Introduction

Foreign exchange reserves are a nation’s financial shield. In India, they are managed by the Reserve Bank of India (RBI). These reserves, comprising foreign currencies, gold, Special Drawing Rights (SDRs), and India’s IMF position, help the country meet its global obligations, protect the rupee from volatility, and build confidence in the economy.

India’s reserves have come a long way, from near-exhaustion of foreign exchange reserves during crises like 1966 and 1991 to today’s stronger levels that cover many months of imports. In this blog, we’ll explore the composition of reserves, the lessons learned from past shortfalls, and what rising gold holdings and changing global trends, especially among BRICS nations, signal about the future.

Foreign Exchange Reserves and Their Key Components

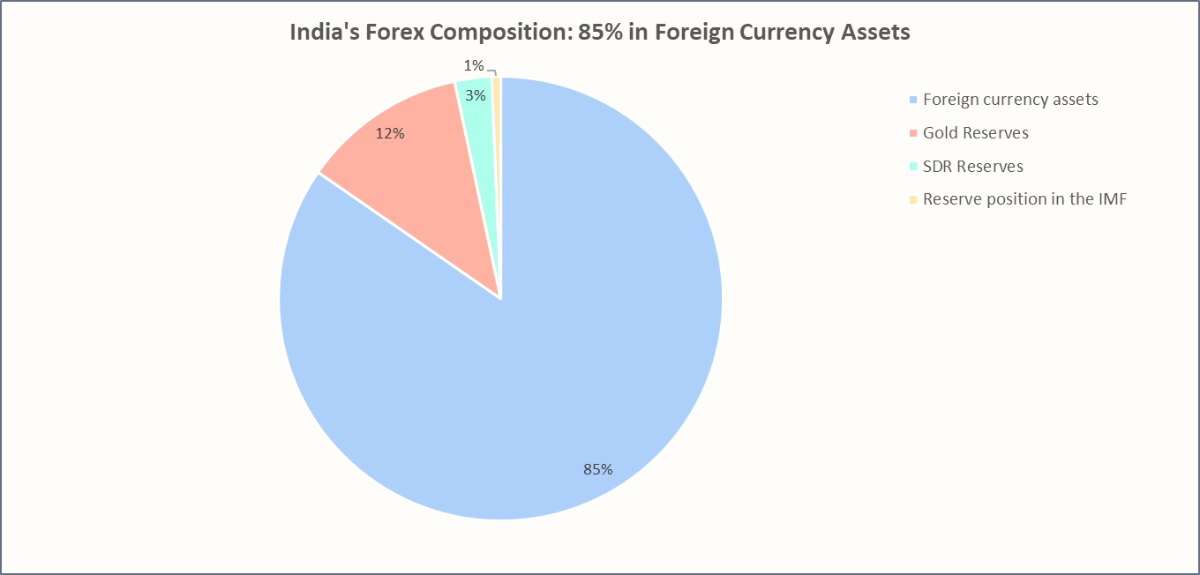

India’s foreign exchange reserves comprise four primary components, as illustrated in the chart below. Of these, the Foreign Currency Assets constitute ~ 85% of the total reserves. Gold Reserves are the second-largest with ~12%, serving as a hedge against inflation and economic uncertainties. SDRs and the Reserve Position in the IMF form up the small remaining portion under 3%, enhancing international liquidity and financial stability.

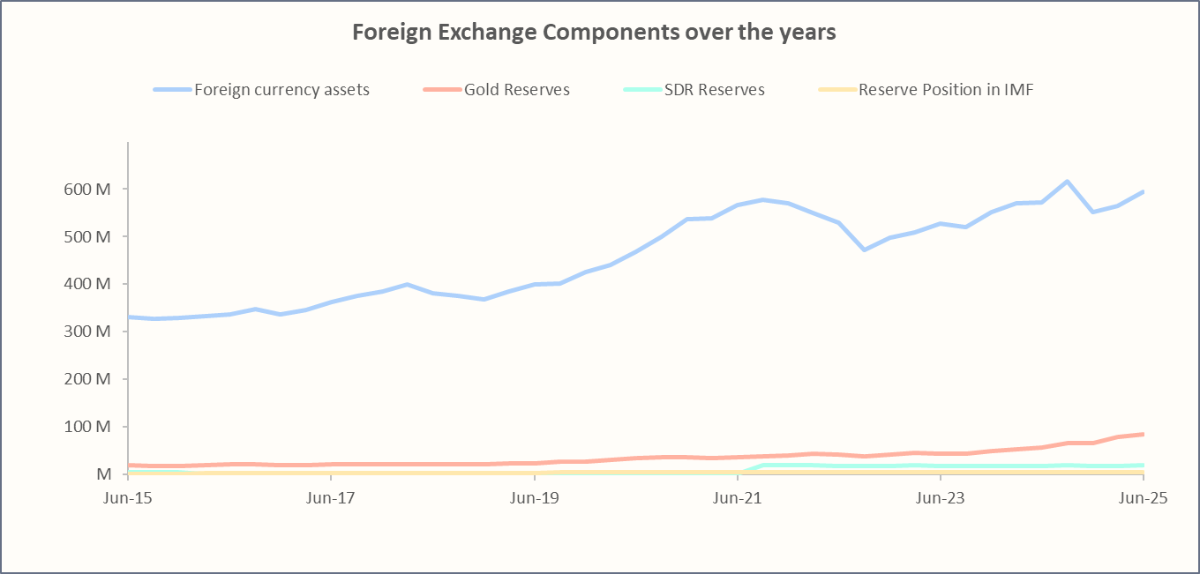

Foreign Currency Assets (FCA) are denominated in major global currencies such as US Dollars, euros, yen, pounds, and others. These assets are invested in foreign government bonds, sovereign securities, and deposits with central banks. FCA historically constitutes around 80-85% of the total reserves. In recent years, we have witnessed volatility due to global shocks and movements in the USD. The value of FCAs can fluctuate not just with currency inflows and outflows, but also due to exchange rate revaluations against the US dollar and other major currencies.

Let’s take a look at the major components within the Foreign Currency Assets:

Government Securities and Bonds: FCAs are primarily invested in sovereign bonds, especially U.S. Treasuries. They are highly liquid, safe, and provide stable returns, making them a secure store of value.

Deposits with Foreign Central Banks and Commercial Banks: These consist of cash balances and deposits held with overseas central banks and reputable commercial banks. They ensure immediate liquidity for interventions and serve as a safeguard during crises.

Money Market Instruments: This category includes short-term assets such as treasury bills, certificates of deposit, and commercial papers. They help the RBI manage liquidity efficiently while earning modest returns.

Other Reserve Assets: These comprise foreign government agency securities and other fixed-income instruments denominated in foreign currencies. They diversify the portfolio and enhance the resilience of India’s reserves.

Gold Reserves are the physical gold held by the RBI domestically and abroad. Its value is revalued regularly based on prevailing international prices. Gold’s share in India’s reserves has notably increased since 2024. In 2019, gold accounted for only 6.7% of reserves. By Jun-25, this rose to 12%, amid both price appreciation and RBI acquisitions. As of Jun-25, RBI holds around 880 metric tonnes, valued at $84.5 billion, with nearly 60% kept domestically.

Recommended for you

Readers also explored

The Fed’s 2025 Rate Cut and Why It Matters Now

Currency in Circulation: How Much Money Exists in the World?

Special Drawing Rights (SDRs): SDRs account for ~2–3% of India’s reserves. They are significant as they provide an international reserve asset that supplements countries' foreign exchange reserves without being actual currency. Valued on a basket of five major currencies (USD, EUR, CNY, JPY, GBP), SDRs offer liquidity, allowing countries to access freely usable currencies of IMF members during financial stress. This mechanism reduces reliance on costly borrowing, particularly benefiting small and financially constrained economies.

The Reserve Position in the IMF, or the Reserve Tranche Position (RTP), represents the difference between a country’s IMF quota and the IMF’s holdings of that country’s currency. This provides an unconditional right to withdraw foreign currency from the IMF without any interest or policy conditions. This tranche acts as a financial safety net during balance of payments crises, enabling countries to access funds quickly and maintain stability without formal IMF lending arrangements.

India's Balance of Payments (BoP) Crises and the Role of Forex Reserves: Lessons from the Past

India’s journey through multiple economic crises highlights the critical importance of foreign exchange reserves as a stabilising shield. These crises challenged the country’s ability to meet external payment obligations but also catalysed reforms that laid the foundation for India’s economic resurgence, including the accumulation of a robust forex reserve buffer.

The 1966 Balance of Payments Crisis

In 1966, India faced a severe Balance of Payments crisis due to droughts, war expenses from conflicts in 1962 and 1965, and declining foreign aid. At the time, foreign exchange reserves had fallen drastically, almost 65% in three weeks. To improve export competitiveness and address imbalances, the government devalued the rupee by approximately 57% under IMF supervision.

The 1991 Gulf War

In 1991, India faced another acute Balance of Payments crisis with foreign exchange reserves plummeting to about $1.2bn, barely enough to cover three weeks of imports. Triggered by rising oil prices due to the Gulf War, fiscal deficits of around 8%, a collapsing Soviet trade partnership, and capital flight, India was forced to seek an IMF bailout. The government responded by devaluing the rupee in two stages, totalling ~18-19%, to boost exports and attract capital inflows. This crisis led to landmark economic reforms, including liberalisation and the opening up of the economy.

2008 Financial Crisis

During the 2008 global financial crisis, India’s foreign exchange reserves were adequate, providing an import cover of roughly 8-9 months. Capital outflows totalling ~$26bn over four months triggered the pressure on the rupee, which depreciated nearly 20%, weakening from ₹39 to ₹48 per USD. The RBI intervened actively, using the forex reserves to stabilise the currency, provide liquidity, and maintain external payment capacity without seeking emergency aid. RBI’s policy measures helped limit deeper depreciation and recession, cushioning India’s economy during turbulent global times.

2013 Fed Tapering

In 2013, after years of Quantitative Easing, the U.S. Federal Reserve signalled a slowdown in its bond-buying program. As a result, global investors pulled funds from emerging markets, triggering sharp capital outflows from India. The rupee depreciated nearly 20% between May and Aug-13, creating fears of a balance of payments strain. In response, RBI actively used reserves to smooth volatility, sold dollars to contain speculative pressure, and introduced measures to attract foreign inflows, such as special deposit schemes for non-resident Indians.

Together, these events demonstrate that a country’s economic resilience relies on reform, prudent fiscal management, sufficient foreign exchange reserves, and adaptive monetary strategies to successfully navigate global uncertainties and the speculative attacks on markets that follow.

Next, let’s look at the recent trends in Foreign Exchange Reserves across the world.

Foreign Exchange Reserves Trends across the World

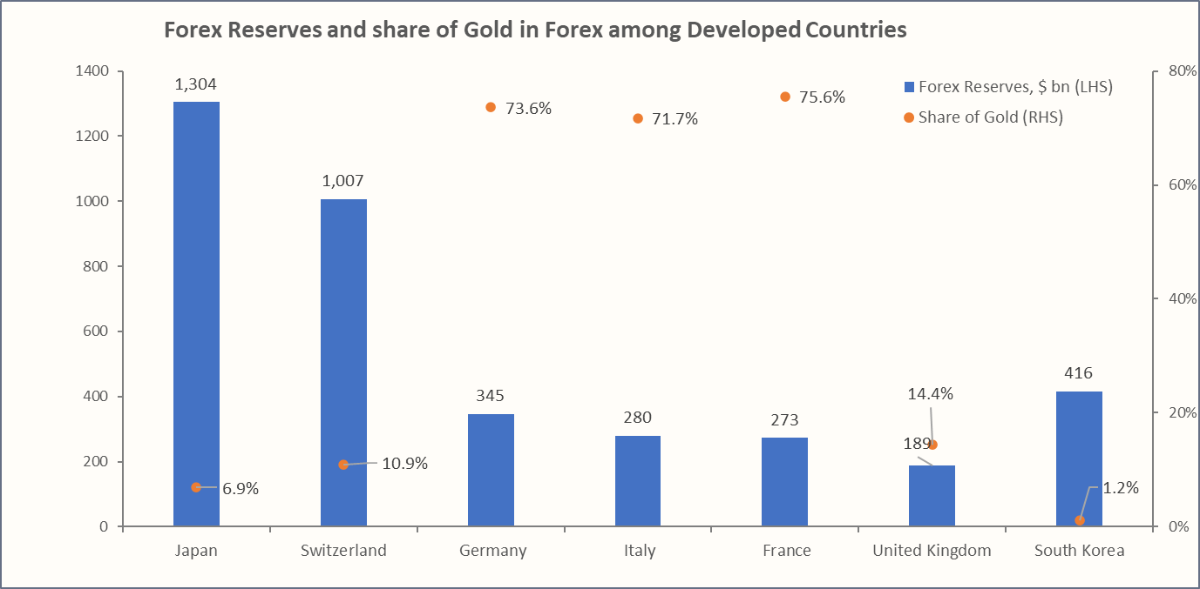

Among developed countries, Japan ($1.3tn) and Switzerland ($1tn) hold the largest reserves, but with very little gold (7% and 11% respectively). In contrast, European countries like Germany, France, and Italy keep more than 70% of their reserves in gold. The heavy reliance on gold in Europe is historical. Large holdings were built up during the Bretton Woods system and maintained as symbols of monetary stability. These stocks are a legacy, not a new defensive strategy. In recent years, we have seen no significant changes in their gold holdings.

On the other hand, the US holds very low foreign exchange reserves compared to major economies, with only $38.2B (Jul -25). Gold comprises about 4% of its total reserves. This is because the US dollar's dominance as a global reserve currency reduces the need for large foreign exchange holdings.

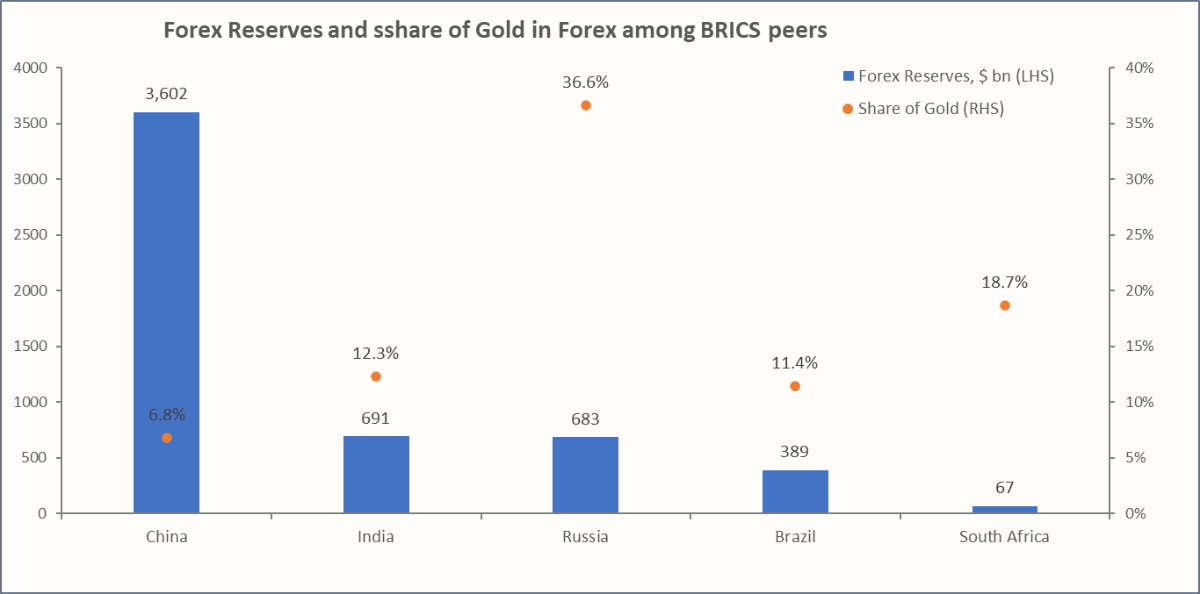

Among BRICS nations, China dominates in terms of forex reserves with $3.6tn, yet gold forms just 7% of the total reserve. India and Brazil have a modest share (11–12%), while South Africa’s gold share is somewhat higher (19%). Russia is the outlier with nearly 37% of reserves in gold, reflecting its effort to reduce reliance on the dollar after sanctions.

Since 2022, China, Russia, and India have all expanded their gold holdings, whereas South Africa and Brazil have not followed the same path. This trend reflects a domestic reserve diversification strategy rather than a unified BRICS move. At the same time, the bloc’s broader agenda has focused more on settling trade in local currencies and developing alternative payment systems, signalling that gold accumulation and de-dollarisation are parallel but distinct strategies, shaped by each country’s economic priorities and geopolitical concerns.

Significance of Forex Reserves for Investors

Monitoring India’s foreign exchange reserves gives investors and financial advisors a valuable lens into how the RBI views global risks and prepares for them. It is not only the size of reserves that matters, but also their composition and the strategy behind their movements that matters.

In 2024, India’s forex reserves crossed $650bn, partly due to an increase in gold holdings caused by higher global gold prices (21%) and active RBI purchases. Over the year, the RBI bought around 73 tonnes of gold, raising its total to about 876 tonnes.

For an India-based investor and financial advisor, these numbers matter. Central banks buy gold when uncertainty is elevated due to geopolitical tensions, volatility in dollar assets, or fears of inflation. Gold acts as a hedge in times of systemic stress. By increasing gold’s share of reserves, the RBI is signalling caution while simultaneously strengthening the rupee’s external resilience.

The implication is twofold. First, investors and advisors can expect lower tail risks on currency volatility, supporting stability in equities and bonds. Second, the RBI’s tilt toward gold should prompt private investors and financial advisors to consider diversifying portfolios with increased asset allocation towards gold-linked instruments as a hedge against global uncertainty.

Concluding Remarks

The composition of foreign exchange reserves reflects both policy choices and responses to global uncertainty. India’s reserves, which crossed $ 650bn in 2024, remain dominated by foreign currency assets, but gold’s share has been rising steadily. From about 6% in 2021 to nearly 12% by 2025, gold has doubled its weight, supported by price gains as well as the RBI’s active purchases of gold.

This shift is best understood against India’s BoP history. In the 1991 crisis, India pledged gold to meet external obligations, highlighting the risks of inadequate reserves. Today, India’s strong reserve position signals resilience, but the RBI’s tilt toward gold shows greater emphasis on safety and diversification rather than just adequacy.

Looking ahead, gold accumulation will remain an important theme as it provides a hedge against both inflation and geopolitical risks. However, this should be viewed more as prudent diversification than a coordinated de-dollarisation effort. The BRICS agenda on local currency trade and alternative payment platforms is advancing, but progress remains uneven, with India emphasising de-risking rather than abandoning the dollar. Globally, the U.S. dollar will likely retain its dominance in forex reserves of the developed as well as the developing countries, though incremental diversification into gold and regional currencies is expected to accelerate in a world of rising geopolitical fragmentation.