Introduction

The services sector emerged as a major component of India’s economy, serving as an engine for growth, employment, and international competitiveness. Covering a wide range of industries, such as information technology, hotel & tourism, finance, and professional services, the sector contributes over 55% to India's GDP. Given India’s skilled workforce and technological expertise, services exports have grown exponentially accounting for nearly 10% of GDP. Also, it has positioned itself as a global leader in services exports.

According to the Global Trade Outlook and Statistics by the World Trade Organisation (WTO), India ranked as the seventh largest exporter of commercial services globally in 2023, contributing 4.4% of the total, and in digitally delivered services, India holds the fourth position with a 6.0% share.

Trade in services is crucial to promoting economic growth and attracting foreign investments. Rising demand for these services leads to higher growth opportunities in these sectors generating employment and investment opportunities. Also, strong services exports help offset trade deficits in goods, improving India's overall trade balance and strengthening the Balance of Payments (BoP) through foreign exchange earnings.

In this blog we explore the dynamics within India's service trade, focusing on the trends in services exports in recent years, and the nuanced interplay between technological innovations, their contributions to the economy, employment and investments. By carefully analysing these factors and staying attuned to India's evolving services outlook, investors can identify promising opportunities that align with the country's economic trajectory and global market demands.

Brief Overview of India’s Services

Trade Imports and Exports

Unlike the merchandise (goods) trade, India is a net exporter in services trade. Although India imports various commercial and non-commercial services, the value of imports of services has historically been lower than that of exports (See chart below), resulting in a positive trade balance in services. While there has been no major shift in the composition of what we trade in services over the years, both exports and imports of services have grown at a CAGR of 8.5% each in the last decade. In FY2024, the net services exports (exports minus imports) stood at US$162.8 billion, increasing by 13.6% YoY, as services imports contracted by 2.2% ($3.7 bn).

Source: CMIE Economic Outlook, 1 Finance Research

Recommended for you

Readers also explored

Indian Economy’s Q2 Boost and The Upcoming Labour Reforms

India’s Unemployment Rate in 2025

Composition of Services Exports

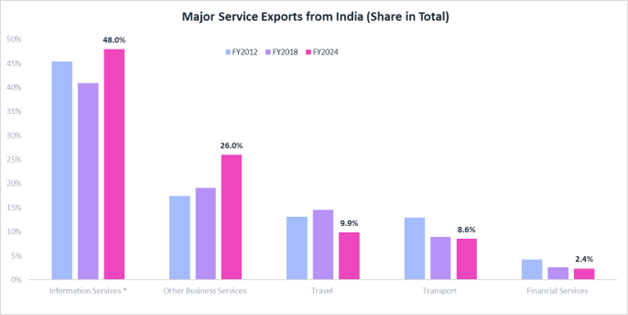

India's service exports have progressed significantly over the years which is evident from their steadily rising share in GDP to around 9.5% in FY2024 from 3.5% in FY2001. As a major player in digitally delivered services, India is leveraging its talented workforce, with English language skills and tech capabilities to expand its global footprint, supported by substantial Foreign Direct Investment (FDI) and a thriving Information Technology and Business Process Management (IT-BPM) industry. Looking at the composition, it is evident that India is leading in exports of IT-BPM services. Information services comprise nearly half of the total services exports (48.0% share in FY2024), followed by ‘other business services’ (26.0%). Technological advancements and the shift towards a digital economy have increased software and business services, while, sectors like travel, transportation, and financial services have faced some challenges due to the COVID-19 pandemic, geopolitical crises and increased competition.

Note: For a detailed composition of services exports see FAQs at the end of the report.

* Includes Telecommunications and Computer Services

Source: CMIE Economic Outlook, 1 Finance Research

Telecommunications, Computers, and Information Services are the major contributors to total services exports. However, exports grew at a moderate level in the last 10 years (8.6% CAGR), and their share in total services improved marginally from 45.4% in FY2012 to 48.0% in FY2024. This slow growth could be due to challenges in adapting to new technological advancements and competition from other developing economies like China. The rise of automation and artificial intelligence poses an additional threat to these services.

Other Business Services contribute nearly 26.0% of services exports, which include consulting, management, and professional services. Exports in these services increased notably over the last ten years with a CAGR of 12.0%. The expansion of business process outsourcing (BPO) and Knowledge Process Outsourcing (KPO) has fueled this growth. The government's focus on ease of doing business and regulatory reforms also boosted this sector.

Transportation Services make up about 10.0% of services exports, as this sector benefits from India's strategic location and growing logistics industry. However, their share in total decreased from 13.0% in FY2012 to 8.6% in FY2024. Transportation services were likely affected by global disruptions and a shift towards digital services. The rise of e-commerce and digital transactions may have reduced the need for physical transportation services, contributing to this decline.

Travel Services share declined notably in FY2021 and FY2022 due to the COVID-19 pandemic, which significantly reduced international travel. However, travel regained the share gradually by FY2023 reaching the pre-pandemic levels and to 9.9% by FY2024.

Financial services saw a decline in their share from 4.2% to 2.4% in the last 10 years. This reduction could be due to increased competition from international financial hubs and the evolution of financial technologies that might have decentralised financial service provision.

Employment Aspects

The analysis of India's services exports and the employment growth rates in various sectors over the past decade reveals a diverse relationship influenced by technological advancements, sector-specific dynamics, and broader economic trends. For instance, the adoption of digital communication technologies and automation in telecommunications has reduced the need for a large workforce, despite substantial increases in services exports.

- Exports in software services grew at a CAGR of 8.6% in the last ten years, other business services reported 12.0% growth. Employment in other business services increased by 8.1%, while the IT-BPM industry as a whole witnessed subdued growth. This shows that technology adoption results in higher productivity, but does not necessarily translate to increased employment.

- In the last decade services trade in travel grew at a CAGR of 6.5%. The travel sector's labour-intensive nature might have resulted in job creation in tourism and hospitality, proportional to the increased demand for travel services. For example, employed persons in ‘Hotels and Restaurants’ increased by a CAGR of 3.8% according to RBI’s KLEMS data in a decade. Similarly, the moderate growth in the transportation sector (5.3% CAGR) resulted in a 2.4% rise in employment in the transport and storage industry.

India's Global Presence in Services Exports

India has established itself as a major player in the global services export market, and in 2022, it ranked second (next to China) among the developing economies, in terms of the value of services ($309.0 billion) sold internationally. In 2023, India contributed 4.4% of the total commercial services globally and 6% to digitally delivered services.

- The US is the largest importer of Indian services (62%), and the demand is particularly for software services, IT-enabled services, and professional services.

- The UK (17%) and the EU (11%) are the other two major importers of services.

India's performance in digitally delivered services has been particularly noteworthy. This growth underscores India's strength in IT and IT-enabled services, which continues to be a major driver of its services exports. With rising global interconnectivity, India has significantly expanded its export of services, which has risen steadily over the years and amounted to $341.1 billion by FY2024 compared to $140.9 billion in FY2012. This growth highlights India's growing influence in the services sector, indicating its importance to the nation's economy. However, the global economic environment and regulatory changes also play a crucial role in shaping the demand for these services, rendering the country vulnerable to global economic fluctuations.

Challenges and Opportunities

Global Economic Challenges

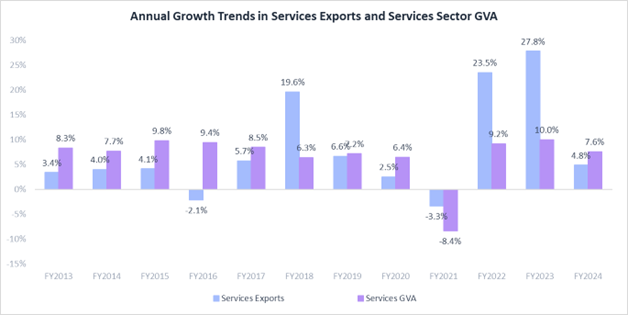

The services economy, unlike other sectors, is prone to global economic challenges. In recent years, global trade has been affected by a series of adverse factors, such as supply and demand shocks related to the COVID-19 pandemic, supply chain disruptions, and the impacts of increased trade policy uncertainty following geopolitical rivalries. Services trade too was impacted by these factors, but displayed remarkable resilience and the value of services exports in dollar terms has grown at double-digit levels in FY2022 and FY2023. However, in FY2024, the growth rate slowed down to 4.8%, potentially due to a global slowdown leading to subdued demand for professional services and a decline in transport services. Economic stability in major markets, such as the US and Europe, influences the volume of services trade. For instance, slower economic growth in these regions can dampen demand for services, including IT and BPO, which are key components of India's exports.

Exchange Rate Fluctuations

Exchange rates significantly impact the competitiveness of services exports. A weaker Indian rupee makes Indian services more affordable for foreign buyers, boosting demand. Conversely, a stronger rupee can make exports more expensive and less competitive on the global market.

Geopolitical Tensions & Rising Protectionism

Geopolitical issues, such as the Russia-Ukrain war, and conflict in the Middle East, have disrupted trade routes and increased uncertainty in international trade in recent years. Such tensions can lead to trade fragmentation, where countries prefer to trade within aligned geopolitical blocs, imposing protectionist policies. Such decisions potentially affect the global trade dynamics. Measures such as tariffs, trade barriers or sanctions, and restrictive regulations can hinder the free flow of services, impacting countries like India that have significant external trade dependency.

Technological Advancements and Digitalisation

The rapid advancement in technology and the increasing digitalisation of services have created new trade opportunities. India's strong IT sector has benefited from this trend, with significant growth in digitally delivered services such as software, cloud computing, and cybersecurity. However, training sufficient technology graduates to meet the demands of the job markets has often been cited as a challenge.

Market Diversification

Diversifying export markets helps mitigate risks associated with dependence on a few countries. India's strategy to expand its presence in new markets, including emerging economies in Asia and Africa, has helped sustain its export growth despite global uncertainties.

Government Policies and Trade Agreements

Supportive government policies, including trade agreements and incentives, play a vital role in boosting exports. India's efforts to negotiate favourable trade deals and provide incentives for the services sector have contributed to its competitive position in the global market.

To enhance the competitiveness of Indian service exports in global markets, the government launched the Service Exports from India Scheme (SEIS) in April 2015 under the Foreign Trade Policy 2015-2020. SEIS replaced the Served From India Scheme (SFIS) to boost the export of notified services from India by providing financial incentives. The scheme grants Duty Credit Scrips, calculated as a percentage of net foreign exchange earned, to eligible service providers. The Duty Credit Scrips received can be used to pay various duties, including Basic Customs Duty, and are transferable, allowing service providers flexibility in their use. The rate of reward varies, with most eligible services receiving a 5% reward on net foreign exchange earnings. Ineligible sectors include financial services, foreign currency loans, and foreign equity issuances, among others.

Conclusion

The services sector in India has witnessed remarkable growth and transformation over the years. As a global leader in IT and outsourcing, India has capitalised on its technological excellence to boost its exports, while sectors such as tourism and business services are progressing rapidly. Despite challenges such as global economic slowdowns and increased competition, the country's services exports have shown resilience, contributing significantly to BoP's position through foreign exchange earnings as well as generating employment opportunities. The technological advancements and employment dynamics present both opportunities and challenges, highlighting the need for strategic policy interventions for balanced growth. Government initiatives such as the SEIS play a crucial role in enhancing the competitiveness of Indian services in the global market. Amid the rapidly changing global landscape, the focus on innovation, skill development, and strategic investments will be crucial in maintaining a competitive edge and driving sustainable growth.

With strategic government initiatives designed to enhance export competitiveness, India is poised to maintain its status as a dominant player in the international services market, steering the global economic challenges.

***********************

FAQ

What are the different items /services covered under various categories of services exports?

The Balance of Payments (BOP) statements encompass various items and services under different categories:

- Computer and information services cover IT-related services such as hardware and software consultancy and implementation, database and data processing charges, repair and maintenance of computers and software, news agency services, subscriptions to newspapers and periodicals, and off-site software exports.

- Other business services include merchanting services, trade-related commissions on exports and imports, operational leasing services, legal services, accounting, auditing, bookkeeping, tax consulting, business and management consultancy, public relations, advertising, trade fairs, market research, public opinion polling, research and development, architectural, engineering, and technical services. It also covers agricultural, mining, and on-site processing services, inward remittance for the maintenance of offices in India, distribution services, environmental services, and other miscellaneous services.

- Transportation includes receipts of surplus freight or passenger fares by Indian shipping companies and airlines operating abroad, operating expenses of foreign shipping and airline companies in India, and purchases for operational leasing with crew. It also covers other transportation services such as stevedoring, demurrage, and port handling charges.

- The travel category covers purchases for travel such as foreign traveller’s cheques and currency notes by hotels, hospitals, emporiums, educational institutions, and amounts received by TT/SWIFT transfers or debits to Non-Resident accounts. It also includes foreign currency surrendered by returning Indian tourists.

- Communication services include receipts from postal services, courier services, telecommunication services, and satellite services.

- Construction services include receipts for the cost of construction projects in India.

- Insurance services cover receipts from life insurance premiums, freight insurance related to the import and export of goods, other general insurance premiums, reinsurance premiums, auxiliary services such as insurance commissions, and settlement of claims.

- Financial services include banking and financial activities such as bank charges, collection charges, LC charges, cancellation of forward contracts, commissions on financial leasing, brokerage, underwriting commissions, and charges on operations, regulatory fees, custodial services, and depository services.

- Royalties and license fees include receipts from intellectual property and licensing arrangements, covering patents, copyrights, trademarks, industrial processes, franchises, and the use of produced originals or prototypes like manuscripts and films.

- Personal, cultural, and recreational services include audio-visual services like motion picture production, rentals, fees for actors, directors, producers, and distribution rights.

- It also covers services related to museums, libraries, archives, sporting activities, and correspondence courses from Indian universities and institutes.

- Government services not included elsewhere (G.n.i.e) cover the maintenance of foreign embassies in India.