Understanding inflation and economic growth starts with knowing the right indicators. Among the most crucial tools economists use is the Wholesale Price Index (WPI). This index reflects the average change in prices of goods at the wholesale level, before they reach the consumer. While the Consumer Price Index (CPI) receives more media attention, the Wholesale Price Index (WPI) plays a foundational role in shaping India’s economic strategies and fiscal decisions.

What is the Wholesale Price Index?

The Wholesale Price Index (WPI) measures the average change in the prices of goods at the wholesale level over time. It provides insight into price movements before goods reach the retail market. Unlike CPI, which captures consumer-level data, WPI focuses on producers and distributors.

Historical Background of WPI

In India, the WPI was first published in 1942, and since then, it has undergone several revisions to remain relevant in a changing economic landscape.

Key Milestones

1942: First WPI published in India.

1970s-1990s: Multiple revisions to the basket of goods and base year to reflect changing consumption patterns.

2017: Latest revision with base year set to 2011-12, expanding the basket to 697 items.

These updates ensure that the WPI index remains a reliable reflection of the current economic structure, accounting for new products and changing market dynamics.

WPI vs. CPI: Key Differences

The WPI index and CPI serve distinct purposes in economic analysis. WPI focuses on wholesale prices of goods, while CPI measures retail prices, including both goods and services. This distinction makes each index suited for specific applications.

| Parameter | Wholesale Price Index (WPI) | Consumer Price Index (CPI) |

| Definition | It measures the average change in the prices of goods at the wholesale level over time. | It measures the change in the prices of a basket of goods & services purchased by consumers. |

| Focus | It focuses on goods traded between businesses. | It focuses on goods and services purchased by consumers. |

| Scope | It covers only goods. | It covers both goods and services. |

| Use in Policy | Inflation tracking, policy formulation | Cost-of-living adjustments, retail inflation |

| Published by | Office of Economic Advisor (OEA) | Central Statistics Office (CSO) |

Recommended for you

Readers also explored

Index of Industrial Production: What Is It and How Does It Affect You?

Currency in Circulation: How Much Money Exists in the World?

Components of WPI

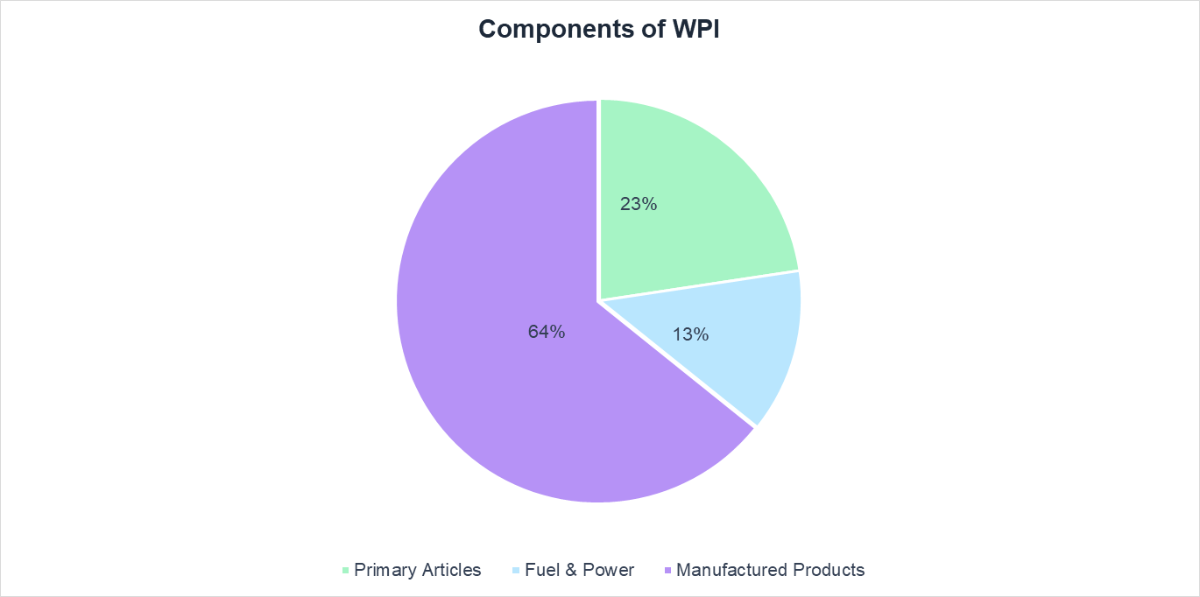

The Wholesale Price Index (WPI) in India is composed of a weighted basket of 697 items, grouped into three major categories: Primary Articles, Fuel & Power, and Manufactured Products. These components are selected to reflect the structure of production and trade in the Indian economy. Each category plays a unique role in shaping the overall index and inflationary trends.

1. All Commodities

- Primary Articles (22.62%)

It includes items like food articles, non-food articles, minerals, crude petroleum and natural gas.

- Fuel and Power (13.15%)

It includes LPG, Petroleum and Electricity.

- Manufactured Products (64.23%)

This includes a wide range of manufactured goods such as food products, beverages, tobacco products, wearing apparel, chemicals, pharmaceuticals, rubber and wood products, basic metals and other non-metallic products.

2. WPI Food Index

To provide more targeted insights into food inflation, the government of India also publishes a WPI Food Index, which tracks price movements of food items within the WPI basket. Introduced alongside the headline WPI, this sub-index serves as a focused lens to understand wholesale-level food inflation.

The WPI Food Index comprises:

- Food Articles under the Primary Articles group (e.g. cereals, pulses, fruits, vegetables, milk, eggs, meat, and fish).

- Food Products under Manufactured Products (e.g. sugar, edible oils, processed food, bakery products).

How is WPI Calculated?

The Wholesale Price Index (WPI) is calculated using a standard and time-tested statistical method known as the Laspeyres formula. This formula helps track how the prices of a fixed basket of goods change over time, using a base year as the reference point.

Step-by-step breakdown of WPI calculation:

1. Price Relative for Each Item

First, for each item in the WPI basket (like wheat, petrol, or cement), a price relative is calculated. This is done by:

Price relative = (Current Price / Base Year Price) X 100

This tells us how much the price has increased or decreased compared to the base year (currently 2011–12).

2. Weighted Average for Groups

Items are grouped into categories like Primary Articles, Fuel & Power, and Manufactured Products. Each item is assigned a weight, depending on its importance in the economy. The index for a group (or the overall WPI) is calculated using a weighted average:

WPI = ∑ (Item Index X Weight) / ∑ (Weights)

This ensures that items with higher economic relevance (like crude oil or steel) have a larger impact on the overall index.

3. Fixed Weights, Updated Prices

The weights remain fixed throughout the life of the WPI series (until the next revision), while prices are updated regularly. This means changes in WPI reflect price changes only, not changes in consumption or production patterns.

Significance and Limitations of WPI as an Economic Tool

Why WPI Matters

The Wholesale Price Index plays a vital role in understanding the overall economic environment, especially in terms of inflation and pricing trends at the wholesale level. Here's why WPI is considered important:

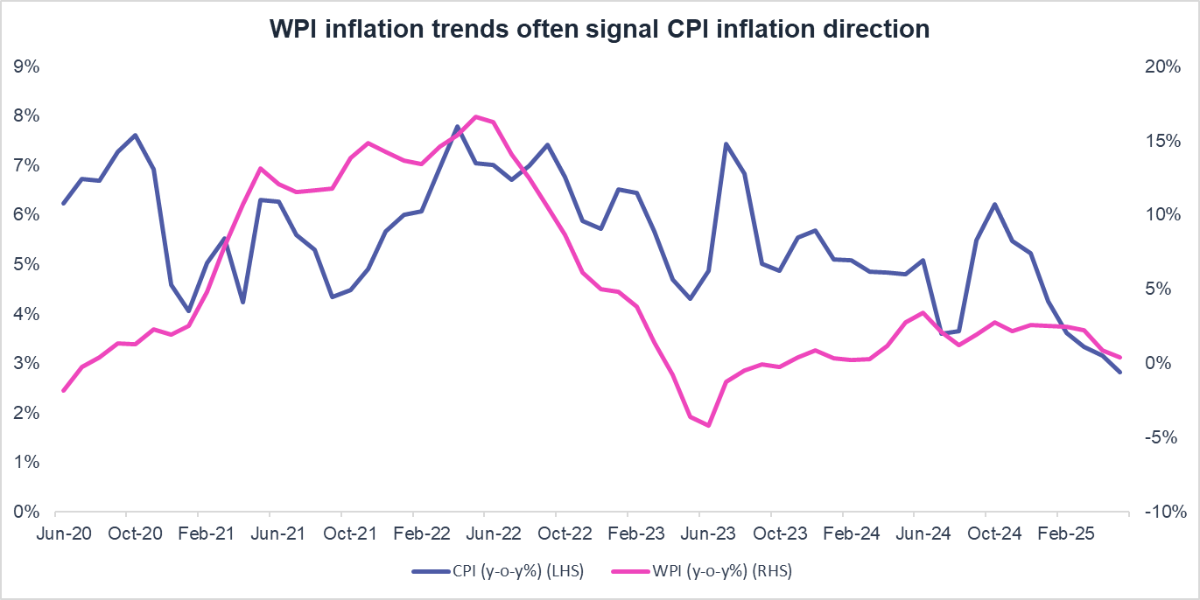

- Early Indicator of Inflation- WPI often shows price trends before they’re felt by consumers. Rising WPI can signal upcoming inflation at the retail level.

- Guides Policy Decisions- Central banks and the government track WPI to decide on interest rates, subsidies, and import/export policies.

- Business Planning Tool- Companies use WPI trends to forecast raw material costs, negotiate contracts, and adjust pricing strategies.

- Sectoral Insight- Since WPI covers primary articles, fuel, and manufactured products, it offers valuable insights into supply-side dynamics in agriculture, energy, and industry.

Limitations of WPI

While WPI is a powerful economic indicator, it also has some important shortcomings:

- Excludes Services- WPI covers only goods, not services like education, health, or transport, which make up a large part of household spending.

- Doesn’t Reflect Retail Prices- It measures price changes at the wholesale level, not what consumers actually pay in the market (that’s covered by the Consumer Price Index, or CPI).

- Fixed Weights- The weights assigned to goods in WPI are based on the base year (currently 2011–12) and may not reflect current consumption patterns.

- Limited Urban-Rural Insight- WPI doesn’t show how inflation affects different sections of society (e.g. rural vs. urban consumers) as clearly as CPI does.

- Less Relevant for Households- Since it excludes many items that directly affect consumers, it’s less relatable to the general public than CPI.

Recent trends in WPI

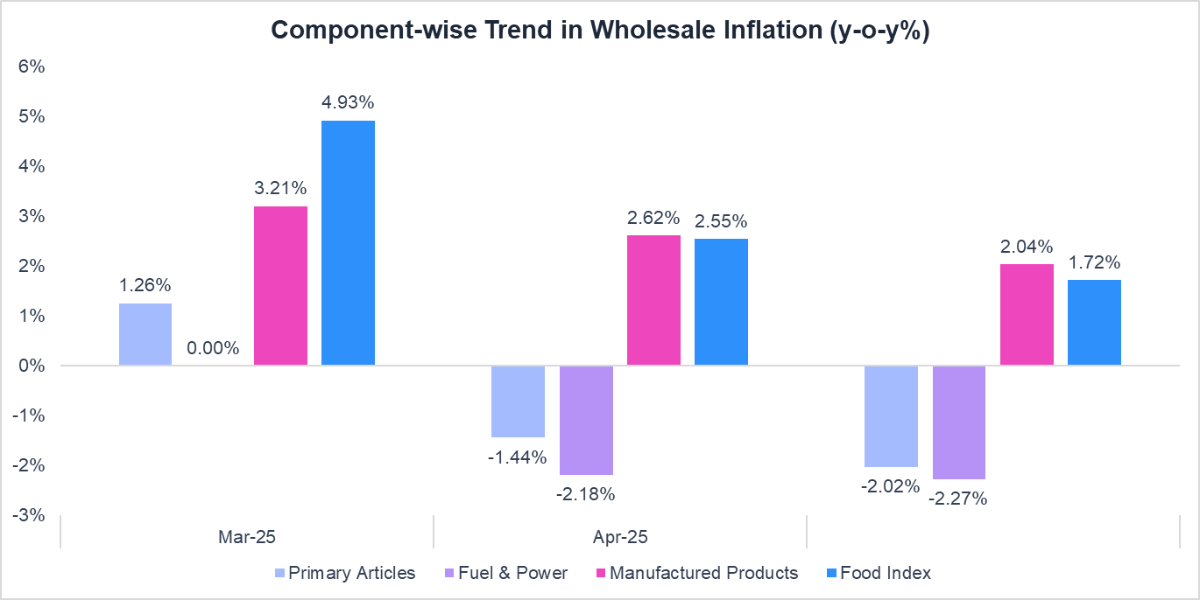

In May 2025, India’s Wholesale Price Index (WPI) inflation dropped to a 14-month low of 0.39% year-on-year, easing from 0.85% in April and undershooting market expectations of around 0.8%.

- Food: Wholesale food price inflation slowed significantly to 1.72% in May, down from 2.55% in April.

- Fuel & Power: This segment saw a drop of 2.27%, a sharper decline compared to April’s 2.18% drop.

- Manufactured Products: Prices in this major component (over 60% of the WPI basket) rose by just 2.04%, down from April's 2.62%.

Implications for the Economy

- Policymakers: The sharp dip in WPI gives the RBI some room to support growth, though global volatility warrants caution.

- Business Impact: Lower input costs, especially in food and fuel, can help businesses better manage margins.

- Consumer Outlook: A softening WPI often precedes moderated consumer inflation, reinforcing a benign CPI outlook.

The May 2025 WPI reflects a harmonious cooling of wholesale prices across major components—food, energy, and manufacturing—driven by both supply stability and favourable base comparisons, while global uncertainties remain a watchpoint.

Conclusion

The Wholesale Price Index may not grab headlines like the stock market or fuel prices, but it plays a crucial role behind the scenes, shaping how we understand inflation, policy, and price trends. However, like most economic indicators, WPI tells just part of the story. Still, for anyone keeping an eye on where the economy is headed, the WPI is a number worth watching.