Financial decision-making is one of the most important skills in modern life. Every choice we make: whether it’s saving, investing, borrowing, or spending—shapes our financial future. With rising economic uncertainty, inflation, and global market volatility, making informed money decisions has become critical. The ability to align personal financial choices with broader macroeconomic trends is what separates secure households from financially vulnerable ones.

In this guide, we explore what financial decision-making means, why it matters, the key principles behind it, and how individuals can improve their decisions by linking them to macroeconomic indicators such as GDP growth, inflation, and interest rates.

What is Financial Decision-Making?

Financial decision making is about how you choose to use your money- whether you save it, spend it, borrow it, or invest it. It may sound simple, but in practice it’s a constant balancing act. Do you pay off debt faster or invest for growth? Should you buy a home now or wait for interest rates to ease? These are the kinds of decisions that can have long-term consequences.

In short, financial decision-making is the process of selecting the best course of action when managing money. At its core, it’s about maximising value while minimising risk.

Good decision-making ensures that your limited resources are used wisely. It builds wealth over time, keeps risks under control, and gives you the confidence that your money is working for you, not against you.

For individuals, financial decision-making governs personal finance activities, including:

- Budgeting: Deciding how to allocate income for needs, wants, and savings.

- Saving and Investing: Choosing between immediate consumption and future wealth growth.

- Borrowing: Determining when to take on debt (e.g., mortgages, student loans) and under what terms.

- Insurance: Selecting policies to protect against unforeseen risks.

For businesses, financial decisions are often categorised into three key areas:

- Investment Decisions: Choosing where to allocate funds (equity, debt, real estate, or business).

- Financing Decisions: Deciding how to raise capital (equity, debt, or retained earnings).

- Dividend Decisions: Determining how much profit to distribute vs. reinvest.

| Key Fact: The principle of "time value of money" is fundamental to all financial decisions. A dollar today is worth more than a dollar tomorrow due to its potential to earn returns. This concept guides everything from investment analysis to retirement planning. |

Why Financial Decision Making is Important

The quality of your financial decisions is directly correlated with your financial outcomes. Poor decisions can lead to financial distress, insurmountable debt, and a lifetime of missed opportunities. Conversely, sound decisions lead to wealth creation, stability, and goal attainment.

- Wealth Creation: Strategic financial decisions, particularly in investment planning, can exponentially grow your assets over time through the power of compounding.

- Risk Management: Proper financial analysis and decision-making allow you to identify, evaluate, and mitigate risks, protecting you from unexpected financial shocks.

- Goal Achievement: Whether your goal is a comfortable retirement, a child’s education, or business expansion, aligning your financial decisions with your objectives provides a clear path to success.

- Efficient Resource Allocation: In both personal and corporate contexts, financial decisions are about using limited resources (money, time, and effort) as efficiently as possible to maximise return.

| 💡Tip: Think of your financial life as a journey. Your decisions are the turns you take on the road. A clear destination (your goals) and a good map (your financial plan) are essential for a successful trip. |

Recommended for you

Readers also explored

Inflation and Personal Finance: Protect Your Purchasing Power

Currency in Circulation: How Much Money Exists in the World?

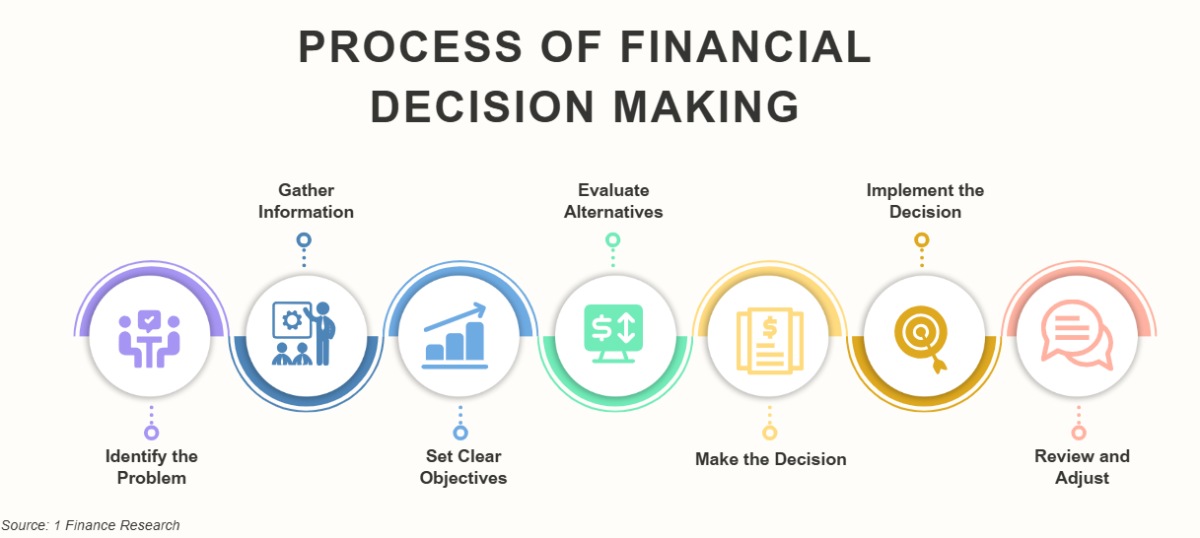

The Process of Financial Decision Making

A systematic approach is the most effective way to make financial decisions. By following a clear process, you can reduce emotional biases and focus on rational analysis.

- Identify the Problem: Clearly define the financial choice you need to make. (Example: "Should I pay off my high-interest credit card debt or invest in the stock market?")

- Gather Information: Collect all relevant data. This includes your current financial situation, potential costs and benefits of each option, market trends, and any associated risks.

- Set Clear Objectives: What do you hope to achieve with this decision? Is it to increase net worth, reduce debt, or generate passive income?

- Evaluate Alternatives: Compare each option against your objectives. Use tools like financial calculators or scenario planning to visualise potential outcomes.

- Make the Decision: Based on your analysis, choose the alternative that best aligns with your goals and risk tolerance.

- Implement the Decision: Execute the plan you've chosen. For investments, this means opening an account; for loans, it means making payments as planned.

- Review and Adjust: Financial decisions are not one-time events. Regularly monitor your progress and be prepared to make adjustments as your circumstances or the market change.

The Behavioural Aspects of Financial Decisions

Financial decisions are often irrational. Behavioural finance studies how psychological biases influence our choices, leading us to make suboptimal decisions. Understanding these biases is the first step toward overcoming them.

- Overconfidence Bias: The belief that you are a better investor than you actually are, leading to excessive risk-taking.

- Loss Aversion: The psychological pain of a loss is stronger than the pleasure of an equivalent gain, which can cause people to hold on to losing investments for too long, hoping they will recover.

- Herd Mentality: Following what others are doing without independent research, often leading to market bubbles.

- Present Bias: The tendency to choose immediate rewards over future gains, which is a major obstacle to saving and retirement planning.

| 💡Tip: Before making a major financial decision, pause and ask yourself: "Am I being influenced by emotion or a market trend? What does the objective data say?" |

The Macroeconomic Link: How the Big Picture Guides Your Choices

Your personal financial decisions don't happen in a vacuum. They are constantly influenced by larger economic forces that you can’t control. This is the realm of macroeconomics, the study of the economy as a whole. Understanding these big-picture trends is crucial for making smarter financial decisions. It's like checking the weather forecast before planning a major outdoor event; you're better prepared for what's coming.

Here’s how key macroeconomic indicators can be used to improve your financial decisions:

| Macroeconomic Factor | What It Shows | Why It Matters for You | Quick Action Tip |

|---|---|---|---|

| Consumer Price Index (CPI) | Change in consumer prices | Rising CPI erodes purchasing power | Raise savings/investments to outpace inflation |

| Interest Rates | Cost of borrowing & return on savings | Higher rates mean costlier loans but better savings returns | Lock fixed-rate loans when rates rise; borrow more in low-rate phases |

| Economic Cycles | Expansion or recession trends | Expansions = job security & growth; recessions = risk & lower returns | Take more investment risk in growth; build an emergency fund or consider buying assets at a discount in downturns |

| Unemployment Rate | The percentage of the labour force that is jobless and actively seeking work. | Low = strong job market; high = job insecurity | Pursue career moves when low; focus on stability and building a larger cash reserve when high |

| Gross Domestic Product (GDP) | Overall economic health | Strong GDP = higher profits & opportunities; declining GDP indicates a slowdown. | Invest in cyclical sectors during growth; re-evaluate your portfolio and shift to more defensive sectors if slowing |

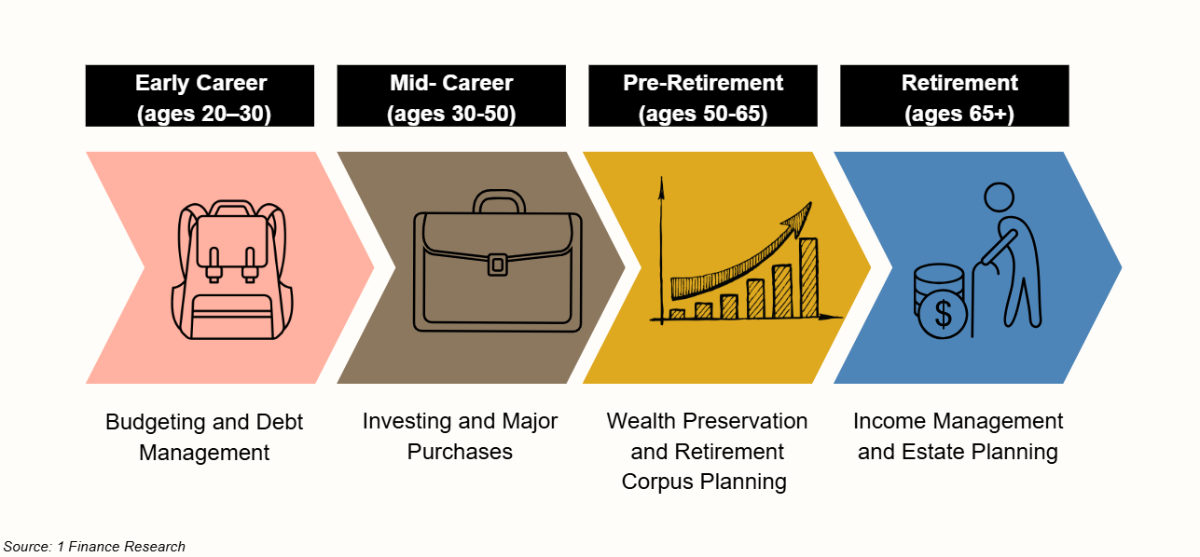

Financial Decision-Making at Different Life Stages

Your financial priorities aren't static; they evolve as you move through life. The key to successful financial planning is to align your decisions with the goals and challenges of your current life stage. The priorities, risks, and opportunities you face in your 20s are vastly different from those in your 50s. Understanding these shifts helps you stay financially vigilant while working towards long-term goals.

Early Career (20–30): Laying the Foundation

This stage is all about building a solid foundation. Your top priority is to establish good money habits and get a handle on early debt.

Your Mission: Start strong by creating a budget. Know where every dollar goes so you can take control of your spending.

Key Decisions:

- Tackle high-interest debt like credit cards or student loans first. It’s a huge drag on your future wealth.

- Begin building an emergency fund (aim for 6-9 months of expenses) and start investing, even if it’s just a little bit. The power of compounding is your secret weapon.

| 💡Tip: Use the 50-30-20 Rule- Allocate 50% of your income to needs (rent, utilities, essentials), 30% to wants (lifestyle, entertainment), and 20% to savings and investments. |

Mid-Career (30–50): Balancing Growth and Responsibility

As your career and income grow, you can focus on major life goals and accelerate wealth creation.

Your Mission: Transition from basic savings to more strategic investing. Use your increased income to make your money work harder for you.

Key Decisions:

- Tax planning becomes crucial; using instruments like PPF, ELSS, or NPS can help optimise returns while reducing liabilities.

- Decide whether to buy a home, which involves a complex financial decision on loans, interest rates, and a long-term commitment.

- If you have a family, make critical decisions about life insurance and a child's education savings.

| 💡Tip: This is the time to embrace a diversified portfolio that aligns with your long-term goals. |

Pre-Retirement (50–65): Securing the Future

The focus shifts to protecting your accumulated wealth and preparing for the next chapter.

Your Mission: Safeguard what you’ve built while making the final push towards retirement.

Key Decisions:

- Healthcare planning becomes non-negotiable; rising medical costs can undermine even the most effective financial strategies.

- Begin transitioning your portfolio from high-growth, high-risk investments to more conservative, income-generating assets.

- Create a detailed plan for how you will live in retirement, including a withdrawal strategy and a careful review of your healthcare options.

Retirement (65 and Beyond): Preserving Wealth, Ensuring Income

Congratulations! This stage is about living off your assets and ensuring they last for the rest of your life.

Your Mission: Manage your income streams and make sure your savings are sustainable for the long haul.

Key Decisions:

- Make a plan for how to draw down your retirement accounts in a tax-efficient way.

- Finalise your will and estate plans to ensure your assets are distributed as you wish.

- Plan for the possibility of a long life by creating a sustainable spending plan and making sure your money doesn’t run out.

(Use our Asset Allocator tool to explore how diversification across equities, debt, gold, and other assets can be adjusted to suit different life stages and risk profiles).

Conclusion

Financial decision-making is at the heart of financial well-being. Whether it’s choosing personal investments, managing debt, or directing corporate strategy, each money decision carries consequences.

It’s about aligning every choice with your life goals, risk appetite, and the broader economic environment. From starting an emergency fund in your 20s to protecting wealth in retirement, each stage demands a different strategy. By understanding macroeconomic signals, staying disciplined, and reviewing your plan regularly, you can turn money decisions into a powerful tool for financial security and freedom.

The key is to stay informed, stay disciplined, and always connect your personal goals with the bigger economic picture.