As macro conditions evolve, gold is once again drawing attention as a strategic hedge. A confluence of factors—ranging from persistent central bank accumulation to a weakening U.S. dollar and renewed geopolitical tensions- is reshaping the outlook for gold in India. While gold may not always lead performance charts, its track record during uncertain and rate-cutting cycles reinforces its value as a portfolio diversifier and safe-haven asset. Here are the key developments shaping the outlook for gold this financial year:

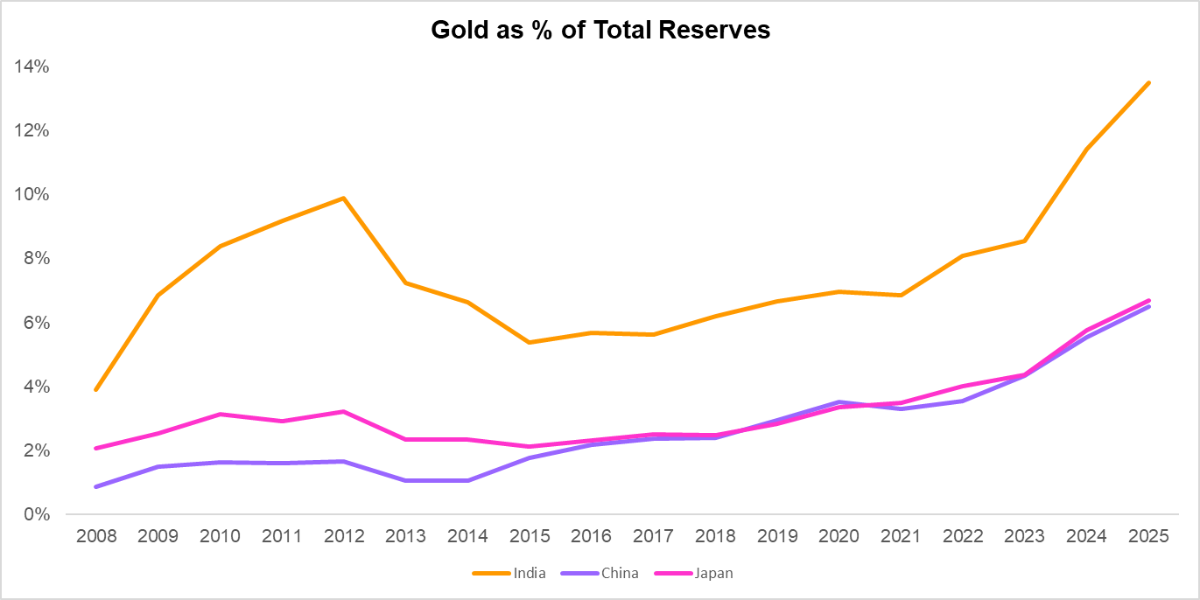

1. Central Banks are Increasing their Gold Reserves

Central banks globally continue to diversify away from the U.S. dollar amid mounting geopolitical and economic uncertainty.

India is at the forefront—as of March 2025, gold accounts for nearly 14% (879.6 tonnes) of India’s total foreign reserves ($653 billion)—a sharp rise from just 4% in 2008, making it one of Asia’s most aggressive accumulators.

2. Gold to Benefit from Further Rate Cuts

Gold has historically outperformed during the early stages of rate-cutting cycles, as lower interest rates reduce the opportunity cost of holding non-yielding assets.

In line with our Macro Outlook 2025, where we had anticipated that gold would benefit from an easing interest rate environment, the trend is already playing out. Since the first rate cut in February 2025, gold has already delivered a return of 12% (as of 20 May 2025), despite only a 50 bps repo rate cut.

With additional easing of 50-75 bps expected in FY26, gold is poised to continue benefiting from a softening rate environment.

| Date of First Rate Cut | Reason | Repo Rate | 1Y Return | ||

| Starting | 1Y Later | Gold | Nifty 500 | ||

| 20-Oct-08 | Global Financial Crisis | 9.00% | 4.75% | 11% | 51% |

| 17-Apr-12 | Private Capex Slowdown | 8.50% | 7.50% | 12% | 5% |

| 14-Jan-15 | Export Weakness | 8.00% | 6.75% | -4% | -6% |

| 07-Feb-19 | Growth Deceleration | 6.50% | 5.15% | 23% | 9% |

| 26-Mar-20 | COVID-19 Pandemic | 5.15% | 4.00% | 51% | 72% |

| 07-Feb-25 | Easing Inflation | 6.50% | 6% (as of April 2025) | 12%* | 5%* |

Source: ACE MF, NSE, 1 Finance Research (Gold prices as of Gold London AMR (INR))

Recommended for you

Readers also explored

India's Brightening Horizon: Staying Invested for Sustainable Growth

World GDP Breakdown 2025: Who Powers the Global Economy?

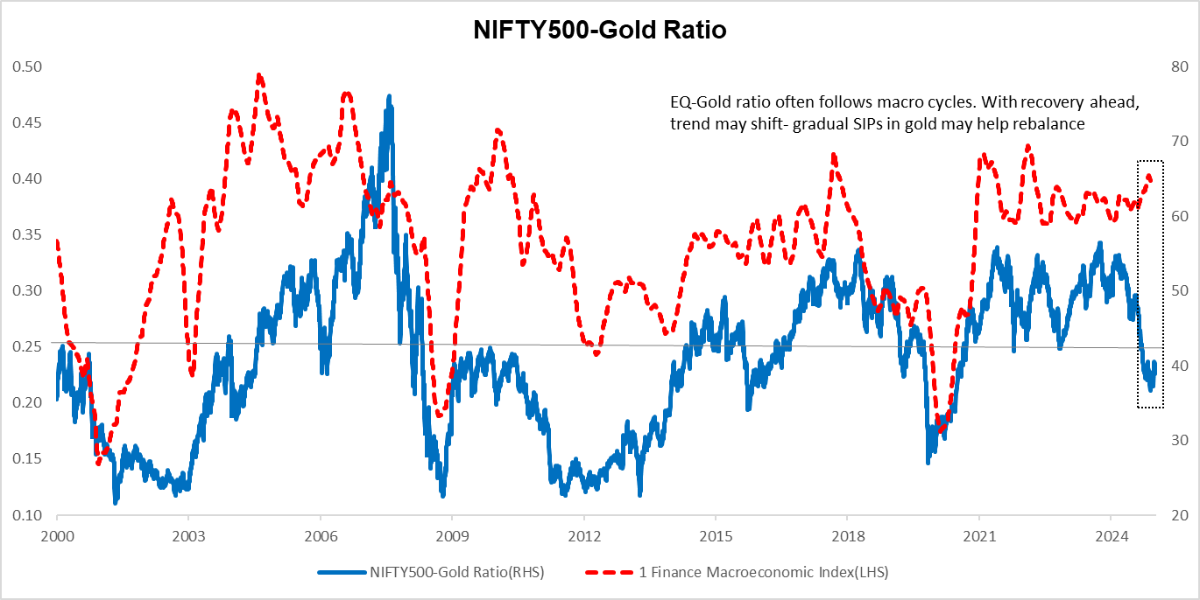

3. Is the Equity-Gold Ratio Signalling a Turning Point?

The Equity-Gold Ratio compares the performance of equities (NIFTY 500) to gold. A rising ratio signals stronger equity performance, while a falling ratio implies rising risk aversion and stronger gold performance.

Historically, during macroeconomic stress (e.g., the 2008 Global Financial Crisis or the 2020 COVID shock), the ratio has declined sharply, signalling gold’s safe-haven appeal.

In 2025, the Equity-Gold Ratio has trended downward, reflecting gold’s stronger performance relative to the Indian equity market. Meanwhile, the 1 Finance Macroeconomic Index (1FMI) is showing signs of stabilisation and an early macro recovery. If this recovery sustains, the ratio may reverse course, signalling a potential rebound in equity performance relative to gold. However, the ratio remains above its historical lows, suggesting that gold may continue to have upside potential if macroeconomic uncertainty lingers.

However, with global and domestic uncertainties still simmering, it may be premature to pivot too aggressively. A more balanced strategy would be to gradually reduce overexposure to gold, or initiate small SIPs in gold ETFs or sovereign gold bonds rather than making large allocations at once. This provides portfolio flexibility while preserving gold’s diversification benefits.

4. Our Outlook on Gold for FY26

| Key Factor | Current Scenario (May 2025) | Impact on Gold |

| Central Bank Demand | Global central banks, especially India, China, and emerging markets, continue accumulating gold. | ⬆ Positive |

| USD Outlook | Weaker USD as Fed edges toward rate cuts; de-dollarisation trend gaining pace. | ⬆ Positive |

| Inflation | While headline inflation is cooling, long-term inflation hedging remains relevant. | ↔ Neutral |

| Geopolitical Risks | Rising global uncertainties — including the ongoing Russia-Ukraine war, US-China tensions and instability in the Middle East. | ⬆ Positive |

| Bond Yields | Real interest rates remain low as central banks globally maintain a cautious easing stance, enhancing gold’s appeal as a non-yielding asset. | ⬆ Positive |

| Indian Gold Demand | Retail and festive demand rebounded in Q1 2025; imports were steady despite high prices. | ↔ Neutral |

As we head into FY26, gold remains a compelling asset for portfolio stability. Its historical performance during easing cycles, the strategic buildup by central banks, and its outperformance relative to equities during stress periods underscore its relevance.

However, given early signs of macro recovery, a balanced approach is essential.

- Maintain modest exposure to gold as a hedge.

- Use SIPs in gold ETFs instead of large one-time allocations.

Gold may not always glitter at the top of performance charts, but its role in enhancing risk-adjusted returns and acting as a shock absorber during uncertain times remains crucial.