As we enter 2025, India stands at a pivotal moment, poised to become the world’s fourth-largest economy while embracing a complex global landscape. This quarterly update highlights India’s transition from a transitory slowdown to a recovery phase, driven by moderating inflation, robust rural consumption, and a strong manufacturing sector. Despite global challenges like trade tensions and monetary policy shifts, India’s domestic fundamentals offer a stable foundation for growth. This update distils the key insights from our Macro Outlook 2025, exploring investment opportunities, asset class trends, and the economic themes shaping India’s trajectory in 2025.

Key Takeaways

- India’s economy is expected to shift from a transitory slowdown to a recovery phase in 2025, with a 60% probability, driven by cooling inflation (4-5%), rising rural demand, and private capex revival.

- Indian large-cap equities are better positioned than mid- and small-cap due to reasonable valuations and resilience to global volatility. Sectors like banking, infrastructure, and pharma show promise.

- With expected repo rate cuts of 50-75 basis points, short-term bonds (1-3 years) are set to benefit from a steepening yield curve, offering attractive returns.

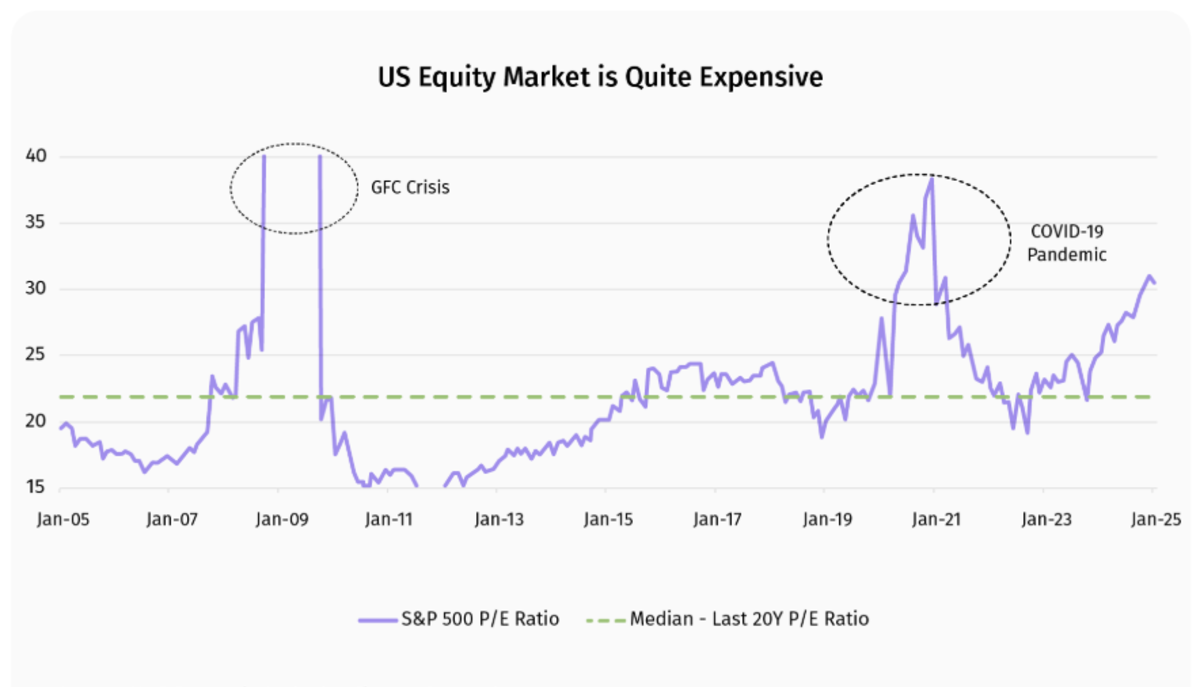

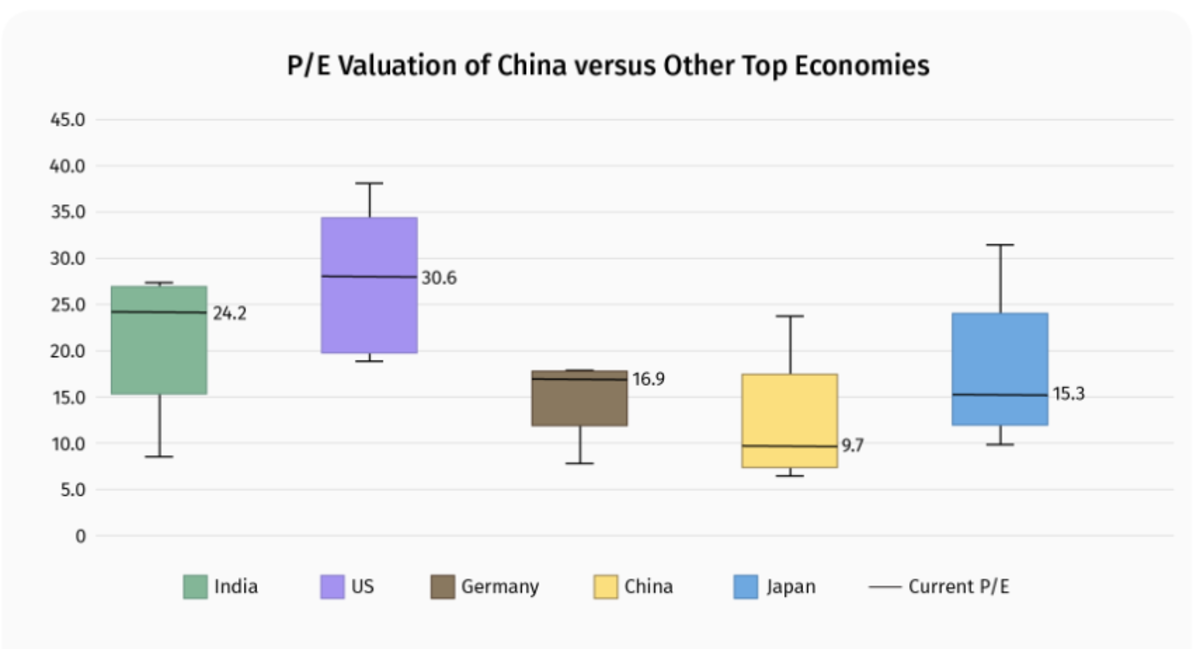

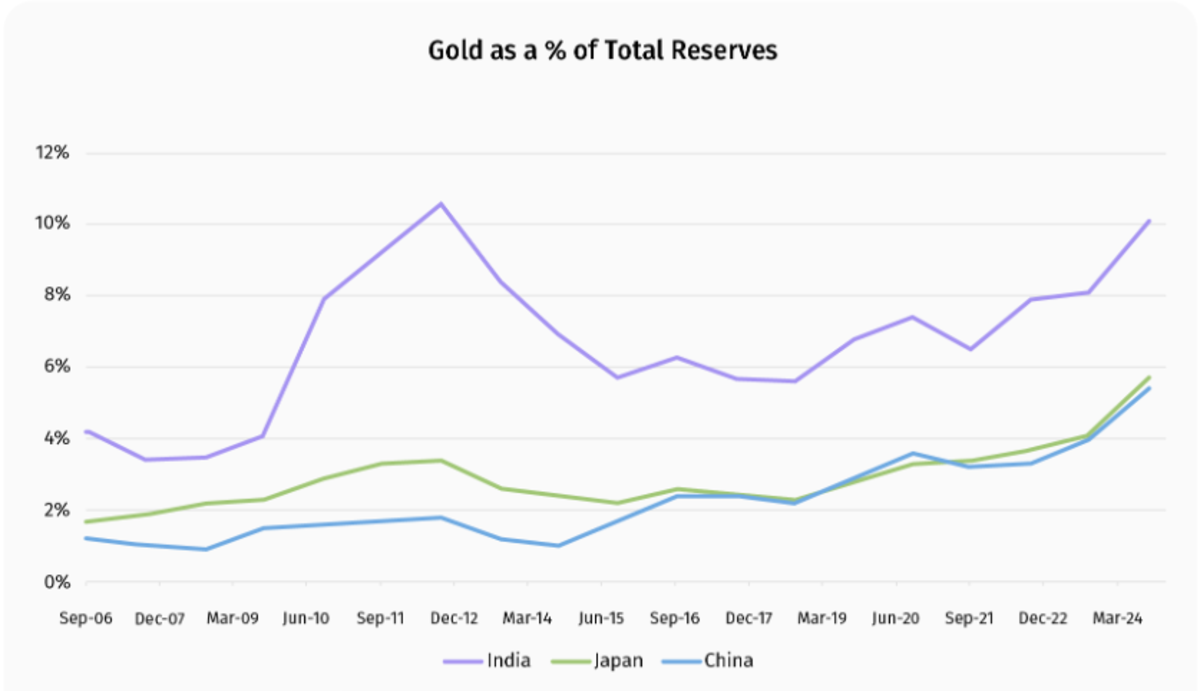

Gold is likely to outperform equities during the rate-cut cycle, supported by central bank reserve accumulation and its role as a portfolio diversifier. - US trade tariffs, China’s property sector challenges, and elevated US equity valuations (S&P 500 P/E at 30.6x) could create global market volatility, impacting India’s export sectors and FPI flows.

Here are 15 of our key views for 2025

1. India Poised to Enter 'Recovery' Mode

A 60% likelihood of economic recovery, driven by cooling inflation to 4-5% and surging rural consumption.

Recommended for you

Readers also explored

Indian Economy’s Q2 Boost and The Upcoming Labour Reforms

Currency in Circulation: How Much Money Exists in the World?

2. 2025: The Year to Diversify Across Asset Classes

Mitigate risks by allocating investments across large-cap equities, short-term bonds, and gold.

Asset Class | Outlook 2025 | Key Drivers | Risk Factors |

| India Large Cap Equity | Risk Rating 2/5 Positive |

|

|

| India Mid, Small and Micro Cap Equity | Risk Rating 5/5 Negative |

|

|

| US Equity | Risk Rating 3/5 Neutral |

|

|

| China Equity | Risk Rating 2/5 Positive |

|

|

| India Ultra Short (<1 year) and Short Term (1-3 year) Bonds | Risk Rating 1/5 Positive |

|

|

| India Medium/ Long Term Bonds (>3 years) | Risk Rating 2/5 Positive |

|

|

| Gold | Risk Rating 1/5 Positive |

|

|

| India Residential Real Estate | Risk Rating 2/5 Positive |

|

|

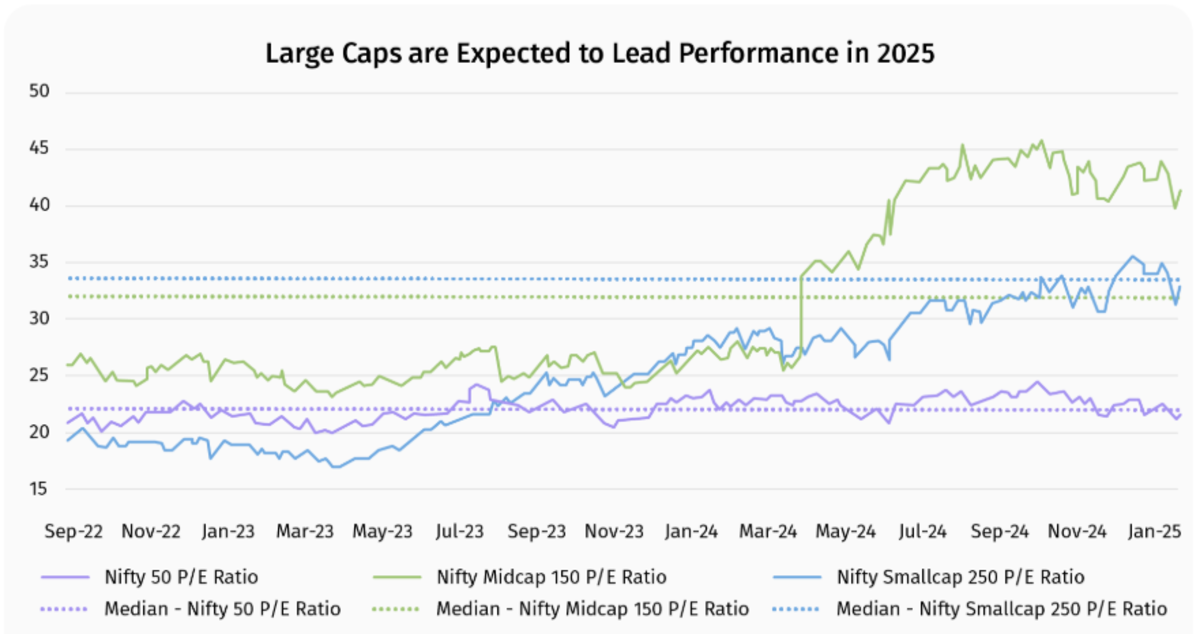

3. Valuation Divergence in Indian Equities Should Reduce

Large-cap, with reasonable valuations, are expected to outperform overvalued mid/small-cap (41% and 8% premiums).

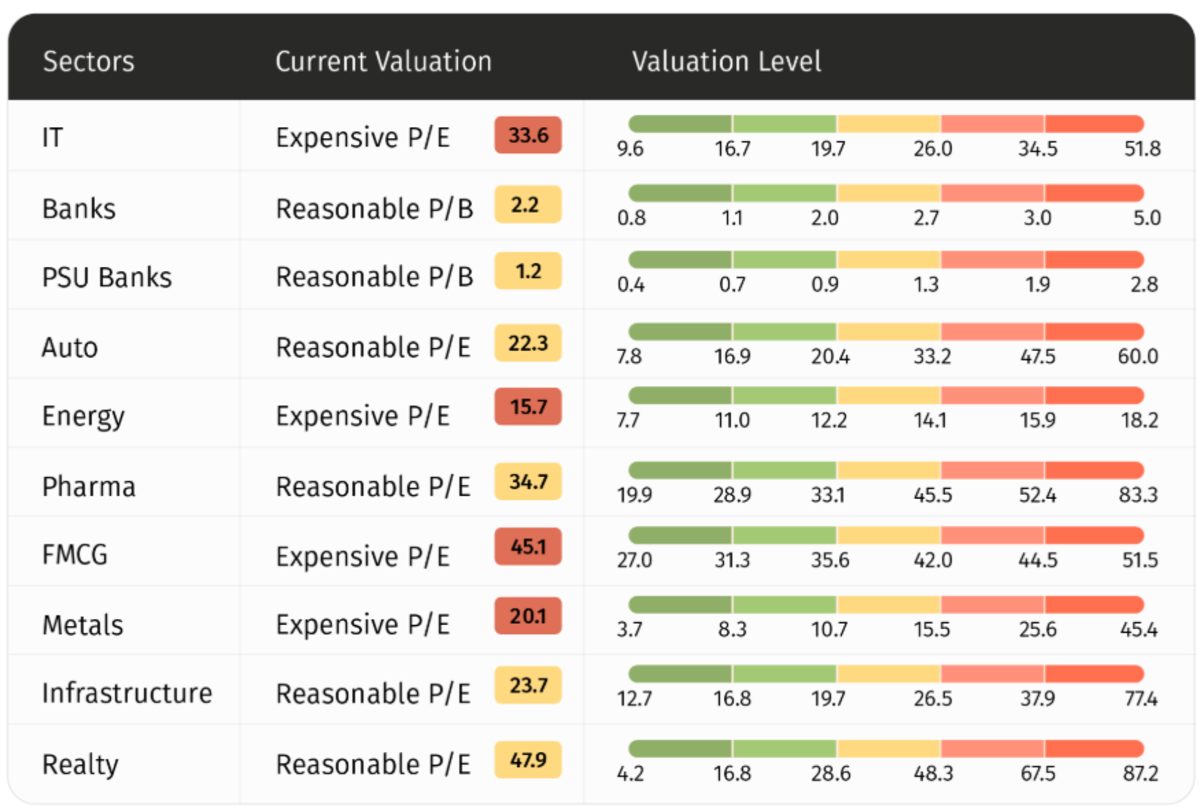

4. Select Sectoral Themes to Perform Better

Banking, infrastructure, and pharma sectors to thrive on domestic demand and government capex.

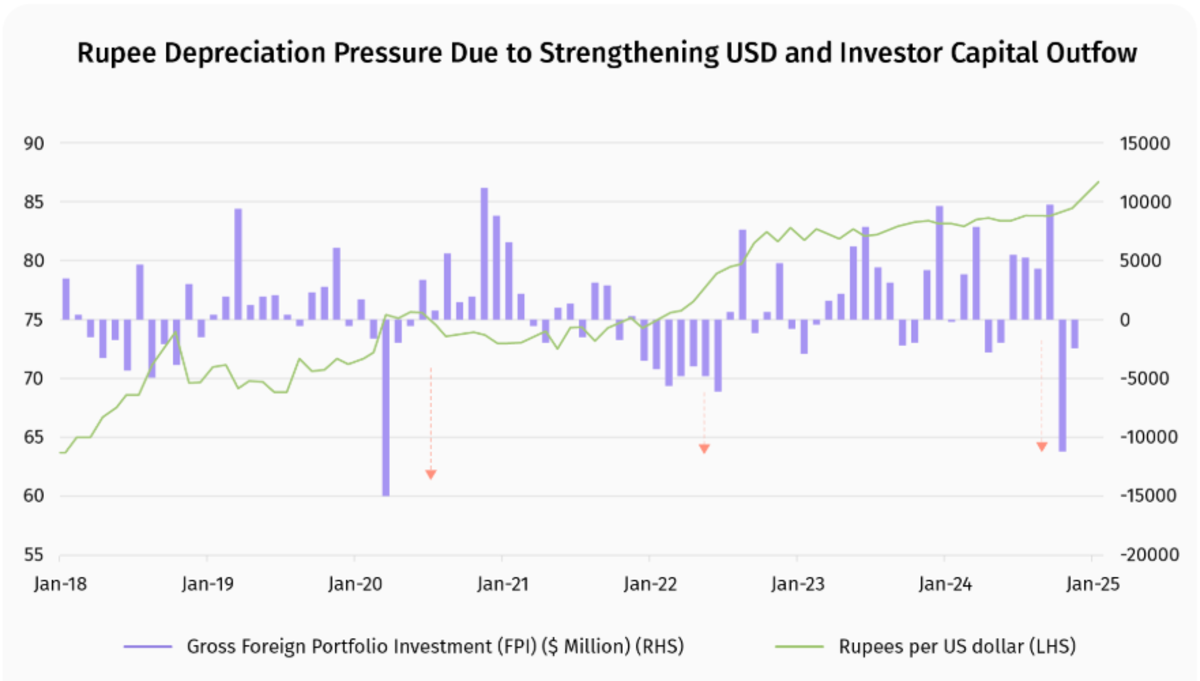

5. Rupee Depreciation to Continue in Near-term

Strengthening USD and FPI outflows, driven by US inflation, to pressure the rupee.

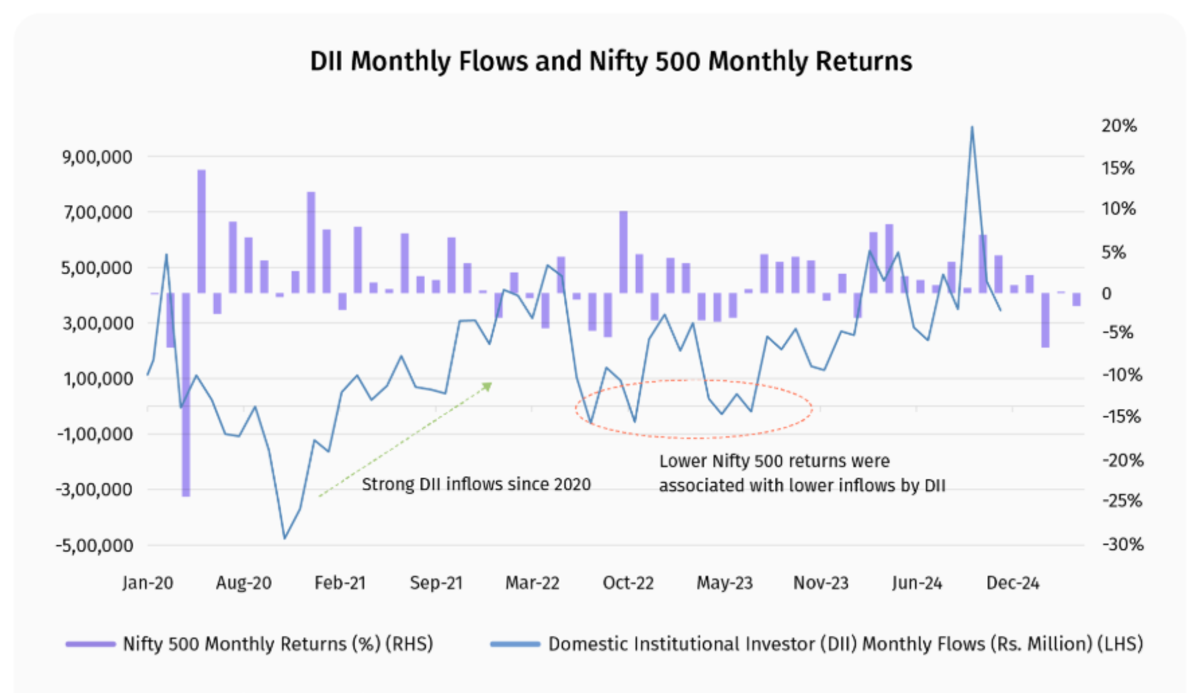

6. DII Inflows Unlikely to Maintain Past Momentum

DII inflows have been quite strong in a largely unidirectional Indian stock market since 2020. But when markets consolidate, DII flows become negative.

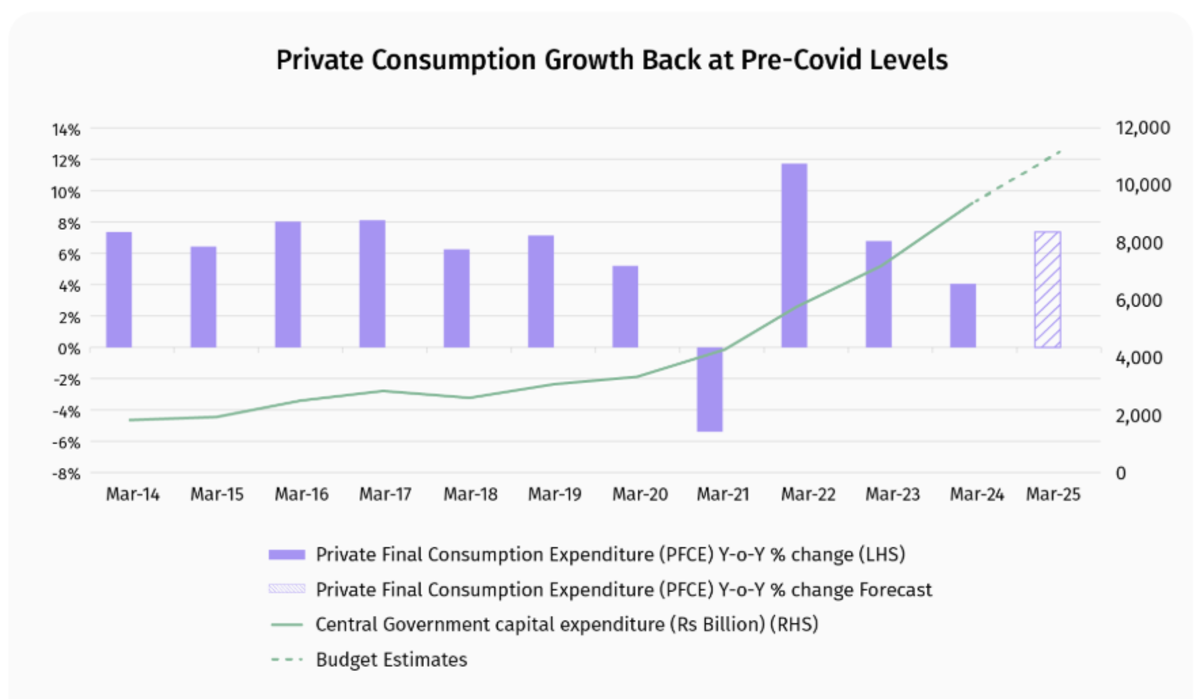

7. Government's Infrastructure Push Drives Recovery

Investments in roads, railways, and urban development have boosted jobs and thus, driven consumption to pre-COVID levels.

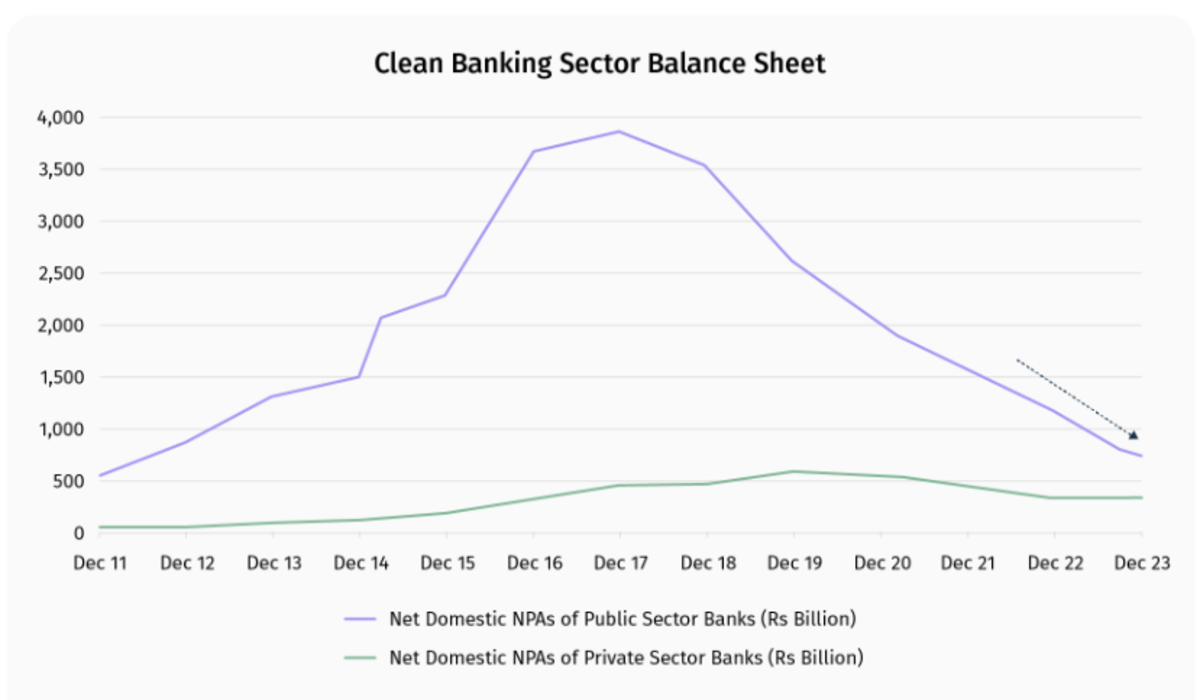

8. Banking Sector Health Supports Growth Momentum

Historic low NPAs and 50-75 bps rate cuts to enable banks to fund private sector growth.

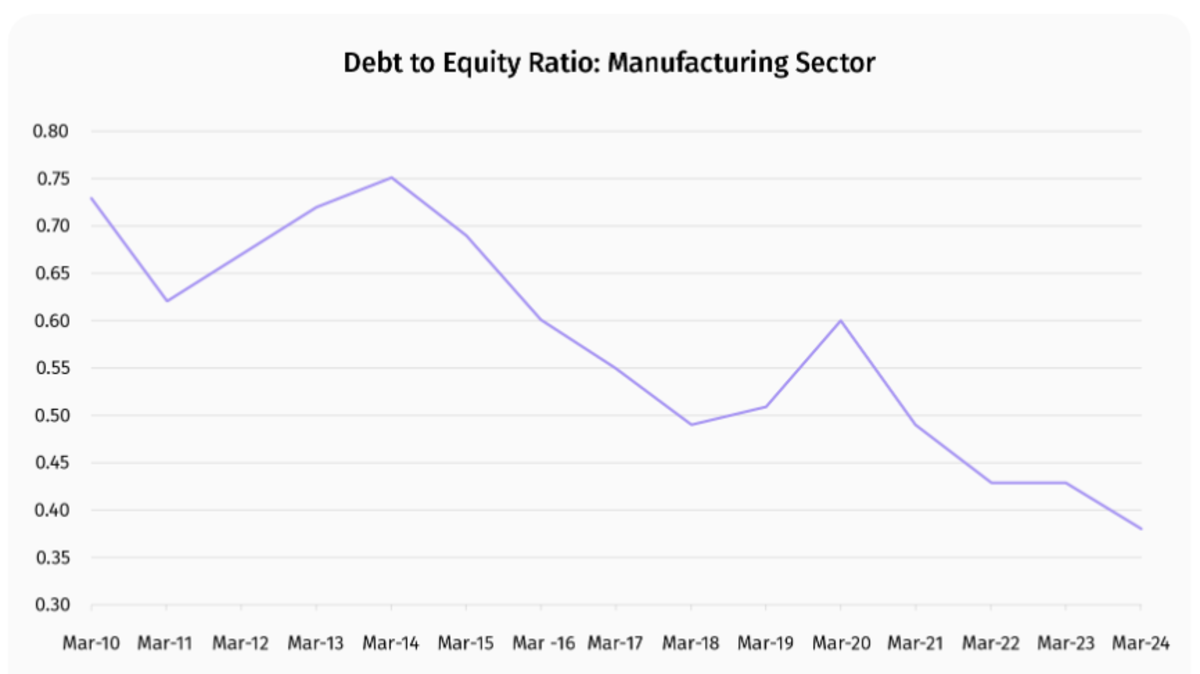

9. Manufacturing Sector Ready for Capex Cycle

Low debt-to-equity ratios and PLI schemes to spur manufacturing expansion.

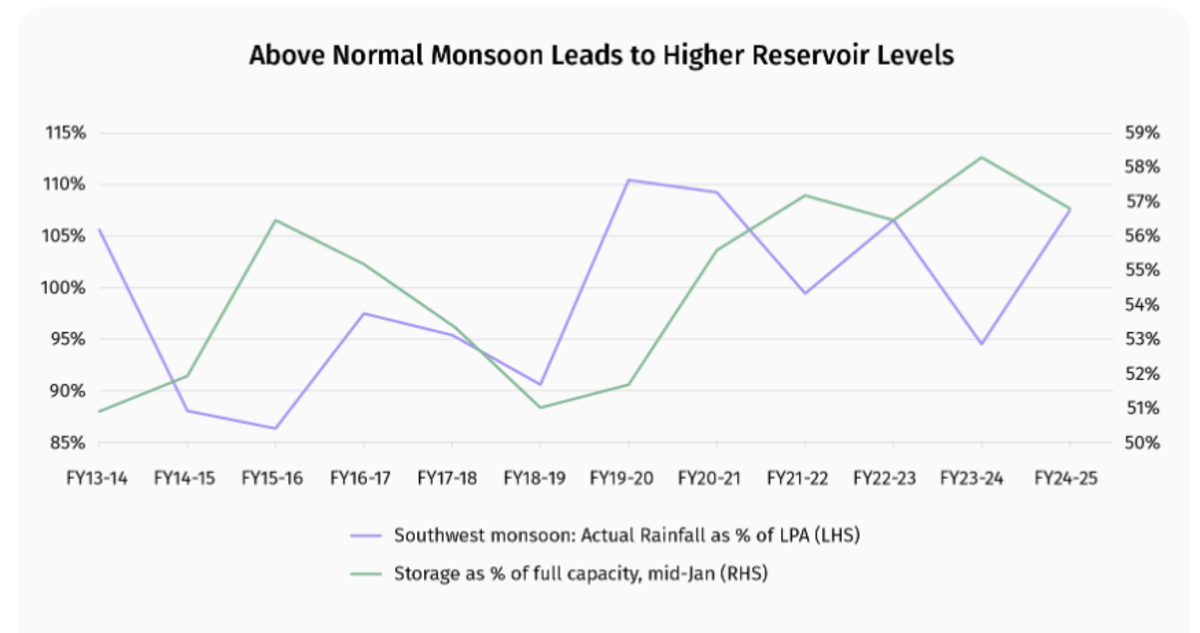

10. Agriculture Recovery to Drive Rural Growth

Above-normal monsoons and strong Rabi sowing to yield 4%+ agricultural growth, curbing food inflation.

11. US Market Rally Faces Multiple Stress Tests

S&P 500’s high P/E (30.6x) and potential trade tariffs risk derailing US equity gains.

12. China's Growth Revival Hinges on Policy Support

China's equity market presents a compelling opportunity in 2025, driven by aggressive policy measures to combat deflation and revive growth. Stimulus and focus on semiconductors, EVs, and AI to aid growth, despite property sector woes.

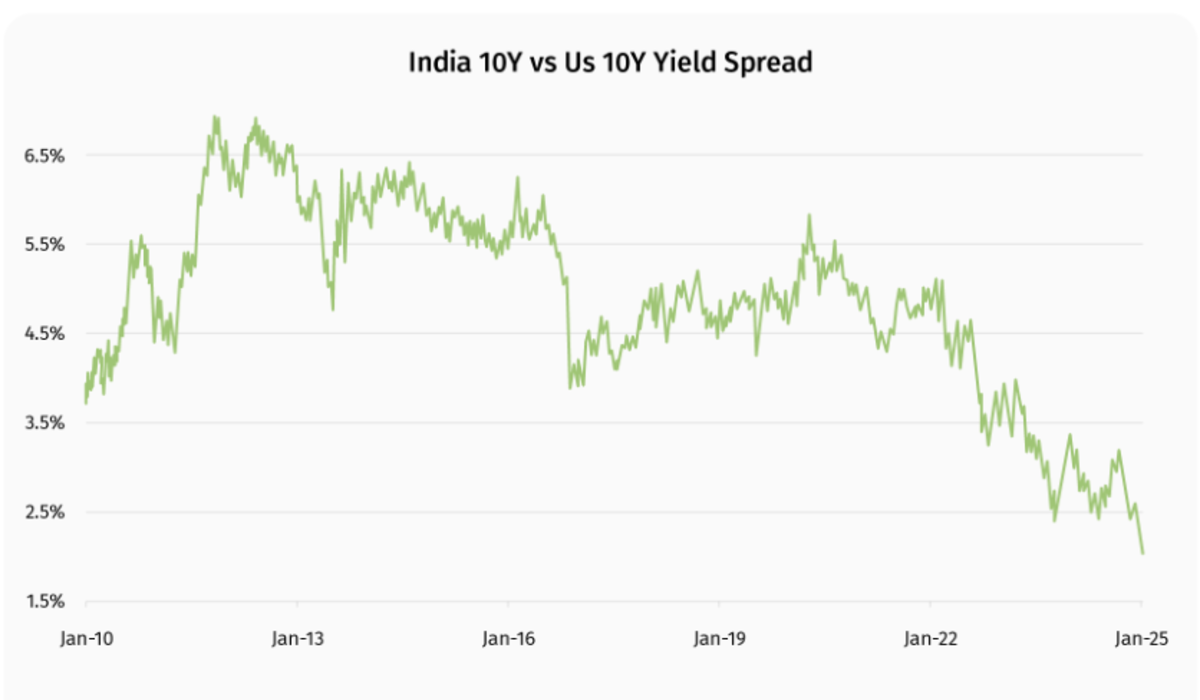

13. India Short-Term Bonds to Lead Rate Cut Rally

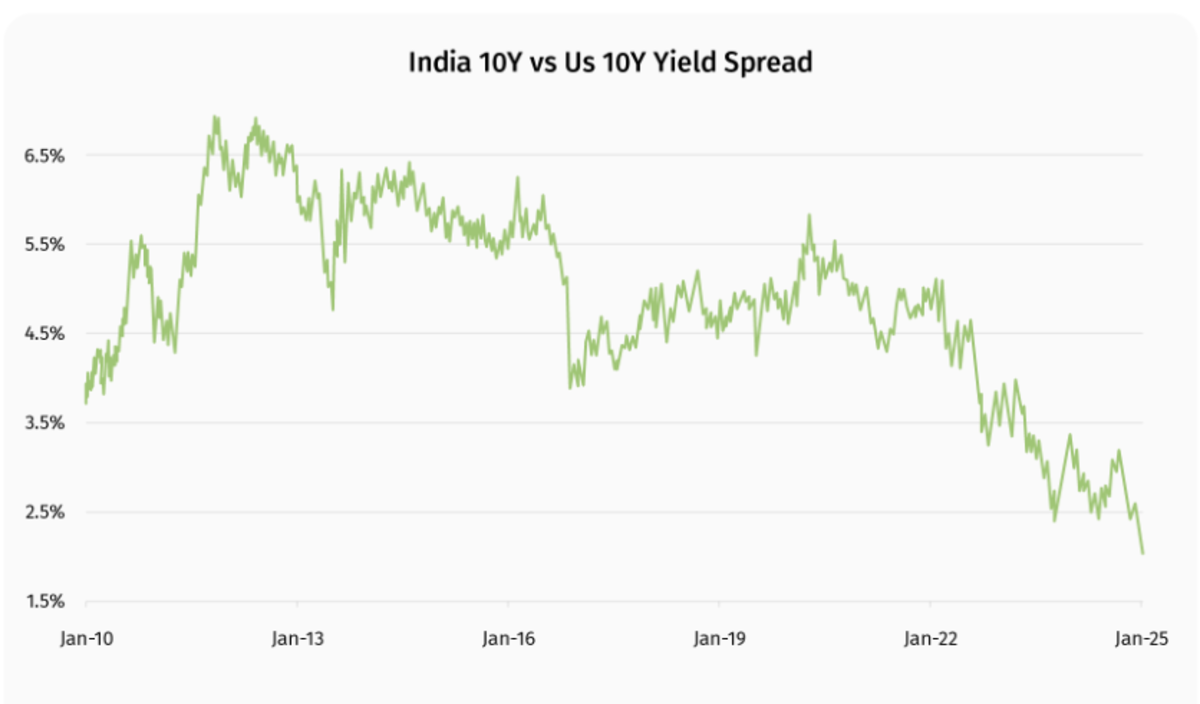

Expected 50-75 bps repo rate cuts to drive yields in short-term bonds (1-3 years).

14. Gold Set to Benefit from Rate Cut Cycle

Gold to outperform equities, supported by central banks’ 400 MT annual reserve additions.

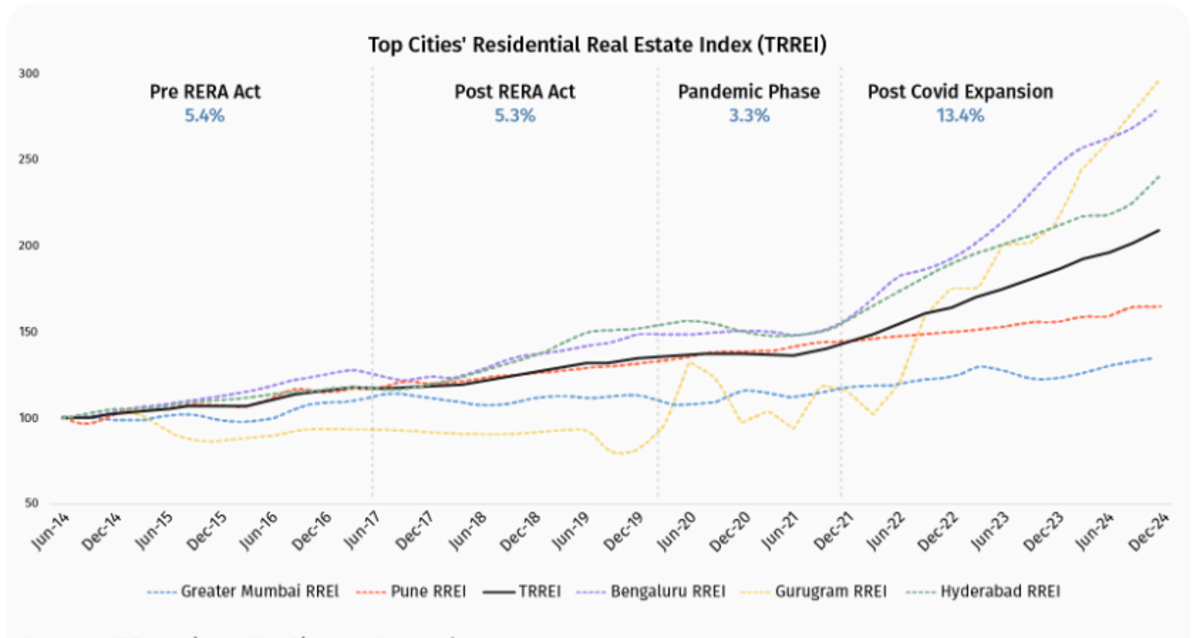

15. Rising Incomes and Rate Cuts to Drive Residential Prices

Strong demand and lower rates to fuel real estate price appreciation in top cities.

The CAGR returns for each phase are written in blue

Looking Ahead

India’s macroeconomic outlook for 2025 paints a promising picture of recovery, driven by moderating inflation, robust rural consumption, and a revitalised manufacturing sector. While global uncertainties like US trade policies and market volatility pose challenges, India’s strong domestic fundamentals and policy support provide a solid foundation for growth. Investors can capitalise on opportunities in large-cap equities, short-term bonds, and gold by adopting a diversified approach.

For a deeper dive into the 15 key views and detailed analysis, explore the full Macroeconomic Outlook 2025 report here.