India's commercial office market has changed from being an institutional-grade asset class to a more mainstream one. In 2024 alone, over $8.9 billion poured into Indian real estate, with $2.5 billion into commercial spaces and $800 million raised via REITs. This signals growing investor preference for structured, income-generating opportunities in the commercial segment.

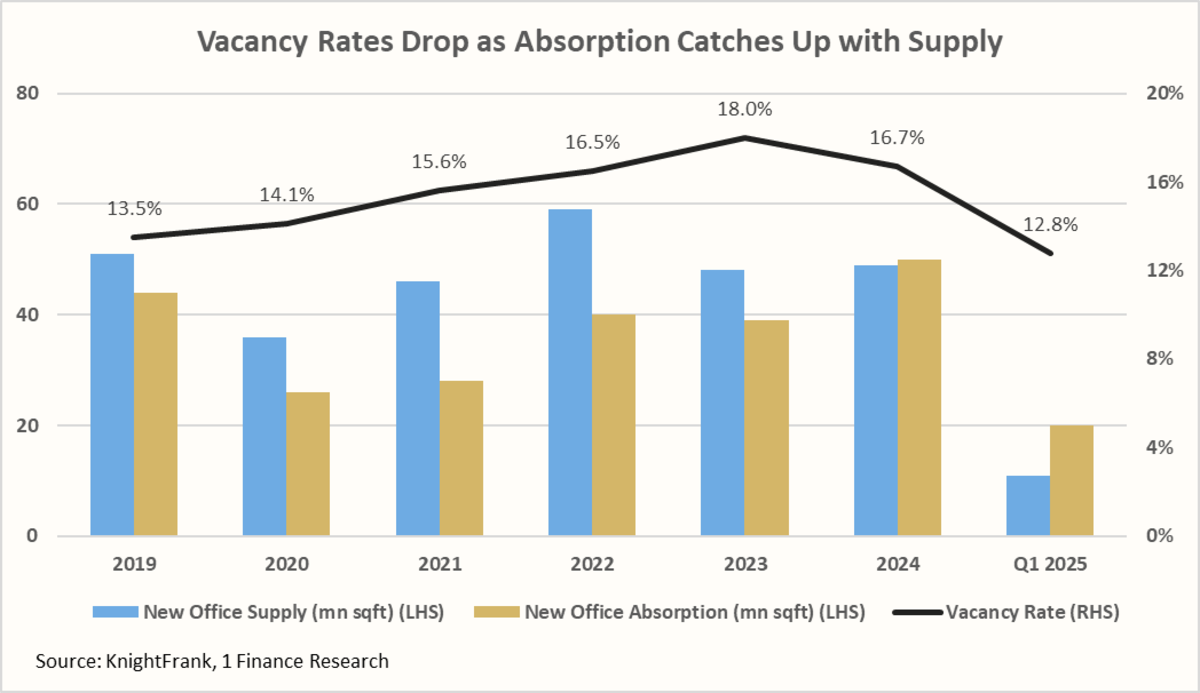

Q1 2025 clocked over 20 msf in new supply absorption. Vacancy rates are compressing across metros, even as fresh supply enters. This signals strong tenant demand, improving rental income, and an occupier base now more diversified than ever, led by IT, BFSI, GCCs, and the fast-growing flex space segment.

The geographical spread of demand and the quality of assets being absorbed stand out. Business corridors in Bengaluru, Hyderabad, and Pune are seeing healthy pre-leasing, while Mumbai and NCR are witnessing growing tenant movement toward newer, better-managed office assets that offer superior infrastructure and accessibility.

As we explore the market further, it becomes clear why India's commercial real estate now deserves a strategic spot in diversified investment portfolios of individuals.

City-wise Commercial Market Snapshot

| City | Avg. Grade A Rent (₹/sq. ft/month) | Gross Yield | Total Stock (msf) | Vacancy | Upcoming Supply (msf) | Upcoming Supply (Key Submarkets) |

|---|---|---|---|---|---|---|

| Mumbai | 162 | 7.8% | 120 | 13% | 25 | SBDs & peripheral markets (e.g. Jogeshwari, Andheri, Thane) |

| Delhi NCR | 84 | 8.0% | 154 | 21% | 22 | Noida Expressway & suburban Gurugram (NH-8) |

| Bengaluru | 94 | 7.8% | 204 | 10% | 20 | Outer Ring Road, Peripheral East (Whitefield) |

| Hyderabad | 83 | 8.0% | 113 | 23% | 40 | Madhapur & Gachibowli (western IT corridor) |

| Pune | 90 | 8.0% | 77 | 11% | 21 | SBD East (Kharadi) & PBD West (Hinjewadi) |

- Mumbai: Mumbai’s office market is seeing a structural realignment, with tenants shifting away from traditional CBDs like Nariman Point and BKC toward more cost-effective and infrastructure-rich micro-markets such as SBD West (Andheri, Jogeshwari) and Powai. These emerging nodes are benefiting from ongoing metro projects, Coastal Road construction, and a preference for Grade A developments. Demand is largely driven by BFSI firms, legal services, and GCCs seeking connectivity, scalability, and rental efficiency.

- Delhi NCR: The region continues to exhibit bifurcated demand dynamics. Gurugram remains the top choice for flex space operators, consulting firms, and IT/ITeS companies due to its established commercial clusters and talent accessibility. Meanwhile, the Noida-Greater Noida Expressway is gaining traction as a preferred location for telecom, IT back-office, and digital infrastructure tenants. Demand here is bolstered by competitive rentals and sustained GCC interest, particularly in new supply corridors like Golf Course Extension and Noida Sector 62.

- Bengaluru: As India’s most mature commercial office market, Bengaluru commands strong interest from global tech, fintech, and R&D-focused occupiers. Outer Ring Road (ORR) and Whitefield continue to be preferred for their SEZ infrastructure and integrated campuses. A notable trend is the rising appeal of North Bengaluru, where the upcoming supply is being absorbed even before handover. High pre-leasing rates across projects reinforce institutional confidence in the city’s long-term growth and rental resilience.

- Hyderabad: Despite high vacancy rates, Hyderabad remains attractive due to its affordability and future-ready infrastructure. Key micro-markets like HITEC City and Gachibowli are attracting co-working operators, global banks, and GCCs. The state government’s proactive approach toward SEZ conversion and corridor-based infrastructure planning is unlocking new investable pockets, particularly in the western business district.

- Pune: Pune has established itself as a low-volatility market with strong rental traction in Hinjewadi Phase II and Kharadi. Its occupier mix is expanding from IT services to auto-tech, clean energy, and software product firms. Limited but steady new supply ensures faster absorption, while improving connectivity is boosting investor appetite. Pune’s appeal lies in its predictable returns, low vacancy cycles, and ability to attract both R&D hubs and global startups.

Recommended for you

Readers also explored

The Strategic Importance of Real Estate in Financial Planning

India’s Unemployment Rate in 2025

Comparing India’s Office REITs

India’s listed REITs – Embassy Office Parks REIT, Mindspace REIT, Brookfield India REIT, and Nexus Select Trust now collectively own about 126 msf of commercial portfolio.

| REIT | Leasable Area (msf) | Occupancy | FY25 Dividend Yield | LTV Ratio | Key Strength |

|---|---|---|---|---|---|

| Embassy Office Parks | 51 | 87% | 6.2% | 27% | Diversified IT-GCC base in core locations |

| Mindspace Business Parks | 35 | 91% | 5.7% | 22% | Low leverage, strong IT park exposure |

| Brookfield India | 29 | 85% | 6.7% | 35% | Global sponsor, upside in SEZ markets |

| Nexus Select Trust (Retail Focused) | 11 | 97% | 5.7% | 18% | High occupancy in malls, consumption growth |

- Embassy Office Parks REIT: Embassy REIT manages one of India’s largest and most institutionally anchored commercial office portfolios. With over 82% of its tenant base comprising Fortune 500 and multinational corporations, it offers a high degree of income stability. The REIT also has 8 million square feet under development, nearly half of which has already been pre-leased, underscoring strong demand visibility and operational strength.

- Mindspace Business Parks REIT: Mindspace REIT operates high-quality, integrated office parks concentrated in Mumbai and Hyderabad, accounting for more than 60% of its rental income. The REIT stands out for its sustainability-linked financing, being the first in India to issue ESG-tied bonds. Through a Right of First Offer (ROFO) arrangement with its sponsor, K Raheja Corp, it enjoys preferential access to a pipeline of institutional-grade assets. This structure enables disciplined portfolio expansion without exposure to inflated market pricing.

- Brookfield India Real Estate Trust: Brookfield REIT is the only publicly listed REIT in India managed entirely by an institutional sponsor. It has adopted a strategic repositioning of SEZ assets into flexible-use formats to accommodate a broader tenant base, including global consulting, legal, and shared services firms. With over 4 million square feet in the development pipeline, it offers investors a compelling mix of income generation and capital appreciation.

- Nexus Select Trust REIT: Nexus Select, while not office-focused, remains significant for investors seeking exposure to India’s consumption-driven real estate story. With a retail portfolio that includes premium malls in 14 cities and a tenant mix featuring over 1,000 brands, the REIT enjoys strong occupancy (97%) and brand recall.

Direct vs. REIT Investment Profiles

| Investor Category | Best-Suited Route | Grade A Access | Diversification | Liquidity | Yield & Growth Potential |

|---|---|---|---|---|---|

| ₹10–50 lakhs | REITs | ✅ Yes (fractional) | ✅ High | ✅ High | ✅ Stable yield, moderate NAV growth |

| ₹50L – ₹1 crore | Primarily REITs | ✅ Yes (multiple REITs) | ✅ High | ✅ High | ✅ Escalating rents, low volatility |

| ₹1–5 crore | REITs + Small Direct Assets | ✅ Yes (partial) | ⚠️ Limited | ⚠️ Medium | ⚠️ Tenant dependent income, micro-market risk |

| ₹5 crore+ | Direct Office + REITs | ✅ Yes (entire projects) | ⚠️ Depends on portfolio size | ⚠️ Low | ✅ Strong upside in early-lease, prime assets |

- REITs are most appropriate for portfolios up to ₹1 crore due to their liquidity, regulatory oversight, and embedded diversification.

- Investors with ₹1–5 crore can explore hybrid strategies, but direct deals require careful diligence on location, lease terms, and tenant quality.

- For ₹5 crore+ clients, direct ownership may offer better customisation and long-term capital growth, but with lower liquidity and higher entry complexity.

Conclusion

India’s commercial office real estate is a strategic asset class evolving with new access points, investor structures, and return profiles. As the market matures, investors have a wider toolkit to align their capital with quality office exposure, whether through liquid REITs or curated direct deals.

Understanding tenant dynamics, supply corridors, and yield visibility is key to tailoring the right product for each portfolio size. With rising occupier confidence, stable policy support, and deepening capital flows, commercial real estate stands well-positioned to deliver long-term income and diversification in client portfolios.