India’s housing market is still active, but the way it is growing has changed. New supply is increasing across major cities, especially in peripheral and infrastructure-linked areas, while sales are becoming slower and more sensitive to rising inventory. Pune and parts of Greater Mumbai and Thane remain relatively stable. However, Delhi NCR, Hyderabad, and Bengaluru are adjusting to higher unsold inventory and weaker same-quarter sales of new launches.

The gap between localities is widening. Demand and price stability are now concentrated in well-connected, job-driven corridors, while supply-heavy or weaker-demand areas are moving into consolidation instead of seeing widespread growth.

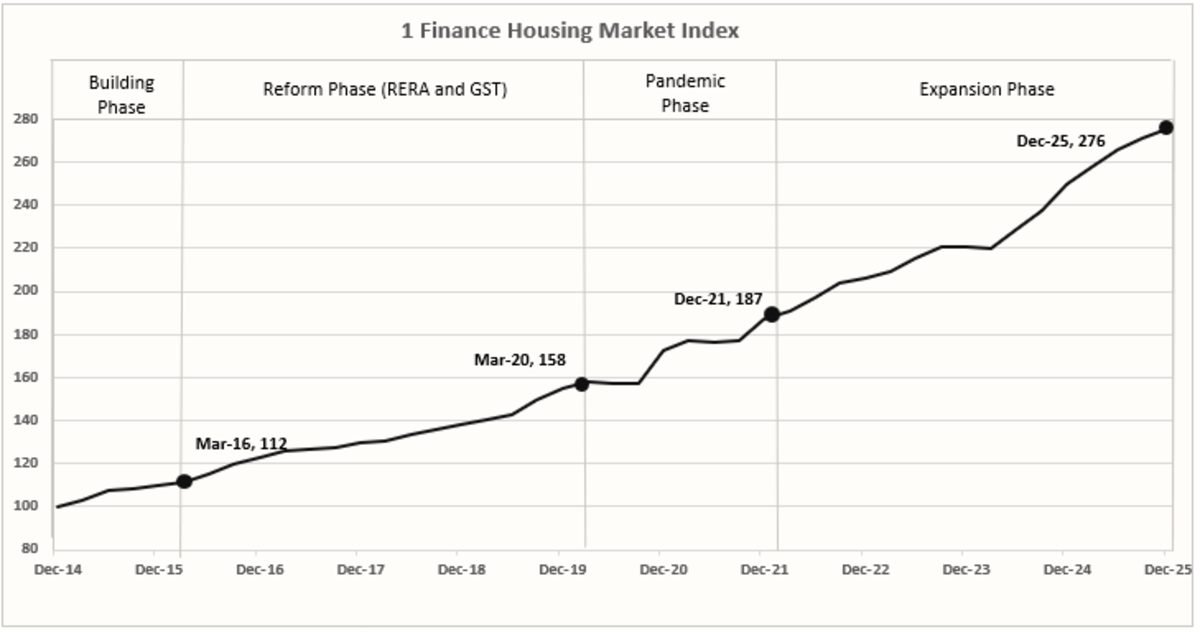

The 1 Finance Housing Market Index Shows a Regime Shift

The 1 Finance Housing Market Index captures the long upcycle, but also hints at the current regime shift. Based on RERA-registered transaction data, the index delivered a 10.2% CAGR over five years, reaching 276 in Dec 2025.

While earlier growth was driven by strong end-user momentum, the current phase is more measured, with inventory discipline shaping outcomes across cities.

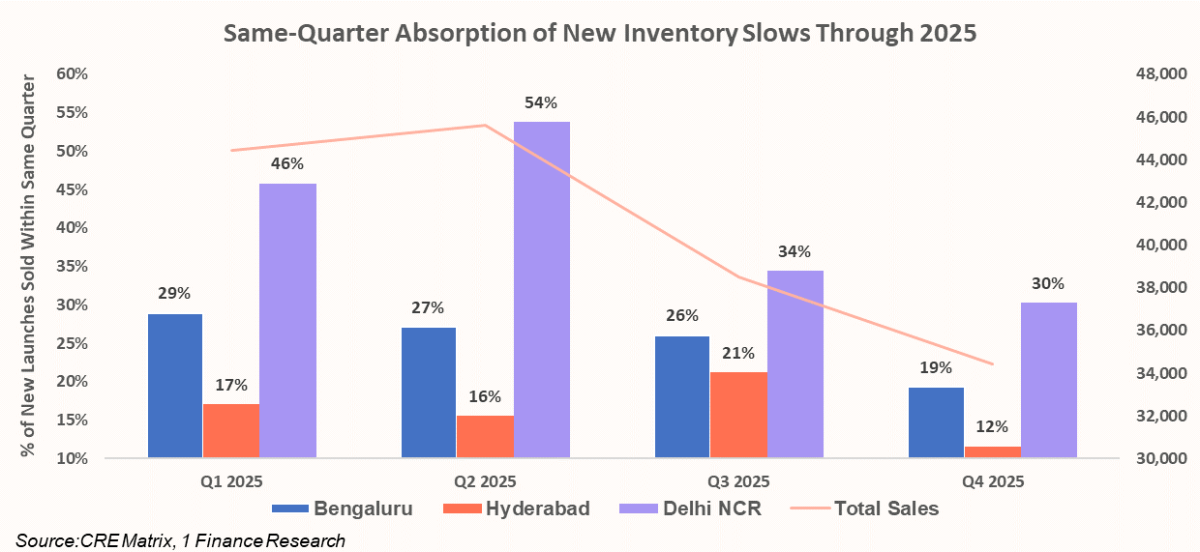

Absorption Cools Through 2025 outside Maharashtra

Enthusiasm for newly launched inventory declined steadily through 2025 across Bengaluru, Hyderabad, and Delhi NCR. Same quarter absorption rates (the percentage of newly launched units sold within the same quarter of launch) softened meaningfully, due to weaker buyer appetite for highly priced fresh supply. Total sales also declined in these markets, reinforcing the shift from expansion-driven momentum to a more cautious, inventory-sensitive consolidation phase.

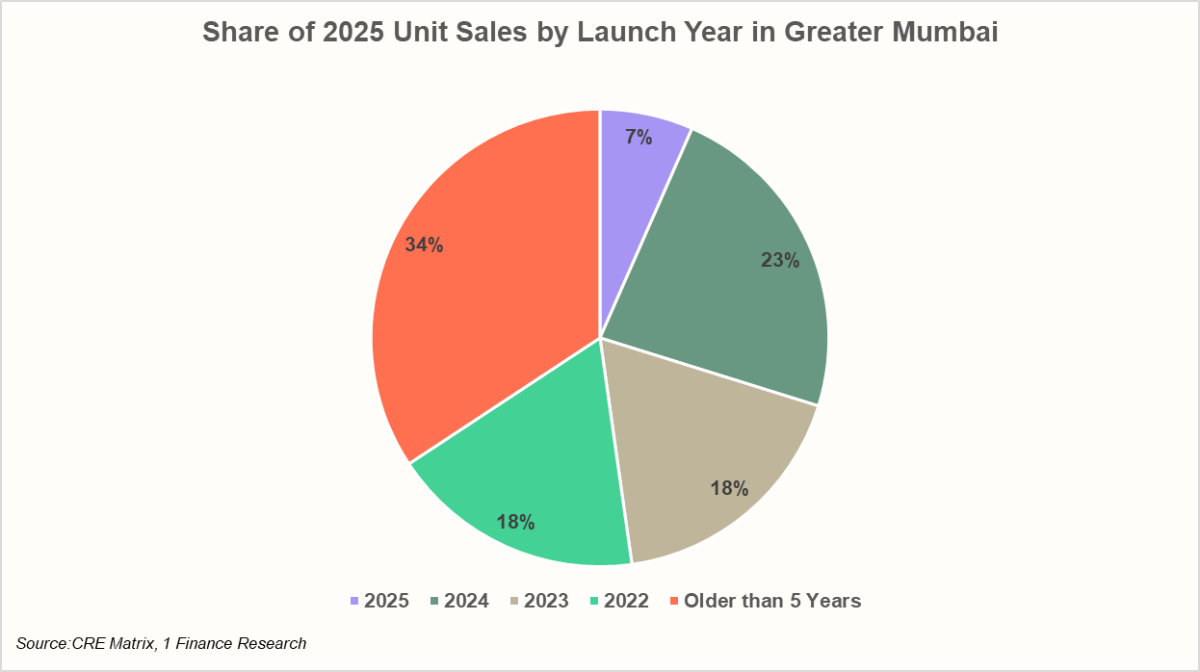

Older Inventory Keeps Greater Mumbai and Thane Markets Moving

Greater Mumbai’s residential market is adjusting through a supply contraction.

- Annual launches fell to 30,463 units (-56% YoY)

- The sharpest drop was in the Eastern Suburbs: 7,242 launches in 2025 vs 16,374 in 2024

Despite this slowdown, sales remained steady, leading to a gradual reduction in unsold inventory. However, absorption remains skewed toward older projects, which are 15–35% more affordable than new supply, limiting traction for fresh launches and keeping the growth largely stagnant.

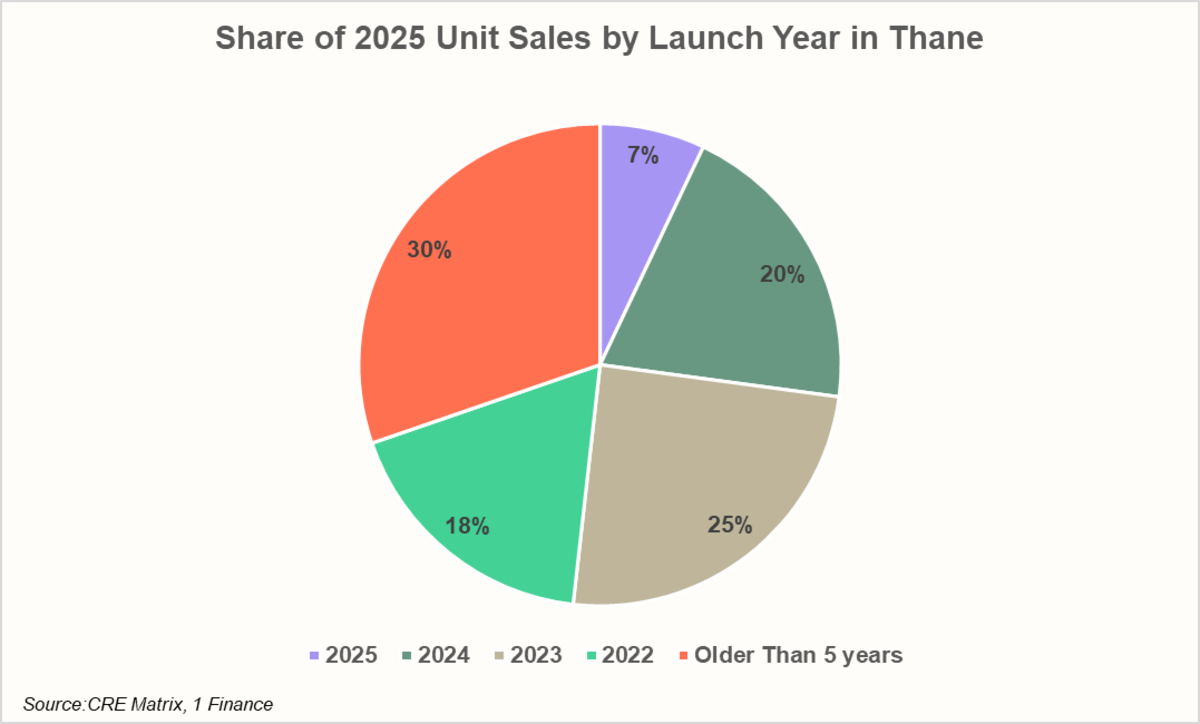

Thane is resilient on volumes, but pricing is being anchored by the older supply.

- 54,019 units launched, nearly 10,000 fewer than in 2024

- 59,065 units sold, about 3,000 higher than in 2024

- Unsold inventory moved below 3.55 lakh units

However, 46% of primary sales in 2025 came from projects launched more than five years ago, which sold at a 30% discount to the newly launched inventory, exerting downward pressure on newer inventory and constraining broad-based PSF growth.

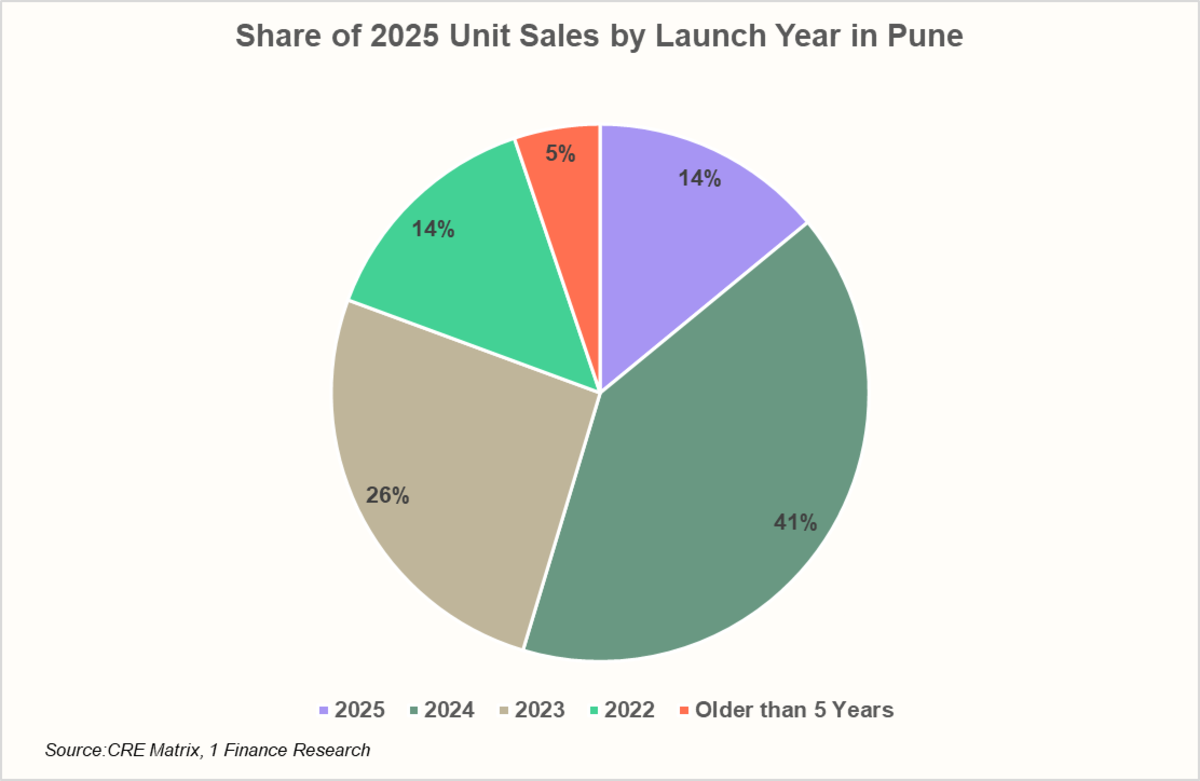

Pune’s New Supply is Selling Fast

Pune remains one of the more balanced markets entering into 2026. Sales have consistently outpaced supply, reducing unsold inventory to 2.83 lakh units in Q4 2025 from 2.88 lakh units in Q1 2025.

Peripheral corridors such as North West and South East Pune continue to witness QoQ price appreciation. Importantly, over 80% of inventory sold during the year was launched within the last 36 months, supporting healthier pricing stability compared to other Maharashtra cities.

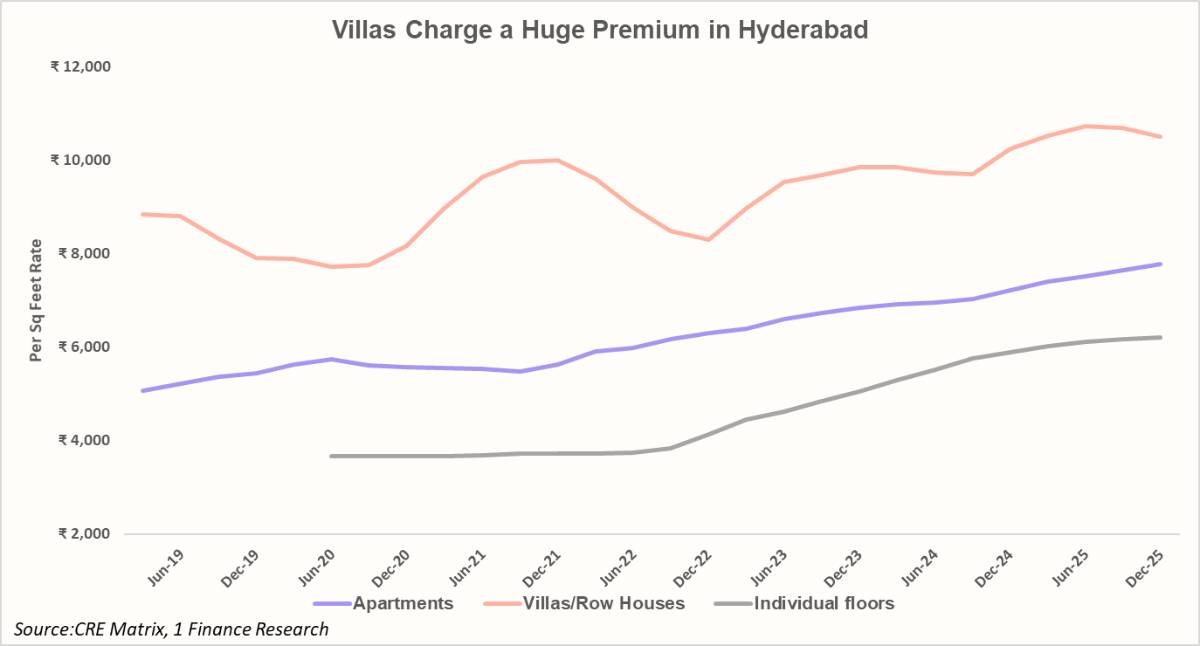

Hyderabad’s Inventory Is Rising While Villas Lead Price Stack

Inventory is building up in Hyderabad.

- Sales fell to 52,793 units (from 60,293 in 2024)

- Supply stayed elevated, with 16,138 units added in the latest quarter

- Unsold inventory crossed 1.4 lakh units

The buyer preferences have tilted toward more modern, spacious homes with villas priced 50% above luxury apartments and 100% above independent floors.

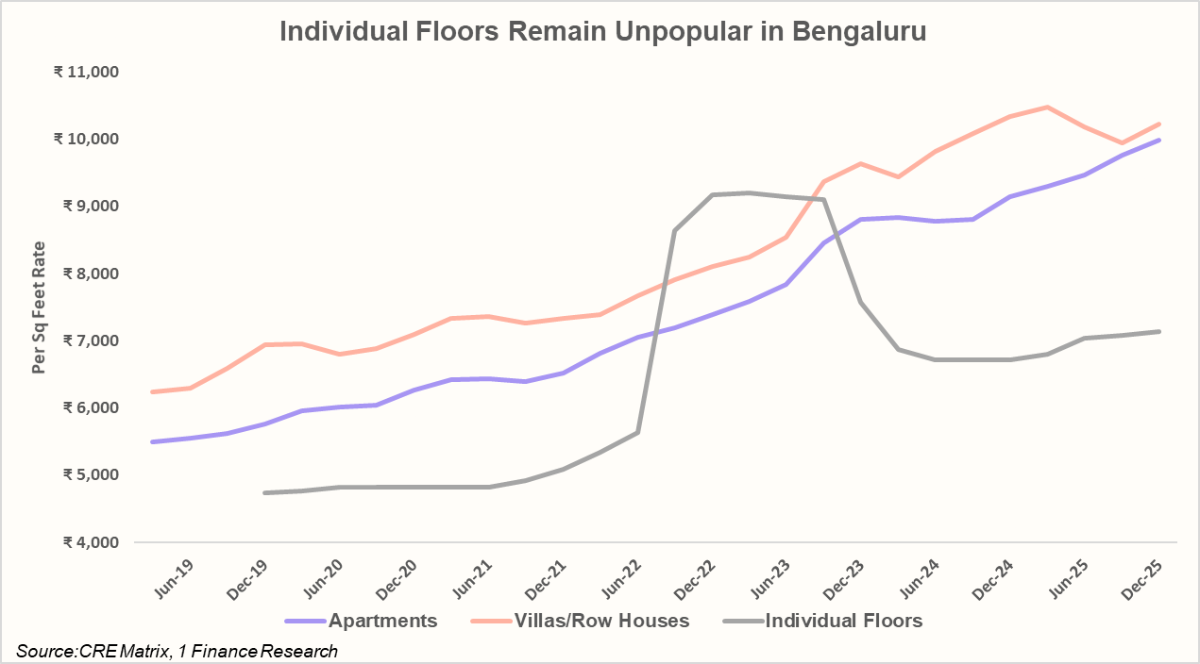

Individual Floors Are Losing Buyer Interest in Bengaluru

Inventory is building up across Bengaluru:

- Unsold inventory is up 44% since Q2 2024

- Same-quarter absorption fell from 29% (Q1 2025) to 19% (Q4 2025)

Individual floors remain the weakest segment, while premium formats (including villas/row houses) continue to command pricing. While the demand exists, it’s getting more corridor-led and more selective.

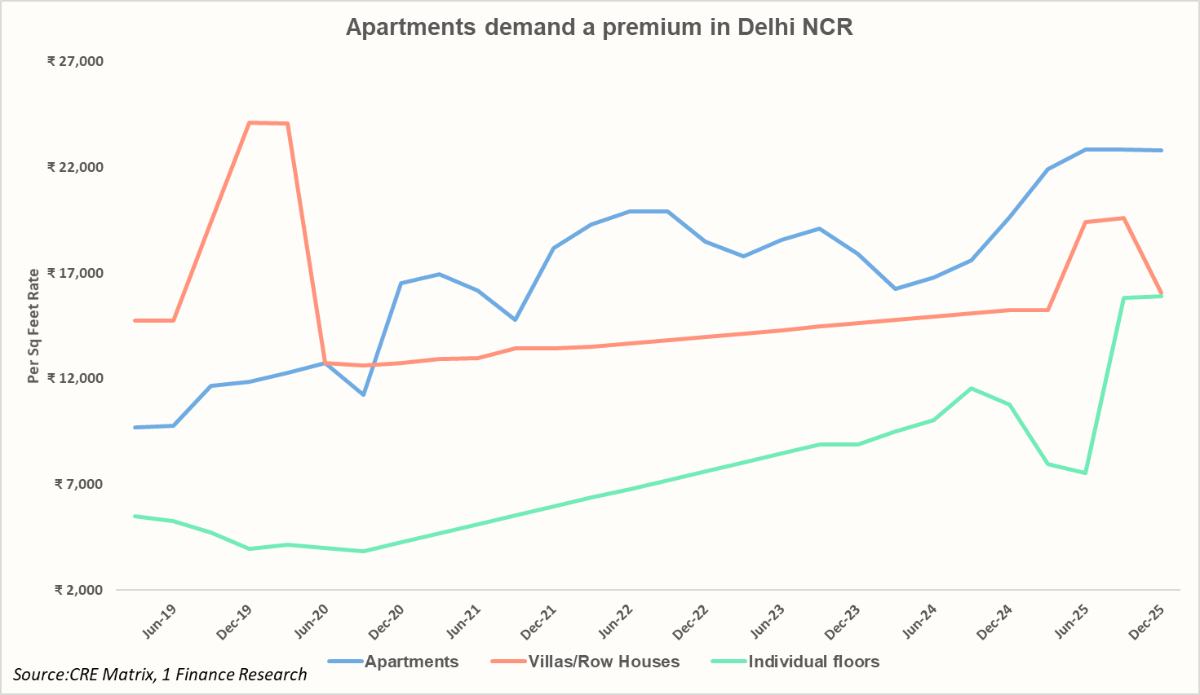

Apartments Still Command the Highest Premium in NCR

Delhi NCR’s trend is that supply still comes, but buyers slow down.

- Annual sales at 49,741 units, 10% YoY decline

- Same-quarter absorption fell from 46% (Q1 2025) to 30% (Q4 2025)

Supply remains concentrated in peripheral corridors. Dwarka Expressway alone saw 4,456 units launched, the highest since Q1 2021. But pricing is no longer uniformly rising as per sq feet rate declines are visible across most of NCR. On execution, Independent Floors had recorded a 22% delay rate, compared with 42% for Villas and 33% for Apartments over the years.

Outlook

India’s housing market is transitioning into a disciplined, consolidation-led cycle. Markets with elevated supply and weakening new-launch absorption are likely to see range-bound pricing until inventory normalises.

At the same time, structurally strong corridors backed by employment and infrastructure will continue to demonstrate strong growth. The next phase of growth will be driven less by broad expansion and more by inventory discipline, product quality, and micro-market fundamentals.