As India reaches the final quarter of 2023, the economy finds itself at a pivotal juncture, balancing strong growth in key sectors against the backdrop of global headwinds and domestic challenges. While manufacturing and services are witnessing robust expansion fueled by urban demand and increased government capital expenditure, rural consumption and agricultural output remain under pressure due to erratic monsoons and El Niño-induced climate irregularities.

Key Takeaways:

- India is experiencing a transitory slowdown driven by uneven sectoral recovery.

- Manufacturing and services sectors remain strong, while agriculture and rural demand are weak.

- Inflation pressures persist, despite easing crude prices and core inflation trends.

- Equity markets are buoyed by strong domestic participation, even as global economic volatility continues.

- The RBI’s monetary stance is expected to remain cautious, with repo rate cuts likely delayed amid inflation concerns.

India’s Macroeconomic Summary

| Our Indices | Recent Updates | Near-term Outlook |

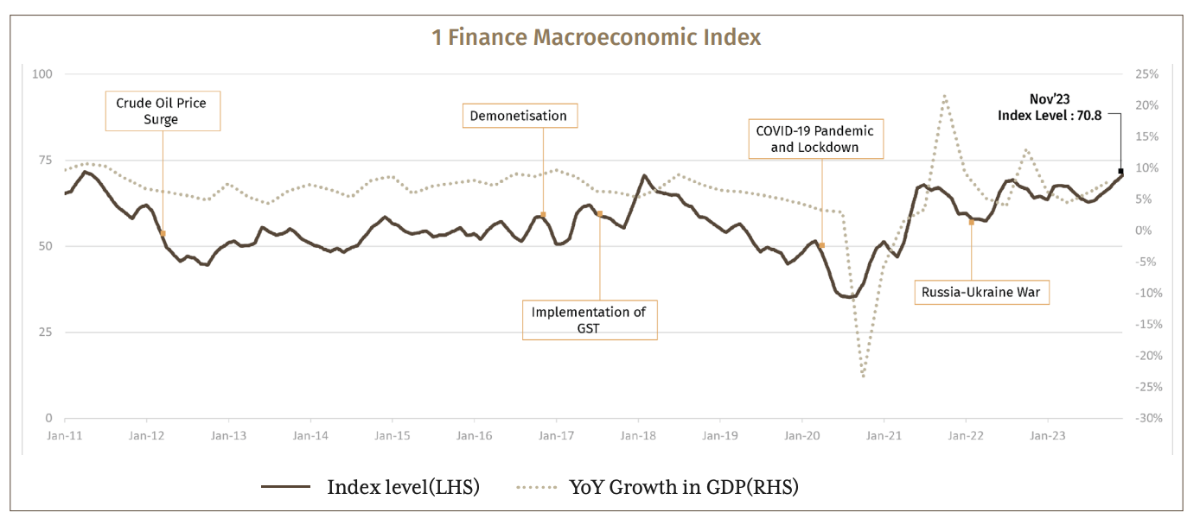

| 1 Finance Macroeconomic Index |

|

Pickup in government capex to drive steady economic recovery, with high interest rates (due to inflationary concerns) to keep recovery in check in the near term. Adverse external developments could hinder economic progress, potentially leading to a continued slowdown. |

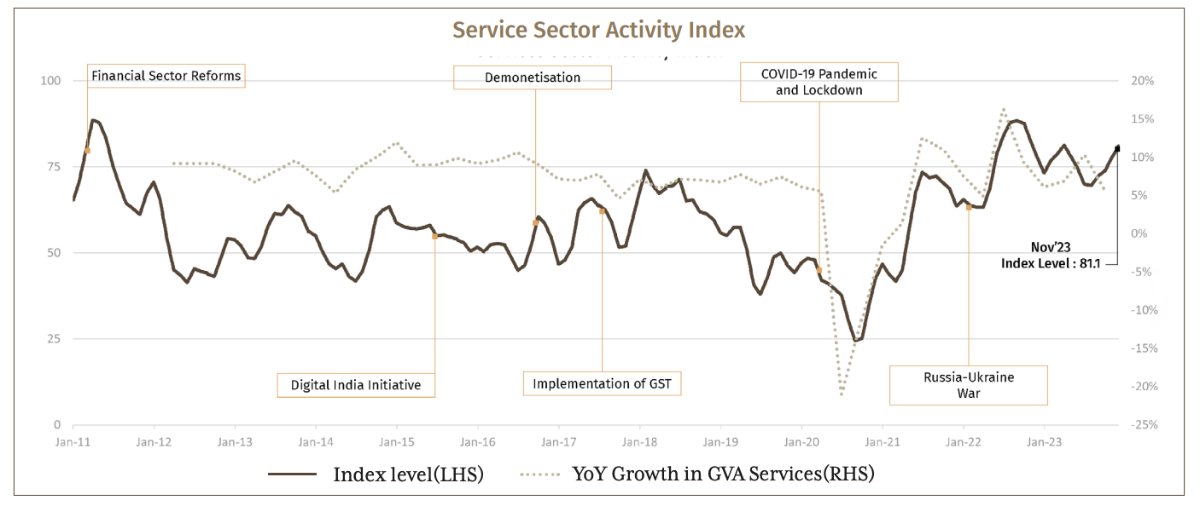

| Services Sector Activity Index |

|

A rise in government capex is expected to drive domestic demand and boost discretionary spending. Adverse external conditions could act as a drag. |

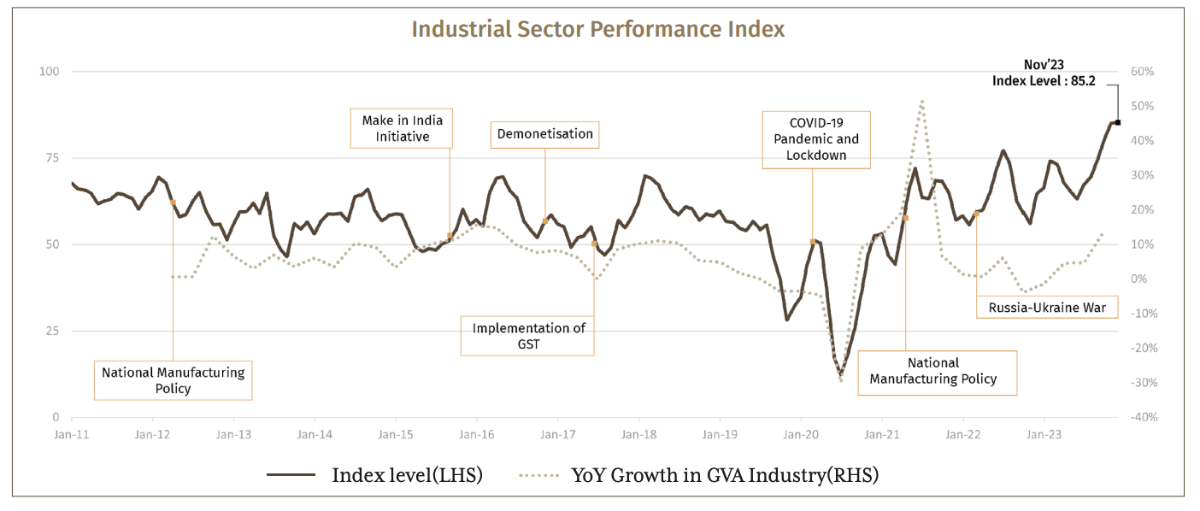

| Industrial Sector Performance Index |

|

Rising consumer demand for manufactured goods is expected to increase production and provide business expansion opportunities for industries. |

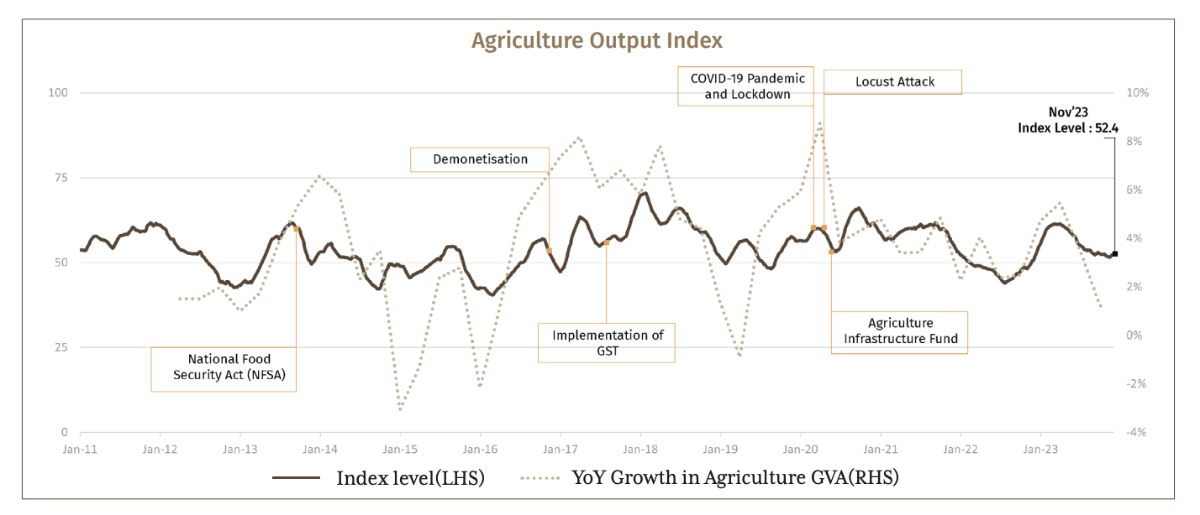

| Agriculture Output Index |

|

Growth in Agri GVA for the full fiscal year is expected to remain below last fiscal year’s growth rate of 4%. Decline in the production of pulses in the Kharif season, and expectations of lower agricultural production in the Rabi season, remain a concern on the food inflation front. |

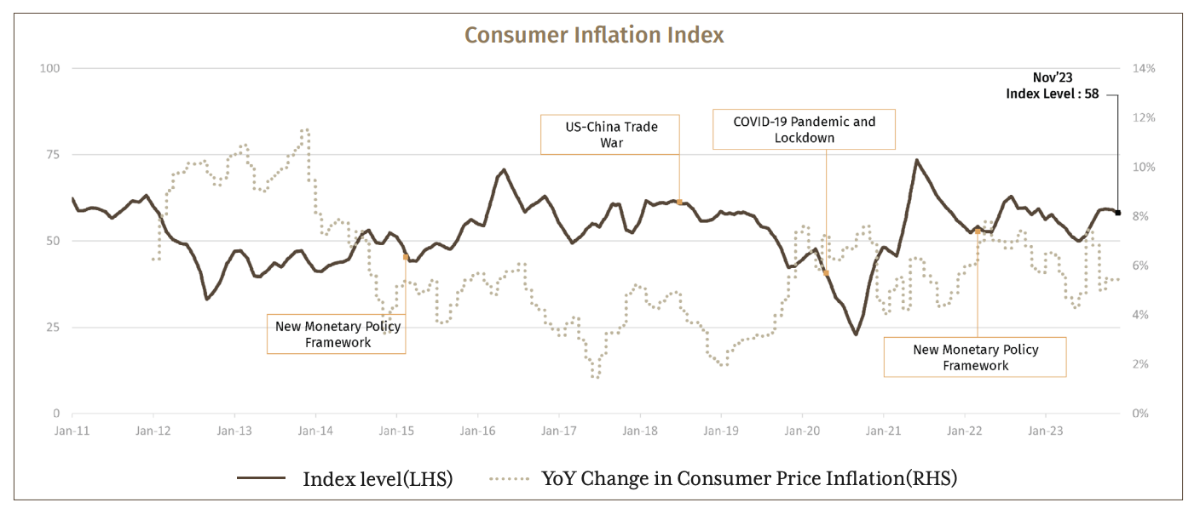

| Consumer Inflation Index |

|

Inflationary pressures to continue amid rising domestic demand, repeated supply-side shocks, volatile vegetable prices, and anticipation of lower agricultural production. |

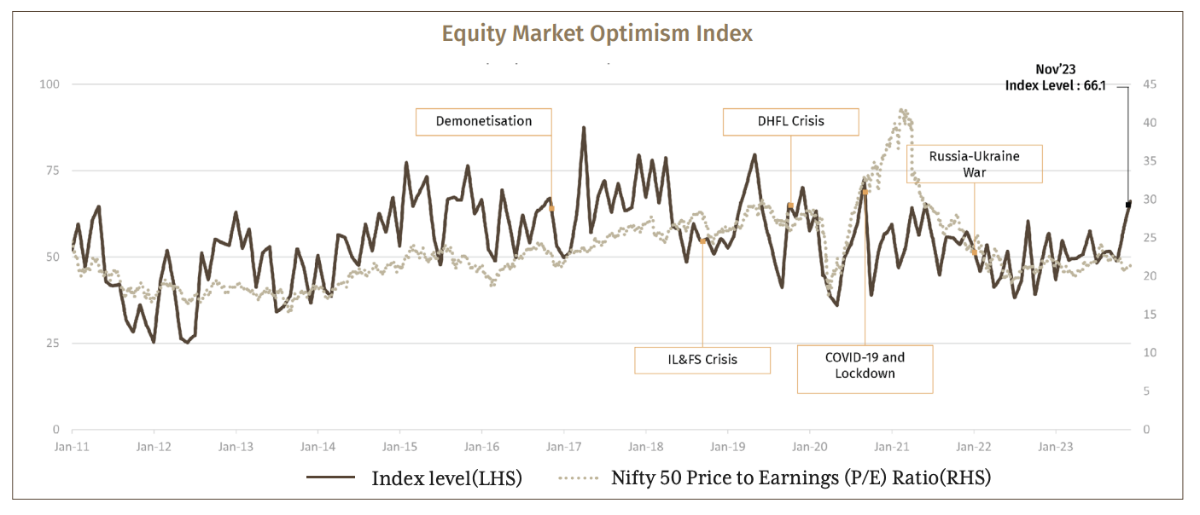

| Equity Market Optimism Index |

|

Domestic investors' confidence to support market valuation, while FPI investments could fluctuate due to challenging global economic conditions, and the domestic political environment and growth prospects. |

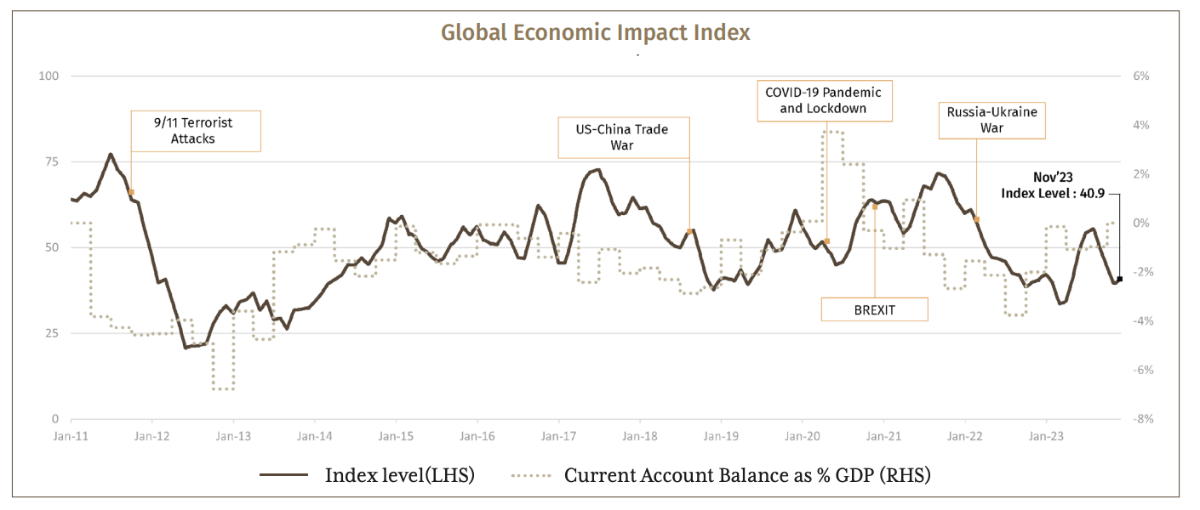

| Global Economic Impact Index |

|

India is expected to witness volatility in exchange rate, FPI investments, and global commodity prices, and lower demand for exports. |

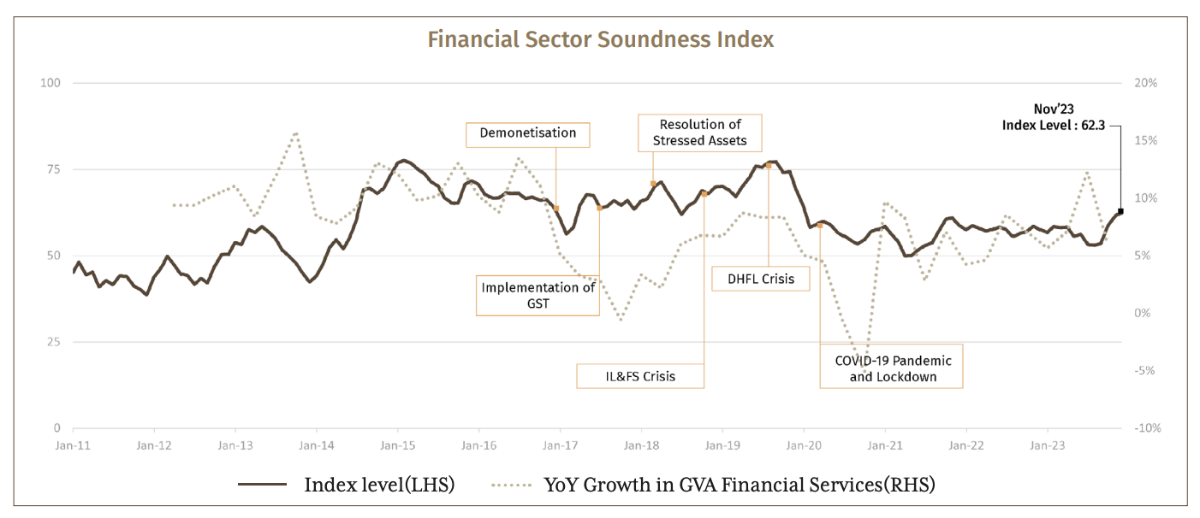

| Financial Sector Soundness Index |

|

Credit growth expected to remain firm due to rising investment activities by businesses. Deficit banking system liquidity may lead to increased borrowing costs, which could limit the credit growth. |

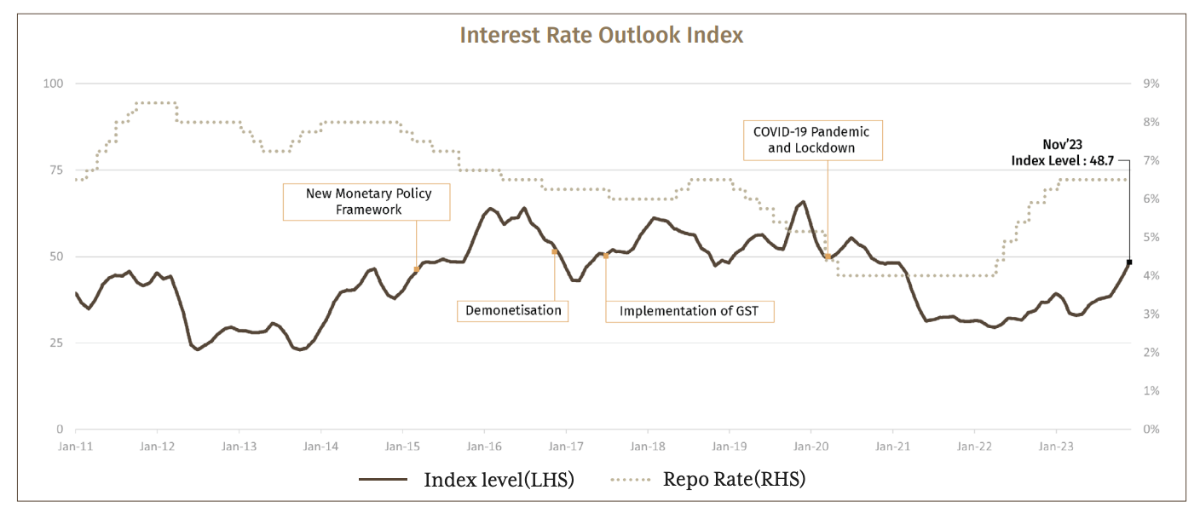

| Interest Rate Outlook Index |

|

With retail inflation still above 4.0%, the RBI is likely to maintain the repo rate at 6.5% for at least another six months to achieve the desired (4%) price stability. This is expected to lead to a rise in interest rates for consumers. |

Recommended for you

Readers also explored

A Mid-Year Check: Whether India is in Flux

Nifty 50 Companies List 2025 : Top 50 Stocks in India

1 Finance Macroeconomic Index

- The Indian economy is in a transitory slowdown phase, and the GDP growth in the coming quarter (Q3 FY24) is likely to be lower than Q1 and Q2 due to the base effect.

- The agriculture sector is likely to underperform, as the impact of uneven monsoon and El Nino weighs on the over- all growth prospects. Food grain production in the Kharif season is anticipated to be 1% lower than last year.

- The Manufacturing and Services sectors are expected to continue on a higher growth path, supported by the government’s emphasis on capital expenditure.

- With steady economic recovery and lower agriculture output, inflation is expected to remain above the comfort zone of RBI (4%) at around 6% in the coming months, which may delay the repo rate cut by RBI in the near term.

1. Services Sector Activity Index

- The services sector has recovered sharply in recent months, and the output is expected to further expand in the near term.

- Higher capital expenditure by the government is also supportive of the sector.

- The increase in credit flow to the services sector indicates sustained efforts to increase capacity, while rising borrowing costs may hinder this growth to some extent.

2. Industrial Sector Performance Index

- The manufacturing activity has been recovering since May 2023.

- Optimal level of capacity utilisation, a sharp increase in steel and cement production, are some of the indicators reflecting an increase in infrastructure and manufacturing activity.

- The increase in energy demand was accompanied by a notable softening of wholesale prices, which lowered manufacturing input costs.

3. Agriculture Output Index

- The agriculture sector growth is sluggish, and there are downside risks in the current fiscal year.

- Below average reservoir levels of 62.1% (versus a 10-year average of 66.3%) due to below-normal monsoon, and lower tractor sales are hinting at a slightly lower agriculture output in 2023-24.

- The divergence between a relatively high rural Consumer Price Index (CPI) inflation and lower Wholesale Price Index (WPI) inflation is hampering the rural income.

4. Consumer Inflation Index

- The CPI has softened from its peak of 7.4% in July 2023 to 5.5% in November, but still remains above the median target of 4%.

- The production indicators (8 core, IIP, cement, etc.) and credit to these sectors have improved notably, whereas consumption indicators (like vehicle sales) are reporting a slowdown.

- Prices of essential commodities are on the decline, however, the anticipated reduction in Kharif and Rabi sowings is expected to keep the pressure on food inflation.

- Inflationary pressures are likely to continue amid rising domestic demand, repeated supply-side shocks, volatile vegetable prices, and lower pulses production.

5. Equity Market Optimism Index

- Domestic investor confidence remained high likely due to the domestic political environment and growth prospects.

- Primary issuances in equities have increased by 88.4% during April to November 2023, over the corresponding period previous year, indicating optimism in the market sentiments.

- FPI inflows were volatile due to challenging global economic conditions.

- Higher government capital expenditure is boosting business sentiments and presenting a favourable environment for investment opportunities.

6. Global Economic Impact Index

- The external sector indicators are showing heightened volatility amidst adverse global economic situations, weak global demand, and geopolitical crises.

- The INR-USD rate remained volatile reflecting this instability and depreciated by 2.1% so far in the current fiscal. The intervention by the RBI helped the currency from sharp depreciation.

- The ongoing slump in the world economy will likely put pressure on domestic export demand.

7. Financial Sector Soundness Index

- Prevailing higher policy rates are keeping the borrowing cost higher. Deficit liquidity in the banking system is further adding to this concern.

- Although an increase in the repo rate is unlikely, the elevated CPI inflation levels in the economy do not support a shift from the accommodative monetary policy stance of the RBI. Hence, policy rates may remain unchanged for the next two quarters.

- The bank credit growth may remain robust despite the higher interest rates, as the ongoing higher capital expenditure by the government continues to drive demand in the economy which will lead to higher private sector investments.

8. Interest Rate Outlook Index

- The consumer price levels are still high, while the spread in G-secs for varied maturities is widening. The rising spread between G-sec and corporate bonds is hinting at rising borrowing costs for the corporates.

- The lending by banks is on the surge, while banks are facing a liquidity shortage and accessing the RBI’s LAF window to meet the requirements.

- GDP growth is relatively better; hence, the RBI may wait for the inflation to cool down to close to 4% levels before reducing the repo rates to meet its monetary policy objective.

Conclusion

India’s macroeconomic landscape in the final quarter of 2023 reflects a complex yet steady economic environment. Despite a transitory slowdown driven by uneven sectoral performance and global headwinds, the economy is buoyed by robust growth in manufacturing and services, fueled by government capital expenditure and rising urban demand. However, challenges in agriculture, persistent inflationary pressures, and volatile external trade conditions underscore the need for cautious optimism. With the RBI likely to maintain steady interest rates to address inflation, India’s growth trajectory remains promising but sensitive to both domestic and global developments. The insights from the 1 Finance Macroeconomic Index and other subindices highlight opportunities for strategic investments and policy interventions to sustain momentum in this dynamic economic landscape.