Introduction

This month brought three big changes, namely, next-gen GST reforms, a long-awaited rating upgrade, and the RBI’s push to take the rupee global. In this edition, we break down what happened, why it matters, and how it could shape your money decisions.

GST Reforms are set to boost India’s Consumption Engine

On August 15, 2025, the government proposed a new GST reform designed to boost everyday spending. If implemented, the four tax rates: 5%, 12%, 18%, and 28% will be simplified into just two: 5% for essentials and 18% for most goods, with a steep 40% levy on luxury or “sin” items. The aim is simple: leave households with more money in hand.

| Earlier GST Rate | Now (Proposed) GST Rate |

|---|---|

| Multiple Slab Structure to Dual Slab Structure | |

| 0%, 5%, 12%, 18%, 28% | 5%, 18% |

| Consumer Durables (ACs, TVs, Appliances) | |

| 28% | 18% |

| Essentials (Food, Medicines, Education) | |

| 0%, 5%, 12% | Nil or 5% |

| Sin Goods (Tobacco, Pan Masala) | |

| 28% + cess | 40% flat slab rate |

| Precious Metals | |

Gold & Silver 3% Diamond 3% | Gold & Silver 3% Diamond 0.5% |

| Services | |

Mostly all Services 18% Insurance at 18% | Mostly all Services remain at 18% Insurance may fall to 5% / Nil |

Key Trends to Watch:

- Inflation is at an 8-year low of 1.55% (Jul-25). GST reforms could shave inflation further over the next year, strengthening the case for rate cuts, a positive for short- to medium-duration debt.

- This move may lead to sector-specific winners like Autos, Cement, and Consumer Durables.

- Extra household income should be directed towards SIP top-ups rather than lifestyle expenses.

Why Did S&P Upgrade India’s Debt?

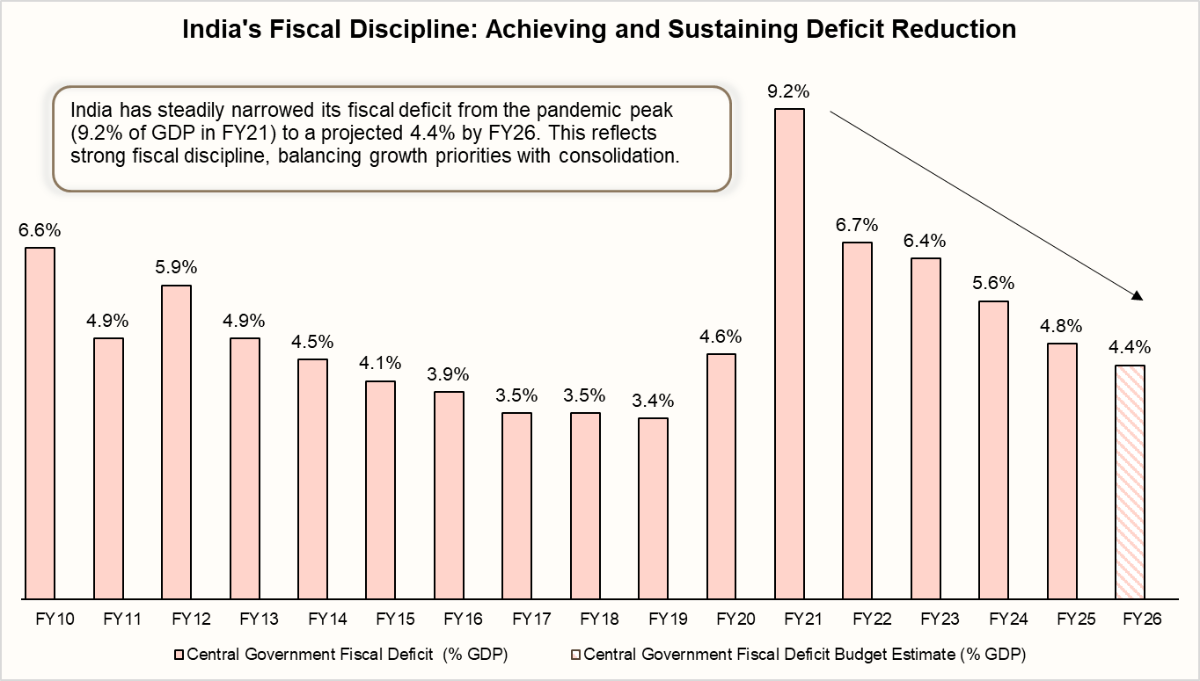

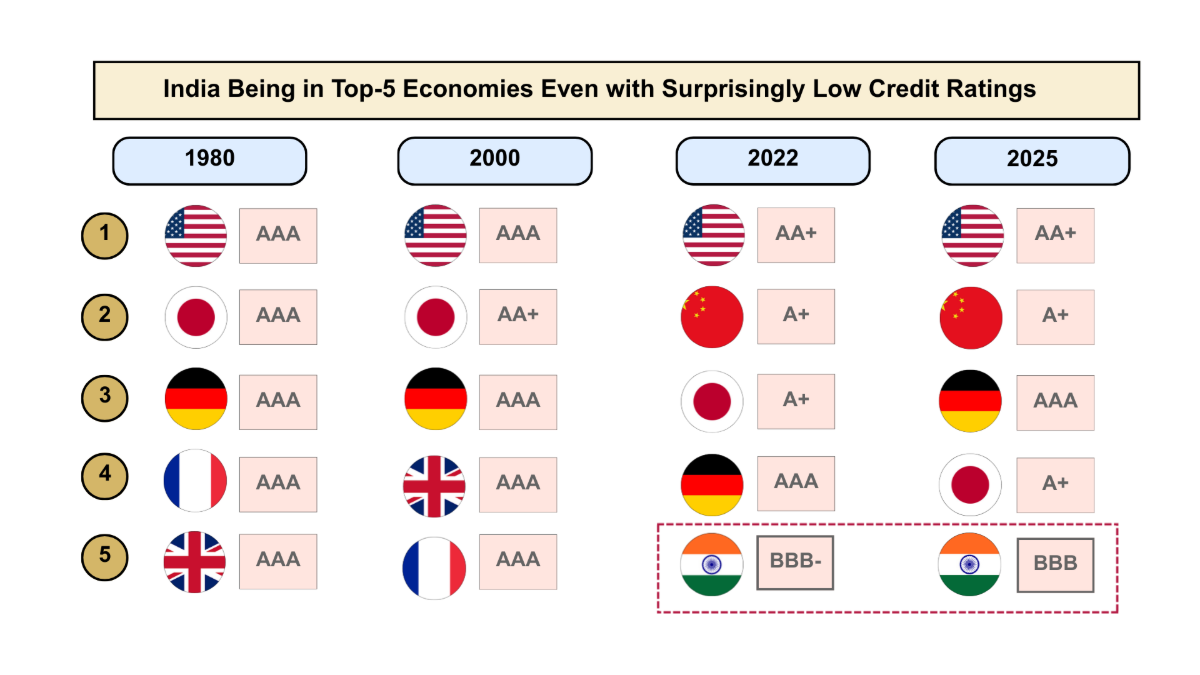

S&P has upgraded India’s credit rating from “BBB-” to “BBB”, the first in 18 years. It’s not a trading signal, but it does mean a lower cost of capital over time, helping infrastructure, banks, and borrowers. The upgrade rests on one pillar: fiscal discipline. India has cut its fiscal deficit from 9.2% of GDP (FY21) to 4.8% (FY25) without slowing growth, a rarity in today’s world.

Recommended for you

Readers also explored

Investing after the Budget: A New Playbook

Nifty 50 Companies List 2025 : Top 50 Stocks in India

Why History Warns Us Not to Overreact to This Upgrade

India’s ratings debate isn’t new; they’ve long lagged fundamentals. As the chart shows, even while India and China rank among the world’s top 5 economies, their ratings sit far below their peers. The latest upgrade isn’t a surprise; it’s simply overdue recognition.

Ratings have rarely moved markets in a definite direction; Sensex returns or the rupee barely reacted to past upgrades or downgrades. But foreign investors? That’s where the story changes. After upgrades, equity FPIs surged 303% and debt FPIs spiked 578% on average within one year. The real takeaway: ratings don’t drive macros, but they open the floodgates for foreign capital. Stay invested in equity and debt, as a higher rating opens doors to global indices, drawing more FPI flows over time.

| Summary of Average Changes in Select Indicators during India’s Sovereign Credit Rating Upgrades (1998-2018) | ||||

|---|---|---|---|---|

| Indicator | Short-Term | Medium-Term | Long-Term | |

| Sensex Returns | 0.2% | 1.8% | 13% | |

| Exchange Rate | -0.03% | -0.36% | -2.3% | |

| FPI Flows | Equity | Debt | ||

| - | - | 303% | 578% | |

| Summary of Average Changes in Select Indicators during India’s Sovereign Credit Rating Downgrades (1998-2018) | |||

|---|---|---|---|

| Indicator | Short-Term | Medium-Term | Long-Term |

| Sensex Returns | 0.38% | 0.5% | 26% |

| Exchange Rate | -0.01% | 0.2% | 2% |

Note: Short-Term: 0 to +10 days from rating change, Medium-Term: Up to 6 months after, Long-Term: Up to 1 year after. Based on S&P and Moody’s sovereign rating actions.

Trade Pressures vs. Currency Reform Progress

India faces two key risks: trade tensions and a volatile rupee. India’s rupee is under pressure. U.S. tariffs on exports are now near 50%, and the rupee fell 4% vs USD, 6% vs EUR, and 7% vs GBP between May 25 and Aug 25.

But here’s the offset: RBI has just made cross-border rupee trade a lot simpler. Foreign banks no longer need prior RBI approval to open Special Rupee Vostro Accounts (SRVAs). The table below is a summary of key changes proposed:

| Action | Before: With Prior RBI Approval (Jul-22) | After: No Prior RBI Approval (Aug-25) |

|---|---|---|

| Account Opening Process | Formal request to RBI required, wait for approval. | Indian banks open accounts directly. |

| Time Taken | Days to Weeks | Very Few Days |

| Surplus Balance Usage & Liquidity | Surplus rupee balances could only be used for trade payments, with a 30% limit on investments. | RBI removed the cap; foreign banks can now freely invest surplus rupees in G-Secs and T-Bills. |

| Promoting Rupee Trade | Slow Adoption, Limited Partners. | Quick adoption, wider partner base. |

Why Does This Matter:

- Lifting the 30% cap allows foreign investors greater access to G-Secs and T-Bills. This will support stable interest rates and deeper debt market liquidity.

- A less volatile rupee will make Indian debt, equity, REITs, and InvITs more attractive to foreign investors by reducing currency risk.

- This reform will reduce dollar dependence, lower exchange risks, and strengthen the rupee’s global role.

The Bottom Line

India is at a turning point. GST reforms will boost domestic consumption. The ratings upgrade signals stronger fiscal credibility and will attract more FPI inflows. RBI’s currency manoeuvres will increase the rupee’s global acceptability. Yes, tariffs and rupee volatility may create short-term noise. But the structural story is intact. These reforms will drive long-term growth. For investors, the focus should be clear, stay aligned with India’s long-term opportunity, not every headline.