As the world vacillates between the Fed rate easing cycle, trade wars, and AI manias, India is moving stealthily in its own direction. The RBI has held off on rates, introduced 22 key reforms, and brought inflation down, but the story is far from simple. Here are our top portfolio recommendations:

| Top Recommendations for Portfolio |

|---|

| Continued preference for India's large-cap over small- and mid-caps. |

| Stay invested in Indian Equities via SIPs. Recent tariffs and H1B fees add short-term uncertainty; systematic investing helps one to benefit when clarity emerges. |

| Government stimulus and policy measures can boost growth, but sustainable high earnings need a nominal GDP near 11-12%. |

| Get ready for refinancing opportunities as repo rate cuts are on the horizon. We anticipate an additional 50 basis points reduction in the repo rate by the end of FY26. |

| Invest in short-to medium-duration debt funds. Inflation is at an 8-year low, offering a favourable environment for debt instruments. |

| Keep balanced exposure to REITs & InvITs. The new ECB framework may boost real estate funding. This framework can also support foreign debt capital, which can help stabilise the rupee. |

In the next section, we break down the data and insights behind these views and what they could mean for your portfolio.

Rate Cuts on the Horizon?

The RBI’s October policy unfolded largely as expected, keeping the repo rate steady at 5.5% and maintaining a neutral stance. But this pause was a strategic wait-and-watch.

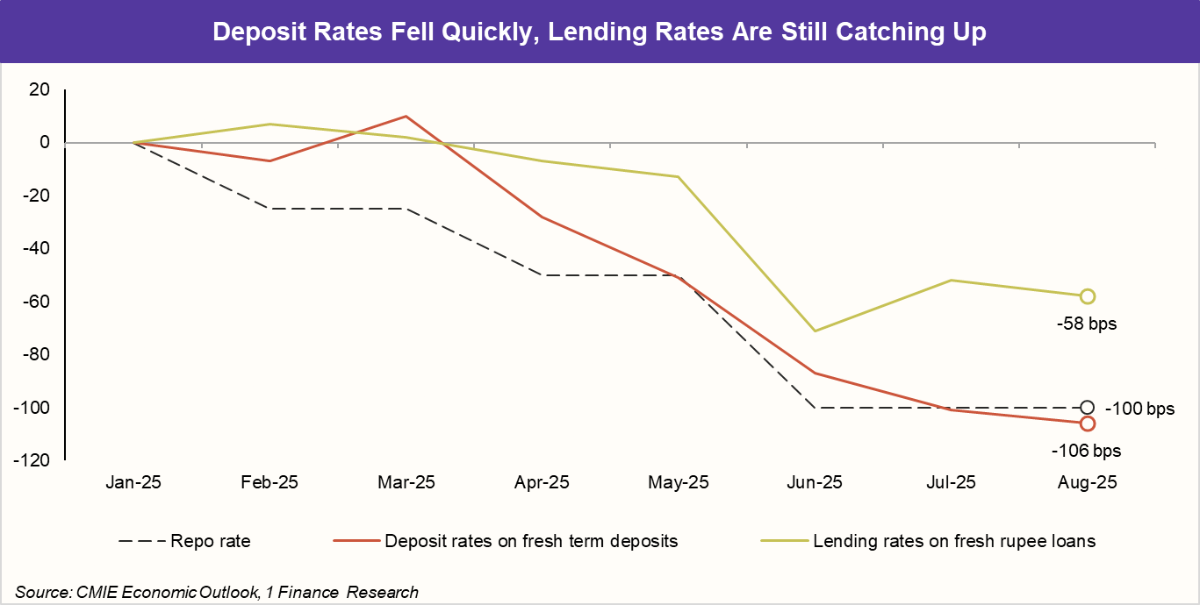

Between February and August 2025, the repo rate was cut by 100 bps, yet the impact on lending rates has been gradual. Deposit rates have dropped by 106 bps, but lending rates on fresh rupee loans have fallen only 58 bps. This gap indicates that RBI is waiting for the full transmission before taking the next step to support growth.

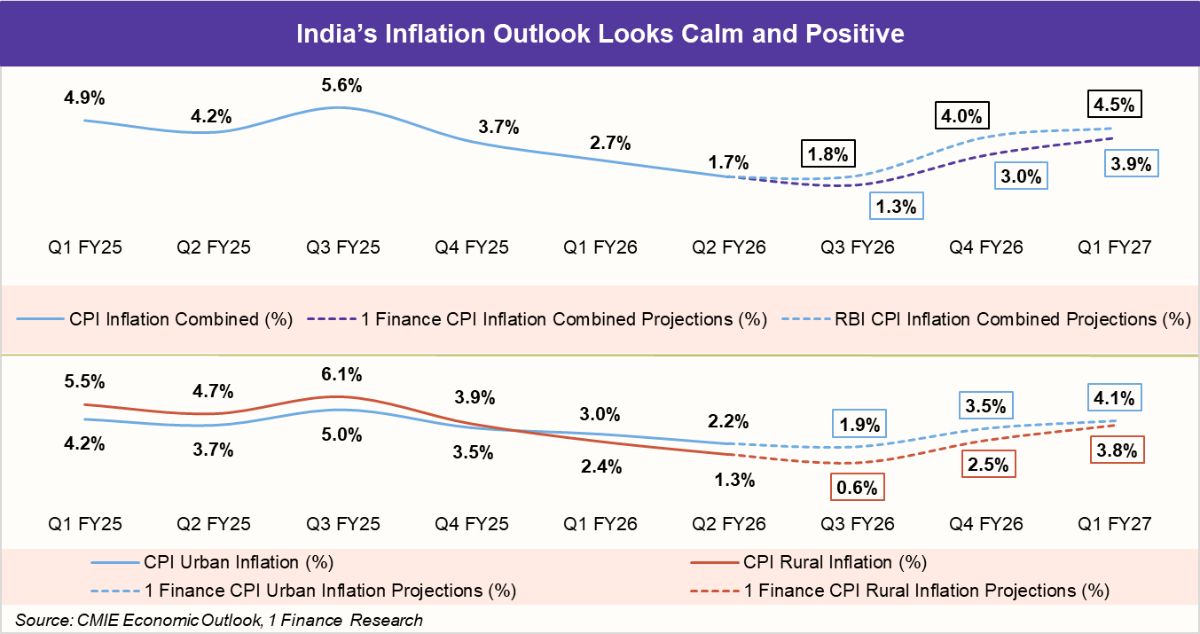

Falling inflation is setting the stage for a possible rate cut. Thanks to easing food prices, retail inflation fell to an eight-year low of 1.5% in September 2025. While the RBI expects the FY26 inflation to be around 2.6%, we expect inflation to be slightly lower at 2.2%. Breaking it down further, urban inflation is likely to hover near 2.7%, with rural inflation even gentler at 1.7%. Overall, the outlook points to stable prices, with only a modest uptick expected toward the fourth quarter of FY26.

Given this backdrop, 1 Finance anticipates an additional 50 basis points reduction in the repo rate by the end of FY26.

Implications for Portfolio:

- Get ready for lower loan costs; rate cuts can open up chances for refinancing and improved loan management.

- In view of sustained low inflation, consider allocating to short- to medium-duration debt.

Recommended for you

Readers also explored

UK Economy 2025: FTSE 100 Valuation, The India-UK FTA and Macro Trends

Currency in Circulation: How Much Money Exists in the World?

Reforms that Don’t Make Headlines, But Should

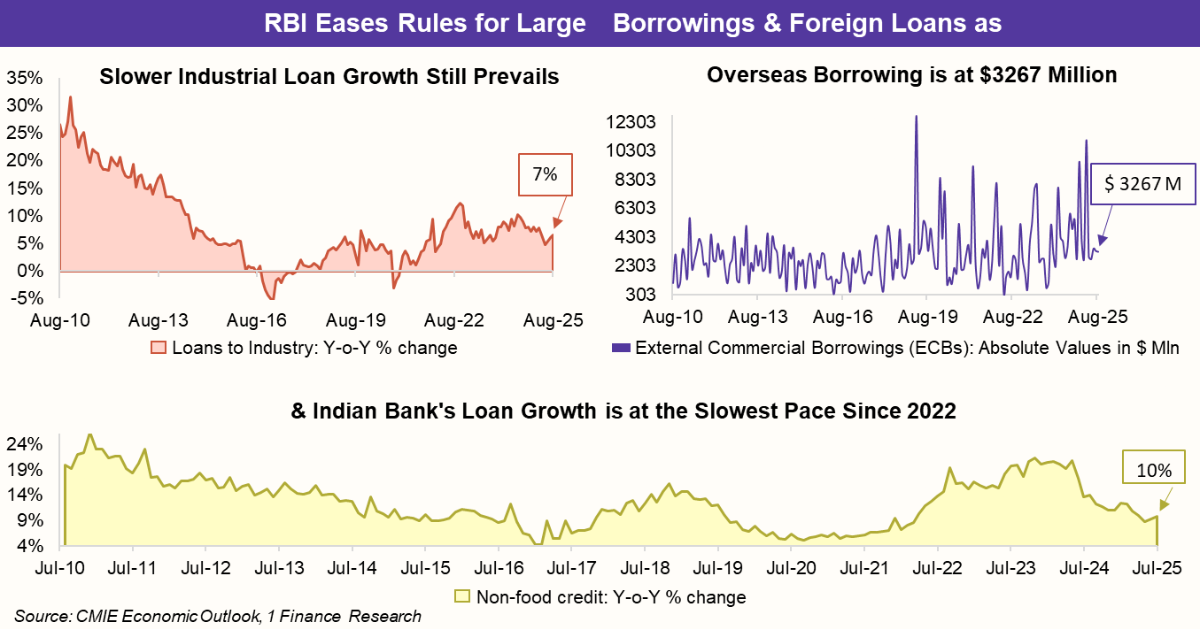

Despite multiple RBI moves earlier this year, from 100 bps rate cuts to structural reforms, credit growth has yet to pick up. Bank lending stayed soft through H1 FY26, with only a slight uptick recently. Infrastructure lending remains the weakest link, though July showed a small rebound.

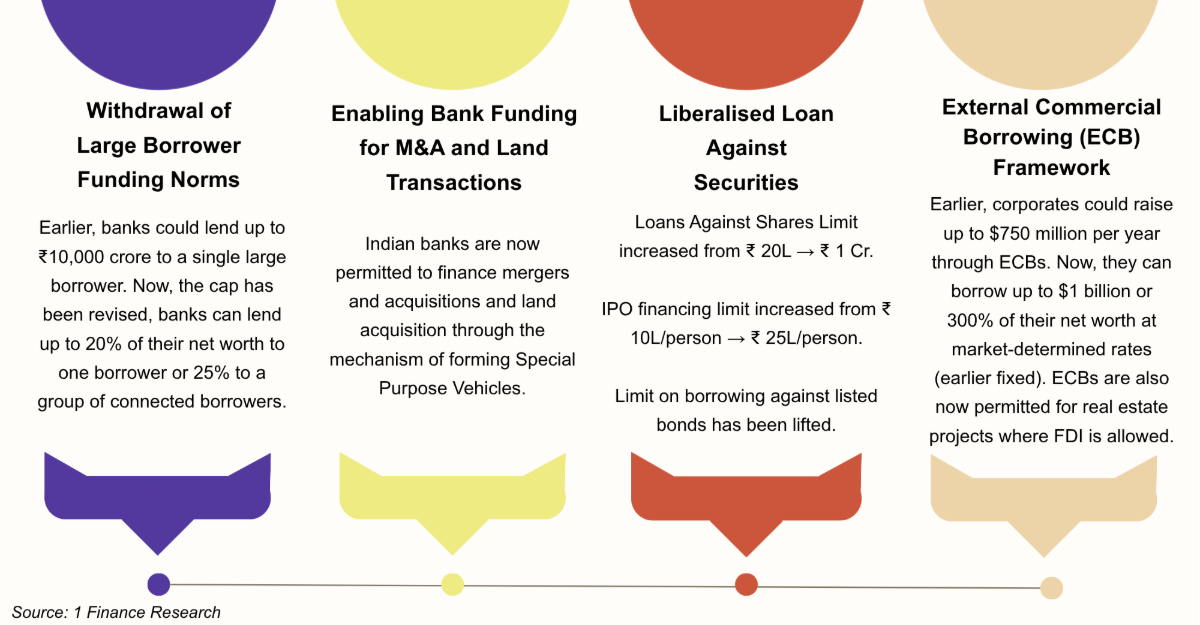

To address this, the RBI announced 22 reforms on October 1, designed to unclog credit channels, deepen markets, and simplify regulations. The old framework will be phased out by April 2026. These may not make headlines like a repo cut, but they aim to boost liquidity and revive SME growth.

Some of the most impactful reforms among the 22 include:

Just as 1992 opened India’s equity markets to the world, 2025 could do the same for its credit markets. Revised norms could lift bank lending, currently around ₹27 lakh crore of total ₹77 lakh crore corporate borrowings. Even a 10-15% shift back toward banks could meaningfully expand credit.

However, does this strategy come without risks? Definitely not.

At present, India’s corporate leverage stands at a healthy 24% of GDP (FY25), nearly the same as in 1995, suggesting there’s room for expansion. Yet bank loans now form just 36% of total corporate borrowings, the lowest in years.

| Year | Corporate Leverage % of GDP | Share of Bank Borrowings in Total Corporate Debt |

|---|---|---|

| FY95 | 23% | 35% |

| FY05 | 29% | 45% |

| FY09 | 43% | 55% |

| FY15 | 49% | 50% |

| FY20 | 43% | 43% |

| FY25 | 24% | 36% |

Note: Corporate leverage includes borrowings from banks, inter-corporate loans, foreign currency borrowings, and issuance of debentures and bonds by both listed and unlisted companies, including financial and non-financial entities in India.

This structure implies that while India’s corporates are not overleveraged, the credit intermediation role of banks has shrunk. Relaxing the large exposure framework now allows banks to lend more to big corporations, a move helpful for growth, but riskier if defaults rise. While corporate leverage remains below 30% of GDP, additional liquidity is not without risk. A higher concentration of lending to a few large borrowers can reduce diversification and expose banks to stress during economic downturns, potentially leading to asset-liability mismatches.

Moreover, while merger and acquisition (M&A) financing may appear attractive, it comes with regulatory constraints; banks must maintain adequate Tier I capital, typically setting aside around 10% as a cushion when extending credit to riskier activities like M&A.

Lastly, the recent relaxation in limits for loans against securities could also heighten vulnerability; if share prices fall sharply and borrowers fail to pledge more shares or repay part of the loan, banks could face significant losses.

Implications for Portfolio:

- M&A activity in fragmented sectors like manufacturing, textiles, and chemicals may rise, positive for broader equity markets and long-term funds.

- The cost of financing for Indian firms will drop, making them more competitive versus foreign peers.

- Expanded ECB use and shorter tenors will attract foreign debt capital, supportive for rupee stability and the domestic rate environment.

- ECBs can now fund real estate activities (commercial, logistics, annuity assets like roads). Overall, greater liquidity will support real estate and infrastructure assets.

The Road Ahead

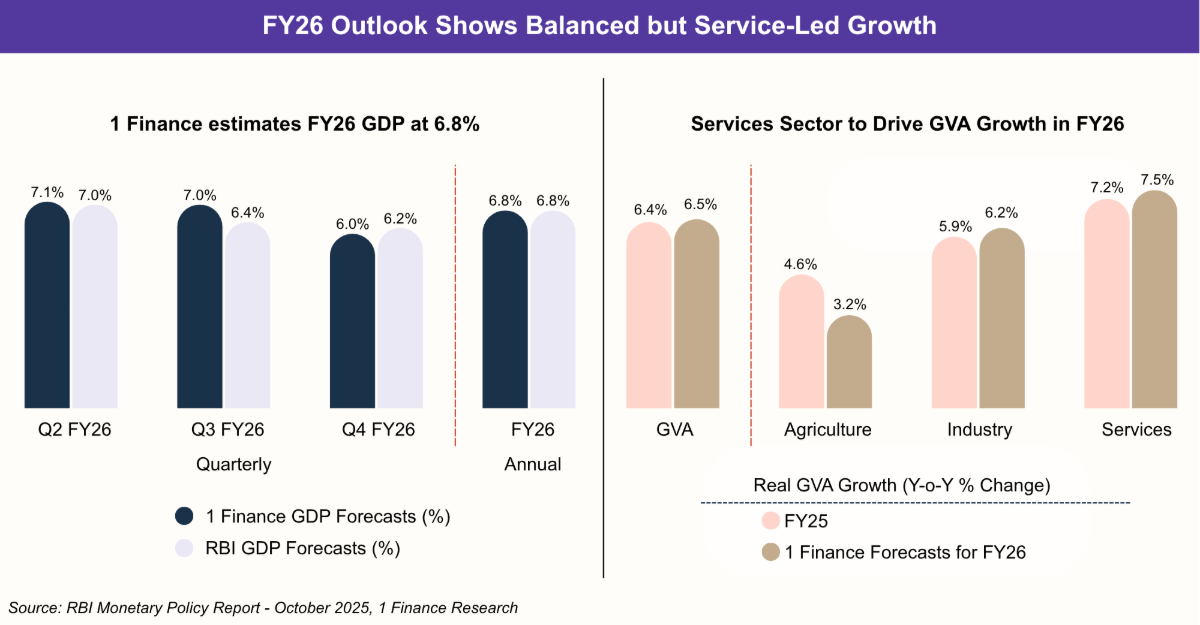

India’s Q1 FY26 GDP growth of 7.8% was impressive and well above expectations. This momentum was largely driven by stronger rural consumption and front-loaded government capital expenditure, while private investment remained subdued. But momentum is likely to moderate through the second half.

Looking ahead, 1 Finance expects FY26 real GDP growth at 6.8%, broadly in line with the RBI’s projection, with activity peaking in Q2 and easing through the second half. Against this backdrop, the RBI’s 22 structural reforms aim to unclog credit, boost liquidity, and support SMEs. Services are likely to remain the key growth driver, with service GVA growth estimated at 7.5% for the year.

Corporate leverage remains moderate at 24% of GDP, offering room for expansion, yet higher lending concentration and economic shocks pose risks if leverage rises too quickly.

For investors, this environment suggests opportunities in large-cap equities, debt, REITs/InvITs, and sectors benefiting from improved credit flow, while maintaining a careful eye on potential vulnerabilities in corporate lending and refinancing cycles.