India’s CPI inflation eased sharply to 2.1% year-on-year in June 2025, down from 2.8% in May, according to the National Statistics Office (NSO). This marks the lowest inflation level in over six years, with the last comparable print seen in January 2019. The decline brings inflation just above the RBI’s lower tolerance band of 2%, raising expectations of a shift in monetary policy in the coming months.

In this article, we unpack the reasons behind this unexpected disinflation, evaluate its implications for the RBI’s interest rate trajectory, and discuss how a prolonged low-inflation environment could impact bond yields, household budgets, EMIs, savings rates, and investment allocations.

Factors causing Low Inflation

Several factors have combined to pull India’s CPI inflation down to 2.1%. The most notable ones being a decline in food prices and softening in Fuel prices. Besides these, supply-side improvements, an above-normal monsoon, and a high base effect from last year have all led to an outright decline in prices of key goods, especially food.

Miscellaneous Items category, which includes services such as Healthcare, Transport and communication and Education among other services saw an increase in inflation in Jun-25 (5.5%) as compared to May-25 (5.1%)

| Category | Weight % | May-25 Inflation Rate | Jun-25 Inflation Rate |

|---|---|---|---|

| Food & Beverages | 45.9% | 1.5% | -0.2% |

| Miscellaneous | 28.3% | 5.1% | 5.5% |

| Housing | 10.1% | 3.2% | 3.2% |

| Fuel & Light | 6.8% | 2.8% | 2.6% |

| Clothing and footwear | 6.5% | 2.7% | 2.6% |

| Pan, tobacco and intoxicants | 2.4% | 2.4% | 2.4% |

Here is the brief summary of factors causing the decline in Inflation in Jun-25:

- Decline in Food Prices

The single biggest category driving inflation in India has been Food prices, which make up nearly 46% of the CPI basket. These have slowed down considerably compared to last year, slipping into the negative territory with a -0.2% inflation in Jun-25. Among these, the prices of vegetables have seen the highest decline of ~19%, compared to a 13.7% decline in May 2025. Other items within this category, such as Pulses, Spices, Meat & Fish, have also seen a decline as compared to last year, while Cereals, Milk & Milk Products, Oil & Fats, and Fruits have seen an increase in prices as compared to last year.

The Consumer Food Price Index (CFPI), a more focused and granular standalone index published by MoSPI, recorded an inflation rate of -1.1% in June 2025, down from 0.99% in May 2025, indicating a notable softening in food prices. - Softening Fuel & Light inflation

Fuel & Light inflation also eased to 2.6% in June, down from 2.8% in May, reflecting stable global crude prices. This softening helped limit inflation spill-over into household utility costs, supporting overall disinflation. - Effective Supply-Side Interventions

In recent months, the Indian government has taken measures such as the Open Market Sale Scheme (OMSS), under which over 5 million tonnes of wheat and rice were released to curb inflation in cereals and pulses. A Price Stabilisation Fund (PSF) was announced in this year’s budget, which continued strategic buffer stocking and calibrated market sales of onions, pulses, and tomatoes to curb volatility. Further, duty-free imports of pulses also ensured lower prices. - Stable Monsoon

India’s monsoon in mid-July has been above average overall, with 109% of average in June and expected to be ~106% in July, supporting agriculture and replenishing reservoirs. However, regional disparities persist: central and northwest regions have thrived, while the east, northeast, and southern parts lag. A stable and early monsoon has boosted kharif sowing and crop yields, easing food supply pressures. This is also a meaningful contributor to low inflation. - Base Effect

A favourable base effect also contributed to June’s low inflation: last June saw elevated food prices, so this year’s CPI reflected a sharp YoY decline. This statistical effect magnifies the year-on-year decline in current prices, especially in vegetables, pulses, and cereals.

Recommended for you

Readers also explored

August 2025 MPC Review: Calm Now, But Global Storms Brewing

India's IT Sector Outlook for FY2026

Rising Core Inflation- A cause for worry?

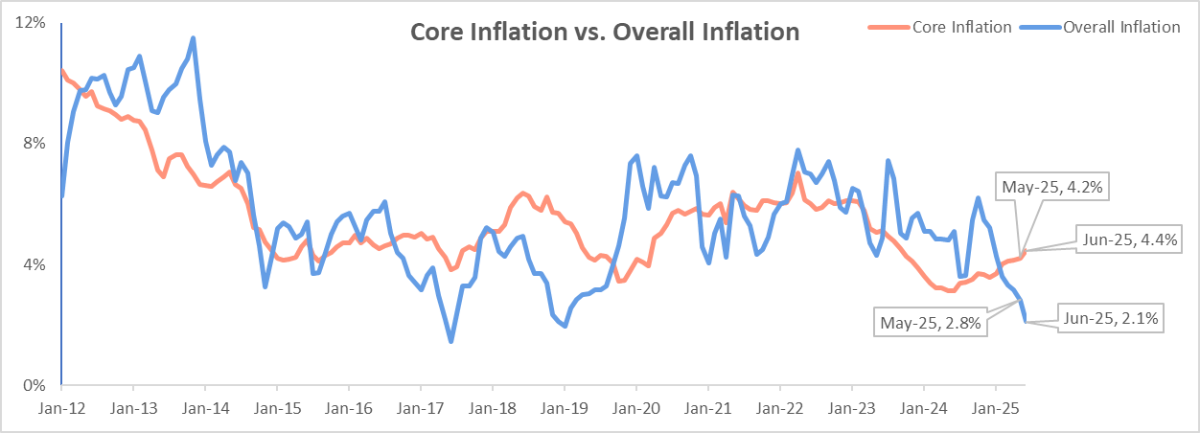

If we exclude food and fuel prices, we get core inflation. It includes all other components of CPI, such as Tobacco and Intoxicants, Clothing and footwear, housing, and miscellaneous items such as healthcare, transport, and education. Core inflation in India has slowly been inching higher and has reached 4.4%, its highest since Sep-23. The rise has been attributed to the following factors:

- Inflation in services such as Personal Care (14.8%), Healthcare (4.43%), Education (4.37%), and transport & communication (3.9%) has been increasing, reflecting strong domestic demand and indicating sticky inflation

- Soaring prices of precious metals such as Gold (~36.0% yoy in Jun-25) and silver (~17.8% yoy in Jun-25) are impacting inflation in specialty goods

- Rising government expenditures and improved rural demand due to an increase in Minimum Support Prices (MSP) have also been driving up

Rising core inflation, especially when it becomes persistent and broad-based, can be a cause for concern. It indicates demand-based inflation and is less sensitive to seasonal or volatile shocks. Rate cuts can boost demand in services, potentially adding further upward pressure unless accompanied by supply-side reforms. In this regard, RBI’s neutral stance and front-loaded easing in their Jun-25 MPC meeting reflects their caution toward inflation stickiness, with future cuts likely to be data-dependent.

Impact on RBI’s Monetary Policy Decisions

The RBI finds itself at a crucial juncture in its policy calibration. On one hand, the India’s CPI inflation has fallen to a 77-month low of 2.1%, well within the lower bound of its 2–6% target range, driven by food deflation and easing price pressures across major consumption categories. The WPI inflation for Jun-25 also stood at -0.1%, turning into the negative territory. Rate cuts would help revive the weak domestic demand, revive private investment, and reduce real borrowing costs.

On the other side, high and sticky core inflation level (4.4%) reflects underlying demand resilience in services and non-food sectors. Additionally, the monsoon variability and global uncertainties, especially related to Federal Reserve policy, US trade tariffs and crude oil prices, introduce the downside risks of cutting interest rates.

U.S. CPI data for Jun-25 shows headline inflation at +2.7% yoy and core inflation (excluding food & energy) at +2.9% yoy. As a result, the Federal Reserve is expected to hold rates steady during its upcoming meeting in July. This also limits the RBI’s room to cut rates in its August meeting, as a rate differential could trigger capital outflows, weaken the rupee, and fuel imported inflation.

Furthermore, in Jun-25, the RBI had already front-loaded its easing cycle with a 50-bps rate cut while shifting to a neutral policy stance from an accommodative one, signalling flexibility.

Thus, the dilemma is between responding proactively to the low headline inflation with further easing, versus maintaining a watchful stance amid sticky core pressures and global uncertainties. We expect a pause in the August policy meeting, with scope for measured cuts in October or December, if the disinflation persists and global uncertainties subside.

Low Inflation Environment and its impact on Households, Firms and Investors

Low inflation, particularly in essentials like food and fuel, reduces the cost of living for households. As households experience higher real incomes, salaried individuals as well as fixed pensions retain more purchasing power. EMIs become more affordable, especially in a falling interest rate environment, and consumer confidence also improves. This benefits low-income families the most, as food comprises a larger share of their consumption basket. Lower inflation also supports financial planning stability, making it easier to budget and save.

For firms, a low inflation environment typically brings stability in their input costs and improves price predictability. This helps with long-term planning and margin management. In an easy monetary policy environment, it can also reduce financing costs for working capital and enable higher capital expenditure.

For investors, low inflation improves the attractiveness of fixed-income instruments as real returns rise. Bond yields tend to fall, boosting prices, making it attractive for debt market investors. For equity investors, too, low inflation supports valuation expansion and improves corporate profitability, especially in interest-rate-sensitive sectors like real estate, banking, and automobiles. For long-term investors, low inflation offers a conducive environment for predictable returns, but asset allocation strategies may need to adapt to lower nominal growth.

Future Outlook

With India’s CPI inflation declining to a six-year low of 2.1%, it is expected to fall further, buoyed by favourable base effects and continued food supply stability, unless there are external shocks stemming from tariff-related risks. Full-year average inflation is expected to be lower than the 3.7% forecast for inflation as provided by the RBI. Low inflation is likely to pave the way for measured rate cuts later in the year. Markets will likely respond positively to supportive RBI moves, but only if core inflation remains under control and global risks are contained.