Buying a home or planning retirement may dominate most financial plans, but there’s one goal silently becoming more expensive: a child’s education.

Education, especially in urban India, has transformed from a basic necessity into a high-cost, long-term investment. And most families don’t realise its impact until it’s too late.

Beyond Tuition Fees: The Silent Surge in Household Education Spending

When we think of education inflation, we think of tuition fees. But zoom out, and a more structural shift is visible: Indian families are choosing to spend more on education.

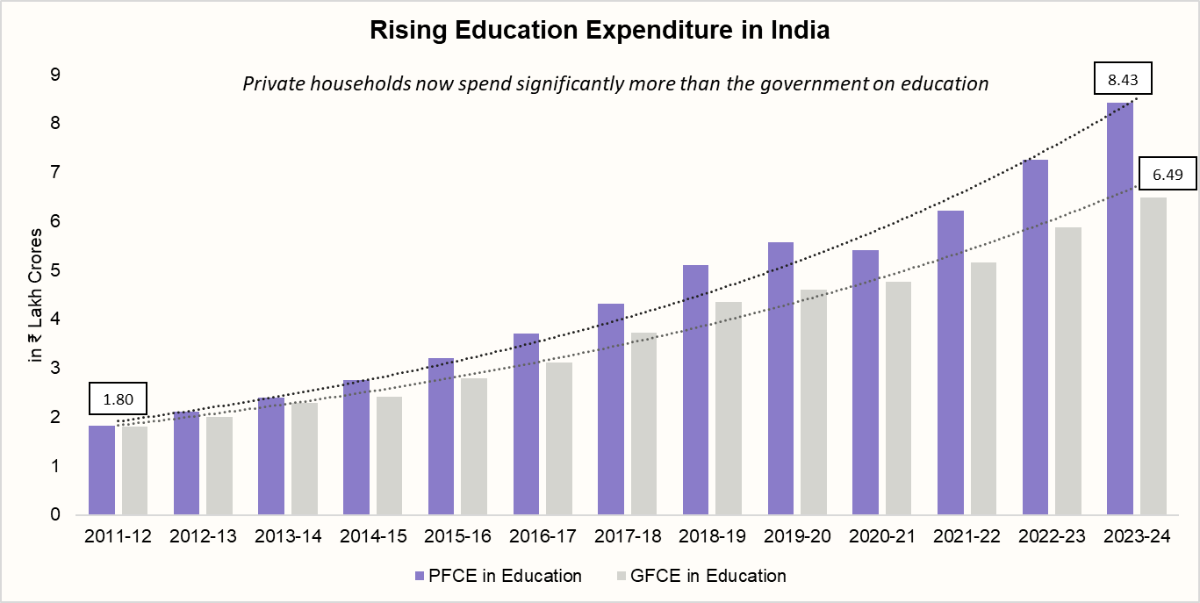

Note: PFCE = Household spending on education (fees, books, coaching, etc.)

GFCE = Government spending on public education (schools, teachers, infrastructure).

According to MoSPI data:

- In FY12, households spent ₹1.8L crore on education.

- By FY24, this soared to ₹8.43L crore — a 4.6x increase in 12 years.

This isn’t just about rising costs. It reflects a behavioural shift. In FY12, education made up 3.1% of total private consumption. By FY24, it rose to 4.1% despite the inflation and job insecurity.

💡 Per capita PFCE on education also rose from ~₹1,500 in FY12 to ₹6,100 in FY26.

Education is no longer just an expense—it’s a non-negotiable investment. One that families are increasingly unwilling to compromise on, regardless of external uncertainties.

The Real Cost of Private Schooling in India

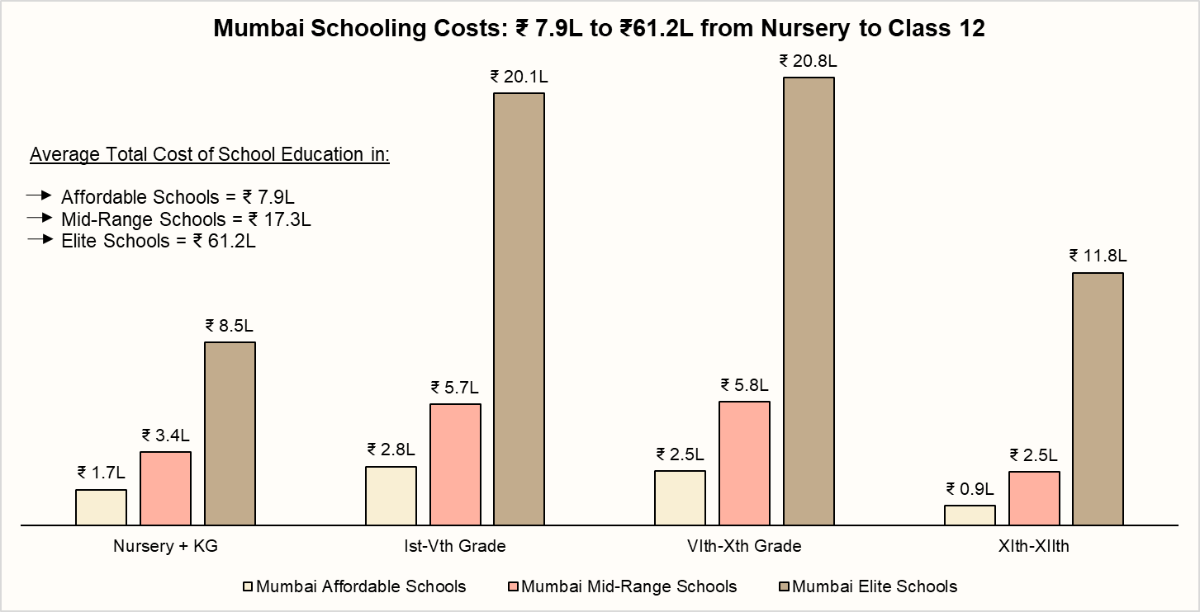

A closer look at fee structures from premium schools across Mumbai, Delhi, Pune, and Hyderabad reveals a harsh truth:

School education alone is now as expensive as an MBA was. In cities like Pune, Hyderabad and Mumbai, 15 years of schooling can cost more than ₹15 lakhs, especially in international or IB boards. And this doesn’t include uniforms, books, and admission fees, just the tuition fees.

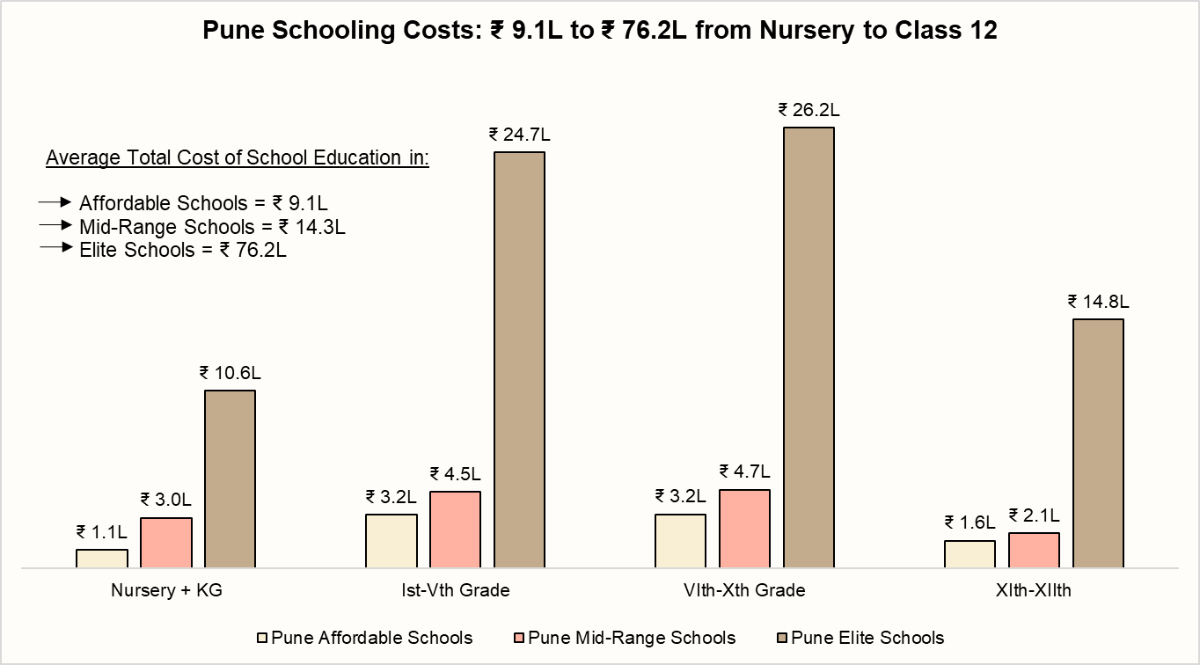

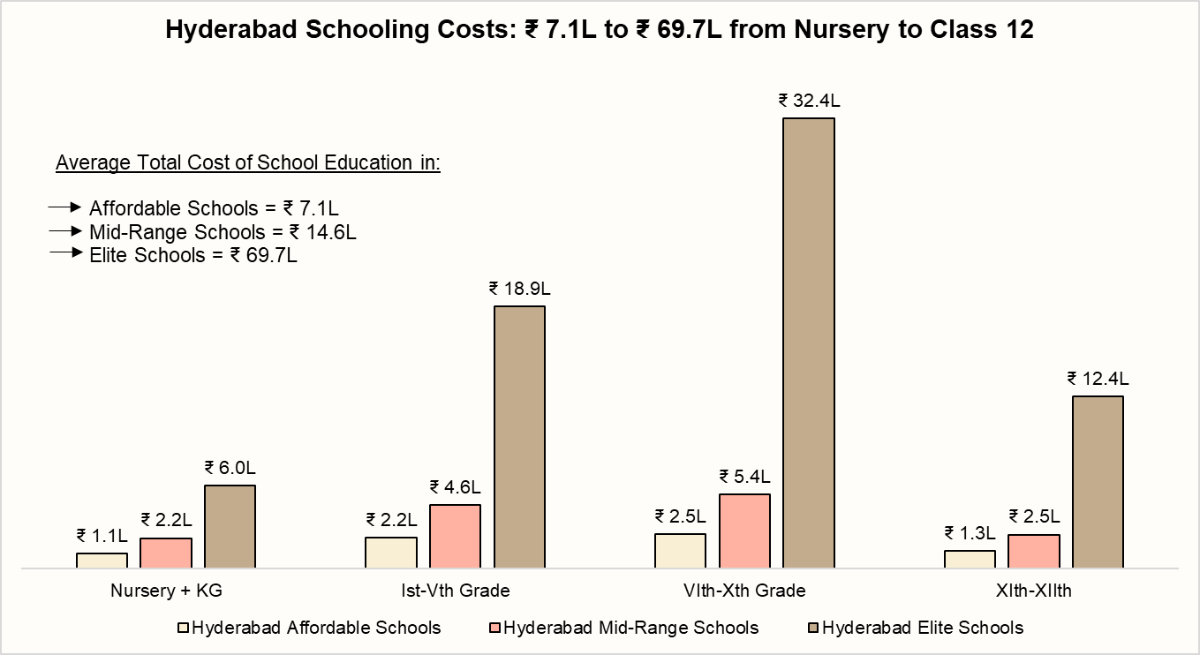

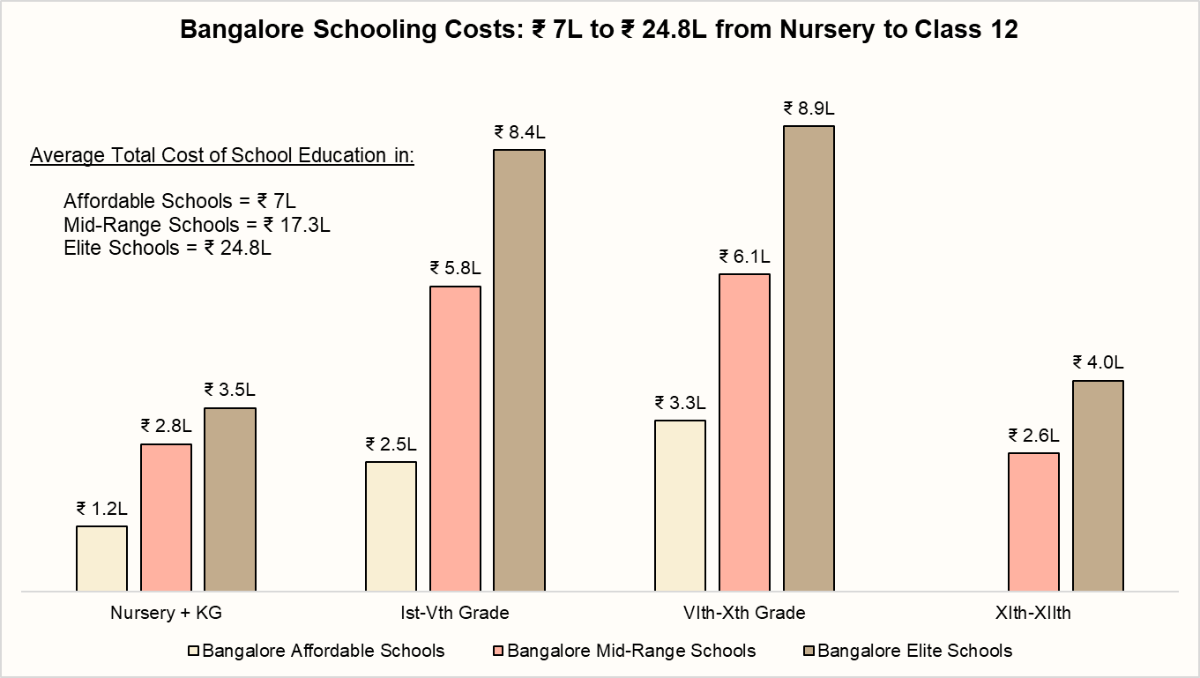

(Note for below graphs: Fee categories—Affordable (<₹10L), Mid-Range (₹10L–₹20L), and Elite (>₹20L)—are based on average total education costs (Nursery to Class XII) for 2025-26, using school data. Excludes transport, uniforms, books, and admission fees.)

➔ Mumbai

Elite school education in Mumbai is nearly 8 times costlier than mid-range schooling. For example, just VIth to Xth Grade education can cost ₹20.8L in elite schools vs ₹2.5L in mid-range ones. Top-tier schools like École Mondiale and Oberoi International drive this premium. Overall, total education costs in Mumbai range from ₹7.9L to ₹61.2L, depending on the school category.

Recommended for you

Readers also explored

FMCG Sector in India: Key Trends and Economic Drivers

World GDP Breakdown 2025: Who Powers the Global Economy?

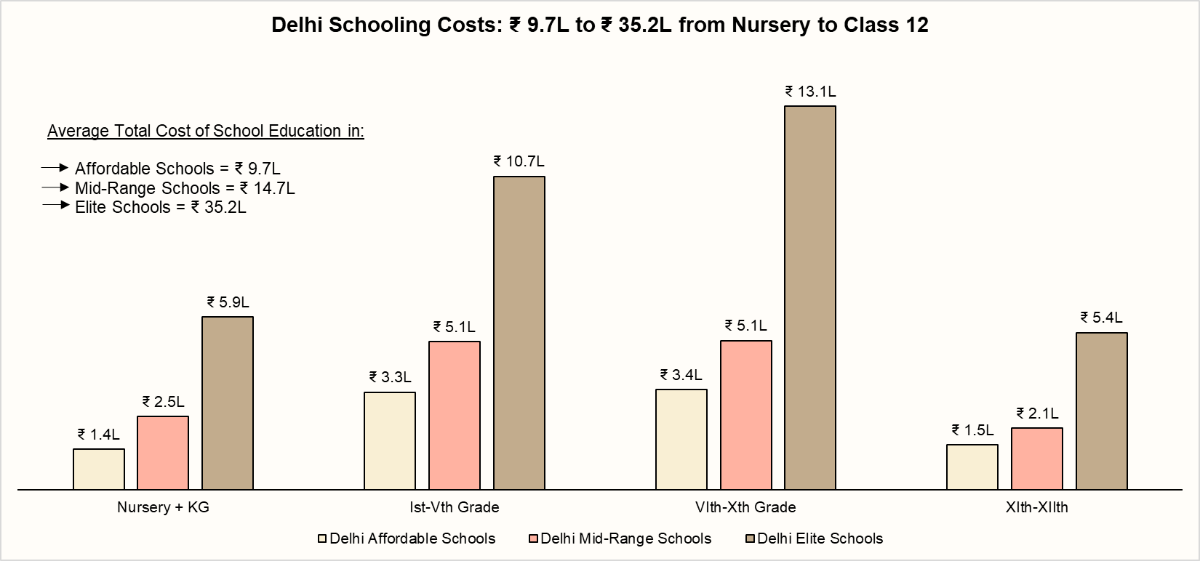

➔ Delhi

In Delhi, even affordable schooling costs over ₹9L, pushing the limits of affordability. In Delhi, total schooling costs range from ₹9.7L to ₹35.2L, based on the chosen category.

➔ Pune

Pune’s mid-range schools are costlier than elite schools in Delhi, with elite education averaging ₹76.2L. Schooling at top schools like Mahindra International can cost ₹1.68 Cr, and just Grade XI-XII in Pune elite schools can cost ₹15L. Overall, schooling in Pune ranges from ₹9.1L to ₹76.2L.

➔ Hyderabad

Across major Indian cities, Classes VI to X have emerged as the most expensive schooling phase, especially in Hyderabad, where elite schools charge as much as ₹32.4L just for these five years. Overall, total education expenses now range from ₹7.1L to ₹69.7L, depending on the type of school chosen.

➔ Bangalore

Elite school education in Bangalore costs significantly more than mid-range options, with total expenses ranging from ₹9L to over ₹25L. The premium reflects international curricula, better student-teacher ratios, and enhanced facilities and activities.

(Note: The average schooling costs for XIth and XIIth grades in the affordable school category are not included here due to a lack of available fee data from many affordable schools.)

School Fee Inflation > MOSPI’s Education Inflation

The detailed analysis of school fee data from several leading institutions highlights a consistent upward trend. Fee hikes vary widely, with some schools experiencing a CAGR of over 15% annually. This rapid increase highlights the importance of financial planning for parents seeking to provide a high-quality education for their children.

| School | City | Grade Level | Previous Fee (Year) | Current Fee (Year) | Fee Hike (% per year) |

|---|---|---|---|---|---|

| Nalanda Public School | Mumbai | Vth-Xth Grade | ₹97,320 (2023-24) | ₹1,11,926 (2024-25) | 15% |

| City International School | Mumbai | Nursery | ₹40,000 (2024-25) | ₹45,000 (2025-26) | 13% |

| Delhi Public School | Delhi | Nursery | ₹90,000 (2019-20) | ₹1,70,685 (2025-26) | 11% |

| Delhi International School | Delhi | IXth-Xth Grade | ₹1,23,535 (2021-22) | ₹1,58,780 (2025-26) | 6% |

| Millennium National School | Pune | XIth-XIIth Grade | ₹94000 (2025-26) | ₹1,08,000 (2026-27) | 15% |

| SB Patil Public School | Pune | VIIIth-Xth Grade | ₹70,000 (2024-25) | ₹75,000 (2025-26) | 7% |

| Santinos Global School | Hyderabad | Sr. KG | ₹70,000 (2024-25) | ₹76,200 (2025-26) | 9% |

| Vikas The Concept School | Hyderabad | Ist-IVth Grade | ₹80,500 (2022-23) | ₹97,000 (2024-25) | 10% |

Note: Fees shown are annual and reflect data from select prominent schools across Indian cities. CAGR reflects compounded annual growth in fees over the indicated period

Education inflation is not a future problem; it’s already here. Most still think of education savings as a one-time, milestone-based goal (like college fees at age 18). But the data shows a clear trend: families need ongoing education budgeting, from kindergarten to post-graduation.

- Start Early: A modest SIP combined with thoughtful asset allocation can turn massive expenses into manageable goals.

- Budget for the Full Picture: Tuition is just the tip. Factor in books, transport, living costs, and index them to 7–9% inflation.

- Use Loans as Levers, Not Lifelines: Avoid last-minute panic borrowing.

- Track Scholarships Early: Don’t miss deadlines, start looking 1–2 years ahead.

Just like retirement, education is now a multi-decade expense that requires structured planning, diversified investments, and regular reviews.

With education inflation often outpacing headline CPI, the best way families can stay ahead is by treating it not as a future goal but as an active, evolving financial commitment.