We live in times where the markets move faster than ever, economies spring up surprises in both strength and slowdowns, and opportunities often hide behind uncertainty.

As a follow-up to our previous edition, we take a look at some of the largest economies around the world: China, the United States, Japan, and the United Kingdom, and take a deeper look at how their markets are positioned as of Sep-25.

We compare valuations, earnings, recent market performance, and the underlying economy. We highlight where the investors might find value and also where they need to exercise caution, and also cover how to build more globally balanced portfolios.

Here’s a quick look at how major global markets stack up as of Sep-25 and what makes each of them attractive right now.

| Index Performance and Quick Summary | ||

|---|---|---|

| Country (Index) | Index Returns (LTM) | Market View & Relative Attractiveness |

| US (Nasdaq-100) | 23.0% | Overvalued (Score: 69). High Valuations. High Risk. Earnings Growth Pressure. Tariff-Related Headwinds. |

| China (HSI) | 27.1% | Overvalued (Score: 63) Tactical Allocation Option and a Diversification Alternative. Poor Long-term Returns |

| Japan (Nikkei 225) | 16.2% | Fairly Valued (Score: 79) Attractive Diversification Option. Geopolitically Stable. Exposure to Global Industry Leaders. |

| UK (FTSE-100) | 13.5% | Undervalued (Score: 82) Attractive Dividend Option. Globally and Sectorally Well-Diversified Index. Low Valuations |

We cover the key valuation metrics and assign a comprehensive score for all major global markets in detail on our Global Markets P/E Dashboard

Let’s now take a deeper look at the economic performance of some of the world’s leading indices:

🟠 United States – Overvalued

Recent Economic Trends

U.S. GDP grew 3.8% in Q2 2025, after contracting by 0.6% in Q1. The recovery was due to an increase in consumer spending and a decline in imports due to higher tariffs.

The Federal Reserve has cut the federal funds rate by 50bps (25bps each in Sep and Oct) after a pause since Dec-24. Inflation remains high at 3% in Sep-25 (above the 2% target).

Let us take a quick look at the performance and valuations of the Key US Indices

| Benchmark Index | PE Ratio | 25-Yr Median PE | Index Growth LTM | EPS Growth LTM | Category |

|---|---|---|---|---|---|

| S&P 500 Index | 25.6x | 18.8x | 16.1% | 12.0% | Overvalued |

| NASDAQ 100 Index | 33.0x | 27.0x | 23.0% | 19.7% | Overvalued |

| Russell 2000 Index | 32.8x | 37.1x | 9.3% | -17.8% | Overvalued |

| Russell 1000 Growth Index | 41.0x | 22.6x | 24.8% | 13.2% | Highly Overvalued |

| Russell 1000 Value Index | 20.4x | 16.5x | 7.2% | 1.6% | Fairly Valued |

U.S. equity indices appear overvalued, with current P/E ratios well above their long-term medians. PE Ratios for Russell 2000 and Russell 1000 value index are around their 25-Year Median PE levels, indicating high valuations despite poor earnings growth.

PE Ratios for tech-heavy and growth-focused indices such as the S&P 500, Nasdaq-100, and Russell 1000 Growth are very high. These have still delivered strong returns. However, their earnings growth has lagged, and they will need to keep pace to justify current price levels as concerns around valuations have intensified. For details, refer to our blog on the US market

Outlook and Recommendations

- US growth may soften as tariffs impact consumption. Rising unemployment with high inflation will keep the Fed cautious, but it will lean toward gradual rate cuts.

- Nasdaq’s Earnings growth has outpaced the S&P 500 and other indices, driving strong returns. However, elevated valuations, fueled by AI optimism, increase downside risk. SIPs in indices with steady earnings growth can be considered, while maintaining sectoral and global diversification.

Recommended for you

Readers also explored

As 2025 Wraps Up, What’s Next for Global Markets?

India’s Unemployment Rate in 2025

🟡 China - Fairly Valued

Recent Economic Performance

China’s GDP grew 5.4% in Q1-2025, driven by strong exports and investments. In Q2, it moderated to 5.2% as consumption slowed and the property sector weaknesses continued.

In May 2025, China’s central bank cut key lending rates to support economic growth to counter weakening industrial output and export pressures amidst the U.S.–China trade war.

On the fiscal side, the government has lowered taxes to stimulate consumer spending and domestic demand and support property recovery.

Performance of Key China Indices

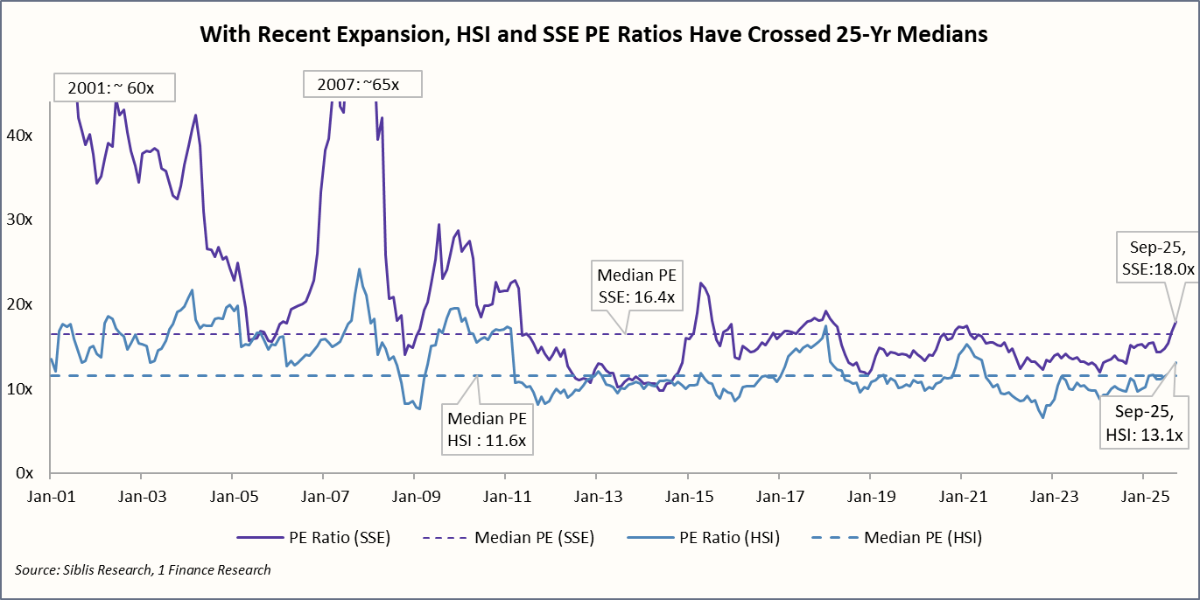

Hong Kong’s Hang Seng Index has surged ~ 27% over the last twelve months (LTM), while the earnings have grown 8%. Shanghai Composite Index (SSE) has gained 16% LTM, even as the earnings contracted ~2%,

The P/E has grown, as valuations had dropped considerably in 2023. It was driven by stimulus measures, state-led investment, and easing credit conditions, rather than by earnings growth. For details, refer to our blog on the China market.

Outlook and Recommendations

- Over the medium and long term, both indices have underperformed compared to other global indices such as the S&P-500 and NIFTY-50.

- Therefore, Chinese equities should be viewed as a tactical allocation and are a diversification alternative rather than a strategic long-term compounder.

🟡 Japan – Fairly Valued

Recent Economic Performance

Japan’s economy has grown modestly by ~1.9% in 2024, slowed to 1.2% y-o-y in Q1-2025 and 0.9% in Q2-2025 as exports softened and consumption weakened.

In 2025, Inflation has eased from 4% to 2.9% (Sep-25), moving towards the 2% target rate, allowing the Bank of Japan to end yield-curve control and consider small rate cuts in late 2025 to support growth.

Index Performance

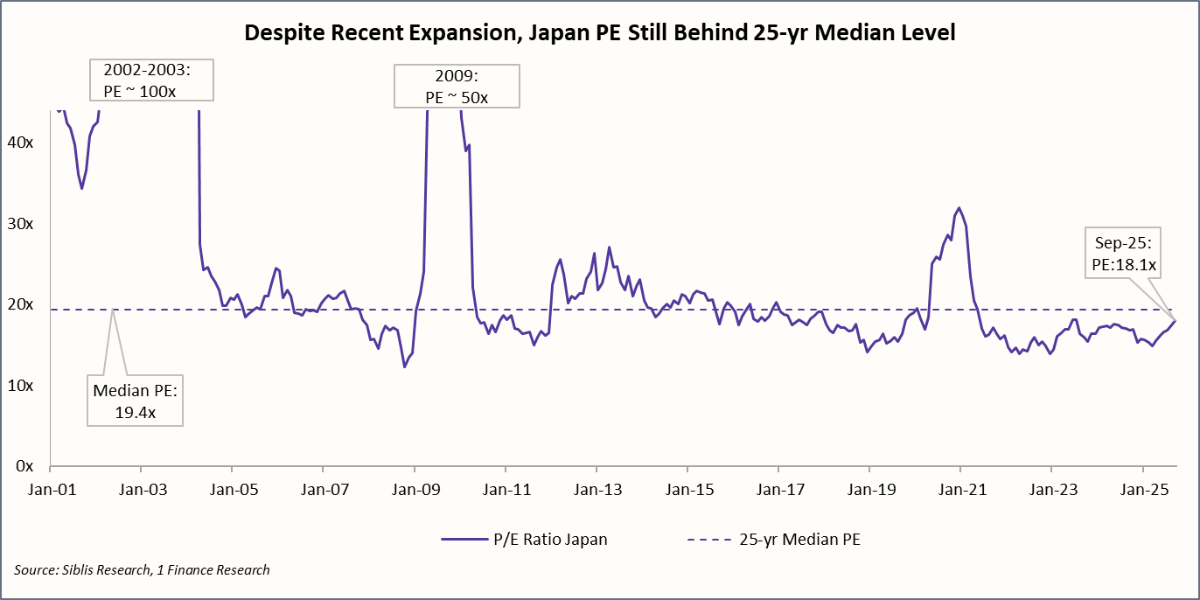

Nikkei 225 Index has grown ~16% over the last twelve months, while its Earnings Per Share (EPS) have increased by ~8.1%. However, its PE (18.1x) is still below its 25-year Median PE (19.4x). Our valuation category for Japan has moved from Undervalued to Fairly Valued.

Outlook

- Indicators, such as High M&A activity, signal investor confidence in undervalued firms, while wage growth (~5%) and steady consumption support positive sentiment, pointing to a constructive medium-term equity outlook.

- For Indian investors, the Nikkei 225 offers a valuable diversification option, with exposure to global and Asian firms having strong export linkages. Japanese markets also offer geopolitical stability and strong corporate governance through their reforms and buybacks.

🟢 United Kingdom – Undervalued

Recent Economic Performance

UK GDP has grown 0.7% in Q1 2025 and 0.3% in Q2, and is reflecting weak consumption and fading export strength.

The Bank of England has cut rates by 25bps in Sep-25 and signalled another rate cut by the year-end, as inflation eased to 2.4%, slightly above the 2% target level, as growth risks remain elevated.

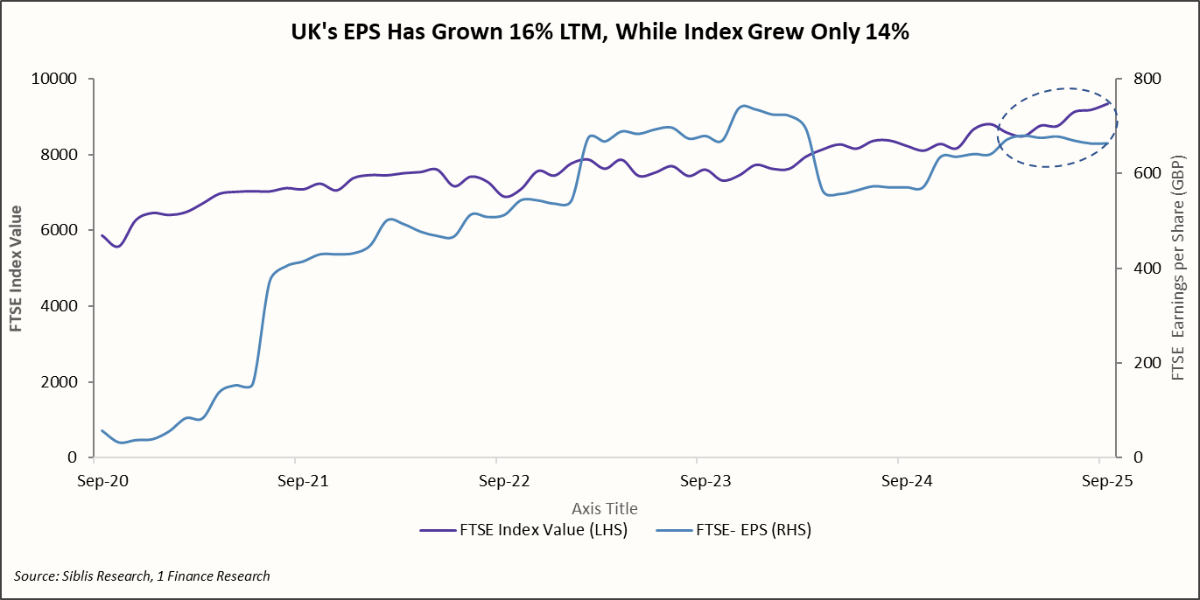

Index Performance

UK equities are undervalued as FTSE 100 earnings per share have increased 16.5% over the last twelve months, growing faster than the index (13.5% gain). This signals recovery in earnings and also attractive valuations, indicating a potential for further upside.

The FTSE-100 is a geographically diversified index, with over 75% revenue coming from its global exposure. It is also sectorally diversified across energy, financials, and consumer staples, providing growth and stability. It is also an attractive dividend-yielding option for income-oriented portfolios. For details, refer to our blog on the UK market.

Outlook

- There are expectations of another rate cut by the Bank of England, as inflation eases, and an uptick in private equity and M&A deals. The recent trade agreements signed by the government will also enhance the appeal of UK assets to global investors.

- The UK market remains undervalued and also has a mean reversion potential, as its current PE (14.1x) is likely to move towards its long-term median value (16.9x).

Concluding Remarks

Global stock markets can fluctuate due to changes in economic conditions, government policies, and investor sentiment.

As central banks recalibrate policy, valuation discipline and diversification across sectors, geographies, and themes remain crucial.

Markets such as those of the UK and Japan offer growth potential as their economies recover, their governments announce policy support, and the investor sentiment improves. These markets are likely to grow and converge towards their long-term median PE values.

On the other side, markets like the US and China face risks of a slowdown in earnings and the broader economy amidst geopolitical tensions. They remain risky but will continue to generate high returns as long as these are backed by strong earnings growth.