Introduction

The Credit Deposit (CD) ratio is an important indicator for understanding a bank's lending practices, liquidity conditions and overall financial health. It has gained significant attention recently due to the growing gap between deposit mobilisation and credit disbursement. According to the RBI, the Scheduled Commercial Banks (SCBs) CD ratio reached a record high of 78.9% in June 2025. The rising CD ratio due to diverging credit and deposit growth raises concerns about potential structural liquidity challenges within banks.

In this blog, let us explore why the CD ratio is rising, its significance in the banking sector, and why banks must maintain a healthy balance between deposits and loans.

What is the CD Ratio?

The CD ratio measures the proportion of a bank's total deposits that have been disbursed as loans. The ratio is calculated by dividing the total loans by the total deposits and represented in percentages. The CD ratio provides insights into a bank's liquidity condition and its ability to fund the credit requirements of the various sectors of the economy. A higher CD ratio means the bank is lending out a larger portion of its deposits, indicating higher demand for loans. Also, it could be possible that the bank is unable to mobilise enough deposits to fund the credit demand. A lower CD ratio suggests banks' conservative lending practices, a low-risk appetite, weak demand for credit and higher deposit mobilisation.

Role of CD Ratio in Banking Stability

The CD ratio is one of the important parameters to assess the financial health of the bank, Bank deposits are liabilities for banks, while bank credit or loans and advances are their assets; thus, maintaining the balance between deposits and credit (how they have been utilised) is crucial for a bank's operations and stability.

It provides valuable insights into:

- How a bank balances its deposit mobilisation with its lending activities.

- The effectiveness of the monetary policy transmission.

- Banks' role in promoting productive sectors of the economy by supporting their credit requirements.

Banks can manage their CD ratios based on their risk management strategies. The CD ratio for a bank varies depending on several factors, including the bank's size, risk appetite, and the economic environment. A higher CD ratio implies a greater credit orientation among banks, while a low ratio may indicate underutilization of funds and potential missed revenue opportunities. A high ratio also signals liquidity risks and possible difficulties in meeting withdrawal demands. Aggressive lending practices could heighten risks throughout the financial system. According to Ashima Goyal, “Credit eventually creates deposits through rising incomes and savings, but in the meanwhile, banks should maintain adequate liquidity buffers”.

A balanced CD ratio indicates that a bank is effectively utilising its deposits to generate income through lending while maintaining sufficient liquidity to meet withdrawal demands. Although there is no mandatory target range for the CD ratio that banks must maintain a ratio between 65% and 75% is generally considered to be healthy according to experts.

Recommended for you

Readers also explored

Private Final Consumption Expenditure as the Pulse of India’s GDP

India’s Unemployment Rate in 2025

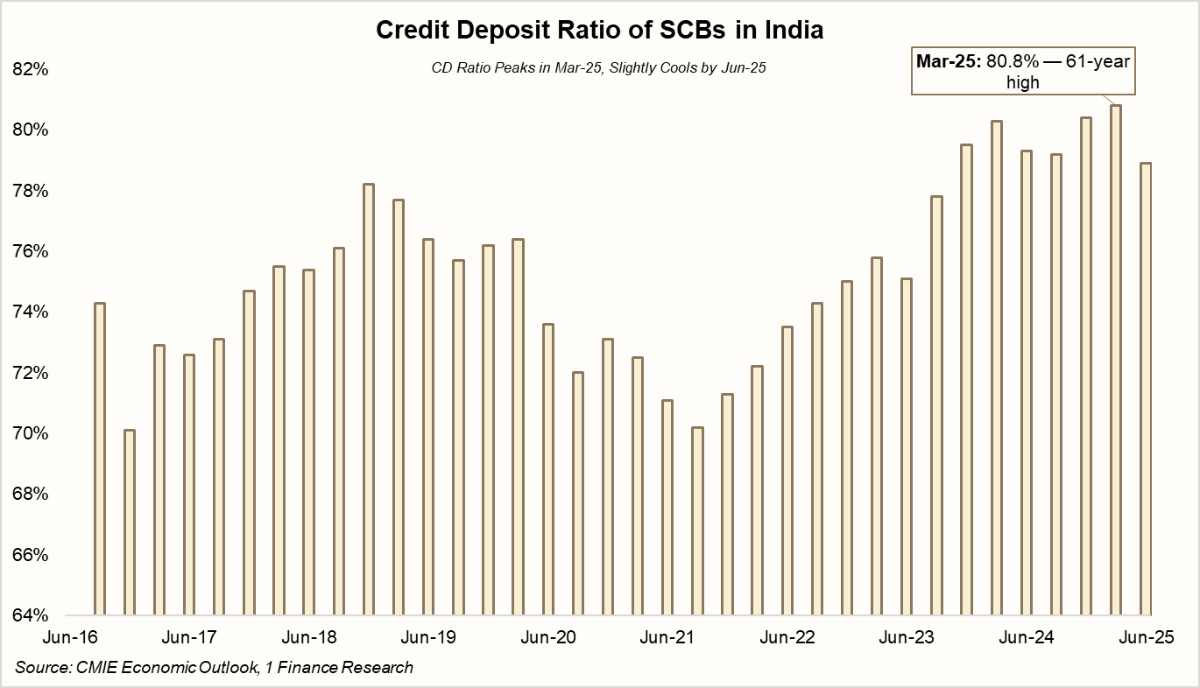

Trends in SCBs CD Ratio

India’s banking sector is seeing big shifts in its credit-to-deposit (CD) ratio.

The big moment came on July 1, 2023, when HDFC Ltd merged with HDFC Bank. That move alone pushed the CD ratio up by about 2.2 percentage points.

By March 2025, the ratio climbed to 80.8% — the highest in 61 years. It showed how fast lending was growing, but also how deposits weren’t keeping up.

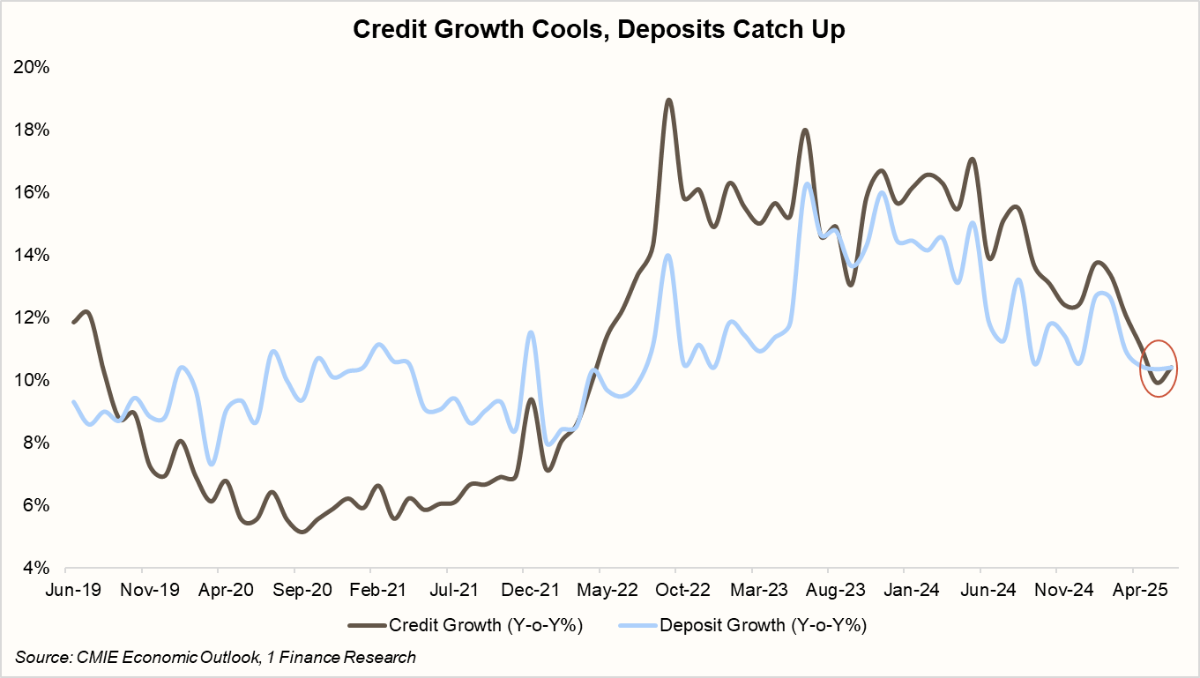

Since then, the ratio has eased a bit to 78.9% in Jun-25. Why? Since from Apr-25, deposit growth has held steady at around 10% year-on-year, while credit growth has slowed. As a result, the gap has narrowed. Credit and deposit growth are now moving more in line with each other.

Factors Behind the Recent Stabilisation of the CD Ratio in India

A key driver of the change has been credit demand. After three consecutive years of strong growth, loan expansion has started to moderate. Retail and corporate borrowers are showing more caution as inflation eases and consumption slows.

Deposits, in contrast, have been steady. Year-on-year growth has remained close to 10% since Apr-25. With credit demand easing, this consistency has helped narrow the gap between loans and deposits. Policy support has further reinforced stability. Liquidity measures and rate cuts by the RBI have improved funding conditions. This has supported deposit flows even as lending momentum softens. That said, this phase may not last indefinitely. Credit growth could regain strength, though the turnaround may take a few more quarters. For a historical perspective on how credit growth typically lags policy rate cuts in India, explore here.

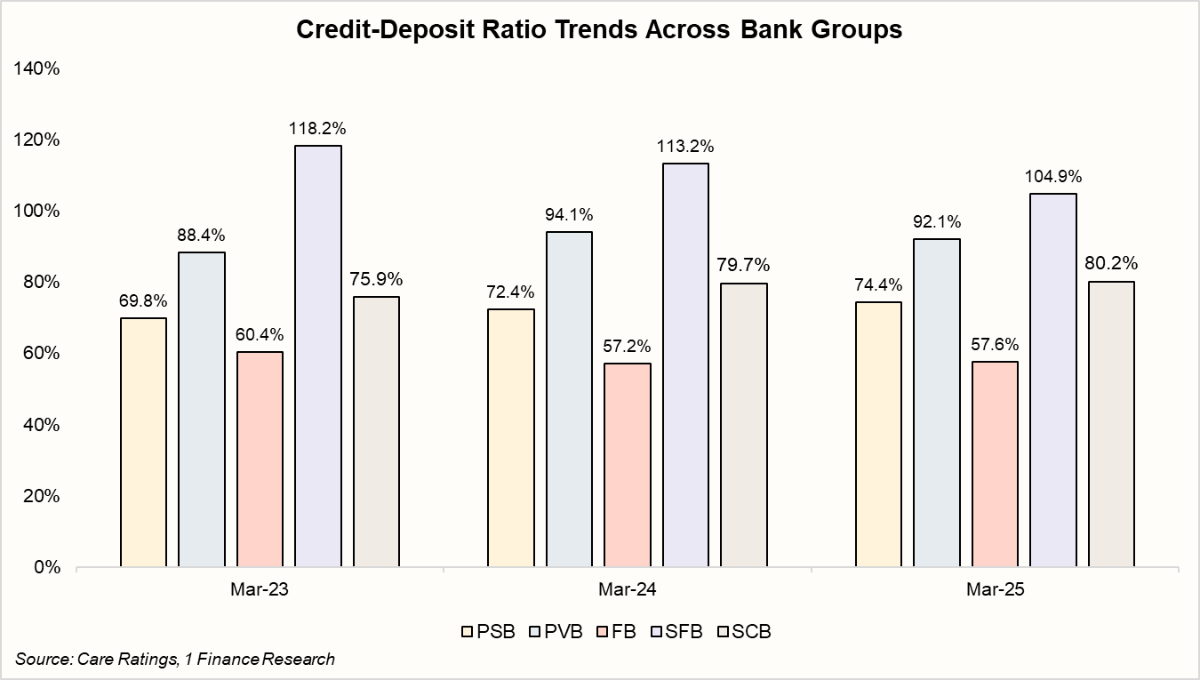

Bank Group-Wise CD Ratio in India

The CD ratio of Private Sector Banks (PVBs) has been particularly high compared to Public Sector Banks (PSBs). In the last two years, PVBs have held steady around 92-94%, while PSBs inched up from 69.8% in Mar-23 to 74.4% in Mar-25. Small Finance Banks stayed elevated above 100%, though slightly cooling from 118% to 105%. Foreign banks, meanwhile, remain the lowest at 57-60%, highlighting their selective lending and reliance on wholesale deposits.

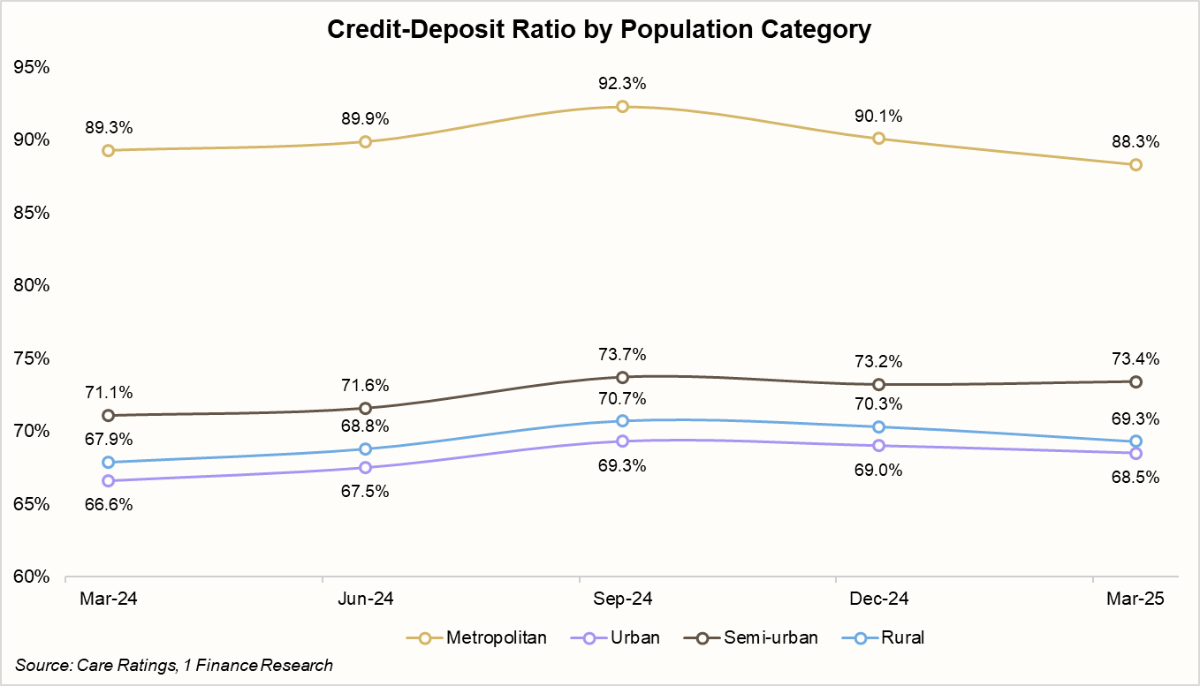

Population-Wise CD Ratio in India

The CD ratio varies significantly between rural, semi-urban, urban and metropolitan banks, according to RBI data.

- The greater demand for credit in cities is reflected in the CD ratio of semi-urban and metropolitan banks compared to rural banks, which remained relatively low.

- In FY25, the share of metropolitan centres in total credit disbursement stood at around 57%. In terms of deposit mobilisation, the share of metropolitan centres slightly varied at 53% in FY25.

- The share of non-metropolitan centres (Urban (20%), semi-urban (15%) and rural (10%)), in the total bank credit, is lower than their respective shares in the total bank deposits (Urban (21%), semi-urban (16%) and rural (11%)).

- Rural banks often struggle with lower CD ratios due to limited lending opportunities. They also face challenges in maintaining liquidity due to seasonal fluctuations in cash flows, limited access to diverse funding sources and higher operational costs.

Why PVB’s CD ratio is higher than PSBs?

Aggressive lending strategies: PVBs are generally more willing to take calculated risks in lending, and tend to be more oriented towards unsecured personal loans, credit cards, and retail lending, as they can charge higher interest rates to these lendings. While PSBs have more conservative lending approaches.

Focus on high-growth sectors: Growing sectors of the economy, such as consumer finance, Small and Medium Enterprises (SMEs), and emerging industries are the most preferred ones for PVBs lending. While PSBs are more towards agriculture and industrial credit due to mandatory priority sector lending.

Efficient fund management practices: PVBs maintain a higher Capital-to-Risk-weighted Assets Ratio (CRAR) compared to PSBs, which allows them to support higher levels of lending relative to their deposit base. For example, as per RBI’s FSR - June 2024, the PVBs CRAR stood higher at 17.8% compared to PSBs 15.5%, and all SCBs (16.8%) as of March 2024. PSBs also have a higher proportion of low-cost deposits.

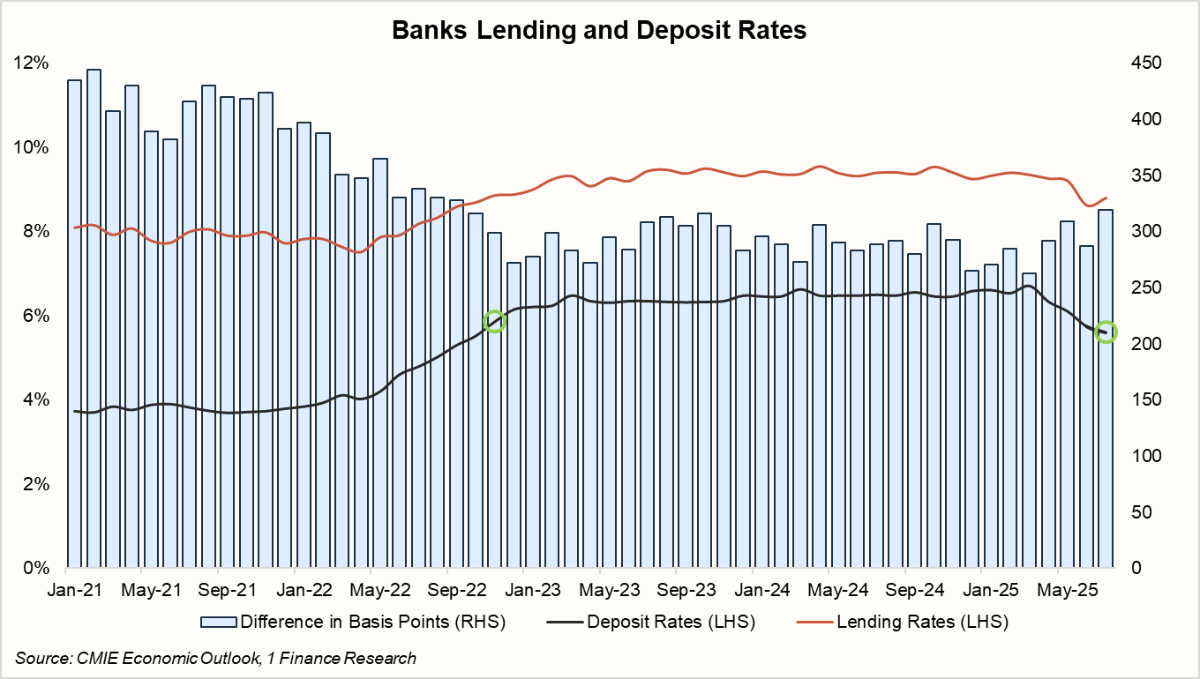

India’s Deposit Rates Fall to 2022 Lows While Lending Rates Rise in July 2025

The falling interest rate cycle is finally showing up in deposits. The weighted average domestic term deposit rate (WADTDR) fell to 5.61% in Jul-25 (from 5.75% in Jun-25). This is a 14 bps drop, and also the lowest deposit rate since Oct-22. This signals that banks are gradually lowering the cost of funds as liquidity improves post-RBI repo cut.

In contrast, the weighted average lending rate (WALR) on fresh rupee loans rose to 8.80% in Jul-25 (from 8.62% in Jun-25). That’s an 18 bps increase, bucking the expected decline. Banks appear to be defending their margins, not immediately transmitting repo rate cuts to borrowers.

The gap between deposit and lending rates has narrowed considerably since 2021. Now, with deposit rates falling but lending rates rising, the spread may temporarily widen again — but this is more about banks’ margin management than credit demand.

Implications of High CD Ratio

On Banks:

- This may potentially expose the banking system to structural liquidity issues.

- Pressure on banks to increase interest rates to attract deposits.

- Challenges in maintaining regulatory capital requirements and adequate liquidity buffers.

On Bank Loans:

- More stringent loan approval criteria.

- Higher interest rates on loans to reduce demand for credit or match with higher deposit rate.

- Increased focus on high-quality borrowers and a low-risk appetite.

On Depositors:

A high CD ratio may lead to higher deposit rates to attract more funds.

Implications of Low CD Ratio

On Banks:

- More aggressive lending practices with a higher risk appetite.

- Competitive interest rates to attract more deposits.

- Easier access to credit for borrowers.

On Depositors:

A low CD ratio could result in lower deposit rates due to excess liquidity.

Strategies for Managing Healthy CD Ratio

Recently, RBI Governor Shaktikanta Das stated, “We are closely monitoring the credit-deposit ratio trends and will take appropriate measures to ensure banking sector stability”. To maintain a healthy CD ratio and to ensure long-term banking stability, balancing deposit growth with credit expansion is crucial. Banks can employ several strategies to manage high credit deposit ratios, such as:

- Diversify funding sources (e.g. bonds, securitisation).

- Implement stricter lending criteria.

- Optimise asset-liability management.

- Enhance risk assessment and monitoring systems.

- Focus on deposit mobilisation through innovative products

To mobilise deposits, SBI has launched products like:

- SBI Green Rupee Term Deposit, which aims to mobilise deposits for financing green initiatives.

- SBI We Care Deposit scheme with higher interest rates extended to senior citizens; and

- Sarvottam (Non-Callable Deposit) Term Deposit scheme with higher interest rates for 1-year and 2-year deposits.

Conclusion

Credit demand in the economy remained strong in the past two years, prompting banks to gather substantial deposits to address this demand. Nevertheless, these efforts were insufficient to satisfy the high credit demand, resulting in a continuous increase in the CD ratio. The elevated CD ratio of certain banks could potentially pose credit or liquidity challenges. Although the RBI has raised concerns, it considers the current CD ratio levels to be manageable given the overall health of the banking system.

Hence, to avoid any risks in the future and to maintain banking stability, the RBI may implement measures such as:

- Increase scrutiny of banks with high CD ratios.

- Guidelines for maintaining adequate liquidity buffers.

- Stress testing requirements for banks to assess liquidity risks.