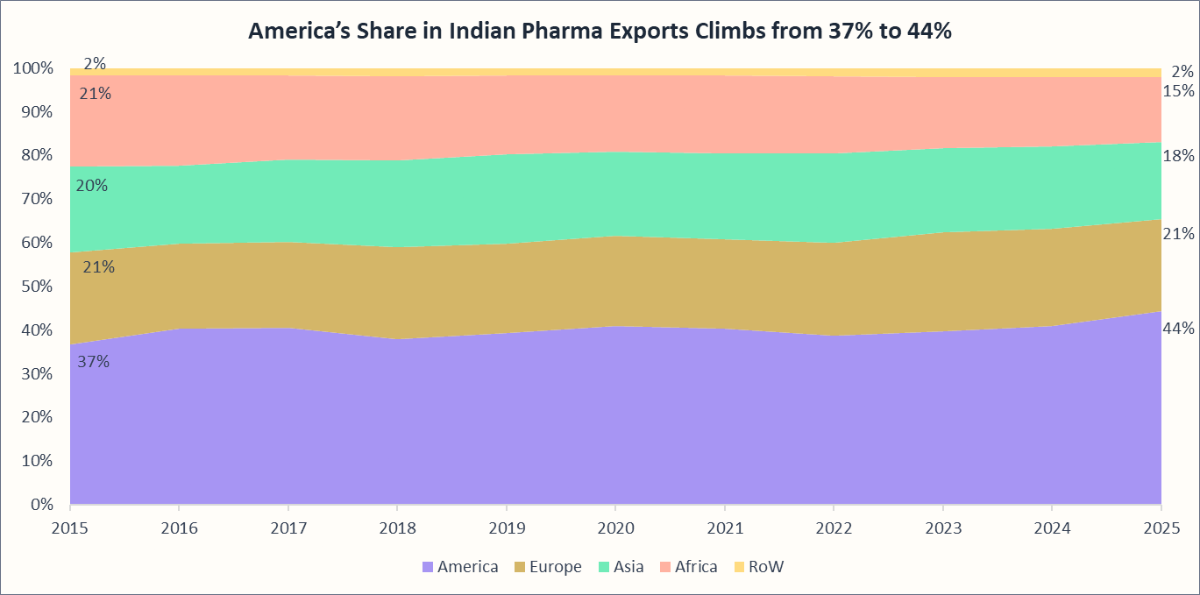

India’s pharma sector earns over half its revenues from exports, which touched USD 30.5 billion in FY2025, growing at an 11% CAGR over the past decade.

Moreover, the sector’s exports to America have grown at a 13% CAGR over the last decade, making America a key export market. Naturally, any policy changes in Washington, especially regarding tariffs, will impact the sector’s exports. While medicines have so far escaped the current 50% tariff regime, the threat of tariffs on drugs still lingers.

But, even if the tariffs are imposed, the fallout may be contained. Indian Pharma companies specialise in low-cost generics that either escape tariff hikes or allow firms to pass on part of the cost. With medicine demand being largely inelastic, any disruption would likely show up as short-term margin and topline pressures rather than a structural long-term threat.

And realistically, the US doesn’t have many alternatives. India supplies 20% of the world’s generics and nearly 40% of all US generic imports. China is strong in APIs but lacks finished dosage capacity; Europe focuses on expensive innovation; Latin America doesn’t have the scale or regulatory approvals. That leaves India indispensable, tariffs or not.

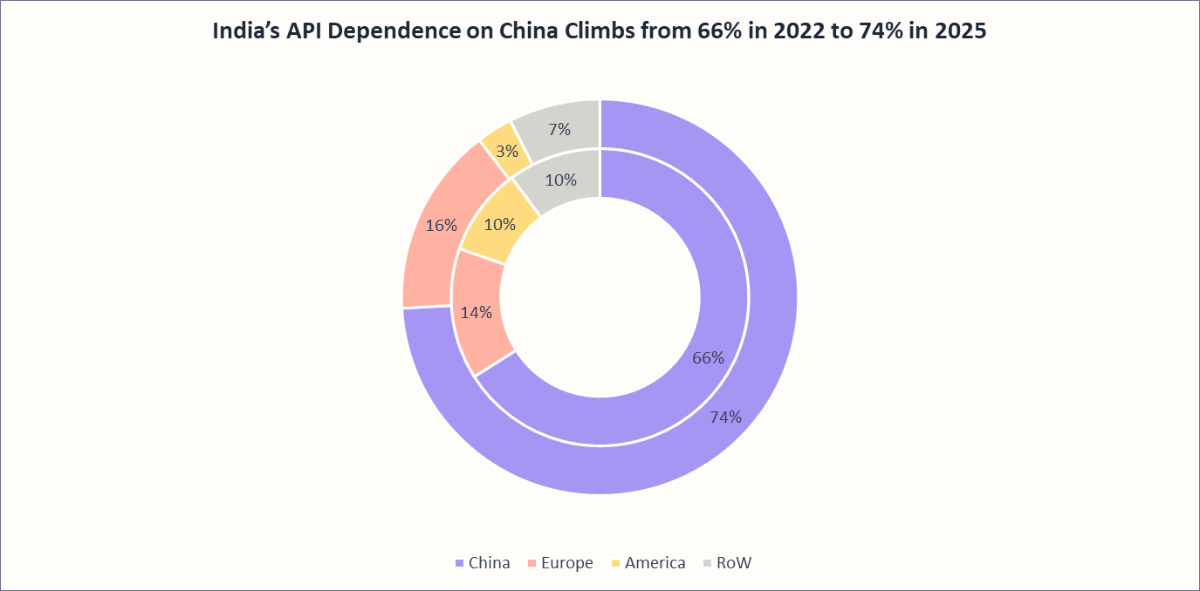

🟡India’s API Dependence on China

India’s pharmaceutical industry may be a global export powerhouse, but it also depends on imports for key inputs. In FY2025, imports of medicinal and pharmaceutical products were around USD 9 billion. While finished drug imports remain modest, the real story lies in the raw materials, especially Active Pharmaceutical Ingredients (APIs) and key intermediates.

Over 74% of India’s bulk drug and API imports now come from China, up from about 66% in FY2022. This concentration makes India vulnerable to price swings, supply disruptions, and policy shocks from Beijing.

This heavy reliance is risky because the COVID-19 shutdowns in China exposed how quickly India’s pharmaceutical supply chain can be disrupted. When Chinese factories closed, many Indian manufacturers faced delays or even temporary halts in production. On top of that, API prices from China tend to swing sharply, squeezing margins and eroding India’s cost advantage. And with geopolitical tensions between the two countries never far from the surface, the continuity of supplies remains unpredictable.

🟢Regulatory and Policy Support

With rising import dependence, the government has not sat still. Over the past few years, it has rolled out a series of initiatives to boost self-reliance, attract investment, and strengthen the domestic pharmaceutical base:

Production-Linked Incentive (PLI) Scheme for APIs, KSMs & Drug Intermediates:

The government launched the PLI scheme for APIs, KSMs, and drug intermediates with a total budget of ₹15,000 crore to boost local manufacturing and cut imports of 41 designated bulk drugs. By late 2024, investment commitments had already surpassed the ₹3,938.6 crore target, reaching ₹4,253.9 crore. Of the 48 approved projects, 34 are operational, covering 25 key APIs, including flagship plants like the ₹1,910 crore Penicillin G unit in Andhra Pradesh and the ₹450 crore Clavulanic Acid unit in Himachal Pradesh.

Bulk Drug Park Scheme:

Backed by a total outlay of ₹3,000 crore, the government’s Bulk Drug Park scheme aims to create world-class manufacturing hubs for APIs. Three parks have been approved in Andhra Pradesh, Gujarat, and Himachal Pradesh, each eligible for up to ₹1,000 crore or 70% (90% for hilly regions) of infrastructure costs as central support. These parks are designed to lower capital costs, offer shared facilities like testing labs and effluent treatment, and build a more integrated, pharma-friendly ecosystem.

Liberalised FDI Policy:

Alongside domestic schemes, India has opened the sector to foreign capital. 100% Foreign Direct Investment (FDI) is allowed under the automatic route for greenfield pharmaceutical projects, while up to 74% FDI is permitted automatically for brownfield investments (beyond that, with government approval). It signals long-term commitment to building capacity and integrating India more deeply into global supply chains.

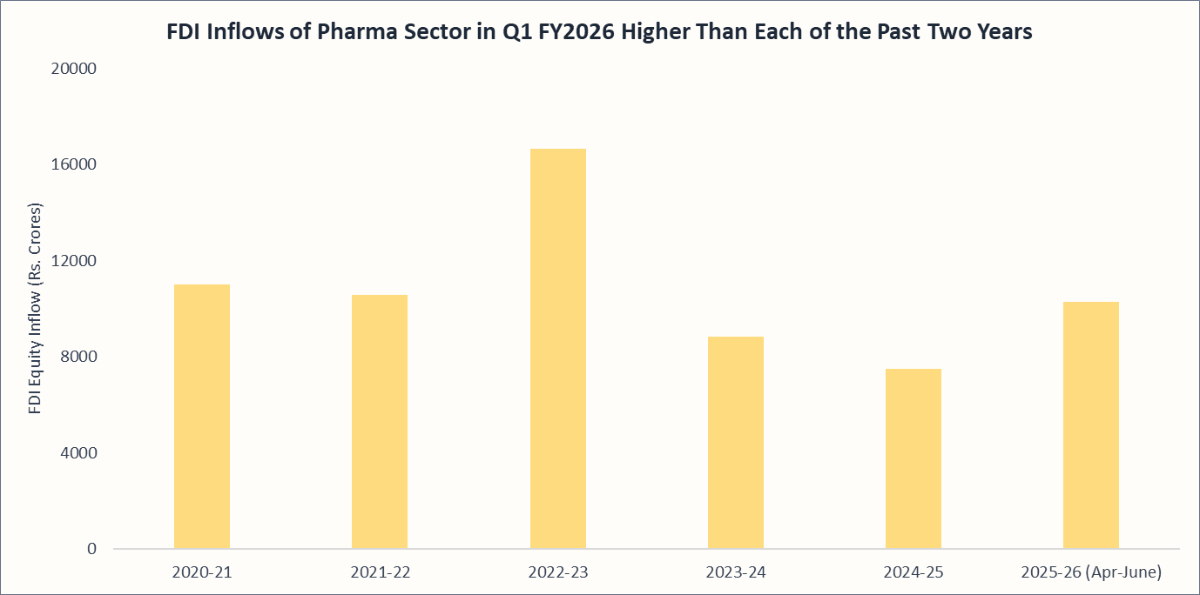

🟡Diverging Foreign Investor Sentiment

Liberal FDI policies and consistent government support have made India’s pharmaceutical sector a magnet for foreign investors. Since April 2000, the sector has attracted over ₹1.5 lakh crore in equity inflows, placing it among the top 10 sectors for FDI in the country.

Over the past five years, pharma has consistently drawn steady FDI, reflecting both sustained investor interest and confidence in its growth potential. In fact, between April and June 2025 alone, the sector received ₹10,273 crore in equity inflows, already surpassing the totals for the entire FY2025 and FY2024.

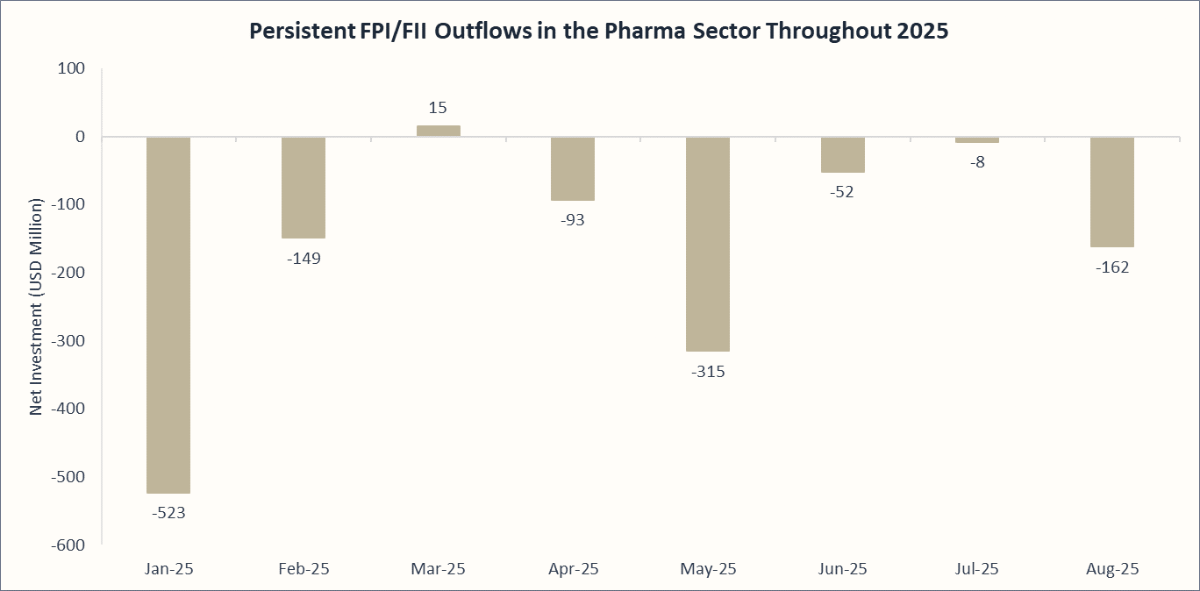

While FDI inflows reflect strong long-term confidence in India’s pharmaceutical sector, the behaviour of Foreign Institutional Investors (FIIs) tells a different story. Since January 2025, FIIs have been consistent net sellers, largely driven by tariff concerns and broader global uncertainties.

This has created a split in sentiment: foreign investors still believe in the sector’s long-term story, but are treading carefully in the short term. For new investors, the current uncertainty could be a chance to step in at cheaper valuations, while existing investors may be better off simply holding on and riding out the volatility.

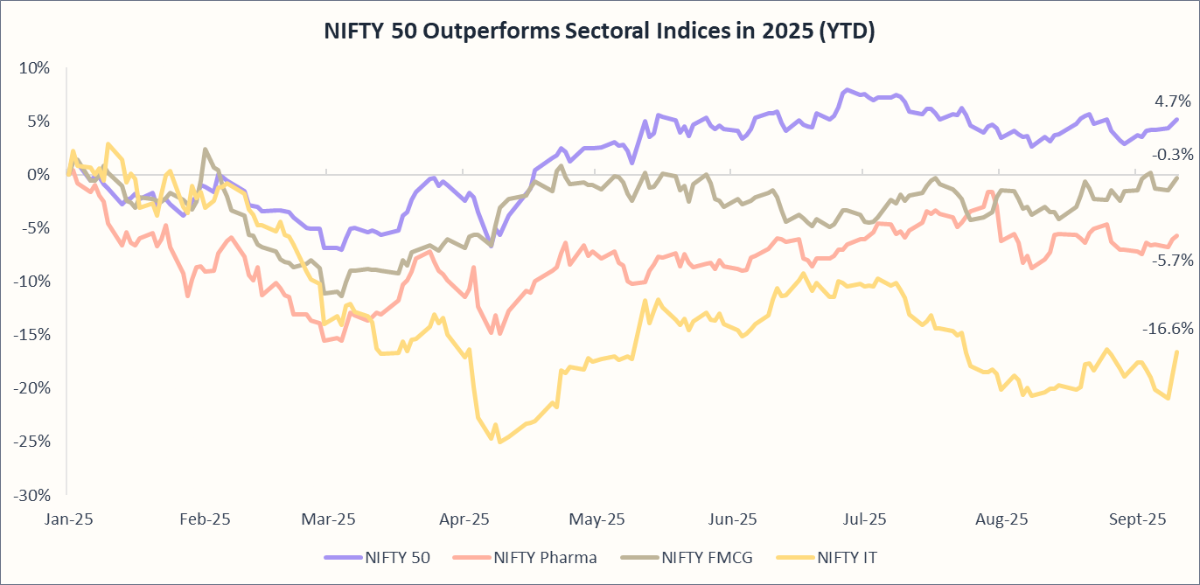

We can see this divergence play out in the capital markets, too. NIFTY Pharma, along with its defensive peer NIFTY FMCG and its export-oriented peer NIFTY IT, has underperformed the broader NIFTY 50. FMCG, despite a consumption boost from GST reforms, remains negative year-to-date, and IT has been weighed down by weak global demand. This shows that the sector’s weak showing is not only the result of its own tariff-related challenges but also part of a wider bearish market mood where even traditional defensives are struggling to keep pace.

🟢Currency Fluctuations:

Indian pharma companies earn most of their revenue from exports but depend on imported raw materials, especially APIs from China. Because exports outweigh imports, a weaker rupee generally works in the sector’s favour, boosting overall revenue even as input costs rise.

Since the start of 2025, the rupee has slipped from about ₹85.95 to ₹88.44 per US dollar, touching an all-time low and falling roughly 3%. This has lifted export earnings in rupee terms and led to foreign-exchange gains for some companies, although higher import costs are trimming margins.

Analysts expect the rupee to hover around ₹87–₹89 over the next few quarters. A weak but steady currency would continue to support Indian pharma exporters, but companies will need to manage rising input costs and hedge against volatility to protect profitability.

Final Thoughts

India’s pharmaceutical sector has carved out a strong place on the global stage, built on solid infrastructure, supportive government policies, expertise in low-cost generics, and steady foreign interest. Yes, there’s short-term noise around tariffs, but the sector’s fundamentals are strong enough to ride it out and keep growing

In an environment where demand is largely inelastic and companies are always looking for the next big opportunity, our confidence in the sector’s long-term prospects only grows. With healthy revenues, stable valuations, and a clear growth story ahead, this could be a good moment for investors to start building a position and be part of the next chapter in India’s pharma journey.

Recommended Reads

Looking for more sector insights? Explore these:

- India’s Banking Sector: FY2025 in Review & What to Expect in FY2026

- IT Sector Outlook 2026: Flat Earnings, Rising GCCs - What’s Next?

- India’s Automobile Industry: Trends, Performance, and What Lies Ahead

- Oil & Gas Sector 2025: India’s 89% Import Challenge

- FMCG Sector in India: Key Trends and Economic Drivers