In a historic move on January 27, 2026, India and the European Union (EU) announced the conclusion of their negotiations for a Free Trade Agreement (FTA).

This blog dives into what this deal truly means for India. We break down the biggest opportunities it unlocks. We also examine the key risks that cannot be ignored.

India-EU Trade Growth Over the Years

India and the EU wrapped up FTA negotiations in January 2026. The deal brings together two of the world’s largest economic blocs and marks the most ambitious chapter in India’s trade strategy so far.

But before getting right to the topic, let’s first look at the history of India-EU trade. The relationship between India and the European Economic Community (EEC) has evolved from a 1960s diplomatic partnership to a massive economic engine. By 2024, the EU had solidified its position as one of India's largest trading partners.

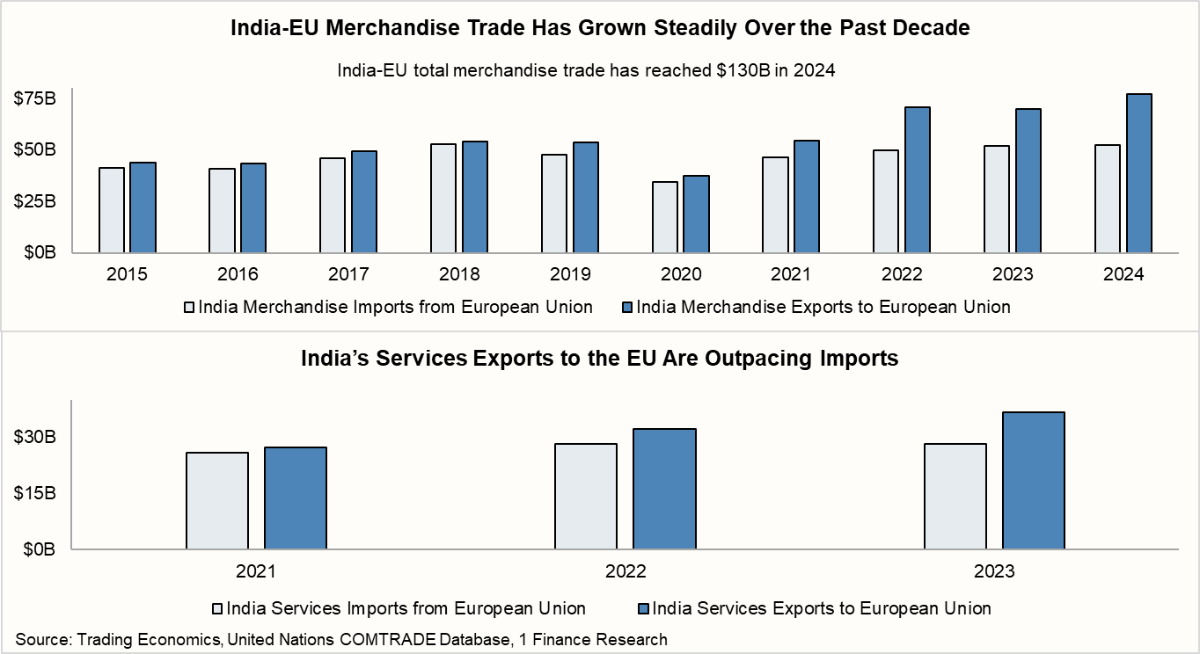

The data reflects this shift clearly. India’s merchandise exports to the EU have risen from $44B in 2015 to $77B in 2024. The relationship has also deepened beyond goods. India exports more services to the EU than it imports, reinforcing its growing role in higher-value trade.

That naturally raises the next question. If we zoom in further, which goods and services does India export the most to the EU?

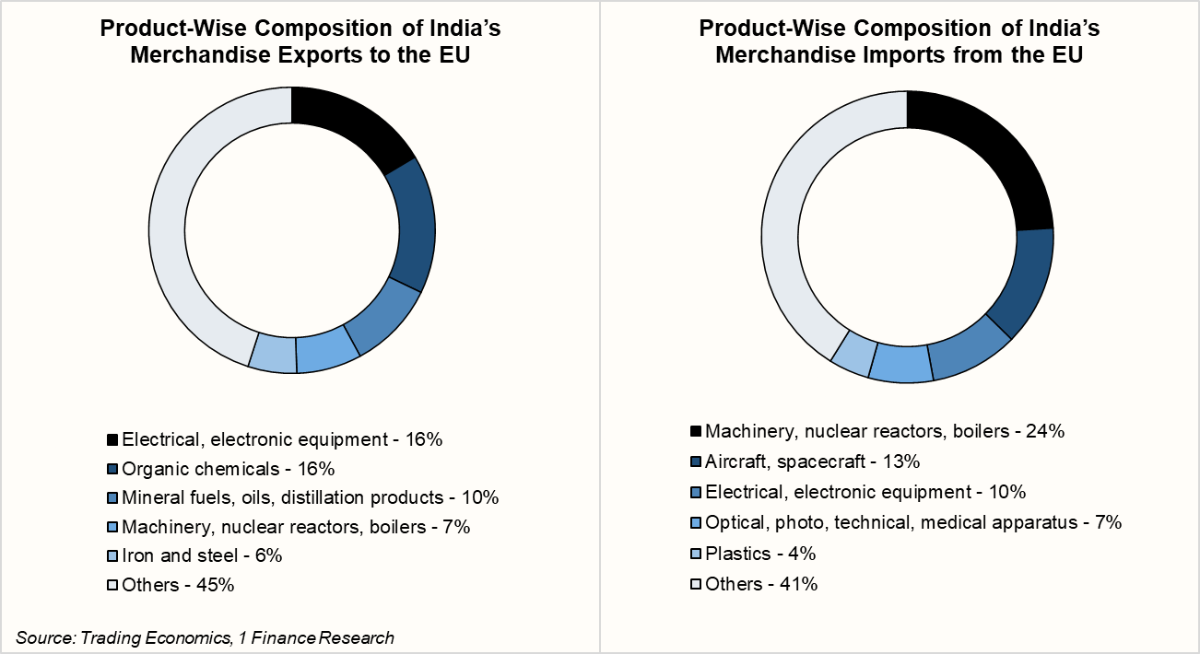

On the merchandise side, exports are led by electronic equipment, organic chemicals, mineral fuels, textiles, and iron and steel. These categories together make up a large share of India’s physical exports to the region. On the other hand, imports are led by machinery, aircraft and electronic equipment.

Recommended for you

Readers also explored

India’s Economy Meets Fresh Roadblocks

India’s Unemployment Rate in 2025

Five Big Ways India Benefits from the New EU Agreement

With the ink now dry on the January 2026 deal, the focus shifts from "what if" to "what’s next." This isn't just a list of tariff cuts; it’s a structural upgrade for the Indian economy.

Here are the five major ways this deal changes the game for India:

| India’s Textile Industry Gets a Long-Awaited Edge | For years, Indian textiles faced 9–12% duties while competitors like Bangladesh had zero-duty access. This FTA wipes those duties to zero immediately. |

| A Big Opportunity for Indian Students | Alongside the trade deal, India and the EU signed a Migration and Mobility Partnership Agreement. The EU offers Indian students uncapped mobility with multi-year, multi-entry visas and up to 3 years of post-study work permits. This positions the EU as a top alternative to the U.S. and UK amid tightening visa rules there. |

| EU’s FDI Presence in India Is Set to Expand Significantly | As of late 2024, the EU's FDI stock in India reached approximately $152 billion, up from $92 billion in 2019. With the 2026 FTA providing a stable “Investment Protection Agreement,” officials expect this stock to increase significantly over the next decade as 6,000+ European firms expand their “Make in India” footprint. |

| Easier Entry for Indian Professionals in the EU | India is already a services superpower. This FTA opens 144 out of 155 sub-sectors, allowing Indian engineers, accountants, and architects to work on EU projects without being treated like “outsiders.” |

| A Big Positive for India’s Pharma Story | The FTA removes the 11% tariff on Indian pharma exports, making them more competitive. This matters even more as access to the U.S. market becomes less predictable. Beyond tariffs, aligning with the EU’s strict quality standards gives Indian medicines a global seal of approval, helping them sell across markets worldwide. |

| 💡Did you know? In the India-EU trade deal, India kept key sensitive areas like dairy, wheat, rice, poultry, and soymeal outside the agreement to protect domestic industries. |

Well, to put numbers to it, the EU has agreed to grant preferential market access for over 99% of India's exports by trade value. For many of India’s most critical labour-intensive sectors, tariffs that once reached as high as 26% now drop to zero the moment the deal comes into effect.

Below is a detailed table showing the earlier tariff rates versus the new post-FTA tariffs for key Indian exports to the EU:

| Sector / Product Category | Earlier Tariff ⟶ New FTA Tariff | Phasing / Notes |

|---|---|---|

| Textiles & Apparel | Up to 12% ⟶ 0% | Immediate elimination |

| Leather & Footwear | Up to 17% ⟶ 0% | Immediate elimination |

| Marine Products (Shrimp/Fish) | Up to 26% ⟶ 0% | 0% for most lines; some phased |

| Gems & Jewellery | Up to 4% ⟶ 0% | Immediate zero duty |

| Chemicals | Up to 12.8% ⟶ 0% | 97.5% of export basket |

| Medical Instruments | Up to 6.7% ⟶ 0% | 99.1% of trade lines |

| Mines & Minerals | Varying rates ⟶ 0% | 100% of tariff lines |

| Engineering Goods | Up to 22% ⟶ 0% | Duty elimination on entry |

| Tea, Coffee & Spices | Varying rates ⟶ 0% | Immediate access |

| Electronics | Up to 14% ⟶ 0% | Under preferential access |

Three Big Ways the EU Benefits From This Deal

The EU's primary win lies in High-Value Manufacturing. Historically, European luxury cars, wines, and precision machinery were hit with "prohibitive" Indian tariffs, some as high as 150%. This FTA effectively dismantles those walls.

| Big Benefit for the EU’s Automobile Industry | European automakers, particularly from Germany, Italy, and Sweden, stand to gain from a phased reduction in India’s historically high import duties on premium vehicles. |

| French and Spanish Wines May Soon Get Easier Access to India | After nearly two decades of deadlock, European wines and spirits will see a phased reduction in duties, finally allowing French and Spanish labels to compete on Indian shelves. |

| EU Gets Front-Row Access to India’s Infrastructure Boom | Germany and Italy, the EU’s industrial engines, now have duty-free access to India’s massive infrastructure and manufacturing boom. |

To secure zero-duty access for textiles and pharma, India had to bring down some of its most guarded trade barriers. The following table highlights the dramatic shift for EU goods entering the Indian market:

| Sector / Product Category | Earlier Tariff ⟶ New FTA Tariff | Phasing / Notes |

|---|---|---|

| Machinery and electrical equipment | Up to 44% ⟶ 0% | Over 90% of lines eliminated on entry |

| Luxury & ICE Vehicles | Up to 110% ⟶ 10% | Phased over 5 years (Quota-based) |

| Electric Vehicles (EVs) | Up to 100% ⟶ 10% | EV tariff cuts delayed for years with protections |

| Wines | Up to 150% ⟶ 20–30% | Phased over 5–10 years |

| Spirits | Up to 150% ⟶ 40% | Immediate cut |

| Pharmaceuticals | 11% ⟶ 0% | Mutual recognition of quality standards |

| Olive Oil & other vegetable oils | 45% ⟶ 0% | Phased over 5 years |

| Processed Foods (e.g., chocolate, pastries, biscuits) | 50% ⟶ 0% | Phased over 5 years |

| Chemicals | 12.8% ⟶ 0% | 59% of lines immediate cut; the remainder are phased over 5–10 years |

| Plastics & Rubber | 6.5% ⟶ 0% | 63% of lines immediate cut; the remainder are phased over 5–10 years |

Risks and "Green Barriers" for India

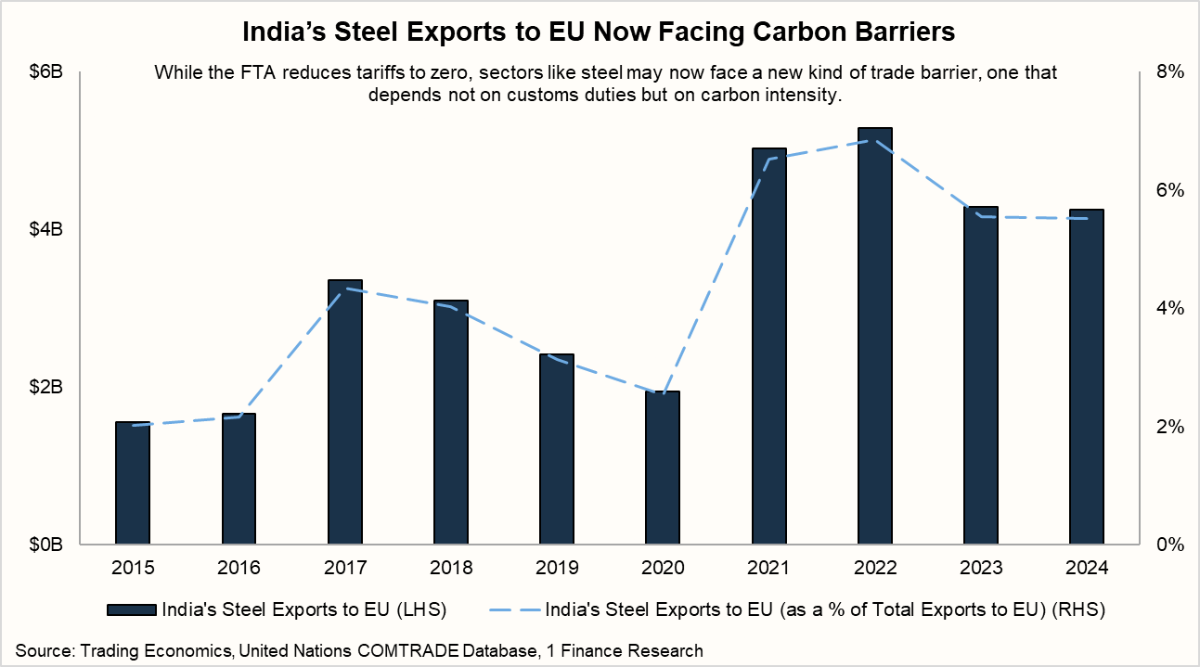

Despite the celebratory headlines of the "Mother of All Deals," the 2026 FTA carries significant structural risks. The most prominent threat isn't a tariff, but a regulation: the Carbon Border Adjustment Mechanism (CBAM).

The CBAM Crisis (The "Carbon Tax")

The EU’s CBAM, which became fully operational in January 2026, acts as a "green tariff." It forces importers to pay a levy on the carbon emissions generated during the production of goods like Steel, Aluminum, Cement, and Fertilizers.

- The Risk: Since India’s power grid is still coal-heavy, Indian steel is significantly more "carbon-intensive" than European steel.

- The Impact: Experts estimate this could act as a 20-35% hidden tax, effectively neutralising the 0% tariff benefit won in the FTA. India’s steel exports to the EU, worth billions, are now at a crossroads: “Go Green or Get Taxed.”

The graph below highlights India’s rising steel exports to the EU, now increasingly vulnerable to carbon tariffs:

The Data Adequacy Wall

The EU’s strict GDPR (General Data Protection Regulation) remains a friction point. India is pushing for "Data Adequacy" status, which would allow seamless data transfer for our IT companies. Without it, Indian tech firms face higher compliance costs and legal hurdles compared to their European counterparts, potentially limiting the "Services" win.

Sustainability & Labour Standards

For the first time, India has agreed to a "Trade and Sustainable Development" (TSD) chapter. This means:

- Labour Laws: The EU can question Indian exports if they appear to violate global labour norms. This includes unsafe working conditions, low wages, excessive hours, child or forced labour, and limits on collective bargaining. Sectors like agriculture, textiles, and leather may face higher scrutiny due to informal employment and weaker documentation.

- Deforestation Regulations: New EU norms require “deforestation-free” sourcing. Products like leather, coffee, and agri-commodities may need farm-level traceability. This could raise compliance costs, especially for small exporters with limited supply-chain visibility.

The "Import Surge" Fear

While Indian textiles gain, our Automobile and Liquor industries are nervous. As tariffs on European cars drop to 10%, domestic manufacturers face direct competition from premium European brands at much more aggressive price points.

Why the U.S. Trade Deal is Still in Limbo

While the India-EU FTA is being hailed as a historic victory, it highlights a glaring void in India's trade architecture: the delayed negotiations with the U.S.

For all the momentum in Brussels, the bridge to Washington remains under construction, and the delays are becoming expensive. As of late January 2026, despite six rounds of high-level talks, a comprehensive India-US trade deal remains "on the horizon" rather than on the table.

The "Surprise" 50% Tariff Wall

The primary roadblock has been the aggressive trade stance of the Trump administration. In 2025, India was expected to be an "early winner" in the new U.S. tariff regime. Instead, India was hit with a cumulative 50% tariff on a vast majority of its merchandise exports.

This 50% figure is broken down into two punishing layers:

- A 25% Reciprocal Duty: Applied in April 2025 as part of the "fair trade" initiative.

- An Additional 25% Penal Tariff: Imposed in August 2025, specifically citing India’s continued purchase of Russian crude oil as a move that "fuels the war machine."

While the EU deal offers an "escape route," the U.S. remains India's largest single-country export destination. The chart below shows how the US continues to account for a significant share of India’s merchandise exports despite rising trade barriers:

Without a deal, Indian exporters in textiles and gems are fighting a losing battle against a 50% price disadvantage.

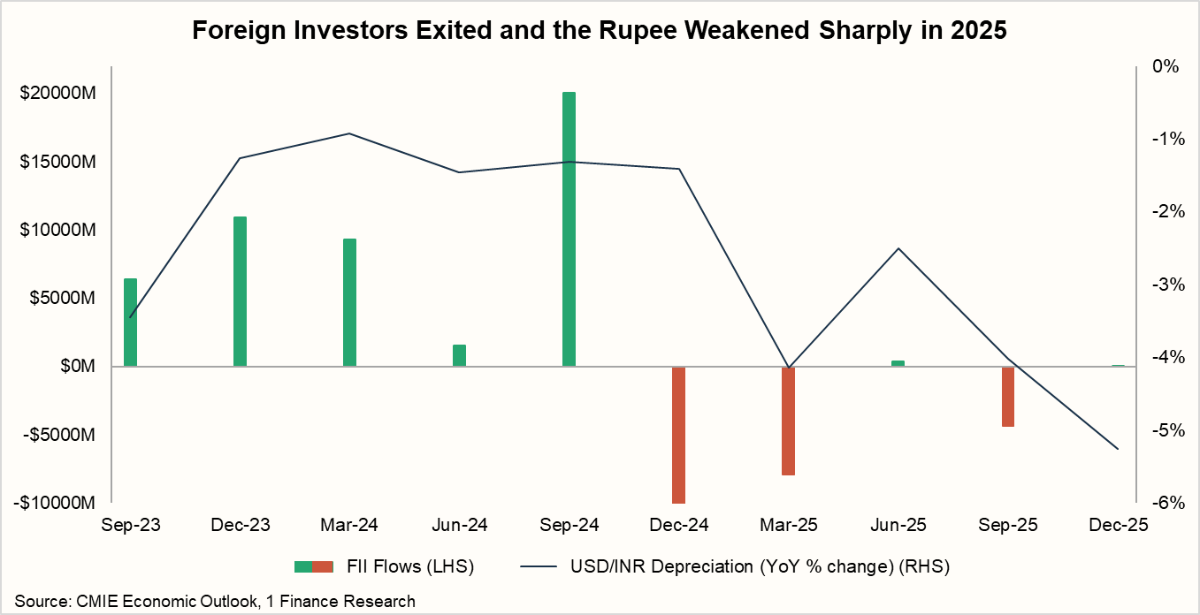

The Great FII Exit and What It Meant

The trade deadlock hasn't just hurt exporters; it has rattled the very foundations of India’s financial markets. The "Tariff Shock" of August 2025 triggered a massive flight of capital.

FII Outflows: Foreign Institutional Investors (FIIs), spooked by the prospect of a prolonged trade war with the U.S., pulled out over $11 billion in 2025.

The Rupee's Slide: These outflows forced the Indian Rupee to record lows. By January 2026, the Rupee has been trading near 91.6 per USD, up from roughly 86.5 a year prior.

Diversifying to the EU is smart, but it is not a total substitute for the American market. The U.S. absorbs nearly 18% of India's total merchandise exports and remains the primary destination for our high-value IT and services sector.

Building Trade Ties at Full Speed

The U.S. trade deadlock and aggressive tariffs were more than a challenge, they were a wake-up call. India realised relying heavily on just a few partners was too risky, too fast.

That urgency has accelerated India’s FTA strategy. While negotiations with the U.S. remain delayed, India has been moving quickly elsewhere, from the Oman deal to the EFTA bloc agreement. The message is clear: diversify or get left behind.

Here’s a snapshot of how India’s trade roadmap has gained momentum in recent years:

| Partner | Agreement Type | Status |

| European Union (EU) | Free Trade Agreement (FTA) | Signed (2026) |

| Oman | Comprehensive Economic Partnership Agreement (CEPA) | Signed (2025) |

| United Kingdom (UK) | Free Trade Agreement (FTA) | Signed (2025) |

| New Zealand | Free Trade Agreement (FTA) | Signed (2025) |

| EFTA (Norway, Switzerland, etc.) | Trade and Economic Partnership Agreement (TEPA) | Signed (2024) |

| Australia | Economic Cooperation and Trade Agreement (ECTA) | Signed (2022) |

| United Arab Emirates (UAE) | Comprehensive Economic Partnership Agreement (CEPA) | Signed (2022) |

| United States (U.S.) | Bilateral Trade Agreement | In progress (Negotiations ongoing) |

| Peru | Trade Agreement | In progress (Expected conclusion early 2026) |

| Saudi Arabia | Free Trade Agreement (FTA) / Comprehensive Economic Partnership Agreement (CEPA) | In progress (Active negotiations) |

| 💡 Did You Know? Not all trade deals are equal. CEPAs are the most business-friendly, covering services, investment, mobility, and intellectual property. Meanwhile, traditional FTAs largely focus on reducing tariffs on goods. The India-EU deal is officially being called an FTA, but in reality, it goes far beyond a typical one. Given the breadth of areas under negotiation, services, investment protection, labour mobility, etc, it effectively looks more like an FTA+ in scope. |

Conclusion

To summarise everything, the India-EU deal comes with a very big opportunity for India. It arrives at a time when global trade is turning more protectionist. That makes diversification not just smart, but necessary. This agreement helps India reduce over-reliance on a few markets. It creates a more balanced export base.

The benefits go beyond goods. Manufacturing gains from lower tariffs and wider market access. Services gain from mobility, recognition, and deeper integration. Indian professionals, students, and businesses get a stronger foothold in the EU. That matters for long-term competitiveness.

Of course, this deal is not risk-free. Steel exports face pressure from carbon rules. Auto makers will see tougher competition. Wines and spirits will test domestic players. But over time, these risks can be offset. Greater access for talent, higher FDI flows, and technology partnerships can raise overall productivity.

But this is not the finish line. India cannot afford to pause here. More trade agreements are essential. Wider partnerships will further reduce external dependence. They will also protect India from sudden geopolitical shocks.