We hear the term ‘GDP’ thrown around all the time—in newspapers, on TV, in government reports, and corporate discussions. But have you ever wondered what GDP really means and why it matters so much?

As an investor or financial professional, understanding Gross Domestic Product (GDP) is critical. It serves as a key barometer of a country’s economic health, influencing market trends, policy decisions, and investment strategies. But GDP isn’t just a number—it tells a story of economic activity, consumer confidence, and business performance. Let’s break it down.

What is Gross Domestic Product (GDP) Meaning?

Gross domestic product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period.

A country’s Gross Domestic Product (GDP) is calculated by summing up various economic activities, including private and public consumption, government expenditures, investments, additions to private inventories, and construction costs. Additionally, the foreign Balance of Trade plays a crucial role, and significantly impacts GDP. When a country exports more goods and services than it imports, it experiences a trade surplus, leading to GDP growth. Conversely, a trade deficit occurs when imports exceed exports, often resulting in a decline in GDP.

In India, the National Statistics Office (NSO), which falls under the Ministry of Statistics and Programme Implementation (MoSPI), calculates the GDP of the country on a quarterly basis and releases it as a press release on specified dates.

Types of GDP: Nominal GDP vs. Real GDP

Understanding the distinction between Nominal and Real GDP is critical for effectively measuring economic success. Both measurements represent the entire value of goods and services generated in an economy, but they differ in how they account for price changes.

| Basis for Comparison | Nominal GDP | Real GDP |

| Definition | Measures the total value of goods and services at current market prices. | Measures the total value of goods and services adjusted for inflation, using constant prices. |

| Inflation Adjustment | Not adjusted for inflation or deflation. | Adjusted for inflation to reflect the real value of economic output. |

| Purpose | Useful for comparing economic output at a specific point in time. | Provides a more accurate measure of economic growth over time. |

| Impact of Price Changes | Can increase due to rising prices, even if output remains the same. | Reflects actual production growth, eliminating price effects. |

| Value of GDP | Is higher as current market prices are taken into consideration. | Is lower since base year prices are considered. |

| Reliability for Growth Analysis | Less reliable due to price fluctuations. | More reliable as it isolates real production growth. |

| Use Case | Used for international comparisons and short-term economic analysis. | Used for long-term economic trends, policy-making, and living standard assessments. |

Nominal GDP is useful for quick comparisons, but if you’re looking for real economic progress, Real GDP gives a clearer picture by eliminating the effects of inflation.

Our Take: Real GDP is what truly matters when making financial and investment decisions. It reflects whether the economy is actually growing or if price hikes are just making it seem like it is.

Recommended for you

Readers also explored

Fiscal Deficit Explained with Real World Examples

World GDP Breakdown 2025: Who Powers the Global Economy?

Components of GDP

GDP is essentially the sum of four major economic activities:

GDP= Consumption (C) + Investment (I) + Government Spending (G) + Net Exports (X-M)

- Consumption (C): Consumption is the total amount of products and services purchased by citizens, such as retail items or rent, and it increases as more are consumed. Higher consumption is considered a sign of a healthy economy as it signifies higher consumer confidence in spending.

- Investment (I): Investment is defined as any domestic investment or capital expenditure in new assets that will deliver future benefits. Companies invest money in company operations by purchasing equipment, inventory, and creating new facilities. Higher investment boosts productive capacity and employment rates.

- Government Spending (G): The government spends money (consumption expenditure and gross investment) on goods and services such as education, transportation, the military, and infrastructure. This spending is financed by taxes, businesses, or borrowing.

- Net Exports (X-M): The exports-imports component of the equation refers to the exports of goods and services produced in the home economy and sold abroad, minus the imports acquired by domestic consumers. If a country's exports (X) exceed its imports (M), the net value is positive, indicating a trade surplus. Similarly, if M is bigger than X, the country has a trade imbalance.

How is GDP Calculated?

Three key methods are used to compute GDP:

| Method | Explanation | Example | Formula |

| Production/Output Approach | The production approach calculates the overall value of economic output while deducting the cost of intermediate goods used in the process. | A bakery produces bread using flour. Only the value of the final bread is counted, not the flour (to avoid double counting). | GDP = Total Output - Value of Intermediate Goods |

| Expenditure Approach | Also known as the spending approach, calculates GDP by summing all expenditures made in an economy, including consumption, investment, government spending, and net exports. | If consumers spend ₹50,000 on goods, businesses invest ₹30,000, government spends ₹40,000, and net exports are ₹10,000, the GDP is ₹1,30,000. | GDP = C + I + G + (X - M) |

| Income Approach | Measures GDP by adding all income earned in the economy, including wages, profits, interest, and rent. | If total wages paid are ₹70,000, corporate profits ₹50,000, rent ₹10,000, and interest ₹20,000, total GDP is the sum of these ₹1,50,000. | GDP = Wages + Rent + Interest + Profits |

Each method provides a slightly different perspective, but all aim to capture the size and health of an economy.

Why GDP Growth Matters for Financial Planners and Investors?

The Real GDP growth rate is a crucial economic indicator that helps financial planners and investors assess the overall health of an economy. It measures how fast an economy is growing by comparing one period's GDP to another. A positive growth rate signals economic expansion, increased consumer spending, and higher corporate earnings, while a negative growth rate may indicate a recession, leading to reduced business activity and lower investor confidence. Understanding these trends is essential for making informed financial and investment decisions.

GDP growth directly influences interest rates, fiscal policies, and investment strategies. When GDP grows at an accelerated pace, central banks (Reserve Bank of India) may increase interest rates to prevent overheating and inflation. Conversely, during periods of economic contraction, central banks may lower interest rates and introduce stimulus measures to boost economic activity. These fluctuations impact various asset classes differently, making GDP trends a valuable tool for portfolio management.

During periods of strong GDP growth, investors often favor equities and growth-oriented stocks, as higher consumer demand drives corporate profitability. However, when GDP declines, indicating an economic slowdown or recession, investors may shift toward safer assets like government bonds, gold, or defensive stocks. By analysing GDP trends, financial planners can adjust asset allocation strategies, mitigate risks, and position investments in line with the broader economic cycle.

Using GDP for smarter financial decisions

- Follow GDP reports from RBI, MoSPI, and global institutions like the IMF to stay ahead of economic trends.

- Monitor sectoral GDP trends to identify industries that are thriving or struggling.

- Adjust your portfolio—tilt towards equities during economic growth and shift to safer assets when growth slows.

- Watch central bank policies—strong GDP growth can lead to rate hikes, affecting debt markets and borrowing costs.

Limitations of GDP as an Economic Indicator

There are some criticisms to GDP as a measure-

- The amount of informal economic activity is not taken into consideration. GDP does not take into consideration the value of unpaid volunteer labor, underground market activity, or underhanded employment, all of which can be substantial in some countries.

- GDP does not measure overall well-being or standard of living, as it ignores factors like income distribution, environmental impact, leisure time, and resource depletion. While GDP per capita indicates economic output per person, it does not reflect quality of life.

- GDP does not account for income earned in a country by overseas enterprises and sent to foreign investors. This may exaggerate a country's actual economic output.

- By focusing only on final goods production, GDP ignores intermediate transactions between businesses, making it less responsive to economic fluctuations.

- GDP comprises marketable production but excludes non-marketable productions. For example, employing someone to mow your lawn or clean your house contributes to GDP, whereas doing similar things yourself does not.

GDP Trends in India & Global Comparisons

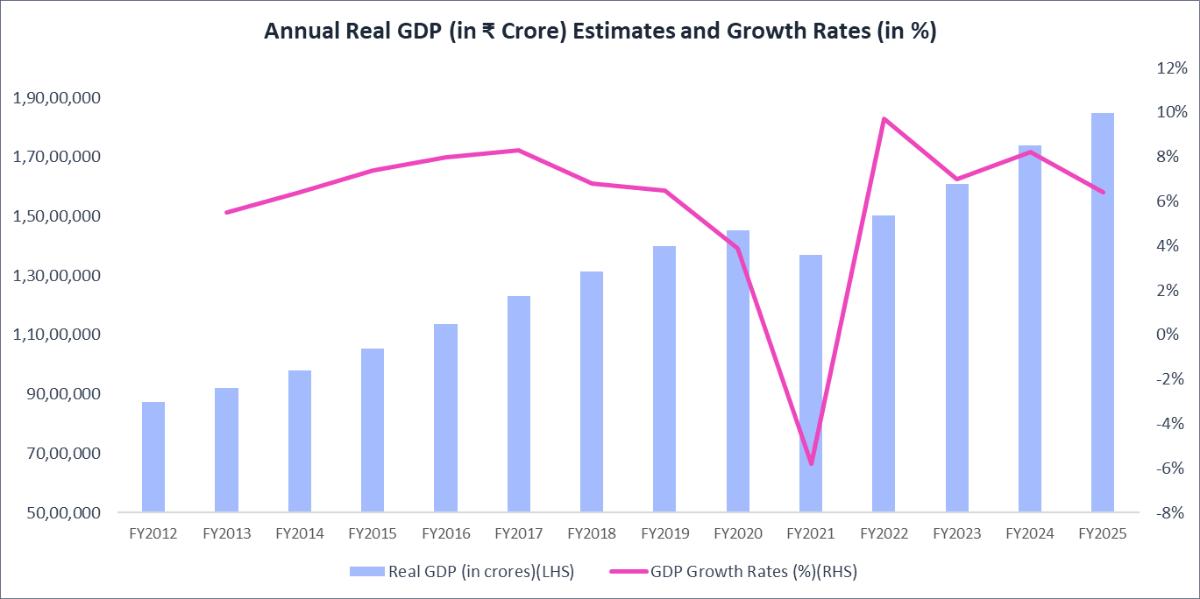

India’s GDP growth in recent years.

The following chart illustrates India's annual real GDP estimates (in ₹ crore) alongside GDP growth rates (%) at constant prices (Base Year: 2011-12) from FY2012 to FY2025.

India’s economy has witnessed impressive GDP growth, with recent years reflecting strong post-pandemic recovery.

Source: MoSPI How India compares to top global economies

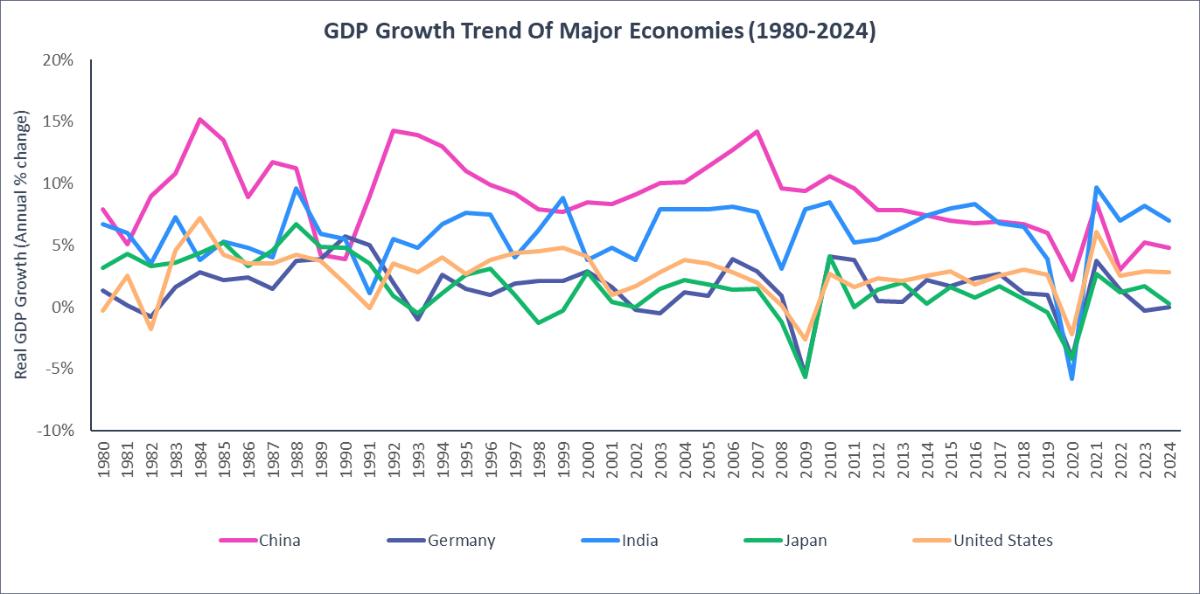

A global comparison of GDP trends from 1980 to 2024 shows that India and China have outpaced Western economies in growth. The U.S. and Germany have maintained steady but moderate expansion, while Japan has struggled with stagnation. Major events like the 2008 financial crisis and the 2020 pandemic have had significant impacts, but recent trends suggest a resilient comeback for many economies.

Source: IMF

Conclusion

Understanding GDP is not just for economists—it’s a powerful tool for investors, financial planners, and business owners to make smart decisions. By tracking GDP trends, you can align your investment strategies with the broader economic environment, manage risks effectively, and seize growth opportunities.

GDP isn’t just a number—it’s the story of an economy’s health. The better you understand it, the smarter your financial decisions will be!