India’s Q2 FY26 GDP numbers, released late Nov-25, offered a whiff of fresh air amid an uncertain global backdrop. Low and stable inflation, combined with robust services activity, a welcome recovery in manufacturing, and strong domestic demand, kept growth comfortably above trend. This reflects a Goldilocks phase for the Indian economy, where growth remains strong enough to support demand and investment, without triggering inflationary pressures.

However, early signs of moderation are beginning to emerge. Certain high-frequency indicators point to some easing in momentum, while fiscal trends and tax collections warrant closer monitoring. This newsletter assesses the post-Q2 FY26 growth outlook, presents updated GDP and inflation forecasts, and examines how recent labour reforms may shape India’s medium-term growth prospects.

| Key Takeaways |

|---|

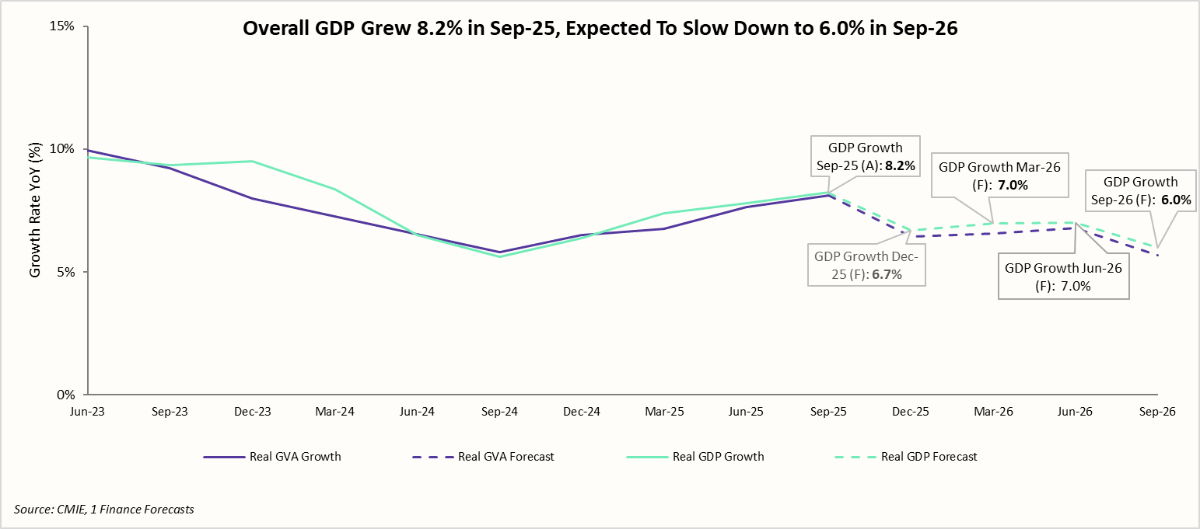

| India recorded a strong 8.2% GDP growth in Q2 FY26, led by services and a sharp recovery in manufacturing, supported by tax cuts, lower interest rates, and export front-loading. |

| Private consumption strengthened, while exports benefited from pre-emptive shipments ahead of US tariffs, supporting near-term growth. |

| HSBC PMIs, IIP data, and front-loaded government capex, along with cautious private capex, indicate some moderation in growth momentum heading into Q3 FY26. |

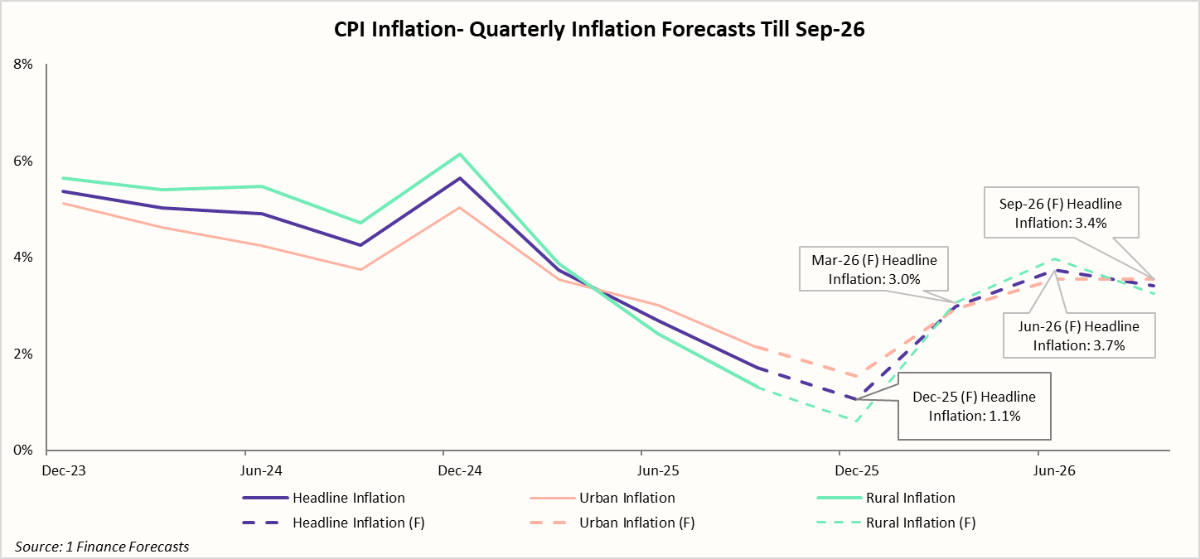

| Inflation is projected to increase but stay below the 4.0% target level in 2026, indicating room for rate cuts, while the GDP growth is expected to moderate to 6.0% by Sep-26. |

| Labour Reforms: The new labour codes can improve efficiency, formalisation, and productivity over the long run, having the potential to add 0.5%- 1% to GDP growth. |

GDP Growth Rebounds in Q2 FY26 as Manufacturing Bounces Back

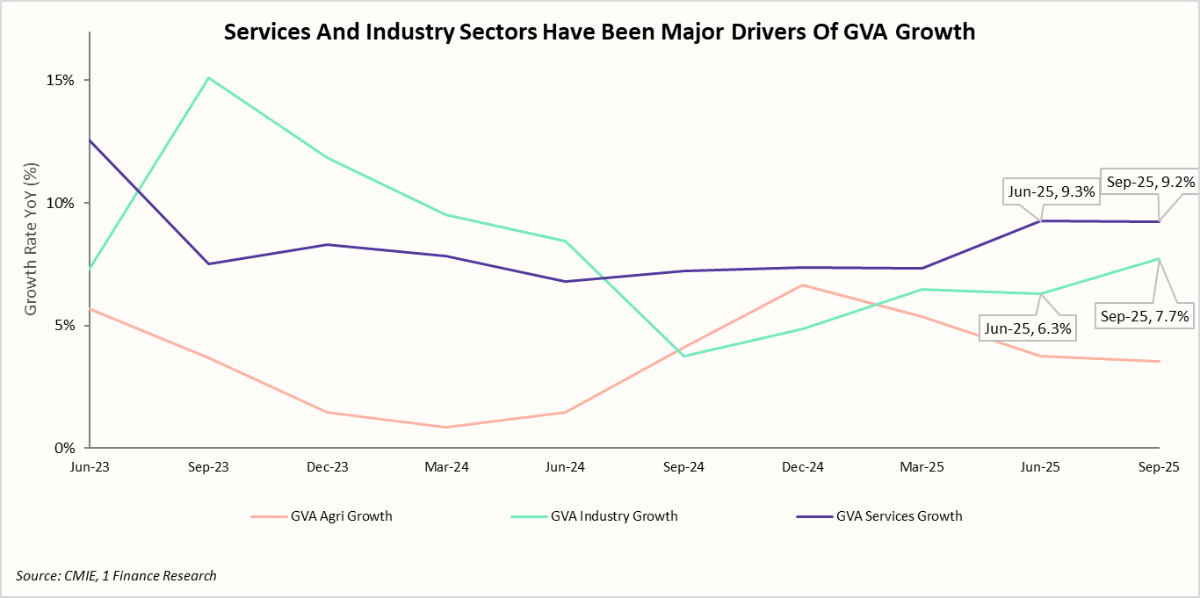

India’s Q2 FY26 GDP numbers provided a clear positive surprise, prompting the RBI Governor to describe the macro environment as “a Goldilocks phase”. The economy grew 8.2% in Q2 FY26 (Jul-25–Sep-25), beating forecasts and accelerating from 7.8% in Q1 FY26. The underlying data also points to strong underlying momentum, achieved despite persistent global trade tensions and uncertainty from US tariff actions.

At the sectoral level, the services sector grew 9.2% year-on-year. Within this, ‘Finance, Real Estate & Professional Services’ sub-segment surged 10.2%, while ‘Public Administration, Defence & Other Services’ sub-segment grew 9.7%, driving the sector's strength.

The Industrial sector also posted a growth of 7.7% year-on-year, with the manufacturing sub-sector leading at 9.1%, a sharp jump from ~ 2.2% growth in Q2 FY25. This was driven by higher output, GST cuts, interest rate reductions, and front-loading of exports ahead of US tariffs. However, the Construction and the Mining & Quarrying sub-sectors remained subdued.

Recommended for you

Readers also explored

India's Growth Surge Meets Agri Hurdles

Nifty 50 Companies List 2025 : Top 50 Stocks in India

The table below summarises the sub-sector-wise performance in detail:

| Sector | Q2 FY26 Growth (Y-o-Y) | Change from Q2 FY25 |

|---|---|---|

| Agriculture, Livestock, Forestry & Fishing | 3.5% | ▼ -0.6% |

| Mining & Quarrying | 0.0% | ▲0.4% |

| Manufacturing | 9.1% | ▲6.9% |

| Electricity, Gas, Water Supply & Other Utility Services | 4.4% | ▲1.4% |

| Construction | 7.2% | ▼-1.2% |

| Trade, Hotels, Transport, Communication & Broadcasting | 7.4% | ▲1.3% |

| Financial, Real Estate & Professional Services | 10.2% | ▲3.0% |

| Public Administration, Defence & Other Services | 9.7% | ▲0.8% |

On the demand side, Q2 FY26 also saw the exports increase by 5.8% YoY, caused by the front-loading of shipments before the 50% tariffs by the US came into effect in late August.

Private final consumption expenditure accelerated to 7.9% (from 6.4% in Q2 FY25), reflecting the impact of income tax cuts, steady rural demand due to an above-normal monsoon, and increased urban spending on durables.

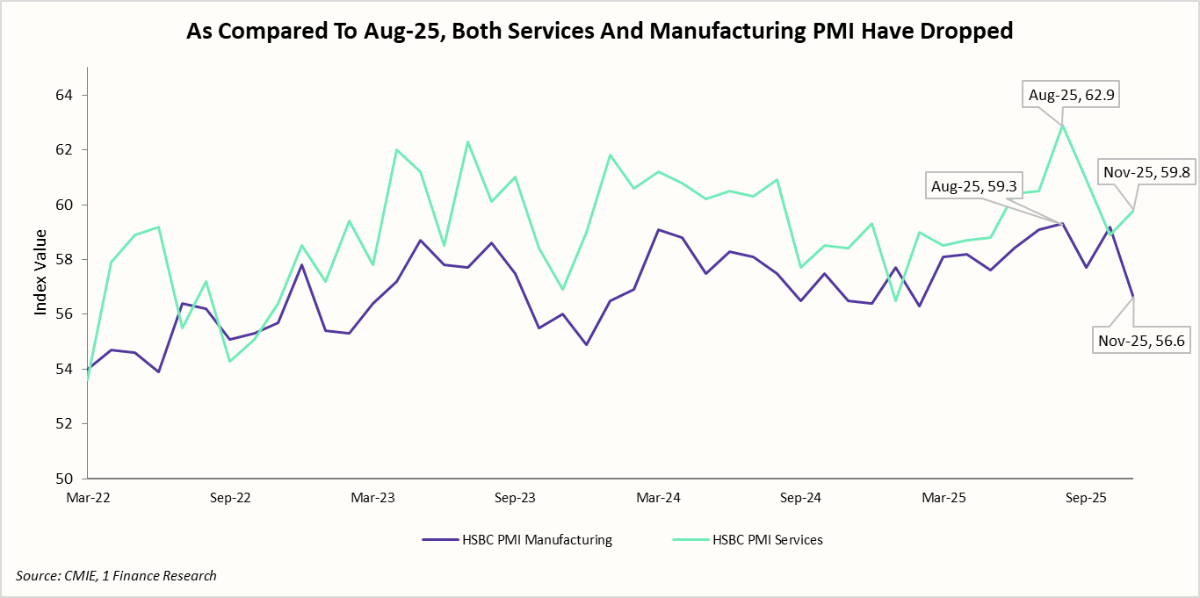

Despite Q2 FY26's robust growth, some high-frequency signals also point to a slowdown in momentum heading into Q3 FY26 (Oct-25 - Dec-25).

HSBC's Purchasing Managers Index (PMI) data for Manufacturing and Services are two such indicators. Manufacturing PMI slipped to 56.6 in Nov-25, with new export orders contracting amid US tariff impacts. Services PMI has also dropped from the peak of 62.9 (Aug-25) to 59.8 (Nov-25).

Other indicators, such as the Index of Industrial Production (IIP), have also slowed down in Oct-25 amid festival base effects, while private capital expenditure has also remained cautious, with firms delaying expansions due to global uncertainties and softening demand signals.

Further, with the recent GST cuts and earlier tax relief announcements, tax revenue for the government is expected to soften in the second half as economic momentum normalises.

1 Finance GDP forecasts for the next 4 quarters indicate that GDP growth is projected to ease from 8.2% in Sep-25 (Q2 FY26) to around 6.0% by Sep-26 (Q2 FY27). The moderation is mainly due to the base effect and a weakening growth momentum, especially within the Services sector.

Our inflation forecasts for the next 12 months suggest a gradual rebound from the current low, while remaining comfortably below the Monetary Policy Committee’s 4% target. Average annual inflation for FY27 is forecasted at 3.6%. This benign inflation trajectory will allow policy space for further rate cuts. However, growth forecasts remain subject to the monsoon outcomes and evolving global conditions, posing both upside and downside risks to the outlook.

Next, let's look at another major event last month that will be a key driver of India’s long-run economic growth. These were India's new labour law reforms announced in Nov-25.

These simplified labour codes consolidate 44 fragmented laws into four streamlined ones, making hiring easier and cheaper for companies while reducing bureaucratic red tape. By pushing more workers into formal jobs and boosting productivity, the reforms would enable Indian industry to attract domestic and foreign investment. Economists estimate this could lift long-term GDP growth by 0.2-0.5% annually.

Let’s look at the summary of the four streamlined labour codes.

| Labour Code | What’s New (Nov-25 onwards) | Likely Impact Across Sectors |

|---|---|---|

| Wages Code |

|

|

| Industrial Relations Code |

|

|

| Social Security Code |

|

|

| Occupational Safety Hazards & Working Conditions Code |

|

|

Overall Assessment

Overall, India’s GDP growth remains robust, supported by strong services activity and a steady domestic demand. Investment and consumption continue to anchor growth.

However, a slowdown in the HSBC PMI indicators, IIP and indications of front-loaded government capital expenditure point to some near-term growth risks, possibly causing a slowdown in the coming quarters.

Looking ahead, inflation is expected to remain benign, averaging around 3.6% in FY27, below the MPC’s 4% target, while the GDP growth is expected to gradually moderate to about 6.0% by Q2 FY27.

The recent reform bills are unlikely to materially influence growth in the near term, as implementation and adjustment take time. However, over the medium to long term, these measures will enhance efficiency, improving labour market flexibility and increasing productivity gains.