Following a robust 7.4% growth in Q4 FY25, India’s economic engine appears to be running strong. But under the surface, several evolving global and domestic risks threaten to test the country’s strength. In this edition of our newsletter, we explore the most pressing threats and what they mean for Indian investors, policymakers, and financial advisors.

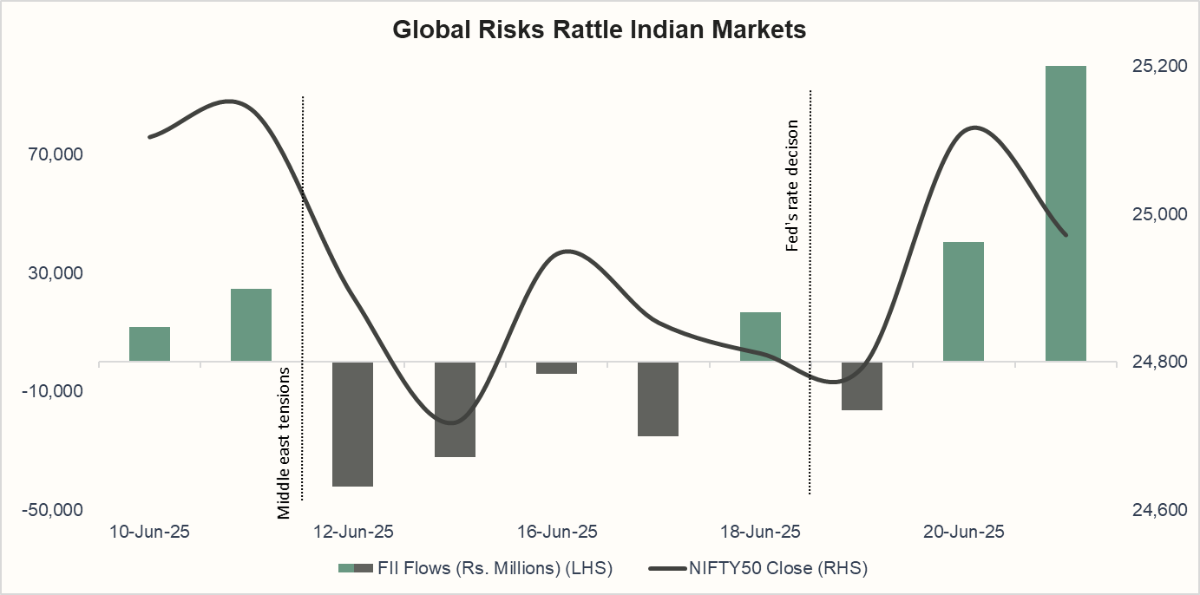

Escalating Geopolitical Tensions and Financial Market Volatility

Rising global tensions, particularly the Israel-Iran conflict, have disrupted energy trade routes, pushing up freight and insurance costs for crude oil. This inflates India’s import bill and stokes inflation concerns. Meanwhile, the U.S. Fed’s June 2025 signal of fewer rate cuts has triggered capital outflows and market volatility. While the RBI has intervened, persistent volatility could challenge India’s ability to attract capital and manage borrowing costs.

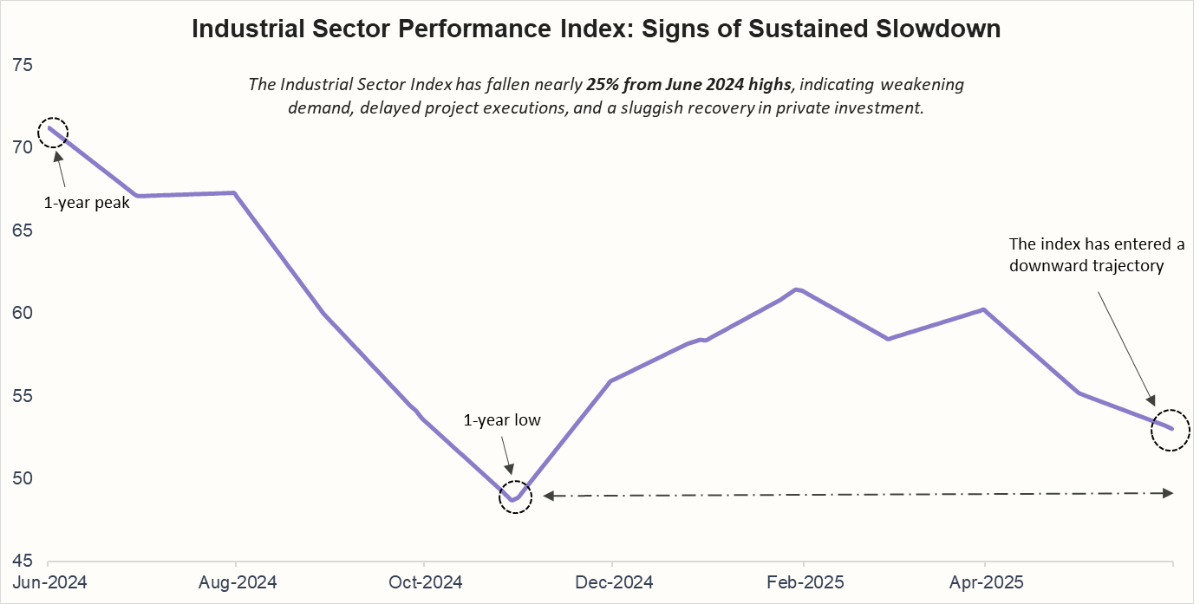

Manufacturing Slowdown and Delay in Private Capex

India’s manufacturing sector, while still expanding, is showing clear signs of a slowdown in 2025. Growth rates have moderated across key indicators, and private capital expenditure (capex) remains subdued, raising concerns about the sustainability of the recovery and the sector’s ability to drive broader economic growth.

You can explore the Industrial Sector Performance Index by 1 Finance here.

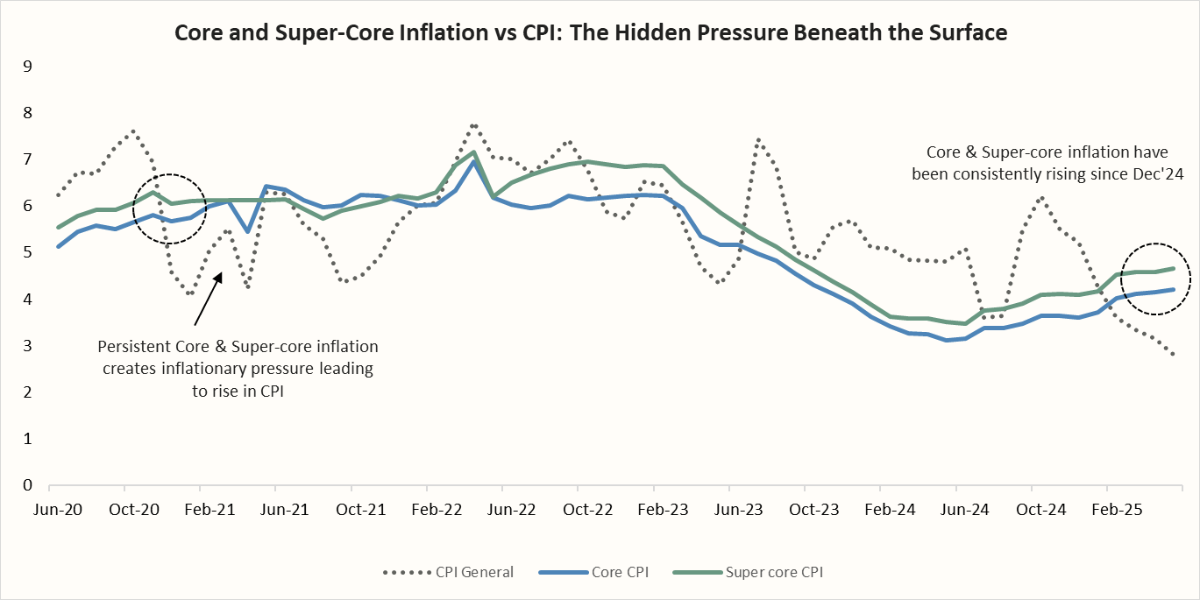

Core Inflation: Quiet but Persistent

May’s CPI eased to 2.8% on the back of softer food prices, but core inflation remains sticky, above 4%. Rising global gold prices and geopolitical tensions are adding to inflation risks. The RBI must strike a balance between inflation control and growth support—cutting rates too soon risks capital flight, while remaining too hawkish could hinder the recovery.

Recommended for you

Readers also explored

A Mid-Year Check: Whether India is in Flux

Nifty 50 Companies List 2025 : Top 50 Stocks in India

Our Risk Outlook

India’s macro fundamentals remain strong, but the economy is not immune to global shocks. As external risks mount, it is crucial for financial advisors and investors to monitor these developments actively. Below is a snapshot of key risks shaping the outlook as of June 2025:

| Risk Event | Event Description | Impact on Markets | Expected Direction of Impact |

| Global trade protectionism | Rise in tariffs, reshoring trends, and shipping disruptions reduce trade efficiency | Indian Auto & Textile Sector | ▼ |

| INR/USD | ▼ | ||

| Gold | ▲ | ||

| Middle East regional war | Escalation disrupts crude oil supply, raises risk sentiment globally | Crude oil (INR) | ▲ |

| Indian Oil Manufacturing Companies (OMCs) | ▼ | ||

| INR/USD | ▼ | ||

| Gold | ▲ | ||

| U.S.–China Tariff war | Fragmented global trade & investment reduce global growth prospects | FPI inflows | ▼ |

| Domestic Electronics Manufacturing | ▲ | ||

| Indian Govt. Bonds | ▲ | ||

| U.S. debt rollover concerns | Rising U.S. yields or a default scare trigger global risk aversion | INR/USD | ▼ |

| Indian IT Sector | ▼ | ||

| Indian Govt. Bonds | ▼ | ||

| Gold | ▲ | ||

| Yen carry trade unwinding | Rising Japanese yields trigger repatriation from EMs, causing capital outflows | Indian Large Cap Equities | ▼ |

| INR/USD | ▼ | ||

| FPI debt flows | ▼ | ||

| Manufacturing slowdown | Industrial production remains subdued amid weak demand and global headwinds | Employment | ▼ |

| Bank Credit Growth | ▼ | ||

| Indian Corporate Bonds | ▼ | ||

| Energy Demand | ▼ | ||

| Delay in private capex revival | Firms delay capacity expansion due to high borrowing costs or uncertainty | Indian Banks | ▼ |

| Infrastructure Demand | ▼ | ||

| Bank Liquidity | ▲ | ||

| Indian Real Estate | ▼ |

A Health Check on India’s Macro Fundamentals

What India's Key Indices Reveal Amid Global Uncertainty

To complement our Risk Radar, we turn to the 1 Finance Sub-Indices, which track real-time economic momentum across key sectors. These offer a ground-level view of how India’s economy is holding up under pressure.

Here's how the economy is tracking across major dimensions as of May 2025:

| Service Sector Activity 👍 | Latest Month | Vs. Last Year | Vs. Last Month |

| The services sector is expected to maintain its growth trajectory, supported by sustained domestic demand and international orders. | 77 | +39% | +0% |

| Industrial Sector Performance 👎 | Latest Month | Vs. Last Year | Vs. Last Month |

| Ongoing global economic conditions, trade policies, and domestic industrial reforms will play a crucial role in shaping the industrial sector's performance in the coming months. | 53 | -26% | -4% |

| Agriculture Output 👍 | Latest Month | Vs. Last Year | Vs. Last Month |

| The agriculture industry will likely maintain its strong growth rate, aided by favourable weather and government support. | 52 | +8% | -1% |

| Equity Market Optimism 👍 | Latest Month | Vs. Last Year | Vs. Last Month |

| The RBI’s rate cuts and ample liquidity are expected to sustain positive market sentiment, supporting further gains in equities. | 67 | -10% | +9% |

| Global Economic Impact 👎 | Latest Month | Vs. Last Year | Vs. Last Month |

| India is projected to remain the fastest-growing major economy in 2025-26, with growth supported by domestic consumption, policy reforms, and ongoing fiscal consolidation, even as global growth slows to its lowest pace since 2008. | 57 | +19% | +11% |

| Financial Sector Soundness 👍 | Latest Month | Vs. Last Year | Vs. Last Month |

| While RBI’s rate cuts and CRR reductions aim to ease liquidity, transmission to borrowers remains uneven; credit growth is expected to gradually recover as lending rates fall. | 70 | +14% | -1% |

*Data as of May 2025, hence growth comparisons are for May 2024 for Y-o-Y and April 2025 for M-o-M growth comparison.

Despite geopolitical shocks and policy uncertainty, the services sector, agriculture, and financial system are showing notable strength. However, global headwinds and sticky core inflation continue to weigh on industrial sentiment and investor confidence.

India’s economy continues to show steady growth, backed by strong domestic demand and a stable financial sector. However, emerging risks—from geopolitical tensions to trade disruptions and volatile global markets- pose real challenges that investors and advisors must closely monitor. As the global landscape shifts, a nuanced understanding of these dynamics will be essential for making informed financial decisions in the months ahead.