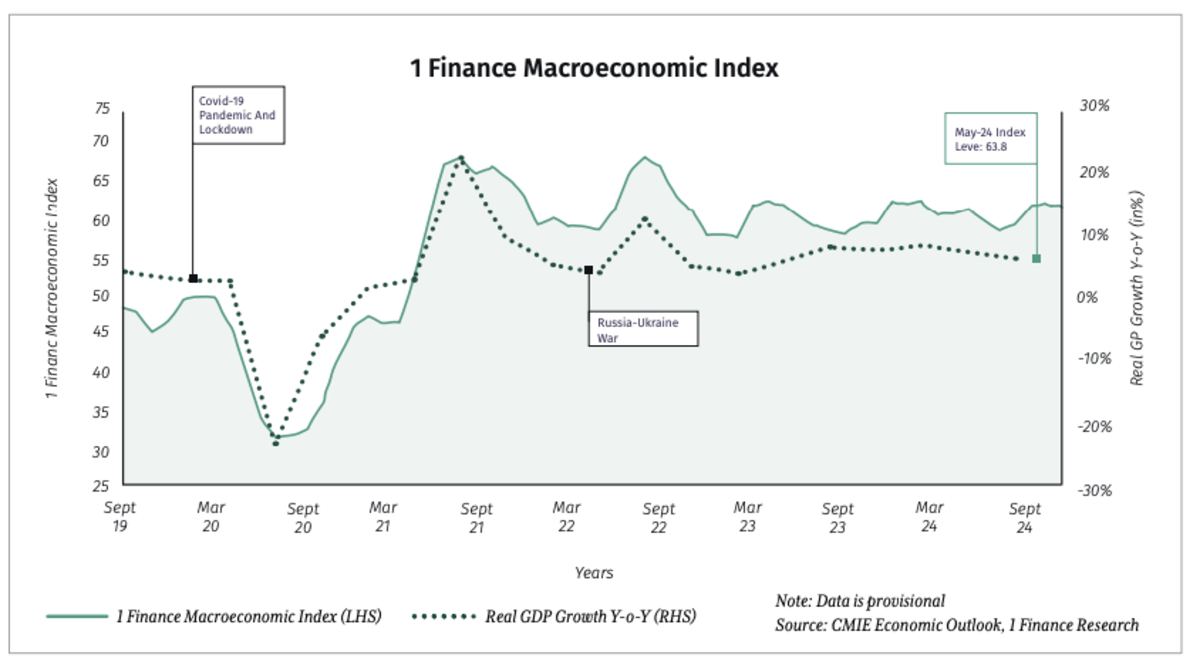

India’s economy continues to steer a complex landscape, with GDP growth moderating to 6.7% YoY in Q1 FY2025 (June 2024) from 7.8% in the prior quarter, yet maintaining a robust 7.2% projection for FY2025, as per the Reserve Bank of India. Despite global headwinds, the services sector (7.2% GVA growth) and industrial sector (8.3% GVA growth) remain pillars of strength, supported by steady domestic demand and government capital expenditure. However, agriculture, though improved at 2.0% GVA growth, faces risks from erratic monsoon patterns despite an 8% above-normal rainfall season. Retail inflation surged to 5.5% in September 2024, prompting the RBI to hold the repo rate at 6.5% for the tenth consecutive meeting. Bolstered by a record $700 billion in forex reserves and a fiscal deficit target of 4.9% of GDP, India’s economic outlook remains resilient. This quarter’s update, guided by the 1 Finance Macroeconomic Index’s rise to 62.5 in September 2024, explores the trends shaping India’s macroeconomic trajectory for July-September 2024.

Key Takeaways

- India’s GDP growth slowed to 6.7% YoY in Q1 FY2025 from 7.8% in Q4 FY24, with FY2025 projected at 7.2%, driven by services (7.2% GVA) and industrial (8.3% GVA) sectors.

- Agri GVA rose to 2.0% in June 2024, supported by an 8% above-normal monsoon, but early deficits (33.1% as of June 19) and climate risks threaten Kharif output.

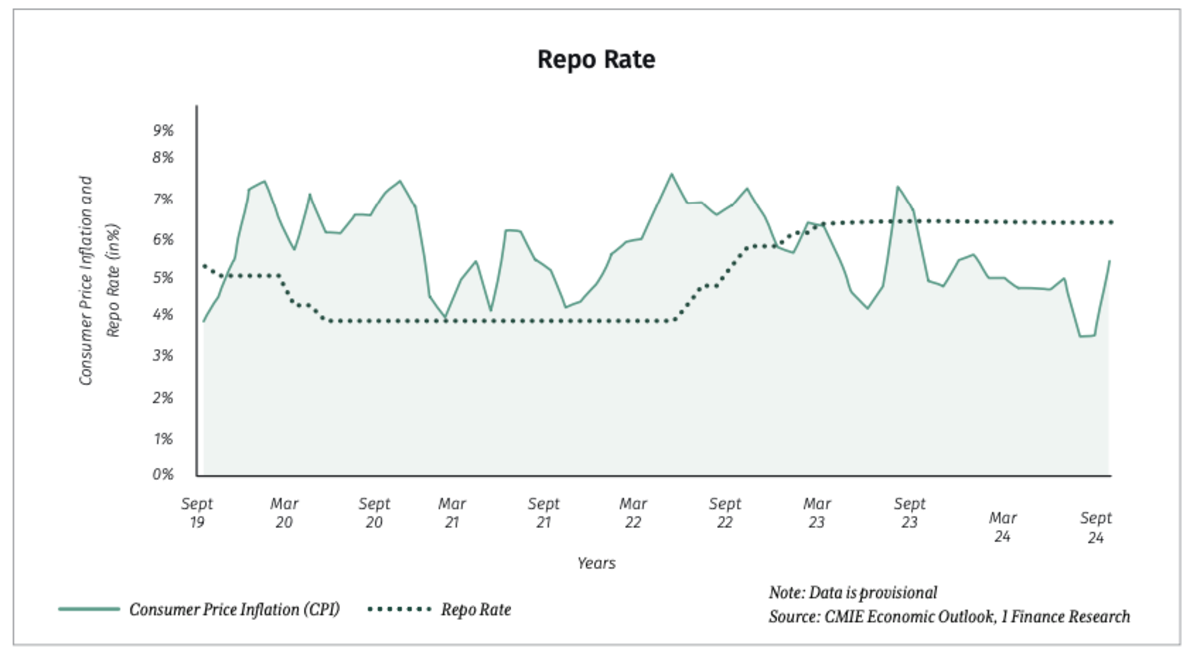

- CPI inflation hit 5.5% in September 2024, up from 3.6% in August, with food inflation at 5.7%; crude oil prices ($75/barrel in October) and OPEC+ cuts add pressure.

- RBI maintained the repo rate at 6.5% in October 2024, with no immediate cuts expected due to inflation above the 4% target, keeping borrowing costs high.

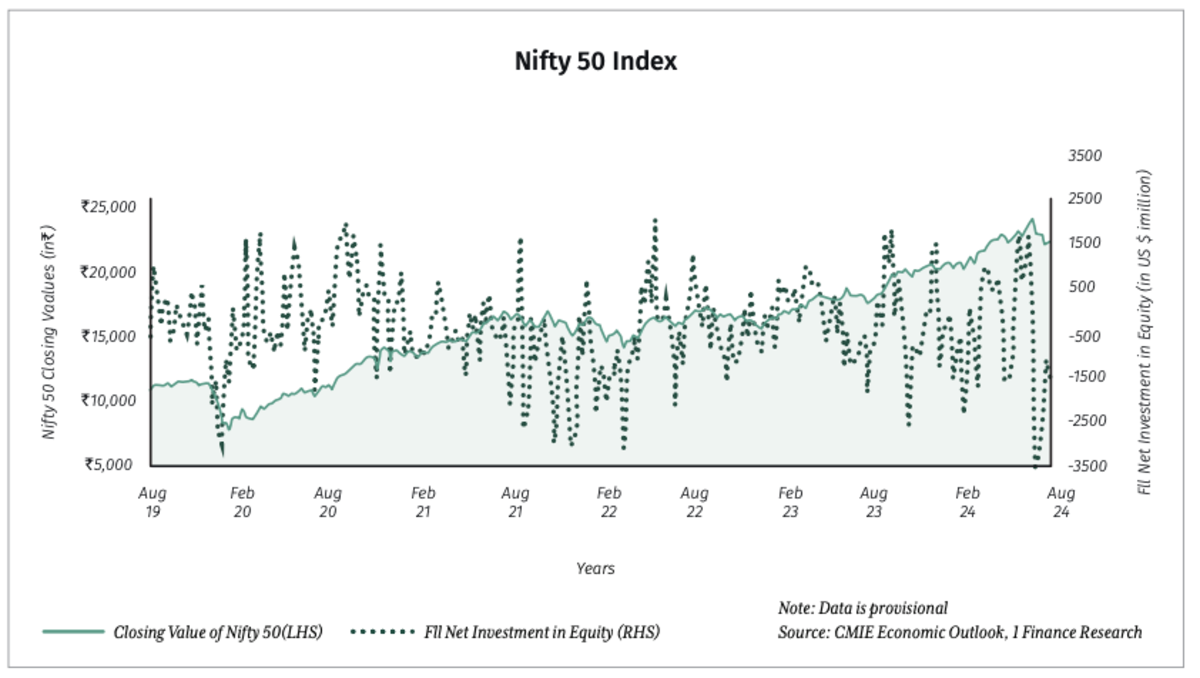

- Nifty 50 gained 2.3% in September, with FPIs investing $13.8 billion in equities and domestic AUM soaring 63% YoY to ₹31.1 trillion, despite coalition-related volatility.

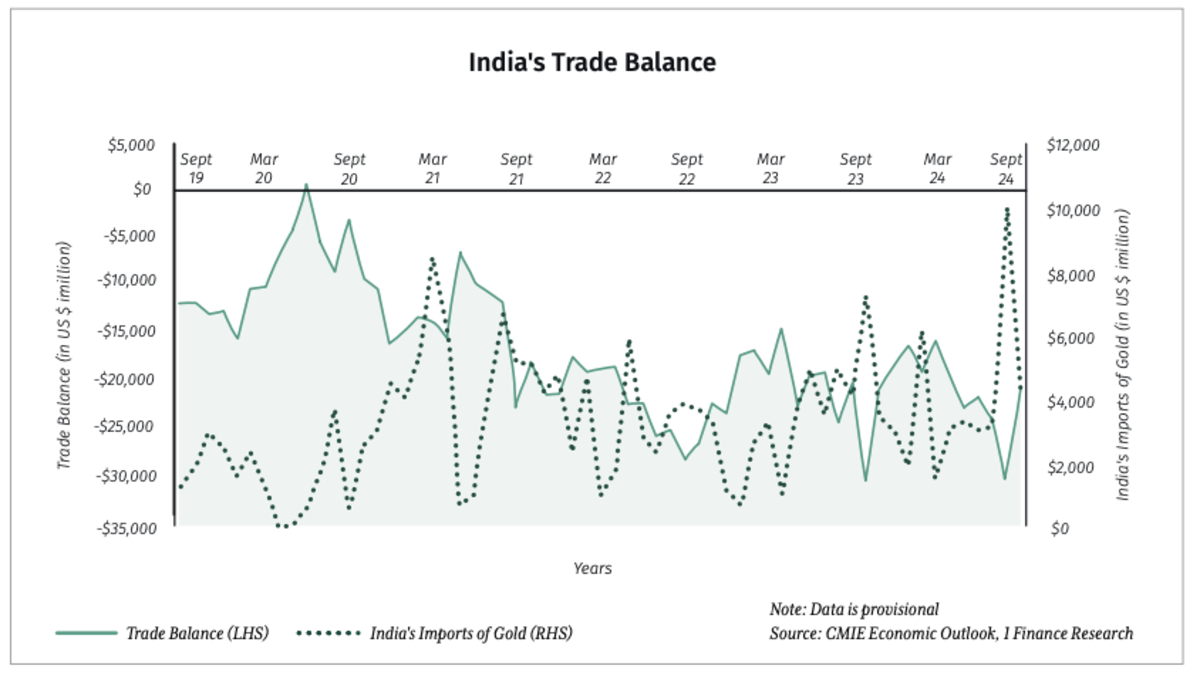

- Forex reserves reached $700 billion, but merchandise exports fell 9.3% YoY in August, and the trade deficit widened to $29.6 billion; bond index inclusion boosts FPI inflows.

- RBI’s ₹2.11 lakh crore surplus transfer and a 4.9% fiscal deficit target for FY2025 enhance fiscal space, supporting capex or reduced borrowing.

Recommended for you

Readers also explored

Growth Momentum Moderates Amid Economic Shifts

Currency in Circulation: How Much Money Exists in the World?

India’s Macroeconomic Summary

| Economic Landscape | Recent Updates | Near-term Outlook |

| Indian Economy |

|

Easing inflation and prospects of better agri output supported by favourable monsoon enhance India's economic prospects, while the prolonged geopolitical issues remain promising, with some supported by growth in services and industrial sectors and improved fiscal conditions. The NDA government's return ensures policy continuity, though coalition management may cause some market volatility. The RBI's record surplus transfer provides fiscal space for either increased capex or a cutback in market borrowings, which helps reduce pressure on domestic yields. Retail borrowing costs are expected to moderate in FY25, supporting both consumer spending and business growth. Strong domestic demand and an improving global environment are likely to maintain India's growth momentum, with the RBI projecting 7.2% GDP growth for FY25. |

| Services Sector Activity |

|

The services sector is expected to maintain broad-based growth, driven by strong credit demand in sub-sectors such as the hotel and tourism industry and real estate. Expectations of favourable economic policies by the newly elected government should provide conducive business conditions, while lingering geopolitical uncertainties remain a concern. Moderation in government capex growth in FY25 may hinder the pace of growth. |

| Industrial Sector Performance |

|

Global economic recovery is expected to boost demand for Indian manufacturing exports, while diverging consumption patterns in the domestic market may limit broad-based industrial growth. Stagnant credit demand by large-scale industries signals a potential decline in private investments, while a continuation of investment-friendly reforms by the government, such as Make in India 2.0, to attract private and foreign investments will be key for sustaining the growth momentum.

|

| Agriculture Output |

|

The weak start to the monsoon, with a 33.1% deficit compared to normal as of 19th June, raises significant concerns for Kharif crop output. While the IMD forecasts above-normal monsoon for 2024, climate change impacts could lead to erratic rainfall patterns, potentially causing localised flooding or dry spells that may adversely affect crop yields. Timely and well-distributed rainfall remains crucial for boosting agricultural incomes and reviving rural demand, which was adversely affected in FY24. |

| Consumer Price Index (CPI) Inflation |

|

The inflation outlook appears mixed. Favourable monsoon forecast offers some respite, however, the weak progress in the monsoon so far adds to the concern. Crude oil prices, though easing recently, remain ~10% higher than last year's levels and the decision by OPEC+ to maintain deep oil output cuts into 2025 is likely to keep supply tight and prices elevated, potentially exacerbating inflationary pressures. Upbeat consumption demand, coupled with uncertain global commodity prices, is expected to keep inflation beyond the RBI's comfort level of 4%. |

| Equity Market Outlook |

|

The NDA government's return to power has instilled optimism, raising expectations for continued economic reforms and policy consistency. However, the complexities of managing a coalition government may lead to market fluctuations. Global economic headwinds appear to be easing, which, coupled with India's healthy domestic growth prospects, could provide support for market valuations. The market's performance in the coming months will likely be shaped by policy announcements, corporate earnings and global economic developments. |

| Global Economic Impact |

|

Improving global economic conditions and domestic demand are aiding trade growth, however, delays in monetary easing by the central banks may dampen global demand. The inclusion of Indian bonds in global debt indices starting June 2024 is expected to attract huge FPI investments in the debt market, bolstering forex reserves, which will enhance India's resilience against potential global challenges. |

Financial Sector Soundness

|

|

Recent improvement in banking system liquidity is expected to enhance banks' capacity to manage robust credit demand. However, a potential delay in policy rate cuts by the RBI may keep borrowing costs elevated. This could exert pressure on credit growth in FY25, as higher interest rates may dampen demand for loans across sectors. The divergence between credit and deposit growth rates remains a point of concern. Banks may need to focus on attracting more deposits to sustain the current pace of credit expansion, potentially leading to more competitive deposit rates in the coming months. |

| Interest Rate Outlook |

|

Given India’s strong growth fundamentals, ongoing concerns over food inflation and delays in monetary easing by major global central banks, the RBI is expected to continue its focus on managing inflation. Hence, the likelihood of an immediate rate cut is low. |

1. Economic Stability Amid Inflationary Pressures and Industrial Challenges

Source: CMIE Economic Outlook, 1 Finance Research

The 1 Finance Macroeconomic Index is a comprehensive index, integrating multiple subindices based on high-frequency indicators. It offers nuanced insights into India’s economic trends and phases.

- The Monetary Policy Committee’s decision to maintain the policy rate at 6.5% for the tenth consecutive period reflects a commitment to economic stability amidst persistent inflationary pressures.

- While the GDP growth rate stood at 6.8% for Q1 FY 2024-25, the inflation rate of 5.5% in September 2024 remains above the target, necessitating continued caution from the RBI.

- The Index of Industrial Production (IIP) recorded a slight dip of 0.1% in August 2024, with a 1% increase in manufacturing, but showed declines in the mining (4.3%) and electricity (3.7%) sectors. The RBI’s stable policy rates aim to support industrial recovery by ensuring credit availability and investment.

- India’s merchandise trade deficit improved to $20.8 billion in September 2024, from $29.6 billion in August, due to a drop in imports, especially gold, with total merchandise imports marking a five-month low at $55.4 billion. This positive trade balance contributes to macroeconomic stability, bolstered by the RBI’s steady monetary policy.

- The stability of the Indian economy is reflected in the 1 Finance Macroeconomic index (1FMI), which rose to 62.5 in September 2024, compared to 60 in the June 2024 quarter.

2. Understanding Monetary Policy Decision

Source: CMIE Economic Outlook, 1 Finance Research

- The RBI's Monetary Policy Committee (MPC) kept the repo rate steady at 6.5%, marking the tenth consecutive instance of the status quo.

- The MPC’s decision, supported by a majority of 5-1 votes, reflects confidence in India's economic resilience amid global and domestic uncertainties. While one member advocated for a rate cut, the neutral stance allows flexibility for future rate adjustments.

- The RBI revised its inflation outlook: 4.1% for Q2 (Sep 2024), 4.8% for Q3 (Dec 2024) and 4.2% for Q4 (Mar 2025). This reflects a cautious approach to risks like erratic weather, geopolitical tensions and commodity price fluctuations.

- The GDP growth forecast for FY 2024-25 remains at 7.2%, driven by strong consumer spending, investment demand, improved agricultural output and a thriving services sector.

- Concerns about NBFC lending practices, particularly high-interest rates and excessive fees, were raised. The RBI emphasised the need for strict oversight to ensure financial stability.

- The neutral stance maintains flexibility, allowing the RBI to adjust rates in response to future economic conditions while supporting growth and controlling inflation.

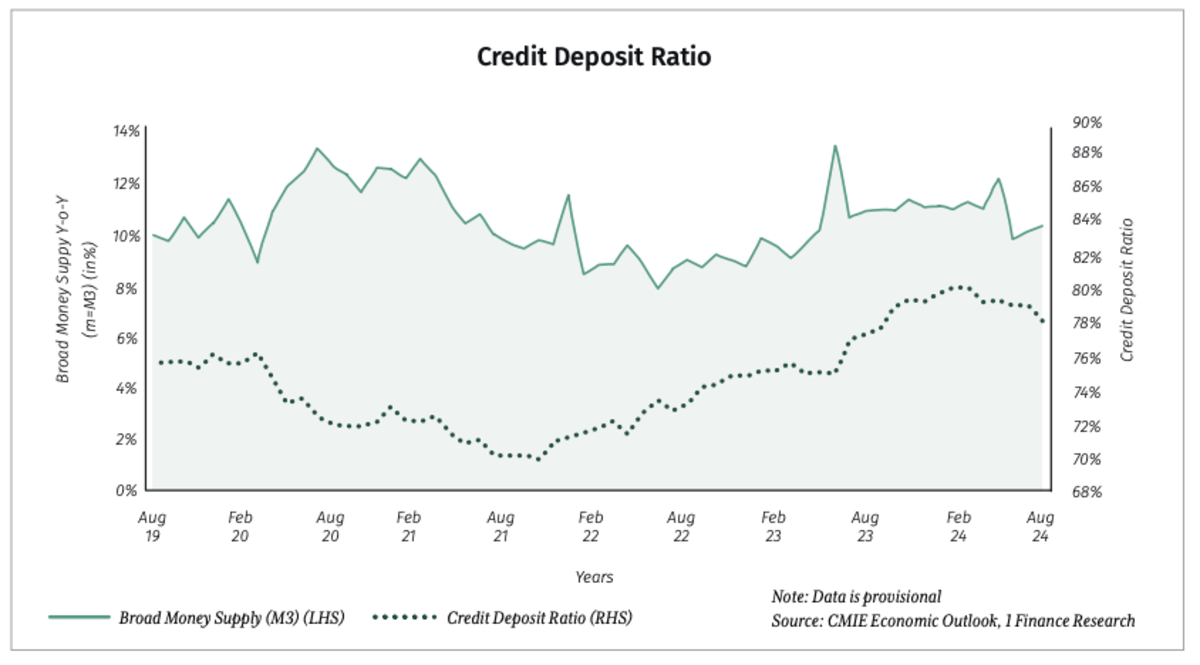

3. Effects on Liquidity

Source: CMIE Economic Outlook, 1 Finance Researc

- By maintaining the repo rate at 6.5%, the RBI ensures stability in the financial system's liquidity and controls the excessive growth in money supply (M3), which increased by 8.3% year-on-year as of September 2024.

- The Credit-Deposit Ratio (CDR) stood at 74.5% in September 2024, indicating healthy demand for credit across sectors.

- Non-food credit from scheduled commercial banks (SCBs) rose significantly by ₹1,425 billion in August 2024, driven by increased lending to the industry and services sectors, reflecting stronger business confidence and credit availability.

- Credit to the services sector grew notably by ₹215.1 billion in August 2024, a significant jump from the average ₹119 billion in prior months, indicating robust demand in the sector.

- Personal loans also saw substantial growth, increasing by ₹530.1 billion in August, further fueling consumer spending and supporting economic activity.

- Overall, the RBI’s steady approach fosters economic growth, ensures price stability and provides adequate liquidity across essential economic segments.

4. Broader Economic Impacts

Source: CMIE Economic Outlook, 1 Finance Research

- In August 2024, the Index of Industrial Production (IIP) subtly declined by 0.1% YoY, signalling a slowdown in key sectors such as mining and electricity generation, which experienced YoY reductions of 4.3% and 3.7% respectively.

- Manufacturing output recorded a modest 1% growth, reflecting challenges in key industries such as chemicals and basic metals. In contrast, the consumer durables sector exhibited positive growth, illustrating a diverse performance in industrial production.

- September saw a significant shift in dynamics, with merchandise imports falling to a five-month low of $55.4 billion. This reduction played a pivotal role in shrinking the trade deficit to $20.8 billion from a ten-month peak of $29.6 billion the previous month, easing pressures on external accounts.

- On the fiscal front, tax revenues, encompassing Goods and Services Tax (GST) and corporate taxes, have shown impressive strength, mirroring the underlying vigour of the economy.

- This fiscal robustness, coupled with a projected GDP growth of 7.2% for the fiscal year 2024-25, is supported by persistent demand in consumption and incremental gains in manufacturing output.

5. The Global Context

Source: CMIE Economic Outlook, 1 Finance Research

- In October 2024, global financial markets experienced mixed trends due to divergent central bank policies and continued economic challenges. Weaker-than-expected Q2 results from major economies, coupled with enduring inflation, painted a bleak picture for the markets.

- Reflecting these global headwinds, Indian equity indices such as the Nifty 50 and S&P BSE Sensex witnessed declines, signalling concerns over the pace of corporate growth and dampening investor confidence.

- During this period, Foreign Portfolio Investors (FPIs) showed a continuation of their cautious stance, withdrawing $1.9 billion in the week ending October 18. While this represented a moderation from the higher outflows of $3.7 billion seen in the prior two weeks, it underscored the ongoing apprehension among investors in light of global uncertainties.

- The Indian rupee weakened against the US dollar, crossing the ₹84 threshold for the first time, a movement influenced by the prevailing risk aversion in the global markets. Despite these challenges, the bond market in India exhibited a degree of resilience.

6. Portfolio Strategy for Investors

| Correlation | Equity | Real Estate | Passive Income Assets | Debt | Alternative Investments |

| Equity | 1.00 | ||||

| Real Estate | -0.02 | 1.00 | |||

| Passive Income Assets | 0.24 | 0.77 | 1.00 | ||

| Debt | 0.12 | 0.09 | 0.05 | 1.00 | |

| Alternative Investments | -0.04 | 0.04 | 0.02 | -0.01 | 1.00 |

- Diversification in investment strategies aims to minimise risk and enhance returns. By spreading investments across asset classes, a diversified portfolio reduces exposure to specific risks and improves overall stability.

- For example, the low correlation of 0.12 between equities and debt instruments shows that when equities decline, bond yields may either hold steady or rise. Similarly, real estate and equities have a near-zero correlation of -0.02, meaning they don’t move in sync, providing a buffer against market volatility.

- Economic cycles impact asset correlations, highlighting the need for dynamic portfolio management. During economic expansions, equities and real estate may show higher correlations, prompting adjustments to capitalise on growth. Conversely, during downturns, shifting towards more stable assets like debt instruments may be beneficial.

- An investor’s life stage also influences their strategy. Younger investors may focus on growth with higher equity allocations, while those nearing retirement should prioritise stability with more conservative assets like debt.

- Timely adjustments to the asset mix, based on life events such as buying a home or approaching retirement, are crucial to aligning investment strategies with changing financial goals.

[Use our Asset Allocator to tailor your investment strategy based on your age and India’s economy, to optimise growth and stability.]

Conclusion

The RBI’s consistent monetary policy, aiming to balance growth and inflation, underscores its cautious approach in an unpredictable economic environment. Despite global uncertainties affecting markets, India’s economic fundamentals, supported by stable fiscal policies and diverse industrial performance, provide a solid foundation for future growth.