It has been forty-five years since the Hunt brothers made their infamous play to corner the silver market — a saga that swung from ambition to excess, from euphoria to collapse. What unfolded in 1980 remains one of the most dramatic episodes in commodity history, when two Texas oil magnates tried to buy up nearly a third of the world’s silver supply. Prices soared to $50 an ounce before crashing spectacularly on the day that became known as Silver Thursday.

Four decades later, silver has returned to those dizzying levels, but this time, the story feels very different.

No shadowy speculators are driving this rally, no feverish buying on borrowed money. The silver that’s now touching $50 an ounce isn’t a product of manipulation; it’s the result of deep, structural shifts that have been quietly reshaping the market for years.

Supply has tightened, technology has found new uses for the metal, and investors are once again treating silver as a serious store of value in a world awash with fiscal and monetary uncertainty.

Silver Reclaims Its Role

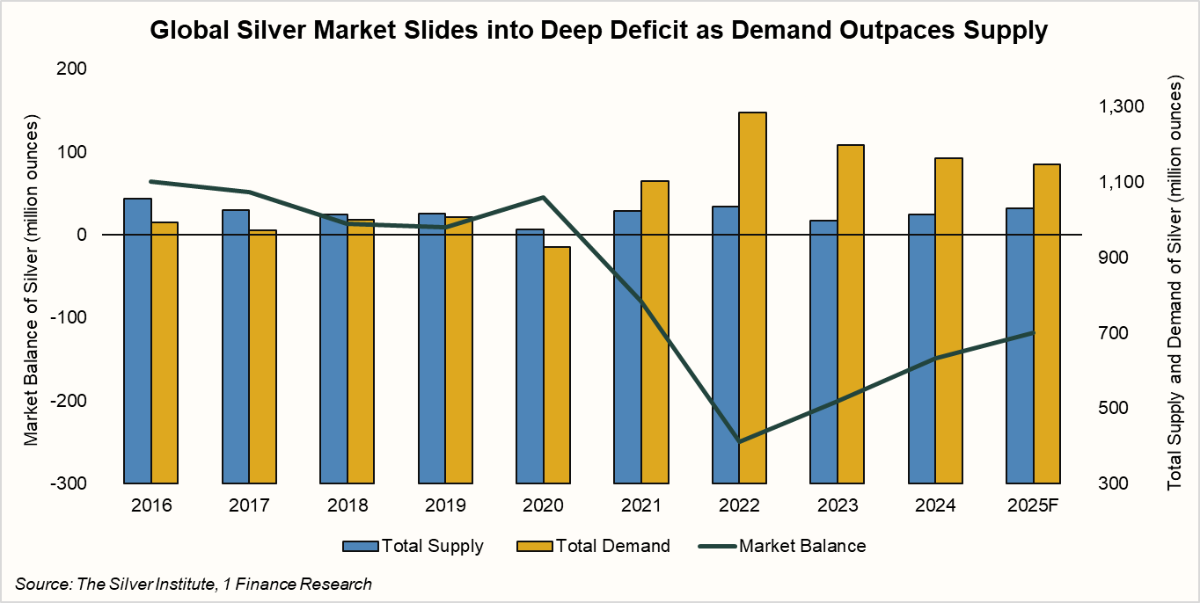

The World Silver Survey 2025 reveals that the market has now run a structural deficit for five consecutive years, with global demand exceeding supply by nearly 150 million ounces in 2024. Mine production has barely moved, recycling remains flat, and inventories have been steadily drawn down.

Unlike 1980, when speculative leverage drove the rally, today’s strength rests on real-world use. India, China, and the U.S. account for over half of fabrication demand, spanning solar panels, electric vehicles, medical devices, and electronics.

Silver Becomes the Metal of the Green Age

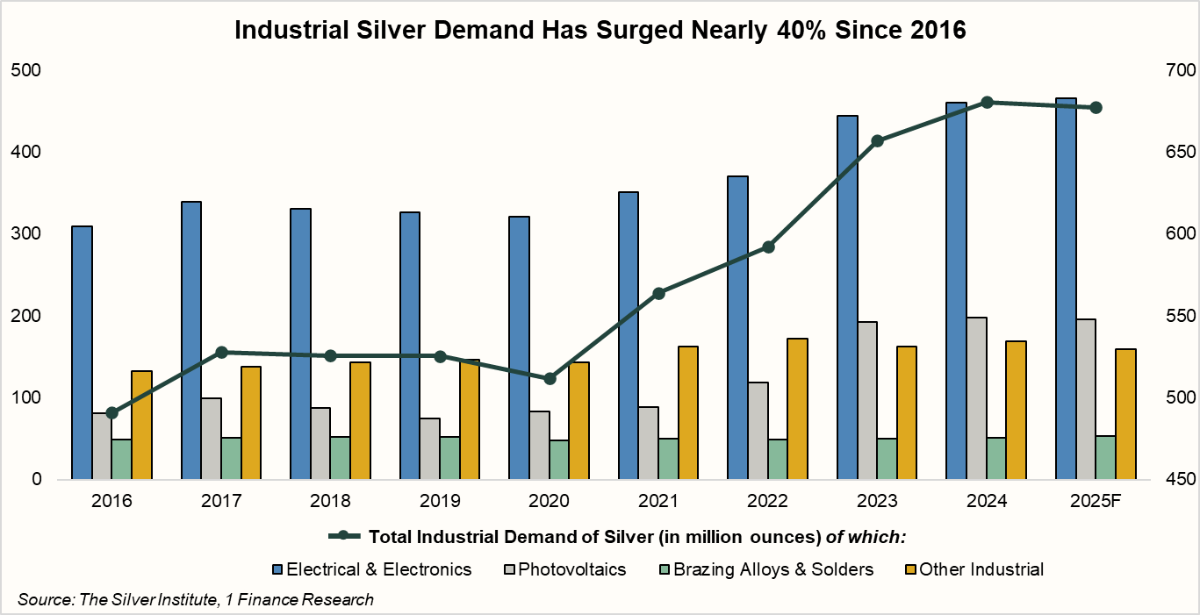

Silver’s dual identity, as a precious metal and industrial raw material, is redefining its place in the global economy. Industrial demand hit a record 680 million ounces in 2024 (58.5% of total demand), driven largely by solar power, where every gigawatt of capacity needs 80-100 kilograms of silver.

With India targeting 500 GW of renewables by 2030, demand from solar, EVs, and 5G technologies is set to soar. The old speculative premium is giving way to a green premium, making silver’s demand story structural rather than cyclical.

Recommended for you

Readers also explored

Gold Outlook in India for FY2026

Currency in Circulation: How Much Money Exists in the World?

The Gold-Silver Ratio

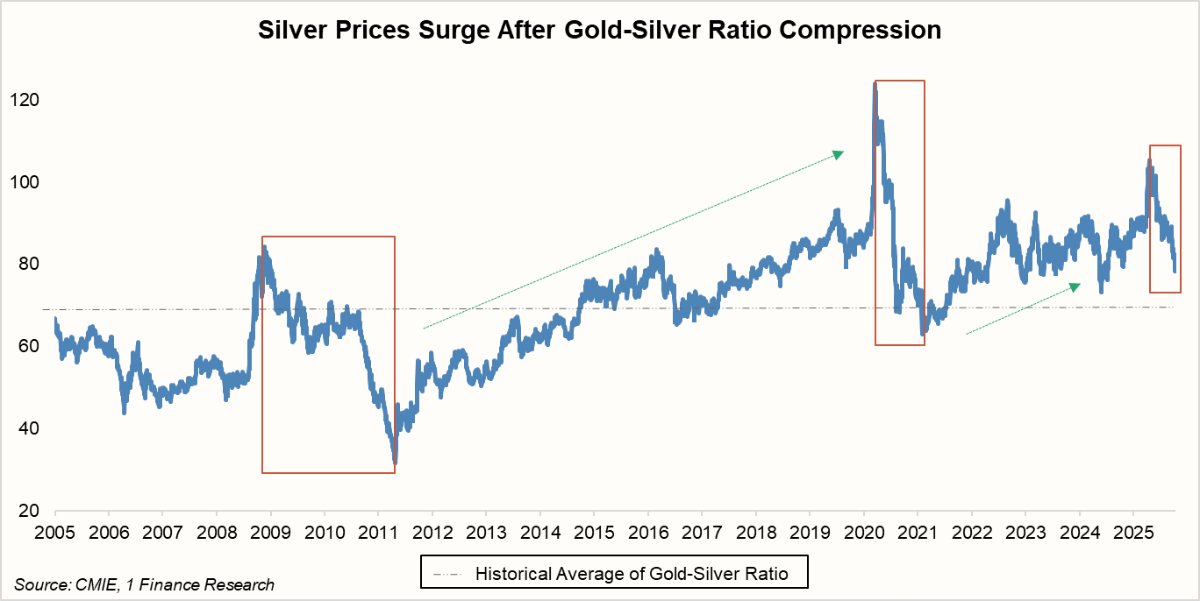

The gold-silver ratio—how much silver you need to buy an ounce of gold—is still running high, hovering between 80 and 85, well above its historic norm of 60-65. Every time this gap has narrowed in the past, think 2009-2011, or 2019-2020, silver went on an impressive run, leaving gold behind. A high ratio usually means silver is trading cheap, and as the spread narrows, it often delivers outsized returns in the next leg of the market cycle.

Silver & The Dollar’s Changing Relationship

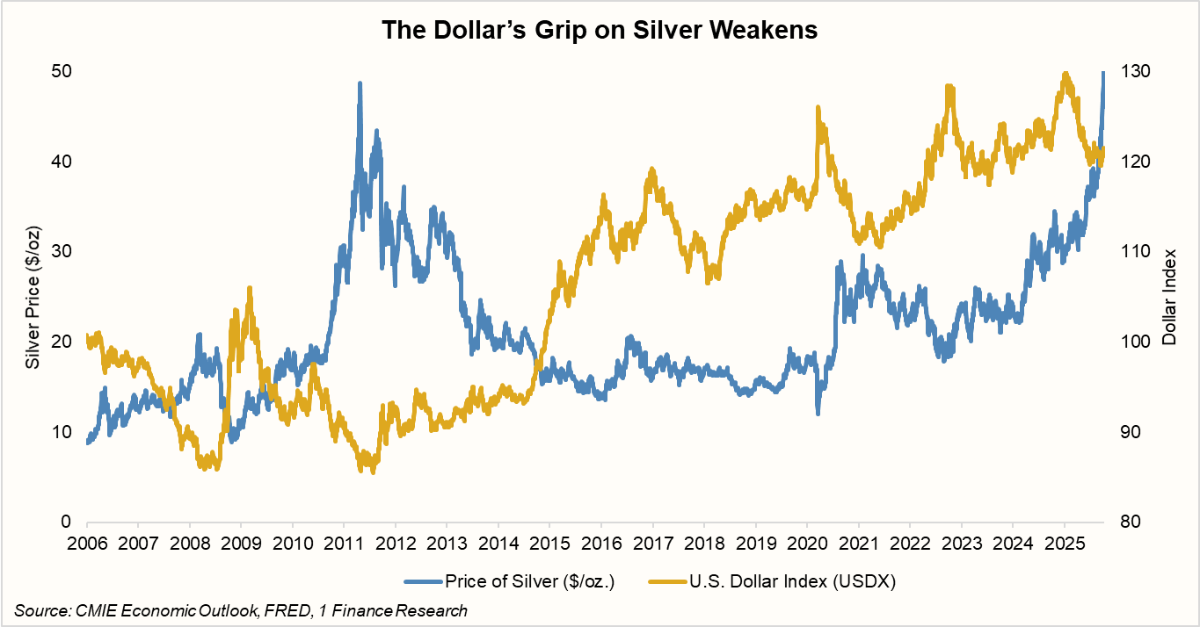

For many years, silver prices moved opposite to the U.S. dollar’s strength. But recently, that connection has loosened. As central banks diversify their reserves and investors seek protection from America’s growing deficits, silver is reclaiming a role as a monetary asset: more affordable and accessible than gold.

The Indian Opportunity as Silver Turns Financial

Silver has quietly evolved from a traditional, physical asset into a mainstream financial product in India. The launch of Silver ETFs in 2022 opened new doors for investors seeking exposure without the hassles of storage or purity concerns.

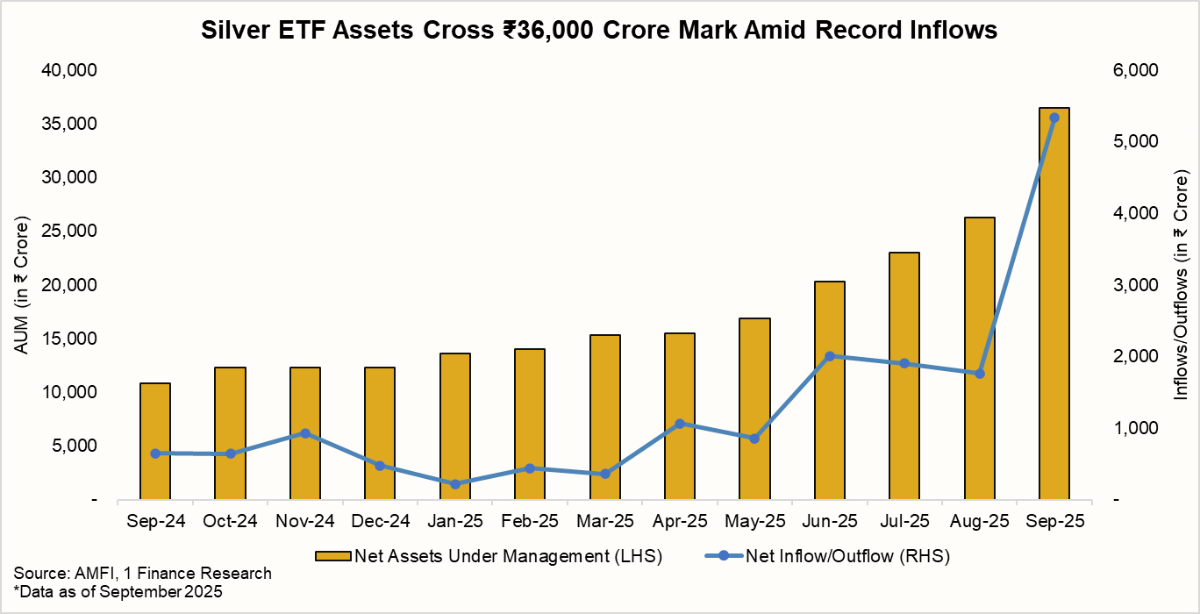

Since then, the response has been remarkable. Silver ETF assets have soared past ₹36,000 crore by September 2025, up from about ₹10,000 crore a year earlier, as per AMFI data- a 250% rise in just twelve months. Inflows have hit record highs, outpacing even gold ETFs, signalling a shift in investor preference toward silver as both an inflation hedge and a play on industrial growth.

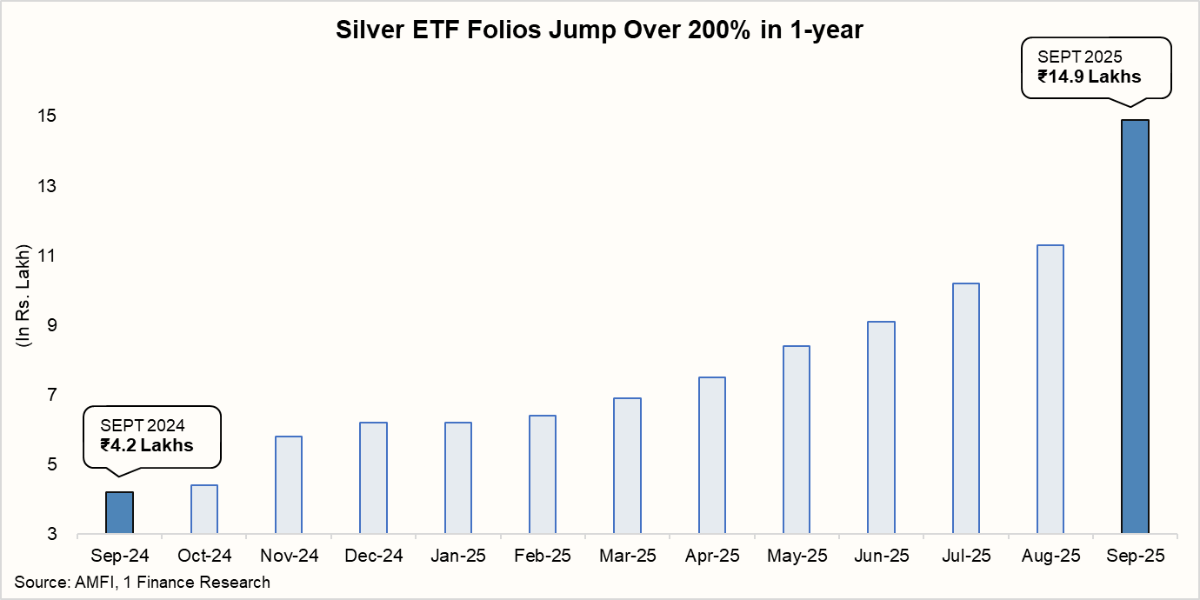

Silver ETFs are not just seeing record inflows; they’re also witnessing a surge in the number of investor folios. Silver ETF folios have jumped dramatically since their launch. As of September 2025, there are now over 14 lakh investor folios across all Indian silver ETFs. This marks a more than 200% growth in folios in just one year, underscoring rising retail and HNI interest even as prices and premiums surge.

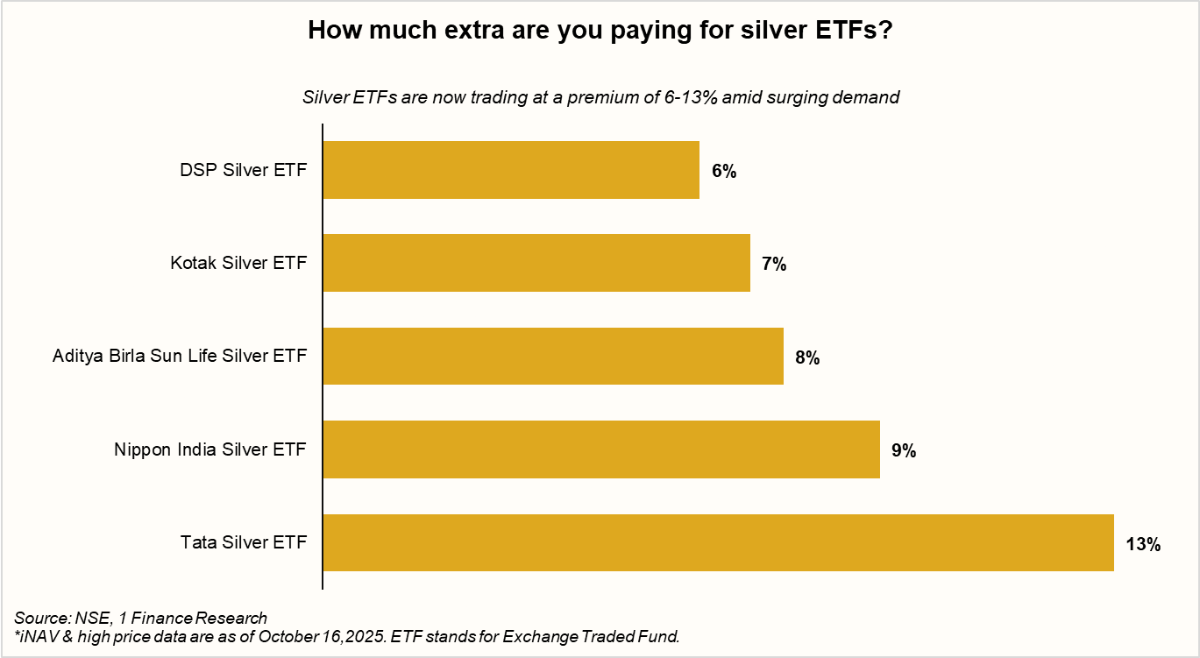

What’s more telling is how ETF prices now trade at premiums of 6-13% over their intrinsic NAVs: a rare sign of demand running well ahead of supply. It reflects not just enthusiasm but also a scarcity of physical silver in the domestic market.

Silver is no longer a niche trade. It’s becoming a long-term portfolio asset for Indian investors seeking both value protection and growth participation.

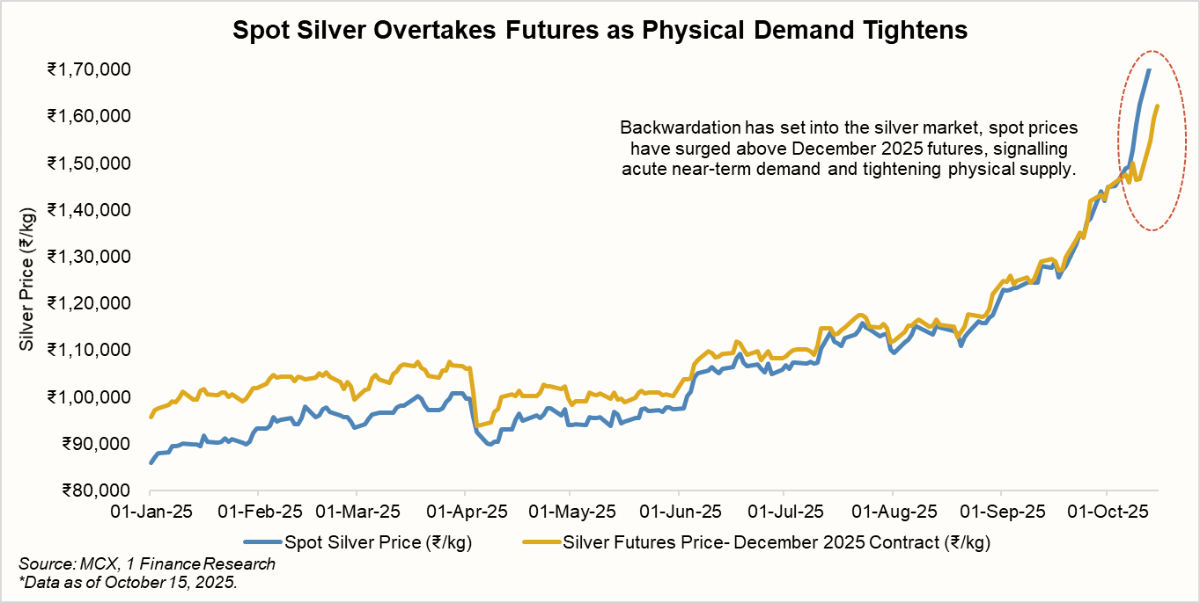

When The Future Costs Less Than Today

A rare twist has surfaced in silver markets: backwardation. Spot prices have climbed above December 2025 futures, a signal that immediate demand is outpacing available supply. The spread between spot and future prices, which had been narrowing for months, has now flipped, a telling shift visible in the chart below. In plain terms, refiners and industrial users are paying extra to secure silver now, while investors sit tight.

The Road Ahead for Silver

As silver revisits levels last seen in the 1980s, this rally feels far more grounded than the Hunt brothers’ speculative mania. Tight supply, surging industrial use, and deepening investor participation suggest the uptrend is structural, not fleeting. But with silver ETFs trading at steep premiums and physical prices inflated by taxes and duties, investors now face a different challenge: how to participate without overpaying for enthusiasm.

ETF Strategy

Indian silver ETFs are currently trading at 6-13% premiums to their intrinsic value, a clear sign that demand has outrun supply. Several fund houses, including SBI, UTI, and Kotak, have even paused lump sum inflows to cool overheating.

✅ Systematic or staggered investments via SIPs can help average costs without chasing inflated premiums.

It’s prudent to accumulate on pullbacks or when NAV premiums narrow toward 2-4%, a level historically seen as sustainable.

Physical Silver View

Physical buyers face similar realities. Domestic prices have shot past ₹1,85,000/kg, lifted not just by global prices but also by rupee weakness, import levies, and GST. The net effective costs can be higher by 15-20% over global prices once import duty and GST are factored in.

✅ For long-term portfolios, however, silver still holds merit as an inflation hedge and industrial asset, ideally capped at 5-10% of portfolio allocation and accumulated slowly rather than in single-ticket buys.

With spot silver prices trading higher than forward contracts, the backwardation reflects acute near-term scarcity in physical supply and immediate domestic buying. It’s a sign of strong fundamentals, but also a reminder: when the future costs less than today, markets are telling you something important about scarcity, and the risks that can follow when that scarcity begins to ease.

For investors, the task now is not to chase momentum but to steer it wisely, balancing conviction with discipline in a market that’s finally turning silver into a mainstream strategic asset.