Overview of India's Union Budget 2025

The Budget 2025 has just been announced by the Union Finance Minister on 1st February 2025, and many people are unsure how to plan their investments ahead of the year.

You've probably seen countless takes on Budget 2025, but this blog gives you everything you need to know—covering taxation, sector-wise announcements, and various initiatives in agriculture, MSMEs, exports, etc.

Understanding the Union Budget: A Simple Guide

A budget is a comprehensive financial statement that outlines the government's revenue and expenditure plans for the year ahead, aiming to manage the nation’s economic growth, fiscal health, and policy priorities.

To break it down in layman's terms: Think of a budget like a financial roadmap for a country—just like how you plan your monthly expenses based on your income, the government does the same on a national scale.

It decides how much money will be spent on infrastructure, healthcare, education, and subsidies, and how it will collect revenue through taxes, borrowings, or other sources.

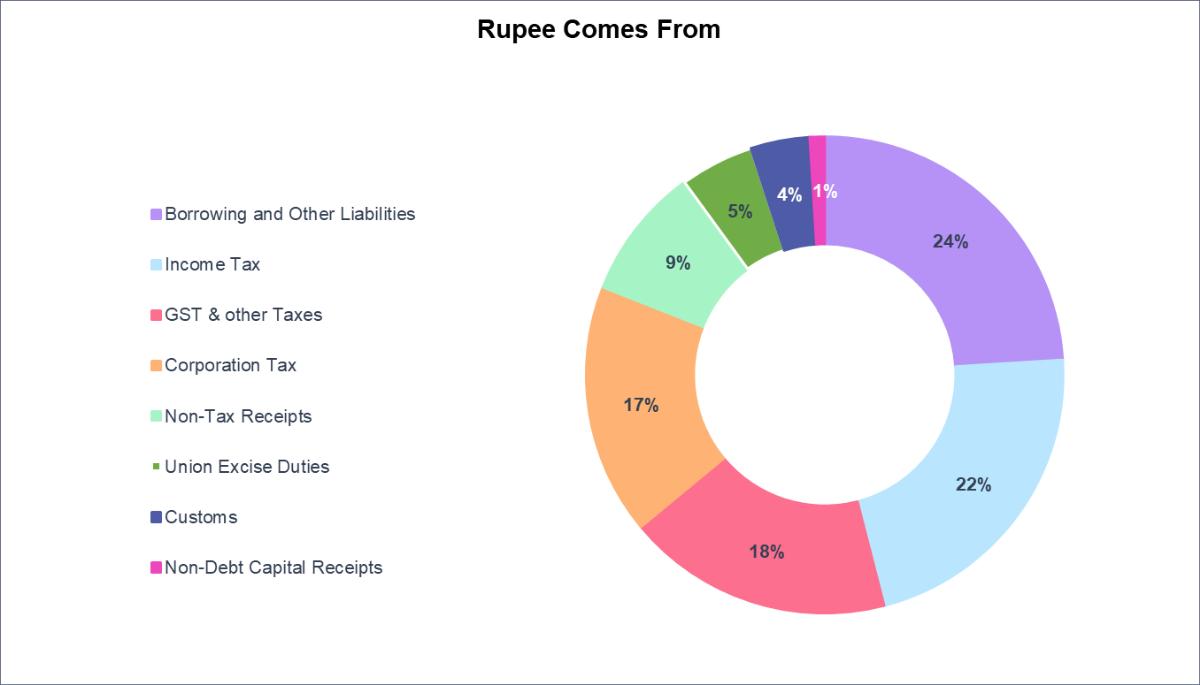

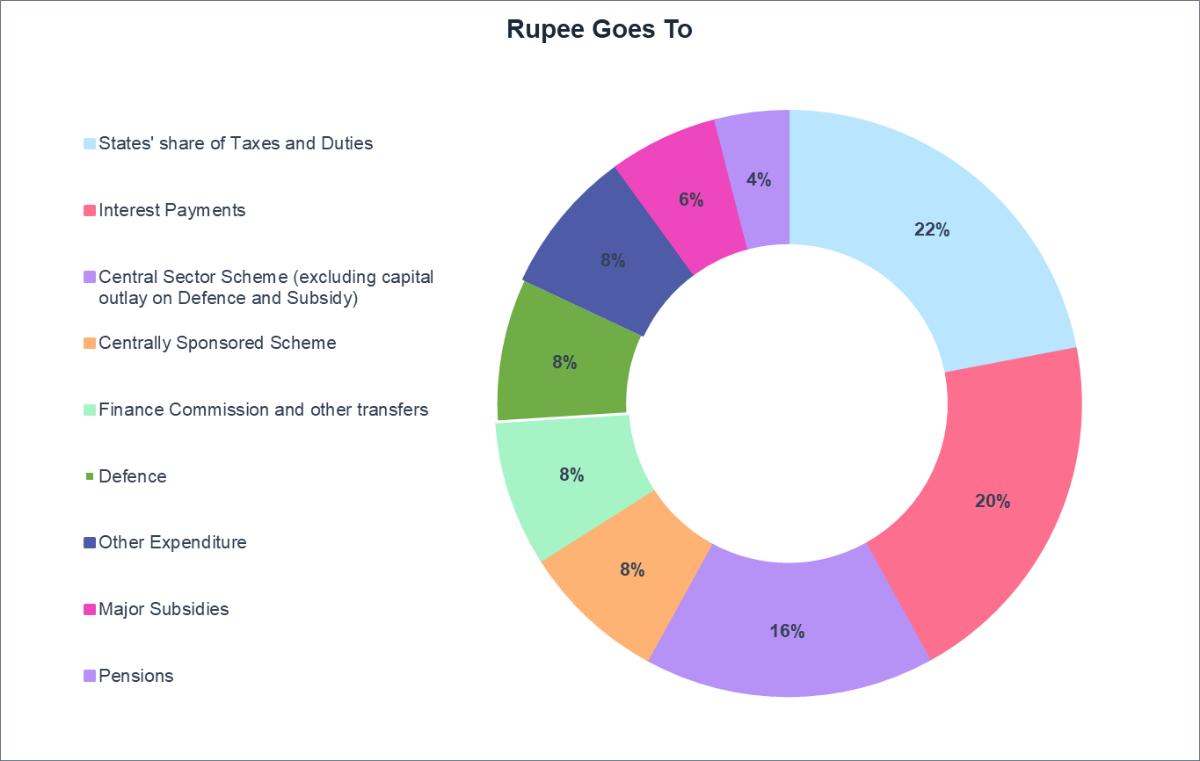

Understanding Government Finances: Where the Money Comes From and Where It Goes

The following two pie charts provide a clear breakdown of where the government's revenue comes from and how it is allocated. These insights help in understanding the key sources of income and expenditure that shape India's fiscal policy.

Recommended for you

Readers also explored

How Tax Relief and Rate Cuts Will Shape India’s Economy

World GDP Breakdown 2025: Who Powers the Global Economy?

Top Highlights from India's Budget 2025: Key Announcements

1. No tax on income up to ₹12 lakh (₹12.75 lakh for salaried individuals) under the new tax regime.

2. Seven tariff rates removed; only eight remain.

3. 36 life-saving drugs fully exempt from customs duty.

4. Exemptions on critical minerals, textiles, electronics, lithium-ion batteries, and shipbuilding.

5. PM Dhan-Dhaanya Krishi Yojana: A program covering 100 districts, benefiting 1.7 crore farmers. MSME Classification Revised: Investment & turnover limits increased by 2.5x and 2x, respectively.

6. A boost to domestic growth through initiatives like Kisan Credit Card (KCC) loans and credit support for micro enterprises.

7. Support for Labour-Intensive Sectors: Footwear, leather, toy, and food processing industries.

8. ₹1.5 lakh crore for State Infrastructure Development via 50- year interest-free loans.

9. Power Sector Reforms: Incentives for distribution improvements and intra-state transmission.

10. UDAN Scheme: Regional connectivity expansion to 120 new destinations over the next decade.

11. Tourism Development: Top 50 tourist destinations to be developed in collaboration with states.

Engines of Development

1. Agriculture & Rural Development in Budget 2025:

Agriculture is the backbone of India’s economy, and the government has put forward several initiatives to boost productivity, improve storage, expand irrigation, and support farmers with better credit access and new technology. The focus is on empowering rural women, young farmers, small-scale growers, and landless families while also encouraging crop diversification. There’s even a push to enhance makhana (foxnut) production, making processing more efficient and improving market access. All of this is aimed at strengthening rural livelihoods and making agriculture more sustainable.

The table below provides a detailed description of all the initiatives that have been launched for agriculture and rural development.

| Initiative Name | Description |

| Prime Minister Dhan-Dhaanya Krishi Yojana | Partnership with states to develop agricultural districts which will help in increased production, crop diversification and credit access. |

| Rural Prosperity and Resilience Programme | Multi-sectoral program to address underemployment in agriculture. Focused on rural women, young farmers, rural youth, marginal & small farmers, and landless families. |

| Mission for Aatmanirbharta in Pulses | The 6-year mission focused on Tur, Urad, and Masoor to increase pulse production and self-reliance. |

| Comprehensive Programme for Vegetables & Fruits | Comprehensive program to promote production, supply, processing, and remunerative prices. |

| National Mission on High Yielding Seeds | Mission to strengthen research, develop, and propagate high-yield seeds. The main mission is to develop and make commercial availability of 100+ seed varieties. |

| Mission for Cotton Productivity | 5-year mission to improve cotton farming productivity and sustainability. |

| Enhanced Credit through KCC | Increased loan limit under Modified Interest Subvention Scheme. Loan limit increased from ₹3 lakh to ₹5 lakh. |

| Fisheries Framework | Framework for sustainable harnessing of fisheries. Focus on Andaman & Nicobar and Lakshadweep Islands. |

| Makhana Board in Bihar | Establishment of Makhana Board. Improve makhana production, processing, value addition, and marketing. |

| Urea Plant in Assam | New urea plant in Namrup. 12.7 lakh metric tons annual capacity. |

As evident, Budget 2025 has rolled out many steps and initiatives to boost farm productivity and rural incomes, capitalising on good monsoons and healthy reservoir levels. As per our Macro Economic Outlook 2025, agri growth is set to top 4% for the third year in a row, thanks to strong sowing trends and easing rural inflation. This should help keep food prices stable and fuel rural consumption, which is already bouncing back. With a focus on agri-infra and lowering input costs, the budget could further speed up this momentum, creating a growth cycle in rural India. By introducing more initiatives beyond agriculture and offering tax reliefs, the government is actively fostering economic momentum.

2. Budget 2025 for MSMEs & Manufacturing: Key Policy Changes and Support:

| Initiative Name | Description | Target/Implementation |

| Revision in MSME Classification | Investment and turnover limits increased. | Limits enhanced to 2.5 and 2 times respectively. |

| Credit Cards for Micro Enterprises | Customised Credit Cards with ₹5 lakh limit. | 10 lakh cards in the first year. |

| Fund of Funds for Startups | New Fund of Funds with expanded scope. | ₹10,000 crore contribution. |

| Scheme for First-time Entrepreneurs | Term loans up to ₹2 crore. | Next 5 years. |

| Focus Product Scheme for Footwear & Leather Sectors | Scheme to enhance productivity, quality, and competitiveness. | Target: 22 lakh jobs, ₹4 lakh crore turnover, ₹1.1 lakh crore exports. |

| Measures for the Toy Sector | Scheme to create high-quality, innovative toys. | Make India a global toy hub. |

| Support for Food Processing | National Institute of Food Technology, Entrepreneurship and Management. | Institute to be set up in Bihar. |

| National Manufacturing Mission | Mission covering small, medium, and large industries. | Furthering "Make in India". |

The budget gives a big push to MSME financing, expanding credit access with a higher guarantee cover and a dedicated Fund of Funds for startups. This should drive credit growth and fuel overall economic expansion. On the financial inclusion front, revamped schemes like PM SVANidhi, higher Kisan Credit Card limits, and the Grameen Credit Score framework aim to bring more underserved communities into the fold.

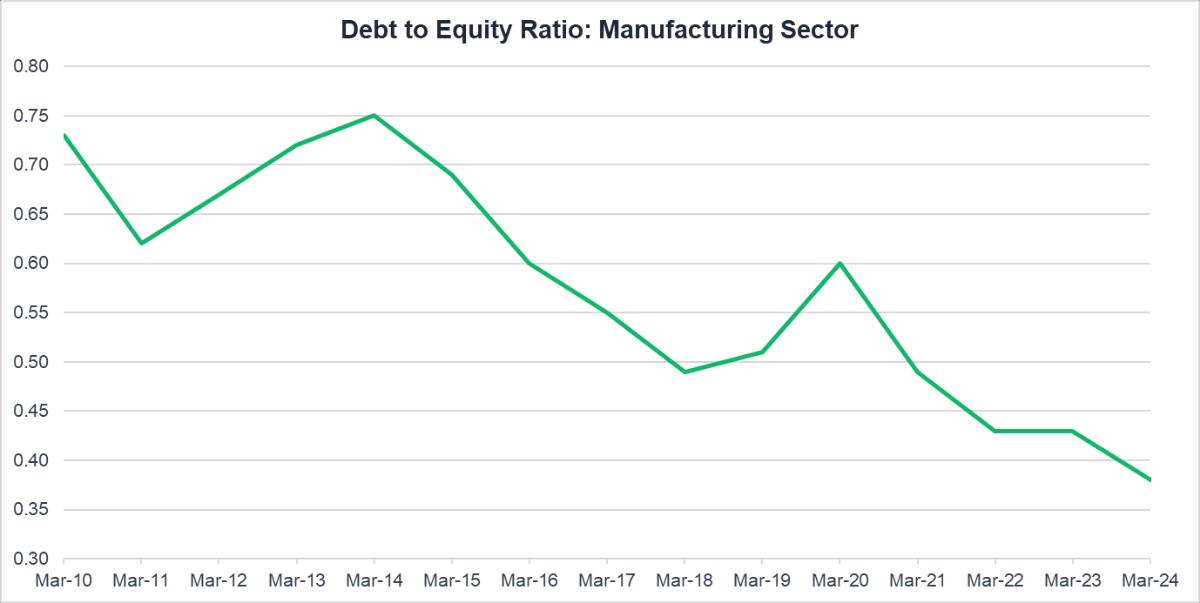

Our Macroeconomic Outlook highlights that bank NPAs are at historic lows, setting a solid foundation for growth. With cleaner balance sheets, potential rate cuts, and higher government infra spending, banks are well-positioned to fund the next wave of private sector expansion. Additionally, manufacturing companies' debt-to-equity ratios have reached multi-decade lows, while capacity utilisation has remained above 70% since the end of 2021. These budget moves not only strengthen the banking sector but also create a positive growth cycle for the economy, signaling broad-based consumption pick-up and a private capex revival led by manufacturing.

This aligns with our prediction that there is a 60% probability of the Indian economy transitioning from the current ‘Slowdown’ phase into the ‘Recovery’ phase. The outlook explores this shift in greater detail, providing insights on what it means for investors and businesses. We’ve provided our views on key themes which are essential for understanding the potential economic shift and its implications for investment strategies.

3. Union Budget 2025: Boosting Investment and Infrastructure in India:

In Budget 2025, the government has rolled out a bunch of exciting initiatives across different sectors, all aimed at boosting investment and driving growth in India.

- On the people's side, there's a focus on education and health. The Saksham Anganwadi & Poshan 2.0 will provide better nutrition for children, while the Atal Tinkering Labs will create 50,000 innovation hubs in government schools over the next five years. The expansion of IITs will also make space for 6,500 more students, and in the healthcare sector, 10,000 additional medical seats will be available next year, along with day-care cancer centers in district hospitals.

- The government is also investing in infrastructure and economic growth. There’s a huge ₹1.5 lakh crore fund for states to improve infrastructure, and the Jal Jeevan Mission, aimed at providing water to every home, will continue until 2028. Not to mention, the government is introducing a ₹10 lakh crore plan for asset monetisation over the next five years. This includes developing new regional airports, upgrading existing ones, and enhancing maritime infrastructure with a new ₹25,000 crore fund.

- On the innovation front, the government is boosting R&D with ₹20,000 crore in funding for private-sector initiatives. They’re also rolling out new programs like the PM Research Fellowship, which will provide 10,000 research fellowships, and establishing a Gene Bank for preserving crops. Plus, there are plans for better geospatial infrastructure and a national mission to preserve India's manuscript heritage.

These moves show a clear push towards improving the lives of citizens, expanding infrastructure, and fostering innovation, all while creating a more vibrant economy for the future. It's an exciting time ahead for India!

4. Impact of Budget 2025 on India's Exports & Trade Growth:

| Initiative Name | Description |

| Export Promotion Mission | Jointly driven by Commerce, MSME, and Finance Ministries. |

| BharatTradeNet (BTN) | Unified platform for trade documentation and financing. |

| Support for Global Supply Chains | Development of domestic manufacturing capacities. |

| Support for Electronics Industry | Support for the domestic electronic equipment industry. |

| National Framework for GCCs | Framework to promote Global Capability Centres. |

| Air Cargo Infrastructure | Upgradation of infrastructure and warehousing. |

India is gearing up for a big trade and manufacturing push! The Export Promotion Mission brings together the Commerce, MSME, and Finance Ministries to supercharge exports. Meanwhile, BharatTradeNet (BTN) is set to make life easier for businesses by streamlining trade documentation and financing.

On the manufacturing front, the government is backing domestic industries—helping them integrate into global supply chains and strengthening the electronics sector. There’s also a big boost for Global Capability Centres (GCCs) with a dedicated national framework, ensuring India remains a hub for high-end services. And let’s not forget logistics—air cargo infrastructure upgrades will improve warehousing and transport, making trade smoother than ever.

Analysing Expenditure Trends and Priorities

Now, let's take a closer look at the expenditure of the Government of India, as it plays a critical role in shaping the country’s economic landscape. Understanding how the government allocates funds across various sectors can offer valuable insights into its priorities and long-term vision for growth.

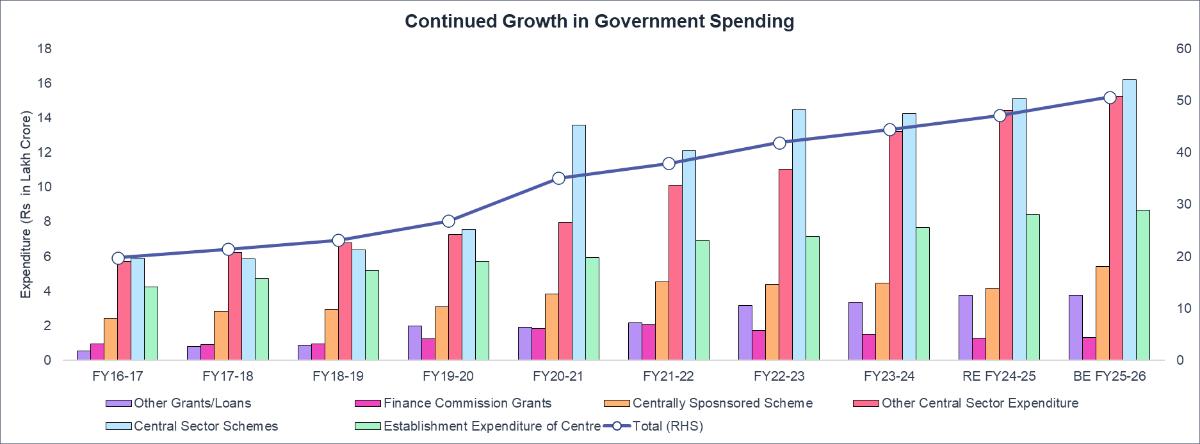

The above chart showcases Composition of Expenditure from FY16-17 to BE FY25-26

- The Indian government's expenditure has been rising, reflecting an expanding fiscal policy.

- Central Sector Schemes and Other Central Sector Expenditure are major drivers of spending.

Budgeted Expenditure (BE FY25-26) suggests continued growth in government spending, aligning with economic growth and policy priorities.

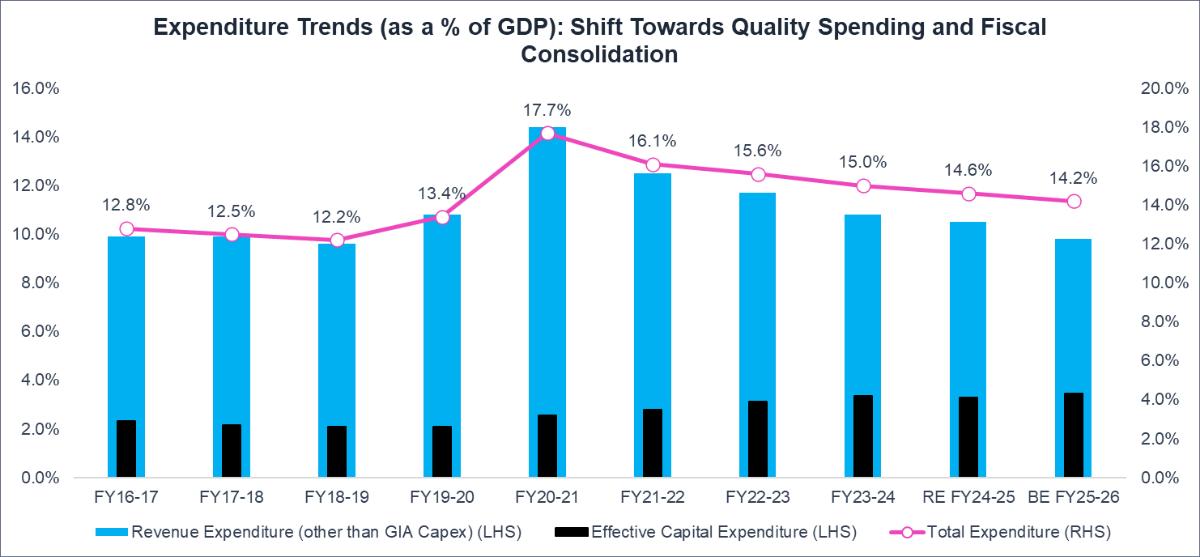

Source: indiabudget.gov.in - The chart shows a shift towards quality spending, with effective capital expenditure (black bars) rising while revenue expenditure (blue bars) declines as a share of GDP. This means more funds are going into long-term asset creation rather than routine expenses.

- Total expenditure (pink line) peaked at 17.7% of GDP in FY20-21 (pandemic spending) and is now stabilising at 14.2% in BE FY25-26, reflecting fiscal consolidation.

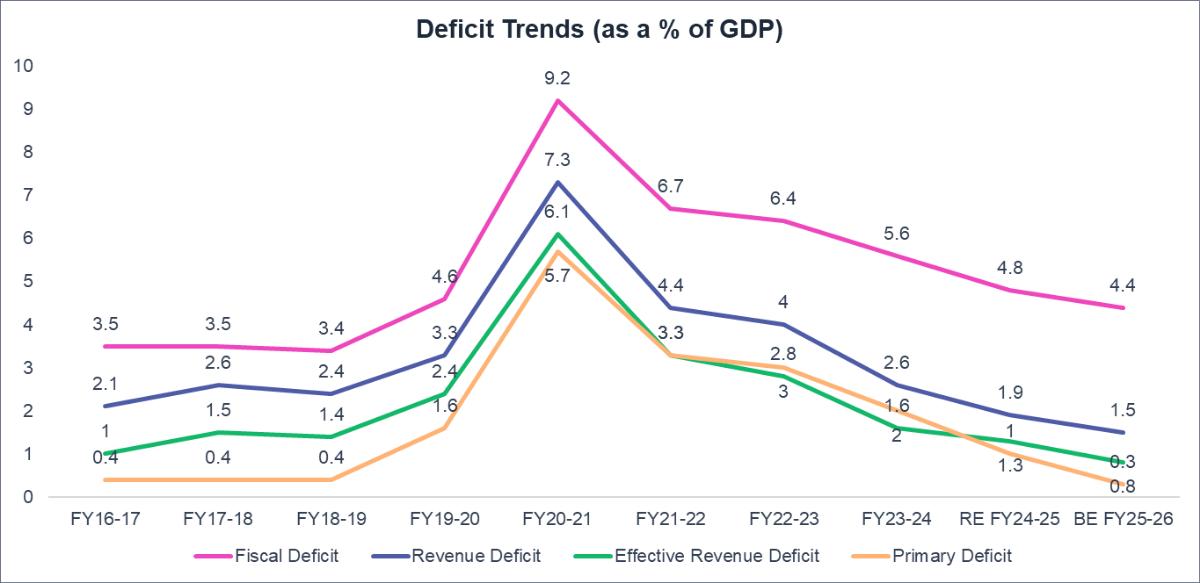

The Union Finance Minister stated that the focus will be on keeping the fiscal deficit low and ensuring that debt follows a declining path as a percentage of GDP.

It is also important to note that the revised estimate for the FY24-25 fiscal deficit is 4.8% of GDP, while the budget estimate is 4.4% of GDP.

Analysis: The government is staying fiscally cautious while keeping growth in mind. The 4.4% target is tighter than what the industry expected (CII suggested 4.5%) and reinforces a strong push for debt reduction.

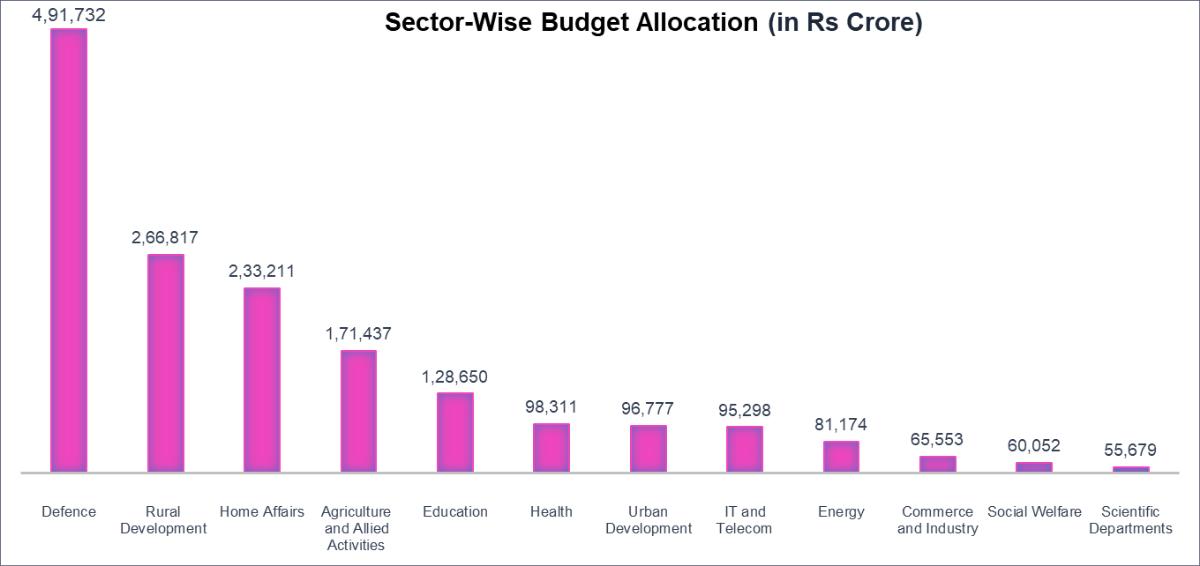

The above chart illustrates the budgetary allocation to various key sectors of the Indian government, highlighting the priorities in expenditure for the given fiscal year. Defence receives the largest allocation, followed by sectors focused on rural development, internal security, and agriculture.

Taxation

1. Direct Tax

When the government looks at the country, it’s clear that urban populations are relatively better off, so the focus naturally shifts to the well-being of farmers. But let’s not forget the middle class—the ones who’ve been carrying the weight of the tax burden for years. Taxes alone can’t be the only way to run a country, especially when, out of 140 crore people, only 8 crore file taxes, and just 2.5 crore actually end up paying them. That’s a staggering gap.

Lately, there’s been a lot of chatter about the middle class. Every other conversation seems to revolve around their struggles—rising costs, stagnant incomes, and the constant pressure of taxes. It’s hard to ignore the collective sigh of frustration. So, when the government announced the Budget 2025, all eyes were on what relief it would bring to this segment. And guess what? The big news finally arrived.

Under the new tax regime, there’s a significant change: no personal income tax will be payable on incomes up to Rs 12 lakh (that’s an average of Rs 1 lakh per month, excluding special rate incomes like capital gains). For salaried individuals, this limit goes up to Rs 12.75 lakh, thanks to the standard deduction of Rs 75,000.

This move is expected to put more money back into the hands of the middle class, potentially boosting household spending, savings, and investments. Plus, the new Income-Tax Bill aims to be simpler and more transparent, making it easier for taxpayers to understand and reducing the chances of disputes. Of course, this comes at a cost—the government will forgo around Rs 1 lakh crore in direct tax revenue. But if it eases the burden on the middle class and fuels economic growth, it might just be worth it.

Followed by this, let’s now take a look at a comparison of the old and new tax slabs.

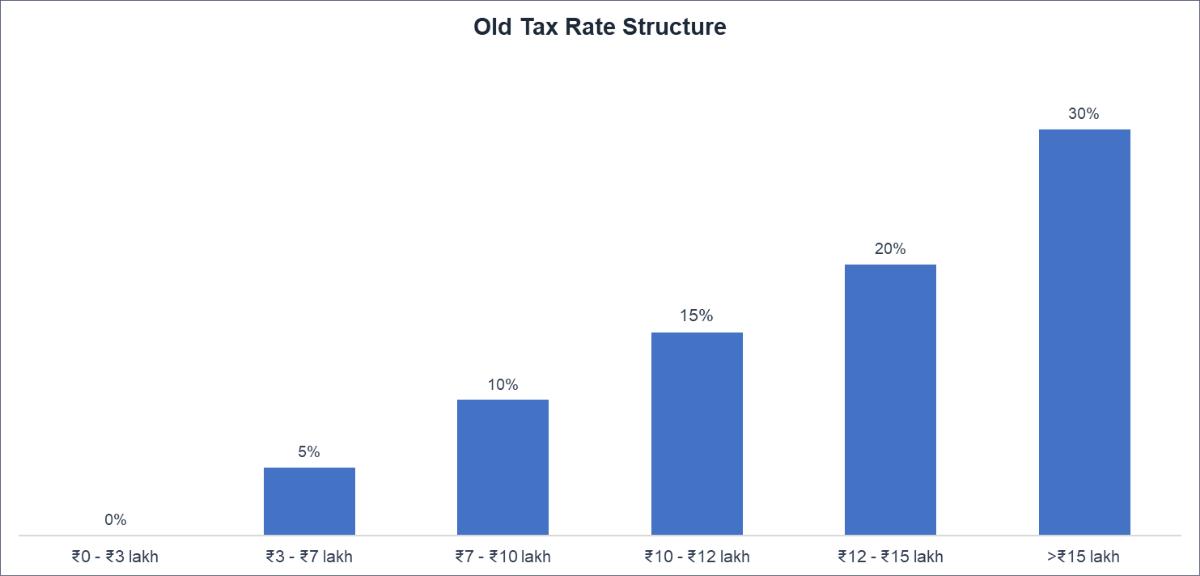

Old Tax Regime (Prior to Budget 2025):

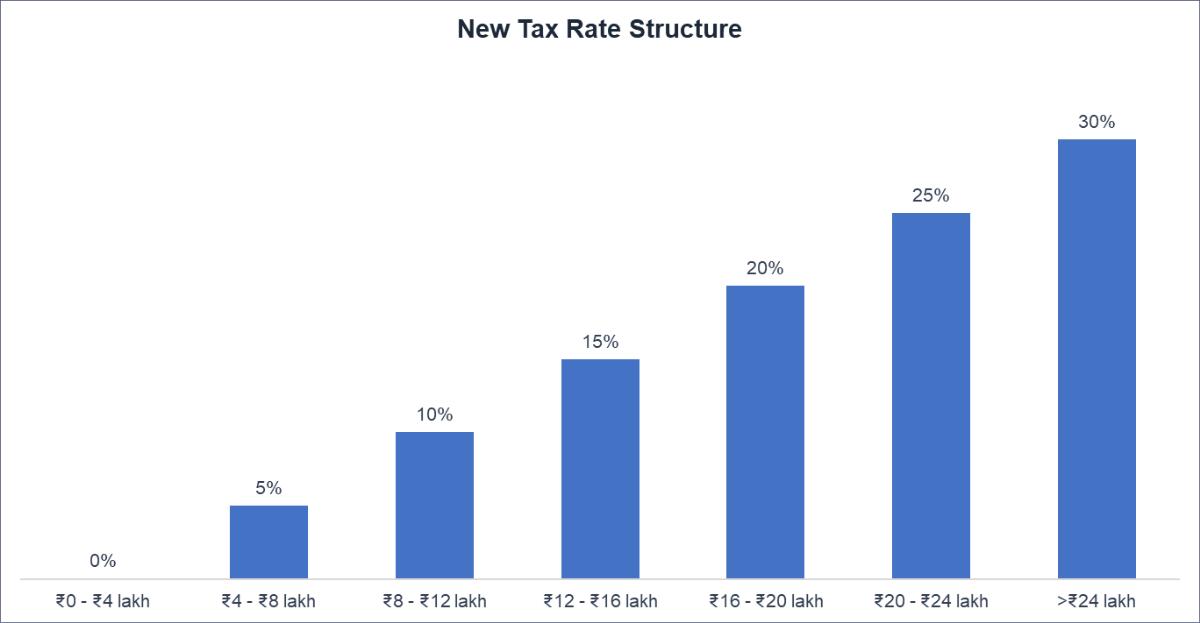

Updated New Tax Regime (Post Budget 2025):

There are some pretty big changes in the tax rules, and it’s clear they’re designed to benefit everyone. The government’s message seems to be: “Go out and spend!”

A few exciting updates:

- You can now file an updated income tax return for the past 4 years instead of just 2 years. This is a game-changer because it gives you more time to correct any mistakes or oversights. How cool is that?

- And here’s something for property owners: if you own more than two houses and keep them vacant, their taxable value will now be considered zero. That’s a huge relief for anyone juggling multiple properties.

- For senior citizens, the TDS threshold has been raised to Rs 1,00,000 from the earlier Rs 50,000. For others, the limit is now Rs 50,000, up from Rs 40,000.

- Plus, there’s no TDS on dividend and mutual fund income up to Rs 10,000, compared to the previous Rs 5,000 limit. These changes are definitely going to make life easier for many.

These amendments will take effect from the 1st April, 2026 and will, accordingly, apply in relation to the assessment year 2026-2027 and subsequent assessment years.

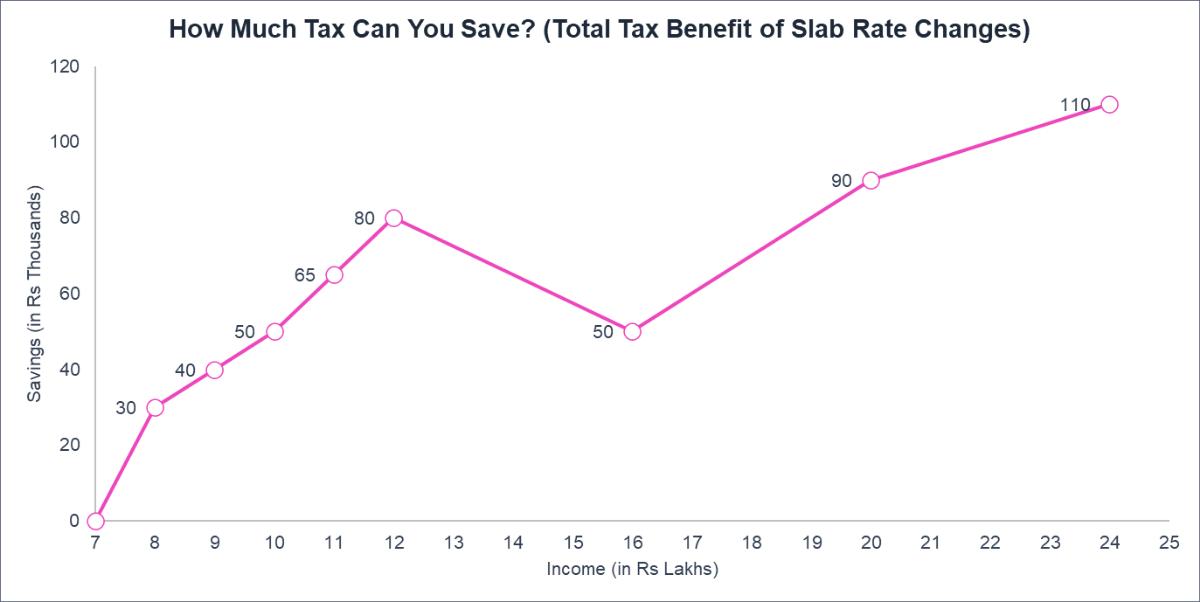

Let's break down this chart because it’s actually super helpful! The chart shows how much money you can save under the new tax slabs announced in Budget 2025. Let’s take an example to make it super clear.

Say you’re earning Rs 25 lakh. In FY 2024-25, you’d pay Rs 4,17,500 in taxes. But in FY 2025-26, thanks to the new tax slabs, you’ll only pay Rs 3,07,500. That means you’re saving Rs 1,10,000.

Now, your question might be: Why are we saving ₹80,000 when earning ₹12 lakh, but only ₹50,000 when earning ₹16 lakh? You can find the answer in the table below.

| Illustration of Total Tax Benefit of Slab Rate Changes and Rebate at Different Income Levels as per the New Tax Regime | ||||||

| Income | Tax on Slabs and Rates | Benefit of | Rebate Benefit | Total Benefit | Tax after Rebate Benefit | |

| Present | Proposed | Rate/ Slab | Full up to Rs 12 Lakhs | |||

| 8 Lakh | 30,000 | 20,000 | 10,000 | 20,000 | 30,000 | 0 |

| 9 Lakh | 40,000 | 30,000 | 10,000 | 30,000 | 40,000 | 0 |

| 10 Lakh | 50,000 | 40,000 | 10,000 | 40,000 | 50,000 | 0 |

| 11 Lakh | 65,000 | 50,000 | 15,000 | 50,000 | 65,000 | 0 |

| 12 Lakh | 80,000 | 60,000 | 20,000 | 60,000 | 80,000 | 0 |

| 16 Lakh | 1,70,000 | 1,20,000 | 50,000 | 0 | 50,000 | 1,20,000 |

| 20 Lakh | 2,90,000 | 2,00,000 | 90,000 | 0 | 90,000 | 2,00,000 |

| 24 Lakh | 11,90,000 | 10,80,000 | 1,10,000 | 0 | 1,10,000 | 3,00,000 |

| 50 Lakh | 11,90,000 | 10,80,000 | 1,10,000 | 0 | 1,10,000 | 10,80,000 |

2. Indirect Tax

- Reducing Tariff Rates for Simplicity

Seven more tariff rates are being removed this year, adding to the seven that were eliminated in the 2023-24 budget. After these changes, only eight tariff rates will remain, including the ‘zero’ rate. This move aims to streamline the system and make things easier for businesses. - Adjusting Cess to Maintain Balance

The cess (an additional tax on top of duties) is being adjusted to ensure that the overall duty burden remains largely unchanged for most items. However, there’s a slight benefit—some items may see a marginal reduction in duty, which could be a small but welcome relief. - Limiting Cess and Surcharge Layers

A significant change is the introduction of a rule that no more than one cess or surcharge can be applied to any item. To implement this, the Social Welfare Surcharge has been exempted on 82 tariff lines that are already subject to a cess. This simplification is expected to reduce confusion and make the tax structure more straightforward for businesses.

Sector Wise Announcements

Overall, major announcements were made in Power, Infrastructure, Education, and Agriculture. Earlier, we used to import toys, but slowly and gradually, we became net exporters. Now, the government is planning to completely change the dynamics and make India a Toy Hub. That's fascinating! Here is a glimpse of the various announcements made in each sector.

| Sector | Announcements |

| Power |

|

| Infrastructure |

|

| Agriculture |

|

| Education |

|

| Banking/Insurance |

|

| Technology |

|

| Fisheries |

|

| Textiles |

|

| Healthcare |

|

| Toys |

|

| Leather |

|

| FMCG/Ecommerce/Financial Services |

|

| Waste Management |

|

| Housing |

|

Why Staying Updated with the Union Budget is Essential for Every Indian?

Let’s say the government announces a tax cut for electric vehicles in the budget, making them more affordable. If you’re planning to buy a car but don’t follow the budget, you might miss out on these benefits and overpay. Similarly, businesses need to stay updated to anticipate changes in policies, investments, or regulations that could impact their growth. Ignoring the budget means missing out on opportunities and being caught off guard by financial changes that could affect your daily life.

Now that we’ve got a clear picture, let’s see what Budget 2025 brings to the table. It mostly lived up to expectations, balancing ease of doing business, fewer compliance hassles, and some relief for the middle class. While the much-needed tax breaks offer some breathing room, capital expenditure seems a bit restrained. We’ll break it all down in detail soon!

That said, fiscal prudence remains intact, with a lower deficit target for next year signaling a commitment to long-term economic stability. Markets, meanwhile, are in wait-and-watch mode, seeking clarity on growth momentum. With key economic indicators expected to unfold in the coming months, March could be a defining moment for market sentiment and investment trends.

As we dive deeper into the budget’s key takeaways, let’s explore how it shapes India’s growth trajectory and what it means for businesses, consumers, and investors.

Conclusion

To wrap things up, Budget 2025 aims to make a real difference in our everyday lives. With smart investments in areas like infrastructure, agriculture, and healthcare, we are gearing up for a brighter future. The main focus will be on how the initiatives and policies introduced will take shape going forward, as much depends on their actual implementation.