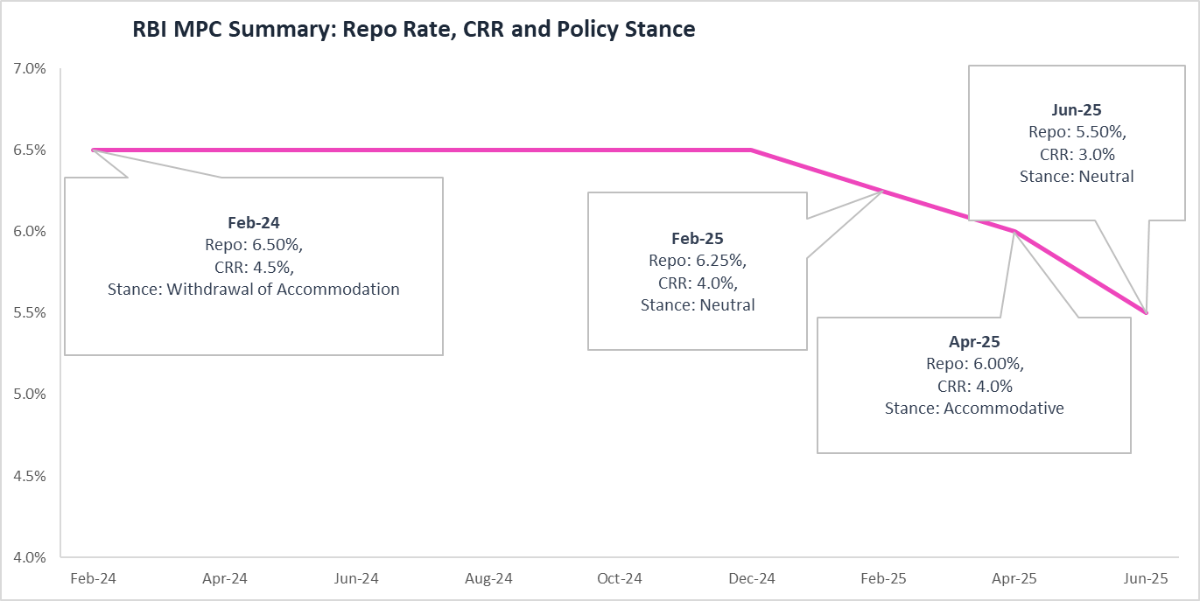

The RBI, in its June Monetary Policy Committee (MPC) meeting, cut the repo rate by 50 bps to 5.50%. Since February, it has implemented a total reduction of 100 bps in the repo rate after the 25 bps reductions each during the February and April meetings. The MPC also decided to change the stance from accommodative to neutral. Further, to provide durable liquidity to the economy, the RBI also announced a reduction in the cash reserve ratio (CRR) by 100 bps to 3.0%.

Here are the key takeaways from the June MPC meeting:

Why is this rate cut significant?

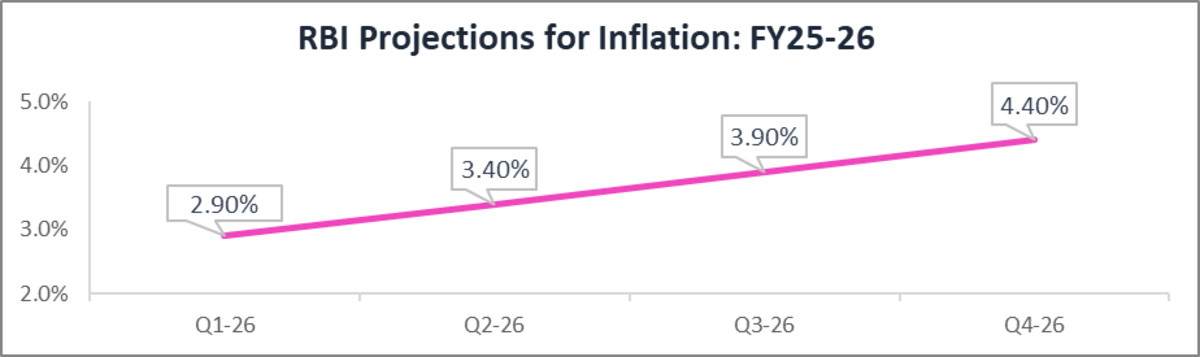

The decision by the RBI to reduce the policy repo rate by 50 basis points to 5.5% marks a pivotal moment in India’s monetary policy trajectory in 2025. This cut reflects the central bank’s increased confidence in the inflation outlook. Headline CPI inflation has moderated sharply, from levels above the tolerance band in Oct-24 to a six-year low of 3.2% in Apr-25, driven by a broad-based decline, especially in food inflation. With a record rabi harvest, an early onset of the monsoon, and projections of an above-normal rainfall season, the RBI now anticipates CPI inflation to undershoot the 4% target, revising the forecast down from 4.0% to 3.7% for FY2025–26.

Further, the policy easing reflects concerns about India’s growth outlook amidst fragile and uncertain global conditions. Global growth projections have been downgraded by institutions like the IMF and OECD, and global trade remains under pressure from persistent geopolitical and tariff-related uncertainties. These headwinds, along with heightened volatility in capital flows, pose risks to India’s external demand.

Amidst these global challenges, domestic growth remains below aspirational levels, and private consumption and investment require further support. The RBI has thus opted for a “frontloaded” policy rate cut, aiming to stimulate domestic demand by improving liquidity, reducing borrowing costs, and enhancing monetary transmission.

Change in Stance: Accommodative to Neutral

The MPC also observed that with the cumulative 100 basis point repo rate cut since Feb-25, it had already frontloaded significant policy support and it was left with limited space to support growth, hence changed the stance from accommodative to neutral to ensure that its future actions are more data-dependent. This change signals that the RBI will now carefully monitor incoming data, inflation dynamics, and growth trends before taking further steps. The RBI also highlighted increased uncertainty in the global environment, particularly due to escalating trade tensions and tariff-related risks. These developments, coupled with potential weather-related food inflation risks, warrant a prudent pause and a flexible policy approach that balances near-term growth with long-term price stability.

Recommended for you

Readers also explored

August 2025 MPC Review: Calm Now, But Global Storms Brewing

India's IT Sector Outlook for FY2026

Reduction in CRR

Another significant outcome of the Jun-25 monetary policy was the decision to reduce the Cash Reserve Ratio (CRR) by 100 bps, bringing it down from 4.0% to 3.0%. This reduction will be implemented in four equal monthly tranches starting Sep-25, to complete the adjustment by Dec-25. According to the RBI, this calibrated move is expected to release around ₹2.5 lakh crore of durable liquidity into the banking system over the coming months.

The CRR cut is designed to enhance liquidity conditions, reduce the cost of funds for banks, and improve the transmission of the cumulative 100 bps repo rate cuts undertaken since Feb-25. By lowering the mandatory reserve requirement, banks will have more resources available for lending to productive sectors of the economy.

Given the current macroeconomic backdrop of subdued global demand, benign inflation within target, and a nascent recovery in private consumption and investment, the RBI views this liquidity infusion as a timely enabler for sustained economic revival. It also reflects a strategic shift towards supporting credit growth while remaining alert to potential inflation or financial stability risks in the months ahead.

Banking Sector Liquidity and Overall Performance

The Reserve Bank of India (RBI) highlighted a generally positive outlook for the Indian banking sector, underpinned by strong fundamentals and an improving macro-financial environment. The financial parameters of Scheduled Commercial Banks (SCBs) remained robust, with indicators such as capital adequacy, asset quality, liquidity buffers, and profitability metrics showing further strengthening.

Within Asset quality improvements, the RBI notes that the gross non-performing asset (GNPA) ratio of SCBs declined, reflecting better risk management, improved credit appraisal mechanisms, and strong recoveries under various resolution frameworks. Similarly, liquidity buffers were healthy, with the Liquidity Coverage Ratio (LCR) at 130.2%. Additionally, capital adequacy stood strong, with Capital to Risk-weighted Assets Ratio (CRAR) at 16.4%, well above regulatory minimums. Banks also posted healthy profitability, with Return on Assets (RoA) at 1.4% and Return on Equity (RoE) at 14.1%. Similarly, the sectoral outlook for Non-Banking Financial Companies (NBFCs) also showed comfortable capital buffers, improvement in GNPA. The sector’s Return on Assets moderated slightly, but remained sound.

In terms of credit quality across retail segments, the RBI observed that stress in unsecured personal loans and credit card receivables—a concern in previous reviews—had abated. However, stress persists in the micro-finance segment where banks and NBFCs active in these areas have begun to recalibrate business models, tighten credit underwriting standards.

On the liquidity front, the RBI stated that conditions had improved significantly as ~ ₹9.5 lakh crore of durable liquidity had been injected into the banking system since Jan-25 through a combination of Open Market Operations, variable rate repo (VRR) auctions, and USD/INR buy-sell swaps. As a result, the system moved from a liquidity deficit to surplus by March-end.

Reflecting this improved liquidity, the Weighted Average Call Rate (WACR)—the operating target of monetary policy—traded at the lower end of the LAF corridor since the last policy. Specifically, WACR averaged 16 basis points below the repo rate.

How It Impacts You

- For borrowers, EMIs on home, auto, and personal loans are likely to reduce, improving disposable income. If you are considering a home loan, refer to 1 Finance’s Home Loan Outlook for 2025 to better navigate this rate-cut cycle.

- For fixed-income investors, returns on debt instruments are likely to decrease. Therefore, it is vital to diversify and find the right balance between low-risk debt and high-risk investments.

- Equities tend to benefit, as lower interest rates support corporate profitability and valuations.

- For high-net-worth individuals and retail investors alike, this is a cue to rebalance portfolios, reducing overexposure to long-duration fixed-income products and considering equities or hybrid assets.

To summarise, the RBI’s latest policy reflects a careful balancing act amid a fluid global environment. With inflation declining sharply and now projected below target for most of FY26, the 50 bps rate cut and CRR reduction are timely measures to support growth. Improvements in bank balance sheets, better liquidity conditions, and declining short-term rates indicate effective transmission. However, stress in segments like microfinance and global uncertainties still persists. The RBI’s shift to a ‘neutral’ stance underscores its cautious optimism. Moving ahead, policy will remain data-driven, aiming to sustain growth momentum without compromising on inflation and financial stability objectives.