Union Budgets are often judged by tax-change announcements, headline allocations, and immediate market reactions. Yet the deeper significance of a budget lies in the choices it makes about capital, capability, and long-term competitiveness.

Union Budget 2026 is a case in point. Beyond the familiar announcements, the budget reflects how policymakers are thinking about growth, competitiveness, and strategic autonomy in a more uncertain global environment.

This newsletter does not attempt to summarise the budget. Instead, it focuses on the economic logic behind key allocations and reforms, and what they imply for investors and financial advisors looking beyond the next quarter.

Additionally, India and the US have agreed to cut tariffs on Indian goods to 18% from 50%, easing export pressures and removing penalties on crude purchases, alongside India’s $500 billion import commitment. While the full agreement is still being finalised, immediate tariff relief marks a reset, with further details to be assessed after they are finalised.

Budget 2026 and Investor Impact

| What the Government Did | What It Changes for the Economy and Markets |

| Fiscal Deficit Target and Increasing Capital Expenditure |

|

| Expanded incentives under the Electronics Components and Manufacturing Scheme (ECMS), with a ₹40,000 crore outlay India Semiconductor Mission 2.0 |

|

| Launched Biopharma SHAKTI with a ₹10,000 crore outlay to build biologics and biosimilars capabilities |

|

| Announced Rare Earth Corridors alongside the ₹7,280 crore REPM scheme to integrate mining, processing and magnet manufacturing |

|

| Introduced plans for CPSE REITs to monetise public-sector real estate and infrastructure assets |

|

Fiscal Consolidation with a Focus on Capital Expenditure

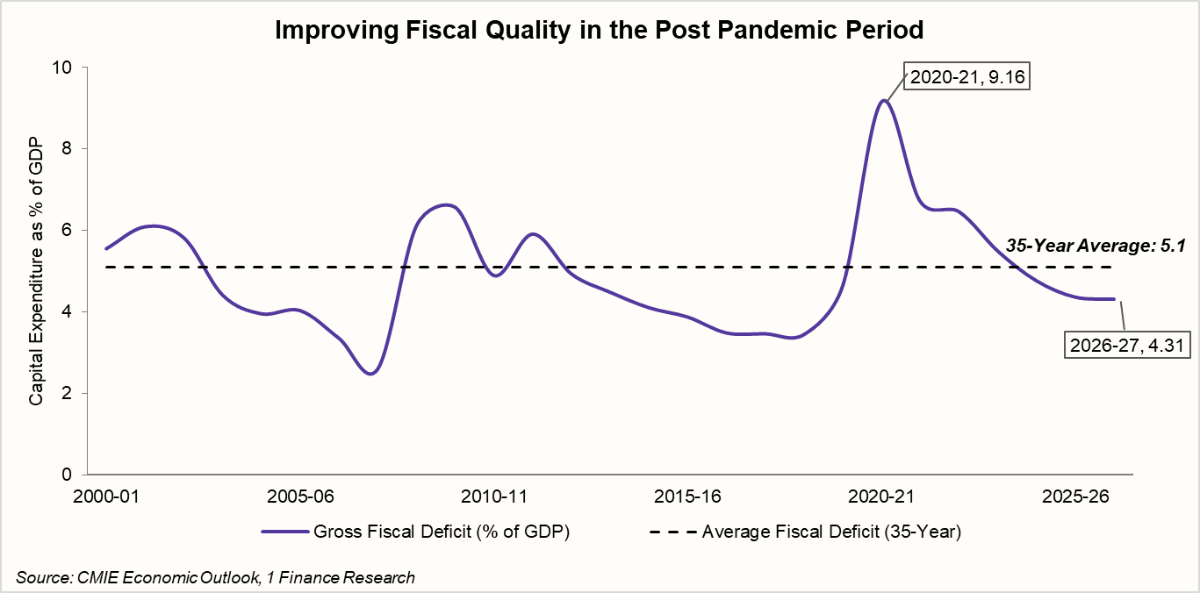

The fiscal deficit, which measures the gap between government spending and revenues, had widened sharply during the pandemic as revenues declined and emergency spending increased, pushing it well above the long-term average of 5.1%. A persistently high deficit limits fiscal flexibility and long-term stability of the economy.

The government met last year’s fiscal deficit target of 4.4% of GDP and has now set a marginally lower target of 4.3% for FY 2026–27, supported by lower subsidies and steady tax collections. This steady glide path reduces uncertainty around borrowing costs and preserves fiscal space for growth-supportive spending.

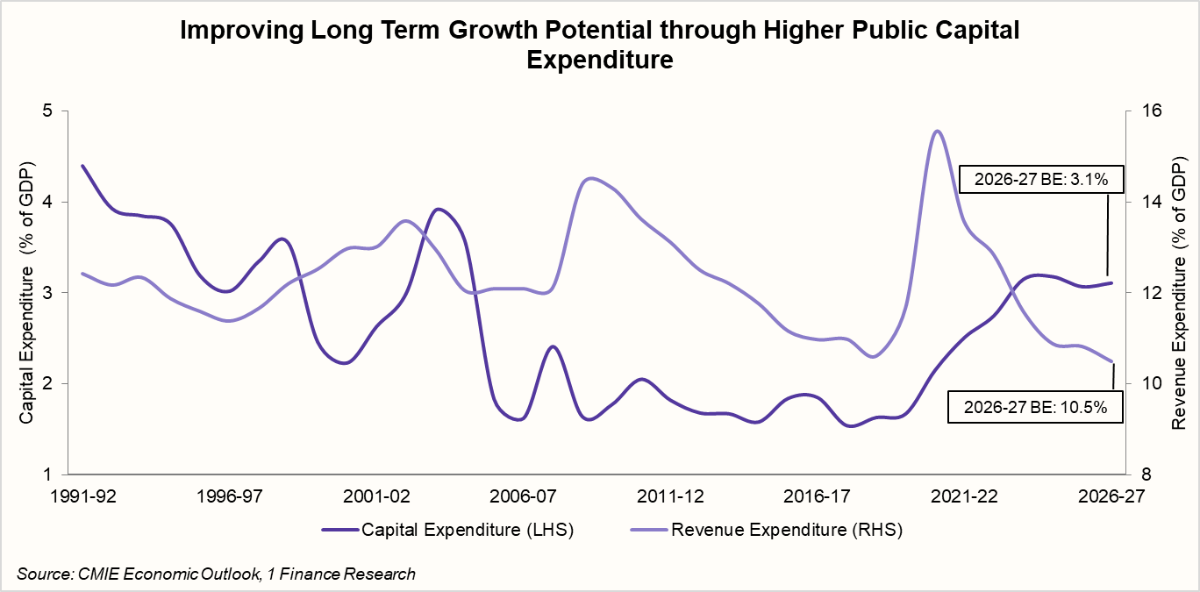

Alongside fiscal consolidation, the budget continues to prioritise capital expenditure as a growth driver. Public capex is maintained at 3.1% of GDP, while revenue expenditure is lowered to around 10.5% of GDP from 10.8% last year.

For FY 2026-27, capital expenditure has been raised by 9% to ₹12.2 lakh crore, led by infrastructure, transport, and energy spending. At the same time, revenue expenditure is budgeted to decline from 10.8% of GDP to 10.5%, reinforcing the shift toward a more growth-oriented expenditure mix. The next section outlines key announcements and major capex initiatives in detail.

Recommended for you

Readers also explored

Wholesale Price Index: Key to Inflation and Economic Trends

India's IT Sector Outlook for FY2026

Biopharma Building Value Where India Historically Lost It

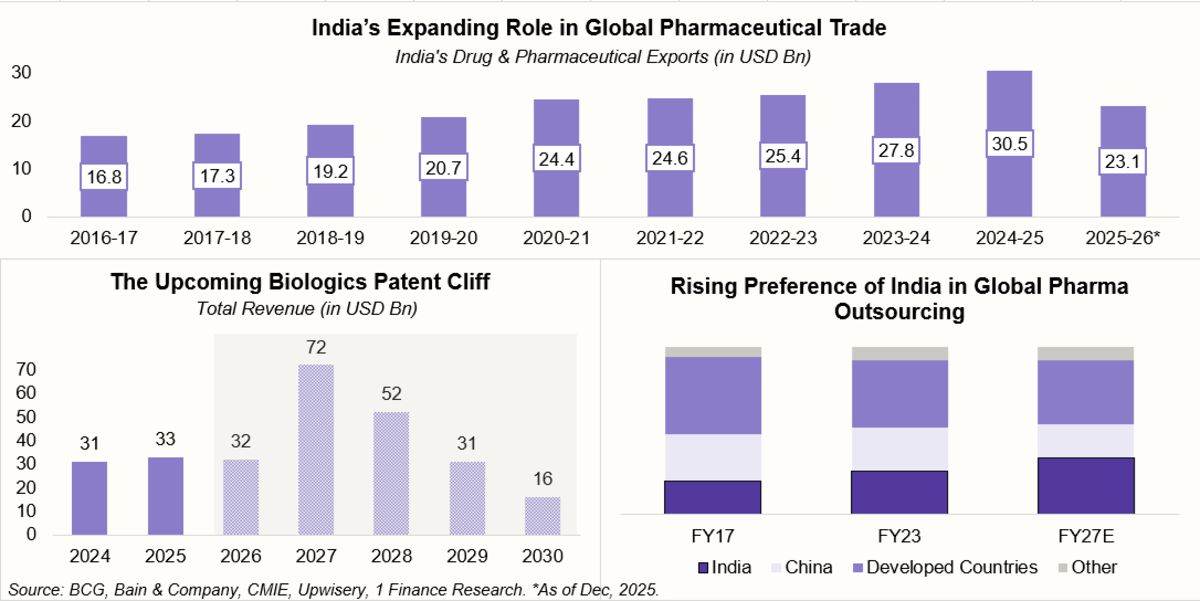

The Union Budget 2026 allocation of ₹10,000 crore to the Biopharma SHAKTI initiative signals a clear shift in India’s pharmaceutical strategy. For decades, India’s role as the “pharmacy of the world” has been built on small-molecule generics, delivering close to 20% of global volumes but only about 3% of global value, leaving a persistent volume–value gap.

That gap reflects a broader change in global pharma. Biologics and biosimilars now account for nearly 40% of worldwide drug spending, yet India’s footprint in this segment remains limited. The impact is visible domestically as well, with non-communicable diseases accounting for over 60% of India’s disease burden and demand for advanced therapies still largely met through imports.

The timing is critical. Over the next five years, more than $200 billion of biologic drugs are expected to go off-patent globally. By lowering entry barriers through shared infrastructure, regulatory capacity and scale-up support, the budget aims to position Indian firms to capture this biosimilar opportunity.

For advisors and investors, biopharma is not a tactical theme. It represents a long-cycle transition from low-margin volume exports to higher-value, innovation-led manufacturing.

Rare Earth Corridors Securing the Most Fragile Link in the Energy Transition

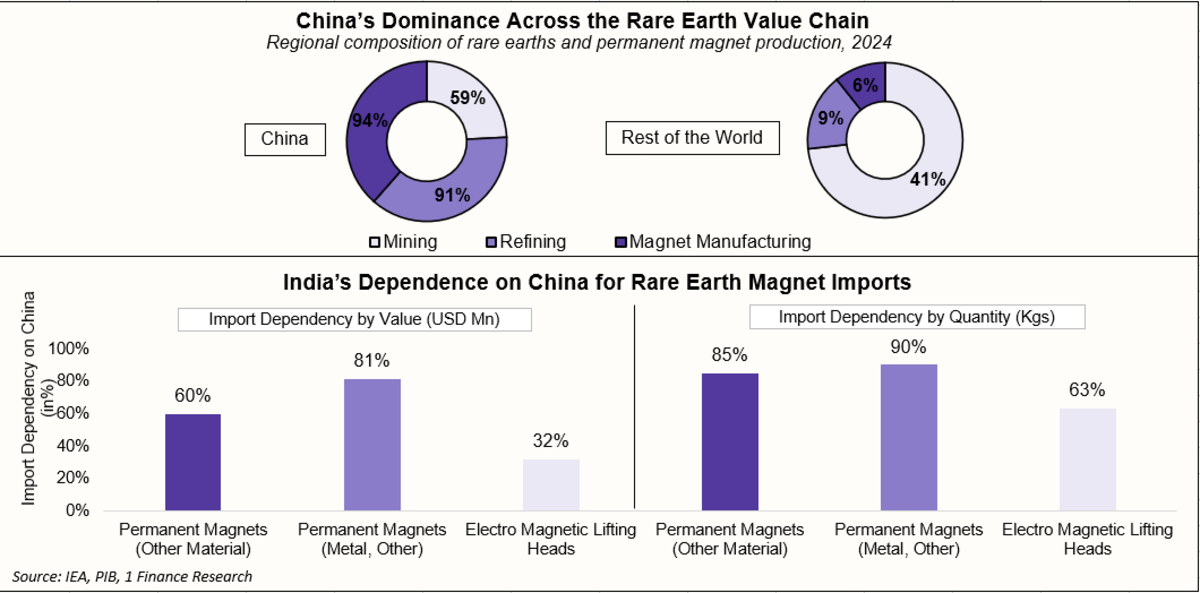

The Union Budget 2026 proposal to create Rare Earth Corridors across Odisha, Kerala, Andhra Pradesh and Tamil Nadu addresses a key weakness in India’s energy transition. Despite large reserves, India remains dependent on imports for refined magnets used in EVs, wind power and defence, reflecting limited domestic processing capacity rather than resource scarcity.

This gap persists as China controls nearly 90% of global refined rare earth output, backed by decades of state-supported scale and cost advantages. In India, private investment in midstream processing has lagged due to high capital needs, environmental challenges in monazite separation, and weaker early-stage returns.

The corridor approach directly targets this bottleneck. By aligning mining activity with the ₹7,280 crore ‘Scheme for Sintered Rare Earth Permanent Magnets’, the government is attempting to integrate the value chain and reduce global dependence on China for heavy rare earths such as dysprosium and terbium.

For investors, this is not a commodity trade. It is a long-term supply security play that could move India from exporting low-value mineral sands to producing high-value magnets, embedding it deeper into the $130 billion clean-energy supply chain.

A Bigger Budget Bet on Semiconductors

Semiconductors underpin everything from smartphones and EVs to defence systems, power grids and AI, yet India still imports most of its chips, leaving it exposed to supply disruptions and strategic risk.

To address this, the government expanded the Electronics Components Manufacturing Scheme to ₹40,000 crore from ₹22,900 crore, and allocated ₹1,000 crore to India Semiconductor Mission 2.0 in FY27 to strengthen equipment, materials and IP capabilities.

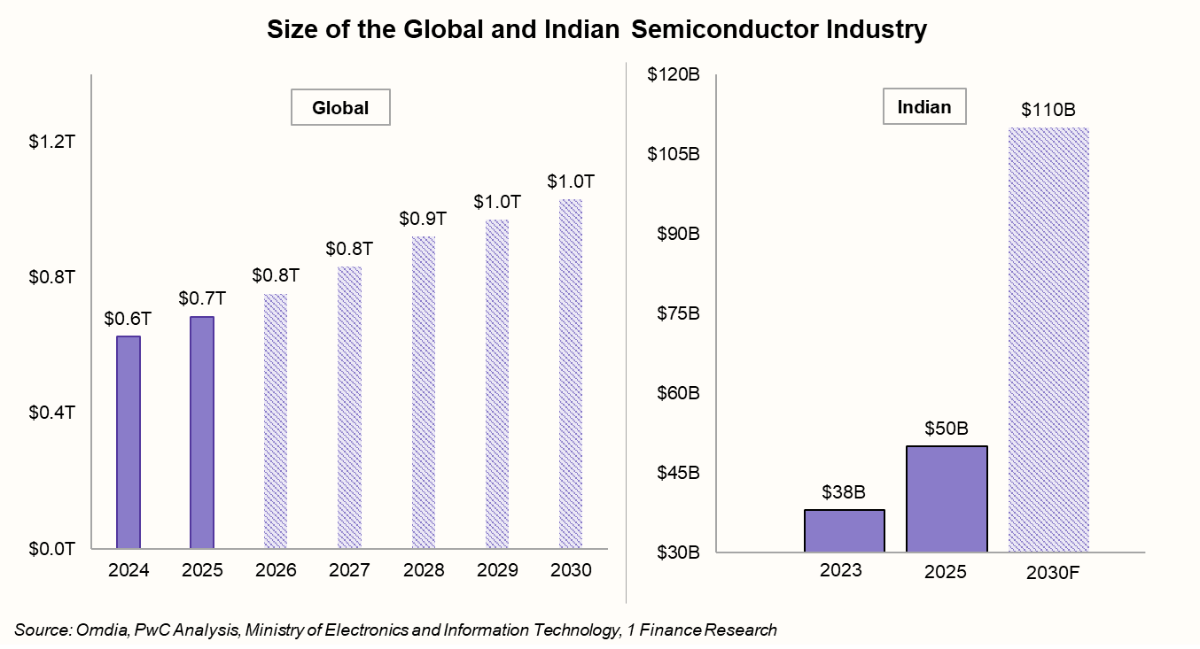

This push comes as global chip demand heads toward $1 trillion this decade, while India’s market is expected to grow from $38 billion in 2023 to $110 billion by 2030.

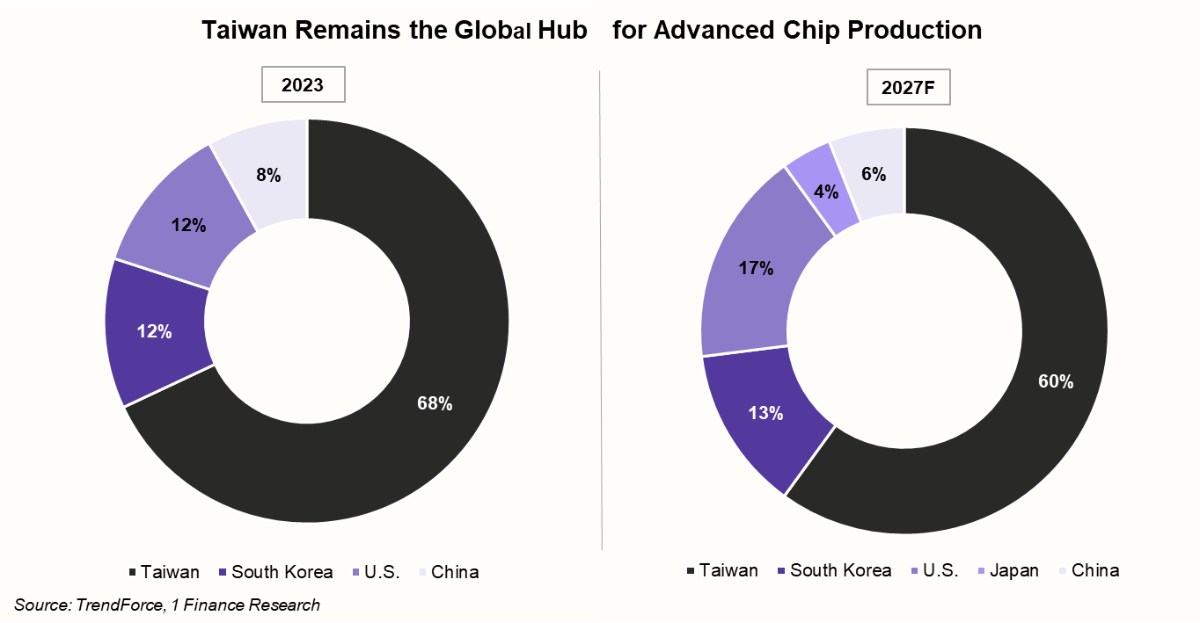

However, India remains a marginal player in chip manufacturing. Its strength so far lies in design talent, not fabrication. Advanced chip production is concentrated in a handful of countries, creating global supply risks and pushing governments worldwide to diversify capacity.

Why Are Smaller Chips Better?

Smaller chips can fit more transistors into the same space. This makes devices faster, more efficient, and more powerful. They also consume less energy and generate less heat, improving efficiency and battery life.

| Chip Size | Common Uses |

|---|---|

| 14-10 nanometres | Smartphones, basic electronics |

| 7-5 nanometres | Advanced phones, EVs, and cloud computing |

| 3 nanometres | High-performance AI and data centres |

| 2 nanometres | Next-generation AI and ultra-efficient processors |

ISM 2.0 will help fulfil India’s long-term ambitions:

Meet 70-75% of domestic chip demand locally by 2029.

Current situation: India still imports most chips; local production has only just begun.

Produce 3-nanometre chips by 2032 and 2-nanometre chips by 2035.

Current situation: India has designed a 7-nanometre chip, but manufacturing today is focused on 28-40 nm nodes, with advanced fabrication targeted for the next decade.

Becoming one of the top four semiconductor nations globally.

Current situation: India is strong in chip design talent but remains a marginal player in global chip manufacturing capacity.

Crucially, ISM 2.0 prioritises equipment and materials, ensuring India controls not just factories, but the machines and chemicals behind chipmaking. If executed well, this budget bet could add billions to manufacturing output, create high-skill jobs, and anchor India’s role in future technology supply chains.

CPSE REITs Monetising Public Assets to Fund the Next Capex Cycle

The Budget also announced plans for public-sector REITs, allowing the government to monetise completed infrastructure and commercial assets through a listed trust. This will provide investors with stable, yield-oriented returns, while the government unlocks capital, improves balance-sheet efficiency, and recycles proceeds into fresh capital expenditure.

| Metric | Public-sector (CPSE) REITs | Existing REITs (listed) |

| Launch Date | Announced in the FY 2026-27 budget to accelerate monetisation of CPSE real estate and recycle capital for capital expenditure. | The REITs regime began in 2019. Embassy Office Parks (2019), Mindspace Business Park (2020), Brookfield India Real Estate Trust (2021) and Nexus Select Trust (2022) are the major listed REITs. |

| Expected returns (distribution yield) | Expected to offer stable dividends, depending on asset mix and leverage. | Historically listed REIT yields vary by trust and quarter. Dividend Yields of ~2.5%–5%, along with additional capital gains. |

| Risk/credit profile | Potentially lower risk if backed by large CPSE assets and transparent pipelines. | Risk depends on sponsor quality, portfolio, occupancy, lease covenants, and leverage. |

| Why attractive to investors | Access to high-quality public sector assets, predictable cash flows, and higher transparency. | Access to commercial real estate without direct ownership or management. Adequate liquidity is ensured as these are listed on exchanges. |

| Use of proceeds/ purpose | Monetisation of completed CPSE assets; proceeds recycled into fresh capex and balance-sheet efficiency for CPSEs. | Typically used to pay down sponsor debt, fund new projects, or return capital to sponsors. |

Union Budget 2026 prioritises long-term capacity building over short-term stimulus, reshaping India’s growth model through capital discipline, manufacturing depth, and strategic autonomy.