What a rollercoaster of a year it has been! We saw the rupee hit a shocking historic low of 90. Foreign investors also massively pulled out funds from Indian equities. Global tariffs made the whole picture even tougher. Credit growth overall faced its own major hurdles.

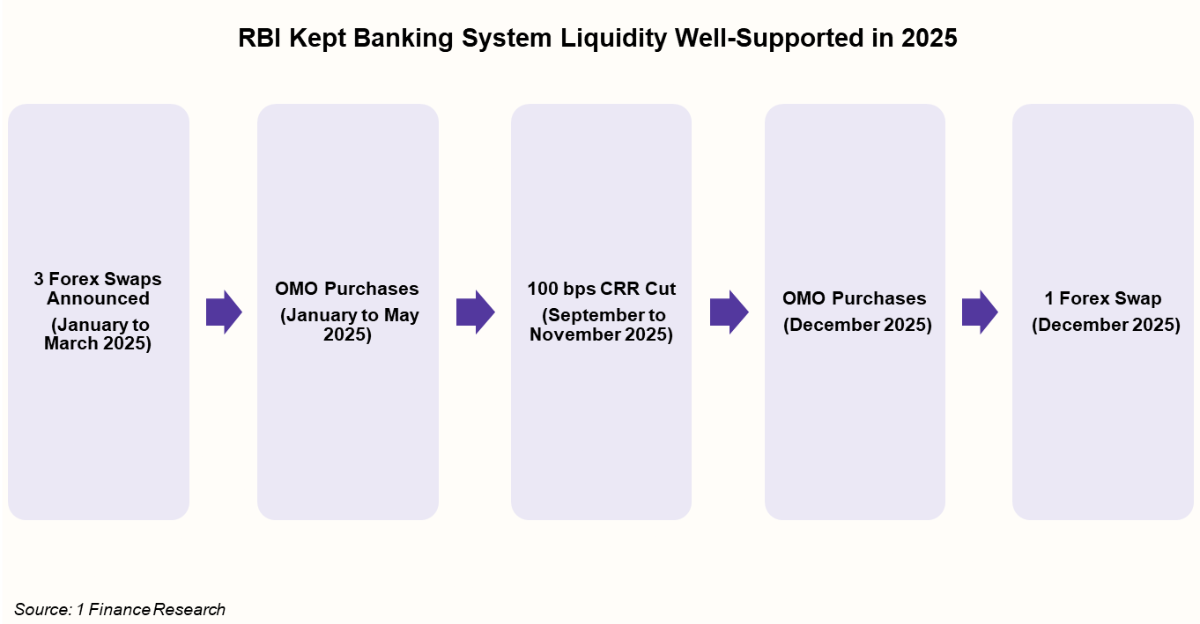

But here is the big question: How has the overall banking system liquidity been in 2025? RBI took massive steps to support bank liquidity. And guess what? Their December policy meeting just announced new moves! They covered rate cuts, bond purchases, and forex swaps.

This edition breaks down every key highlight. We will look at how banks reacted to the previous rate cuts. We also check the impact on bond yields. Finally, we give our take on how all this affects you.

| Key Highlights |

|---|

| → The RBI kept up its strong liquidity support throughout 2025 by using a ton of open market operations, forex swaps, and CRR cuts. |

| → The central bank lowered the repo rate by a total of 125 bps in 2025, including a recent 25 bps cut to try and lower borrowing costs. |

| → Even though the rates were cut and there was plenty of liquidity in 2025, 10-year government bond yields stayed high because of fiscal issues, but short-term yields dropped. |

| → RBI’s latest December moves include ₹1 lakh crore OMO purchases and a $5 billion USD/INR forex swap. This is expected to inject fresh liquidity into the banking system. |

| → We expect more 50-75 bps of rate cuts by the end of 2026, supported by controlled inflation forecasts and subdued nominal growth amid trade deal uncertainties. |

RBI Moves in 2025

It looks like the RBI kept banking system liquidity strong throughout 2025. Their actions included many forex swaps and OMO purchases. There was also an important CRR cut during the year. Not to forget, the 125 bps of total rate cuts. All of these measures supported the banking system's liquidity very well.

| What is the purpose and effect of the RBI conducting an Open Market Operation (OMO) purchase of government securities? Open Market Operations are when the RBI buys government bonds from the banks. This injects cash into the banking system. More cash increases liquidity. Banks then feel more able to lend out funds. All of this helps push along economic growth in the end. What is the mechanism and primary objective when the RBI announces a 'Buy/Sell' USD/INR Foreign Exchange (Forex) Swap? The RBI buys USD from banks (taking USD into its reserves) and sells them a corresponding amount of INR (injecting rupee liquidity) at the spot rate. The banks and the RBI agree to reverse this transaction on a future date (e.g., three months later) at a pre-agreed forward rate. The primary aim is to inject durable rupee liquidity into the banking system. |

Surprisingly, the RBI has nearly broken its OMO purchase record already. The previous record was ₹3,13,295 crore in FY21. Now, total OMO purchases will reach ₹3,66,503 crore this fiscal year. This new peak shows strong efforts to infuse system cash. The RBI is clearly focused on boosting liquidity.

Recommended for you

Readers also explored

The New Phase for Rates, Liquidity and Inflation

Currency in Circulation: How Much Money Exists in the World?

Rate Cuts Unfolded Just As We Expected

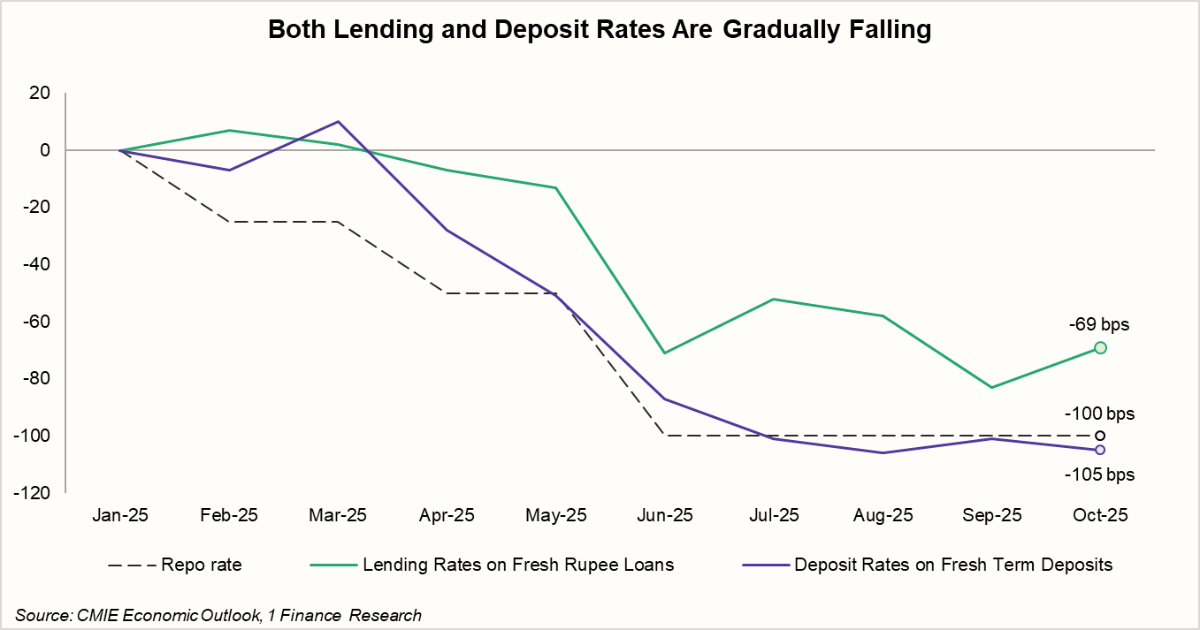

The RBI’s December policy unfolded largely as we expected. RBI cut the repo rate by 25 bps, from 5.50% to 5.25%. From February to June 2025, the repo rate was reduced by a full 100 bps.

Transmission of these cuts is already becoming visible across banking products. Deposit rates have fallen by 105 bps, outpacing the policy rate adjustment. Lending rates on fresh rupee loans have declined by only 69 bps so far. With the latest cuts, more pass-through to lending rates should follow in the coming months.

The RBI's ₹1 Lakh Crore and $5 Billion Rescue

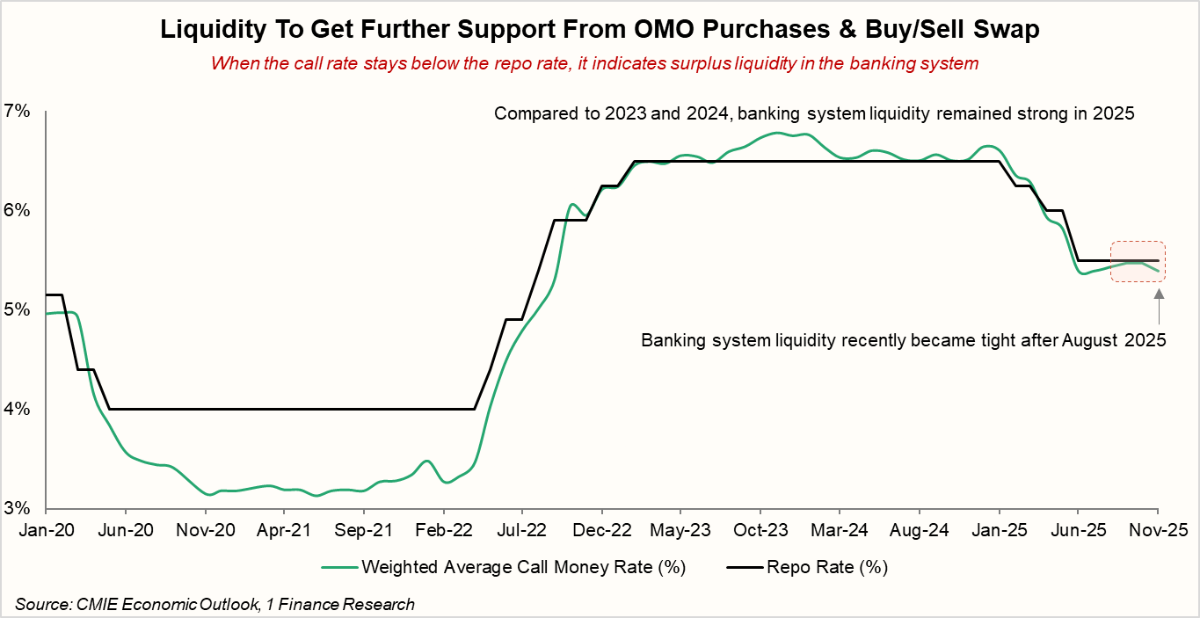

After tight liquidity in 2023 and 2024, banks finally got support in 2025. The weighted average call money rate stayed mostly below the repo rate in 2025. This shows that the banking system had adequate liquidity. But, as the chart below shows, liquidity tightened after August 2025. This tightening raised the need for a liquidity infusion.

The RBI responded well in its December policy meeting. It announced ₹1 lakh crore in Open Market Operations (OMO). The RBI will buy back government bonds from the banks. So, the ₹1 lakh crore OMO will provide banks with more funds. In short, banks will have more liquidity.

Moreover, the RBI also announced a $5 billion Buy/Sell USD/INR swap. The swap is for a three-year term. The RBI will buy $5 billion USD from banks. This gives banks about ₹45,000 crore. The swap will be reversed after three years. This swap adds another ₹45,000 crore of rupee liquidity for banks.

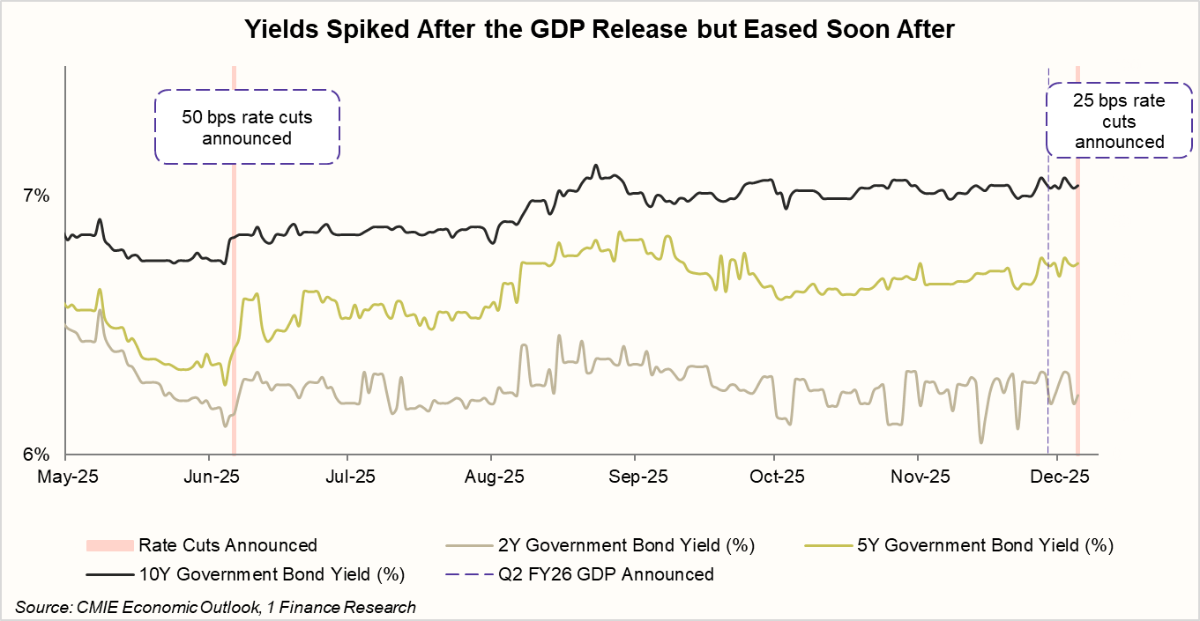

Shorter Maturity Government Bond Yields Expected to Fall

How has 2025 been for government bond yields? Well, the 10-year government bond yield stayed high throughout the year. This occurred despite rate cuts and ample system liquidity. High government borrowing and low demand are the key reasons for this persistence. In contrast, shorter maturity bond yields have fallen significantly. They are down notably from their highs in May 2025.

The 10-year Government bond yields may remain elevated for now. This is because ongoing fiscal pressures are likely to keep longer-term yields high.

The recent move in government bond yields is particularly notable. On November 28th, India's Q2 FY26 Real GDP growth reached 8.2%. This strong performance led to an initial spike in government yields. The market believed that strong growth combined with a weakening rupee could postpone rate cuts. These were some of the factors that contributed to the temporary rise in yields.

However, yields soon began to decline after this initial jump. Why the change? Investors noted that some headwinds still persist in the economy. PMI Manufacturing and IIP showed some early signs of weakness. Moreover, persistent low inflation provided room for policy action. And since the trade deal was still not announced, the possibility of rate cuts remained open.

Understanding the Direct Impact of RBI Decisions

The 25 bps cut should lower company borrowing costs. This drop will likely support more business expansion and spending. It may also reduce home loan interest rates for existing borrowers. Overall, this action is expected to increase consumer spending.

Moreover, the RBI's actions, such as Open Market Operations (OMO) bond purchases and Foreign Exchange (FX) swaps, will inject cash into the banking system. Banks may lower their lending rates. Lower rates and better liquidity should lead to higher credit growth.

Future Outlook

The policy outcome largely met our expectations. Although the RBI kept a neutral stance, we still see room for another 50-75 bps repo rate cut by the end of 2026. This is due to ongoing uncertainty in the India-US trade deal. Also, our two-quarter-ahead inflation and growth expectations support this outlook.

Our forecasts show inflation will remain low. We expect 2.8% in Jan-Mar ’26 and 3.6% in Apr-Jun ’26. Furthermore, the growth narrative appears slightly weak. Nominal GDP is still only at 8.8%. The delayed trade deal is causing negative market sentiment. Rate cuts may happen in the early quarters of 2026 rather than the latter half, as inflation may pick up later.

Bank liquidity should improve from here. There can be further OMO purchases near the FY26 end. This action will provide softer government bond yields. It can also lead to a steeper yield curve. This steepening should benefit short to medium-duration debt funds.