India’s economic policy seems to have entered a phase of recalibration, as underscored by the Prime Minister’s Independence Day address, when seen in line with the Union Budget announcements and the Reserve Bank of India’s recent policy stance. The government plans to slash the Goods and Services Tax (GST) rates on select consumption categories. This will come into effect from 22nd September 2025. This comes on the back of earlier personal income tax reductions announced in the Feb-25 Budget.

On its part, the RBI has doubled up with a cumulative 100 bps reduction in the repo rate, and might announce more cuts in the subsequent MPC meetings, marking one of the sharpest easing cycles in recent years.

These measures, an expansionary monetary and fiscal policy, taken together, signal a coordinated policy push aimed at reviving household consumption, boosting savings and private investment, and cushioning the economy against both domestic demand weakness and persisting global uncertainties.

In this blog, we will explore how such interventions promise near-term relief for individuals and businesses. We will also look at the implications of these tax cuts on fiscal deficit and inflationary risks, while also looking at some of the sectors that stand to gain from these policy measures within the broader macroeconomic context of mid-2025.

A Brief Overview of the Income Tax and The GST Rate Cuts

In the Union Budget 2025‑26, the government announced a complete income tax rebate on incomes up to ₹12 lakh under the new tax regime, with standard deduction increased to ₹75,000 (from ₹50,000 earlier) and realigned the higher tax brackets, effectively raising the tax‑free threshold to ₹12.75 lakh.

On the indirect tax front, the Prime Minister, on 15th August, unveiled the “next‑generation” GST reforms as a Diwali gift, promising substantial rate reductions on everyday items to lighten the tax burden on households. This was subsequently approved by the Group of Ministers (GoM), eliminating the 12% and 28% slabs in favour of just 5% and 18%, with a higher 40% levy on sin and luxury goods.

From Feb-25 to Jun-25, the RBI implemented three consecutive repo rate cuts, cumulatively reducing the benchmark rate by 100 bps from 6.5 % to 5.5 %. In its June meeting, RBI delivered a surprise 50 bps cut, accompanied by a 100 bps reduction in the Cash Reserve Ratio, aiming to boost liquidity, lower EMIs, and support growth amid soft inflation.

Recommended for you

Readers also explored

Index of Industrial Production: What Is It and How Does It Affect You?

Nifty 50 Companies List 2025 : Top 50 Stocks in India

Why were these moves necessary

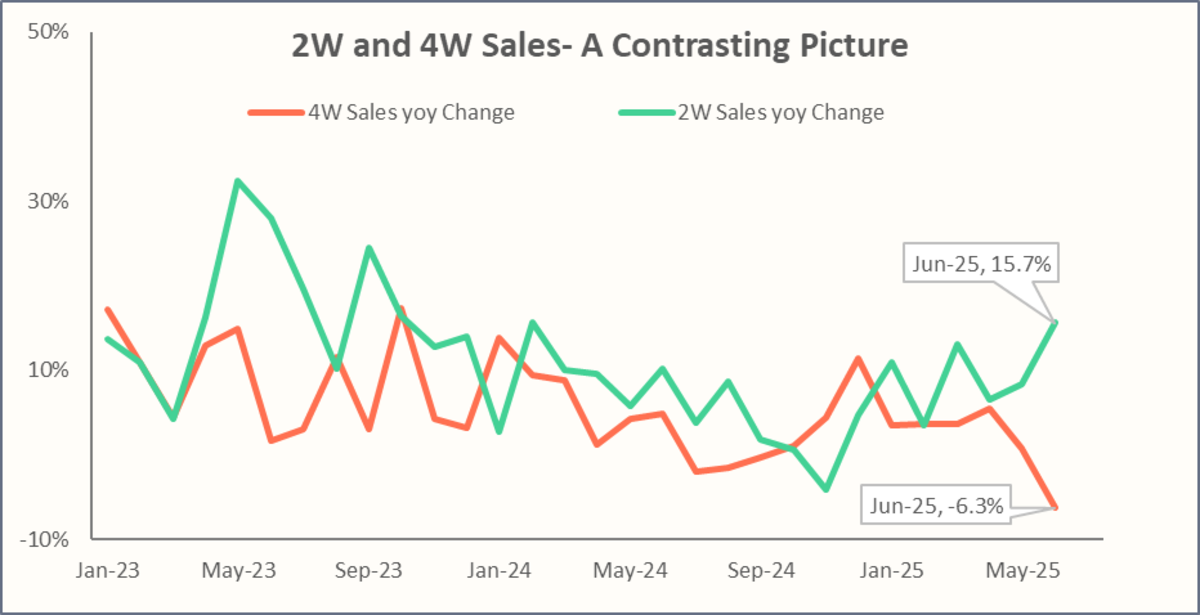

These moves were necessary as the Indian economy had been showing mixed signals recently, with a marked slowdown in urban demand while the rural demand remained resilient. This can be seen by looking at certain High-Frequency Indicators (HFIs), such as 4-wheeler sales (4W’s), which are often considered a proxy for urban demand. Car sales fell 6.3% yoy in Jun-25, marking an 18‑month low, a clear warning of subdued urban consumption. On the other hand, 2-wheeler (2W) sales have stayed firm, growing ~15.7% in Jun-25 year-on-year, driven by rural consumers who have benefited from easing inflation, improved monsoon prospects, and recovered farm incomes.

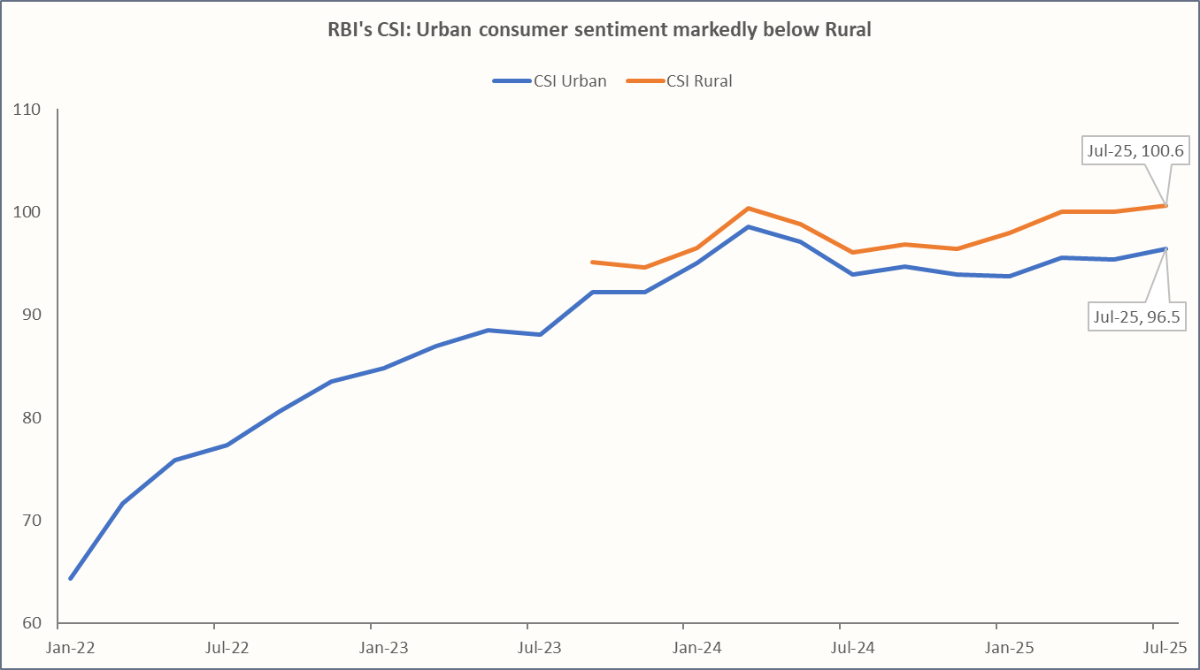

Further, the RBI’s bi-monthly Consumer Sentiment Index (CSI), which is a part of its Consumer Confidence Survey, tracks how households feel about income, jobs, prices, and spending. The chart shows that rural CSI has consistently stayed above urban levels over the last few months. The chart suggests that while the rural economy has held up relatively well, urban consumers remain under pressure due to factors like higher living costs, stagnant wages, and rising household debt.

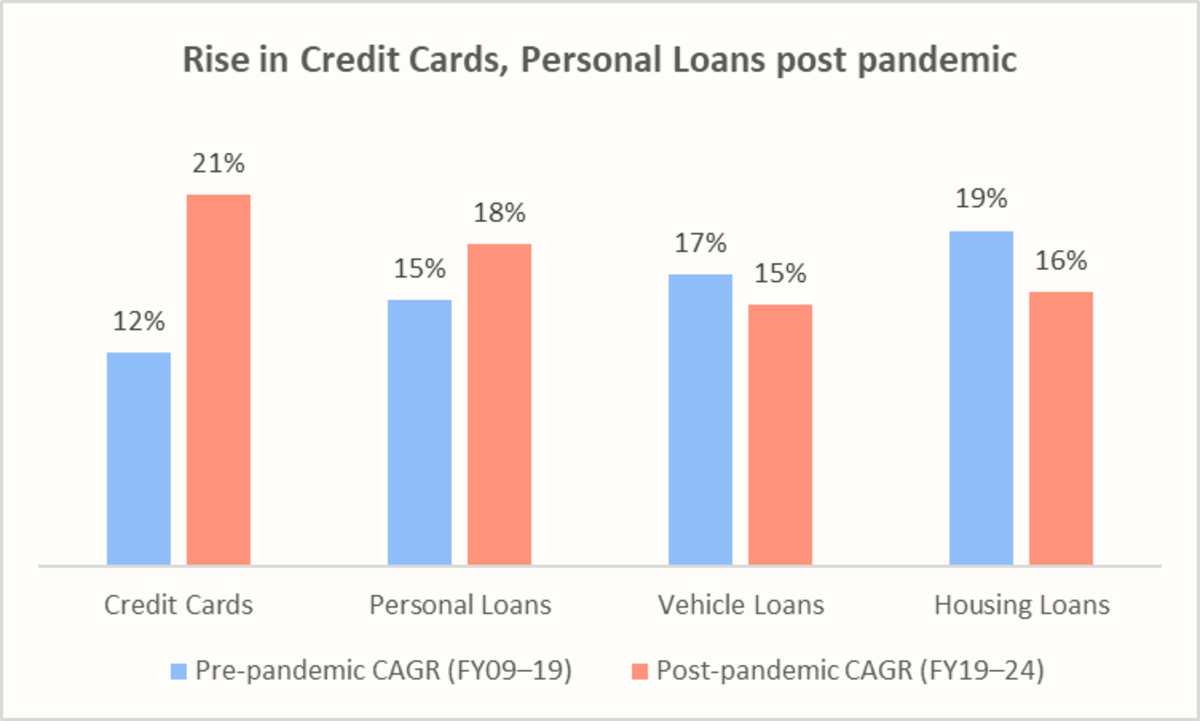

The RBI’s Financial Stability Report reveals that, while housing and vehicle loans slowed, growth in personal loans and credit cards accelerated sharply. This trend is largely urban-centric, reflecting borrowing for lifestyle and consumption needs amid stagnant wages and higher living costs. The RBI flagged this as a systemic risk and also highlighted the rise in delinquency rates within unsecured credit segments, credit cards, personal loans, and microfinance, which are most prevalent in urban and semi-urban households.

Another indicator, NielsenIQ’s FMCG Quarterly Snapshot, urban India recorded just 4.6% volume growth, well below rural India’s 8.4%, in sales of non-durable goods for Jun-25, marking six consecutive quarters of rural outperformance, reflecting faltering urban consumption. This suggests that higher-income urban households are tightening discretionary spending. There are also signs of downtrading, consumers shifting from premium to value packs, and growing adoption of private labels, especially in personal care and packaged foods, as families look for affordability without compromising usage.

Lastly, we also see that the wages have remained flat, even as corporate profits soar. The Economic Survey 2024-25 notes that while corporate profitability soared to a 15-year peak in FY’24, employment only rose 1.5%. Further, despite Indian companies achieving a stable EBITDA margin of 22% over the last four years, wage growth has moderated, highlighting persistent wage stagnation.

Next, let us look at the impact of these cuts on the economy, the household budget, and the government’s fiscal position.

The Impact of the Tax Cuts on the Economy

The most immediate effect of the expansionary fiscal and monetary policy is felt through consumption, which accounts for nearly 60% of India’s GDP. Urban households, under pressure from stagnant wages and rising debt, will benefit directly from increased disposable income due to lower income tax deductions. GST reduction is expected to reduce the out-of-pocket spending on essentials and discretionary items. Similarly, lower interest rates would enable a lower EMI burden or a decrease in loan tenure.

Let’s break down what this means for an individual earning ₹25 lakh annually and spending on items such as Insurance, packaged foods, and personal care.

How These Reforms Affect Your Finances

- Income Tax Savings stemming from the two key changes in the new regime mentioned above. Together, the tax liability for an individual earning ₹25 lakh annually decreases from ~ ₹4.3 lakh to ~ ₹3.2 lakh. That’s a saving of ~₹1.15 lakh annually (₹9,500 per month).

- GST Rationalisation Gains are expected to bring most essentials and even some lifestyle expenses into the lower 5%/ Nil bracket.

- Insurance Premiums (Health & Life) of around ₹5,000 monthly for health and life cover are likely to attract Nil GST instead of 18%. That’s a relief of about ₹10,800 every year.

- Personal and household care product spends of roughly ₹1.2 lakh per annum, the GST cut from 18% to 5% translates into savings of nearly ₹15,600 each year.

- Packaged and processed foods with spends of around ₹2 lakh per annum, the GST drop to 5% from 12% brings in another ₹14000 of annual savings.

- One-time purchases, like appliances and automobiles, are also likely to see a reduction in GST from 28% to 18%. However, we have excluded this from the estimate for simplicity.

Together, these rate revisions are likely to free up ~₹40,400 annually (excluding one-time purchases) in additional disposable income.

- The RBI’s 100 bps rate cut in 2025 has been partially transmitted to borrowers, approximately 70 bps so far. Therefore, for a ₹1 crore home loan over 20 years, the rate cuts reduce the annual EMI burden by ~₹47,000.

When we add it up, the numbers from the three reforms together deliver substantial relief, adding up to around ₹2 lakh (~8% of the annual salary) in extra disposable income.

This translates to almost ₹16,600 more each month flowing back into the household budget. The amount will be even higher if we include purchases of appliances and automobiles. This is a significant financial shift that eases cost-of-living pressures, improves savings potential, and creates room for investments, helping middle-class families strengthen their financial resilience and long-term security.

Beyond policy-driven relief, lower food inflation and daily-use goods have further ensured that the real purchasing power for salaried individuals improves alongside tax, GST, and EMI savings.

Next, let’s examine the key business sectors that are likely to see the maximum benefit from these rate cuts.

Key Sectors Likely to Benefit From These Moves

| Sector | Income Tax Cut | GST Reduction | Repo Rate Cuts |

|---|---|---|---|

| Automobiles | Spurs delayed automobile purchases, especially in low-income households. | Reduced GST(~ 10% for cars, 2W’s) lowers vehicle prices | Lower auto loan EMIs improve affordability, aiding both rural and urban demand. |

| FMCG | Supports discretionary purchases of FMCG products | Reduced prices of essentials and lifestyle purchases | - |

| Consumer Durables | Supports big-ticket spending on appliances | Lower GST ( reduction from 28% to 18%) reduces the retail prices of appliances | Lower EMIs on financed consumer durables spur demand for appliances |

| Housing & Real Estate | Boosts savings for down payments and upgrades. | - | Lower EMIs improve affordability, spur home purchases and newer constructions |

| Industrial | Higher consumption drives demand for manufactured goods, aiding industrial production. | GST rationalisation reduces compliance and logistics costs, improving efficiency. | Cheaper capital lowers project financing costs, supporting new investments and expansions |

Next, let’s look at the impact of these measures on the government finances

Impact on the government’s fiscal position

In FY 2024-25 revised estimates, income taxes make up over one-third of total tax receipts, while GST contributes nearly one-fourth. With the recent reforms, the government is set to forego income tax (estimated at ₹1 lakh crore, around ~ 8% of FY 2024-25 collections) as well as GST revenues. This creates a notable shortfall that could widen the fiscal deficit beyond initial targets.

By putting more disposable income in the hands of urban households and lowering indirect tax burdens on key consumer goods, the government hopes to revive consumption and boost personal final consumption expenditure, which is critical for India’s GDP growth. Officials also expect higher compliance, faster nominal GDP growth, tax buoyancy, and the demand multiplier to partly offset the near-term revenue loss.

However, these measures also carry risks of fiscal slippage, i.e., missing the fiscal deficit target, inflationary pressures, and potential currency volatility if markets doubt consolidation efforts.

Summary

The government’s recent reforms represent a coordinated policy push to counter urban consumption stress. By cutting personal income taxes earlier this year and announcing the rationalisation of GST rates and supported by the RBI’s repo rate reductions, policymakers are attempting to ease the financial burden on households while reviving demand. For the urban middle class, this translates into tangible relief: lower monthly tax outgo, cheaper EMIs, and reduced GST on key consumption categories. Together, these measures are expected to stimulate demand across automobiles, housing, durables, and FMCG, while indirectly reinforcing rural momentum through spillover demand.

However, the fiscal implications of these tax cuts are significant. With ~8% of income tax and ~9–10% of GST revenues likely to be foregone, the combined shortfall could widen the fiscal deficit, derailing its consolidation pathway. This also raises risks of inflationary pressures and potential currency volatility if investor sentiment weakens.

The government’s stance, however, is that stronger consumption growth will expand the tax base and partly offset revenue losses, while higher GDP growth will keep fiscal ratios sustainable. The balance between short-term stimulus and long-term prudence will define the policy’s success.