The Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) met for its third bi-monthly review of the financial year 2025-26, and the outcome has left many in the financial world with a sense of cautious optimism. While the decision to keep the repo rate unchanged at 5.5% might seem like a simple "status quo," a deeper look reveals a complex and nuanced strategy from the central bank.

The Findings: Why the RBI Pressed Pause

For months, the Indian economy had been enjoying a series of rate cuts, with the RBI front-loading a total of 100 basis points of easing since February 2025 to support growth amid steadily falling inflation. Inflation hit a six-year low of 2.1% in June, largely driven by food price deflation and a favourable base effect. However, the August meeting marked a significant departure from this trend. The MPC's unanimous decision to hold rates steady, while maintaining a 'neutral' stance, was a carefully calculated move.

Key Highlights from the Meeting:

| Parameter | June 2025 MPC | August 2025 MPC | Remarks |

|---|---|---|---|

| Repo Rate | 5.5% | 5.5% | Unchanged |

| Stance | Neutral | Neutral | Dovish Pause Continues |

| GDP Forecast | 6.5% | 6.5% | Maintained Forecast |

| Inflation Forecast | 3.7% | 3.1% | Revised Downwards |

The decision was a balancing act. On one hand, domestic indicators are strong: rural demand is steady, consumption is rising, and the monsoon has been supportive, aiding the agriculture sector. On the other hand, a dark cloud of global uncertainty looms large. This is where the MPC’s focus on “tariff uncertainties and global risks” comes into sharp focus.

Inflation: The Devil in the Supply Chain

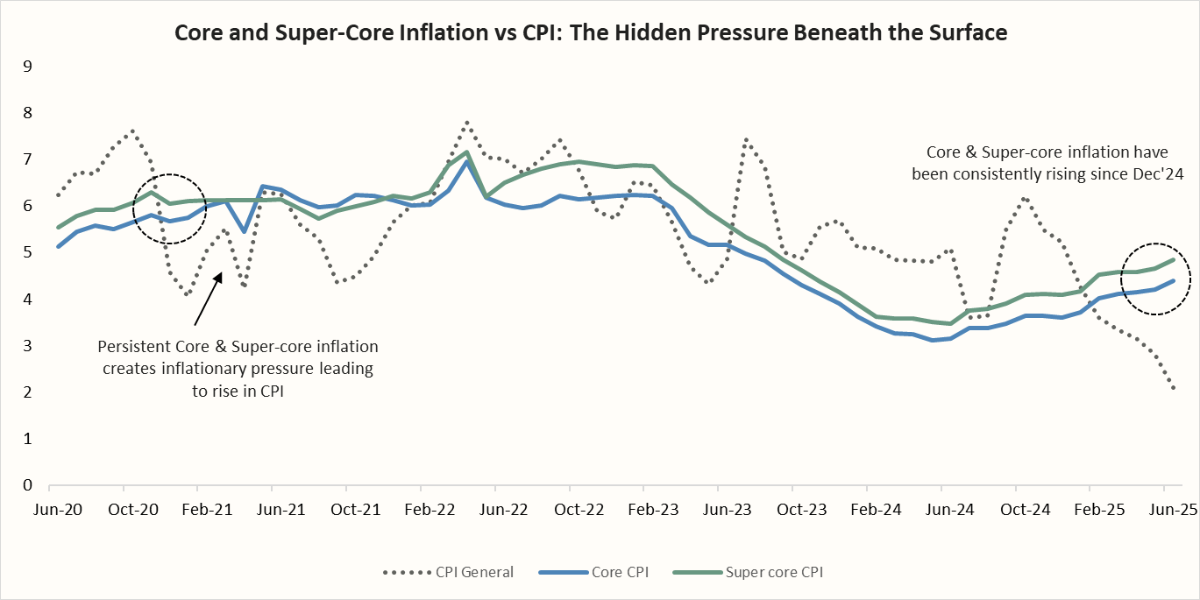

The CPI headline inflation for June stood at 2.1%, comfortably within the RBI’s 2–6% tolerance band, but this was driven by transient factors like a sharp fall in vegetable prices and last year’s high base. The RBI noted that as the base effect wanes and seasonal patterns take hold, food prices, particularly those of vegetables, could firm up. Moreover, core inflation (excluding food and fuel) showed signs of hardening to 4.4% , driven by education, health, and gold prices.

| RBI’s Inflation Projections (%) | ||||||

|---|---|---|---|---|---|---|

| FY26 | Q1FY26 | Q2FY26 | Q3FY26 | Q4FY26 | Q1FY27 | |

| June 2025 (previous MPC meeting) | 3.7% | 2.9% | 3.4% | 3.9% | 4.4% | - |

| August 2025 | 3.1% 🔻 | 2.7% (A) 🔻 | 2.1% 🔻 | 3.1% 🔻 | 4.4% ↔️ | 4.9%

|

(A) - Actuals

Note: Core CPI= CPI excluding food and fuel, Super-core CPI= CPI excluding food, fuel and housing

However, the RBI’s forward guidance emphasised that inflationary risks are no longer purely domestic. With tariff threats from the US targeting key trade partners, including India, supply chains could get squeezed. India’s $212 billion bilateral trade with the US, where it runs a $40 billion surplus, is now a double-edged sword.

India’s auto, smartphone, and pharmaceutical industries, which are heavily reliant on US-made raw materials and intermediate goods, could face cost escalations and pass-through inflation to consumers.

Recommended for you

Readers also explored

Sustained Domestic Growth Momentum

Nifty 50 Companies List 2025 : Top 50 Stocks in India

Transmission Still a Work in Progress

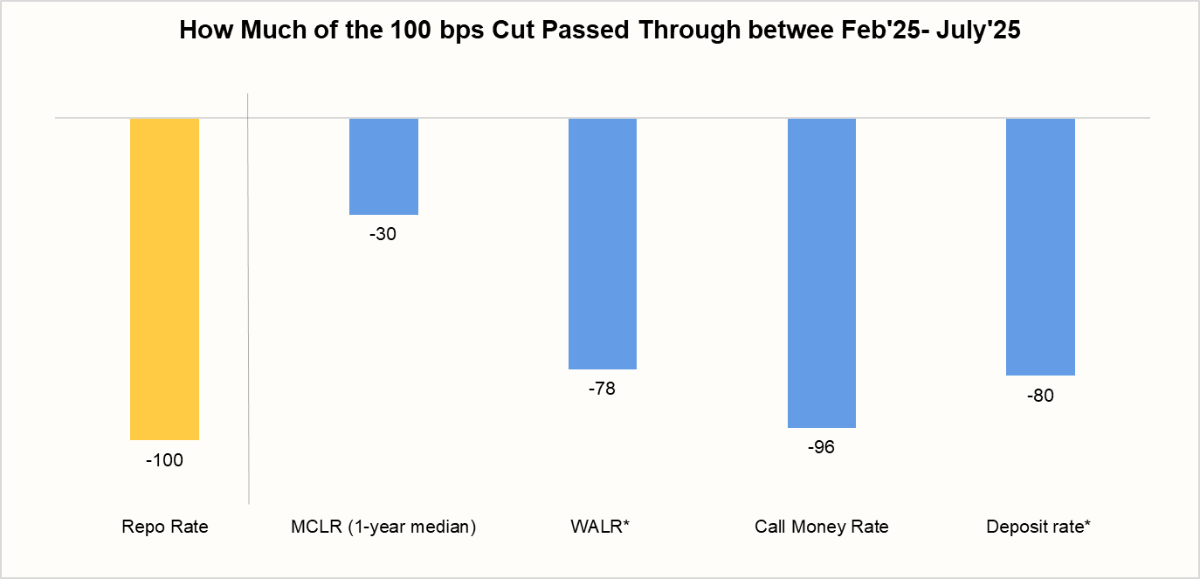

The RBI has already delivered a cumulative 100 bps rate cut in 2025: 25 bps each in February 2025 and April 2025, and an unexpected 50 bps in June 2025. These moves were aimed at countering global headwinds and stimulating domestic growth.

Yet, transmission remains incomplete and uneven. Lending rates for MSMEs and housing loans have dropped more slowly than expected. Liquidity mismatches in NBFCs and sector-specific credit frictions suggest that the full effect of past easing is still in progress. The RBI prefers to "wait and watch" how the economy digests this stimulus before committing to further cuts.

*Note: Deposit Rate on new term deposits and Weighted Average Lending Rate (WALR) on fresh loans is taken as June 2025, the latest data available.

The Elephant in the Room: Global Tariff Threats

The US’s two-stage tariff blitz—first 25%, then an additional 25% (totalling 50%) comes as a geopolitical penalty for India’s continued oil purchases from Russia. This suddenly puts India in the group of countries facing some of the world’s highest US import barriers. This is a direct response to India's continued purchase of Russian crude oil and military hardware, which the US alleges is "fuelling the Russian war machine." The threat of further, more substantial tariffs has added a layer of unpredictability to India’s trade outlook.

In FY2025, India-US bilateral trade for goods alone reached $132b, with India running a $40b surplus and sending almost 20% of its exports to America. Sectors like autos, electronics, textiles, and pharma are highly exposed, many being dependent on American raw materials and intermediate goods, complicating domestic supply chains.

Snapshot of US Tariffs on Indian Goods

| Category | Exports to US ($ billion) | US share in India's exports (%) | US MFN tariff (%) | New tariff (%) | Total tariff (%) |

|---|---|---|---|---|---|

| Diamonds, gold, related products | 10 | 40 | 2.1 | 50 | 52.1 |

| Machinery, mechanical appliances | 6.7 | 20 | 1.3 | 50 | 51.3 |

| Steel, aluminium, copper | 4.7 | 16.6 | 1.7 | 50 | 51.7 |

| Textiles | 3 | 48.4 | 9 | 50 | 59 |

| Organic chemicals | 2.7 | 13.2 | 4 | 50 | 54 |

| Vehicles and parts | 2.6 | 11.4 | 1 | 25 | 26 |

| Shrimp | 2 | 32.4 | 0 | 50 | 50 |

| Smartphones | 10.6 | 43.9 | 0 | Temporary exemption | 0 |

| Pharmaceuticals | 9.8 | 39.8 | 0 | Temporary exemption | 0 |

Note: MFN stands for most favoured nation. Export data is for fiscal year 2024-25.

The RBI governor acknowledged the uncertainty: “We do not see a major impact on immediate inflation or GDP, but the risks are rising, and we remain vigilant.” While the central bank is not factoring in a sharp slowdown at present, prolonged tariffs through FY26 could incrementally weigh on GDP growth and exert mild upward pressure on prices, especially in sectors dependent on imported components.

A trade war, and the subsequent disruption to supply chains, could lead to a surge in local inflation as input costs rise. This is the very scenario the RBI is trying to preempt, and it explains their cautious "wait-and-watch" approach, ensuring policy flexibility if external headwinds begin to materially affect domestic conditions.

Looking Ahead: What’s Next for Rate Cuts?

The RBI has left the door open for further rate cuts, but the trajectory will hinge on three critical factors:

- Inflation Outlook: If CPI inflation remains within 2–4% and core inflation stabilises, there may be room for another 25 bps cut in FY26.

- Transmission Effectiveness: If credit transmission improves and demand-side inflation remains muted, a policy easing cycle could resume.

- Global Trade Dynamics: Any resolution of the US-India tariff standoff, or successful diversification of supply chains, would lower inflationary risks and revive growth optimism.

Scenarios for Future Rate Decisions

| Baseline Scenario | The RBI is likely to maintain the repo rate at 5.5% through at least the October 2025 MPC meeting. If global tariff pressures ease or India successfully diversifies its trade partnerships, the RBI could resume modest rate cuts (25 bps) in early 2026 to support growth. This scenario assumes inflation remains within the 2–6% band and GDP growth stays close to 6.5%. |

| Upside Risk Scenario | If US tariffs escalate further or supply chain disruptions intensify, inflation could climb toward 5–6%. In this case, the RBI may adopt a more hawkish stance, potentially holding rates in 2026 to curb inflationary pressures. This would prioritise price stability over growth, especially if global commodity prices rise. |

| Downside Risk Scenario | Should global demand weaken significantly, dragging India’s exports and growth below expectations, the RBI could further cut rates by 50 bps to stimulate growth. This would depend on inflation remaining subdued and domestic consumption continuing to drive growth. |

Action Plan for Financial Advisors:

- For clients with high-interest-rate loans or borrowing needs, consider refinancing now to take advantage of lower rates to avoid future volatility.

- Encourage diversification into sectors less reliant on US imports or tariff-exposed supply chains, while selectively maintaining positions in domestic demand-driven industries like FMCG, Pharma and agriculture-linked businesses.

- Maintain moderate, staggered investments in gold to preserve its role as a hedge against global uncertainty.

- With CPI projected near the lower end of the RBI’s tolerance band, consider increasing exposure to short to medium-duration debt funds to capture current yields before any future cuts.

- Encourage clients to diversify globally across equities, bonds, and alternative assets to reduce concentrated domestic geopolitical and trade risk.

- Transmission of rate cuts to retail borrowers is still incomplete; advise clients to review their loan agreements and explore refinancing if beneficial.

- Monitor RBI policy signals, inflation trends (especially vegetable and core inflation), and US-India trade developments to adjust strategies promptly if macro conditions shift.

Conclusion:

The August 2025 MPC decision reflects strategic patience, not indecision. With inflation well-anchored but external clouds gathering, the RBI has chosen prudence over impulse. For markets and businesses, the message is simple: prepare for stability in rates, but not in the global trade order.

While the central bank remains ready to act if conditions worsen, it is equally prepared to wait if recovery holds. This is monetary policy at its most calibrated—calm today, watchful tomorrow.