Introduction

The Reserve Bank of India's (RBI) monetary policy stance refers to the central bank's overall approach towards managing interest rates and money supply in the economy. The policy stance signals the likely course of the RBI’s actions with interest rates and liquidity to achieve price stability and economic growth based on the prevailing economic conditions.

The RBI explains its monetary policy measures and stance with the rationale, information, and analysis to enable market participants and other stakeholders to provide clarity about its assessment of the evolving monetary and financial market conditions.

The Reserve Bank of India Act, 1934 was amended in 2016 to provide a statutory basis for a monetary policy framework, the MPC, and the inflation target to be set by the Government of India, in consultation with the RBI, once every five years. In 2016, India’s monetary policy framework moved towards flexible inflation targeting, and a six-member Monetary Policy Committee (MPC) was constituted for setting the policy rate. With this step towards modernisation of the monetary policy process, India joined the set of countries that have adopted inflation targeting as their monetary policy framework. The Consumer Price Index (CPI) inflation target was set by the Government of India at 4% with ± 2% tolerance band from August 5, 2016 to March 31, 2021. The same target was extended for five years (April 2021-March 2026).

The changes in policy stance announced by the Monetary Policy Committee (MPC) of RBI set a direction towards where the interest rates are headed, and the potential liquidity conditions in the financial system. RBI uses its monetary and liquidity tools to manage liquidity in the economy, and these changes affect the borrowing and lending costs and the credit demand in the economy. However, the effectiveness of monetary policy actions depends on various factors such as transmission mechanisms within the banking sector, demand for credit, and overall business sentiment.

The policy repo rate is the rate of interest at which the commercial banks borrow from the central bank. The MPC decides the policy repo rate for the economy based on the prevailing inflation levels and undergoing economic situations. Historically, when the policy stance changes, it signals the potential cost of borrowing in the economy and when the repo rate changes it gradually translates into the economy.

Various Types of Monetary Policy Stance

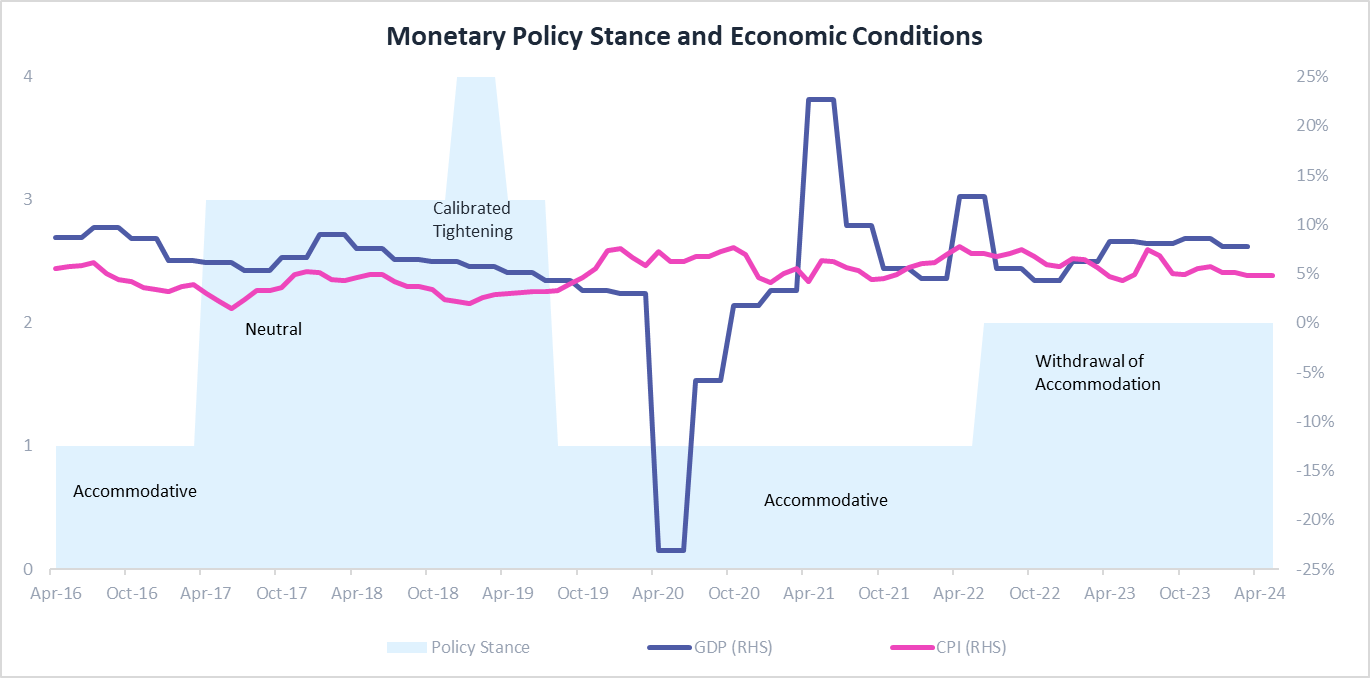

Following are the policy stances adopted by RBI since 2016 in different economic scenarios and their objective:

Accommodative (Oct 2016 to March 2017, August 2019 to May 2022)

- To stimulate the economy, RBI lowers policy rates and increases the money supply

- Reduces the repo rate and infuse liquidity to encourage banks to decrease the lending rates

- Lower rates encourage borrowing and spending, thus increasing demand

Neutral (April 2017 to November 2018, April 2019 to July 2019)

- RBI generally does not alter interest rates when economic conditions are balanced.

- This stance signifies the flexibility of RBI to change the policy rates in either direction, depending on macroeconomic conditions

- Borrowing and lending costs generally remain stable, with stable economic conditions

Calibrated Tightening (December 2018 to March 2019)

- RBI makes measured adjustments in interest rates to manage rising inflation and economic stability

- RBI adopts a proactive approach and makes gradual and cautious increases in interest rates, or opt for tightening the money supply

- This results in a marginal increase in borrowing and lending costs in the economy, thus tightening the credit conditions and gradually bringing inflation within the target levels.

Withdrawal of Accommodation (July 2022 onwards)

- This stance involves gradually reducing the monetary support that was provided during the economic crisis. For example, the monetary accommodation introduced during the pandemic to stimulate the economy was gradually withdrawn when the economy started to recover.

- RBI brings back the interest rates from the lows in a phased manner and squeezes excess liquidity from the banking system

- The RBI aims to ensure that inflation aligns with its target of 4% while supporting economic growth.

In addition to the accommodative and neutral stances, the RBI adopts a hawkish stance to control persistently high inflation. This involves raising interest rates to curb consumption demand by tightening money supply and borrowing costs. The inflation has generally remained within the RBI's target range of 2% to 6% since 2016, except for some intermittent spikes such as in 2020 due to pandemic disruptions. Hence the situation has not necessitated the RBI shifting to a hawkish stance in recent years.

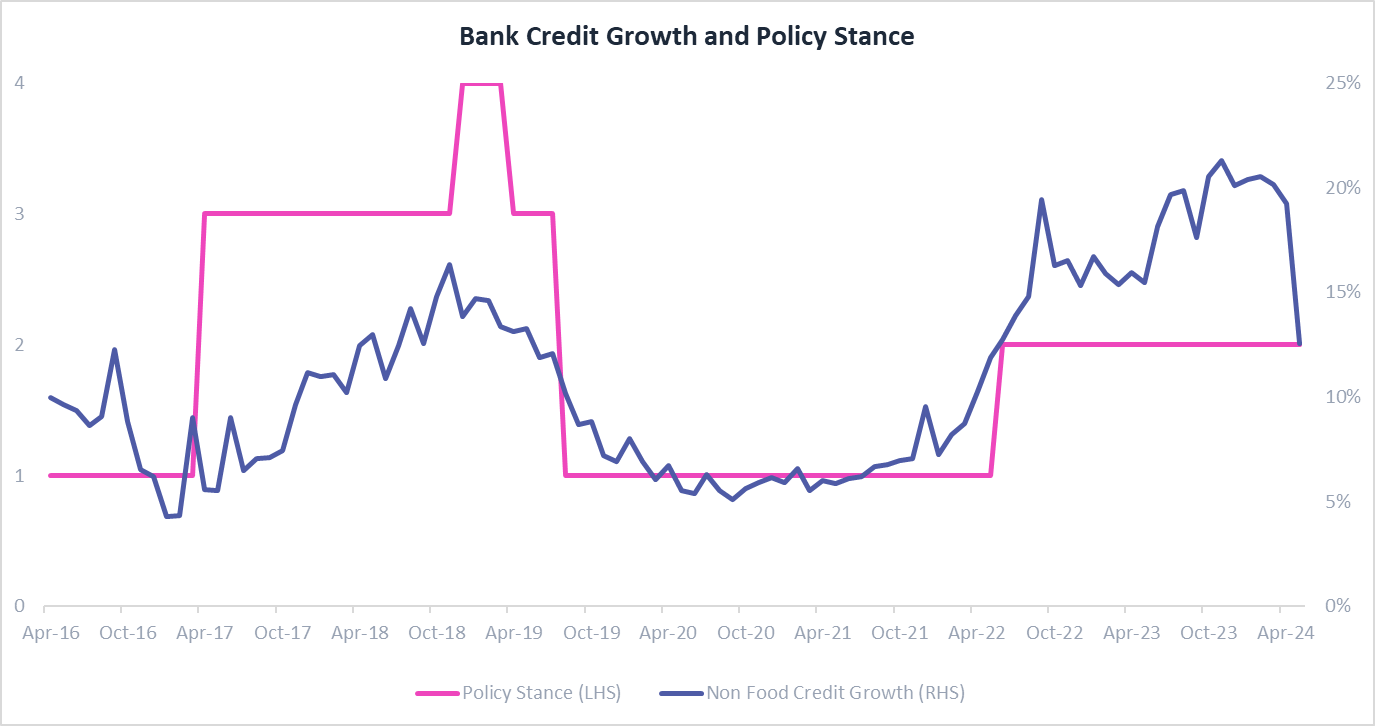

Note: Various monetary policy stances are represented on a numeric scale of 1-4, where Accomodative is 1, Withdrawl of Accommodation is 2, Neutral is 3, Calibrated Tightening is 4

Recommended for you

Readers also explored

RBI’s Repo Rate and CRR Cut- What it Means For You in 2025

World GDP Breakdown 2025: Who Powers the Global Economy?

Transmission of Monetary Policy

The policy stance signals the likely course of the RBI’s actions while policy rates impact the actual cost of borrowing in the economy. The influence of the policy stance and policy rates on various sets of interest rates in the economy also depends upon the credit demand and liquidity availability in the economy. Here we tried to explore the impact of these changes or any potential lag in the transmission of monetary policy using the historical data, and their consequences on the various segments of the economy:

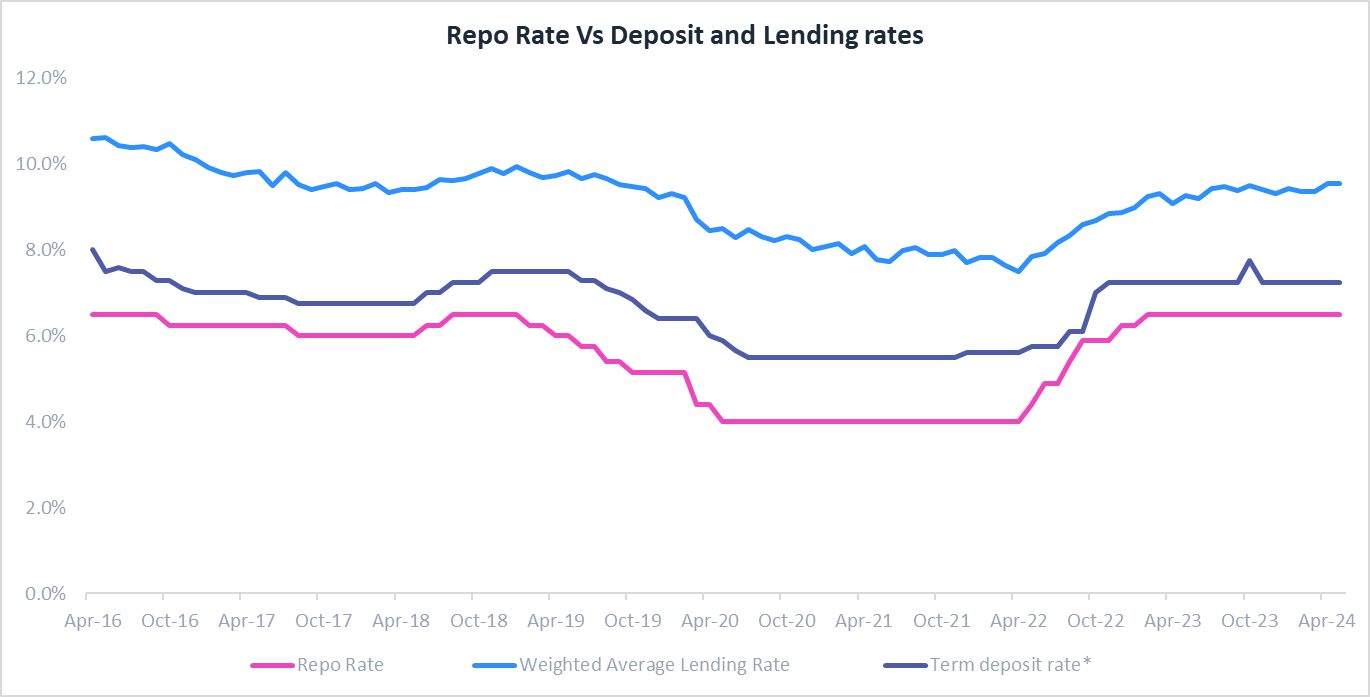

Repo Rate & Term Deposit Rate

There is a high positive correlation between the repo rate and the term deposit rate (popularly known as Fixed Deposits or FDs). Karl Pearson's coefficient of correlation is calculated to be 0.95 from April 2016 to April 2024. This means the term deposit rates move in tandem with the repo rate.

The research findings suggest that the transmission of repo rate changes to FD rates is symmetric but with some exceptions. When the RBI raises the repo rate banks increase their lending rates, but are slower to raise FD rates. However, with rising inflation people tend to save less, hence to attract more deposits and to meet the credit demands, banks offer higher deposit rates. On the other hand, when the repo rate decreases, banks lower FD rates more quickly. It has been observed in recent years that the difference between the repo rate and term deposit rates tends to remain low when the RBI maintains a neutral policy stance, as the repo rate may move in either direction. While, during the tightening policy stance, banks start increasing their deposit rates expecting further increases in the repo rate.

As a saver, the optimal strategy would be:

- Lock in higher FD rates when the RBI shifts to an accommodative stance, as interest rates may fall

- Wait to fix your savings when the RBI shifts to a tightening or hawkish stance, as FD rates may rise, although with a lag

*The highest rates offered for deposits > 1 year.

Repo Rate & Weighted Average Lending Rate

The weighted average lending rate (WALR) is the average interest rate levied on loans extended by banks. When the RBI hikes the repo rate, banks incur a higher cost for their borrowings from the central bank. When there is a shortage of funds, banks borrow from the RBI, which is repaid according to the applicable repo rate. The central bank provides these short-term loans against securities such as Treasury Bills (TBs) or government bonds. This rise in the cost structure translates into a natural upward pressure on the WALR as banks pass on their cost of borrowing to their customers.

However, the changes in WALR do not necessarily move in tandem with the repo rate as the overall demand for credit in the economy and liquidity conditions also play a part in this. During periods of surging loan demand, banks may possess greater bargaining power, enabling them to raise lending rates even if the repo rate is stable. This premium reflects the additional return that banks demand to compensate for the inherent credit risk associated with lending to borrowers. Conversely, weak loan demand might force banks to maintain lower lending rates despite a higher repo rate.

Unlike risk-free government securities, loans carry the potential for default. The risk premium creates a persistent gap between the repo rate and the WALR. This gap remains relatively stable over time, reflecting the prevailing risk landscape. When the RBI’s monetary policy stance hints at a possible change in the course of interest rates, WALR is quick to respond.

As a borrower, the optimal strategy would be:

- Opt for fixed interest rates, when the RBI shifts to a tightening or hawkish stance from the neutral or accommodative stance, suggesting lending rates are likely to increase

- When the RBI shifts to an accommodative or neutral stance from the tightening or hawkish stance, opt for floating interest rates, as lending rates are likely to drop from their highs.

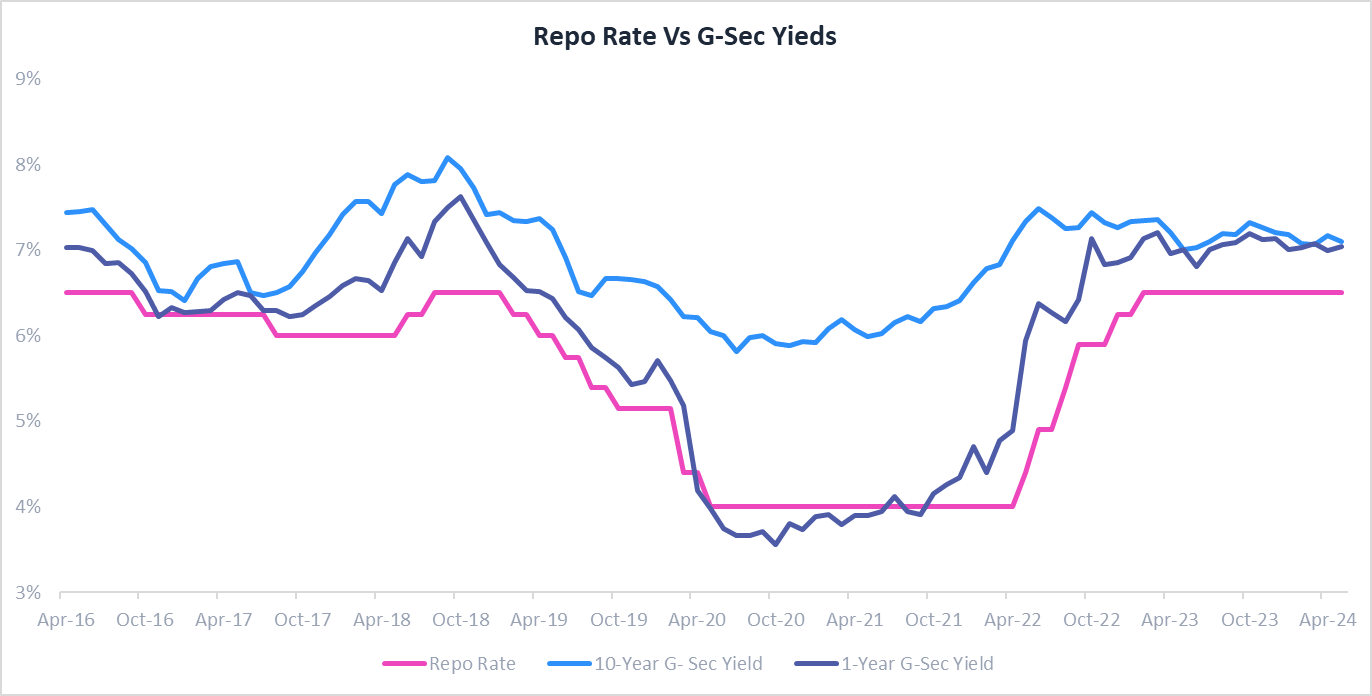

Long-Term and Short-Term G-Sec Yields

There is a high degree of positive correlation between the repo rate and both the short-term and the long-term (10-year) G-Sec yields indicating that the change in repo rate strongly influences the G-Sec markets. The coefficient of correlation (0.73 for 10-year and 0.95 for 1-year) (April 2016- April 2024) supports this fact. However, the G-Sec yields can be influenced by other factors such as market sentiment, inflation expectations, and economic conditions and they give early signs of any potential future changes in interest rates, following the existing stance of the monetary policy.

- If the repo rate is expected to rise, investors and market participants generally expect this to influence long-term rates which can lead to an increase in long-term G-Sec yields.

- When short-term interest rates rise, investors face a higher opportunity cost by holding long-term bonds instead of short-term investments. Higher rates increase the risk premium demanded by investors for holding long-term bonds and push the long-term yields.

However, financial institutions and investors constantly look for arbitrage opportunities. If the repo rate goes up it becomes more profitable for banks to borrow from the central bank and invest in government securities. This increased demand for G-Secs pushes their prices down and yields up until the arbitrage opportunity disappears.

When there is a higher demand for short-term bonds compared to long-term the yield for shorter maturities exceeds long-term yields resulting in an inverse yield curve. This inversion often predicts economic slowdowns or recessions, signalling investor pessimism about future economic prospects.

Changing credit demand in response to changes in monetary policy decisions

Other than adjusting policy rates, the RBI uses various liquidity tools to influence interest rates and credit demand in the economy. The use of these tools defines the existing monetary policy stance of the RBI. For example, OMO purchases or sales are intended to influence liquidity, interest rates, and credit demand.

- When there is excess liquidity, RBI resorts to the sale of securities (OMO sales), thereby sucking out the rupee liquidity. Conversely, when liquidity is tight, RBI buys securities, releasing liquidity into the market.

- OMO purchases increase the money supply and reserves with banks. With more funds available banks can cut interest rates to attract borrowers to lend more. This makes credit cheaper and boosts consumption and investment.

- OMO sales reduce money supply and reserves. With fewer funds to lend, banks may raise interest rates. This makes borrowing costlier, curbing credit growth and economic activity.

Note: Various monetary policy stances are represented on a numeric scale of 1-4, where Accomodative is 1, Withdrawl of Accommodation is 2, Neutral is 3, Calibrated Tightening is 4

Generally, reductions in the repo rate are intended to lower borrowing costs for banks, encouraging them to lend more at lower interest rates to the credit-starved sectors of the economy. This can stimulate credit growth across various sectors of the economy, including non-food sectors such as manufacturing, services, and infrastructure. But sometimes there could be a lagged response in the credit demand by these sectors as against the changes in repo rate. For example, the repo rate declined from 6.5% to 6.25% in April 2019, while the credit to industries continued to decline and remained muted (at around 0.5% YoY) until December 2019. With the disruptions caused by the Covid-19 pandemic, there was a sharp decline in gross bank credit and the RBI brought down the repo rate to a historic low of 4.0% by March 2021 and maintained this level till February 2023. Yet, the credit demand in the economy across sectors remained tepid, with industries reporting negative growth at -1.3% YoY in March 2021. This could be attributed to repeated lockdowns due to the emergence of Covid variants which resulted in a sharp slowdown in manufacturing activities reducing the borrowing demand despite lower rates.

Although there was a lagged response from the industries, credit demand from other sectors picked up gradually, and gross bank credit grew at double digits in FY2021 (10.9%), but again declined in FY2022 (9.7%) and FY2023 (9.6%). This could be due to the bank’s cautious approach to lending.

The sharp reduction in repo rates and subsequent credit growth from mid-2020 onwards suggests a prolonged period of accommodative monetary policy to support economic recovery post the COVID-19 pandemic and global economic slowdown. The lower borrowing costs spur investment and consumption, aiding economic growth, evident from the recovery in GDP which grew by 9.7% in FY2022 after contracting by -5.8% in FY2021, and sustained the growth in subsequent years.

Conclusion

As mentioned above the primary objective of RBI’s MPC is to manage price levels and economic growth in the economy. The monetary policy stance whether accommodative, neutral, hawkish, or calibrated tightening, determines the direction of interest rates and credit availability in the economy. Empirical evidence suggests a 100 bps increase in real interest rates could reduce investment rate by about 50 bps and GDP growth by 20 bps.

When the inflation level increases and remains outside the comfort zone of 2% to 6%, RBI turns cautious in its policy actions and adjusts its policy stance before altering the rates. If the inflation persistently remains at elevated levels, the RBI initially hints at a higher interest rate scenario by changing the monetary policy stance by providing enough space for the stakeholders to make the adjustments to avoid any knee-jerk reactions. Similarly when it comes to reducing the rates. For example, when economic growth slows down and inflation levels also go down, RBI emphasises on accommodative stance to increase the demand conditions potentially hinting at a rate cut. Conversely, when the economy grows at a higher rate inflation pressure increases, and the central bank may change the policy stance from accommodative or neutral to caliberated tightening, hinting that it may raise the repo rate to control the rising price level. Thus, when RBI changes the repo rate the stakeholders will be well prepared based on the prevailing policy stance. Overall, the RBI's policy stance is critical in managing economic stability which influences financial market behaviours, directly impacting businesses and consumers. Closely monitoring the stance can help make informed investment and borrowing decisions and take necessary actions well in advance to avoid any potential losses.