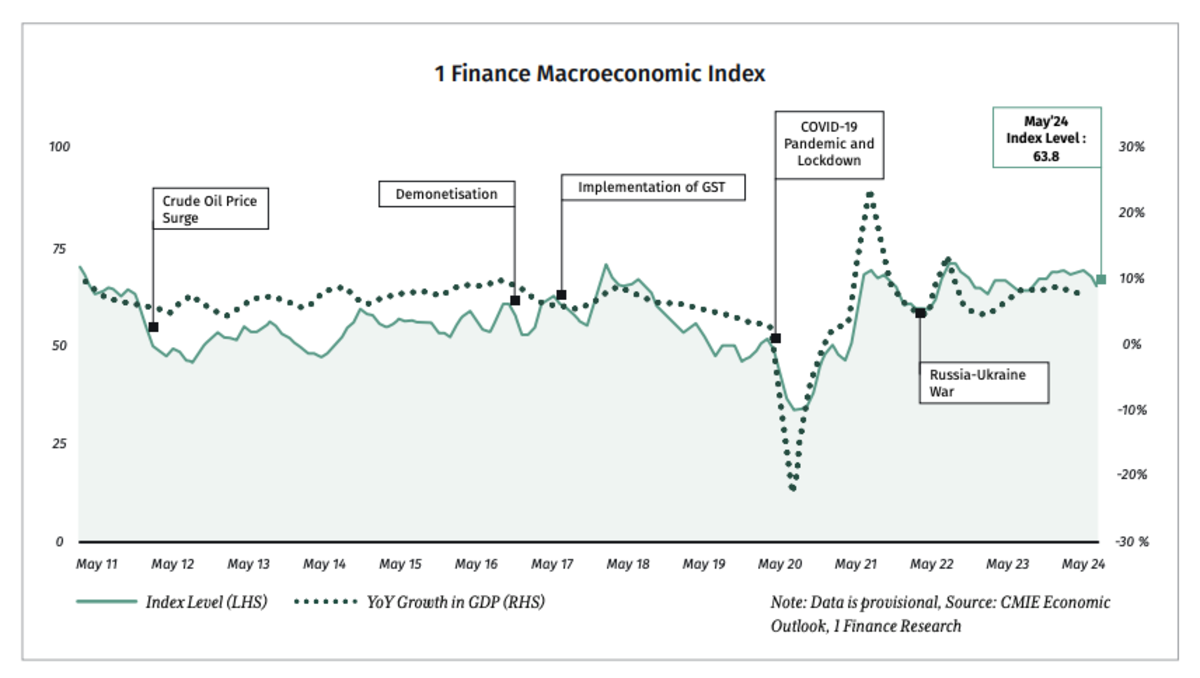

India's economic trajectory remains largely positive, despite a moderation in growth momentum in the final quarter of FY24. With a strong full-year GDP growth of 8.2%, bolstered by robust industrial and services sector performance, India continues to outpace many global peers. However, sectoral divergences, sticky food inflation, and uncertainty over the monsoon add complexity to the economic narrative.

The re-election of the NDA government ensures policy continuity, which is expected to support economic stability and reforms in FY25. At the same time, global economic recovery, improving trade performance, and the inclusion of Indian bonds in global indices are set to strengthen India’s external position. Yet, inflation risks, subdued agricultural output, and high interest rates may pose challenges going forward.

Key Takeaways

- India’s GDP growth eased to 7.8% in Q4 FY24, with FY24 at 8.2% YoY, driven by industrial (9.9%) and services (7.6%) sectors, while RBI projects 7.2% for FY25.

- Agri GVA grew by only 1.4% in FY24, with foodgrain production down 6.17% YoY; a 33.1% monsoon deficit as of June 19, 2024, threatens Kharif output and sustains food inflation at 8.7%.

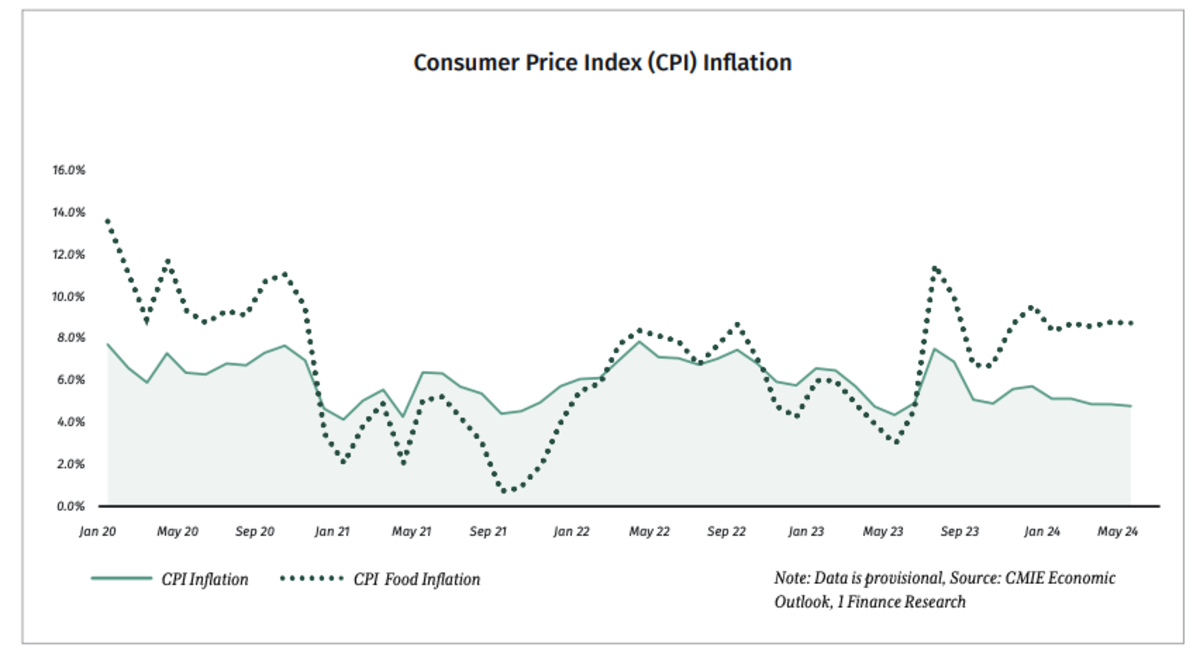

- CPI inflation hit a 12-month low of 4.8% in May 2024, but food inflation remains high at 8.7%, with crude oil prices ($81.8/barrel) and OPEC+ cuts adding pressure.

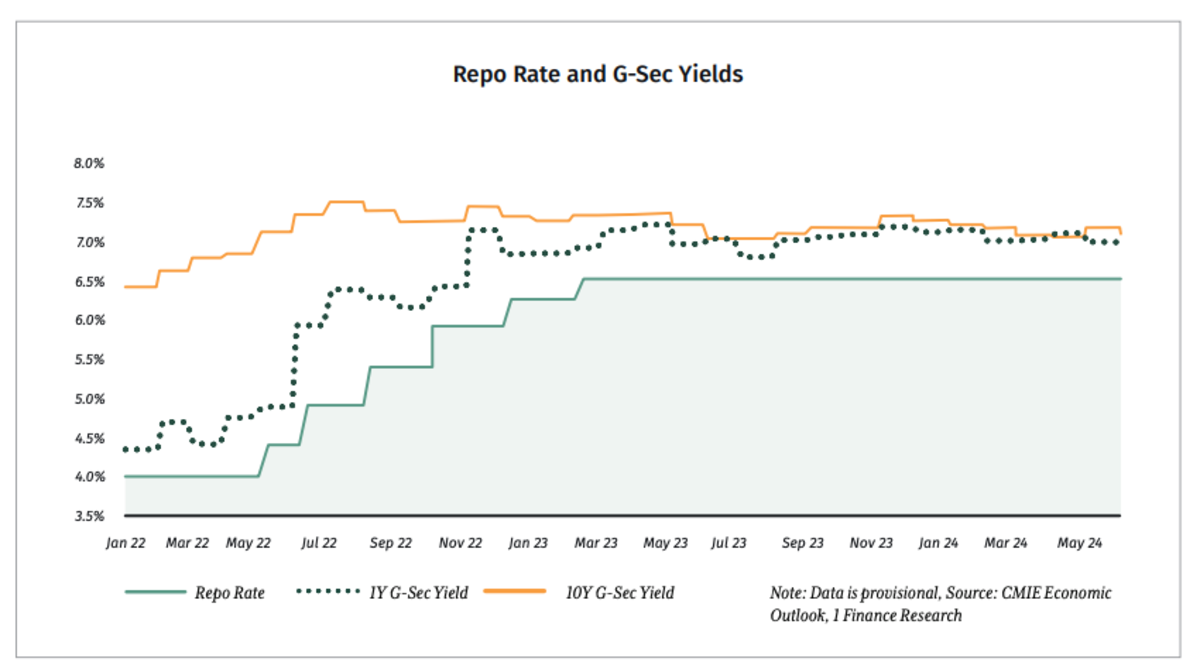

- RBI maintained the repo rate at 6.5% in June 2024, with no immediate cuts expected due to inflation above the 4% target, keeping borrowing costs elevated.

- Nifty 50 dipped 0.3% in May, with FPIs selling $1.9 billion amid election uncertainties; domestic AUM in equities surged 50.7% YoY, supporting valuations.

- Forex reserves hit $650 billion, with merchandise exports up 9.1% YoY and Indian bonds’ inclusion in global indices boosting FPI inflows.

- RBI’s ₹2.11 lakh crore surplus transfer enhances fiscal space, potentially reducing borrowing or increasing capex, supporting growth in FY25.

India’s Macroeconomic Summary

| Economic Landscape | Recent Updates | Near-term Outlook |

| Indian Economy |

|

India's economic outlook remains promising, supported by growth in services and industrial sectors and improved fiscal conditions. The NDA government's return ensures policy continuity, though coalition management may cause some market volatility. The RBI's record surplus transfer provides fiscal space for either increased capex or a cutback in market borrowings, which helps reduce pressure on domestic yields. Retail borrowing costs are expected to moderate in FY25, supporting both consumer spending and business growth. Strong domestic demand and an improving global environment are likely to maintain India's growth momentum, with the RBI projecting 7.2% GDP growth for FY25. |

| Services Sector Activity |

|

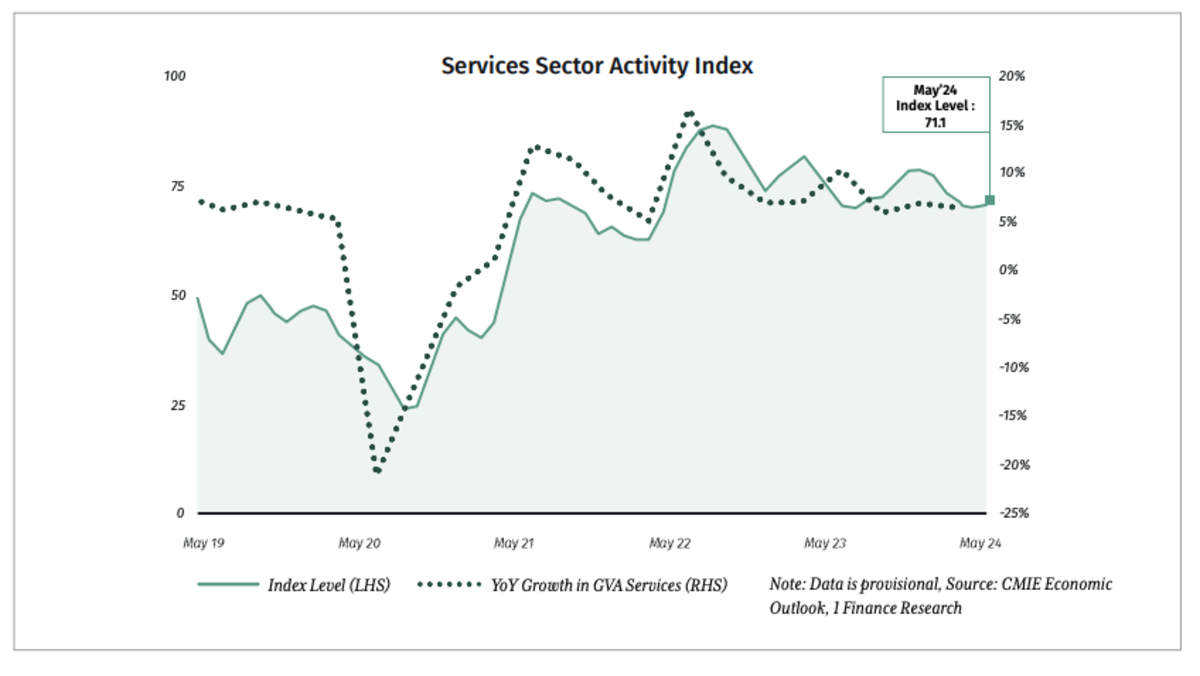

The services sector is expected to maintain broad-based growth, driven by strong credit demand in sub-sectors such as the hotel and tourism industry and real estate. Expectations of favourable economic policies by the newly elected government should provide conducive business conditions, while lingering geopolitical uncertainties remain a concern. Reduction in government capex in FY25 may hinder the pace of growth. |

| Industrial Sector Performance |

|

Global economic recovery is expected to boost demand for Indian manufacturing exports, while diverging consumption patterns in the domestic market may limit broad-based industrial growth. Stagnant credit demand by large-scale industries signals a potential decline in private investments, while a continuation of investment-friendly reforms by the government, such as Make in India 2.0, to attract private and foreign investments will be key for sustaining the growth momentum.

|

| Agriculture Output |

|

The weak start to the monsoon, with a 33.1% deficit compared to normal as of 19th June, raises significant concerns for Kharif crop output. While the IMD forecasts above-normal monsoon for 2024, climate change impacts could lead to erratic rainfall patterns, potentially causing localised flooding or dry spells that may adversely affect crop yields. Timely and well-distributed rainfall remains crucial for boosting agricultural incomes and reviving rural demand, which was adversely affected in FY24. |

| Consumer Price Index (CPI) Inflation |

|

The inflation outlook appears mixed. Favourable monsoon forecast offers some respite, however, the weak progress in the monsoon so far adds to the concern. Crude oil prices, though easing recently, remain ~10% higher than last year's levels, and the decision by OPEC+ to maintain deep oil output cuts into 2025 is likely to keep supply tight and prices elevated, potentially exacerbating inflationary pressures. Upbeat consumption demand, coupled with uncertain global commodity prices, is expected to keep inflation beyond the RBI's comfort level of 4%. |

| Equity Market Outlook |

|

The NDA government's return to power has instilled optimism, raising expectations for continued economic reforms and policy consistency. However, the complexities of managing a coalition government may lead to market fluctuations. Global economic headwinds appear to be easing, which, coupled with India's healthy domestic growth prospects, could provide support for market valuations. The market's performance in the coming months will likely be shaped by policy announcements, corporate earnings and global economic developments. |

| Global Economic Impact |

|

Improving global economic conditions and domestic demand are aiding trade growth, however, delays in monetary easing by the central banks may dampen global demand. The inclusion of Indian bonds in global debt indices starting June 2024 is expected to attract huge FPI investments in the debt market, bolstering forex reserves, which will enhance India's resilience against potential global challenges. |

Financial Sector Soundness

|

|

Recent improvement in banking system liquidity is expected to enhance banks' capacity to manage robust credit demand. However, a potential delay in policy rate cuts by the RBI may keep borrowing costs elevated. This could exert pressure on credit growth in FY25, as higher interest rates may dampen demand for loans across sectors. The divergence between credit and deposit growth rates remains a point of concern. Banks may need to focus on attracting more deposits to sustain the current pace of credit expansion, potentially leading to more competitive deposit rates in the coming months. |

| Interest Rate Outlook |

|

Given India’s strong growth fundamentals, ongoing concerns over food inflation and delays in monetary easing by major global central banks, the RBI is expected to continue its focus on managing inflation. Hence, the likelihood of an immediate rate cut is low. |

Recommended for you

Readers also explored

Balancing Slowdowns and Sectoral Strength

World GDP Breakdown 2025: Who Powers the Global Economy?

Growth Momentum Continues Albeit at a Moderate Pace

India's economy is projected to maintain its growth momentum in FY25, with the RBI revising its GDP growth estimate to 7.2% from the earlier 7.0%. This follows an impressive 8.2% growth in FY24, driven by the industrial and services sectors, which grew by 9.9% and 7.6% YoY in FY24, respectively.

In Q4FY24, the GDP growth declined to 7.8% from 8.6% in Q3. After expanding by 10.4% and 7.1% YoY in Q3, both the industry and services sectors' Gross Value Added (GVA) moderated to 8.4% and 6.7% YoY, respectively in Q4.

The agriculture sector faced challenges due to an uneven monsoon in 2023, leading to a decline in the quarterly growth in Agri GVA in Q3 and Q4, and annual GVA grew by only 1.4% in FY24. In FY25, the sector may continue with challenges such as erratic rainfall, which is already evident from deficit rainfall so far, despite the prediction of an above-normal Southwest monsoon in 2024.

While overall inflation has somewhat moderated, an unchanged interest rate outlook suggests no immediate relief from elevated borrowing costs. Interest rates may moderate in FY25, contingent upon benign inflation, a manageable fiscal deficit and reduced government borrowings.

External sector conditions have shown improvement, and the anticipated recovery in the global economy is expected to improve external demand. The inclusion of Indian bonds in global debt indices starting June 2024 is expected to attract significant FPI investments in the debt market, bolstering forex reserves.

The equity markets outlook continued to remain buoyant, supported by stability in the political environment and the continuation of economic reforms and policies. However, the challenges of running a coalition government may keep market sentiments jittery.

While the overall economic conditions remain positive, underlying weaknesses persist due to varying growth trends across sectors. This is reflected in the 1 Finance Macroeconomic Index (1FMI), which fell from 68.1 in March 2024 to 63.8 in May 2024, indicating a further moderation in economic activity since Q4FY24.

Soaring Food Prices Impede Inflation Targets

8.4%: Average CPI food inflation in the last 12 months

While overall inflation has moderated since early 2024, persistent food inflation around 8.0% remains a significant concern. In May 2024, CPI inflation eased to a 12-month low of 4.8%, but food inflation remained elevated at 8.7%, driven by rising prices of essential commodities and vegetables.

The near-term outlook for food inflation is further complicated by the slow progress of the Southwest monsoon. As of 19th June, there was a 33.1% deficit compared to normal rainfall, raising concerns about agricultural output and potential inflationary pressures.

Crude oil prices have shown some stability ($83.6/barrel as of 25th June). However, the global commodity market remains uncertain, particularly in light of OPEC+'s decision to extend output cuts into 2025.

The robust demand in the economy is evident from the strong non-food credit growth (19.8% YoY in May), increasing GST collections (10.0% YoY) and sustained M3 money supply growth (12.1% YoY). While these indicators reflect positive economic momentum, they also suggest potential inflationary pressures.

Given the uncertain supply-side conditions and strong demand, inflationary pressures are likely to persist in the near term. This situation complicates the RBI's task of managing inflation while supporting growth, potentially influencing its decisions on interest rates and monetary policy in the coming months.

Shift in Monetary Policy Stance is Underway

6.5%: Repo rate since February 2023

The RBI has maintained its ‘withdrawal of accommodation’ stance since June 2022 and has not changed the repo rate since February 2023 to rein in inflation. Despite impressive GDP growth in FY24, the RBI remained focused on achieving its inflation target of 4%, a level that has been consistently exceeded since October 2019.

The government's commitment to fiscal consolidation, as evidenced by the reduced fiscal deficit target of 5.1% for FY25 (down from 5.8% in FY24) and lower proposed borrowing (2.8% YoY decrease), is expected to help curb demand-driven inflationary pressures. However, volatile food prices and potential supply-side shocks continue to pose significant risks to the inflation outlook.

Although CPI inflation eased to 4.8% in May 2024, the near-term inflation outlook is still not very supportive of immediate rate cuts. However, the Monetary Policy Committee's (MPC) decision to maintain the status quo on interest rates with a 4:2 majority in the June meeting hints at the possibility of a shift towards a neutral policy stance in the near future.

Capex Moderation May Hinder Services Sector Growth

10.4%: Government capex growth moderated in Q4FY24

The services sector, contributing nearly 60% to India's GDP, plays a crucial role in the overall economic health. In Q4FY24, services GVA growth moderated to 6.7% from 7.1% in Q3, primarily due to a slowdown in capex growth, which declined to 10.4% YoY in Q4 from 24.4% in Q3. The annual growth for FY24 stood at 7.6% YoY, lower than the previous year's 10.0%, partly attributed to base effects.

Despite this moderation, several indicators point to positive momentum in the sector:

- Robust credit growth in services (21.7% YoY in April 2024)

- Sustained expansion in services Purchasing Managers' Index (PMI), remaining above 60.0 since January 2024

- Revival in services exports, growing by 11.8% YoY in May 2024

However, some challenges persist:

- Decline in passenger car sales (-8.8% YoY), potentially reflecting reduced income growth in the middle-income group

- Anticipated moderation in government spending in FY25, which may constrain the sector's growth pace

- Lingering geopolitical uncertainties affecting global demand

On a positive note, the increase in net member additions by the Employees' Provident Fund Organisation (EPFO) in April over March 2024 (31.3%) suggests rising employment opportunities in the formal sector.

The outlook for the services sector remains cautiously optimistic. While the newly elected government's focus on improving employment opportunities and easing global headwinds could support the sector, the potential reduction in government capex may pose challenges to sustain high growth rates.

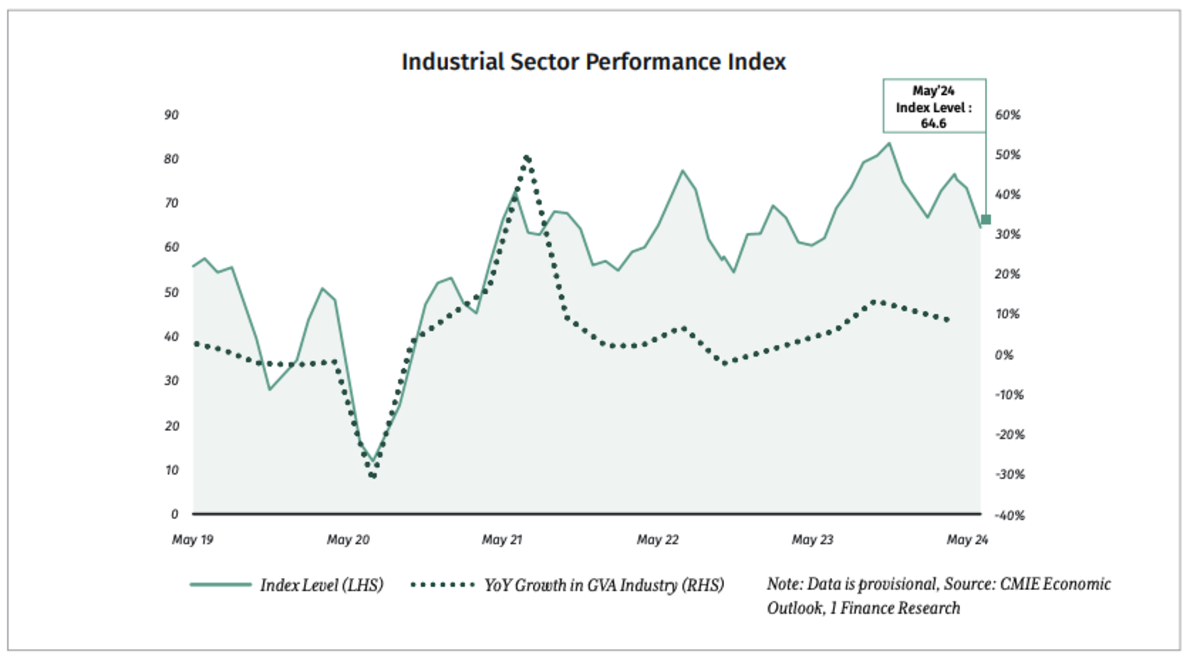

Mixed Trends in Manufacturing Sector Outlook

5.0%: Moderate growth in IIP in April YoY

India's industrial sector has been experiencing a complex mix of trends in recent quarters, showcasing both resilience and challenges that have moderated its pace of expansion. GVA growth in industries slowed to 8.4% in Q4FY24 (10.5% in Q3) and credit offtakes moderated to 7.4% in April 2024 (8.5% in May) due to weak demand from large industries (4.7% YoY in April).

IIP grew moderately at 5.0% in April, but with diverging consumption patterns. Consumer durables recorded notable growth (9.8%) and non-durables contracted (-2.4%). Exports of manufactured goods increased marginally by 2.5% in April 2024 (0.8% in FY24), suggesting a marginal recovery in global demand.

Looking ahead, improvements in global economic conditions are expected to enhance demand for domestic manufacturing, while diverging domestic consumption patterns may limit the growth. Stagnant credit demand by large-scale industries signals a potential decline in private investments, which necessitates the continuation of investment-friendly reforms by the government, such as PLI scheme and ‘Make in India 2.0’, to attract private and foreign investments to sustain the growth momentum.

Overall, while the industrial sector is expected to experience moderate growth in the near term, policymakers and industry stakeholders need to adapt strategies to foster sustainable and inclusive industrial development.

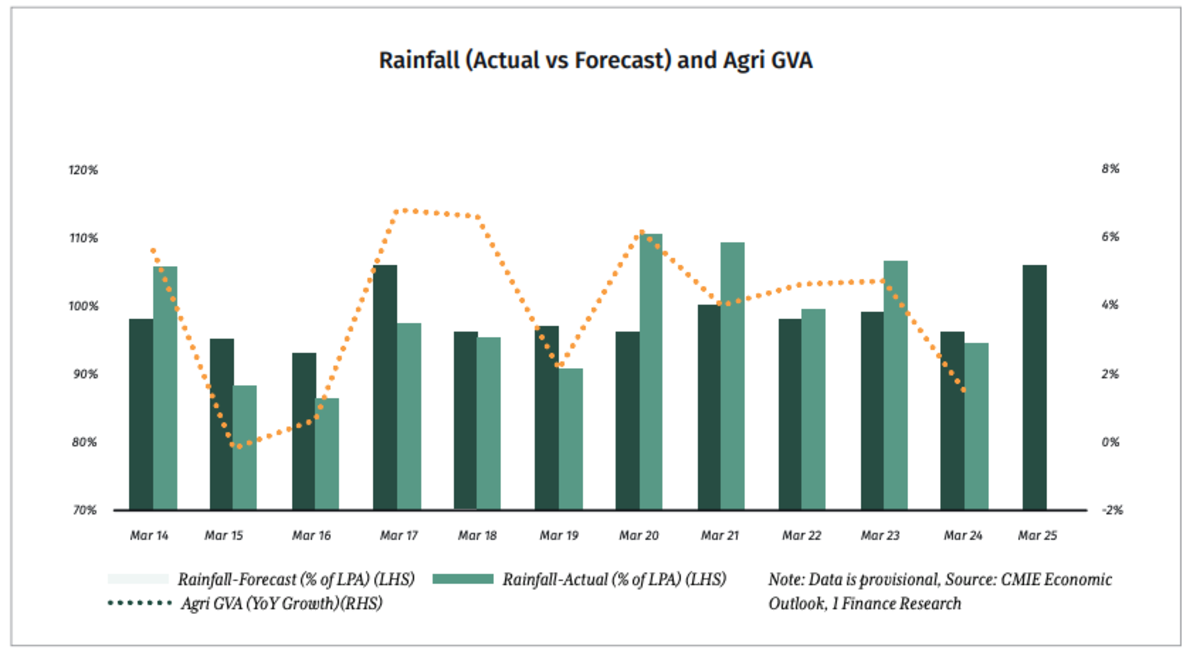

Uncertain Agri Outlook Despite Prediction of Bountiful Monsoon

106% of LPA: Projection of above normal Southwest monsoon in 2024

India's agriculture sector faced significant challenges in FY24, primarily due to uneven rainfall distribution and a below-normal Southwest monsoon (94.4% of LPA). This resulted in an 8-year low GVA growth of 1.4%. The impact was evident in the total foodgrain production, which contracted by 6.2% YoY, with reductions in both Kharif and Rabi outputs. Consequently, food inflation remained elevated, staying above 6.0% for 11 consecutive months and reaching 8.7% in May 2024.

The IMD’s projection of an above-normal Southwest monsoon during 2024 brightens the FY25 agri outlook, however, the slow progress in the onset of monsoon (33.1% deficit compared to normal as of June 19) poses serious challenges for Kharif sowing. Furthermore, the prediction of La Niña conditions forming from July-August could lead to heavy rains later in the season, potentially damaging Kharif output.

The persistent climate challenges, despite favourable monsoon predictions, keep the sector's outlook uncertain. But with the right government policy support and investments in rural infrastructure, the sector has the potential to drive economic growth, as improved agricultural production helps to reduce food inflation and strengthen rural demand.

Conclusion

Despite the recent slowdown, India's economic outlook appears promising, driven by steady public investment, resilient private consumption and improving external environment backed by comfortable forex reserves. The formation of a new government which holds a majority brings stability in terms of the continuation of economic reforms and policies, however, challenges of running a coalition government cannot be ruled out. A strong opposition also brings its own set of pros and cons, nonetheless, the consensus among the parties and members plays a crucial role in terms of bold economic decisions.

The RBI's projection of 7.2% GDP growth for FY25 underscores the economy's robust fundamentals, but achieving this target will require adept navigation of several key areas:

- Inflation Management: While overall inflation has moderated, persistent food inflation around 8% remains a significant concern. The RBI's ability to balance growth stimulation with price stability will be crucial. The slow progress of the Southwest monsoon (33.1% deficit as of June 19) adds uncertainty to agricultural output and food prices.

- Fiscal Consolidation: The government's commitment to reducing the fiscal deficit to 5.1% of GDP in FY25 is commendable. The success of this effort will depend on revenue generation and efficient expenditure management, particularly in light of potential global economic headwinds.

- External Sector Resilience: The inclusion of Indian bonds in global debt indices from June 2024 is expected to attract significant FPI investments, potentially bolstering forex reserves. However, managing currency volatility and trade imbalances in a turbulent global environment will require vigilance.

- Sectoral Disparities: Addressing the uneven growth across sectors is crucial. While services remain strong, manufacturing faces challenges and agriculture grapples with climate uncertainties. Targeted policies to boost lagging sectors and attract investments will be essential for balanced growth.

- Employment Generation: Creating high-quality jobs, especially for the burgeoning youth population, remains a critical challenge. The increase in EPFO net member additions (31.3% in April over March 2024) is encouraging but insufficient to meet the demographic dividend's potential.

Looking ahead, India's economic strength will be tested by both domestic and global factors. The ability to maintain policy continuity while adapting to emerging challenges will be crucial. The country’s potential to emerge as a global economic powerhouse remains strong, provided it can effectively harness its demographic dividend, technological capabilities and reform momentum.