As global capital markets become increasingly interconnected, international equity investing has evolved from a niche strategy into a mainstream portfolio component. For Indian investors, allocating to global equities provides diversification, currency exposure, access to high-growth sectors, and the ability to tap into undervalued or underappreciated markets. However, international investing introduces additional layers of complexity, ranging from vehicle selection and taxation to macroeconomic risk and regulatory compliance.

This blog covers a brief overview of finding the undervalued markets, why Indian investors should look for global undervalued markets, and also a guide on how to invest in global markets using mutual funds, Exchange Traded Funds (ETFs), and Funds of Funds route.

Why should one diversify towards International Equities?

Having a share in international equities in one’s portfolio offers investors several benefits, ranging from Diversification across geographies, managing currency-related volatility, and navigating economic cycles by having a certain exposure to sectors not well-represented in Indian markets (such as energy).

Portfolio Diversification across Economies and Currencies

Investing internationally allows Indian investors to reduce country-specific risks. India’s equity market, while high-performing in recent years, is subject to domestic risks such as inflation and regulatory uncertainty. By allocating a portion of the portfolio to the global markets, investors can mitigate these risks and smoothen the portfolio volatility.

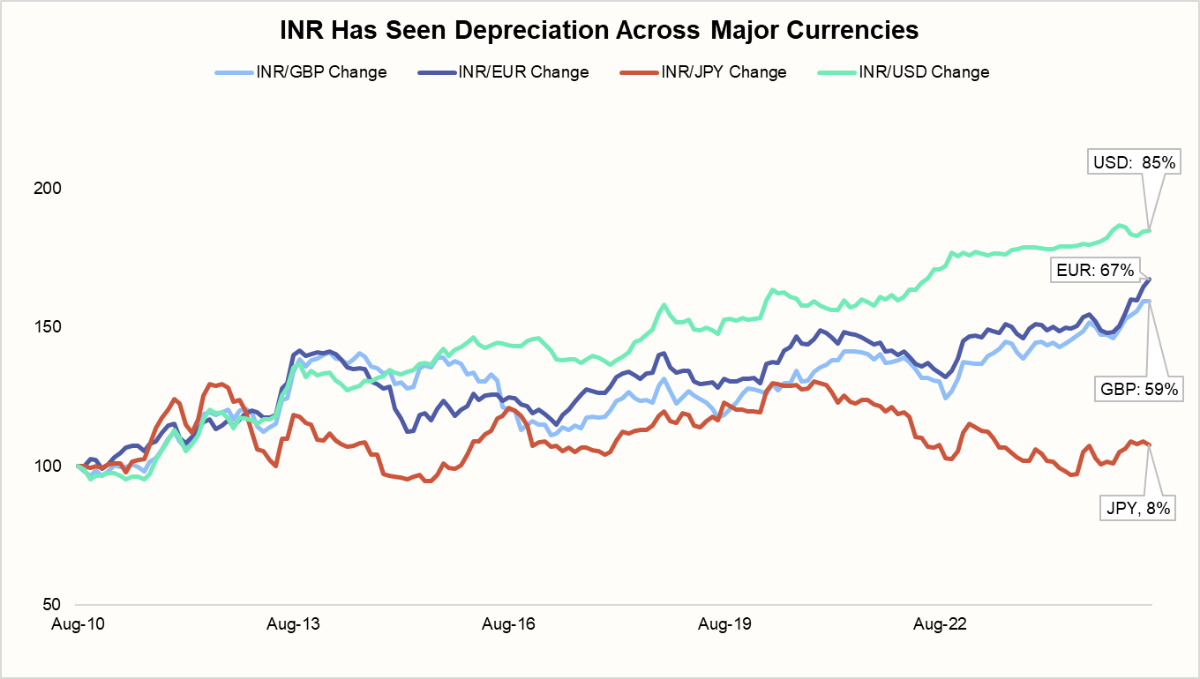

Additionally, foreign equity markets introduce currency exposure. Long-term depreciation of the INR against major global currencies like the USD, EUR, and JPY may enhance overall INR returns. This provides a natural currency hedge, particularly valuable in inflationary environments.

Source: CMIE, 1 Finance Research The chart illustrates the Indian Rupee’s (INR) depreciation against four major global currencies: USD, EUR, GBP, and JPY, over the period from August 2010 to July 2025. The INR has depreciated the most against USD (85%), followed by EUR (67%), GBP (59%), and JPY (8%). This sustained depreciation reflects India’s higher inflation and trade deficit relative to these economies. For Indian investors, this underscores the importance of holding some international assets, as global equities diversify risk and also benefit from favourable currency movements over the long term.

Access to Unique Sectoral Opportunities

Exposure to different sectors can insulate the portfolio against domestic sectoral shocks and enhance thematic diversification.

The table below describes the key sectoral weights of major indices:India (NIFTY 50) Japan (Nikkei 225) UK (FTSE 100) Brazil (MSCI Brazil) Financials: ~38% Technology / Electronics: ~48% Financials: ~23% Financials: ~38% IT: ~11% Consumer Discretionary: ~21% Consumer Staples: ~18% Energy: ~16% Oil & Gas: ~10% Materials: ~13% Healthcare: ~11% Materials: ~13% Automobiles: ~7% Capital Goods: ~9% Energy: ~11% Utilities: ~11% Source: Nikkei 225 Japan, Siblis Research, MSCI Brazil Index, 1 Finance Research - Mean-Reversion and Cyclical Opportunities

Undervalued markets tend to deliver outsized returns over the long term due to mean-reversion in valuations. Markets often trade at lower levels due to temporary dislocations like political instability, high inflation, or currency depreciation. As macroeconomic conditions stabilise, earnings recover, and investor sentiment also improves, these markets experience strong catch-up rallies. - Lower Valuation = Higher Margin of Safety

Undervalued markets inherently offer a margin of safety. Buying into depressed valuations limits downside risk and positions investors to benefit from both multiple expansion and earnings growth. This is especially relevant during periods of global monetary tightening when growth becomes scarce and valuation discipline matters most. - Relative Valuation vs. Absolute Valuation

In a world of capital mobility, it is not enough to assess Indian equities in isolation. Investors must compare valuations and macro-outlooks globally. For example, an Indian equity trading at 23x earnings may look less attractive than a UK or Brazilian index at 10–12x with a stable macro trajectory. - Strategic Rebalancing Opportunities

A global approach allows for periodic rebalancing based on evolving valuations. An investor overweight on India can gradually shift allocations to undervalued global pockets, thereby maintaining optimal risk-reward across cycles.

Recommended for you

Readers also explored

How to Invest in India’s Current Macroeconomic Phase?

Nifty 50 Companies List 2025 : Top 50 Stocks in India

Identifying Undervalued Markets

Valuation tools—such as trailing P/E, forward P/E, CAPE (cyclically adjusted P/E), and PEG ratios—alongside macroeconomic indicators, suggest that certain global equity markets like Japan, the UK, and Brazil are currently trading at significant discounts to their historical valuation norms. These valuation anomalies are not merely statistical; they reflect temporary dislocations due to policy transitions and geopolitical uncertainties.

For instance, Japan continues to trade at modest valuations despite improving corporate governance and a revival in domestic demand. Similarly, Brazil, while historically volatile, offers compelling opportunities as inflation moderates and fiscal conditions improve.

Against this backdrop, a valuation dashboard serves as a powerful decision-support tool—enabling investors to monitor where current valuations stand relative to historical medians and identify regions with asymmetrical upside potential. By combining these insights with a macroeconomic lens, investors can tactically allocate capital to markets that are not only undervalued but also positioned for structural or cyclical re-rating.

How to invest in International Equity Markets

Broadly, we would be looking at three of the most popular routes:

1. International Mutual Funds (Feeder Funds or Fund of Funds)

Indian Asset Management Companies (AMCs) offer mutual fund schemes that invest in overseas funds that track global indices like the S&P 500, MSCI World, NASDAQ 100, or region-specific indices like FTSE 100, Nikkei 225, or MSCI Europe.

This route has been the most attractive as it is easy to invest via INR-based SIP or lump sum contributions and ideal for small-ticket, long-term investors, and is managed by professional fund managers. However, SEBI has capped the total overseas investment by Indian mutual funds at $7bn, with a sub-limit of $1bn per mutual fund house (AMC). These limits were imposed to manage foreign exchange outflows and systemic risk. Once an AMC reaches this limit, it must halt new subscriptions to its international funds. Although some AMC schemes have reopened subscriptions, most overseas mutual funds remain closed unless redemption triggers capacity.

Some of the prominent mutual funds/ fund of funds with their corresponding underlying benchmarks are listed below:

| Mutual Fund (India‑domiciled, FoF) | Underlying Benchmark / Region |

|---|---|

| Edelweiss ASEAN Equity Offshore Fund | ASEAN equities |

| Edelweiss Greater China Equity Offshore Fund | MSCI China Index |

| Edelweiss Europe Dynamic Equity Offshore Fund | STOXX Europe 600 |

| HSBC Brazil Fund (FoF) | MSCI Brazil 10/40 Index |

| ICICI Prudential Nasdaq 100 Index Fund of Fund | Nasdaq 100 |

2. Exchange-Traded Funds (ETFs) – International

International ETFs listed on Indian exchanges offer investors exposure to global equity markets by tracking foreign indices through underlying offshore assets. These ETFs are traded in INR, making them transparent, relatively low-cost, and accessible via domestic trading accounts. They provide a convenient entry point for international diversification.

However, the range of such ETFs remains limited, with most products focused on U.S. indices like the Nasdaq 100 and S&P 500, while coverage of other regions, such as Europe, the UK, or Japan, is still sparse.

Some of the prominent ETFs with their corresponding underlying benchmarks are listed below:

| ETF Name | Benchmark / Region Exposure |

|---|---|

| Motilal Oswal NASDAQ‑100 ETF | NASDAQ-100 Index |

| Mirae Asset NYSE FANG+ ETF | NYSE FANG+ Index |

| Mirae Asset S&P 500 Top 50 ETF | S&P 500 Top 50 TRI |

| Mirae Asset Hang Seng TECH ETF | Hang Seng TECH Total Return Index |

| Nippon India ETF Hang Seng BeES | Hang Seng Index |

3. Liberalised Remittance Scheme (LRS) Route

The Liberalised Remittance Scheme (LRS) is a regulatory framework introduced by the RBI permitting Indian residents to remit up to $250,000 per year, including overseas investments in stocks, ETFs, mutual funds, real estate, and deposits. Under LRS, individuals can open an international trading or brokerage account with SEBI-registered foreign partners or licensed global platforms and invest directly in foreign-listed securities. This provides access to a broader range of international markets beyond what is offered domestically through Indian mutual funds or ETFs.

However, the complexity and compliance burden make it less suitable for novice investors, as it also has several challenges, such as high compliance, forex risk exposure, and execution complexity that includes opening and managing an account with a global broker, making it suited for informed, long-term investors.

Further, from a compliance point of view, investing via LRS attracts a 5% Tax Collected at Source (TCS) on remittances exceeding ₹7 lakh annually, adjustable against income tax. Capital gains are taxed in India based on holding period, and foreign dividends are fully taxable. Investors must also disclose foreign assets in Schedule FA of their ITR.

Therefore, here is a quick summary of the three popular investment routes for Indian investors:

| Route | Currency | Access | Cost | Flexibility | Regulatory Complexity |

|---|---|---|---|---|---|

| Mutual Funds | INR | Easy (SIP) | Medium | Moderate | Low |

| ETFs | INR | Easy (Demat) | Low | Medium | Low |

| LRS | USD | Medium (Form A2) | Low | High | High |

Summary

To summarise, Indian investors can benefit from diversifying into international equities, especially those markets that are trading below historical norms. Markets like Japan, the UK, and Brazil present compelling opportunities due to favourable valuation metrics, improving fundamentals, and sectoral exposures not easily available domestically.

However, identifying opportunities is only the first step. Choosing the right investment vehicle—be it mutual funds, ETFs, or direct investments via the LRS route—requires balancing ease of access, regulatory compliance, cost-efficiency, and long-term objectives. While mutual funds and ETFs offer simplicity and INR-denominated convenience, the LRS route provides unmatched flexibility and global reach, albeit with higher complexity.

Ultimately, successful international investing requires a blend of valuation discipline, informed execution, and regular portfolio rebalancing. By complementing domestic holdings with global undervalued assets, investors can build a more resilient and opportunity-rich portfolio, aligned with both current valuations and future potential.

Disclaimer

International investing involves currency risk, regulatory differences, geopolitical exposure, and liquidity constraints. Past performance is not indicative of future returns. Investors are advised to consult a SEBI-registered advisor and understand tax and compliance requirements before proceeding.