Global uncertainties and volatile geopolitics continue to test investor confidence as we step into the fall of 2025. The UK economy stands right at the centre of this flux, balancing subdued economic growth and persistent price challenges, while its key index, the FTSE‑100, stands out as an undervalued market worth watching. With its global revenue streams and relatively attractive valuations, the index offers a compelling case for diversification. For Indian investors, we also unpack how one can gain exposure to the UK markets.

The UK Economy in Doldrums post Q2-2025

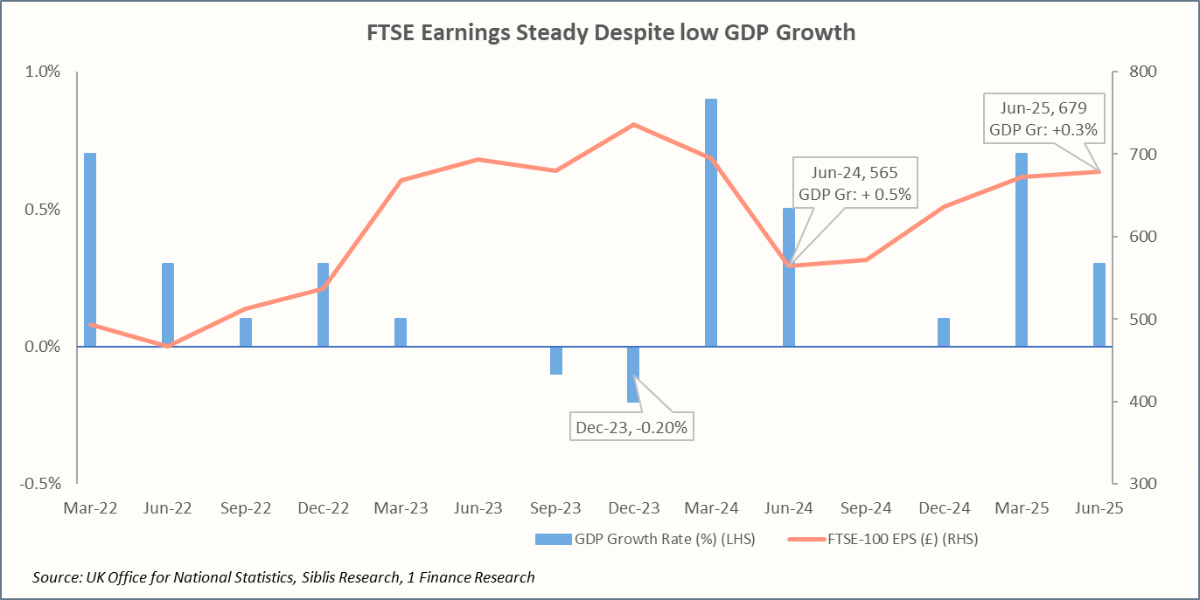

- Real GDP rose 0.7% in the Mar-25 quarter, driven by strong services, production, and construction, and renewed some optimism after virtually flat growth in the quarters ending Sep-24 and Dec-24.

- Growth stumbled to 0.3% in the Jun-25 quarter as production stumbled while services and construction continued modest gains. The UK was the fastest-growing G7 economy for the quarter ending Mar-25.

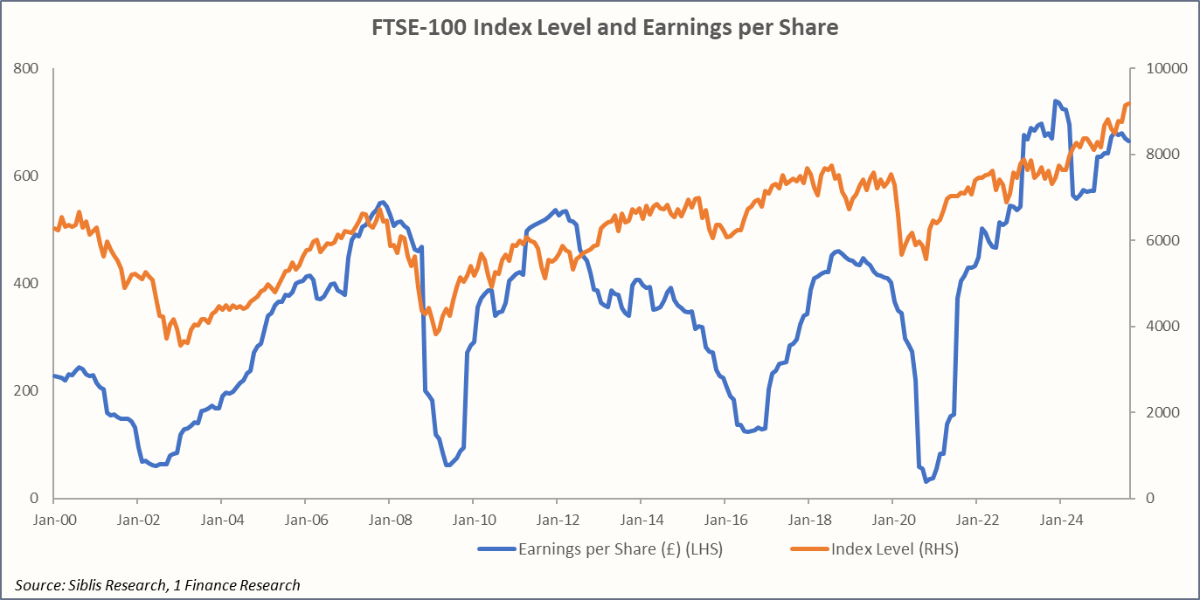

Despite sluggish GDP growth, FTSE-100’s trailing twelve-month EPS has risen ~4% YTD and ~16% since Aug-24, highlighting market resilience as of Aug-25.

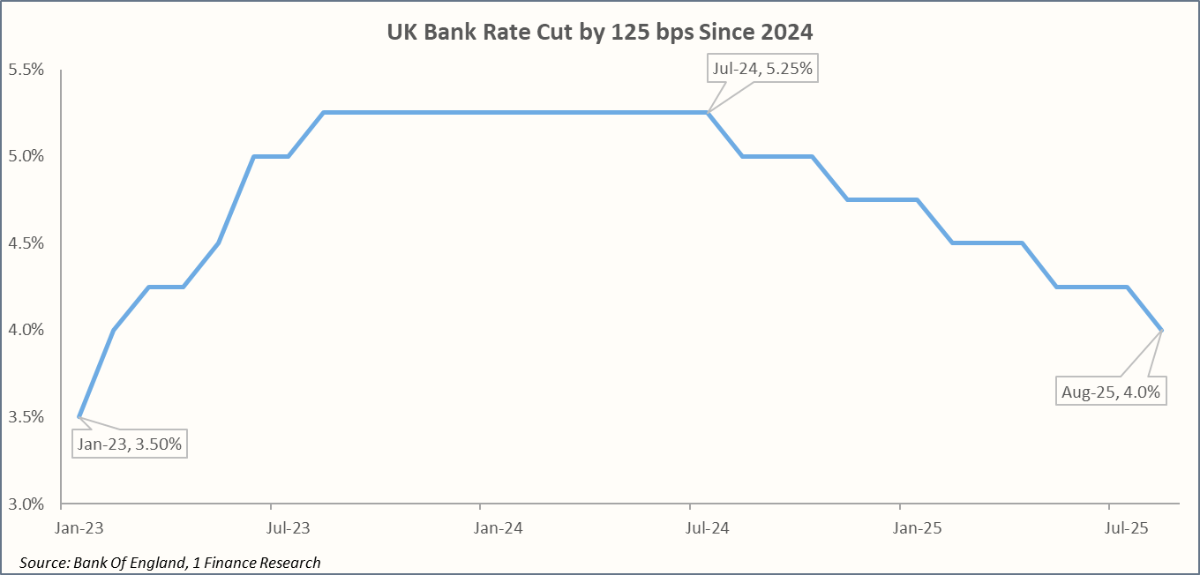

Amid weak GDP momentum, monetary easing by the Bank of England (BoE) has become crucial. Since Aug-24, the BoE has cut rates five times, including three reductions in 2025, the latest being a 25bps move in Aug-25.

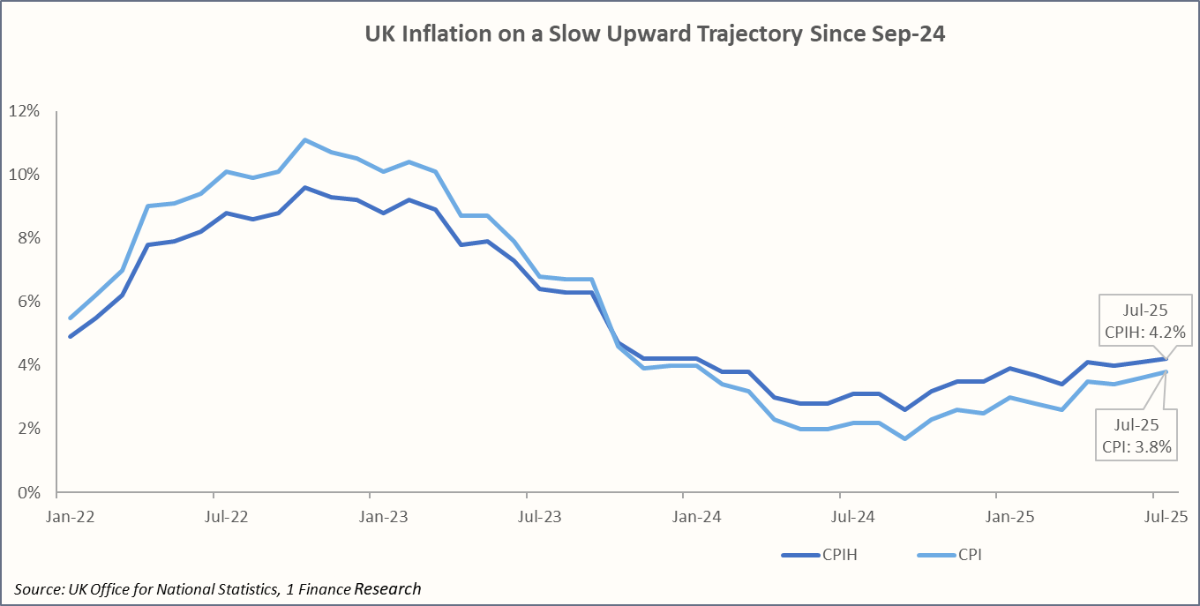

However, Consumer Price Index (CPI) and Consumer Prices Index including Owner Occupiers’ Housing costs (CPIH) are both higher than the Bank of England’s 2% target, leaving the BoE little room to cut interest rates further in 2025.

Recommended for you

Readers also explored

Gold Outlook in India for FY2026

India's IT Sector Outlook for FY2026

Why is the FTSE-100 an Undervalued and Stable Dividend Option

In one of our previous blogs, we covered how the FTSE-100 is an undervalued, well-diversified, consistent, and stable dividend index.

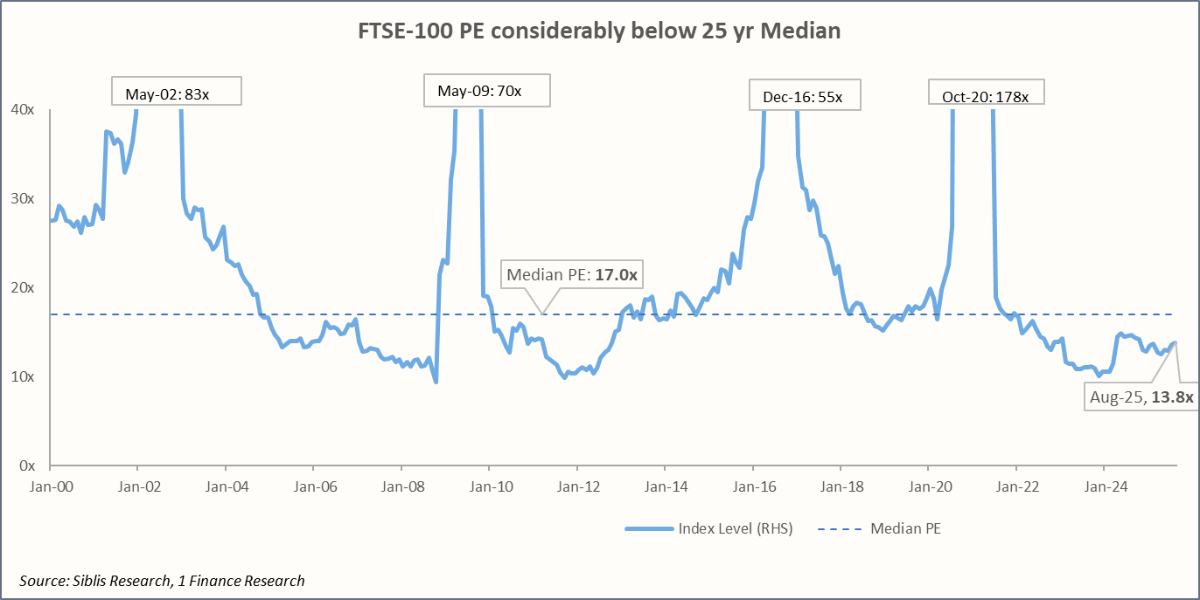

As of Aug-25, the FTSE-100 P/E ratio stood at 13.8x, significantly below the 25-year median of 17.0x. This valuation gap highlights potential upside through mean reversion, offering attractive entry opportunities.

FTSE EPS fell over 20% by May-24 but partly recovered by year-end. Despite weaker profits, the index gained 5.7% in 2024, reflecting investor confidence and underlying resilience. This can be attributed to several factors:

- The index’s multinational exposure meant most revenues, over 75%, were generated overseas, shielding it from sluggish UK GDP. A weaker pound in late 2024 also boosted sterling-reported profits, particularly for exporters and resource majors.

- The sectoral mix of FTSE-100 is concentrated in Financials (23%), Consumer Staples (18%), Industrials (14%), Energy (11%) and Healthcare (11%). Energy and mining giants tie performance to commodity markets, while financials provide scale. Consumer staples and healthcare add defensiveness, offering stability in downturn.

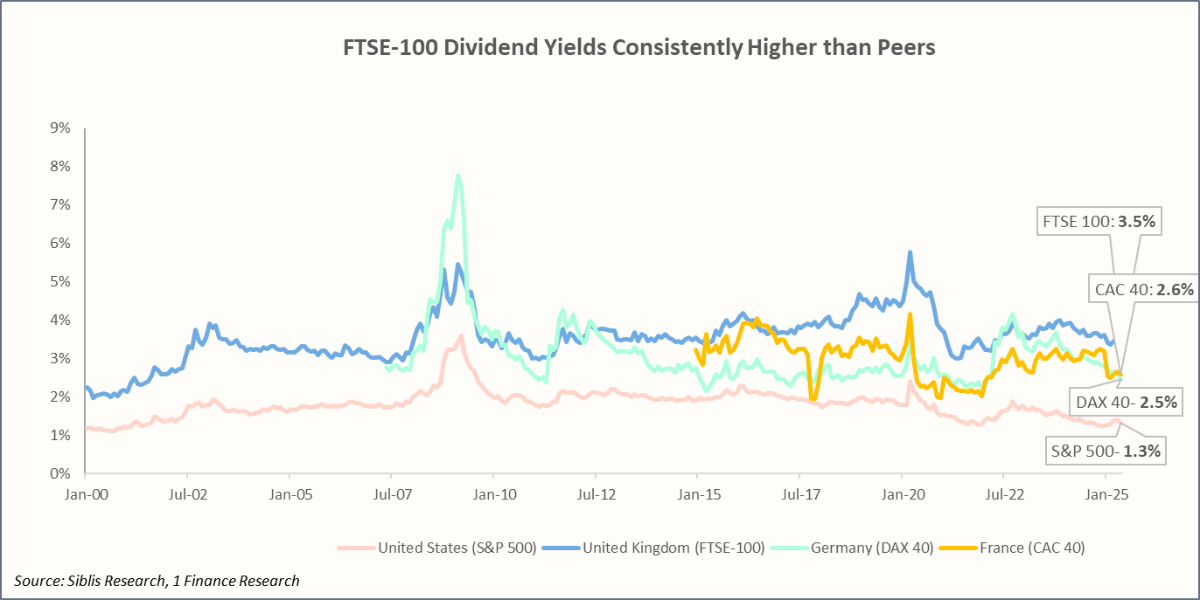

Another key attraction for investors in the FTSE-100 is its stable and attractive dividends, which yield around 3.5%, the highest among major global markets.

With the INR sliding ~3–4% annually versus GBP, the FTSE-100 delivers ~6–7% stable returns when dividend payouts align with currency-driven gains.

Here is a detailed comparison:

| Component | YTD (Jan-25) | 5-year | 10-year | 15-year |

|---|---|---|---|---|

| Depreciation (CAGR) | 9.1% | 3.4% | 1.5% | 3.1% |

| Capital Gain (CAGR) | 12.4% | 9.0% | 3.9% | 3.8% |

| Avg. Dividend Yield | 3.5% | 3.7% | 3.9% | 3.7% |

| Total Return (CAGR) | 26.9% | 16.9% | 9.6% | 11.1% |

Lastly, we examine the routes available for Indian investors to participate in the FTSE-100.

As covered in the blog on global investing, we present a short summary of the investment routes available.

| Route | Access | Cost | Flexibility | Regulatory Complexity |

|---|---|---|---|---|

| Mutual Funds Route | Easy (SIP) | High | Moderate | Low |

| ETF Route | Easy (Demat) listed on Indian Exchanges | Low | Medium | Low |

| LRS Route | Difficult (Global broker + Higher compliance) | Low | High | High |

| GIFT City IFSC | Medium (Requires an IFSC account) | Medium | High | High |

To conclude, the UK economy presents a mixed picture, with growth subdued but the FTSE showing resilience through steady returns supported by dividends and currency gains. Looking ahead, expectations of further BoE rate cuts could provide support, though inflation, fiscal pressures, budget constraints, global uncertainty, and limited policy flexibility pose challenges. For Indian investors, the FTSE-100 remains one of the attractive avenues, offering stable yields and diversification benefits. Access routes include international mutual funds, ETFs, LRS, and GIFT City structures, making it a valuable addition to portfolios while balancing opportunities with evolving macroeconomic and policy risks.