India's economic engine is firing on all cylinders! The recently released Gross Domestic Product (GDP) numbers for the first quarter (April-June) of the financial year 2025-26 have sent a wave of optimism through the nation and the global financial community.

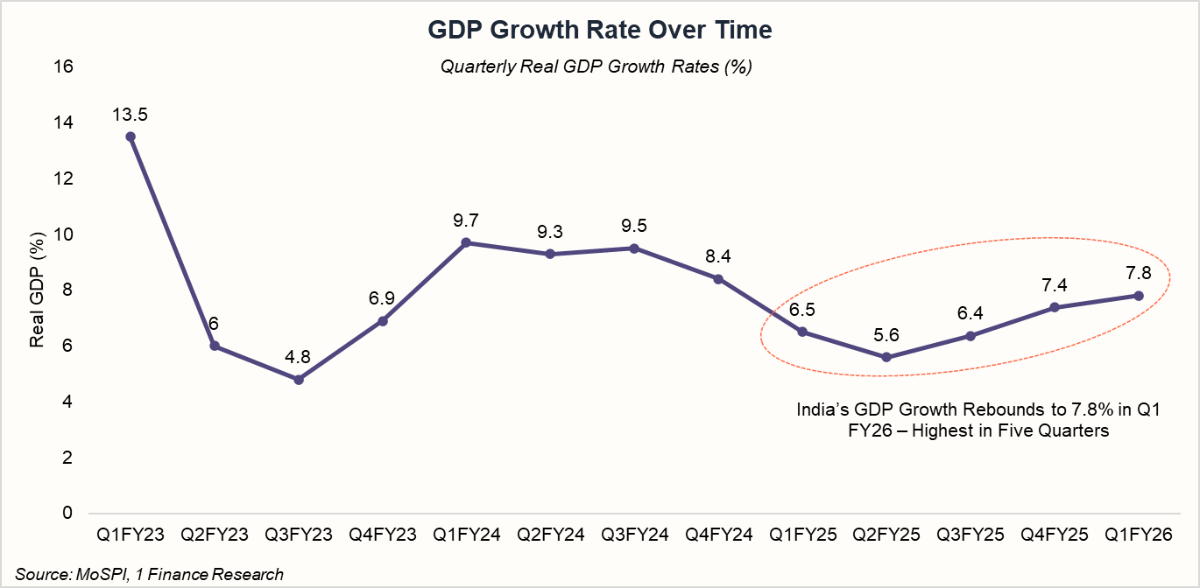

The recently released numbers from the National Statistics Office (NSO) tell a powerful story of growth and momentum. In the first quarter of the fiscal year 2025-26 (April-June), India's Gross Domestic Product (GDP) didn't just meet expectations; it surged past them, clocking a robust 7.8% growth.

This isn't just a number; it's a testament to a nation on the move, a clear signal that India is solidifying its position as the world's fastest-growing major economy. It's the story of millions of individual efforts coming together to create an unstoppable economic force.

Headline Numbers: Q1 FY 2025–26 GDP Results

India’s economy grew by a strong 7.8% year-on-year in the first quarter of FY 2025–26, outpacing market expectations and marking the fastest pace of growth in five quarters. The expansion was supported by buoyant services activity, a rebound in manufacturing, and higher government spending.

A look at the numbers:

- India’s GDP at constant prices for Q1 2025-26 is ₹47.89 lakh crore, up from ₹44.42 lakh crore in Q1 2024-25, reflecting robust year-on-year growth of 7.8%.

- Nominal GDP grew by 8.8%, touching ₹86.05 lakh crore versus ₹79.08 lakh crore a year ago.

- The real Gross Value Added (GVA), a key indicator of economic activity, clocked 7.6% growth, reaching ₹44.64 lakh crore.

India’s Q1 GDP growth exceeded forecasts from the Reserve Bank of India (6.5%) and 1 Finance (6.4%), highlighting underlying economic endurance even amidst global uncertainties and the recent US tariff escalation.

💡One of the standout features of the latest GDP release is the unusually low GDP deflator, which came in at just 0.9%, the lowest in nearly six years. Why is this important? The GDP deflator is the broadest measure of inflation in the economy, capturing price changes across goods and services. A lower deflator means that while nominal GDP rose by 8.8%, the adjustment for inflation made real GDP growth appear stronger at 7.8%. |

The Unsung Heroes of the Growth Story

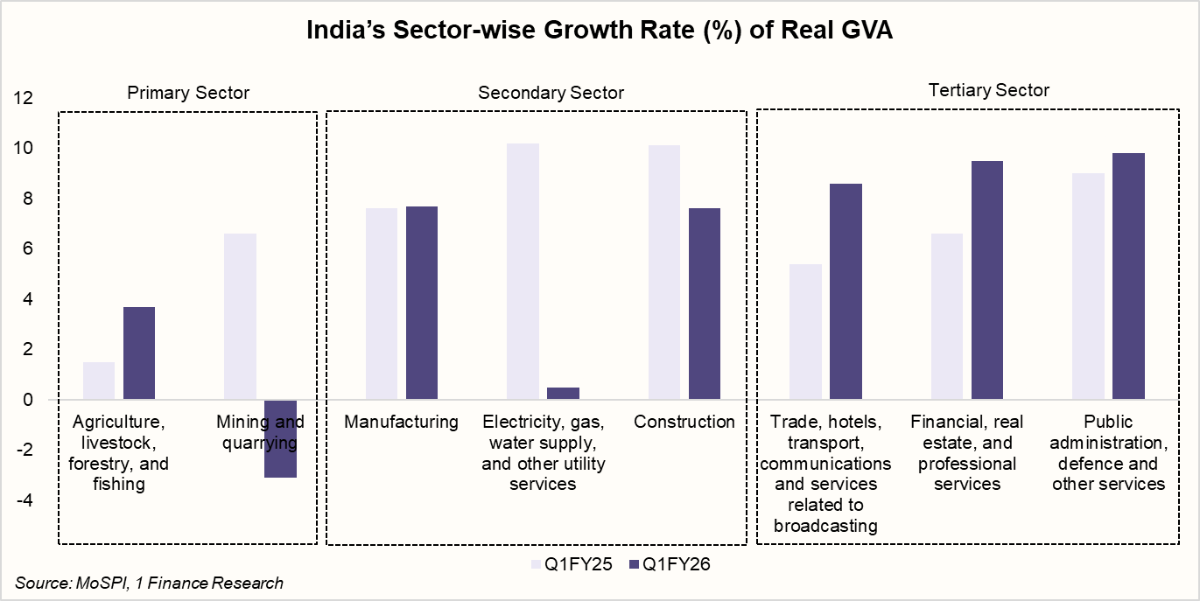

Every great story has its heroes, and India's economic narrative is no different. A single engine didn't power the strong 7.8% growth, but a symphony of sectors performed in perfect harmony. The Q1 data reveal a services-led growth story, with manufacturing providing solid support, while agriculture showed subdued performance.

Recommended for you

Readers also explored

Indian Economy’s Q2 Boost and The Upcoming Labour Reforms

Nifty 50 Companies List 2025 : Top 50 Stocks in India

Primary Sector: Modest Gains Amid Challenges

The primary sector, which accounts for about 15-18% of GVA, grew by 2.8% in Q1FY26 in real terms to ₹6.56 lakh crore. Within this:

- Agriculture, Livestock, Forestry, and Fishing: This sub-sector expanded by 3.7% to ₹5.68 lakh crore, driven by favourable monsoon forecasts and government support schemes like PM-KISAN and increased minimum support prices (MSP). However, erratic weather patterns and input cost inflation tempered the gains.

- Mining and Quarrying: A contraction of 3.1% to ₹87,327 crore highlights issues like regulatory hurdles and global demand slowdowns for minerals.

At current prices, the sector grew 1.7%, underscoring the impact of price volatility in commodities.

Secondary Sector: Industrial Revival on Track

The secondary sector, which includes manufacturing, construction, and electricity, also delivered a strong performance. The industry posted a 7.0% growth to ₹12.66 lakh crore. Key highlights include:

- Manufacturing: A standout performer with 7.7% growth to ₹7.61 lakh crore, fueled by the Production-Linked Incentive (PLI) scheme, which has boosted sectors like electronics, automobiles, and pharmaceuticals. Export-oriented manufacturing benefited from global supply chain shifts away from China.

- Construction: Up 7.6% to ₹3.98 lakh crore, supported by infrastructure push under the National Infrastructure Pipeline (NIP) and real estate demand.

- Electricity, Gas, Water Supply, and Utilities: A sluggish 0.5% growth to ₹1.06 lakh crore, possibly due to seasonal factors and energy transition challenges.

This sector's performance reflects the government's focus on "Make in India" and capital expenditure (capex) to drive industrial output.

Tertiary Sector: The Engine of Growth

The services sector accelerated by 9.3% to ₹25.42 lakh crore, making it the primary driver of Q1 growth.

- Trade, Hotels, Transport, Communication, and Broadcasting: Grew 8.6% to ₹7.48 lakh crore, boosted by e-commerce boom, tourism recovery, and 5G rollout.

- Financial, Real Estate, and Professional Services: A strong 9.5% expansion to ₹12.32 lakh crore, driven by digital banking, fintech innovations, and housing finance demand.

- Public Administration, Defence, and Other Services: Up 9.8% to ₹5.61 lakh crore, reflecting higher government spending on social welfare and defence modernisation.

Overall GVA at basic prices grew 7.6% in real terms to ₹44.64 lakh crore, slightly below GDP growth due to higher tax collections (net taxes up 10.3%).

The Engines of Momentum: What's Driving the Growth?

So, what's behind this stellar performance? It's a combination of smart policy, strategic investment, and rising consumer confidence.

Government Final Consumption Expenditure (GFCE):

Government spending surged 9.7% in nominal terms, more than double last year’s 4.0%. This reflects front-loaded fiscal expenditure, particularly on infrastructure and social schemes, as the government continued its growth-oriented capex push early in the fiscal year. Such expenditure not only supports short-term demand but also crowds in private investment by improving logistics, connectivity, and productivity.

Private Final Consumption Expenditure (PFCE):

In contrast, household consumption growth moderated to 7.0%, down from 8.3% a year earlier. This suggests that despite global uncertainties, the Indian consumer remains optimistic. A drop in inflation, especially in food prices, has put more money in people's pockets, empowering them to spend and drive the economy forward.

Gross Fixed Capital Formation (GFCF):

Investments rose 7.8%, compared to 6.7% in Q1 FY 2024–25. This reflects continued momentum in private sector capex in manufacturing, renewable energy, and construction, alongside robust public infrastructure spending.

- Strong inflows into roads, railways, and energy projects are evident, aligning with the government’s long-term infrastructure pipeline.

- Corporate capex is gaining ground in automotive, semiconductors, and green technologies, signalling improved business confidence.

| 💡A Sovereign Seal of Approval: In a major vote of confidence, global credit rating agency S&P Global recently upgraded India's sovereign rating. This wasn't just a routine move; it was the first such upgrade in 18 years! This is a powerful signal to global investors that India's economy is on a stable, long-term growth path. |

A Bold Stroke of Reform: The GST Revolution 2.0

Just as the economic numbers were being celebrated, the government made a bold move that promises to sustain this momentum: a major Goods and Services Tax (GST) reform. While the GST has been a landmark reform, its multi-slab structure has been a point of contention.

The new GST reform streamlines the tax into a simplified two-slab structure (5% and 18%), eliminating the old 12% and 28% slabs. This is a game-changer with far-reaching implications:

- The rationalisation of tax rates means a wide range of everyday items, from packaged foods and personal care products to consumer durables like ACs and refrigerators, will now be cheaper. This puts more money back into the hands of consumers, especially the middle class, encouraging them to spend. This is expected to give a significant boost to Private Final Consumption Expenditure (PFCE), which is the largest component of India's GDP.

- The reforms are a huge win for sectors that have been struggling with high taxation. The automotive industry, in particular, will see a major boost as small cars and two-wheelers now fall under the 18% slab, making them more affordable for the masses. Similarly, the reduction of GST on construction materials like cement from 28% to 18% will lower project costs and fuel the infrastructure boom.

- By simplifying the tax structure, the government makes it easier for small businesses to comply with the tax code. This reduces the administrative burden and encourages more businesses to enter the formal economy, which in turn expands the tax base and improves revenue collection efficiency over time.

Outlook for India’s Economy

Short-Term (FY 2025–26)

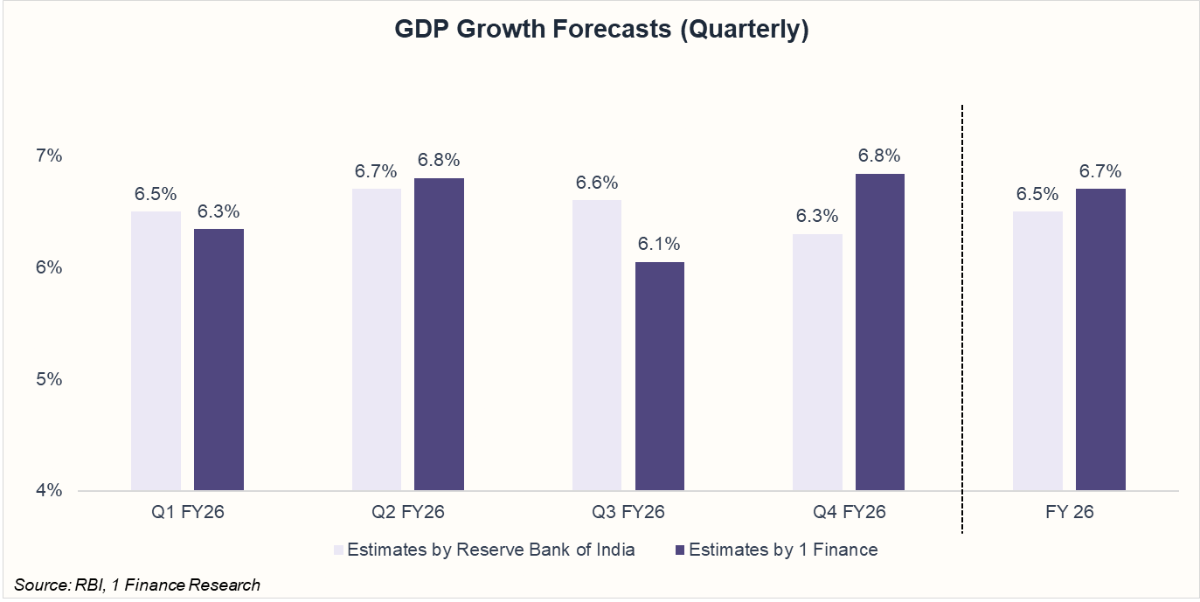

India’s economy is poised to maintain strong momentum with real GDP growth of 6.3–6.7% this fiscal. Key drivers include urban consumption, infrastructure investment, and service expansion, alongside improvements in private capex. Rural recovery is gradually reinforcing growth, though unevenly.

Risks to watch: global trade uncertainties, particularly the 50% U.S. tariffs on Indian exports, which could shave 0.3–0.8 percentage points off annual growth if prolonged.

Medium-Term (Next 3–5 Years)

Growth is projected to average 6–6.5% annually, anchored by:

- Policy reforms like GST rationalisation and sustained capital expenditure.

- Expansion in manufacturing, renewables, and tech-driven sectors.

- Strong demographics and rising investor confidence.

India is on track to overtake Japan by 2026, becoming the world’s fourth-largest economy with GDP crossing $4.2 trillion.

Long-Term (2030 and Beyond)

By 2030, India’s GDP could reach $7–12 trillion, positioning it as the third-largest economy globally after the U.S. and China. Growth will be underpinned by:

- Demographics and rapid urbanisation.

- Digital adoption, green energy, and electronics manufacturing.

- Higher household savings and stronger fiscal health.

The long-term trajectory remains structurally positive, provided reforms and investments stay on course.

Key Risks to Monitor

- External Shocks: Trade disruptions from elevated tariffs, volatile commodity prices, and slowing global demand.

- Fiscal & Policy Risks: Any slowdown in reforms or infrastructure spending could dent growth; global monetary tightening may also limit capital inflows.

- Sectoral Weaknesses: Mining and utilities continue to underperform; urban unemployment and skills mismatches could hinder manufacturing diversification.

- Domestic Demand & Credit: Sluggish private credit growth and inflation risks could weigh on household consumption.

- Structural Challenges: Climate change, rural distress, and inequality remain hurdles to inclusive growth.

The Road Ahead: Cautious Optimism

Of course, no journey is without its challenges. The global economic landscape remains fraught with risk, and potential trade tensions could pose headwinds for India's export sector in the coming quarters.

However, the foundation is strong. India’s economy is less dependent on exports and more on its vibrant domestic market of 1.4 billion people. The twin engines of government capital expenditure and private consumption are roaring. With inflation under control and the reform agenda moving forward, India is well-equipped to navigate these challenges.

While the Reserve Bank of India expects growth at 6.5% across FY26, 1 Finance Research is more optimistic, projecting growth at 6.7% with stronger momentum in Q2 and Q4 FY26. Our outlook factors in sustained investment flows, strong urban demand, and a faster recovery in rural consumption compared to the RBI’s baseline estimates.

The Q1 FY26 GDP numbers are more than just a data point; they are a reaffirmation of the Indian growth story. They tell a tale of a nation that, even when faced with global headwinds, has the resilience, the policies, and the people to not only survive but thrive. India is not just on track to become the world's third-largest economy; it's on a clear path to shaping the future of global growth.