India’s IT sector has long been a market favourite, powering the digital revolution, creating millions of jobs, and delivering steady returns to investors. But lately, the picture has started to change. The sector is dealing with a U.S. slowdown, steep tariffs, geopolitical uncertainty, and the fast rise of AI. Clearly, this is the time to re-evaluate the sector’s macros to understand where it is heading.

Let’s take a closer look at the most relevant macroeconomic factors that will pave the road ahead for Indian IT.

IT Sector Overview

The Indian IT sector contributes 7.3% of the country’s GDP, accounts for approximately 43%–45% of the country’s total services exports, and employs about 5.8 million tech professionals. In FY2025, the sector achieved a revenue of $283 billion, reflecting a 5.1% year-on-year (YoY) growth. Despite this, it remains vulnerable to macroeconomic fluctuations, especially in its key export markets.

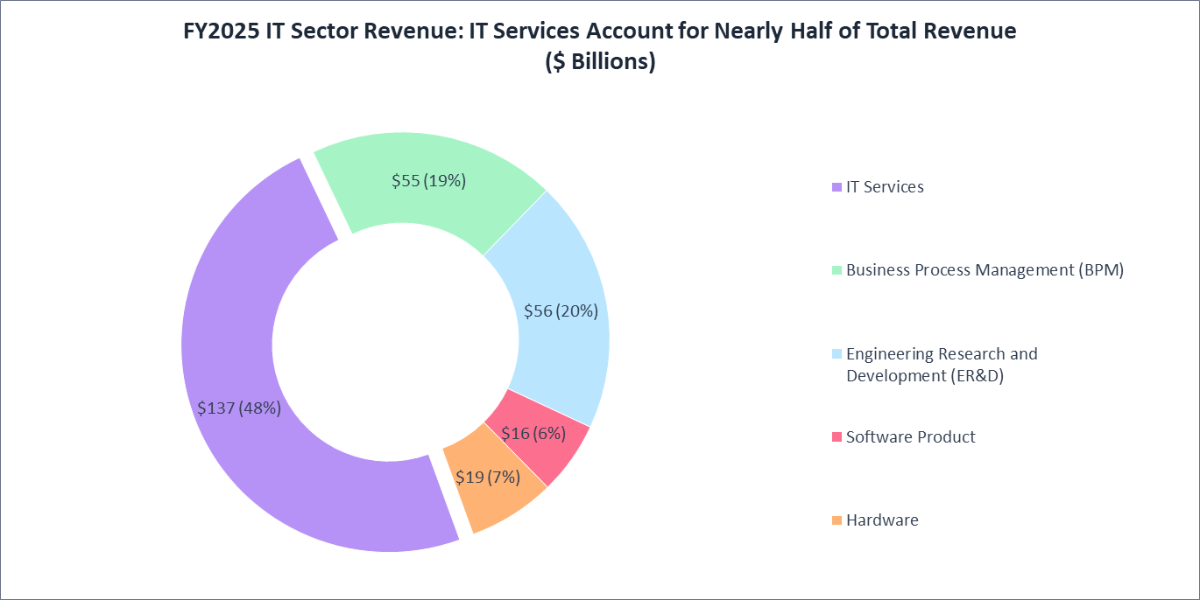

Revenue Breakdown of the IT Sector:

IT Services remain the sector’s backbone, contributing 48% of revenue at $137.1 billion. Meanwhile, Engineering Research & Development (ER&D) and Business Process Management (BPM) segments together brought in 39%, highlighting a shift toward specialised services amid rising digital transformation demand.

Earnings Snapshot

As the Q1 FY2026 earnings season wraps up, IT companies are facing a challenging macroeconomic environment, with global uncertainties weighing on client spending and decision-making cycles.

Here’s how major IT firms fared in Q4 FY2025:

| Company | YoY Growth | QoQ Growth | OPM Q1 FY2026 | OPM Q4 FY20D25 |

|---|---|---|---|---|

| Tata Consultancy Services | 6.2% | -2.5% | 28.0% | 26.0% |

| Infosys | 6.1% | 3.3% | 24.0% | 24.0% |

| HCL Technologies | 6.5% | -2.7% | 32.0% | 21.0% |

| Wipro | -0.7% | -1.3% | 18.0% | 21.0% |

| LTIMindtree | 7.0% | 0.0% | 17.0% | 14.0% |

| Tech Mahindra | 1.9% | 0.1% | 12.0% | 16.0% |

| Persistent Systems | 21.6% | 2.2% | 16.0% | 18.0% |

| Oracle Financial Services Software | 7.4% | 8.3% | 53.0% | 45.0% |

| Coforge | 33.8% | 11.5% | 6.0% | 15.0% |

| Mphasis | 7.2% | -0.5% | 18.0% | 19.0% |

- Revenue Outlook:

Q1 painted a mixed picture for the IT pack. Big names like Tech Mahindra and LTI Mindtree saw flat growth, while mid-tier players such as Coforge and Persistent stood out with strong double-digit gains. Demand clearly isn’t gone, just uneven. Most of the recovery now looks pushed to the second half of FY26, with client budgets still under scrutiny. Normally, tighter budgets slow down new deals, but the fact that companies are still winning contracts shows clients are prioritising critical projects even in a cautious spending environment. This gives some confidence that once budgets loosen, growth could accelerate. - Margins:

EBIT margins are likely to stay under pressure in FY2026 as companies focus more on growth and converting contracts rather than immediate profit. With investments pouring into AI, big deals, and cost-cutting measures, any meaningful recovery in margins is expected to take time. - Deals & Pipeline:

The silver lining this quarter has been on the deal front. Almost every player, from the top guns like TCS, Infosys, and Wipro to the mid-tier challengers like LTIMindtree, Coforge, and Persistent, reported strong Total Contract Value (TCV) wins. That gives the sector a solid pipeline to work with. The key question now is when these deals start showing up in revenue numbers, which will likely decide how the rest of FY26 shapes up. - Risks:

Of course, the sector isn’t in the clear just yet. Companies continue to flag macro worries in the U.S. and Europe, report slower spending in verticals such as BFSI and telecom, and note that deal cycles are lengthening as clients delay approvals and take a more cautious approach to spending. Add in the usual pressure from wage hikes, currency swings, and regulatory noise, and the road ahead looks anything but smooth. In short, Q1 was steady enough, but the IT sector is still walking a fine line between cautious optimism and lingering uncertainty.

Recommended for you

Readers also explored

India's Pharma Sector: Growth & Global Reach FY2026

Currency in Circulation: How Much Money Exists in the World?

Macroeconomic Outlook for FY2026: Key Factors to Watch

🔴 Slowdown in the US Economy

The US is a major market for India’s IT sector, making up 55% of IT exports in FY2024. Naturally, when US business sentiment dips or tech spending slows down, its ripple effect can be seen in India.

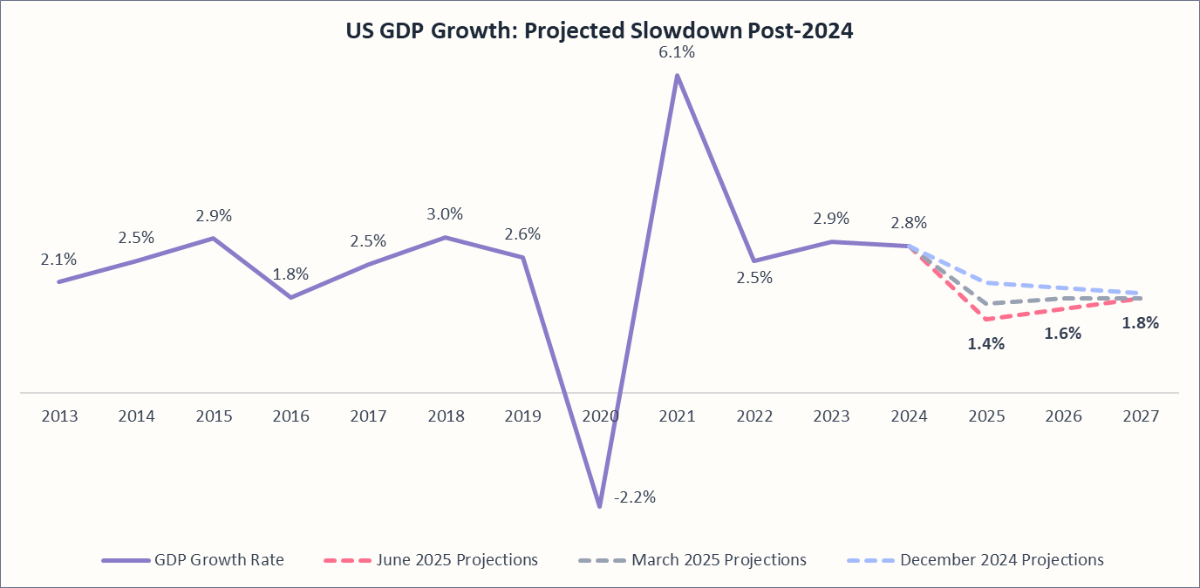

And that’s exactly what’s happening. In March 2025, the US Fed cut its GDP growth forecast from 2.1% to 1.7% for FY2025 — the slowest pace in eight years, pandemic aside. Then in June, it lowered the estimate for the second consecutive time, trimming the forecast again to 1.4%. With further downgrades expected in 2026 and 2027, large outsourcing contracts could feel the pinch, especially as US businesses tighten their budgets and hold back on spending.

🟢 Expansion in India’s Services Sector Activity

In India, the domestic revenue of the IT sector accounts for around 20% of the total, making it more sensitive to global economic changes than local ones. But that could be shifting. NASSCOM projects that domestic IT demand will outpace exports in FY2025, with domestic revenues expected to grow by 7% to $58.2 billion, while exports are likely to increase by 4.6% to $224 billion.

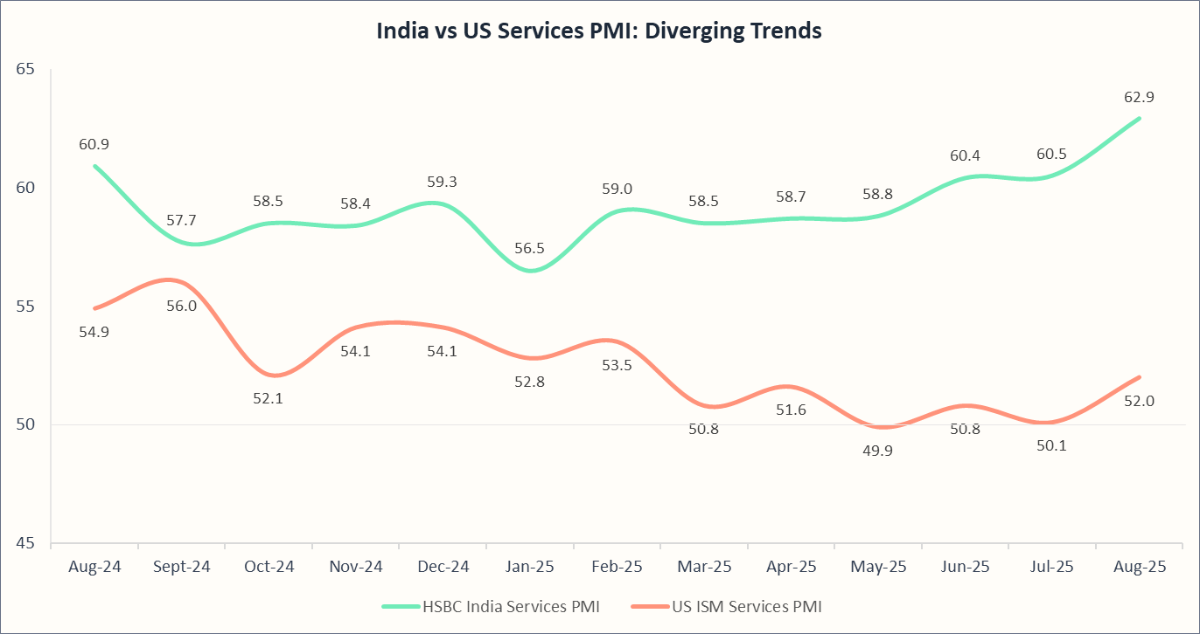

Supporting this trend, the HSBC India Services PMI rose from 56.5 in January 2025 to 62.9 in August, its highest reading since 2010, pointing to stronger business activity and job creation. By comparison, the US ISM Services PMI edged down from 52.8 to 52.0 in the same period, reflecting a stable-to-softening trend and more cautious spending in the US market.

The line graph below reflects the diverging trends in the Indian and US Services markets for the last 12 months:

🔴 Currency Fluctuations

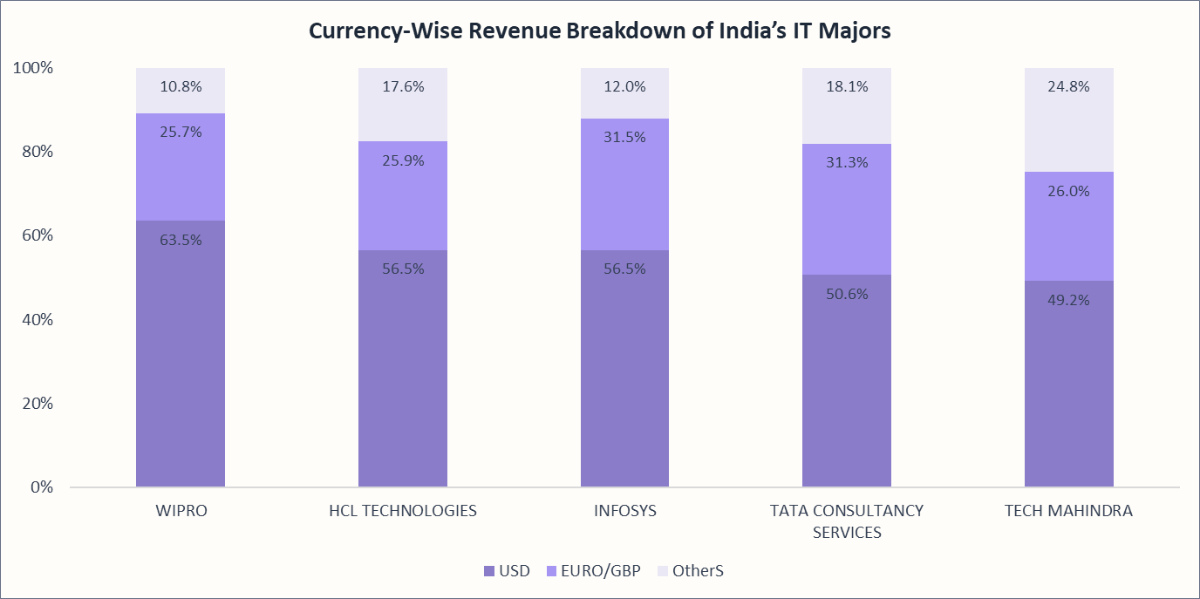

Indian IT companies majorly earn their revenues from export markets, primarily the U.S. and Europe. Naturally, this makes the sector very sensitive to currency fluctuations. When the rupee weakens against the dollar, euro, or pound, revenues booked overseas translate into higher earnings in INR. This is why keeping an eye on INR movements against key currencies is critical when evaluating the sector’s outlook.

Here’s how much of their revenues India’s IT majors actually earn in different currencies:

With such a high dependence on overseas markets, currency fluctuations matter. So far this year, here’s how the rupee has moved against key currencies and what that means for IT players:

| Currency | INR Depreciation YTD | Key Drivers | Impact on the IT Sector |

|---|---|---|---|

| USD | 3.00% | FII outflows, tariff risks, and RBI capping volatility | Positive: Higher INR revenues as most contracts are dollar-denominated |

| Pound | 10.90% | ECB slower to cut rates, capital rotation into Europe, dollar weakness | Mixed: A weaker rupee vs the euro and pound does lift INR revenues on paper, but once you adjust for reporting in USD, higher hedge costs, and soft demand in Europe and the UK, the net impact is mixed. |

| Euro | 16.10% | UK inflation and interest rates kept the pound strong |

🟡 Hiring Blues in Indian IT

According to TeamLease (a leading HR and staffing firm in India), softness continues in the IT sector, reflected in a low Net Employment Change (NEC – a measure of net hiring sentiment) of just 1.8%.

Here is the hiring sentiment of IT firms:

| Employer Response | Share of Firms | Key Drivers |

|---|---|---|

| Plan to Hire | 40% | Project-linked roles in cloud migration, cybersecurity, and GenAI pilots |

| Expect No Change | 36% | Utilization-maximisation mandates, cautious headcount planning |

| Workforce Reductions | 24% | Deal pipeline slowdowns, geopolitical uncertainty, and margin stress |

In their Q1 results, IT majors too expressed a cautious sentiment. TCS cut over 12,000 jobs and froze senior hiring, while Infosys bucked the trend, adding 17,000 employees in Q1 and planning to hire 20,000 new employees alongside large-scale AI training. HCLTech, Wipro, and Tech Mahindra kept net additions minimal, focusing on niche skills in cloud and AI. Together, the top five firms added only about 4,800 employees in Q1 FY26, highlighting the clear shift from mass hiring to selective, specialist recruitment.

Overall, the hiring outlook for FY26 remains cautious and selective. Large-scale fresher intakes are on hold, with firms prioritizing margin protection and specialist roles in AI, cloud, and cybersecurity. Any meaningful recovery will hinge on a revival in global tech spending and stronger deal pipelines.

Global Capability Centers- A Bright Spot in IT Hiring:

Global Capability Centres (GCCs) in India continue to expand their hiring footprint despite broader IT sector headwinds. Between 2019 and 2024, they added over 600,000 jobs, and employment is projected to scale to 2.8–4 million by 2030. For FY2026, 47% of surveyed GCCs plan to increase hiring, while only 17% expect reductions, reflecting sustained confidence in India’s talent pool. The hiring mix is shifting decisively toward value over volume, with strategic roles in product, engineering, data science, and R&D leading demand. Overall, GCC hiring is set to remain strong but increasingly selective, anchored in niche digital skills and early-career pipelines

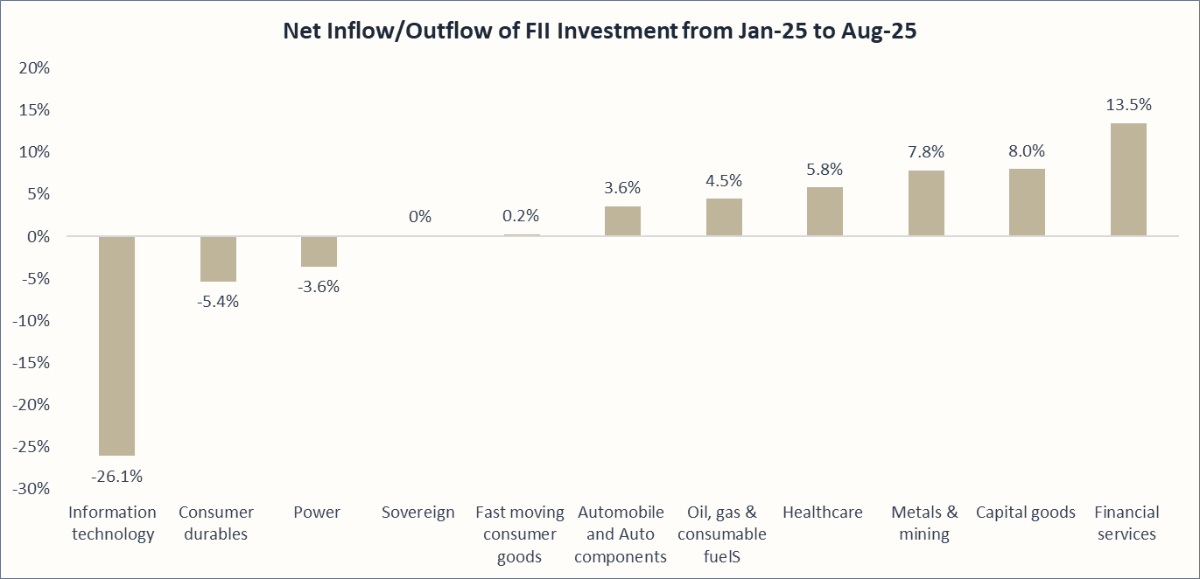

🔴 IT Sector Faces Intensified FII Outflows

The IT sector has borne the brunt of foreign investor outflows in 2025. From January to August, the sector saw a steep 26.1% net outflow of FII investments — the sharpest among all major sectors. In contrast, sectors like financial services (+13.5%), capital goods (+8.0%), and metals & mining (+7.8%) attracted strong inflows, highlighting the divergence in investor sentiment.

- Disappointing Earnings: FY2025 and Q1 FY2026 earnings underwhelmed, with companies like Infosys and Wipro reporting flat to negative revenue growth expectations for the next year.

- Wavering Demand: Export markets, especially the US, are showing signs of strain as tech spending slows down, further dampening investor sentiment.

The data underscores a clear shift in FII preference — away from global export-dependent IT, and toward financials, capital goods, and commodities, which are more aligned with India’s domestic growth story.

🟢 India’s Export Shift: Services Outpace Merchandise

India’s export dynamic is undergoing a noticeable shift, with services exports outpacing merchandise exports in both growth and share. In FY2024- 25, services exports jumped by 13.6% to USD 387.4 billion, driven by strong gains in software services and business consultancy. This now accounts for 88.5% of the merchandise export value.

Meanwhile, merchandise exports remained flat at USD 437.7 billion, with declines in Petrol, Oil and Lubricants (POL) and gems & jewellery offsetting gains in electronics and pharmaceuticals.

The trend is expected to persist in FY2025- 26, with services exports projected to rise by 7.8% to USD 417.7 billion, narrowing the gap to 94.3% of merchandise exports. This underscores India’s growth in global services trade as demand for goods remains tepid.

Final Thoughts

The Indian IT sector heads into FY2026 balancing between caution and opportunity. Earnings are under pressure, hiring has slowed sharply, and foreign investors are pulling back as global demand stays weak. Still, it’s not all negative; a healthy pipeline of deals, steady growth in ER&D exports, and the rise of GCCs are bright spots. The real challenge now is turning these wins into actual revenues and using AI-led transformation to unlock the next phase of growth. For investors, IT in 2026 is less about short-term profits and more about being ready for the bigger digital shift that’s on the way.

Recommended Reads

Looking for more sector insights? Explore these: