Understanding Market Volatility

Volatility refers to the degree of fluctuation in prices during a certain timeframe. Stock market volatility represents the level of risk and uncertainty in the markets, reflecting the unpredictability in both the magnitude and direction of the stock's price movements. Higher volatility implies more significant variations in stock prices, whereas lower volatility indicates more stable and predictable market conditions.

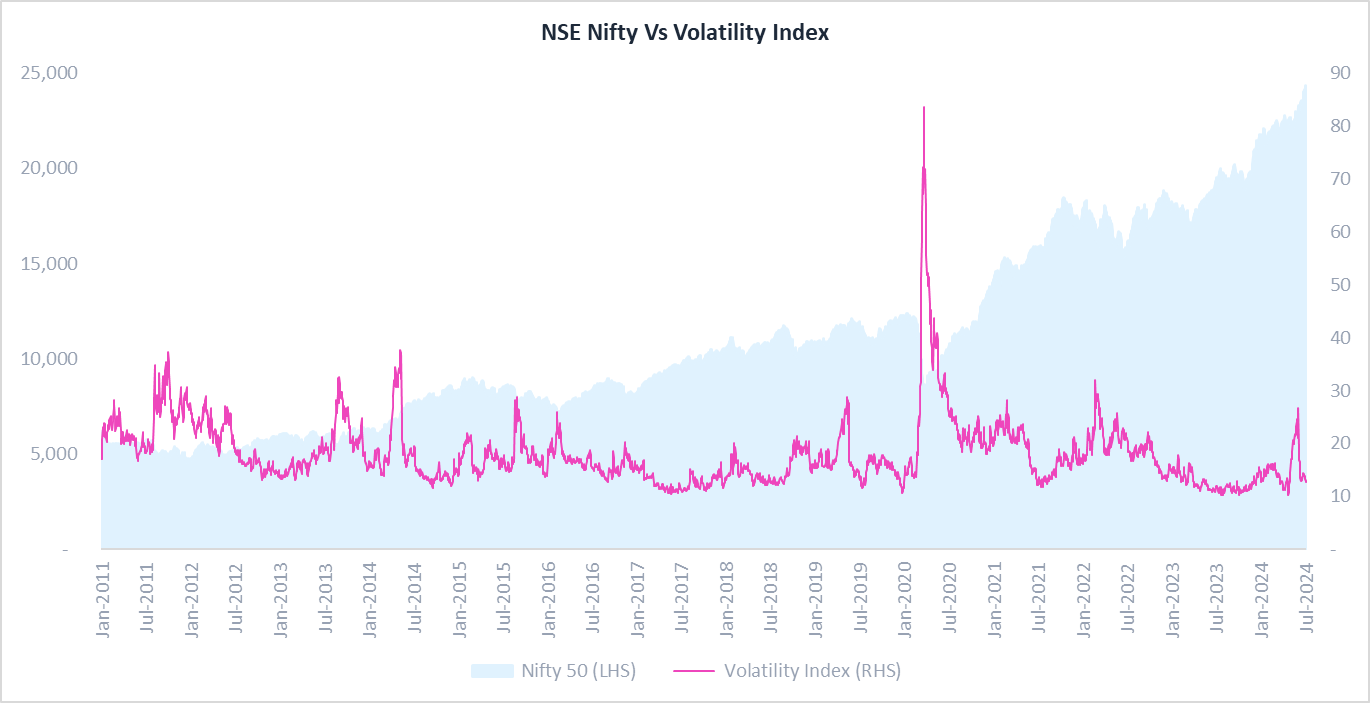

Volatility is typically measured using either standard deviation or variance of the returns of a stock or index over a specific period. For individual stocks, beta measures a stock's historical volatility relative to a benchmark index like the NSE Nifty 50. A beta over 1 means the stock is more volatile than the index. For the overall Indian stock market, the India VIX gauges market volatility based on the Nifty 50 index option prices, which indicates the expected market volatility over the next 30 calendar days.

While volatility is often perceived as a risk due to the potential for significant price fluctuations, it can also present strategic buying and selling opportunities for astute investors to capitalise on market inefficiencies and enhance their long-term investment results. In this blog, we explore how to successfully sail through market volatility and the recommended investment approach to mitigate substantial financial losses and relinquish potential opportunities.

Historical Events Causing High Volatility

Volatility can be caused by various factors, including risk associated with the changes in the political climate, the government’s fiscal and monetary policy decisions, geopolitical events, economic data releases, financial crises, and industry or company-specific news such as corporate results signifying potential business risk, etc. For instance, investors typically respond favourably when the economy is expanding, gathering data on GDP growth or rising consumer expenditure. But, when the GDP growth falls reflecting that the economy is weakening, investors lose confidence and this might lead to a spike in market volatility.

Following are some of the major historical events, when Indian stock markets have experienced high volatility:

- The Russia-Ukraine War (February 2022): Russia's military invasion of Ukraine on February 24, 2022, created significant geopolitical conflict sparking widespread international concern and economic repercussions. The conflict introduced heightened uncertainty among global investors and the India VIX increased by 14.27 points from its closing low of 17.71 on February 10 to 31.98 on February 24, 2022, after peaking to 33.97 points level during intraday trade. Concurrently, the NSE Nifty 50 index plummeted by 1,358 points during the same review period, reflecting the increased pessimism and risk aversion in the market.

- The COVID-19 pandemic and lockdown (March 2020): The severity of the COVID-19 pandemic prompted the Indian government to implement a nationwide lockdown in March 2020, initially for 21 days, followed by subsequent phases. Investor anxiety peaked due to the uncertainties posed by COVID-19 and the lockdown, resulting in one of the highest levels of market volatility. The Nifty 50 index plummeted by 3,400 points from its February level and India VIX reached a high of 86.64 points on March 24, 2020, reflecting the profound impact of the pandemic-induced economic crisis and the announcement of lockdown on financial markets.

- Lok Sabha Elections (2014, 2019 & 2024): Volatility tends to rise in the weeks preceding elections as observed by spikes in the India VIX. Markets often rally going into elections on expectations of the outcome, or see sharp movements and volatility after the election results, especially if there is an unexpected outcome. This pattern repeated in 2014 (VIX reached 39.30 points on 12 May), 2019 (30.18 points on 22 May), and most dramatically in 2024 (31.71 points on 4 June) when the opposition exceeded expectations.

Recommended for you

Readers also explored

Asset Correlation: A Guide to Better Portfolio Diversification

India's IT Sector Outlook for FY2026

Despite short-term volatility, the Nifty 50 has delivered strong returns over the long term. As of June 28, 2024, the NSE Nifty has grown at a CAGR of 15.3%, 12.2%, and 14.9% over the last 5 years, 10 years, and 20 years respectively. Since June 30, 1999, the Nifty 50 index has given annualised returns of 12.8% with annualised volatility of 22.2% as of June 28, 2024. These returns underscore the Indian stock market's ability to weather periods of turbulence and uncertainty. A classic example is that the Nifty 50 had rebounded past 12,000 points in November 2020, fully recovering from COVID-19 lows of 7,610 in March 2020.

Strategies for Managing Risks

One of the most important things for investors to remember during volatile markets is to avoid making hasty, emotion-driven investment decisions. Panic selling, or the sudden and widespread selling of stocks based on fear rather than rational analysis, can be very tempting when markets swing wildly. However, selling into a downturn locks in losses and often causes investors to miss out on the eventual market recovery. Historical trends and research on the Nifty and VIX suggest that market optimism often prevails, but the timing and speed of market recoveries remain uncertain. Therefore, investors are advised to avoid hasty decisions such as withdrawing large sums during market volatility, as it is evident that the markets have rebounded from even the most severe shocks, posting strong long-term gains despite short-term volatility. Investors who stay the course and ride out market declines have a much better chance of achieving long-term financial goals.

A well-thought-out investment plan and the discipline to stick to it is crucial for avoiding impulsive decisions. Your plan should be based on your individual goals, time horizon, and risk tolerance. When volatility strikes, focus on your long-term objectives rather than getting distracted by alarming headlines.

Diversification

Diversification is a risk mitigation technique that reduces exposure to market volatility by investing across several asset classes, industries, and geographies. The goal is to optimise returns by investing in sectors that will provide better and longer-term results.

Some diversification approaches include:

- Avoid concentrated investments: Refrain from investing substantial sums in highly correlated assets. For example, investing heavily in any particular industry or sector could result in a substantial financial loss if a sudden policy change causes a detrimental effect on the sector. Investing in different types of mutual funds within an asset category is preferred.

- Allocating across stocks, bonds, and other asset categories: Invest across stocks, company sizes (large-cap, mid-cap, small-cap), bonds (growth vs value), and alternatives (gold).

Systematic Investing

Another more effective approach is to allocate modest sums of money in different sectors consistently. This may mitigate the likelihood of substantial losses and enable you to acquire equities at a variety of prices, which could result in profits if prices increase after initial purchases at reduced prices. Making consistent, modest investments over time via Systematic Investment Plans (SIPs) can help manage volatility. SIPs leverage rupee cost averaging - buying more units when prices are low and fewer when high. This reduces the impact of short-term fluctuations and the need to time the market. Lump-sum amounts can be invested into debt mutual funds via SIP. , Debt funds are typically considered a safer option and can yield better returns when invested in the long term.

Alternative Investments

Safe-haven assets such as gold are expected to generate stable returns during economic downturns or recessions. Government bonds' high return assurance and low risk make them appealing to safe havens. It is crucial to invest in safe-haven assets in a highly volatile market, as they offer diversification, protection against volatility, and the ability to retain their value, despite the rarity of recessions. For instance, investors received an approximate 20% return during the global financial crisis of 2008-09 as the value of gold increased substantially. Additionally, the high assurance of return and lower risk associated with government bonds make them one of the safer assets that an individual can possess.

Seizing Opportunities in Volatile Markets

Undervalued Assets

High volatility can cause promising securities to trade below their intrinsic value. In times of high volatility, investors seek out stocks that trade for less than their intrinsic values and can acquire these stocks at a discount for significant potential upside when markets rebound, and the stocks revert to their intrinsic values.

Contrarian Investing

The COVID-19 pandemic triggered a wave of panic selling in financial markets, causing the stock prices of many previously profitable companies to plummet. Some investors saw the indiscriminate selling as a rare buying opportunity and bought into hard-hit sectors such as tech, healthcare, and pharma. These contrarian investors made substantial gains as stocks recovered on the back of government stimulus. They recognised that although the short-term economic outlook was grim, well-run companies in these sectors would not only survive but could emerge even stronger after the crisis passed.

Conclusion

Investing in uncertain times has both risks and opportunities. Tools like standard deviation and VIX help investors gauge market sentiment, optimise strategies, and seize the opportunity. By diversifying and targeting undervalued assets, investors can protect their portfolios and harness the profit potential that volatility creates.

For continued risk mitigation, diversification across several asset types is essential, however, it does not eliminate risk or guarantee against losses. Investors need to have a long-term perspective and stay disciplined through market cycles. Avoiding concentrated investing, opting for SIPs, adding safe-haven assets, etc are all ways to lessen the blow of market volatility. But it requires discipline and a steadfast focus on the long-term even in tumultuous markets. The key is a balanced approach that combines proactive opportunity-seeking with prudent risk management.