As we head into 2026, the world today deals with many risks that are beginning to overlap. Trade tensions among large nations are still lingering, major elections across economies hold the potential to shift policy directions, and the two ongoing wars continue to influence energy prices and supply chains. At the same time, central banks are likely to follow different policy paths, creating both openings and uncertainties for the year ahead.

2026 won’t be defined by one single shock, but by how these interconnected risks evolve. This edition breaks down which risks matter and why they matter.

| Section | Key Takeaways |

|---|---|

| The Fragile Equilibrium in US-China Trade Relations | US-China trade relations will remain fragile, and escalating tariffs will also impact supply chains, leading to higher global costs and persistent market risks. |

| The Geopolitical Fault Lines of Ukraine and the Middle East Conflicts | Ongoing conflicts in Ukraine and the Middle East might keep energy prices unstable. It will also elevate inflation and geopolitical risks across global markets. |

| Signals From The Central Bank In 2026 | Global central bank policies are likely to differ from the synchronised easing seen in 2025, creating volatility in exchange rates and cross-border capital flows. |

| The Elections That Will Shape Global Markets In 2026 | Key elections across the key economies will create policy unpredictability, leading to shifts in trade policies, fiscal priorities and commodity prices. |

| US Debt Ceiling and Fiscal Sustainability Risks | An increase in the US government debt and fiscal deficit increases borrowing costs for the government, interest rates worldwide and capital flows to developing countries. |

1. The Fragile Equilibrium in US-China Trade Relations

Trade tensions between the US and China have been one of the biggest global risks of 2025 and remain a major concern heading into 2026. They have shaped prices, disrupted supply chains, and influenced business decisions across the world. The roots of the conflict go far beyond tariffs.

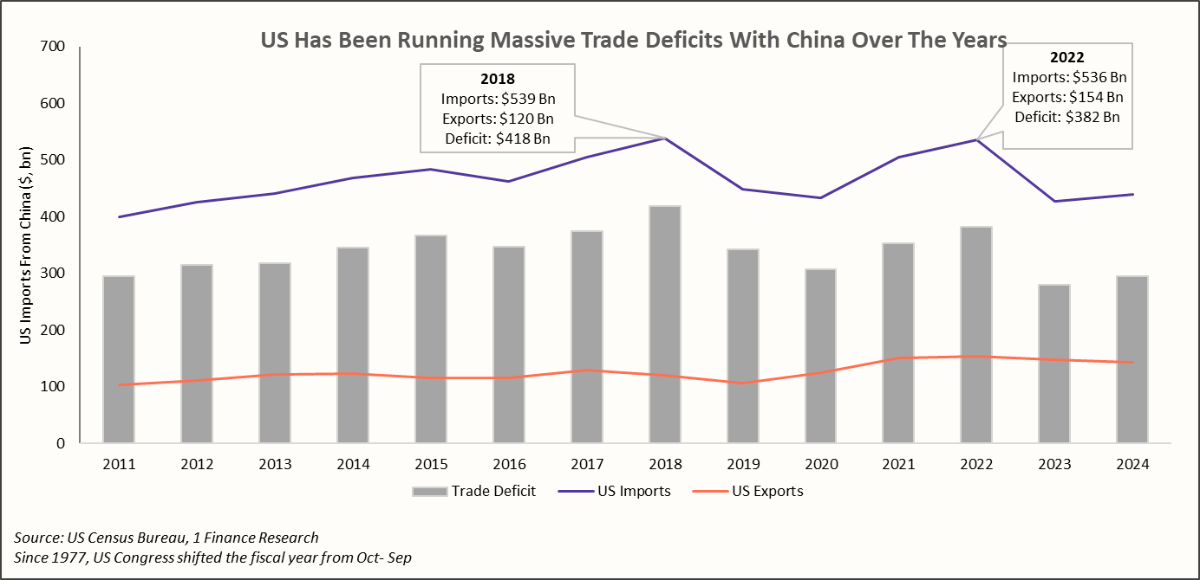

A central driver of these tariffs is the large trade deficit between the two nations. The US imports more than three times as much from China as it exports, making China the single largest contributor to the US trade deficit. This includes electronics, machinery, pharmaceuticals, batteries, and a wide range of consumer goods, central to daily supply chains.

Another major driver is the deeper, long-term race for technological dominance. The US leads in semiconductor design and advanced AI, while China controls over 85% of global rare-earth processing and has emerged as a dominant player in batteries and electric vehicles.

As tensions increased, both sides raised tariffs sharply. US tariffs on Chinese imports reached around 125% at one point. A temporary pause came in Oct-25, when both countries agreed to cap tariffs at 10% until Nov-26. But this remains only a temporary truce. Disputes over chips, EVs, AI, cybersecurity, and critical minerals remain open.

Recommended for you

Readers also explored

How Risks Stack Up in 2026

Nifty 50 Companies List 2025 : Top 50 Stocks in India

Why Is This a Global Risk?

Even after the temporary truce till Nov-26, US-China trade tensions remain a major global risk for 2026. Renewed escalations could again disrupt supply chains, raising input and commodity prices and slowing down global growth in 2026.

The impact extends far beyond the two economies. A major fear is dumping, where China redirects surplus production, especially EVs, batteries, steel, and solar equipment into developed markets as well as developing countries at very low prices, pressuring local industries and triggering defensive tariffs. These combined risks make the conflict globally consequential.

Here is a summary of how the tariff risk affects everyone:

| Region | How It Is Affected | Affected Sectors/Channels | Estimated Economic Impact |

|---|---|---|---|

| United States | Consumption slowdown and an increase in inflation | Consumer goods, EVs, retail, logistics, agriculture | GDP growth to be ~0.5% lower in 2025, 2026 4.9 lakh jobs lost in 2025 |

China | Excess capacity as exports decline, affecting GDP growth | Electronics, machinery, furniture, ports, steel, solar, EV | US-bound exports declined 38% (Apr-25 to Sep-25). GDP growth expected to drop 0.9%. |

| Developed Markets (Europe, Japan, etc.) | Dual effect: Direct US tariff on the country + Inflow of cheaper goods from China | Autos, machinery, EVs, semiconductors and chemicals | Margin pressure on domestic companies. GDP impact minimal, 0.2%-0.4% |

| Developing Countries (India) | Dual pressures: Direct US tariff + shocks from US-China dispute | India: textiles, engineering, chemicals and electronics | Estimated impact on India’s GDP: 0.4% (2025-26) and 0.3% (2026-27) |

Overall, US-China trade tensions remain a defining global risk for 2026. Even with a temporary tariff cap, deep structural conflicts persist, which will continue to affect supply chains, prices, and investment flows.

Additionally, US reciprocal tariffs on other trading partners and growing concerns over Chinese dumping make the risk environment more volatile and extremely sensitive to policy changes.

2. Conflicts in Ukraine and the Middle East

Russia’s war in Ukraine and the Iran-Israel tensions in the Middle East crisis remain major global shocks in 2026.

As the Russia-Ukraine war continues into its third year, Ukraine has faced immense destruction. Reconstruction in Ukraine would require investments amounting to nearly three times its 2024 GDP. Russia’s long-term growth has also been affected by heavy defence spending, sanctions, and weaker energy revenues.

In the Middle East, Israel–Iran tensions after the 2025 conflict have severely damaged both economies, heightening geopolitical and market risks.

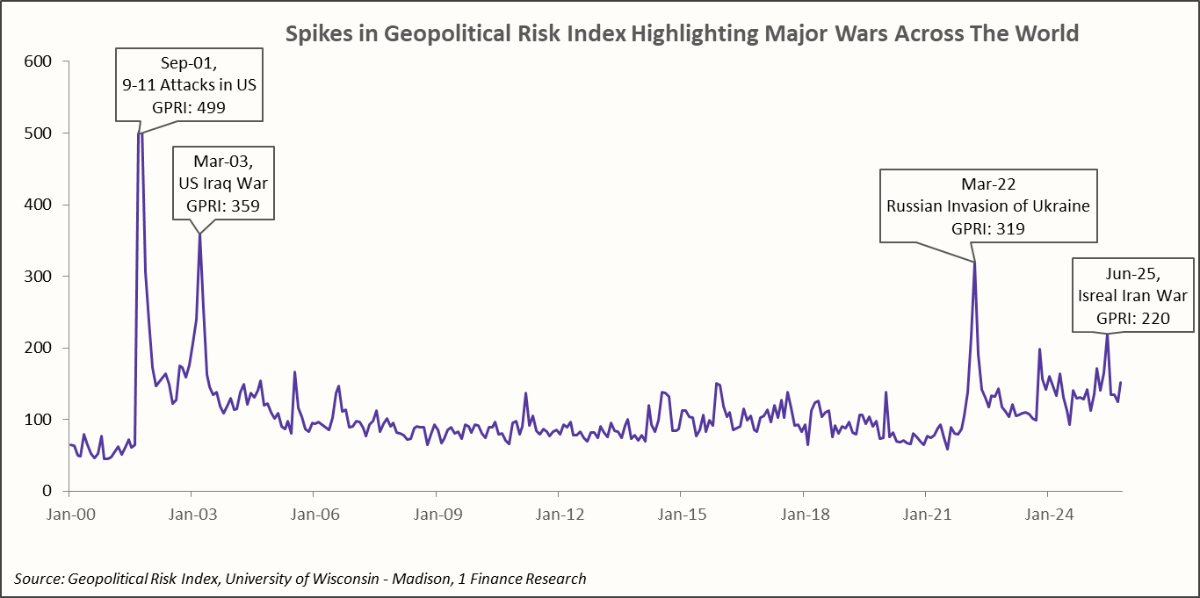

These two conflicts show up as two of the four largest spikes in the Geopolitical Risk Index, a prominent index representing global tensions. Each surge corresponds to periods when markets, supply chains, and policy decisions were sharply unsettled.

For India, which imports 80% of its oil, this vulnerability remains even more pronounced. These conflicts are also known to trigger rupee depreciation and capital outflows from emerging markets.

Overall geopolitical tensions due to these ongoing conflicts are likely to remain high, causing market volatility and risks of supply disruption. However, ongoing peace talks and ceasefire efforts offer hope for reducing conflict and stabilising trade and energy markets in the longer term.

3. Signals From The Central Banks in 2026

Global supply chains were severely impacted, firstly by the COVID-19 pandemic and then by the Russia-Ukraine war, pushing inflation higher through 2022-23.

After aggressive rate hikes to combat inflation, slowing GDP growth in 2024 and 20225 pushed central banks into an easing mode. Amongst the larger economies, the European Central Bank (EU) cut rates by 235 basis points (bps), followed by the US Federal Reserve (US) by 150 bps, the Bank of England (UK) by 125 bps, RBI (India) by 100 bps and the People’s Bank of China by 45 bps, while the Bank Of Japan tightened rates. Despite tariff and conflict risks, major central banks moved in rare synchrony to stabilise markets.

| Economy | Rate cuts in 2024 - 2025 | 2026 policy stance | Key moves and drivers |

|---|---|---|---|

| United States | 150 bps | Gradual easing | The Federal Reserve is expected to lower rates by another 75 bps in 2026 to support growth, but high inflation (3%) and tariff-driven price pressures will be key challenges. |

| Eurozone | 235 bps | Extended pause | The European Central Bank paused rate cuts as inflation neared the 2% target. It is likely to hold them steady, keeping the option to move either way. |

| United Kingdom | 125 bps | Gradual easing | The Bank of England is expected to cut rates modestly to support growth. Inflation (3.6%) remains well above the target rate (2%). |

| Japan | Rates hiked by 60 bps | Gradual tightening | The Bank of Japan is expected to raise rates as inflation (2.8%) is above the 2% goal. |

| China | 45 bps | Small rate cuts, targeted easing | The People's Bank of China is likely to deliver a modest additional cut to counter slowing growth, industrial deflation, and excess capacity. |

| India | 100 bps | Small rate cuts till Mar-26 | The RBI is expected to cut the repo rate by 25-50 bps by the end of FY 2025-26 (Mar-26). For FY-27, easing would depend on inflation and lingering global risks. |

Overall, monetary policy across major economies in 2026 is likely to be cautious with uneven rate cuts, as central banks balance inflation and growth concerns with lingering geopolitical and supply-side risks. While the Fed and ECB are expected to cut gradually, others like the Bank of Japan and emerging markets may move at different speeds, creating a clear divergence in global policy paths.

For markets, these actions will limit the scope for a synchronised risk rally and can keep currency volatility elevated. Equities may benefit from lower rates, but borrowing costs and financial conditions will only adjust slowly.

The Elections In 2026

2026 is likely to witness some of the major elections, which will raise the risk of policy volatility, as leadership transitions could reshape economic priorities, regulations, and geopolitical alignments.

Let’s look at a summary of some of the key elections scheduled in 2026:

| Country | Election type, timing | Key issues/contest | Market Impact |

|---|---|---|---|

| United States | Midterm elections, Nov-26 | Contest between Democrats and Republicans for control of the US Parliament. | Policy direction on spending, taxes and foreign policy can impact the risk sentiment and markets worldwide. |

| Brazil | General elections, Oct-26 | Incumbent Left-leaning government vs. a conservative opposition. | The election outcome will shape Brazil's fiscal path and trade stance and influence the Emerging Market indices. |

| Israel | National elections, 2026 | Fragmented race among multiple parties | Results will drive peace prospects, affecting Middle East conflicts and regional investment flows |

| Sweden, Colombia (and others) | National elections, 2026 | Sweden: Economic governance in the EU. Developing countries: Strength of development priorities. | Shifts in these elections can alter regional stability, trade patterns, and impact the performance of local markets |

Overall, elections in 2026 pose a risk because they introduce policy uncertainty into an already fragile macro environment. Shifts in political leadership can alter fiscal priorities and external relations among countries, all of which influence market sentiment and capital allocation.

From an investor's point of view, electoral uncertainties elevate risk premiums and delay investment decisions until clearer policy mandates emerge.

US Debt Ceiling and Fiscal Sustainability Risks

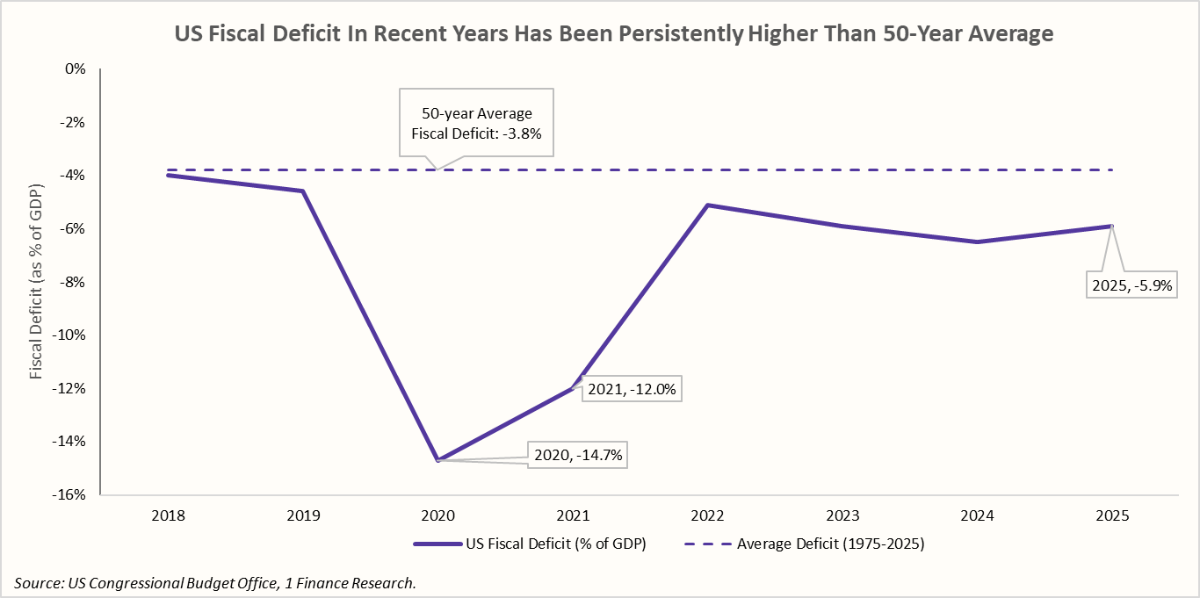

Another major risk in 2026 will be around the growing size of its debt level and its persistent fiscal deficit.

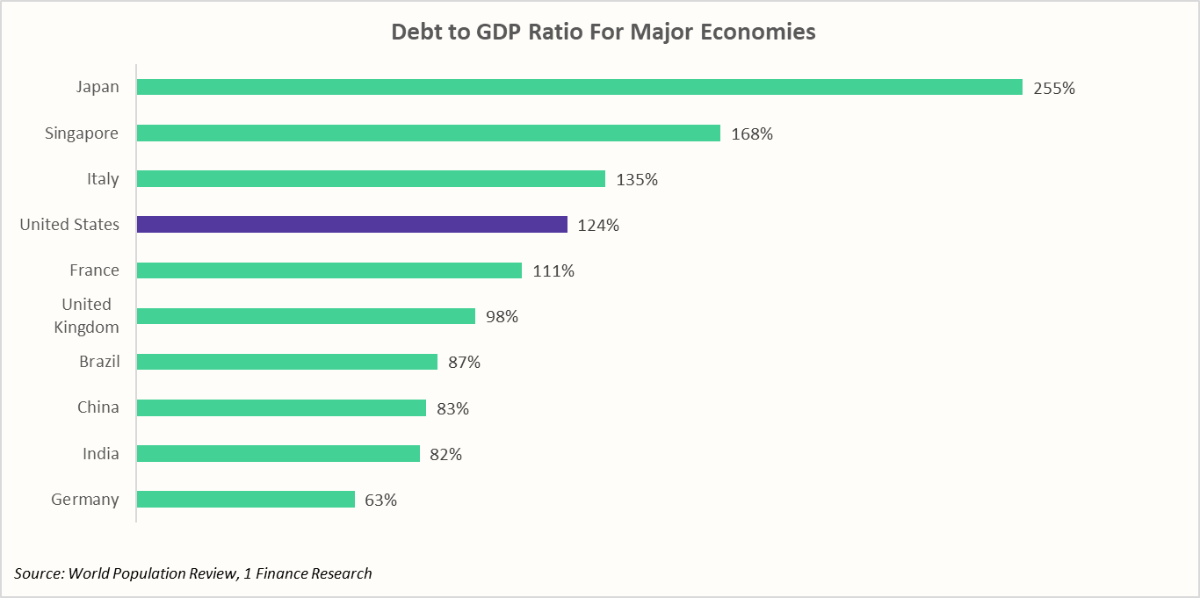

The US now carries $37.9 trillion in debt, with a debt-to-GDP ratio of 124%, meaning the country owes around 24% more than the value of its entire economy.

The government has run deficits every year since 2001, driven by rising spending on Social Security, Medicare, defence and, more recently, very high interest payments on past borrowing.

New tax cuts introduced in 2025 further reduced government revenues, forcing the US Congress to increase the debt ceiling, which ultimately led to a temporary government shutdown.

Why Is This a Global Risk

US debt and fiscal sustainability become a global risk because its borrowings directly affect world interest rates and capital flows.

When the US issues more treasury debt, yields tend to rise, the dollar strengthens as investors, and capital moves out of emerging markets. This can pressure currencies and raise borrowing costs across the world, and tighten financial conditions across developing economies.

The US has faced repeated credit-rating downgrades from major agencies. S&P downgraded first in 2011, followed by Fitch in 2023, and Moody’s in 2025. Each downgrade highlighted mounting fiscal concerns and added uncertainty to the global markets.

Overall, despite the Federal Reserve’s rate cuts, the combination of high deficits and elevated interest costs will keep US fiscal sustainability as a major risk.

For investors, this translates into a year of elevated volatility, sharper reactions to US policy moves, and a risk premium that continues to guide sentiment.

Concluding Remarks

The five risks covered in this edition do not operate in isolation. They interact in ways that can amplify their impact. Trade tensions can push up prices, escalations in wars can affect energy markets further, elections can shift policy directions, and fiscal pressures can influence global interest rates. Together, they create an unpredictable landscape for 2026.

For investors, this makes it important to stay diversified across geographies and also across asset classes and follow key developments closely while tracking changes in the market sentiment.