Despite global headwinds and election-related uncertainties that marked 2024, India's economic narrative in 2025 is one of recovery and resurgence. However, recent geopolitical shifts—including the announcement of reciprocal tariffs by the U.S. under Trump—introduce fresh complexities for global trade dynamics.

As India moves closer to becoming the world’s fourth-largest economy, two key questions arise: How will these trade policy changes influence India’s recovery? And what domestic drivers will sustain its growth momentum?

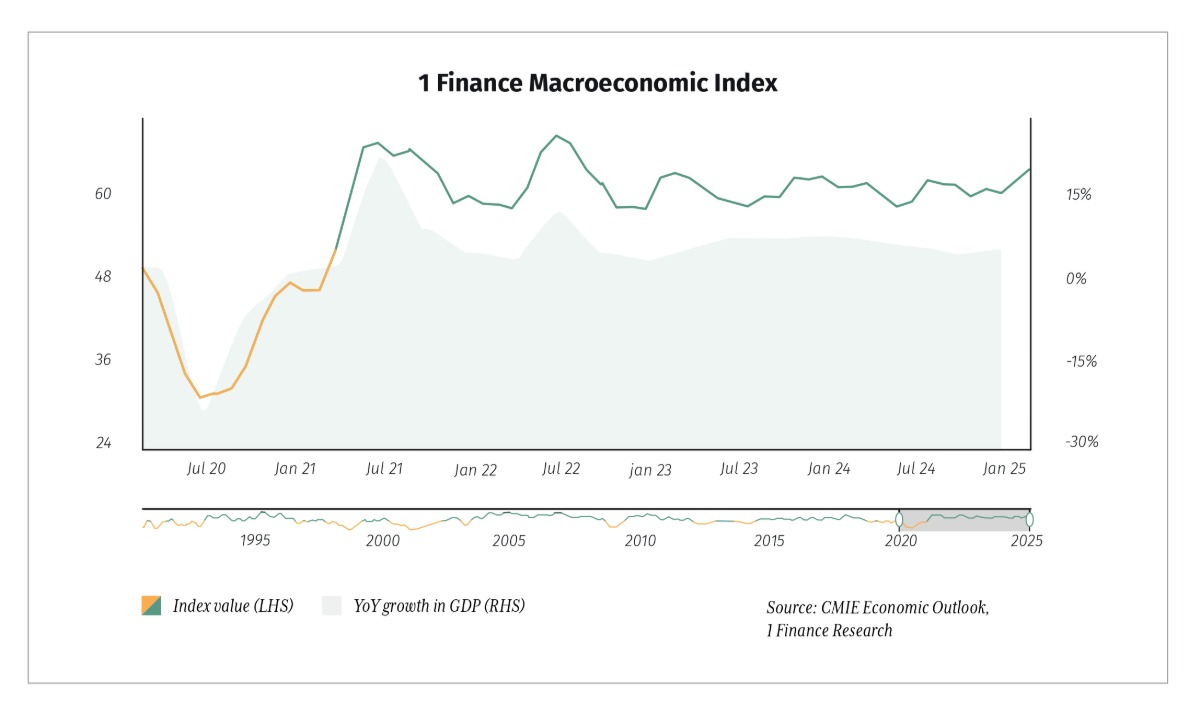

1 Finance Macroeconomic Index

- India’s 1FMI, at 64.7, reflects strong fundamentals despite a temporary slowdown. India stands in a favourable position compared to its peers, with a 60% likelihood of moving from a slowdown to a recovery phase.

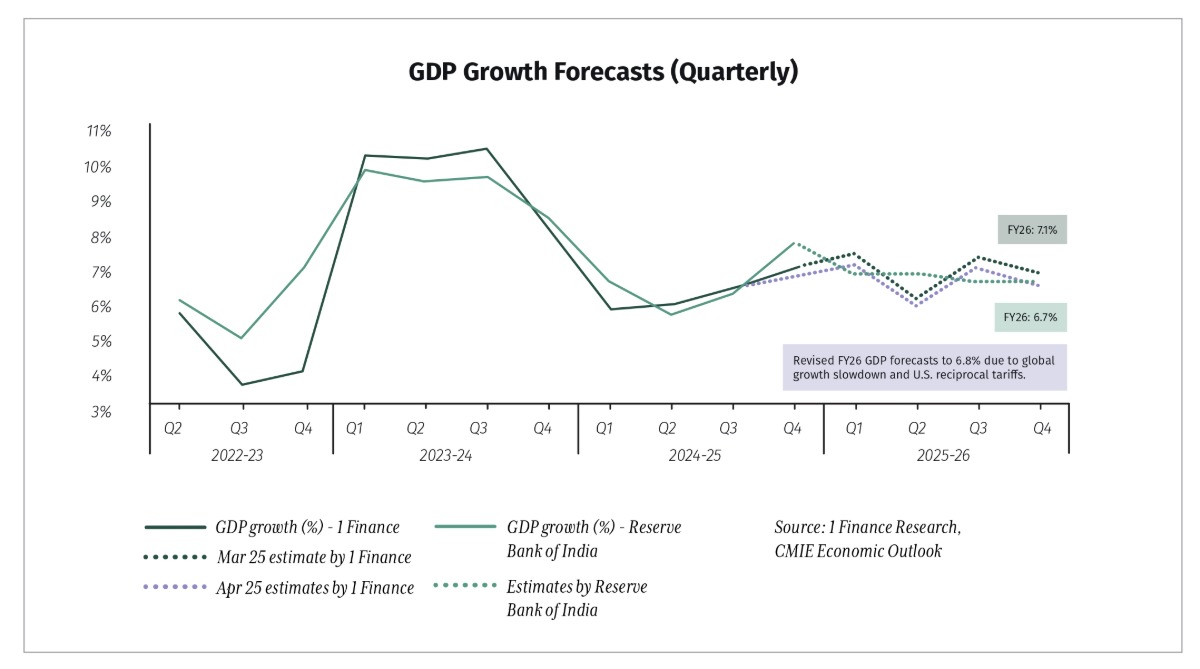

- 1 Finance revises its FY26 GDP growth forecast downward by 30 bps to 6.8% from 7.1%, citing global trade uncertainty, protectionism, lower foreign investments, and a broader global growth slowdown.

- While U.S. economic growth is projected to decelerate from 3% to around 2%, India benefits from a pro-growth fiscal framework and monetary easing, mitigating external risks.

As India explores these shifting global dynamics, its economic endurance will be shaped by a careful balance of policy support, domestic demand, and structural reforms. While external challenges persist, India’s strong fundamentals position it well to sustain growth and emerge as a key driver of the global economy.

Recommended for you

Readers also explored

India's Pharma Sector: Growth & Global Reach FY2026

India's IT Sector Outlook for FY2026

Key Sub-Indices Performance

| Service Sector Activity 👍 | Latest Month | Vs. Last Year | Vs. Last Month |

| The services sector is expected to continue its robust growth trajectory, driven by digital services and e-commerce expansion. | 71.8 | 16% | 5% |

| Industrial Sector Performance 👎 | Latest Month | Vs. Last Year | Vs. Last Month |

| Industrial production is expected to grow by 6.2% in FY26, indicating a possible recovery in the medium term. | 61.5 | -14% | -2% |

| Agriculture Output 👍 | Latest Month | Vs. Last Year | Vs. Last Month |

| The agriculture industry will likely maintain its strong growth rate, aided by favourable weather and government support. | 59.5 | 22% | 6% |

| Equity Market Optimism 👎 | Latest Month | Vs. Last Year | Vs. Last Month |

| Investor sentiment may weaken due to trade tensions, but monetary easing and fiscal support could offer some stability. | 68.6 | -1% | -2% |

| Global Economic Impact 👎 | Latest Month | Vs. Last Year | Vs. Last Month |

| U.S. tariffs may escalate trade tensions, slowing global growth and weakening foreign investor confidence in emerging markets like India. | 47.9 | -19% | -1% |

| Financial Sector Soundness 👍 | Latest Month | Vs. Last Year | Vs. Last Month |

| The index value suggests a sound banking system. | 71.9 | 3% | 4% |

*Data as of February 2025, hence growth comparisons are for February 2024 for Y-o-Y and January 2025 for M-o-M growth comparison.

GDP: What a 6.8% Growth Means for India

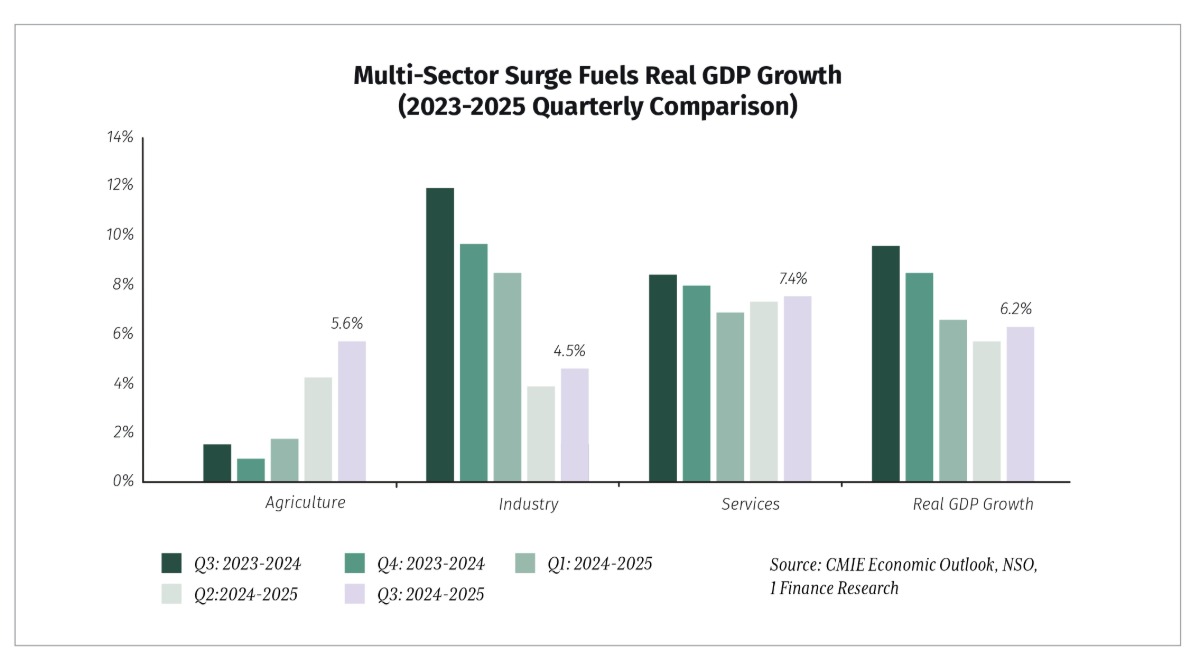

India’s GDP growth of 6.2% in Q3 FY25 and a projected 6.8% for FY26 signals economic stability amid global uncertainties. This uptick from Q2’s 5.6% reflects robust rural consumption, bolstered by a favourable monsoon and increased government spending. Despite a slowdown from FY24’s stellar 9.2%, India outpaces many peers, offering investors a stable yet cautious opportunity.

Agriculture GVA growth improved to a six-quarter high of 5.6% in Q3, up from 4.1% in Q2, aided by robust kharif output. Industry GVA increased to 4.5% from 4%, with manufacturing expanding to 3.5% and electricity GVA accelerating to 5.1%. The services sector maintained strong momentum, growing at 7.4%, led by public administration and defence.

GDP growth for FY26 is projected to dip by 30 basis points due to global trade uncertainty, protectionism, lower foreign investments, and a broader global growth slowdown.

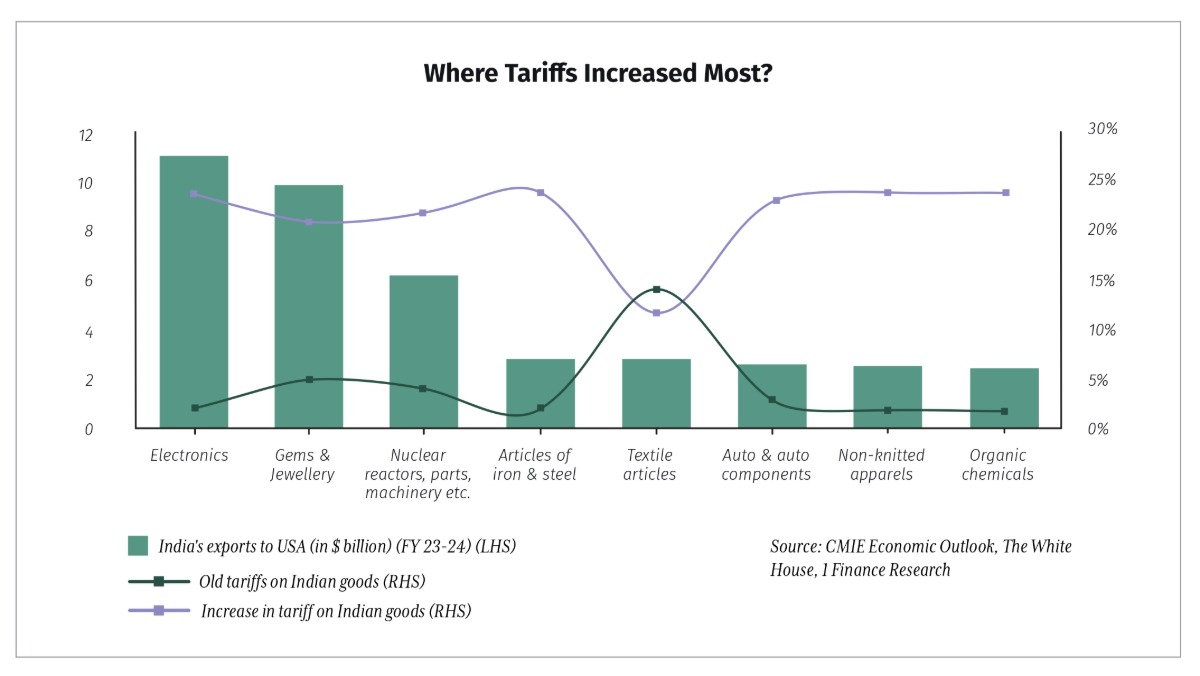

The reciprocal tariffs threaten India’s export competitiveness in gems and jewellery, electronics, and auto components, potentially cutting $12.9 billion (0.3%) from GDP, posing a notable challenge for industries dependent on American markets.

Going forward, the fiscal impulse in the form of tax cuts announced in the budget, coupled with monetary easing and declining inflation, should provide a fillip in the coming quarters.

Balancing Growth and Inflation: Can India Sustain Stability by 2026?

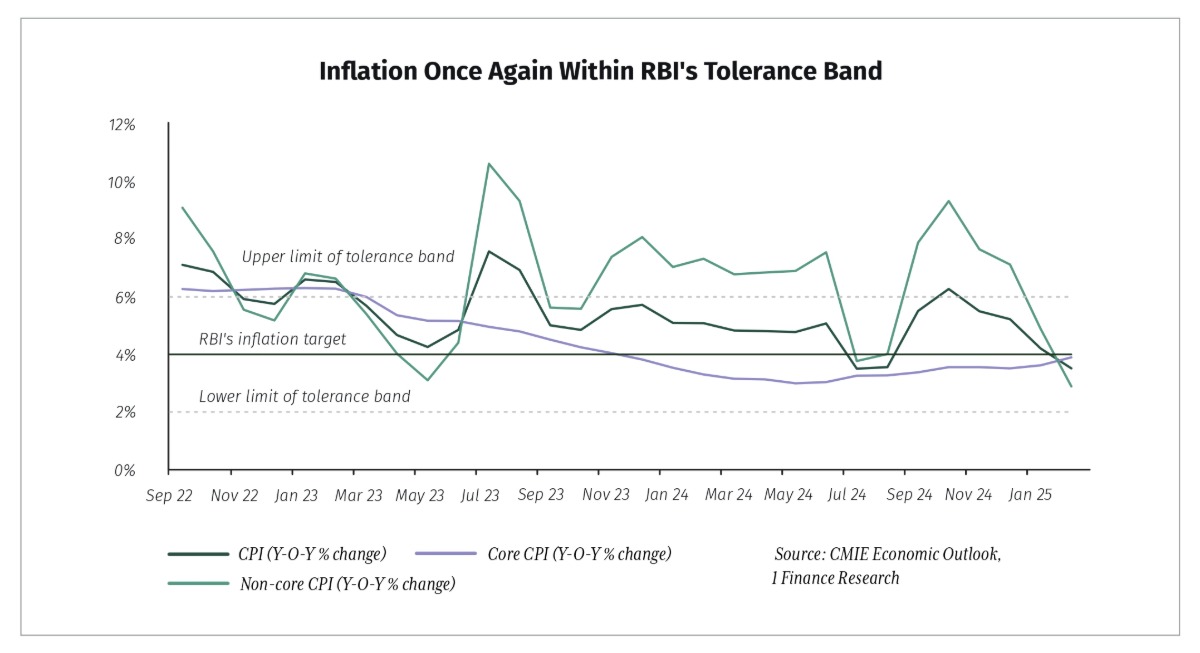

India’s inflation seems to be settling, with CPI dropping to a seven-month low of 3.6% in February 2025, thanks to falling food prices. In response, the RBI cut the repo rate by 25 basis points to 6.25%, aiming to balance inflation control with economic growth.

With further rate cuts of 50-75 basis points expected through FY26, India faces a balancing act between sustaining economic growth and keeping inflation under control.

Food inflation eased to 3.84%, mainly due to a sharp drop in vegetable prices, with garlic, potatoes, and tomatoes accounting for 80% of the decline. Interestingly, dietary shifts during Maha Kumbh played a role. On the other hand, fruit inflation surged to a 10-year high of 14.8%, likely due to increased festival demand.

Despite this relief, core inflation (excluding food and fuel) remains firm at 4.1%, indicating underlying price pressures. Global risks—commodity price swings, a weak rupee, and geopolitical uncertainties—could still challenge inflation management.

Looking ahead, the RBI expects inflation to hover around 4.0-4.2% in FY26. If inflation stays under control, rate cuts in excess of 50-75 bps could boost GDP growth, potentially reaching 7% in FY26 with monetary easing.

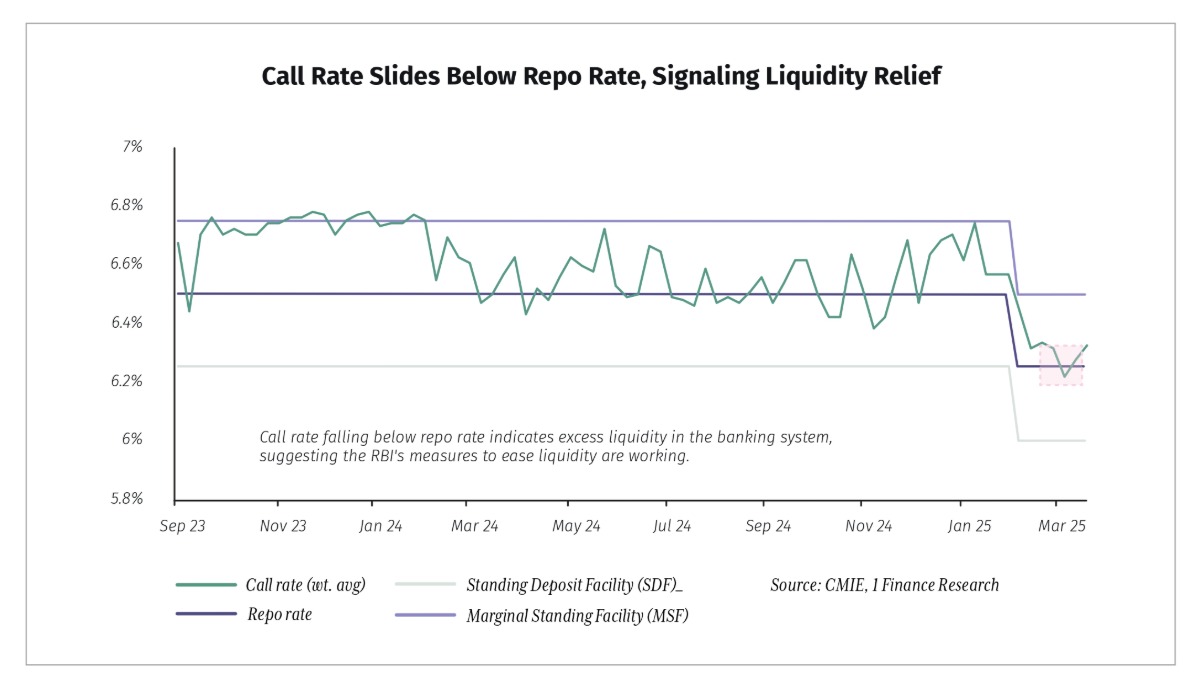

Lower borrowing costs are expected to support private investment in infrastructure, manufacturing, and housing, while tax cuts announced in the budget could enhance disposable incomes and drive domestic demand. The RBI’s policy tools—such as variable rate repos, OMOs, and FX swaps—have pushed India’s weighted average call rate below the repo rate, reflecting eased liquidity conditions.

However, inflationary risks remain. A resurgence in food inflation or supply chain disruptions could force the RBI to pause or reverse rate cuts.

Is Deglobalisation on the Cards for India?

As global trade dynamics shift amid rising protectionism and reshoring, India remains undaunted, balancing self-reliance with global integration. Despite deglobalisation pressures, the country continues to attract foreign investment, with gross inward FDI surging to $67.7 billion in April-January 2025 from $60.2 billion a year ago, reflecting investor confidence. Outward FDI also jumped to $17.3 billion, underscoring India’s expanding global footprint. The government’s recent move to open the space sector to FDI is poised to accelerate private-sector participation.

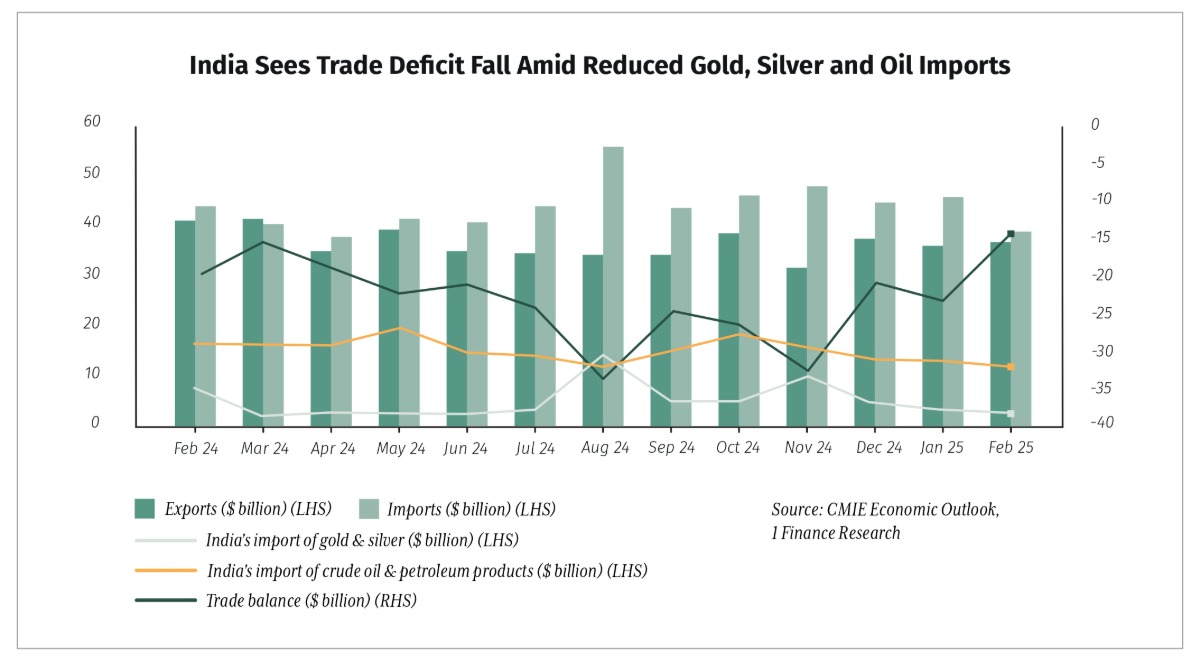

However, external challenges persist. Merchandise exports declined 10.9% YoY in February 2025, though overall exports for April-February grew marginally to $395.6 billion. Imports rose 5.7% to $656.7 billion, led by electronics and machinery, but a decline in oil and gold imports helped shrink the trade deficit to a three-and-a-half-year low of $14.1 billion.

India’s trade ties with the U.S. remain under scrutiny, with ongoing negotiations to lower tariffs on $23 billion worth of U.S. imports now facing added complexity due to the Trump administration’s 26% tariff on selected imports from India, effective April 9, 2025 (delayed by 90 days). Meanwhile, strong macro fundamentals, forex reserves, and robust services exports continue to shield India against global volatility, reinforcing its economic endurance.

Rather than retreating from globalisation, India is actively shaping its economic trajectory through strategic investments, trade realignments, and progressive policy reforms.

Trump Tariffs and India: Shaping a New Trade Horizon

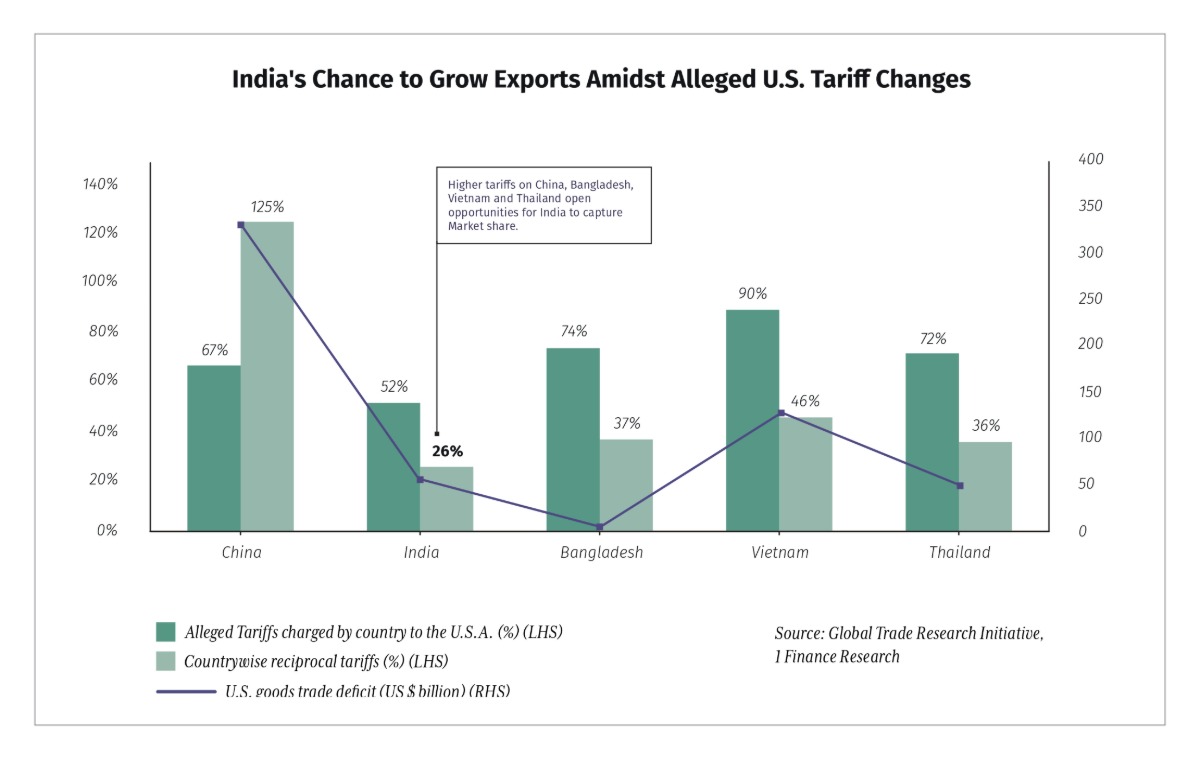

In April 2025, the Trump administration launched its “Liberation Day” tariff strategy, imposing a 10% baseline tariff on all imports from April 5th, followed by steep reciprocal tariffs—34% on China, 20% on the EU, and 46% on Vietnam—to address trade imbalances. As part of this move, the U.S. also slapped a 26% tariff on Indian imports, citing India’s high tariffs on U.S. goods, reshaping bilateral trade dynamics.

On April 9th, Trump delayed tariffs for 90 days on most nations, applying a lower 10% tariff. However, he raised the tariff on Chinese imports to 125%. This latest move has changed the nature of the U.S. trade war, shifting it from a global focus back to a U.S.-China conflict.

Although there is a 90-day delay, this move can spark mixed reactions across industries; while the pharmaceutical sector secured exemptions, industries such as electronics, gems and jewellery may face higher costs, impacting competitiveness.

India has an opportunity in sectors like footwear, furniture, toys, electronics, textiles, and garments, as major exporters like China, Vietnam, and Taiwan face higher tariffs. However, the ultimate impact depends on various factors. The 90-day delay encourages deal-making, and countries heavily reliant on the U.S. might offer more concessions, potentially reducing India's gains.

The tariffs risk a global slowdown. A 0.8-1% drop in global growth will cut India’s GDP by 0.3%, while redirected Chinese oversupply will hurt domestic manufacturing. India’s options are limited, but U.S.-India trade talks by late 2025 could ease tensions if India lowers tariffs on U.S. goods, though political resistance is expected. A successful deal could position India as a key U.S. partner, potentially securing tariff relief or trade agreements in a fragmenting global economy. Without resolution, India faces a delicate balance of risks and opportunities.

Risk Radar: What could go wrong?

| Risk | Description | Likelihood | Impact on India | Our View |

| Global Geopolitical Tensions | Trade disruptions, conflicts (e.g., Russia-Ukraine, Middle East), and supply chain shocks affecting commodity prices and investor sentiment. | High | Higher import costs, rupee depreciation, and potential capital outflows. It could slow down India’s export demand. | India’s strong forex reserves and services exports provide a cushion, but prolonged instability can affect economic growth. |

| Trade Protectionism | Increasing tariffs, local sourcing mandates, and reshoring trends in the U.S. and EU are impacting India’s exports and supply chains. | High | Trump’s tariffs announced in April 2025 could hit key sectors (e.g., textiles, auto parts, gems and jewellery). Could reduce India’s global trade competitiveness. | India is diversifying export markets and enhancing domestic production (PLI schemes), but near-term trade disputes pose a risk. |

| Global Economic Slowdown | Slowdowns in major economies (U.S., EU, China) due to monetary tightening, trade barriers, or recession risks affecting global demand. | High | Weak export growth, slower FDI inflows, and increased market volatility. | India’s strong domestic consumption offers some insulation, but export-driven sectors will face headwinds. |

| Financial Market Volatility | Rapid changes in global liquidity, U.S. Fed rate decisions, or forex volatility affecting capital flows and stock market stability. | High | INR depreciation, rising bond yields, and capital outflows could strain corporate and government borrowing costs. | RBI’s forex interventions and policy tools can stabilise markets, but global spillovers require monitoring. |

| Monsoon and Climate Risk | Unpredictable monsoons, floods, or droughts affecting agriculture and rural livelihoods. | Medium | Weak rural demand can slow down consumption-driven growth. Food price shocks could pressure inflation, affecting monetary policy. | Weather patterns remain unpredictable, but government support (MSP hikes, rural schemes) can help mitigate economic disruptions. |

| Persistent Inflationary Pressures | While CPI has moderated, core inflation remains sticky, and food inflation can resurge due to weather shocks or supply disruptions. | Low | Limits RBI’s ability to cut rates further, reducing growth momentum. Higher costs for businesses and households. | RBI’s cautious stance (repo rate at 6.5%) balances growth and stability; food inflation remains a wildcard. |

Expert Insights

Q&A with Radhika Pandey

Associate Professor

National Institute of Public Finance and Policy

1. What are the biggest macroeconomic opportunities and risks for India in 2025?

India stands at a unique demographic juncture, with over 50% of its population under 25 years old. This young workforce presents an unprecedented economic opportunity. By 2025, India is projected to have the world's largest working-age population. The median age in India is just 28 years (compared to 38 in China, 48 in Japan, and 44 in Germany). Rural consumption showing resilience despite inflationary pressures is another positive upside for the economy. Competitive labour cost and sustained policy push to capital expenditure are the opportunities that could provide an impetus to growth.

Geo-political tensions, hit to exports due to tariffs, threat of global supply glut, and dumping by China are some of the prominent risks to India’s growth outlook in 2025.

2. What are the most pressing internal challenges India must address to sustain its growth momentum?

India needs to address the slowdown in consumption. While rural consumption has been buoyant, urban consumption continues to show signs of sluggishness. A sustained uptick in urban consumption is crucial for a pick-up in private investment at a time when exports (another source of demand and driver of private investment) are likely to be hit by Trump’s tariffs and the overall likelihood of a slowdown in global demand.

India also faces a significant unemployment challenge, marked by high youth unemployment, a mismatch between skills and unemployment and low quality of female employment. To address some of these challenges, deregulation, easing of compliance burden and factor market reforms are crucial.

3. Given India's economic trajectory from a ‘slowdown’ to a potential ‘recovery’, what are the critical indicators you are closely monitoring to validate this transition? Additionally, what factors or triggers do you believe could either accelerate this recovery or pose risks of delay?

India’s economic trajectory is marking a shift from slowdown to potential recovery. In addition to the headline growth numbers, we look at indicators that capture demand: both rural and urban, investment, external sector dynamics, employment, and health of the financial sector. A sustained pick-up in consumption, aided by policy support in the form of income tax cuts and interest rate cuts, could accelerate this recovery. Risks are posed by the external sector uncertainty due to tariffs imposed by the U.S. There are related concerns around global supply glut and dumping from China. The confluence of these factors could dent the recovery in India’s GDP growth.

Another area of concern is the slowdown in bank credit. Banks have turned cautious on account of emerging signs of stress in the unsecured personal loan segment, but a broad-based deceleration in credit growth could hamper the recovery in household consumption.

4. What opportunities and hurdles does India offer foreign investors in 2025? What policy measures or reforms would you recommend to make India a more attractive destination for foreign investment?

Relatively higher growth amid subdued global growth, a large consumer base and sectoral diversification are the key opportunities for foreign investors. Inadequate infrastructure, such as poor transport networks, unreliable energy supply, limits FDI inflows, especially in sectors like manufacturing and logistics. Policy uncertainty, overlapping jurisdictions, excessive documentation, and bureaucratic inefficiencies tend to deter foreign investors.

Policy measures: Eased disclosure requirements. Some initiatives have already been undertaken in this direction by SEBI. Simplification of the tax burden and reduction in compliance burden would further strengthen India’s attractiveness as a destination for foreign investments. Tax treatment of foreign investments is another area that needs policy attention. Foreign investors are liable to pay capital gains tax rates ranging from 10% to 20%, depending on the nature and duration of their investment.

Foreign sovereign funds, pension funds, universities, and high net worth individuals (HNIs) are the key foreign investors in the world and India. Taxing them on their gains, especially when they may not have tax set-off available in their home country, and when they face forex-related risks, leads to souring of foreign investor sentiments.

5. The government's infrastructure push is widely regarded as a major driver of economic growth. How do you evaluate the sustainability of this capex-led growth strategy? Additionally, what are the key risks and challenges that could hinder its effectiveness or long-term impact?

Capital expenditure (CapEx)-driven growth offers clear advantages. It is non-inflationary and has a strong multiplier effect. India’s infrastructure-focused CapEx strategy has held the Indian economy in good stead so far. However, sustaining this momentum will require careful attention to potential fiscal constraints at both the central and state levels. The future approach to public capex is also to ensure adequate space for greater private sector involvement. Prudent spending and an agile approach are needed to ensure funds are allocated to productive areas through continuous monitoring and evaluation.

If the Output-Capital Ratio begins to deteriorate, it may indicate declining efficiency of investment. In such a case, a continuous push to infrastructure-led growth without course correction could lead to diminishing returns.

6. How could geopolitical risks (e.g., US-China tensions, reciprocal tariffs by US, US economic slowdown) affect India’s growth outlook?

India is not immune to the evolving global challenges. Geopolitical risks, tariff wars, and global economic slowdown could dent India’s growth outlook. Hit to exports, disruptions to global supply chains, and sector-specific implications could dent domestic growth by 30-50 basis points in the current year.

The US’s decision to slap reciprocal tariffs on trading partners could intensify global oversupply fears, harming the prospects of businesses in India. The silver lining is that tariffs give India an edge over competitors such as China, Vietnam, Bangladesh and Thailand in certain products, nevertheless, India would have to navigate rising costs and disruptions to supply chains.

7. How should India’s monetary policy evolve in response to global central bank actions, especially if the US Fed pivots to rate cuts?

India’s monetary policy needs to be flexible and respond to the evolving growth-inflation dynamics. The emerging concerns of stagflation in the U.S due to tariffs and the laying off of federal employees have rendered the stance of the U.S monetary policy uncertain. Each central bank would have to calibrate its monetary policy in response to the evolving landscape. While the rate in April is already factored in, the future monetary policy response would depend on the inflation trajectory and the dent to the growth outlook due to the challenging external environment. In summary, monetary and fiscal policy actions would need to work in tandem to navigate the complex and uncertain economic situation.

What's Ahead?

1 Finance forecasts FY26 GDP growth at 6.8%, down from 7.1%, driven by strong domestic demand, sustained government spending, and a robust services sector. Despite global slowdown and trade uncertainty, investment momentum and policy support keep India’s growth outlook compelling.

India's economic outlook for 2025 reflects a cautious yet optimistic trajectory. Despite the transitory slowdown in 2024, the nation stands on the cusp of recovery, fueled by moderating inflation, a manufacturing sector ready for capital expenditure, and a revival in rural consumption.

However, global economic headwinds, rupee depreciation, and geopolitical tensions remain significant hurdles. The Trump tariffs announced in April 2025 add a layer of complexity to India’s trade outlook, though its low export dependence and ongoing U.S. negotiations may soften the blow. To address these challenges, India needs to focus on policy stability and diversification across sectors. While the probability of transitioning to a recovery phase is high, risks such as trade tariffs and supply chain disruptions need careful management.

The road ahead is not without bumps, but with bold decisions and a clear focus, India has the potential to transform challenges into catalysts for robust economic advancement.