China stands at a critical juncture in its economy today, balancing a slowing economic growth with rising global influence. In this edition, we trace its economic evolution over the past few decades, highlight the key trends that shaped its growth trajectory. We also examine its rising dominance in artificial intelligence, electric vehicles, and semiconductors, and its shift toward high-tech growth. Finally, we cover The Hang Seng Index’s rally over the past year, which underscores renewed investor optimism and policy-driven recovery momentum.

Quick Summary and Key Takeaways

China’s economy has seen phenomenal GDP growth between 1978-2010, averaging 10%, driven by reforms and exports, but growth slowed down to ~4.9% between 2020-24, due to COVID-19 and other structural and global challenges.

China is asserting its global leadership through increased bargaining power and dominance in sectors like artificial intelligence, electric vehicles, semiconductors, and rare earth supply chains.

Hang Seng has delivered average long-term returns (~7.0% CAGR over 20 years), and it offers vital diversification across key emerging themes, making it an adequate diversification option.

China’s markets may run ahead of fundamentals in the near term, driven by sentiment and policy support, but lasting gains rely on earnings, consumption revival, global stability, as well as limited government intervention in markets.

China’s Phenomenal Rise As An Economic Superpower

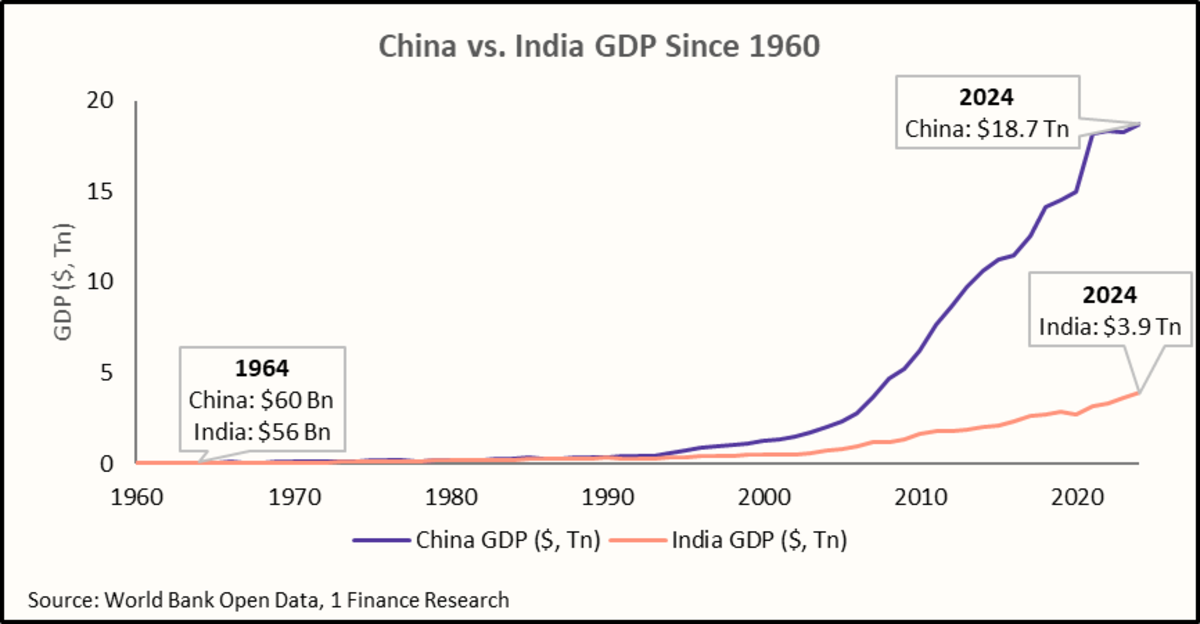

Until the late 1970s, China was mostly a rural, centrally planned economy and had a similar GDP to India. Reforms began under Deng Xiaoping’s “Second Great Leap”, which opened China to private businesses, foreign investment, and Special Economic Zones (SEZs).

This rapid industrial growth transformed its society and economy. Workers migrated to cities, creating vast urban centres and manufacturing hubs. Market reforms, urbanisation, and export-driven manufacturing, supported by massive infrastructure investment, low-cost labour supply, and global trade integration, lifted productivity and incomes.

The impact was enormous: In the 1980s, the average real GDP growth rate stood at 9.3% per year, and in the 1990s, it averaged around 10.5%. This transformation shifted China from an agrarian economy to the world’s manufacturing and export powerhouse.

By 2010, it had overtaken Japan as the world’s second-largest economy, and by 2019, it ranked first globally by Purchasing Power Parity (PPP).

In recent years, the average real GDP growth rate has slowed to ~4.9% (2020-24). Housing market problems have reduced investment and consumer spending. Other headwinds have also contributed, such as high debt levels, an ageing population, and strict crackdowns on sectors like real estate.

Its fast-growing economy and rising influence in trade, technology, and strategy have strengthened its push for global leadership.

Recommended for you

Readers also explored

Decoding China’s Economic Trends and Market Moves

India's IT Sector Outlook for FY2026

China’s Rising Global Leadership Aspirations

China is positioning itself as a dominant industrial and technological player: This can be seen from the advanced AI and large-scale patent filings, raw-material securing through the Silk Road, mining and refining of rare earths, to controlling the EV-battery ecosystem and critical-component supply chains.

Here is a summary of Chinese dominance in key emerging technologies:

| Domain | How China Dominates | How Far Ahead Is China? |

|---|---|---|

| Artificial Intelligence (AI) |

| China filed 60% of global AI-related patent applications in 2023 |

| Rare Earth Mining & Processing |

| China controls ~60–70% of global rare earth mining and ~85–90% of processing capacity |

| Electric Vehicles & Battery Supply Chain |

| In 2024, China produced ~70% of global EVs and over 70% of global EV batteries |

| Critical Materials & Component Ecosystem |

| China produces ~92% of global synthetic/natural graphite for battery anodes |

In the recent US-China trade deal, announced on 1st Nov-25, both nations agreed to a one-year trade truce, including easing export controls on rare earths, reducing certain US tariffs, and China buying more US agricultural goods. The deal highlights its stronger position in global trade, reflecting its growing economic power and influence over global supply chains.

Next, let’s have a look at the recent performance of the Chinese markets and their two prominent indices, the Shanghai Stock Exchange Composite Index (SSE) and the Hang Seng Index (HSI).

Exploring China’s Market Surge

China’s stock market is led by the SSE, which includes around 2000 domestically listed firms, but offers limited foreign investor access, while the HSI represents global investor exposure.

HSI features 82 large Hong Kong and Mainland Chinese companies across sectors like finance (35%), technology (23%), consumer goods (19%), and real estate (12%), providing easier, diversified investment routes for Indian investors.

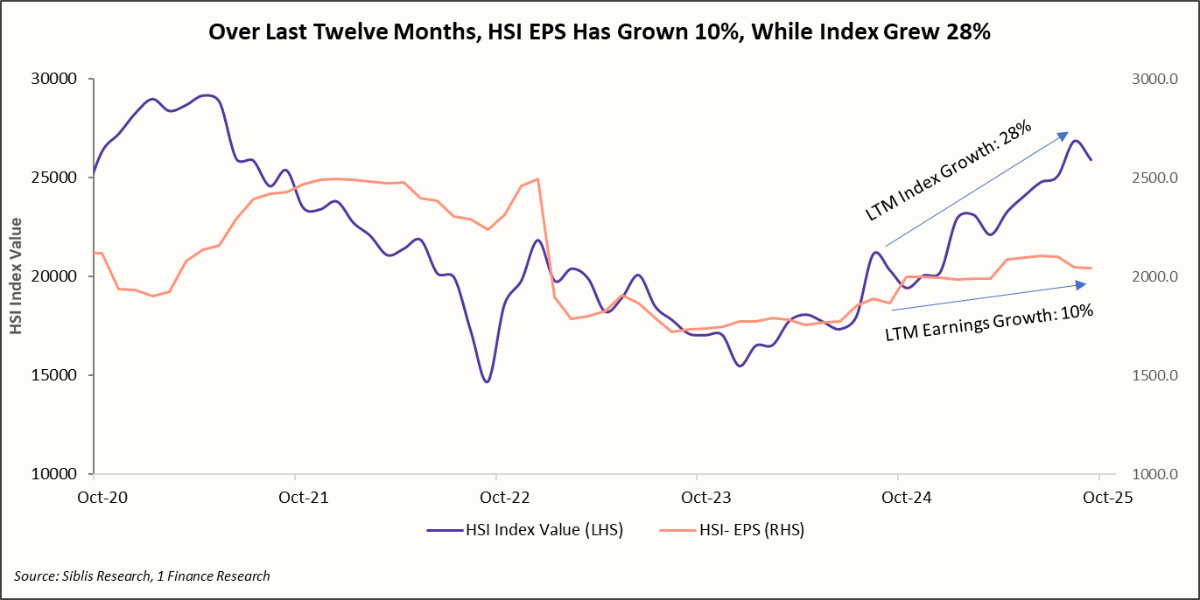

The recent rebound in HSI has come after years of underperformance, outpacing all peers, with 28% returns over the last twelve months (LTM), while earnings per share (EPS) have only grown 10% during the same period.

The rally is driven by factors such as Chinese government stimulus (amounting to $1.5 Tn), easing geopolitical tensions, AI optimism (in companies such as Alibaba and Tencent), and renewed investor confidence.

However, if we see the bigger picture, earnings have remained flat over the last 5 years and are ~ 3.6% lower than Oct-20 levels. The index has also seen modest gains (+7.5%). Other indicators for HSI, such as Price to Earnings Growth (PEG ~-17.3x), also appear weak, and we have categorised the HSI as a Highly Overvalued Index with a score of 62.

| Total Return (including corresponding INR Depreciation) | |||||

|---|---|---|---|---|---|

| HSI | NIFTY-50 | S&P-500 | FTSE-100 | Nikkei-225 | |

| YTD | 40.9% | 4.1% | 18.3% | 25.7% | 18.7% |

| 1-year | 33.6% | -4.6% | 22.1% | 22.3% | 21.0% |

| 3-year | 19.7% | 12.9% | 26.0% | 20.0% | 21.8% |

| 5-year | 5.1% | 17.0% | 19.1% | 14.6% | 10.1% |

| 10-year | 4.2% | 12.0% | 16.8% | 6.2% | 10.8% |

| 20-year | 7.0% | 11.9% | 12.6% | 4.8% | 8.3% |

HSI has also underperformed major peers like the S&P 500 (US), Nikkei-225 (Japan) and NIFTY 50 (India) over the long term, delivering modest returns.

Overall Assessment

China’s Economic Outlook

While China’s GDP Growth is slowing down, it has averaged ~4.9% (2020-24). The policy stimulus (amounting to $1.5 Tr) and a shift toward innovation-led industries could stabilise momentum. The government’s focus on AI, EVs, and green tech will likely define the next decade of China’s industrial rise.

China’s Rising Geopolitical Heft

China’s growing global reach through trade agreements, resource partnerships, and renewed Western engagement also offers opportunities for investors. However, deeper integration also exposes markets to policy shifts and capital flow volatility.

Balancing diversified exposure with geopolitical awareness will define successful long-term investing in Chinese markets.

Market Perspective

The Hang Seng lags behind other global indices due to weak long-term returns (7.0% CAGR over 20 years) and low earnings growth.

Low dividend yields (around 3% annually) and sub-par historical performance make HSI a tactical bet, and not a strategic long-term wealth creator like the S&P 500 or NIFTY 50.

Therefore, it should be considered as a diversification option across other international markets. It will also require patience, active monitoring, and setting realistic expectations.

Looking forward, as the Chinese economy matures and growth slows, the focus will shift toward innovation, green industries, and self-reliance. Markets may see tactical gains, but leadership in key emerging sectors can position China to shape the next phase of global economic competition.