India’s Housing Market continued to expand in Q3 2025, but the pace and pattern of growth are completely shifting. Large metropolitan areas are seeing an abundance of new supply, and infrastructure-led corridors are maturing into active markets where end-user demand is strong, even as home sales remain broadly the same across India. What stands out is how the new launches, sales and price dynamics are increasingly shaped by local infrastructure rather than a uniform national trend.

| Key Takeaways |

|---|

| Infra-led areas are now driving the housing cycle, with price jumps like Sohna (95% YoY), Greater Noida (67% YoY), and South Delhi (46% YoY) directly linked to metro and expressway upgrades. |

| New launches have reached 3.2 lakh units in 2025, while Q3 sales fell to 90,525, widening the supply–demand gap across major metros. |

| Bengaluru (21,293 unit launches vs 13,987 unit sales) and Hyderabad (18,905 unit launches vs 10,957 unit sales) are seeing the sharpest imbalance, reflecting developers' front-loading supply ahead of infra completions. |

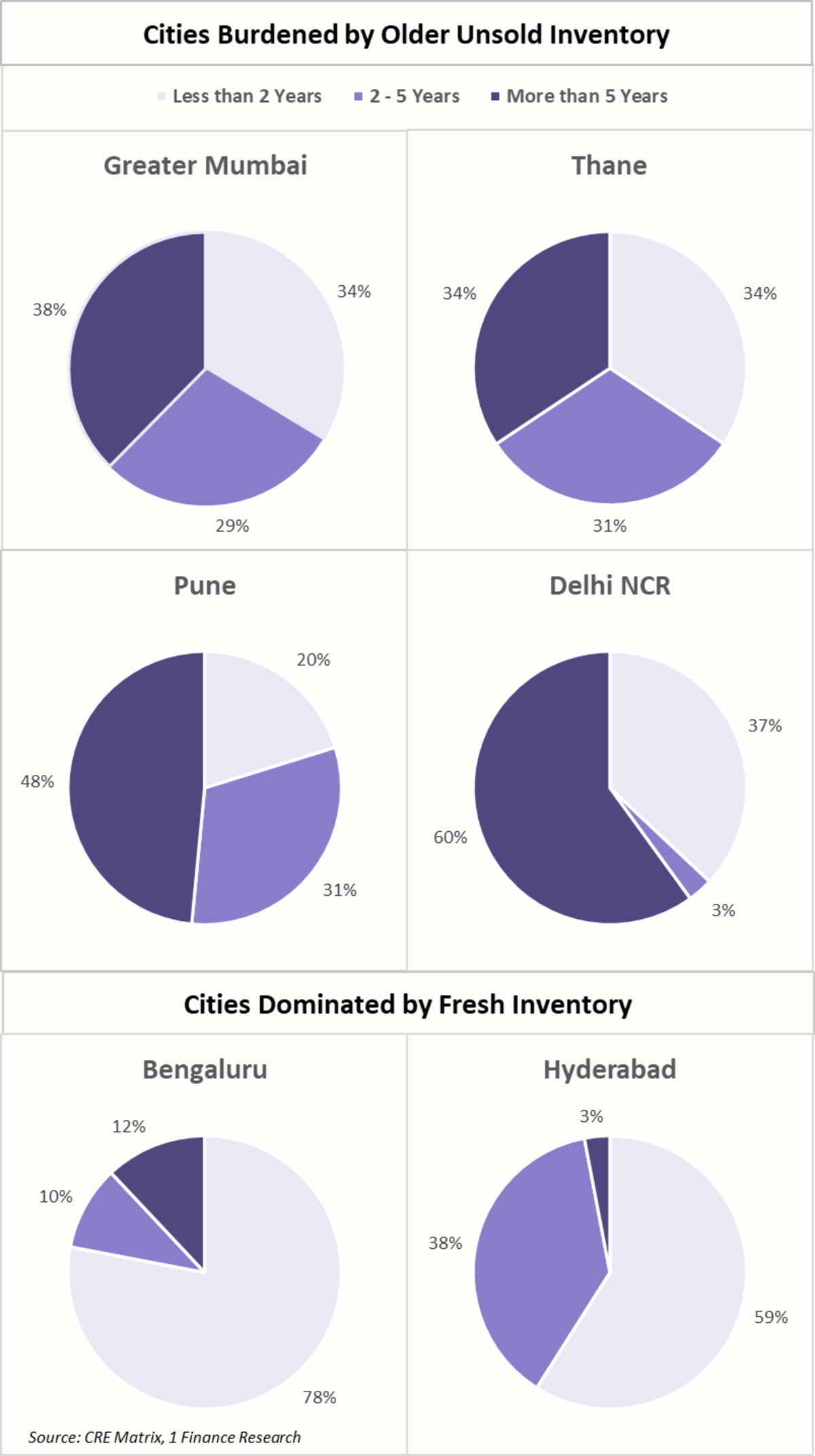

| Inventory is ageing unevenly, with Mumbai, Pune, Thane, and the NCR region carrying the largest share of stock unsold for over 60 months, while Bengaluru (78%) and Hyderabad (59%) remain dominated by fresher (< 2-year) supply. |

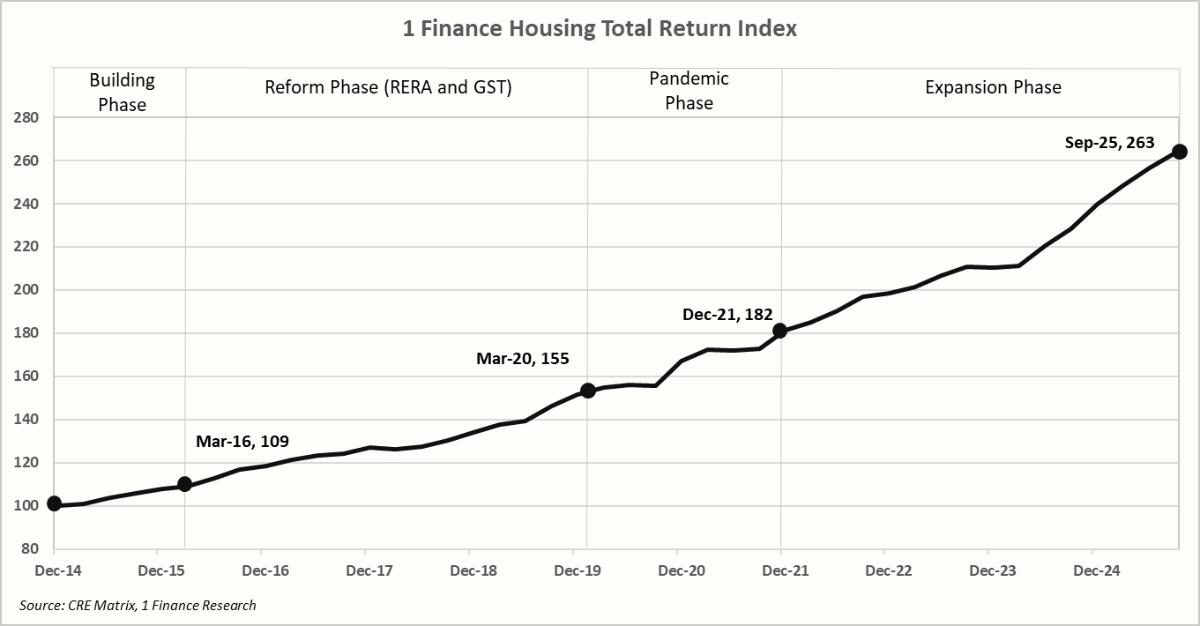

Long-Term Housing Momentum Remains Intact

India’s Housing Market continues to demonstrate long-term momentum, and the 1 Finance Housing Total Return Index captures this evolution clearly. The 1 Finance Housing Total Return Index, India’s first unbiased housing index based on RERA-registered transaction data, delivered a CAGR of 11% over the last 5 years, rising to 263. The latest leg of growth has been driven by strong end-user activity, higher-quality launches, and greater transparency due to RERA compliance. As infrastructure upgrades deepen across major metros, the index reflects not just price appreciation but a structural strengthening of India’s housing ecosystem.

Recommended for you

Readers also explored

Is India’s Housing Market Still a Good Bet?

World GDP Breakdown 2025: Who Powers the Global Economy?

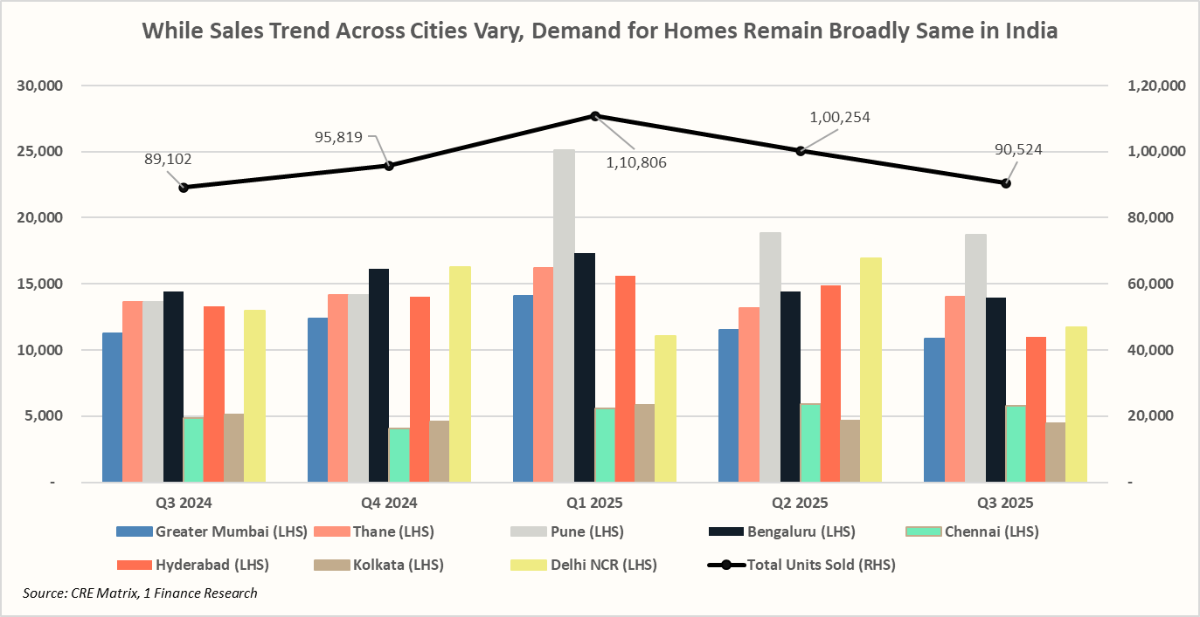

New Launches are Rising, But Demand Remains Steady

New launches rose to 3,20,777 units in the first three quarters of 2025, up from 3,12,305 units in the same period last year, supported by strong infrastructure projects like new metro lines (Mumbai, Bengaluru, Hyderabad), expressways (Delhi NCR, Thane) and airport-linked development zones (Thane, Hyderabad, Noida).

With a total sales value of ₹1,52,263 crores, India’s top 8 cities collectively recorded 90,525 home sales in Q3 2025, 16% down from the high of Q1 2025. This has led to a wider gap between launches and sales, leading to higher inventory levels, hinting at a more mature market where absorption is closely linked to job growth, quality of supply and infrastructure development.

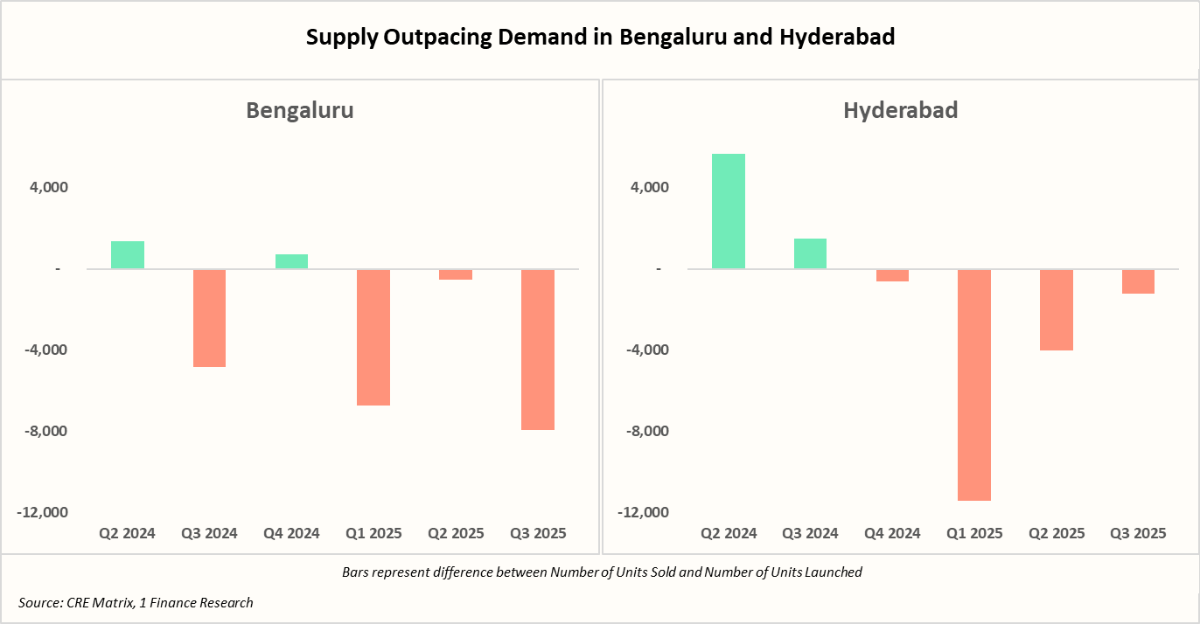

Supply Outpacing Demand in Bengaluru & Hyderabad

In Bengaluru and Hyderabad, two of India’s fastest-growing residential real estate markets, new launches have begun to outpace demand. Bengaluru’s new supply rose from 15,808 units in Q2 2024 to 21,293 units in Q3 2025, while Hyderabad saw a steeper jump from 9,716 to 18,905 units. Sales, however, have not kept pace. Bengaluru (13,987 units sold) saw a softer demand, while Hyderabad (10,957 units sold) saw one of its sharpest quarterly drops in sales volume.

This reflects developers front-loading supply to meet anticipated demand backed by new infrastructure projects. In South East Bengaluru, the phased completion of Namma metro blue line at KR Puram, red line from Sarjapur to Hebbal, and approval of twin tube tunnel from Hebbal to Silk Road are transforming access. Western Hyderabad is seeing a similar push with the start of execution of multi-level flyovers at Jubilee Hills, Serilingampally and the Phase-1 completion of the World Trade Centre at Shamshabad.

Older Inventory Weighs on Key Markets

Older Inventory is piling up across Greater Mumbai, Pune, Thane and Delhi NCR. In all four regions, units older than 60 months form the largest buckets of unsold stock, indicating continued challenges in clearing outdated and less competitive projects. On the other hand, cities like Bengaluru (78%) and Hyderabad (59%) have most of their inventory less than 2 years old, due to launches in their infrastructure-linked peripheral regions.

This reflects a structural shift in buying behaviour as homebuyers today prefer newer, better-located projects rich with amenities, leaving older developments at a disadvantage.

Infrastructure is Leading Price Growth

India’s housing market is increasingly shaped by infrastructure upgrades, and the impact is most visible in areas connected to new metro lines, expressways and new airport corridors are now among the strongest catalysts for price appreciation. Across regions, locations with strong infrastructure upgrades have outperformed their city averages in buyer interest and price appreciation.

New metro phases in Delhi, the Aqua Line extensions in Noida and Greater Noida, and major connectivity additions around Gurugram have all fueled sharp jumps in capital values. The table below highlights some of the fastest-growing infra-led micro-markets in the country.

Area | Infrastructure Project | Growth in Per Sq Feet Rate (YoY %) |

|---|---|---|

| Sohna, Gurugram | Gurugram Metro - HUDA City Centre to Cyber City (with Dwarka Expressway spur) | 95% |

| In Greater Noida, Greater Noida | Aqua Line Metro extension: Sector-51 to Knowledge Park-V | 67% |

| South Delhi, Delhi | Delhi Metro Phase 4: Aerocity-Tughlakabad Corridor | 46% |

| Noida Expressway, Noida | Extension of Aqua Line Metro Corridor: Sector-142 to Botanical Garden | 35% |

| West Delhi, Delhi | Delhi Metro Phase-4: Janakpuri West - RK Ashram Marg corridor | 33% |

India’s Housing Market Is Entering a Consolidation Phase

Today, India's Housing Market sits at a clear inflexion point. The post-COVID demand surge has cooled into a more sustainable rhythm, as supply continues to expand across major cities. The India Housing Market is gradually shifting into a consolidation phase, characterised by high inventory, uneven absorption and sharp differences between infrastructure-rich and infrastructure-poor pockets.

Looking ahead, the areas best positioned for growth in 2026 are those anchored by strong connectivity, short delivery timelines and established developers with strong balance sheets. For homebuyers, the priority shifts toward developer credibility, construction-linked progress and infrastructure-linked locations rather than pure price momentum.