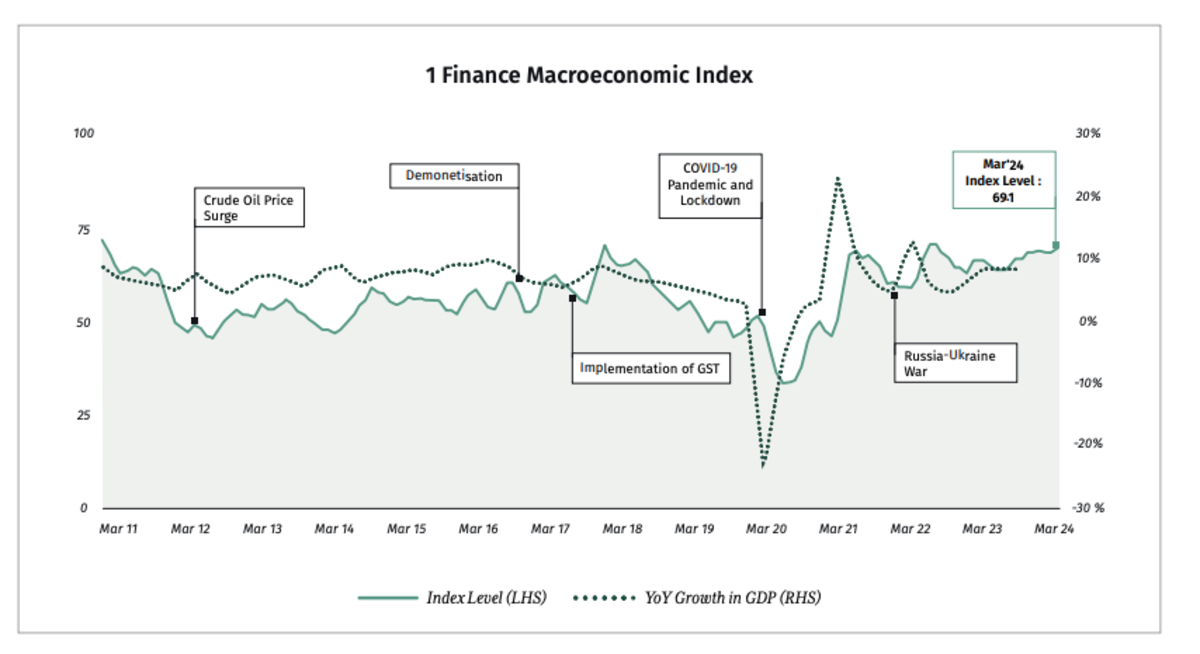

India’s economy continues to shine as a global growth leader, posting an impressive 8.4% year-on-year GDP growth in Q3 FY2024, with the full-year estimate for FY2024 revised upward to 7.6%, according to the Ministry of Statistics and Programme Implementation. Despite global economic headwinds, the nation’s robust industrial and services sectors, fueled by government capital expenditure and rising urban demand, are driving this momentum. However, challenges loom large, particularly in agriculture, where a 0.8% contraction in Q3 due to El Niño-induced monsoon disruptions threatens food inflation and rural demand. As the 1 Finance Macroeconomic Index climbs to 69.1 in March 2024, signalling sustained economic activity, this quarterly update delves into the key trends shaping India’s macroeconomic outlook for January-March 2024. From persistent inflationary pressures to buoyant equity markets and strong forex reserves, explore the forces defining India’s economic trajectory.

Key Takeaways

- India’s economy grew by 8.4% YoY in Q3 FY2024, with FY2024 projected at 7.6%, driven by strong industrial (10.4%) and services (7.0%) sectors.

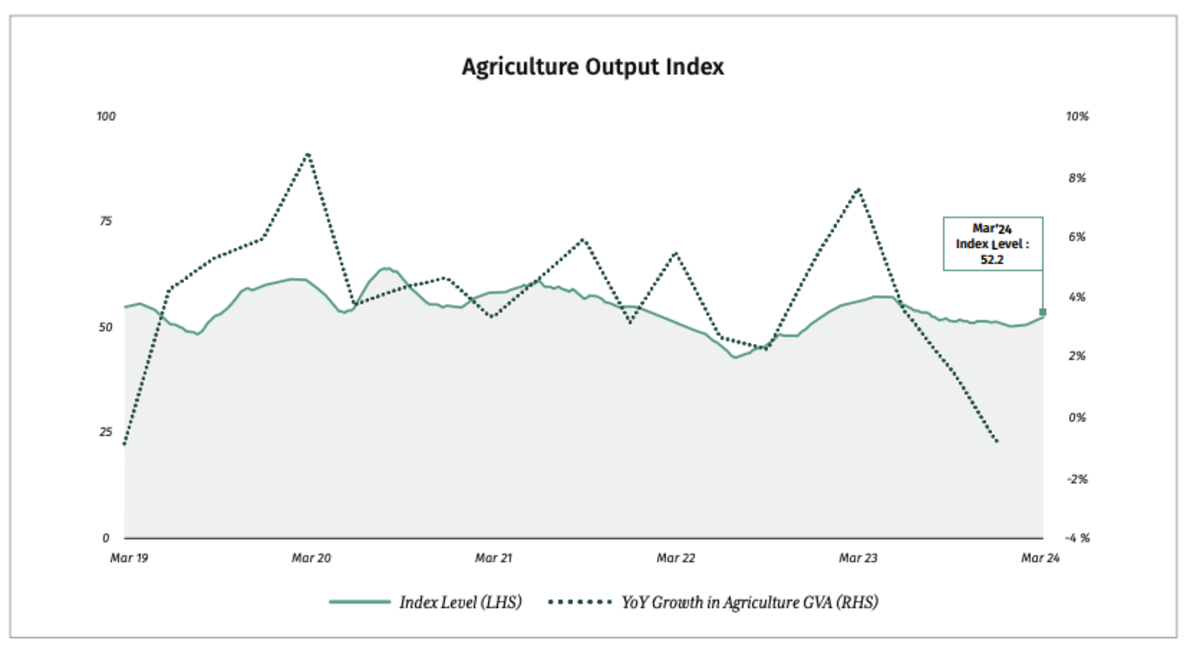

- A 0.8% contraction in Agri GVA in Q3, with food grain production down 6.17% YoY, raises concerns about food inflation (8.5% in March 2024) and weak rural demand.

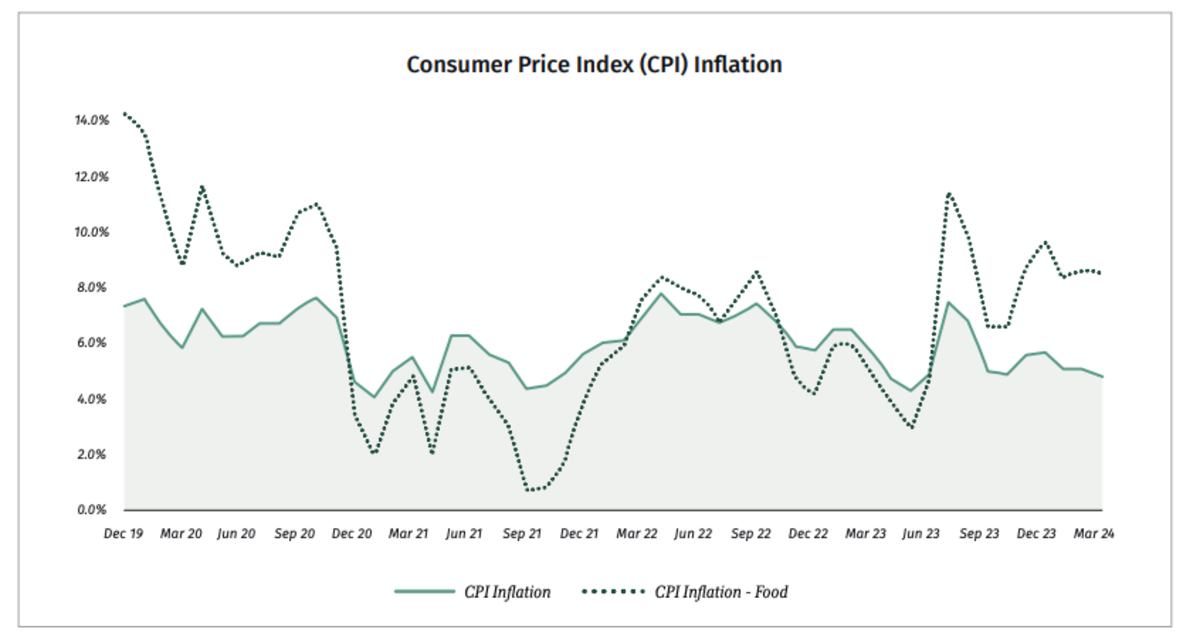

- CPI inflation eased to 4.9% in March 2024, but high food inflation and rising crude oil prices ($88.5/barrel) pose upside risks for FY2025.

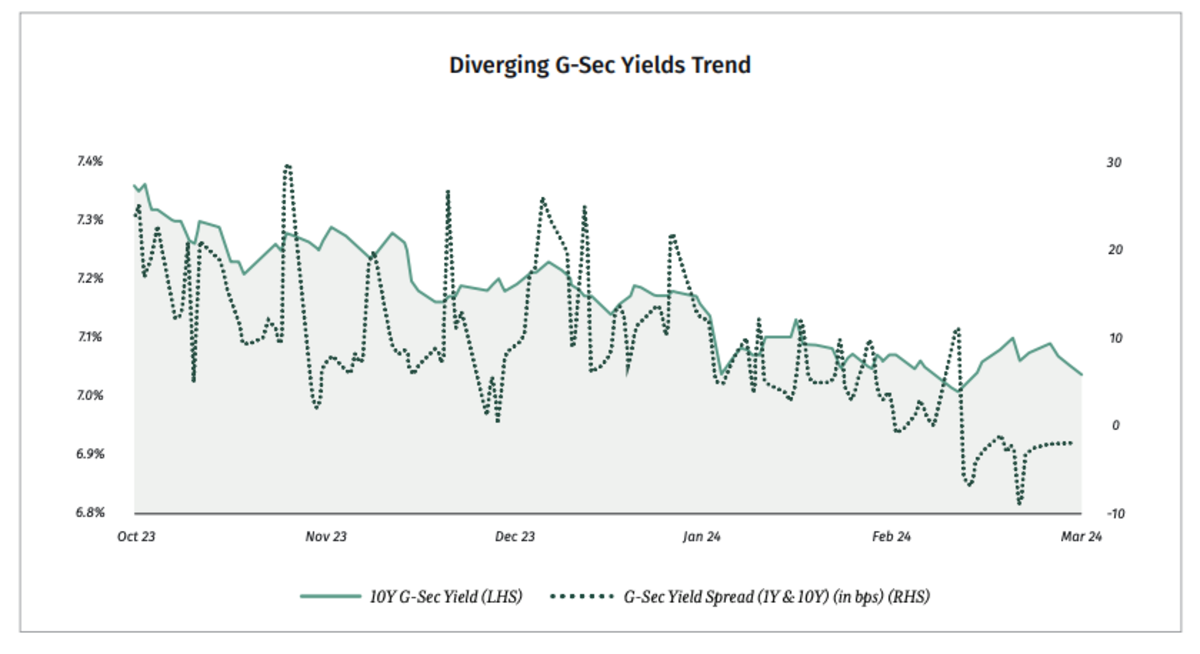

- The RBI’s repo rate remains at 6.5%, with no immediate cuts expected due to inflation above the 4% target, keeping borrowing costs elevated.

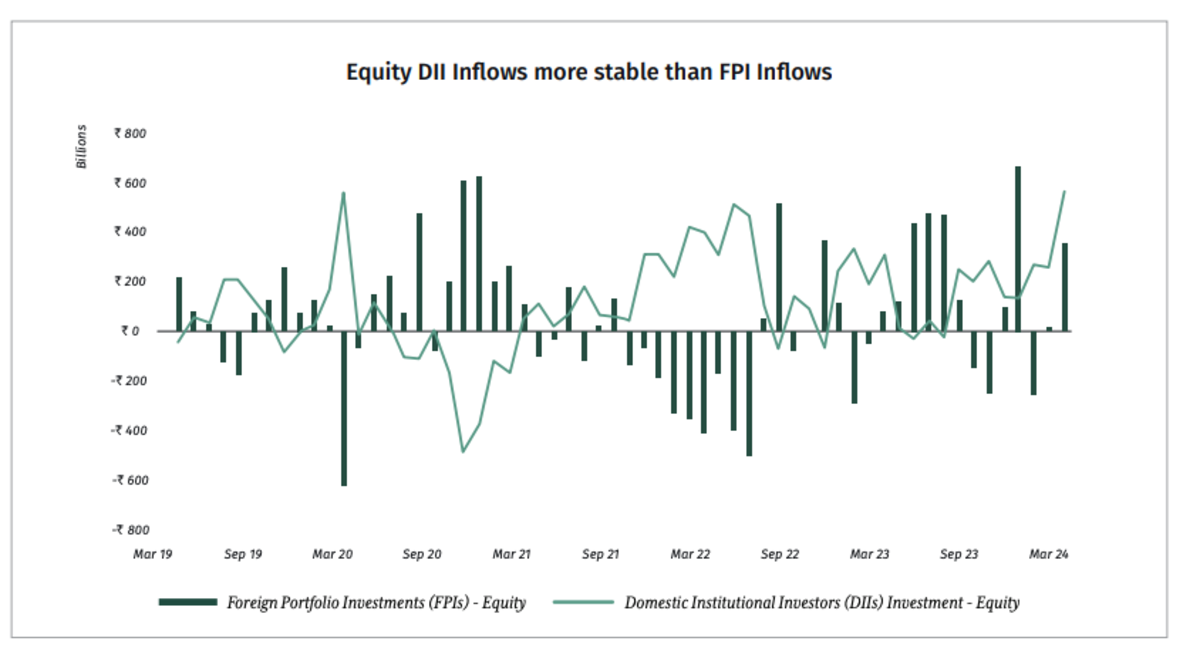

- Nifty 50 gained 2.7% in Q4FY2024, with FPI inflows of ₹108.9 billion and domestic AUM in equities up 54.83% YoY, though short-term volatility may persist.

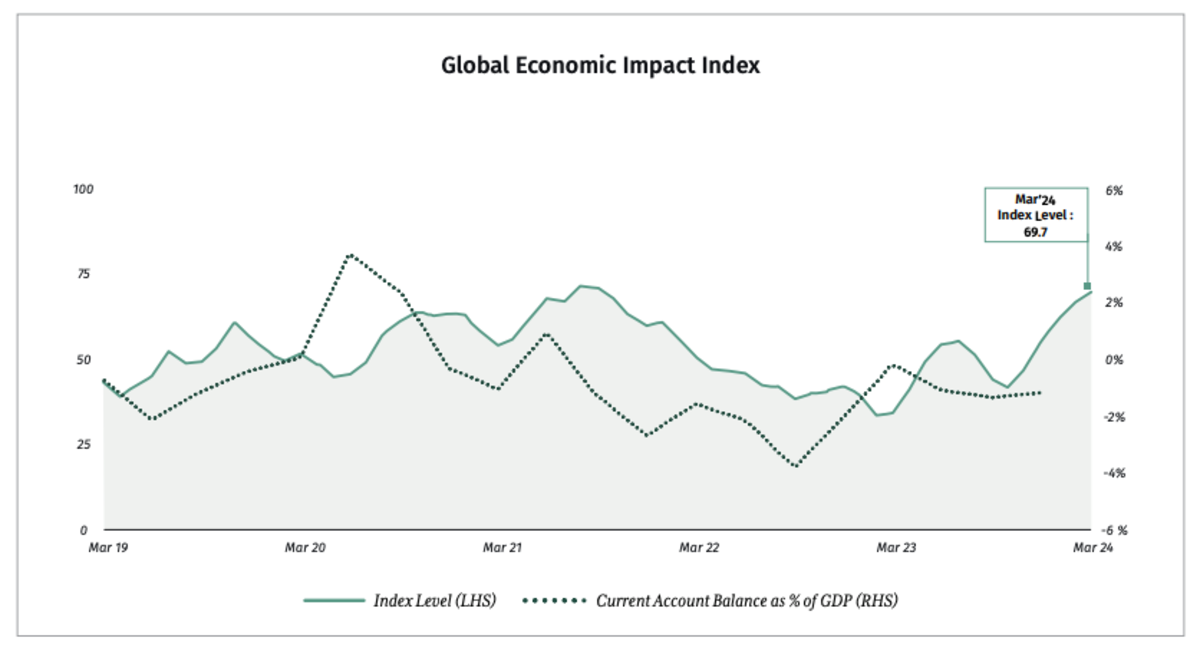

- Forex reserves reached $645.6 billion, providing a buffer against global uncertainties, while the INR depreciated slightly to ₹83.4/$ by March 2024.

India’s Macroeconomic Summary

| Economic Landscape | Recent Updates | Near-term Outlook |

| Indian Economy |

|

Steady domestic demand, progress in global outlook and stability in market sentiments signal better economic prospects; however, a drop in Agri output raise s food inflationary concerns and may result in weak rural consumption demand. The chances of higher interest rates in the economy for an extended period are likely due to sticky retail inflation, which could dent the progress in the economic recovery. |

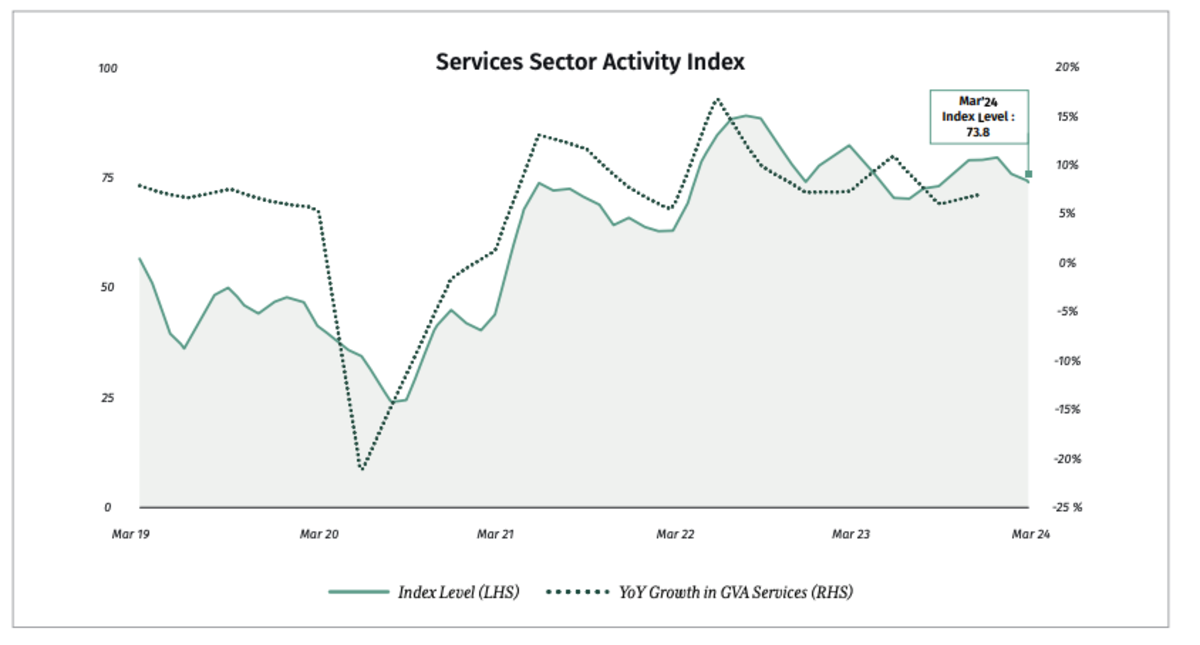

| Services Sector Activity |

|

Recovery in global demand and upbeat domestic business conditions, supported by government capex, are expected to drive the services sector activity in the near term. |

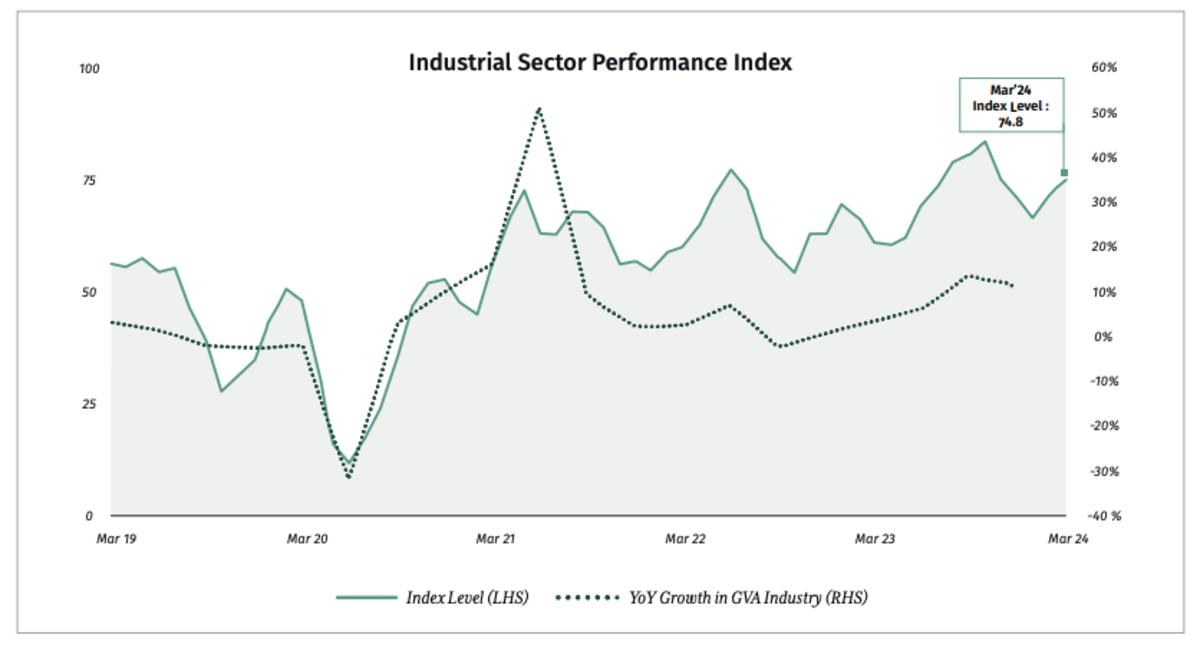

| Industrial Sector Performance |

|

Rising consumer demand for manufactured goods is expected to increase production and investment activity, which is likely to provide business expansion opportunities for industries. Demand for manufacturing exports is likely to pick up in the coming months on the back of improving global demand. |

| Agriculture Output |

|

Growth in Agri GVA for FY2024 is expected to be 0.7% Y0Y compared to 4.7% in FY2023. Rabi output is likely to moderate in line with the Kharif season. Anticipated lower food grain production in FY2024 is likely to result in food inflationary concerns and dampen the rural demand. |

| Consumer Price Index (CPI) Inflation |

|

Steady domestic demand, volatile commodity prices both on the global and domestic front, and the projection of lower agricultural output, are likely to induce upside risk to the inflation outlook in FY2025. |

| Equity Market Outlook |

|

Domestic investors' confidence remains intact to support market valuation, and foreign investments are also likely to hold up amid easing global economic challenges. Domestic political environment and growth prospects add to the market optimism. |

| Global Economic Impact |

|

Subsiding global challenges lowers the risk of fluctuations in domestic exchange rates, global commodity prices and trade. Inclusion of India in the global debt indices supports FPI inflows. Further, the accumulation of strong forex reserves strengthens India's ability to withstand any potential global adversities. |

| Financial Sector Soundness |

|

Credit growth is expected to remain strong due to rising investment activities by businesses. Improving banking system liquidity and potential delay in repo rate cut is likely to keep the borrowing costs higher for an extended period, which is likely to limit the credit growth in FY2025. |

| Interest Rate Outlook |

|

The rising trend in short-term yields with CPI inflation still above the RBI’s median target of 4% limits the prospect of an immediate rate cut. Repo rate, which is at 6.5% since February 2023, is likely to continue for another quarter. |

Recommended for you

Readers also explored

Growth Momentum Moderates Amid Economic Shifts

World GDP Breakdown 2025: Who Powers the Global Economy?

India's Growth Outlook Remains Optimistic Amidst Uncertainties

India's economy has shown exceptional resilience, achieving an impressive 8.4% year-on-year (YoY) growth in the third quarter of FY2024, despite the global economic slowdown and inflationary pressures. This strong performance has led the government to revise its full-year GDP growth estimate for FY2024 to 7.6%, up from the previous projection of 7.3%.

The industrial and services sectors were the primary drivers of growth in Q3, expanding by 10.4% and 7.0%, respectively. The manufacturing sector experienced a significant surge of 11.6%, while construction activities grew by 9.5%. In contrast, the agriculture sector contracted by 0.8% in Q3 due to an uneven monsoon caused by El Niño, leading to a decline in Kharif output.

Despite the setback in the agriculture sector, the overall impact on the Indian economy remained positive, as reflected by the 1 Finance Macroeconomic Index (1FMI). The index increased from 66.0 in September 2023 to 68.2 in December 2023, and the latest reading of 69.1 in March 2024 indicates further improvement in economic activity in the fourth quarter of FY2024.

The government's emphasis on capital expenditure, especially in infrastructure sectors like highways, railways, and defence, has been a significant growth driver in recent years. The central government's annual capex has increased at a CAGR of 30.6% over the past three years, from ₹4.26 trillion in FY21 to ₹9.5 trillion in FY24. However, the interim budget for FY2025 suggests that the government will prioritise fiscal consolidation in the coming year.

Despite the strong economic growth, challenges remain. The divergence in sectoral growth rates, with agriculture expected to grow by only 0.7% in FY2024 compared to 4.7% in FY2023, highlights the need for measures to support the rural economy. Moreover, the anticipated moderation in government spending in FY2025 could potentially hinder growth momentum in the manufacturing and services sectors.

Domestic and Global Factors Impact Inflation

India's inflation story presents a mixed picture, with CPI inflation moderating to a ten-month low of 4.9% in March 2024 from 5.1% in February 2024. However, food inflation remains a key concern, staying high at 8.5% in March 2024. The rise in prices of essential commodities like rice, arhar dal, onion and potato has been a major contributor to this elevated food inflation.

The anticipated lower agricultural output in FY2024 (-6.2% YoY) due to erratic monsoon patterns is likely to exert further pressure on food prices. Moreover, the resurgence of global commodity prices, particularly crude oil ($88.5/barrel as of 25 April 2024), further complicates the inflation landscape.

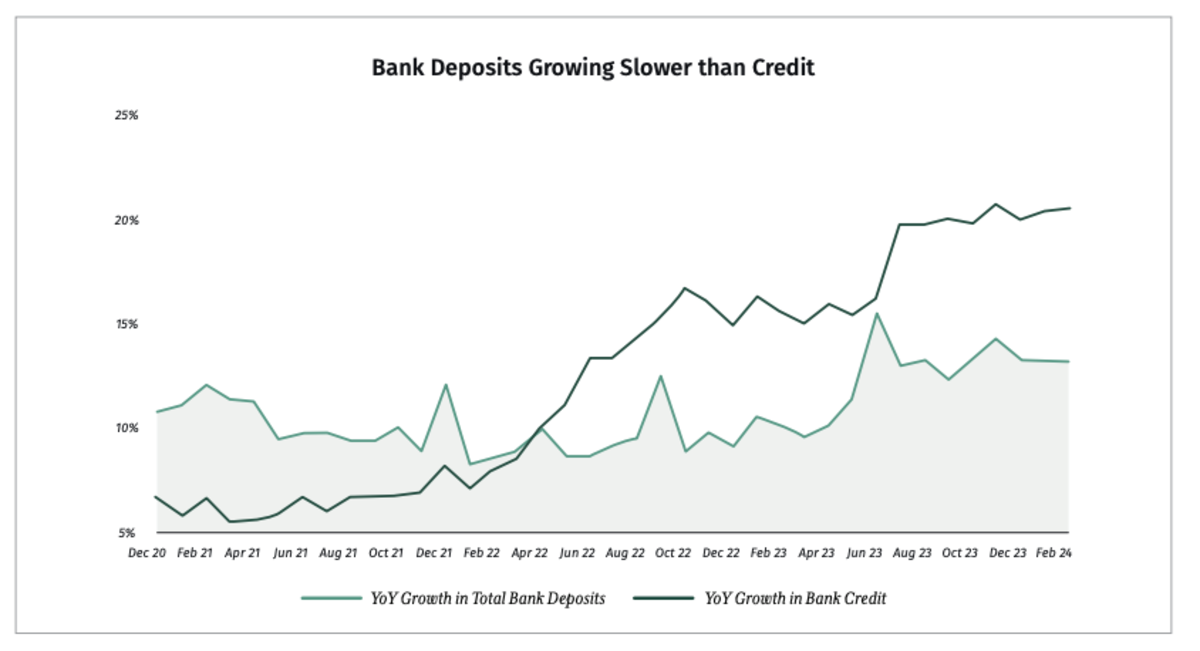

Despite these pressures, the Indian economy has exhibited robust credit demand (non-food credit growth at 20.2% YoY in March 2024), money supply growth (M3 up by 11.2% YoY) and economic momentum (monthly GST collections up by 11.5% YoY).

Inflation Outlook Limits Immediate Policy Easing

The RBI has kept the repo rate unchanged at 6.5% since February 2023, keeping overall borrowing costs elevated. Despite surplus banking system liquidity in March 2024, the diverging movements in yields for different maturities signal uncertainty and a potential delay in policy rate cuts in FY2025. Yields on 1-year to 7-year G-sec increased in the range of 3 to 5 basis points (bps) in March 2024, while the spread between 1-year and 10-year G-sec yield turned negative (-2 bps), resulting in a slight inversion in the yield curve.

The RBI's primary focus remains on achieving its inflation target of 4% in the near term. While CPI inflation eased to 4.9% YoY in March 2024 from 5.0% in February 2024, food inflation remained high at 8.5%. The near-term inflation outlook remains uncertain, with upbeat domestic demand, volatile food prices and potential supply-side shocks posing significant risks.

The government's proposed fiscal deficit target of 5.1% for FY2025 in the interim budget (down from 5.8% in FY2024) and lower budgeted borrowing (2.8% YoY) should help to rein in demand-side inflationary pressures.

Services Sector Momentum Persists with Robust Indicators

The services sector continued its upward trajectory, expanding by 7.0% in Q3FY2024. This growth was underpinned by robust credit demand, which surged by 24.0% YoY in February 2024, and a strong Services Purchasing Managers' Index (PMI), which registered at 61.2 in March 2024.

The sector's vitality was further evidenced by significant growth in international passenger traffic by 19.3% YoY and moderate increases in railway freight (9.0%), domestic passenger traffic (5.8%) and port cargo traffic (2.1%). However, a 20.0% decline in national electronic toll collection indicated a slowdown in road transport across the country.

Employment trends also reflected positive momentum, with the Employees' Provident Fund Organisation (EPFO) recording a 23.2% increase in net member additions during February 2024.

Industrial Sector Growth Driven by Domestic and Global Demand

The industrial sector witnessed robust growth, with the PMI reaching its highest level since 2008 at 59.1 in March 2024, fueled by significant increases in sales, production and new orders.

Credit demand remained strong across all industrial segments, particularly micro & small (14.7% YoY), medium (12.5%) and large (7.1%) in February 2024. Additionally, exports of manufactured goods, which account for a quarter of India's total merchandise exports, showed a recovery in February 2024, increasing by 16.0% YoY.

However, the sector faced rising wholesale prices, as evidenced by the increase in WPI manufacturing inflation from 3.0% in November 2023 to 3.5% in March 2024.

Agri Sector Weathers Erratic Monsoon and Falling Foodgrain Production

The agriculture sector encountered significant headwinds, primarily due to an erratic and below-normal Southwest monsoon (94.4% of Long Period Average) in 2023, influenced by El Niño. This adverse weather led to a 4.6% YoY decline in Kharif output for FY2024.

The second advance estimates for 2023-24 projected that total foodgrain production would fall short of the annual target by 6.8%. Additionally, tractor sales, closely associated with farming activities, continued to decline sharply in March 2024 by 19.5% YoY. Rural CPI food inflation also rose to 7.4% YoY in March 2024, indicating increasing price pressures at the retail level.

Equity Market Attracts Substantial FPI Inflows

The Nifty 50 index returned 2.7% in the fourth quarter of FY2024, outperforming other emerging markets, ending the quarter at a PE ratio of 22.9.

Foreign Portfolio Investors (FPIs), who were net sellers in January 2024, made a strong comeback in February and March 2024, investing a total of ₹108.9 billion in the Indian equity market during the quarter. Domestic investors remained bullish, evident from rising Assets Under Management (AUM) in equities (54.83% YoY as of March 2024-end) and net equity purchases (₹1,084.3 billion in the fourth quarter of FY2024) by Domestic Institutional Investors (DIIs).

However, short-term volatility is expected to persist, driven by fluctuating FPI flows, geopolitical tensions and the 2024 Lok Sabha elections. Despite these challenges, the market's fundamentals remain strong, bolstered by robust corporate earnings and a growing domestic investor base, which is poised to provide stability in the long run.

Banks Manage Credit Growth and Liquidity Challenges

The credit flow to the economy remained strong in March 2024, with services (24.0% YoY growth), personal loans (28.3%) and industries (9.1%) reflecting broad-based demand. The bank credit deposit ratio rose to its highest level since March 2019 of 78.1% (as of 22 March 2024), as gross bank credit grew at 20.2% YoY while deposit growth lagged at 13.5%.

The banking system's liquidity improved as well, with net durable liquidity surplus amounting to ₹2,360 billion as of 22 March 2024, compared to ₹1,639 billion on 23 February 2024, due to increased government spending and the maturity of the RBI's USD-INR sell-buy swap.

Looking ahead, the persistent lag in deposit growth compared to credit growth is expected to keep the banking system liquidity tight. However, improving liquidity conditions may ease borrowing costs, offsetting the impact of delayed rate cuts by the RBI.

Strong Forex Reserves Provide Cushion to External Shocks

India's merchandise exports (0.6% YoY) and imports (-6.0%) growth slid in March 2024 after recovering in February 2024 (11.9% and 12.2% YoY, respectively).

The rupee-dollar exchange rate remained relatively stable, depreciating only slightly to ₹83.4 per US dollar by March-end, supported by forex market interventions by the RBI. However, the resurgence of geopolitical challenges may lead to instability in global economic indicators in the near term, impacting trade and foreign investments and keeping global commodity prices volatile.

Despite these challenges, India's substantial foreign exchange reserves, which increased by $2.7 billion in a month to reach $645.6 billion by March-end, are adequate for covering 11.3 months of imports and offer a robust cushion against potential external headwinds.

Conclusion

India's growth story is not without its nuances. While the services sector continues to flourish, the manufacturing sector's performance has been mixed. Agriculture, a critical component of the economy, has faced headwinds due to erratic monsoons and lower output. Addressing these sectoral disparities and supporting rural incomes will be crucial for sustaining broad-based growth.

India's economic fundamentals remain strong, with a stable financial sector, comfortable foreign exchange reserves and a manageable current account deficit. The government's emphasis on structural reforms, infrastructure development and fiscal consolidation is expected to enhance the economy's competitiveness and attract foreign investments.

As India steers its path ahead, it must focus on inclusive growth, job creation and skill development. Encouraging private investment, fostering innovation and leveraging its demographic dividend will be key to unlocking the economy's full potential.

The road ahead is not without challenges, with global uncertainties, geopolitical tensions and climate-related risks looming large. However, India's economic resilience, coupled with prudent policies and a vibrant entrepreneurial spirit, positions the country to weather these headwinds and emerge stronger.

In conclusion, India's economic story in FY2024 and beyond is one of resilience, reforms and resurgence. By addressing sectoral imbalances, fostering inclusive growth and leveraging its inherent strengths, India is poised to chart a path of sustainable economic development, cementing its position as a global economic powerhouse.