India’s home loan ecosystem is at a key inflexion point. With over ₹33.5 lakh crore in outstanding home loans (as of Sep 2024, NHB), even small shifts in the policy rate or bank funding conditions ripple across crores of borrowers. The central bank's accommodative turn, supported by ample system liquidity, is forcing lenders to recalibrate.

Here’s a breakdown of recent developments in the monetary policy and what they mean for borrowers.

Policy Easing Begins: RBI Turns Accommodative

After a prolonged pause, the Reserve Bank of India shifted its monetary stance to accommodative in early 2025. Key policy actions include-

| Component | Dec 2024 | Feb 2025 | Apr 2025 | Total Change | Impact on Home Loan |

| Repo Rate* | 6.50% | 6.5% → 6.25% | 6.25% →6.00% | -50 bps | Direct |

| Bank Rate* | 6.50% | 6.50% | 6.5% →6.25% | -25 bps | Direct |

| CRR* | 4.5% → 4.0% | 4.00% | 4.00% | -50 bps | Indirect |

| Policy Stance | Neutral | Neutral | Accommodative | Eased | Signals more cuts |

*Repo rate is the rate at which RBI lends money to banks with collateral. Bank rate is the rate at which RBI lends money to banks without collateral. Cash Reserve Ratio CRR is a mandatory reserve that banks must maintain with the RBI to regulate liquidity within the banking system.

Highlights:

- Repo Rate Cut across February and April 2025 marked the first reduction after 11 consecutive unchanged meetings since February 2023. This directly reduces borrowing costs for homebuyers.

- CRR Cut injected ₹1.16 lakh crore into the banking system through phased implementation, ensuring adequate lending capacity while supporting economic growth.

- Credit-Deposit Ratio reached 80.8%—the highest since 1965—demonstrating effective policy transmission and enhanced credit access for borrowers.

- Policy Stance Shifts from "Neutral" to "Accommodative" Signals RBI's commitment to supporting lower interest rates and economic growth. This provides forward guidance that monetary policy will either keep the repo rate unchanged or reduce it.

Floating-rate home loans are set to benefit from further rate cuts, with quicker transmission for loans linked to EBLR (External Benchmark Lending Rate) compared to those linked to MCLR ( Marginal Cost of Funds Based Lending Rate).

Recommended for you

Readers also explored

The New Phase for Rates, Liquidity and Inflation

India’s Unemployment Rate in 2025

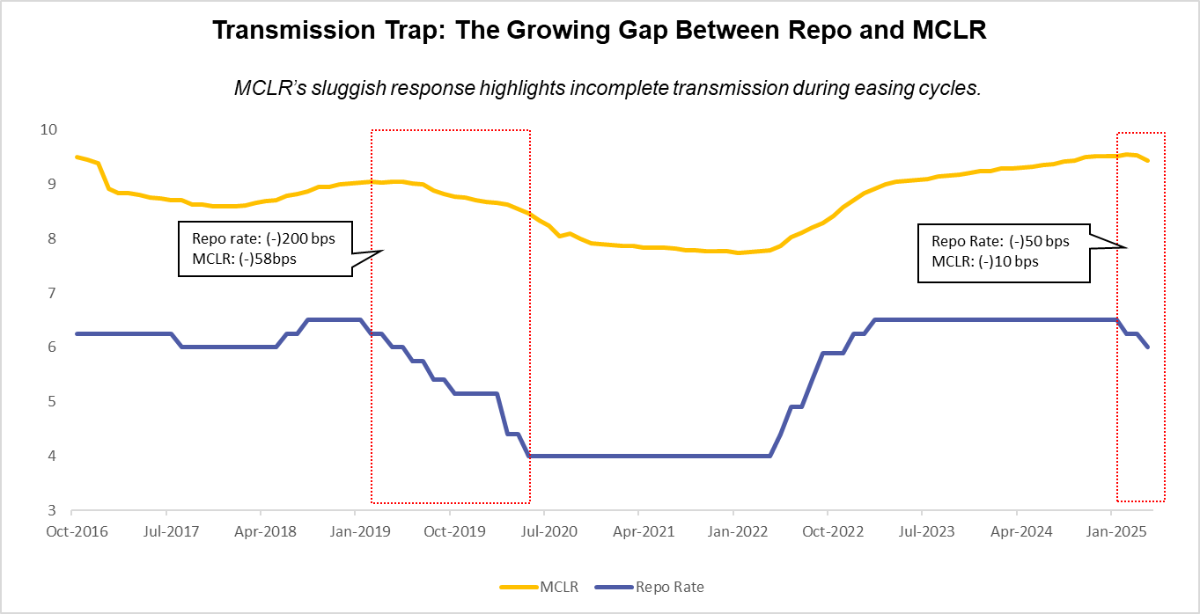

Repo vs MCLR: Uneven Transmission of Rate Cuts

Indin economy is in a declining interest rate environment. The chart below highlights how MCLR has adjusted with repo rate cuts during previous declining interest rate environment and the present.

Historically, loans linked to the Marginal Cost of Lending Rate (MCLR) have been slower to reflect changes compared to those linked to the Repo Rate.

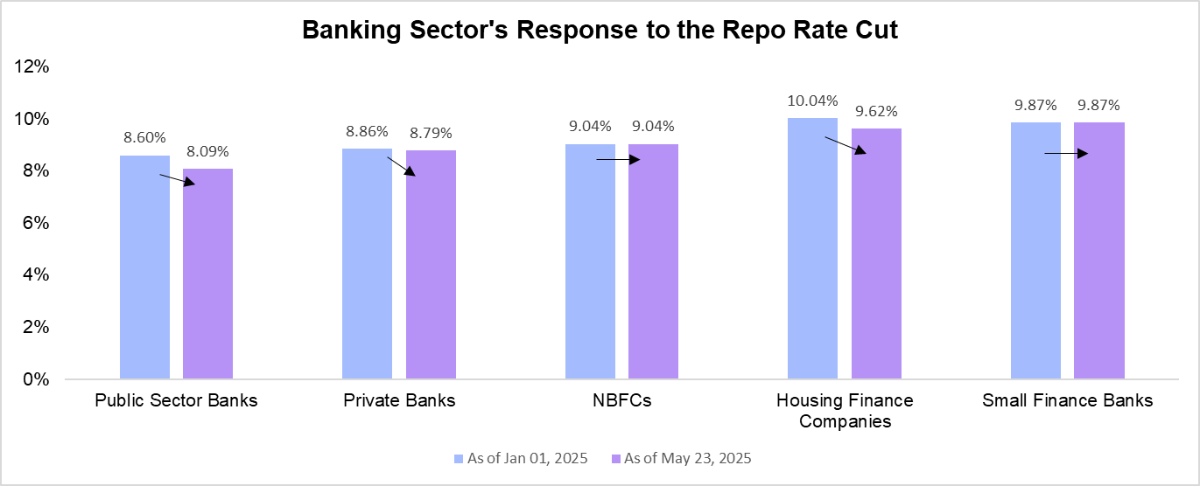

Scheduled Commercial Banks’ Transmission of Repo Rate Cut

While repo rate transmission to the end borrower takes 1-3 months, only a few banks have transmitted the repo rate cut in the home loans. Others likely increased their spread margin, as indicated by the following chart.

| Category | Average Rate Change | Transmission Quality |

| Public Sector Banks | -50 bps | Excellent |

| Housing Finance Companies | -40 bps | Good |

| Private Banks | -5 bps | Poor |

| NBFCs | 0 bps | No transmission |

| Small Finance Banks | 0 bps | No transmission |

Public sector banks not only have transmitted the rate cut benefit but also have the most affordable home loan rates, while private banks have merely passed on the rate cut benefit.

Loan Restructuring Options: RBI’s Guidelines

As per the RBI guidelines released on 18th Aug, 2023, banks are advised to inform the borrowers when the interest rate is reset, so that the borrowers have options to adjust their home loan terms accordingly.

Let’s understand with an example:

| Current Loan Details | Inputs |

| Outstanding Principal | ₹80,00,000 |

| Current Interest Rate | 8.50% |

| Revised Interest Rate | 8.00% |

| Remaining Tenure (months) | 240 |

| Gross Annual Income | ₹30,00,000 |

Borrowers now have three options when interest rates reset:

1. EMI Adjustment: EMI changes while tenure remains the same

2. Tenure Adjustment: EMI remains the same, while tenure changes

3. Hybrid Option: EMI & Tenure change

With this change in the interest rate, the borrower can choose from three restructuring options. 1 Finance’s Floating Interest Rate Calculator helps assess the three options given by the RBI.

| Loan Details | Existing Loan | EMI & Tenure Change | Only EMI Change | Only Tenure Change |

| EMI | ₹69,426 | ₹87,500 | ₹66,915 (Lowest EMI) | ₹69,426 |

| Tenure (months) | 240 | 142 (Lowest Tenure) | 240 | 221 |

| Total Interest | ₹87L | ₹44L (Lowest Interest) | ₹81L | ₹73L |

| Debt-to-Income Ratio (DTI) | 28% | 35% | 27% (Lowest DTI) | 28% |

- A reduction in loan tenure would save on interest payable.

- A reduction in EMI would ease the monthly cash flow while saving on interest payable a little less.

- Adjusting both can help repay the loan at the maximum capacity by adjusting EMI as much as 35% of the monthly income, which is considered a good EMI cap.

Our Outlook on Home Loans for FY26

| Key Factor | Current Scenario (May 2025) | Impact on Home Loan Borrowers |

| Repo Rate | The RBI has cut 50 bps in 2025 so far; further cuts of 50-75 bps are expected in FY26. | Borrowing costs could decline further, directly lowering EMIs for repo-linked loans. |

| Credit Availability | High liquidity from CRR cut (~₹1.16 lakh crore infused) and RBI’s OMOs have boosted credit supply. | Easier availability of credit and improved bargaining power for new borrowers. |

| Inflation | Headline inflation softening; monetary stance now accommodative. | Supports lower long-term interest rates |

FY26 opens a strategic window for home loan borrowers.

- New borrowers should prioritise repo-linked home loans for an expected 50-75 basis point easing in FY26, offering direct policy rate transmission in 1-3 months vs MCLR loans with +6 month lag periods.

- Current borrowers can switch from fixed rate or MCLR-linked interest to floating rate, repo-linked interest rates.

- Repo-linked loan holders should contact lenders to adjust loan terms after interest rate revisions.