Introduction

There is an old saying in geopolitics: there are no permanent friends or enemies, only shifting acquaintances. In 2025, that maxim feels more relevant than ever. U.S. President Donald Trump’s second stint in office has redrawn trade battle lines- reviving tariff wars, unsettling supply chains, and, perhaps inadvertently, accelerating the very thing Washington wants to slow: closer alignment between India, China, and Russia under the BRICS umbrella.

This is no longer just about trade disputes. What is unfolding is a gradual rebalancing of economic influence, with BRICS members working to diversify trade, energy, and financial partnerships. Rather than displacing the U.S., these efforts signal a stronger voice for the Global South in shaping the rules of global commerce. The extent of this shift will depend on BRICS’ ability to overcome internal differences, while the U.S. retains deep institutional and financial strengths.

The Shifting Global Economic Order

Over the past two decades, the global economy has witnessed a subtle but undeniable shift in gravity. What was once a U.S. and Eurocentric order is now increasingly multipolar, with BRICS — Brazil, Russia, India, China, and South Africa emerging as a formidable counterweight. With the bloc’s expansion in 2024–25 to include Saudi Arabia, the UAE, Egypt, Ethiopia, and Iran (commonly referred to as BRICS+), the grouping now represents far more than just a loose coalition of emerging economies.

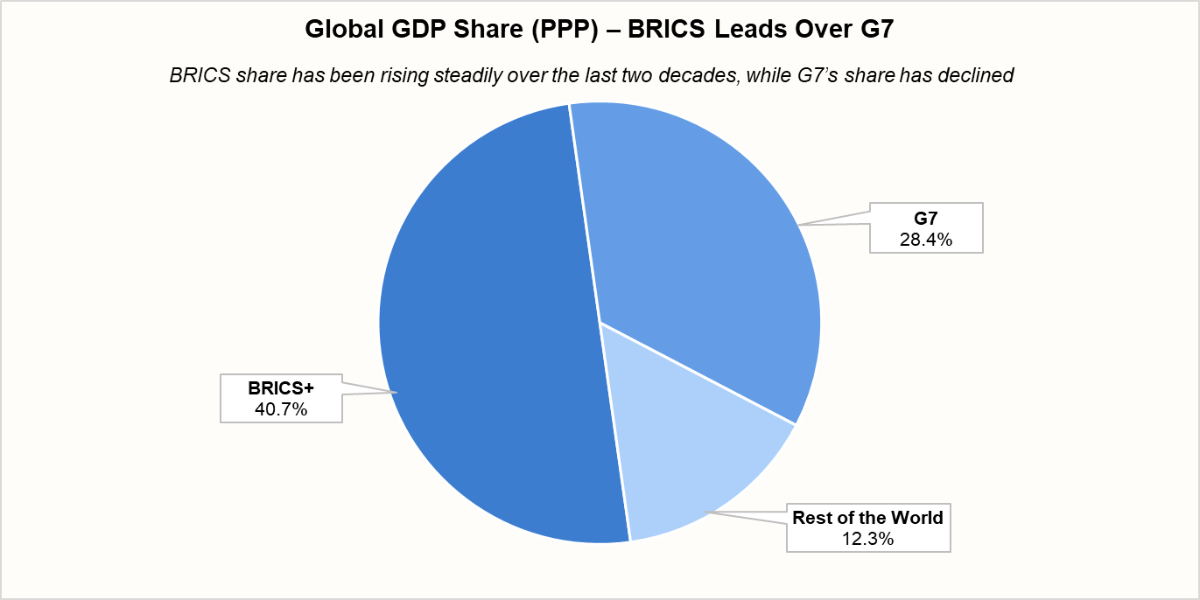

The numbers speak for themselves:

- Population: BRICS+ countries together account for nearly 56% of the world’s population.

- Economy: In Purchasing Power Parity (PPP) terms, they now contribute to ~40% of global GDP, surpassing the G7.

- Trade Flows: The bloc commands a significant share of global oil and gas trade, agricultural exports, and industrial supply chains.

Source: BRICS, 1 Finance Research

These structural advantages are fueling a renewed push by BRICS leaders to transition from an informal dialogue platform into a cohesive economic bloc with its own trade, currency, and geopolitical strategies.

Recommended for you

Readers also explored

Major Macro Risks Shaping 2026

Nifty 50 Companies List 2025 : Top 50 Stocks in India

Trump’s Tariff Gambit and Its Ripple Effects

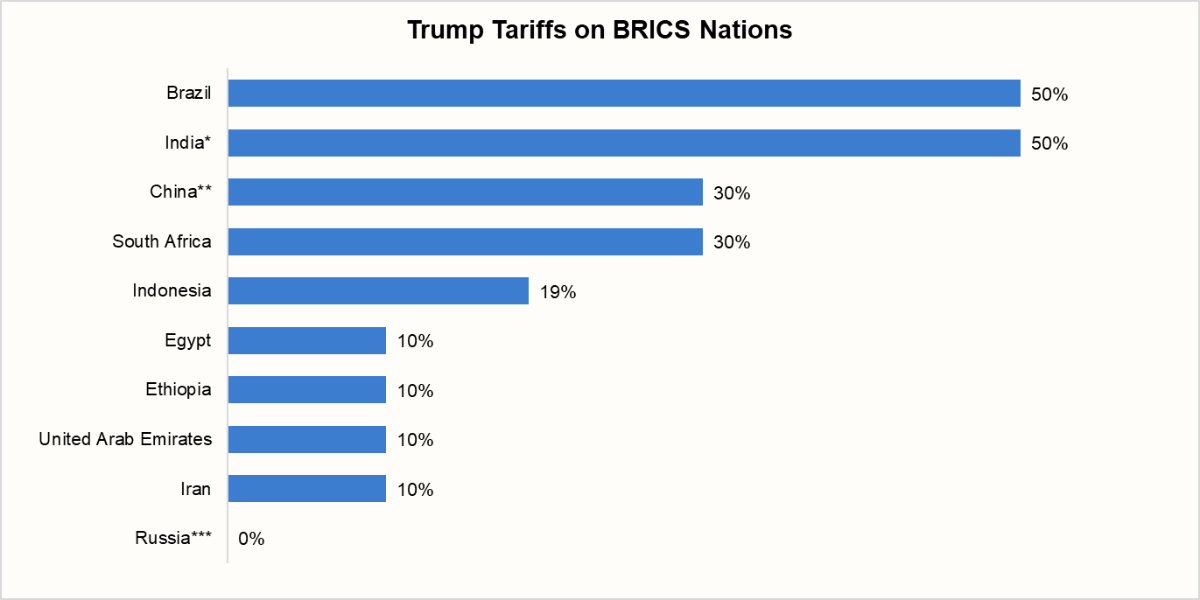

*25% additional tariffs on India for importing discounted Russian oil.

**Could revert to 145% if no trade deal is reached by November 10, 2025.

***No tariffs due to sanctions that have cut most US-Russia trade.

Source: DW, US Department of Commerce, 1 Finance Research

Donald Trump views tariffs as a strategic bargaining tool, intended to pressure allies into aligning with U.S. geopolitical goals. Case in point: in August 2025, he levied a 25% "reciprocal" tariff on Indian goods, followed by another 25% penalty specifically targeting India's continued purchase of discounted Russian oil, bringing total tariffs to a staggering 50%.

But the U.S.’s intention to punish India backfired. Russia deepened its discounts on crude exports, saving India roughly ₹22,000 crore (~US$2.6 billion) annually in oil costs—even as exporters brace for steep losses under the new tariff regime.

Meanwhile, Trump has held back on similar aggression toward China, largely because Beijing controls over 95% of the world’s rare earth element supply, critical to U.S. tech and defence industries. In a strategic countermove, China recently lifted restrictions on rare earth exports to India, reinforcing economic ties with New Delhi just as U.S. pressure mounts.

The irony is clear: by weaponising tariffs, Trump risks triggering a classic beggar-thy-neighbour outcome, where short-term protectionist gains come at the expense of global cooperation. In response, BRICS nations- India, Russia, and China are driven to coordinate more closely, an action-reaction dynamic that mirrors the logic of game theory. Each tariff move by the U.S. incentivises BRICS members to deepen economic ties, reinforcing the very bloc Trump sought to weaken.

| Impact of Trump’s Tariffs on BRICS Trade Dynamics | ||

|---|---|---|

| U.S. Action | BRICS Response | Resulting Effect |

| 50% Tariff on Indian goods | Russia offers India 5% oil discount | India gains US$2.6B in oil savings |

| Threatened tariff aggression toward China | China lifts rare earth export curbs to India | Strengthens Indo–China strategic ties |

| Threatened additional 10% tariffs on all BRICS nations | Enhanced intra-BRICS coordination | BRICS coherence increases |

The Push towards De-dollarisation

At the heart of BRICS’ growing economic clout lies a strategic ambition: to reduce dependence on the U.S. dollar. For decades, the dollar has been the undisputed global reserve currency, conferring “exorbitant privilege” to the U.S. — allowing it to run persistent deficits, borrow cheaply, and weaponise financial sanctions. But in recent years, BRICS economies have become increasingly vocal about breaking free from what they see as a “dollar trap.”

This shift is no longer just rhetoric; it is playing out in real transactions.

- India and Russia, for instance, have settled billions of dollars’ worth of crude oil trade in Indian rupees (INR) and the UAE’s dirham (AED), bypassing the dollar altogether.

- China and Brazil struck a landmark deal in 2023 to settle trade directly in yuan, reducing currency conversion costs and shielding themselves from dollar volatility.

- Meanwhile, Saudi Arabia, historically a linchpin of the U.S.-led “petrodollar” system (where global oil trade has long been settled in U.S. dollars, anchoring the dollar’s role as the world’s reserve currency), signed agreements to accept yuan for oil sales to China, signalling a tectonic shift in energy trade.

Institutionally, the BRICS New Development Bank (NDB) has committed to lending primarily in local currencies, with a target of 30% by 2026. This is not merely a symbolic move — it reduces exposure to dollar funding risks and fosters deeper financial integration within the bloc. Perhaps most ambitious are the ongoing talks around creating a BRICS currency, possibly in the form of a digital unit or even a gold-backed stablecoin. While sceptics argue that political and structural frictions make such a project unlikely in the near term, the very fact that discussions are advancing signals a shared strategic intent.

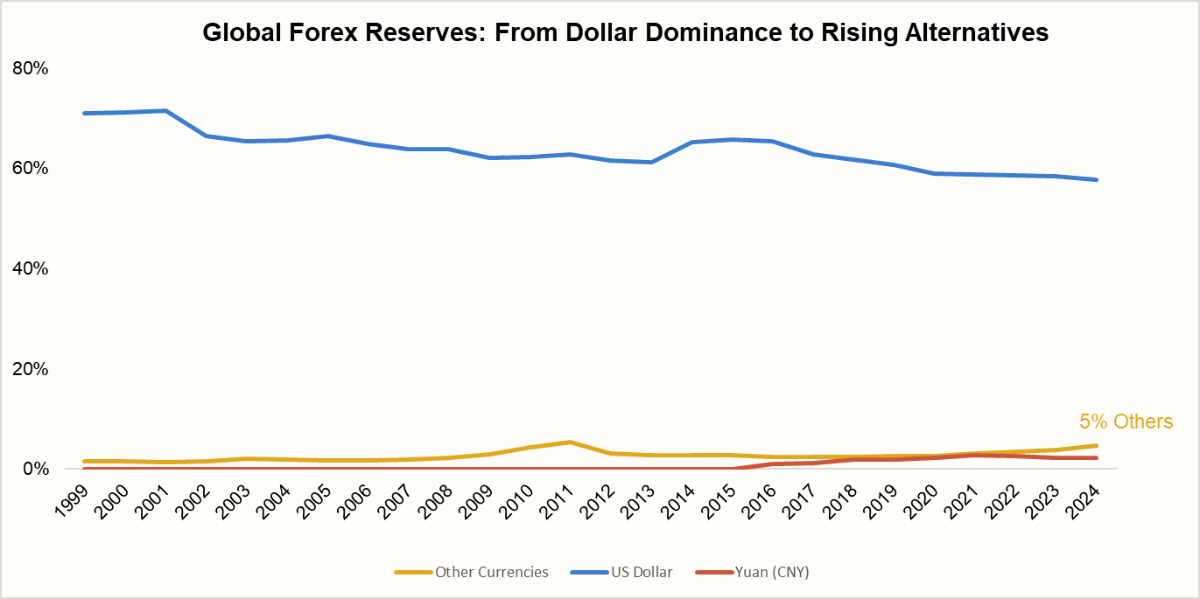

The numbers back this trend. The dollar’s share of global foreign exchange reserves has declined from 72% in 1999 to 66% in 2015 and now around 58% in 2024 (IMF COFER data). Meanwhile, the share of non-traditional reserve currencies such as the yuan (CNY) has steadily increased, reflecting the gradual diversification of global reserves.

For the U.S., this trend is deeply unsettling. Dollar dominance underpins its economic leverage as much as its military power. If BRICS nations succeed in creating viable alternatives, the U.S. risks losing its ability to unilaterally shape global trade and finance, a potential turning point in the balance of global power.

India’s Strategic Pivot: Between the West and BRICS

India today finds itself at a delicate crossroads in global geopolitics. On one hand, it remains a vital partner in U.S.-led frameworks such as the Quad and G20, aligning with Western democracies on issues ranging from security to technology. On the other hand, India’s economic imperatives are drawing it closer to BRICS.

Bilateral trade with Russia has surged fivefold since 2021, touching $65 billion in FY24, largely due to discounted crude oil imports. These purchases alone save India billions annually, cushioning its energy import bill. At the same time, pragmatic trade engagement with China continues despite political frictions. Beijing’s easing of export restrictions, especially on rare earth elements critical for India’s EV and electronics industries, has reinforced India’s reliance on Chinese inputs for its industrial strategy.

Underlying these shifts are the shared BRICS values of multipolarity, financial sovereignty, and South-South cooperation. The bloc’s New Development Bank (NDB), offering alternatives to Western-dominated finance, has become a critical symbol of this alignment. Rather than capitulating to U.S. pressure, such measures could incentivise India to lean more heavily on BRICS frameworks for secure, cost-effective energy and trade arrangements. In essence, India’s balancing act is shifting from hedging between blocs to strategically leveraging BRICS as a counterweight to Western demands.

U.S. Vulnerabilities: Tariffs, Inflation, and Isolation

Tariffs have historically raised costs for U.S. households, with the 2018–19 U.S.–China trade war adding an estimated $1,300 per household annually in higher consumer prices (Peterson Institute for International Economics, 2019). If Trump revives this strategy more aggressively, the U.S. will face higher import prices not just from China but potentially from India, Brazil, and other BRICS economies that are increasingly integrated.

| BRICS Partner | Key U.S. Imports (2024-25) | Value (USD bn) | Key U.S. Exports (2024-25) | Value (USD bn) |

|---|---|---|---|---|

| China | Electronics, machinery, furniture | $462.63 bn | Aircraft, oil seeds, and electronic machinery | $143.54 bn |

| India | Pharmaceuticals, textiles, precious stones, and IT services | $91.23 bn | Precious stones and metals, machinery, mineral fuels and oil | $41.75 bn |

| Brazil | Iron ore, agricultural products | $44.18 bn | Aircraft, mineral fuels and oil | $49.66 bn |

| Russia | Fertilisers, palladium, uranium (post-sanctions) | $3.27 bn | Medical instruments, pharmaceuticals | $0.5 bn |

| South Africa | Minerals, precious metals | $14.92 bn | Nuclear reactors, vehicles | $5.81 bn |

Imports at Risk: The U.S. heavily depends on BRICS for critical goods — electronics and machinery from China, rare earths and pharmaceuticals from India, energy and fertilisers from Russia, and agricultural commodities from Brazil. Tariffs or retaliatory restrictions could raise input costs for American industries, disrupting supply chains and stoking inflation.

Exports at Risk: BRICS collectively represents a rapidly growing consumer market. With rising intra-BRICS trade (over $422 billion in 2023, according to UNCTAD), the bloc is working to reduce its reliance on U.S. suppliers. U.S. exports, particularly in aerospace, high-tech equipment, and agriculture, would lose market share if BRICS members pivot toward each other or alternative partners.

The dollar’s dominance in global trade invoicing has been the U.S.’s greatest shield, but BRICS initiatives to bypass the dollar (yuan-settled oil contracts, India–Russia rupee trade, BRICS Bank lending in local currencies) are eroding this insulation. If the dollar’s share of global reserves continues falling (from 72% in 1999 to ~58% in 2024, IMF), the U.S. would lose the ability to finance deficits cheaply.

BRICS’ Internal Fault Lines: Strengths and Vulnerabilities

While the BRICS bloc has made remarkable strides in expanding its global influence, its future trajectory is not without risks. The grouping is united by a common desire to rebalance global power away from U.S. dominance, but structural challenges, economic asymmetries, and political rivalries still complicate deeper integration.

| Dimension | Strengths | Vulnerabilities |

| Trade | Expanding intra-BRICS trade (e.g., India-Russia >$65 bn; China-Brazil oil & soybeans) | Heavy reliance on Chinese imports; asymmetrical trade dependence |

| Finance | New Development Bank lending in local currencies; growing de-dollarisation efforts | Limited scale vs. IMF/World Bank; varied financial regulations and risk profiles among members |

| Strategy | Shared interest in counterbalancing U.S. dominance; expansion into BRICS+ | Internal geopolitical rifts (India–China border disputes, policy divergences, Russia sanctions exposure), new member disagreements |

| Currency | Push for local currency settlement and BRICS reserve mechanisms | Liquidity, convertibility, and volatility issues; fears of Yuan dominance; coordination and implementation challenges |

| Energy & Resources | Resource complementarity (Russian oil, Brazilian agri-exports, South African minerals) | Exposure to commodity cycles; risk of overconcentration in resource-led trade |

| Governance/ Expansion | Growing bloc (56% of world population, 40%+ global GDP [PPP], new financial infrastructure) | Fragmentation risk from rapid expansion, lack of institutional depth, and a formal secretariat |

Conclusion: A Contest that Defines the Era

The rivalry between BRICS and Trump’s America is not just an economic contest; it is a struggle over the rules and norms of global governance. Trump’s protectionist stance and transactional diplomacy risk weakening U.S. alliances, even as Washington works to preserve the dollar’s primacy. BRICS, meanwhile, draws strength from its demographic scale, natural resources, and expanding trade networks, yet internal rifts and dependence on China remain critical constraints.

What emerges is the possibility of a multipolar order, where influence is distributed more widely across regions rather than concentrated around Washington. If BRICS can deepen cohesion while the U.S. recalibrates its role under Trump, the coming decade may witness a structural rebalancing of global power. For governments, businesses, and citizens, this contest is not abstract; it will shape investment flows, trade rules, and the very fabric of globalisation for decades to come.