When the Fed speaks, the world listens. Historically, Fed rate cuts have been one of the most closely watched events. The impact of Fed rate cuts is not just restricted to the U.S. but extends to various asset classes and countries. On September 17, 2025, the Fed cut the federal funds rate by 25 bps to 4-4.25%. This marks the first rate cut of 2025, and the Fed also hinted at further rate cuts in the current financial year.

Even with inflation still above target, the Fed made a modest 25 bps cut to support a slowing job market.

In this blog, we will dive into all of these factors as reasons for the Fed funds rate cuts, the unemployment problem in the US, the US government shutdown, ongoing US tariff issues and also how all of this has already impacted various asset classes.

Fed Cuts Rates as Unemployment Rises

On September 17, 2025, the Fed cut the federal funds rate by 25 basis points to 4.0%-4.25%. This first cut of the year, made despite inflation still being above target, was a nod to a slowing US job market. Why the sudden shift? The U.S. job market is clearly losing steam, putting the Federal Reserve in a tough spot.

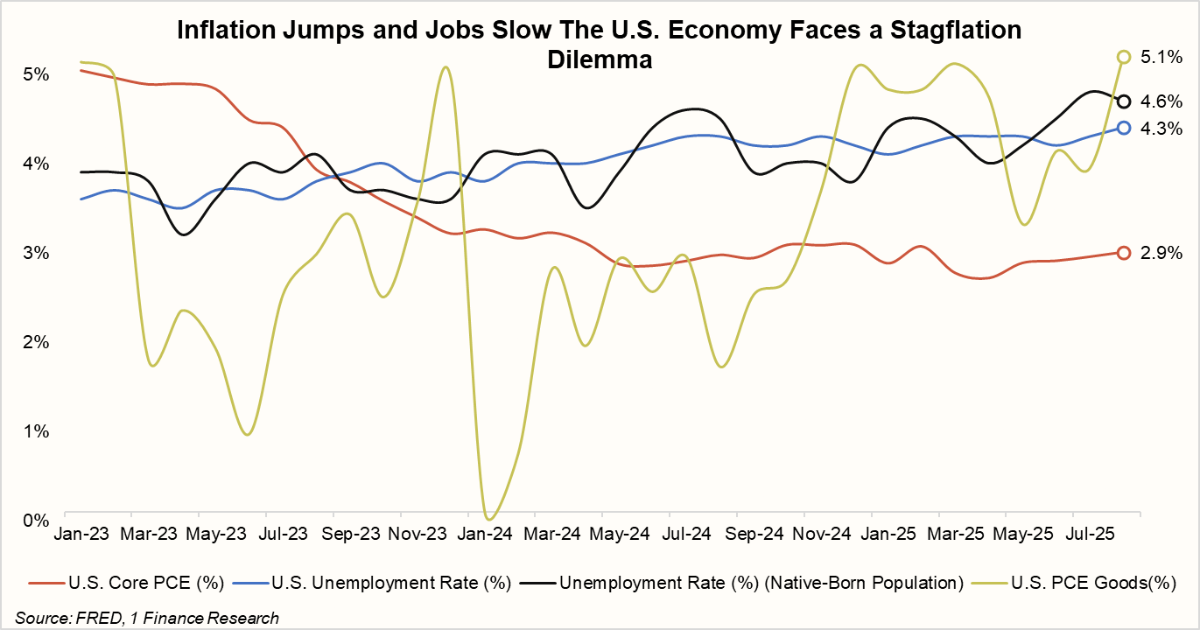

Unemployment rose to 4.3% in August 2025, the highest level since 2021, as the economy added only 22,000 jobs, well below expectations of 76,500. Among U.S.-born workers, the unemployment rate is even higher at 4.6%, highlighting widening demographic gaps in the recovery.

The slowdown in hiring reflects growing strain across households and businesses alike. Tariffs and a shrinking immigrant workforce are starting to weigh on growth, but the primary drag remains sticky inflation. This persistent price pressure is now showing renewed momentum: After months of volatility, U.S. PCE goods inflation jumped to 5.1% in August 2025, showing renewed price pressure in consumer goods. Core PCE inflation, the Fed’s preferred gauge, has stalled near 2.9%, still well above the 2% target.

This mix of rising inflation and higher unemployment has revived talk of stagflation, an uncomfortable phase where growth slows but prices refuse to ease. For the Fed, that means walking a fine line: cut rates too soon and inflation could flare up again; keep them high for too long, and the job market might weaken further.

U.S. Government Shutdown Blues

Adding chaos to complexity is the recent US government shutdown. The federal government shut down on October 1, 2025, after Congress failed to pass appropriations for the fiscal year beginning that day. Since then, the shutdown is still ongoing (as of October 13, 2025). As a result, many key statistical agencies responsible for economic data are closed, meaning crucial reports like September's employment data are delayed indefinitely. Without reliable, up-to-date data, the Fed faces significant uncertainty, making it exceptionally difficult to discern the true state of the economy. This is why private indicators matter: the latest ADP report showed private sector employment fell by 32,000 in September. This actual, negative data point, although unofficial, provided the Fed with sufficient immediate concern to add to the rationale for the rate cut.

Recommended for you

Readers also explored

Inflation Concerns and Interest Rate Outlook

World GDP Breakdown 2025: Who Powers the Global Economy?

The Conflicting Forecast

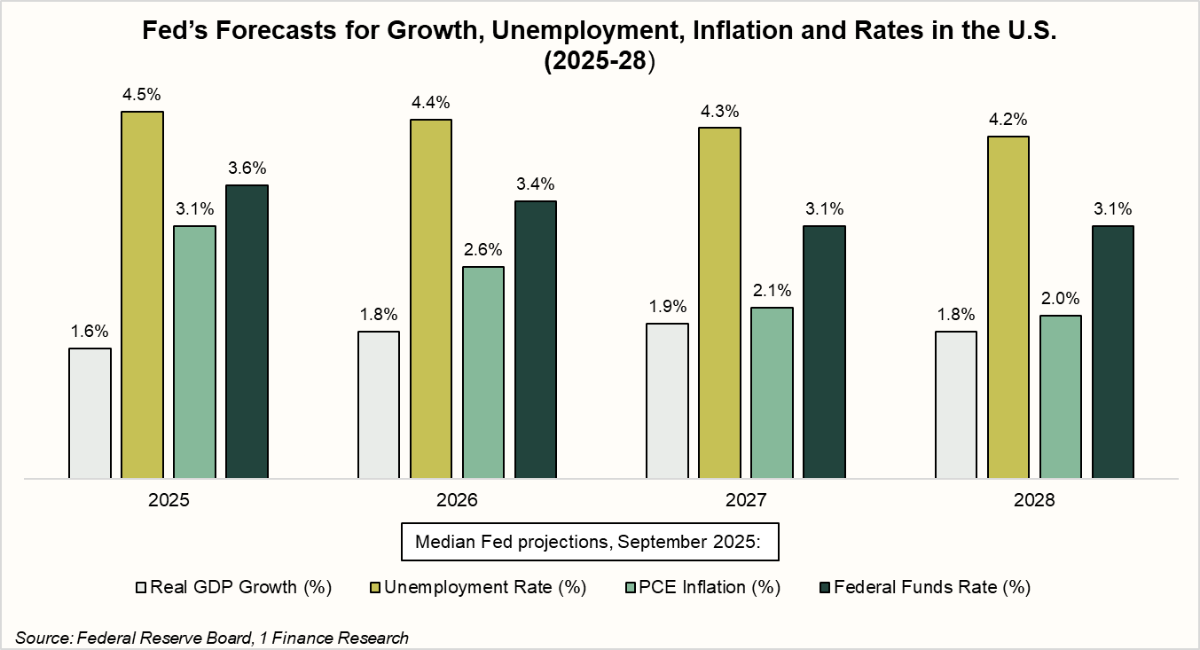

Multiple questions have been raised following the FOMC's release of its projections for various indicators on September 17, 2025. As shown in the chart below, GDP growth is projected to rise from 1.6% in 2025 to 1.9% in 2027, before slightly easing to 1.8% in 2028. Meanwhile, the unemployment rate is expected to gradually decline from 4.5% in 2025 to 4.2% in 2028.

All of this is expected to happen while the Fed gradually cuts rates from 3.6% in 2025 to 3% in 2028. That seems quite contradictory. Why would the Fed cut rates if unemployment is falling and growth is improving?

When questioned about this, the Fed explained that it expects inflation to decline to 2% by 2028. (Exactly how the U.S. economy will sustain stronger growth and lower unemployment without reigniting inflation remains an open question.)

So, whether the U.S. economy might still slip into a recession remains a key concern. In short, the Fed’s projections convey confidence, but its actions reveal deep-seated caution.

How Tariffs Could Prolong the U.S. Inflation Cycle

The U.S. economy is now showing early signs of the delayed effects of tariffs. Companies have so far absorbed higher import costs by building inventories and compressing profit margins, muting the immediate impact on prices. But as these inventories run down and margins normalise, prices are likely to start rising more persistently. This gradual pass-through is already starting to influence consumer behaviour: households are beginning to anticipate higher inflation, which could reinforce a cycle of price increases and wage demands.

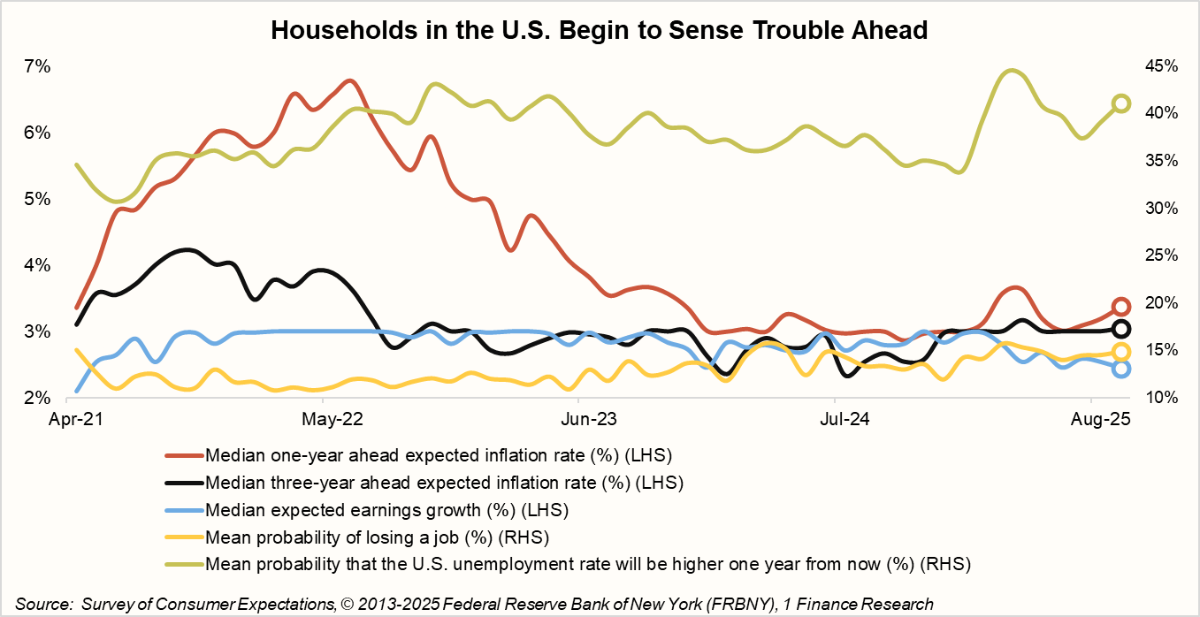

The September 2025 Survey of Consumer Expectations by the New York Fed provides a glimpse of this shift in sentiment. One-year ahead inflation expectations rose to 3.4% in September 2025 from 3.2% in August 2025, while three-year expectations nudged up to 3.1% in September 2025 from 3% in the previous month. The rise was most pronounced among lower-income households and those with only a high school education, groups typically most sensitive to price changes.

At the same time, households are increasingly cautious about the labour market: expected one-year earnings growth slipped to 2.4%, the lowest since April 2021, while the probability that unemployment will be higher in a year jumped to 41.1%, and the risk of losing a job over the next twelve months edged up to 14.9%.

Taken together, these indicators suggest that the delayed tariff pass-through is starting to influence not just prices, but expectations and economic behaviour, setting the stage for a slow, persistent rise in inflation even as the labour market softens.

The Global Impact of the Fed Cut

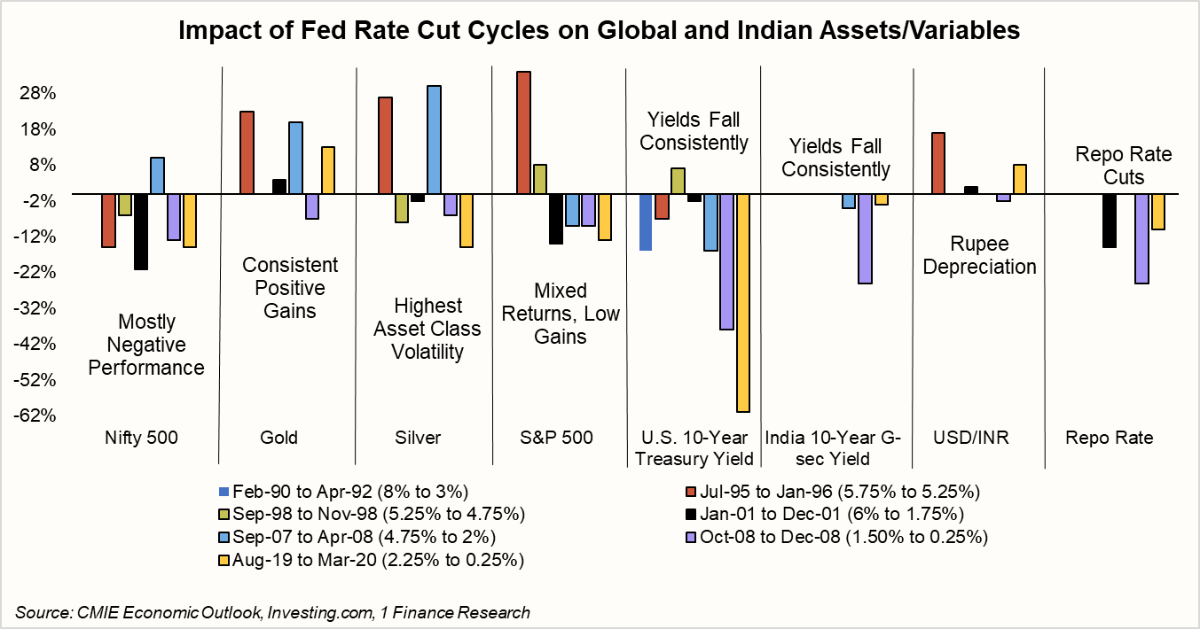

The Fed’s action immediately impacts asset classes, particularly in emerging markets like India, due to capital flows and policy signalling.

Note: The chart values indicate the percentage change in each variable measured from the beginning to the end of the Federal Reserve’s rate-cutting cycle. All performance figures are presented in INR terms.

- Nifty 500: Historically, Fed rate cut cycles often coincide with global distress, leading to flat-to-negative returns for Indian equities. While short-term rallies can happen, the broader trend is cautious, especially when a global slowdown is the root cause.

- Gold and Silver: Rate cuts are a boon for precious metals. Gold consistently delivers positive gains, benefiting from its safe-haven status and the falling real returns on cash. Silver is more volatile, often outperforming gold with sharp spikes, but it remains the most unpredictable of the major asset classes.

- Treasuries and Currencies: US and Indian bond yields consistently fall as the Fed acts, driving bond prices up and creating a safe haven. Meanwhile, the Indian Rupee (USD/INR) often depreciates against the dollar during volatility.

- India's Repo Rate: The RBI usually follows the Fed's lead, acting in tandem but with a lag. This directly supports bond prices and impacts domestic debt and lending markets.

What’s Ahead?

Markets are now anticipating a shift toward further Fed easing, with potential quarter-point rate cuts in October and December 2025. This move could lower the federal funds target range to 3.5%-3.75% by year-end. A dovish Federal Reserve, paired with cooling U.S. economic data, suggests the dollar will face sustained downward pressure through mid-2026. A recovery is only likely once the easing cycle concludes and growth finds its footing again.

These policy decisions are unfolding amid the lingering effects of massive global shocks: the pandemic, supply chain meltdowns, the energy crisis from the Russia-Ukraine war, and this year's tariff spike. All have left deep scars on the labour market, inflation, and consumer confidence.

For India, the Fed’s rate-cut cycle could create breathing room for the RBI to potentially ease its own policy. This would be particularly true if domestic inflation remains manageable and additional growth support is needed. As ever, however, the RBI's future actions will remain firmly tied to India's own inflation and growth outlooks. Ultimately, the Fed's upcoming choices won't just test its finesse in managing a fragile U.S. economy; they will send ripples through global finance, shaping monetary strategies from across the world.