India’s Oil & Gas sector isn’t just about crude barrels or petrol pumps; it’s a story of global diplomacy, rupee-dollar dynamics, domestic supply chains, and how much we drive, fly, or cook every day. But lately, the sector has been in the spotlight for more than just energy demand. With growing international scrutiny over oil trade practices and penalty threats, questions are being raised: What happens if India has to pivot away from Russian oil? How will this impact margins, imports, and our long-term energy roadmap?

In this blog, we simplify the sector’s outlook using five key macroeconomic factors that are shaping the road ahead.

First, let’s understand just how massive and globally relevant India’s oil and gas sector is becoming.

Quick Stats – FY2025 Import Bill: $143 billion (↑ 2.64% from FY2024) Crude Oil Imports (Volume): 244 million tonnes. (↑5.43% YoY) Import dependency: 89% of Consumption. |

Oil Demand in India: Rising Faster Than Ever

For over two decades, China was the undisputed leader of global oil demand growth, adding more barrels per day (b/d) to global consumption than any other country every single year from 1998 to 2023.

But 2024 marked a turning point.

Despite still consuming over three times as much oil as India, it is now India’s demand that is growing faster, making it the largest contributor to global oil consumption growth this year and next.

Let’s look at the numbers:

| Annual Growth in Oil Consumption (barrels/day) | ||

| Year | India | China |

| 2024e | +220,000 | +90,000 |

| 2025e | +330,000 | +250,000 |

According to the U.S. Energy Information Administration (EIA) - the statistical and analytical arm of the U.S. Department of Energy - India is now responsible for a quarter of all global oil demand growth in 2024 and 2025.

What’s driving this surge?

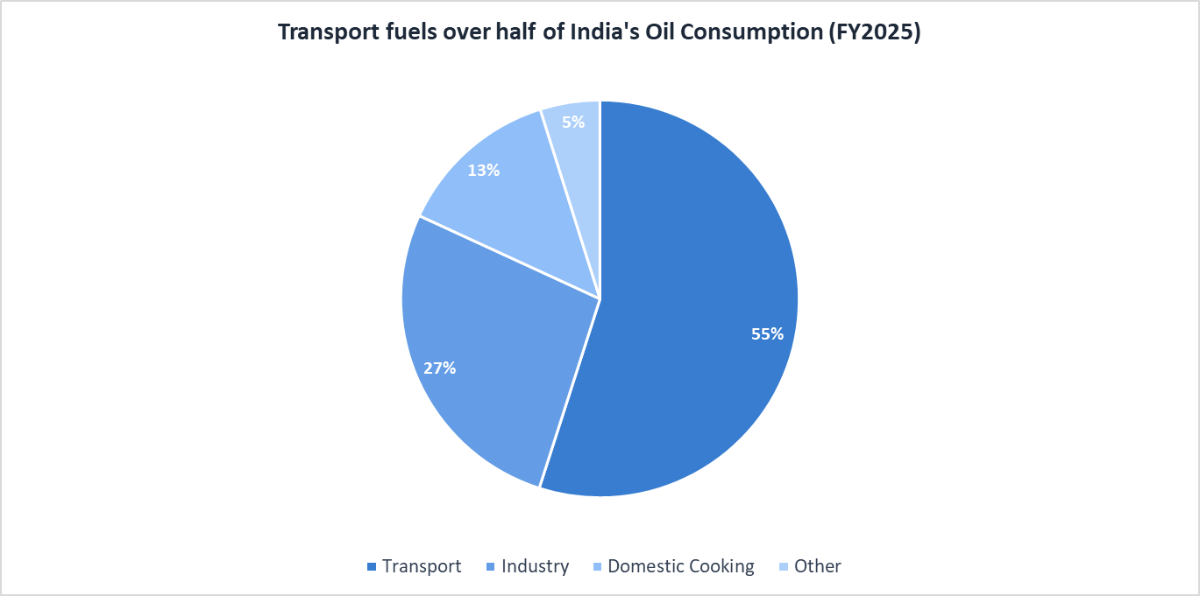

A big jump in the use of transportation fuels, like petrol and diesel, and continued reliance on fuels for home cooking, especially in rural areas.

The chart below shows how India’s oil consumption is dominated by the transport sector, followed by industry and domestic cooking:

Recommended for you

Readers also explored

India’s Economy: Stable, Strong and On the Rise

Nifty 50 Companies List 2025 : Top 50 Stocks in India

Key Macroeconomic Factors to Watch:

With India leading global demand, let’s take a closer look at what factors will influence the sector’s direction and performance in the coming years:

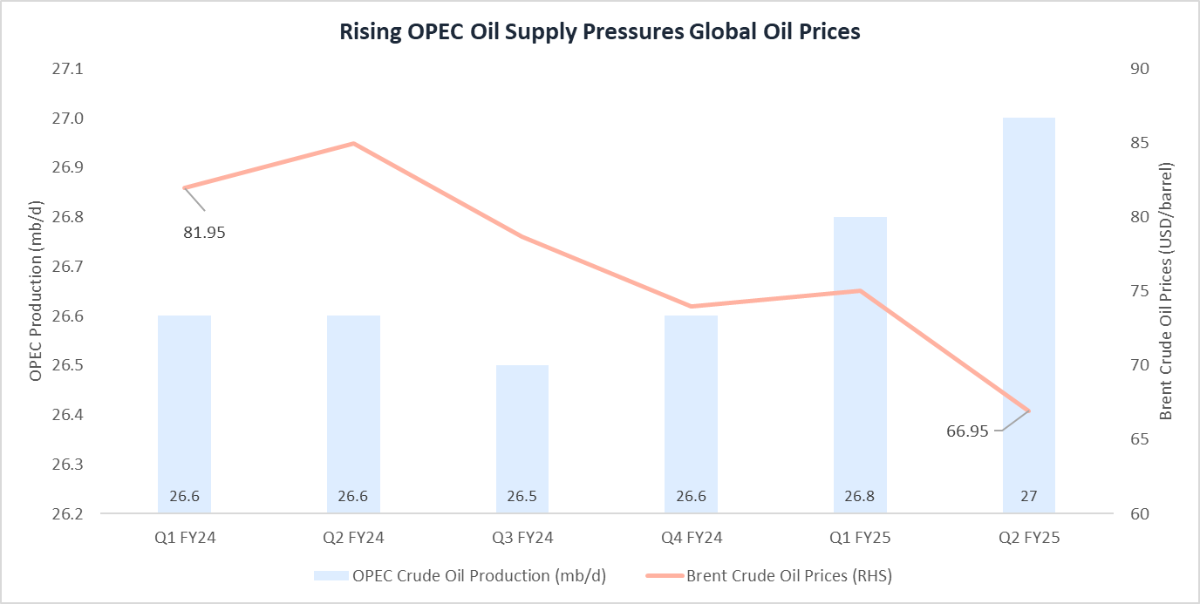

Crude Oil Prices

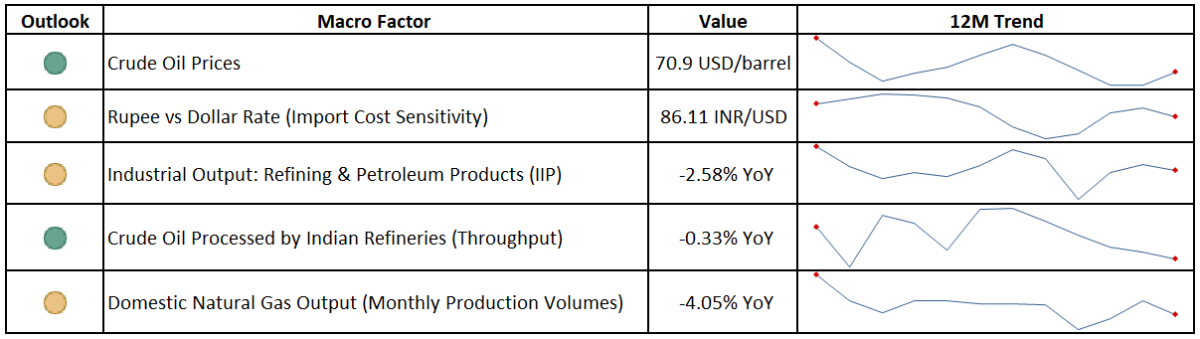

Crude oil prices have been on a steady decline over the past year, falling from an average of $84.2 per barrel in Jul-24 to $70.9 in Jul-25, a drop of nearly 15%.

Why? Mainly because OPEC countries have ramped up supply, battling the U.S. and other countries for market share. Although prices seem to be volatile in the short term due to Middle East tensions, the overall global oil market is heading towards oversupply, ultimately resulting in softer prices.

Over the past year, OPEC’s daily crude oil production has steadily increased, adding more supply to the market. This rise in output has played a key role in driving Brent crude prices lower, as seen in the chart below:

Quarters follow the calendar year, not the Indian financial year.

With India now driving growth in global oil consumption, stable crude oil prices will offer some much-needed relief, especially as we navigate intense global energy pressures.

💡In Other News: Will Tariffs Move Oil Prices? Trump’s decision to double tariffs on Indian goods to 50% won’t directly target crude oil, but can still influence oil prices in two ways: 1) Downward Pressure: Tariffs of this scale can slow global economic growth, trimming oil demand forecasts and putting mild downward pressure on prices. 2) Supply Tightening Risk: If India actually heeds U.S. pressure and stops buying Russian oil, global oil supply could tighten, potentially pushing prices higher. |

Rupee vs Dollar Rate (Import Cost Sensitivity)

The rupee has weakened by ~4.5% over the past year, slipping from ₹83.95 to ₹87.71/USD as of August 12, 2025. While April saw a brief recovery on strong capital inflows, the recent 25% U.S. tariffs on Indian exports and an additional 25% due to Russian oil purchases have revived downward pressure.

Going forward, the rupee sits at a crossroads:

- Upside support: Stable crude oil prices and ongoing foreign inflows may offer relief.

- Downside risk: Prolonged tariff tensions and widening trade deficits could lead to further depreciation — MUFG sees a downside risk to ₹89.5/USD by mid-2026.

For now, RBI’s interventions and softening U.S. inflation are containing volatility. But until a clear resolution emerges on the U.S.–India trade front, the rupee’s trajectory will likely remain in wait-and-watch mode.

Industrial Output: Refining and Petroleum Products (IIP)

- Upstream Weakness: Fuel Minerals Index

Output has been declining year-on-year since June 2024, with May 2025 registering a 2.5% drop. This trend reflects deep-rooted structural challenges - India’s ageing oil fields, low domestic exploration activity, and slow-moving capital expenditure have all contributed to a stagnation in domestic production.

The country’s heavy reliance on imported crude further dampens the incentive to invest in upstream infrastructure.

- Downstream Strength: Manufacturing IIP

In contrast, downstream activity is gaining momentum. Refinery output has been strong, with the manufacturing IIP for coke and refined petroleum products rising by 4.24% in June 2025 — the highest since February.

This growth is being driven primarily by rising demand for auto-fuels, especially, which alone accounts for 59% of India’s total fuel consumption. Auto-fuel consumption is projected to grow by 7.9% year-on-year in the September quarter, which would be the highest growth recorded since June 2023.

| Sector FYI: In the oil & gas industry, upstream refers to exploring for and producing crude oil and natural gas. Midstream involves transporting and storing these resources, often via pipelines, ships, or terminals. Downstream covers refining, processing, and distributing petroleum products to end users. |

Crude Oil Processed by Indian Refineries (Throughput)

India’s total crude oil refining capacity currently stands at 256.8 million tonnes per annum (MTPA), spread across 23 refineries.

Over the past seven years, India’s refining capacity has increased by just 5%, rising from ~245 million metric tonnes per annum (MMTPA) to 258 MMTPA — far below the original 69% expansion target set for 2025, which aimed for 414 MMTPA. This shortfall is primarily due to delays or deferrals in key expansion projects by major players like Nayara Energy, Reliance Industries, and Indian Oil Corporation.

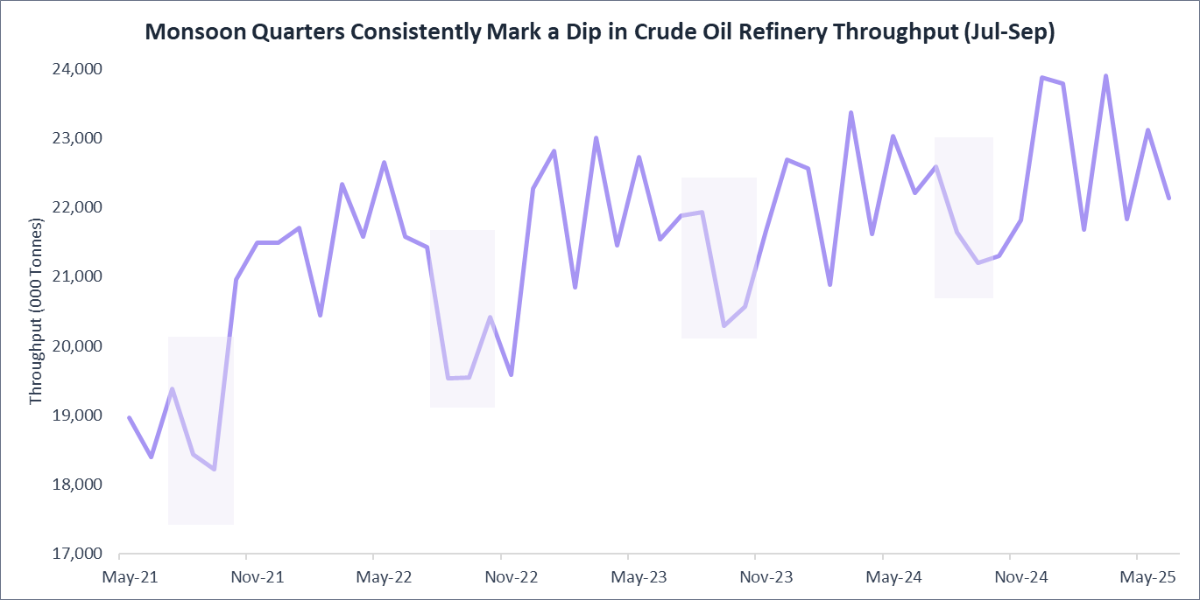

While capacity utilisation has remained high at 103%, a temporary slowdown in refinery throughput is expected during the July–September monsoon quarter, as is historically observed. This dip is typically driven by planned maintenance shutdowns, reduced demand for transport fuel, and logistical challenges during the rainy season.

This seasonal dip is evident in the chart below during the July to September months:

Domestic Natural Gas Output

- Demand: Steady Growth Ahead

India’s natural gas consumption has been rising consistently, growing by around 10% annually in 2023 and 2024. This surge is driven by rapid expansion in city gas networks (PNG for homes, CNG for vehicles), as well as greater use in fertiliser production and industrial applications.

Looking ahead, the IEA - a global body that tracks energy markets and advises on policy - estimates that demand could rise nearly 60% by 2030, touching 103 billion cubic meters (BCM). The government also aims to increase gas’s share in India’s energy mix from 6% to 15% by the end of the decade.

- Supply: Domestic Weakness, Import Dependence

India’s domestic gas production isn’t keeping up. In May 2025, output was 2,979 million metric standard cubic meters (MMSCM), down 4.0% YoY, marking the 11th consecutive month of decline. The main reason? Older gas fields in places like Mumbai Offshore and Assam are running out of steam, and newer fields haven’t picked up the pace yet.

To meet growing demand, India is importing more LNG (liquefied natural gas) — currently making up ~50% of total consumption.

- Outlook: Flat Production, Rising Imports

There’s little scope for recovery in FY26; no major new gas fields are scheduled to become operational, and older ones will continue to decline. As a result, imports will remain essential. By FY27–30, production could increase slightly if offshore fields, such as KG-D5 or smaller discoveries, make progress. But growth will be modest. The IEA projects that domestic production may reach only ~38 billion cubic meters (BCM) by 2030, meaning India will remain heavily import-dependent and exposed to global gas price volatility.

To wrap up the macro picture, let’s look at the two biggest global wildcards shaking up India’s oil & gas sector:

| What’s Happening | Impact on India’s Oil Sector | How India Is Responding |

|---|---|---|

EU sanctions on refined fuels made from Russian crude - Price cap lowered to $47.6/bbl - Nayara under EU scrutiny due to significant ownership (49.13%) by Russian oil giant- Rosneft | • ~30% of Nayara’s refinery output impacted due to trade finance & export hurdles. • Export margins squeezed, especially diesel to Europe. | • Rerouting cargo to Africa, Southeast Asia. • Blending non-Russian crude for export batches. • Shift toward domestic sales. |

Trump’s proposed penalties on countries importing Russian oil - India imports ~40% of crude from Russia - Tariff threat of 25% additional import duty on oil sourced from Russia beginning from August 27, 2025. | • If enforced, could raise India’s oil import bill by $9–11 billion annually. • Pressure on the rupee and trade deficit. | • Maintaining diplomatic ambiguity • Boosting Saudi, U.S., and UAE imports as a buffer. • No official reduction in Russian flows yet. |

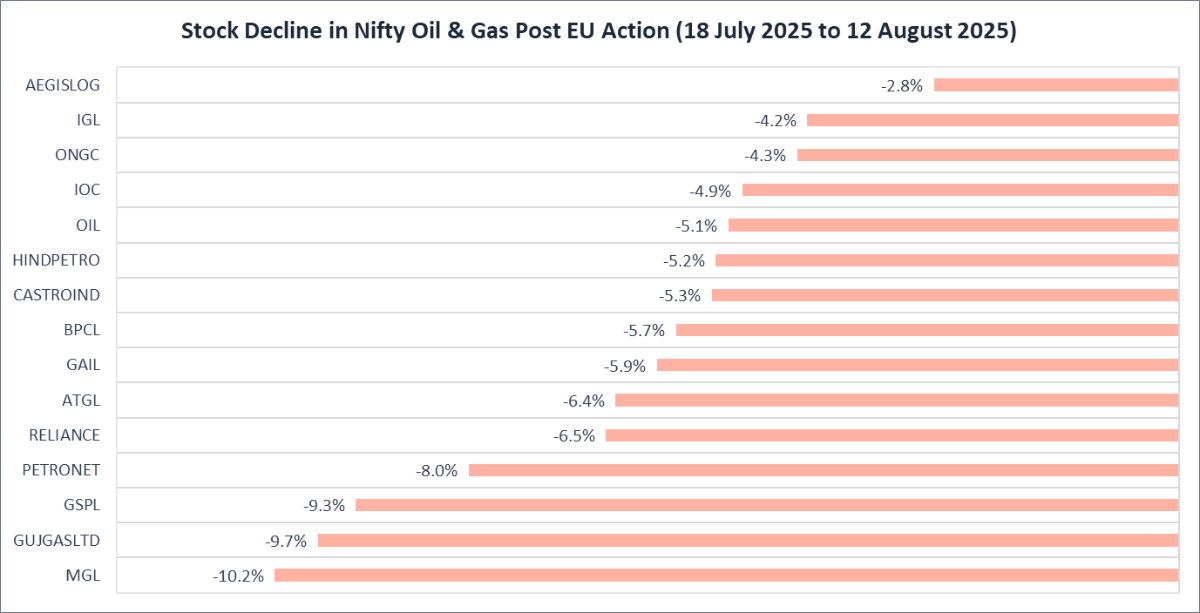

These external shocks have clearly spooked investor sentiment. Since the EU rolled out its 18th sanctions package on July 18, 2025 — followed closely by Trump’s tariff threats — the Nifty Oil & Gas Index has slipped 6.18%. Investors got jittery, and that’s visible in the stock price dip across key sector players:

Conclusion

All in all, from a macroeconomic lens, there’s still room for cautious optimism. Crude oil prices are easing, and domestic demand remains strong. Yes, how India navigates the evolving pressure from the West remains uncertain, but in the long run, we have two key advantages: a growing consumption base and a clear intent for infrastructure expansion.

We may not always have access to discounted oil, and perhaps that’s the nudge we need to reduce our import dependence. That transition won’t happen overnight. But what the sector needs now more than ever is a decisive, future-ready energy policy — one that not only responds to external shocks, but builds internal strength for the years to come.