Introduction

Is India building a clearer growth path? Absolutely. With the Reserve Bank of India making bold moves to manage liquidity and promote expansion, along with rapidly cooling inflation, the foundational elements for a powerful economic advance are firmly in place. In this edition, we explore the significant shifts and opportunities emerging in the Indian market.

Economic Growth Accelerates

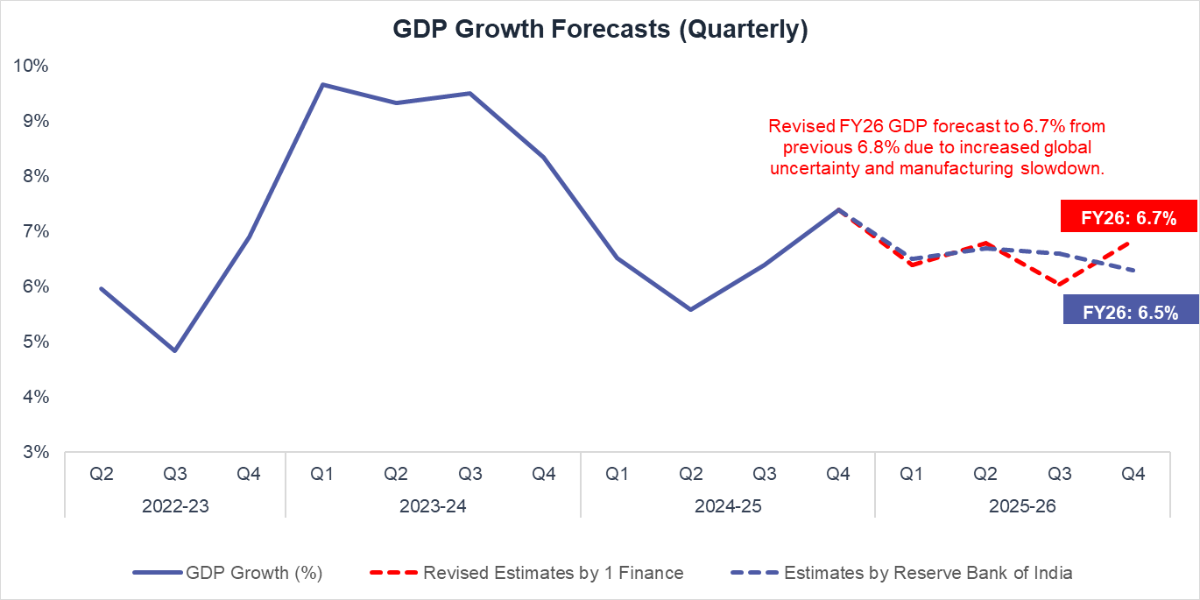

India’s real GDP growth rose to 7.4% in Q4 FY24-25, up from 6.4% in Q3. The full-year GDP growth rate came in at 6.5%, indicating a solid overall performance.

| Period | Key Growth Drivers | Comment |

| Latest Quarter |

| Helped GDP reach a 4-quarter high. |

| Last Financial Year |

| Growth sustained despite weak manufacturing and subdued private sector investment. |

| Outlook Ahead |

| 1 Finance forecasts FY26 GDP growth at 6.7%. |

According to the World Bank, India is set to remain the fastest-growing major economy, supported by strong fundamentals, despite ongoing global trade pressures. The RBI Governor Malhotra stated, “We have won the war against inflation… but there is scope to push the GDP rate further,” signalling a clear policy shift towards growth.

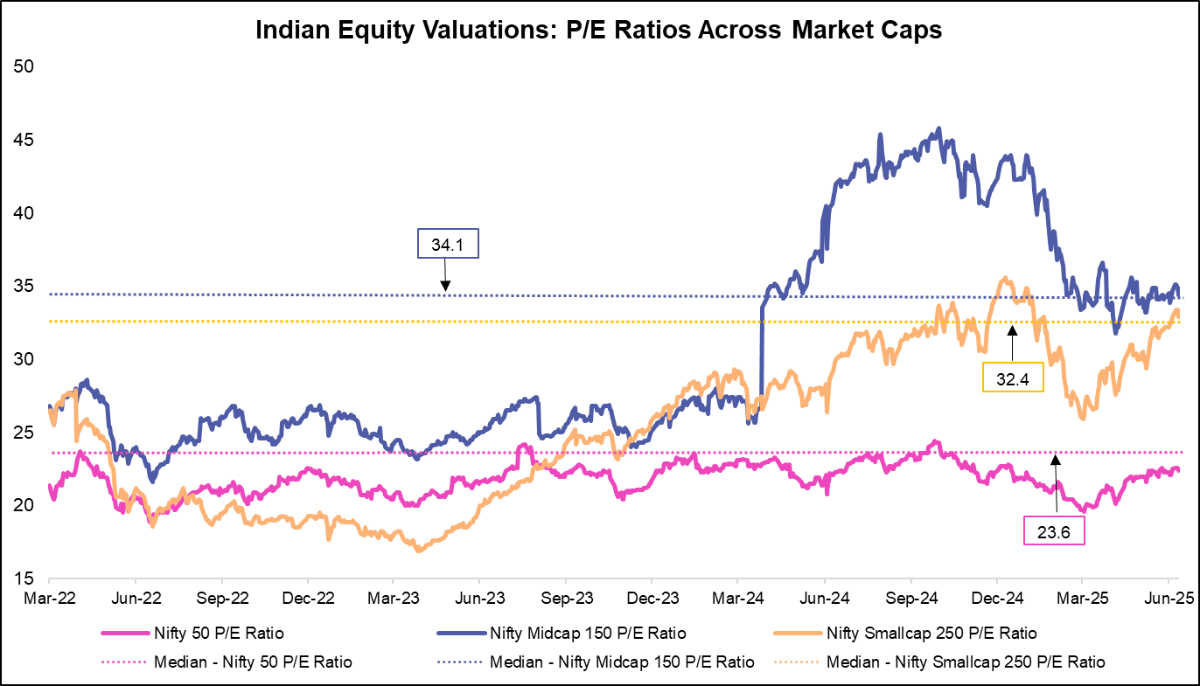

Equity Valuations Converging to Historical Norms

The significant valuation premium previously observed in mid and small-cap segments has largely narrowed. All three market capitalisation categories are now trading very close to their respective long-term median P/E ratios.

Note: Median P/E Ratios are calculated based on the last 10 years of data.

Large caps remain the most stable from a valuation perspective; mid and small caps are no longer extremely stretched. With valuations converging, this may be an opportune time to rebalance across market caps in line with long-term objectives.

Recommended for you

Readers also explored

RBI’s Repo Rate and CRR Cut- What it Means For You in 2025

World GDP Breakdown 2025: Who Powers the Global Economy?

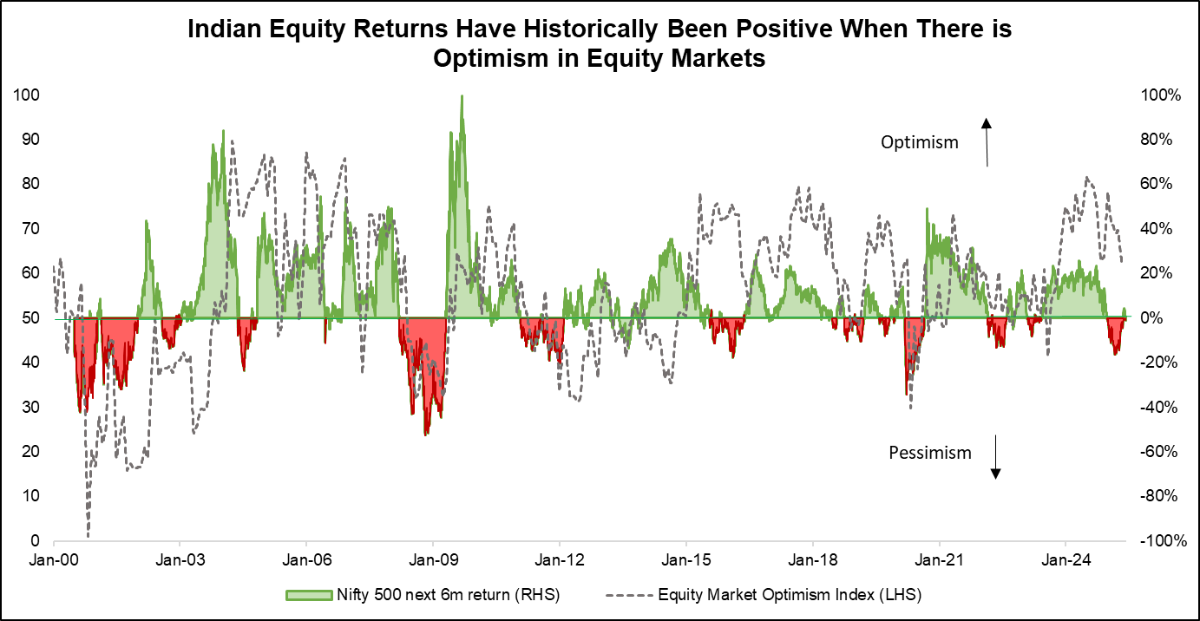

The Equity Market Optimism Index: Charting Its Historical Link to Indian Equities

The Equity Market Optimism Index has edged lower recently, hinting at some caution building in the market. In the past, rising optimism has often led to better returns, but with global uncertainty in the mix, it’s a good time for investors to stay cautious and selective.

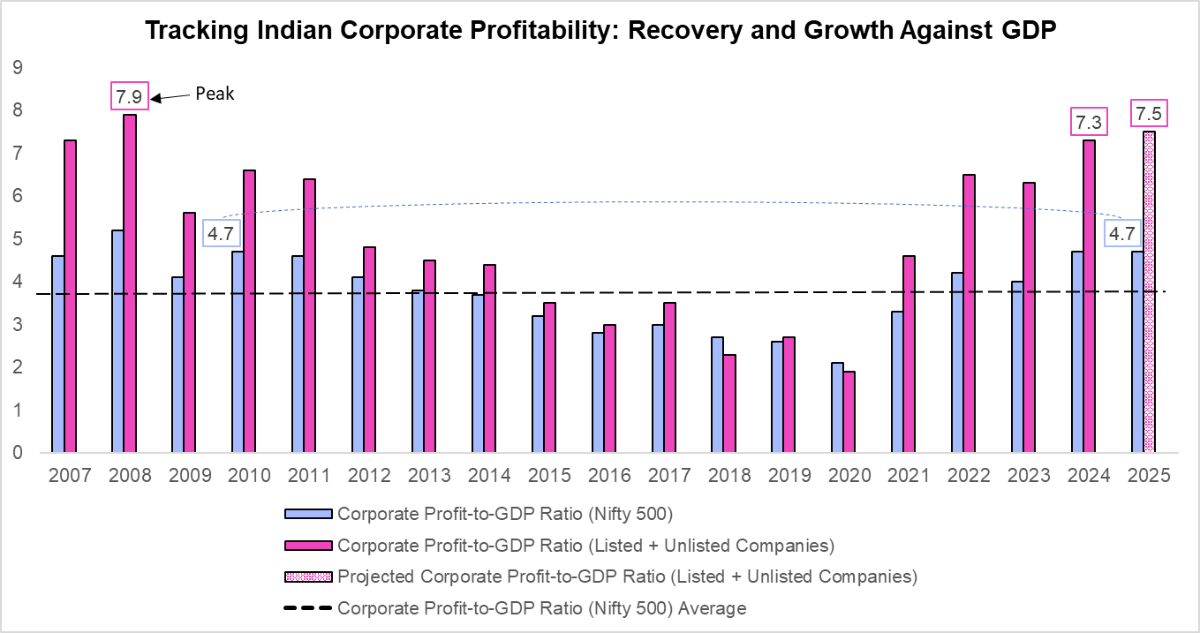

Indian Corporate Profits: Nearing Peak Levels

Corporate profits remain strong, with the Nifty 500 profit-to-GDP ratio strong at 4.7% in 2025, equal to 2010 highs. Including unlisted firms, profits reached 7.3% of GDP in 2024 and are set to rise further. This signals a sustained earnings upcycle that began in 2020 and is expected to continue.

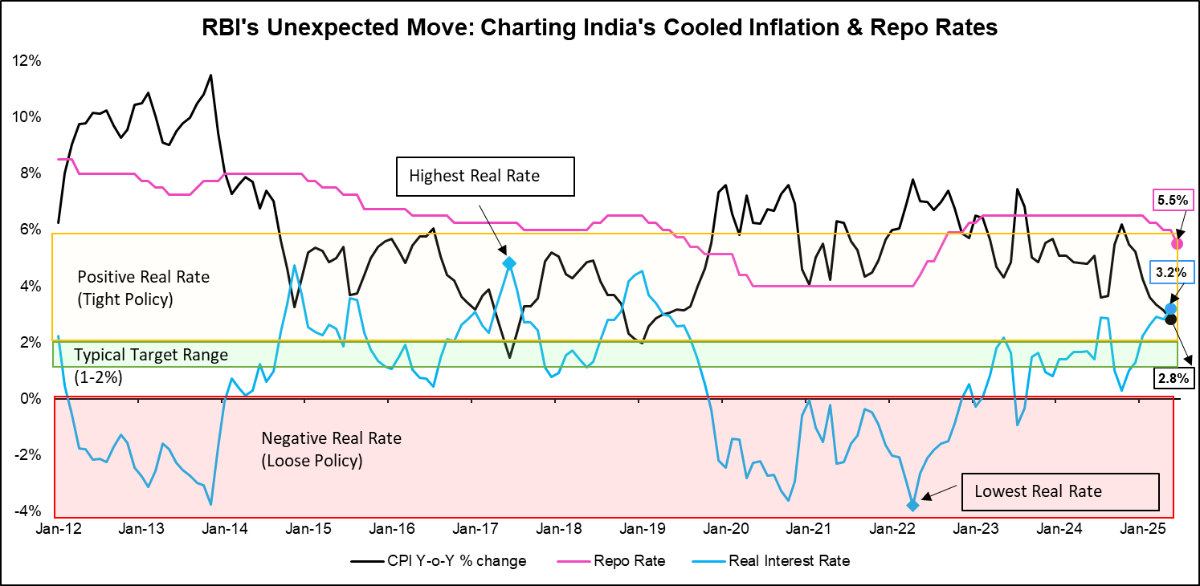

The Surprise Rate Cut: Triggered by Falling Inflation and Liquidity Infusion

In June, the RBI surprised markets with a 50 bps repo rate cut and a 100 bps CRR cut, shifting its policy stance to Neutral, signalling a likely pause after front-loaded easing. Banking system liquidity remains in surplus, with the LAF balance at ₹2.9 trillion as of June. The phased CRR cut is expected to inject an additional ₹2.5 trillion in primary liquidity by December 2025, supporting credit growth.

With May inflation at a six-year low of 2.8%, lending rates have begun falling, easing EMIs (Read more in our previous blog here).

| Scenario | Likelihood | Rationale |

| Rate Hike | Very Low ⬇️ | Inflation is below target, growth risks persist, and real rates are positive and near their target range. |

| Rate Pause | High ⬆️ | After substantial rate cuts and liquidity support, the RBI is likely to hold and assess. A further 25 bps cut is possible in FY26. |

| Rate Cut | Very Low ⬇️ | An immediate rate cut is only possible if inflation falls below 2% or growth needs support. |

Conclusion

| Theme | Key Insight |

| Equity | Lower rates and stable inflation may favour equities. Continue SIPs, stay diversified, and be mindful of food inflation risks. |

| Global uncertainty | Trade tensions and geopolitical risks remain—balance with gold and keep 3–6 months of liquid reserves. |

| Corporate Profits | Nifty 500 profit-to-GDP at 4.7% in 2025 signals healthy earnings in the listed space. |

| Valuations & Market Sentiment | Mid- and small-cap valuations have eased. Markets are now near long-term median valuations with positive sentiment. |

| Debt | Debt funds are benefiting from the surprise rate cut and stand to gain further as global conditions stabilise. Moreover, falling yields and potential RBI cuts in FY26 offer medium-term benefits. |

With inflation now managed and interest rates easing, India’s economy is gaining momentum. This is a key moment for investors to lean into long-term strategies, optimise borrowings, and stay diversified. The RBI’s shift signals that growth is now front and centre- make sure your strategy reflects it.