The past few months have been very tricky for India-US trade ties. The good news is that both governments seem close to a WTO-compliant trade agreement. This would hopefully roll back some of these tariffs.

This edition connects three big themes shaping India right now. How Indian exporters are diversifying markets, how new government schemes are cushioning tariff-hit sectors, and why India’s macro backdrop looks stronger than its peers with lower inflation and an undervalued rupee. We also answer one key question: can the Finance Ministry stay on track for its ambitious 4.4% fiscal deficit target for FY26, and what could this mean for investors?

| Key Takeaways |

|---|

| → India and the U.S. are close to finalising a WTO-compliant trade deal, which could finally ease some of the recent tariff pressures. |

| → The Indian government’s ₹45,060 crore support package is set to give Indian exporters easier finance and better market access. |

| → U.S. President Trump rolled back tariffs on several food products. This will provide mild relief to Indian agricultural exporters. |

| → With inflation at historic lows, the RBI now has room to cut rates. We expect another 50 bps of cuts by the end of FY26. |

| → The FY26 fiscal deficit target of 4.4% will be tough, but still achievable if the Indian government balances spending with steady nominal GDP growth. |

Dealing with the Tariff Brunt

Indian exporters have had a rough few months. Especially after the U.S. slapped steep duties on certain imports starting in August 2025.

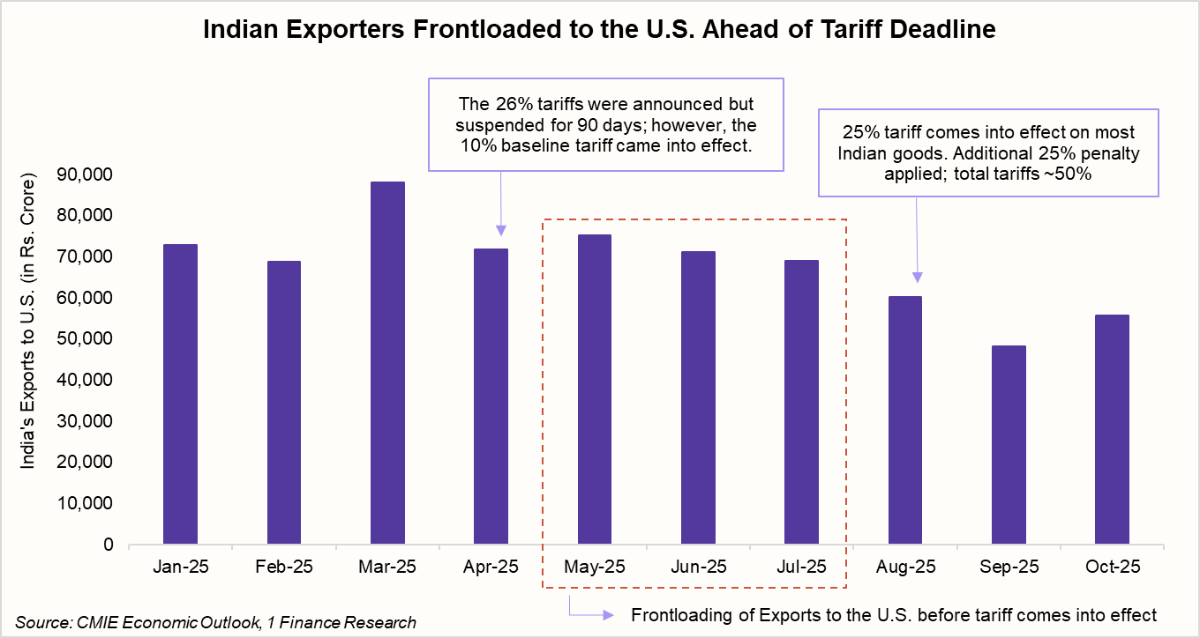

In fact, a lot of frontloading occurred right after the announcement of the tariffs. The graph below illustrates this. Right after President Trump announced tariffs in April 2025, exports to the U.S. peaked around ₹75,000 crore in May 2025. But once those tariffs officially hit, the momentum collapsed, with exports dropping to ₹48,200 crore by September. Some recovery followed in subsequent month, though volumes remained well below their pre-tariff peak.

Indian Exporters Started Strategic Diversification

Indian exporters are rethinking their market strategy. As exports to the U.S. eased from their June 2025 peak, more shipments are heading toward new destinations. Exports to the UAE, China, and Spain rose by about 1% each between April and October 2025. The trend is modest but meaningful. With fresh government initiatives taking shape (details discussed below), India’s export base could become more geographically balanced.

Recommended for you

Readers also explored

Risk Radar: India’s Economy Faces Crosswinds

India’s Unemployment Rate in 2025

India’s ₹ 45,060 Crore Shield for Exporters

On November 12, 2025, the Indian government approved a massive ₹45,060 crore package. This was done to protect Indian exporters, right when it was needed the most. This shield has two parts:

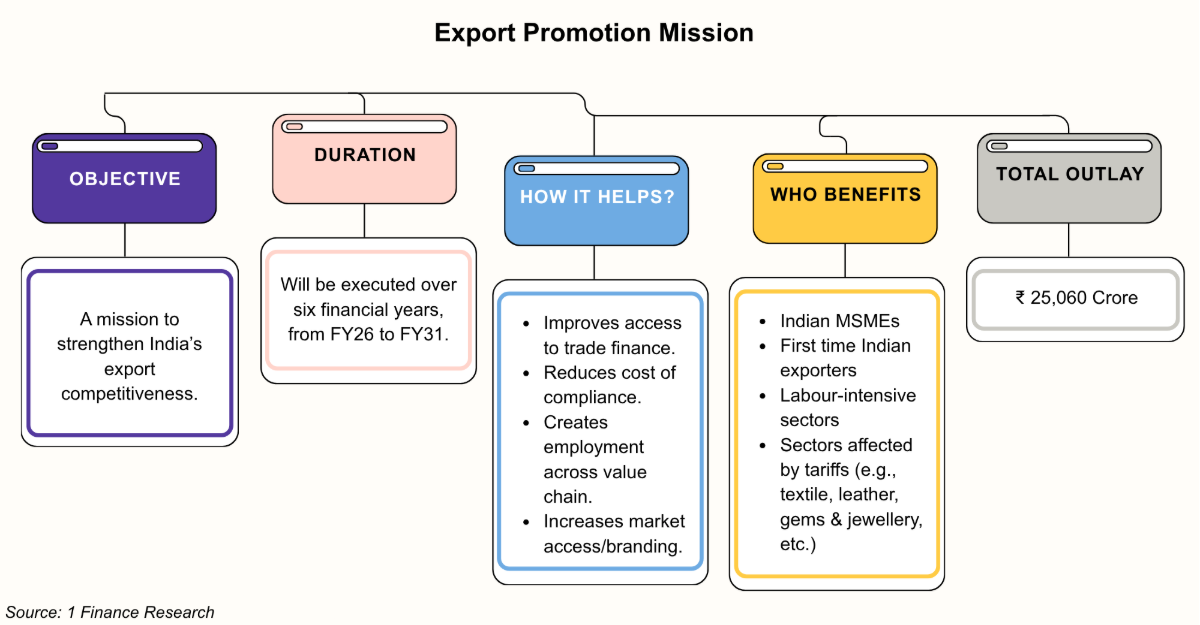

→ Export Promotion Mission (EPM)

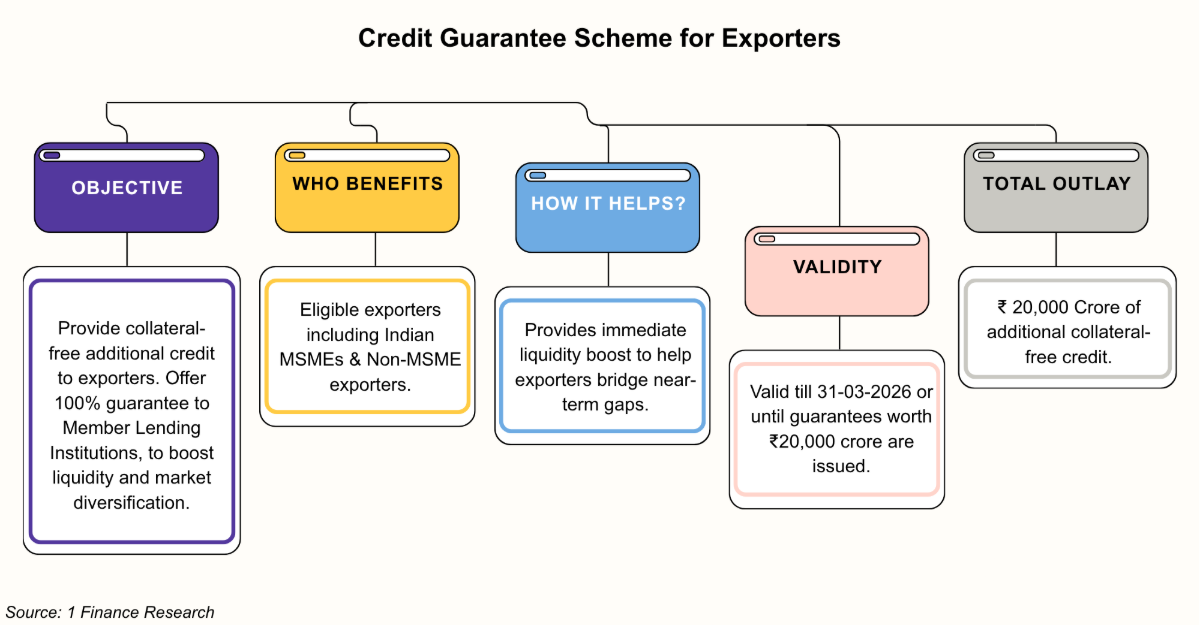

→ Credit Guarantee Scheme for Exporters (CGSE)

EPM is a ₹25,060 crore initiative with two goals. First, it tackles funding problems, giving MSMEs easier access to trade finance, which is a big relief. Second, it helps with non-financial challenges like branding, packaging, and global market access.

Meanwhile, CGSE offers an extra ₹20,000 crore in collateral-free credit. This will give Indian exporters the liquidity they need after the recent tariff shocks.

This combined move is definitely going to help Indian exporters. These schemes will create export readiness, diversify markets, sustain export orders, and create jobs across sectors.

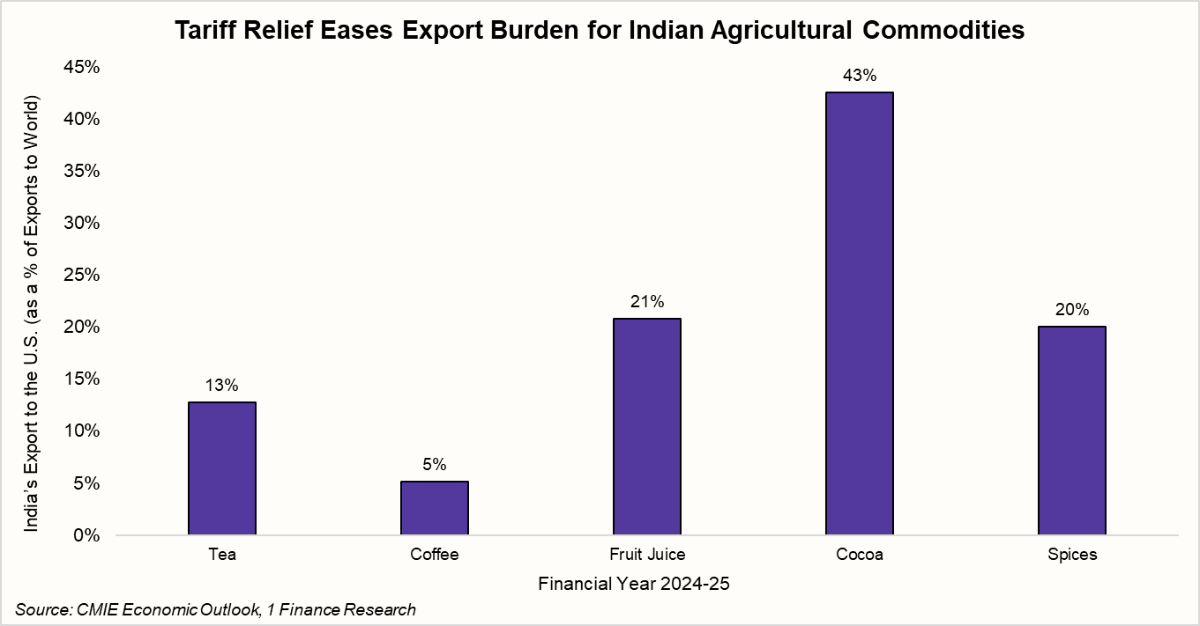

Now, on top of that, another good news came in on November 14, 2025, U.S. President Trump rolled back tariffs on several food products. This was due to a huge surge in grocery prices there. The move offers mild relief to Indian exporters, with cocoa, spice and fruit juice exports to the U.S. likely to benefit the most. The chart below shows India’s share of U.S.-bound exports as a percentage of global exports for these commodities in FY25.

Lower Inflation Opens the Door for an RBI Rate Cut

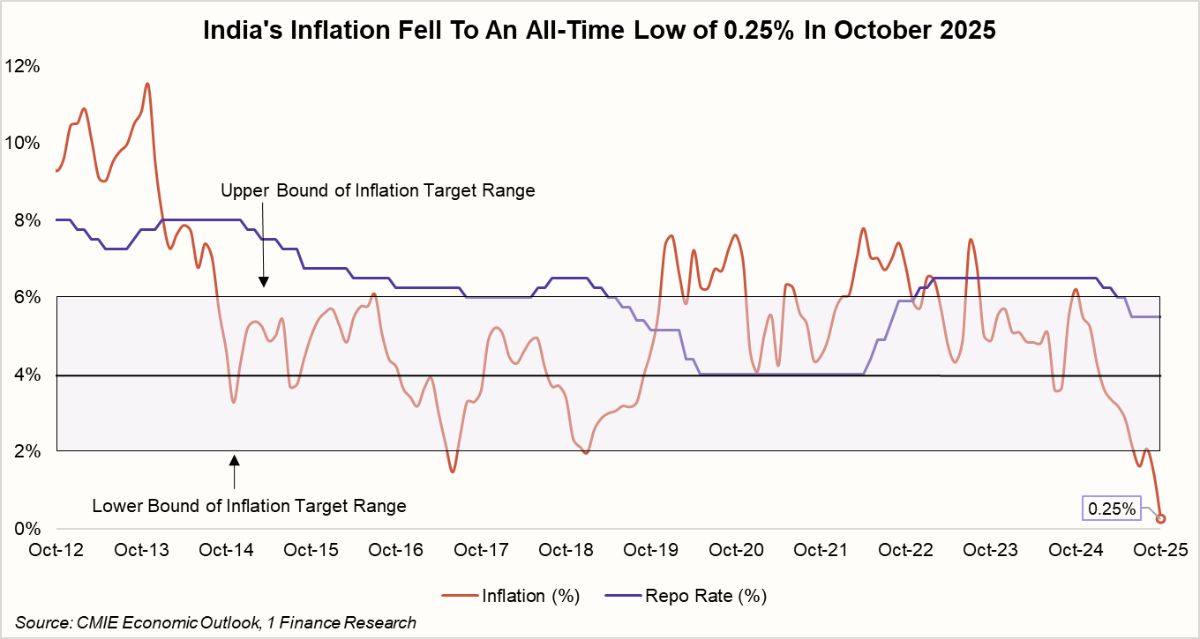

Now that we’ve covered the trade positives, here’s another great update! Retail inflation tumbled to an almost unbelievable 0.25% in October 2025. This is the lowest reading since the 2012 base series began. This sudden cooling does more than just fill household wallets. It hands the RBI a powerful policy lever.

With repo at 5.50% and inflation softening, the case for rate cuts is strong. We expect about 50 bps of cuts by the end of FY26. A lower policy rate would provide a welcome momentum boost to economic growth. But it’s a delicate balance. Such a cut would also narrow India’s nominal yield advantage compared to global interest rates.

How India Offers the Best of Both Yield and Value

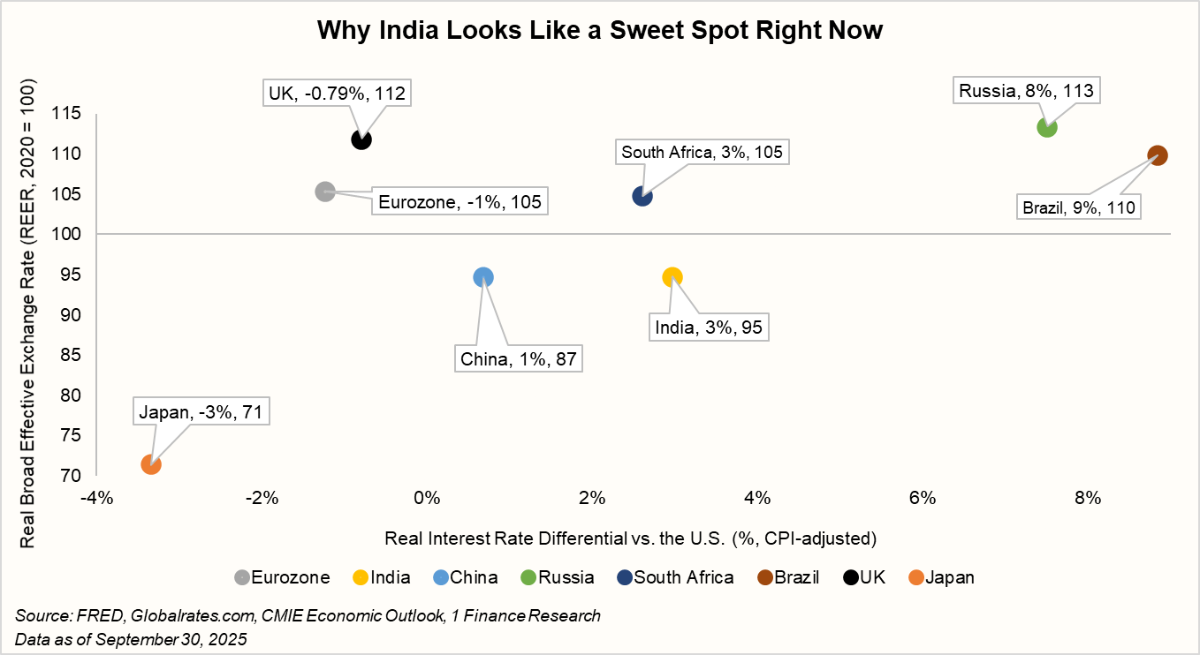

Foreign investor inflows into India have been modest in 2025. The key question now is whether this momentum can strengthen. To answer that, two drivers deserve attention: real interest rate differentials and currency valuation.

Global capital flows tend to follow yield, but what really matters is the real yield, the return after adjusting for inflation. If India offers a higher real interest rate than the U.S., it naturally draws investors seeking better risk‑adjusted returns.

What is the Real Interest Rate Differential v.s. the U.S.?

This measure shows how much extra return investors can earn in India versus the U.S. after accounting for inflation.

It’s calculated as: (India’s interest rate - India’s inflation rate) - (U.S. interest rate - U.S. inflation rate).

A positive differential suggests that India offers higher real returns, strengthening its case as a preferred destination for foreign capital. |

Rates alone don’t tell the full story. Even if yields are attractive, investors also look at the currency’s relative value. The Real Effective Exchange Rate (REER) helps on this front.

What is the Real Effective Exchange Rate (REER)?

Think of REER as a score that indicates whether the rupee is “cheap” or “expensive” compared with other major currencies, after inflation adjustments.

A REER below 100 means the rupee is undervalued, making Indian assets relatively cheaper for global investors. |

So, a positive rate differential and REER below 100 is a strong predictor of where institutional money would flow.

The chart below shows each country’s currency valuation (REER) and its real interest rate difference compared to the U.S.:

India’s interest rate differential v.s. the U.S. is at 3% and REER is at 95. This gives India a rare edge: strong returns supported by an attractive currency. This pairing sets India apart. Other economies offer only parts of this mix. Brazil has high real rate gaps but an overvalued currency.

In contrast, major developed markets like Japan, the UK, and the Euro Area face low or negative differentials and overvalued currencies. India stands out as one of the few large global economies offering both yield and value. This can significantly strengthen its appeal for capital inflows.

Of course, the pace of foreign investment doesn't happen in a vacuum. It will be influenced by risk appetite and the direction of the US dollar. Even with India’s strong story, a stronger dollar or rising global uncertainty could still slow inflows.

But the facts remain. Inflation is stable, policy space is opening up, and the rupee looks relatively strong. India's relative macro appeal has rarely been more compelling.

Will the Centre Meet Its Fiscal Deficit Target?

Last financial year, the government met its fiscal deficit target of 4.8%. For FY26, the aim is to bring it down further to 4.4% of GDP. But meeting the target looks a bit tricky this time.

| Fiscal Component | Current YTD Trend (as a % of Budget Estimate/Revised Estimate) | |||

|---|---|---|---|---|

| FYTD 23 | FYTD 24 | FYTD 25 | FYTD 26 | |

| Central Government Net Tax Revenue | 48% | 50% | 49% | 43% |

| Central Government Capital Expenditure | 47% | 52% | 41% | 52% |

| Central Government Borrowings for Capital Expenditure | 20% | 46% | 32% | 53% |

| Central Government Fiscal Deficit | 35% | 40% | 30% | 37% |

Data as of September 30, 2025.

Note: YTD = Year-to-date

The Central Government’s net tax revenue has reached only 43% of the annual target, well below the 49-50% seen in previous years. Meanwhile, capital expenditure is racing ahead. This reflects an infrastructure push but also adds to borrowing needs. Moreover, government borrowings have already touched 53% of the yearly goal, compared with 20-46% at this stage in earlier years.

This means that the Central Government’s revenue growth is sluggish, but expenditure continues to accelerate. At present, the fiscal deficit is just 37% of the target. Achieving the target isn’t impossible, but it will depend on stronger nominal GDP growth, a measured pace of spending, and improved tax collections.

Where India Stands Now?

India’s trade story is shifting fast. Tariffs will no doubt hurt Indian exporters, but they have also started adapting. Not only that, new markets are opening, and support schemes are also kicking in. This is a big positive for Indian exporters after a rough year.

On the macro front, inflation has cooled significantly, giving the RBI room to act. A rate cut could possibly lift growth and ease borrowing. But the fiscal math looks tight as of now. Achieving the fiscal deficit target is still manageable with better tax inflows and steady nominal GDP growth.

On foreign inflows, India looks relatively attractive. Investors will see value in its higher rate differential and undervalued rupee.

Headwinds still remain, but momentum can be back soon. With macro strength and a bit of luck, these developments could turn into India's next big opportunity.