The events of early 2026 have significantly changed the global environment. This edition focuses on four developments that matter for your portfolio. We look at the U.S. intervention in Venezuela and its implications for global crude supply.

We unpack U.S. President Trump’s endorsement of the Sanctioning Russia Act of 2025, including the risk of steep tariffs on countries buying Russian oil or uranium. We also assess how fresh U.S. tariffs on Iran’s trade partners could affect India. Finally, we discuss the investigation into the U.S. Federal Reserve and why it matters for Indian markets.

Impact Analysis for Indian Investors:

| Global Event Trigger | Near-Term Impact (0-12 months) | Medium-Term Impact (1-5 years) | India Risk Assessment |

| Operation Absolute Resolve (U.S. Control Over Venezuela’s Oil) | Oil price volatility is likely to be modest because Venezuela’s current crude production is under ~1% of global output despite its large reserves. | Additional Venezuelan barrels entering global markets, driven by U.S. engagement, could lower crude prices and reduce pressure on India’s import bill and CAD. Over time, renewed Venezuelan supply would give India an alternative to heavy reliance on Russian or Middle Eastern oil. | Low (Opportunistic) |

| 25% Tariffs on Iran-Linked Trade | Minimal Direct Hit: Iran is <0.2% of India’s trade. The main risk is a potential retreat, leading to reduced or halted business through the Chabahar port, where India has made significant investments. | Strait of Hormuz Risk: Physical disruption remains the "black swan." A blockade could spike oil to $100+, nullifying the Venezuela-driven price softening. | Moderate |

| U.S. "Sanctioning Russia Act 2025" (500% Tariffs) | Risk of 11% of India's goods trade with the U.S. (Gems, Textiles, Pharma) becoming unviable. Indian refiners preemptively pivoting from Russian to U.S./Saudi crude. | Permanent shift away from the 35% Russian crude reliance, raising costs significantly. Asymmetric Trade Deal: India likely forced into significant policy compromises (e.g., opening Dairy/Agri markets, easing Data Localisation, or mandatory U.S. Energy off-take) to "buy" tariff relief from the U.S. | Very High |

| DOJ Investigation of Fed Chair Powell | Risk-off flows from EMs and INR volatility. | Potential for massive U.S. rate hikes later to crush politically-induced inflation. This stalls India’s rate-cut cycle, fuels U.S. recession fears, and triggers a global growth slowdown. | High |

| U.S. Supreme Court IEEPA Ruling | A ruling against Trump would trigger a "relief rally" in Indian equities. A ruling for Trump cements the 50% current tariff floor. | Determines if "Emergency Powers" are the new normal for global trade. Reshapes India's long-term export strategy. | High |

Why Venezuela’s Oil Suddenly Matters to the World

The situation in Venezuela has undergone significant changes in the opening weeks of 2026. Following a period of sustained pressure, the geopolitical environment has shifted from diplomatic sanctions to direct intervention.

| What Happened and Why? On January 3, 2026, the United States launched Operation Absolute Resolve, a series of military strikes on Caracas, the capital city of Venezuela. This resulted in the capture of President Nicolás Maduro and his wife, Cilia Flores. The reason? The Trump administration referred to it as a "cleanup." They accused Maduro of narco-terrorism, drug-trafficking, and conspiracy to import cocaine. While the legal reason for the arrest is narco-terrorism, global markets are looking at the massive energy implications. To market analysts, the "real-world" goal is clear: the U.S. wants to secure the world's largest proven oil reserves. |

Recommended for you

Readers also explored

India's IT Sector Outlook for FY2026

World GDP Breakdown 2025: Who Powers the Global Economy?

High Reserves vs. Low Production

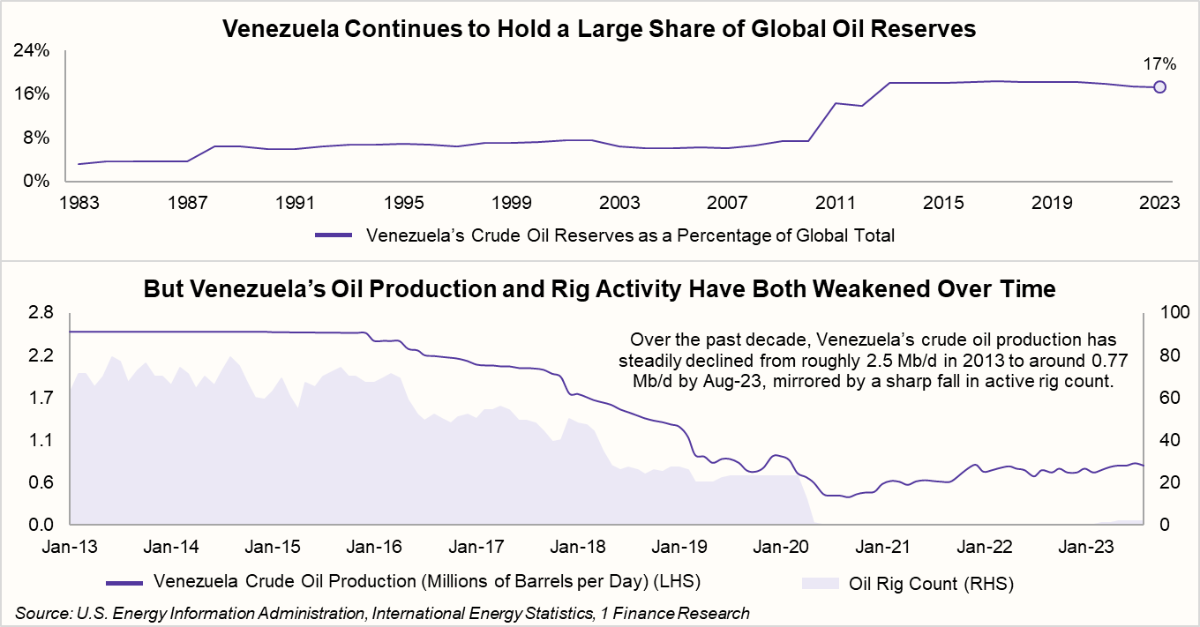

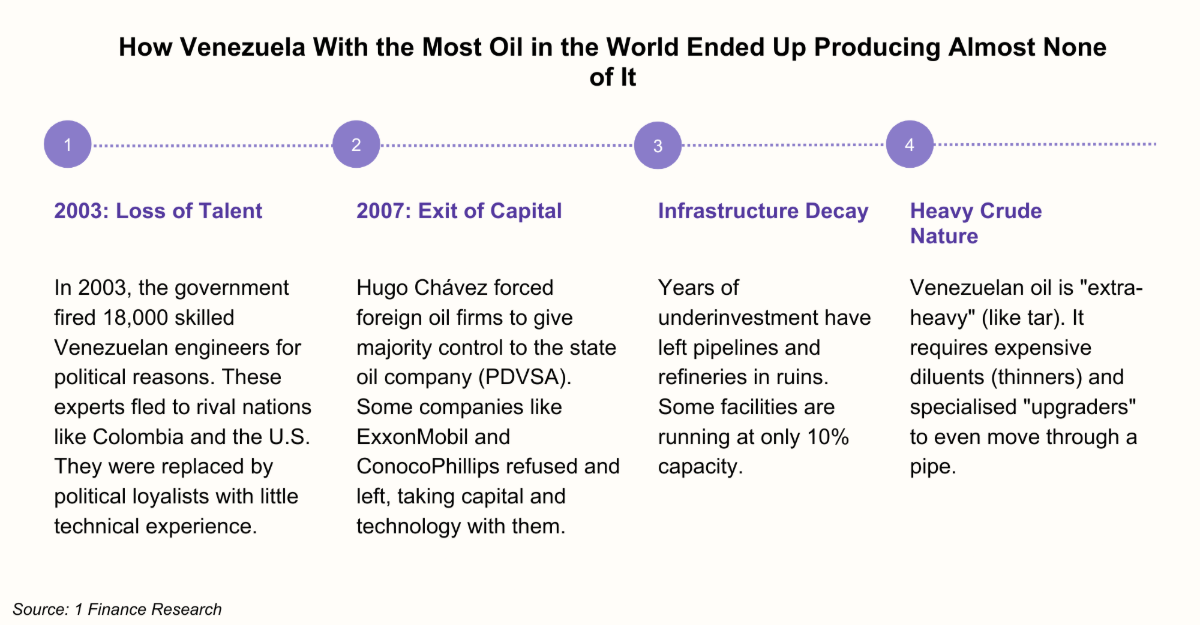

Venezuela holds the world’s largest proven oil reserves (over 303 billion barrels), yet it produces less than 1 million barrels per day (mb/d). The chart below shows this clearly:

So now the question is: Why hasn't Venezuela produced oil if it already has the reserves? It is a story of how political purges, rusted pipes, and global sanctions, which turned the world's largest oil treasure into a 'frozen asset', one that is now being unlocked under a new U.S.-led reality.

Will the U.S. Control Lead to an Immediate Oil Supply Surge?

The short answer is: No.

Rystad Energy, a global consultancy, estimates that recovery will be slow. It could take 16 years and $110 billion to restore the infrastructure. This investment would only raise production to 2 million barrels per day. Restoring this infrastructure is even harder today because global oil prices are softening.

What Does This Mean for India?

India is structurally insulated from the immediate shocks of the Venezuela-U.S. situation. The direct impact on India’s energy bill is negligible, as Venezuela accounts for only 1% of India’s total crude imports in FY25. India’s energy basket is currently dominated by Russia (around 35%) and traditional Middle Eastern suppliers.

Over the longer term, however, a successful U.S.-led stabilisation of Venezuelan production could add incremental barrels to global supply, easing crude prices and reducing pressure on India’s import bill and current account deficit.

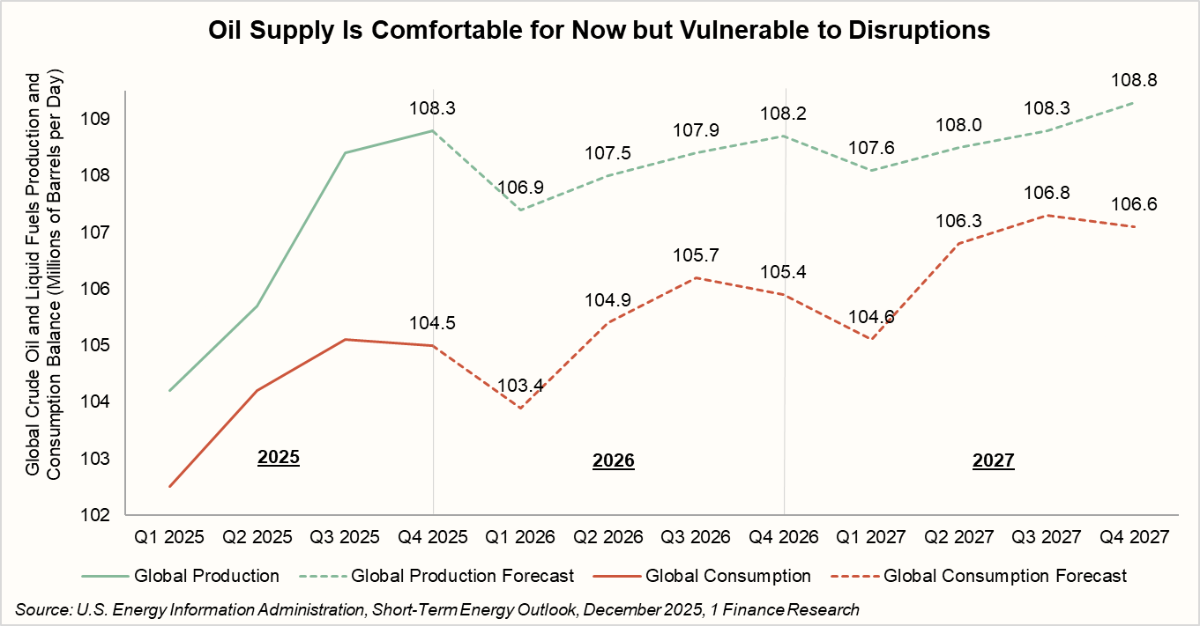

Let’s Look at the Oil Market Situation Today:

|

Why Markets Are Watching Iran Closely

This phase of global “power plays” brings us to Iran. Iran is facing its first nationwide protests since late 2022. The trigger has been a sharp currency collapse and worsening economic stress.

| Key Drivers Behind Iran’s Nationwide Protests: | |

|---|---|

| 1 USD = 10,67,780 Iranian Rials | Inflation = 42% |

| Severe currency collapse has eroded purchasing power and savings | Persistent price pressures are squeezing household incomes |

Source: 1 Finance Research

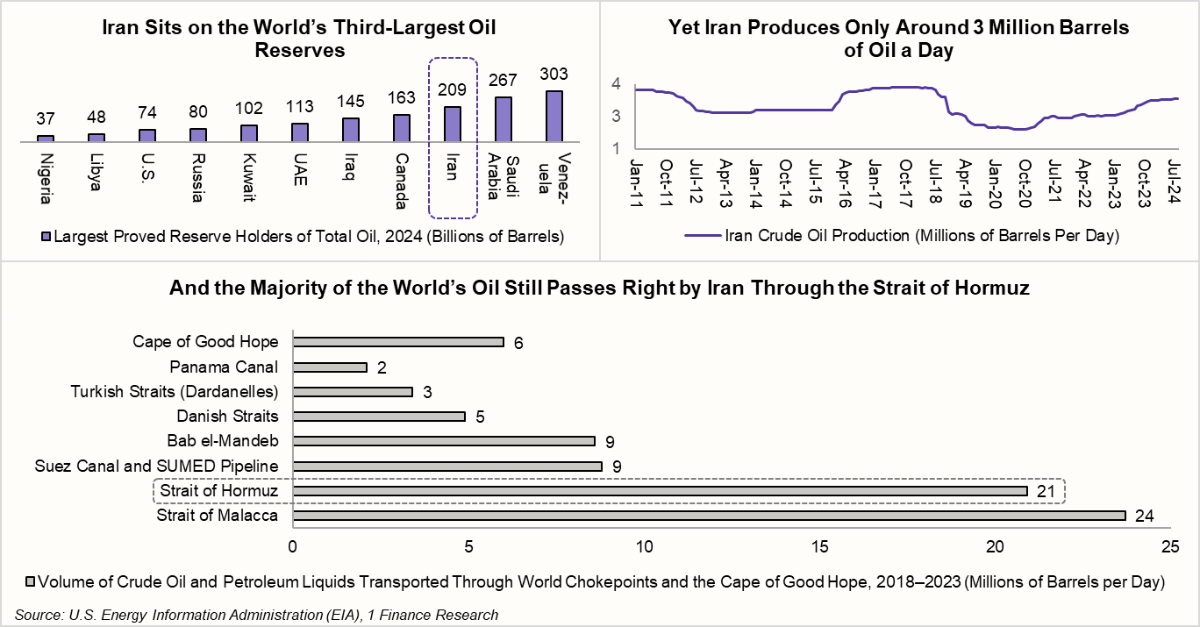

Iran matters because of oil. It holds the world’s third-largest proven reserves. Production, however, is much lower at around 3.3 million barrels a day.

More importantly, Iran sits on the Strait of Hormuz, a narrow sea lane that carries nearly 20% of global oil consumption every day. Even a brief disruption can send oil prices sharply higher.

The graph below clearly illustrates Iran’s massive reserve potential compared to its actual daily production levels:

Recent protests reportedly led to heavy casualties. This drew an immediate U.S. response. President Trump threatened military action, unsettling global markets. Alongside this, the U.S. announced a 25% tariff on any country trading with Iran, effective immediately.

For India, let’s look at the math:

|

But one asset changes the equation: the Chabahar Port.

For decades, India’s access to Europe, Russia, and Central Asia was constrained by geography. Trade routes often passed through Pakistan and faced frequent disruptions. To bypass this, India invested $120 million in Iran’s Chabahar Port.

This route can cut shipping costs by nearly 30% and reduce transit time to Europe by about 15 days. It is India’s most strategic trade corridor to the West.

That corridor is now at risk. The U.S. has imposed a 25% tariff on Iran-related trade. India currently has a sanctions waiver, but it expires on April 26, 2026. If it is not renewed, India risks losing more than an investment.

This is why Iran’s stability matters for India, for two key reasons. The Chabahar Port. And the Strait of Hormuz.

The Tariff Question Hanging Over Indian Markets

The U.S.-Iran episode was just the beginning. Something bigger followed quietly. President Trump recently approved a bipartisan Russian sanctions bill. Under the proposed Sanctioning Russia Act, 2025, any country trading Russian oil or uranium could face a massive 500% U.S. tariff.

This bill has not been passed into law yet, but it places India in a high-stakes dilemma. We have to choose between two difficult paths:

Path 1: End the U.S. Partnership

India could stop trading with the U.S., but that means losing our top trading partner.

Let’s look at the math:

|

Path 2: Drop Russian Crude

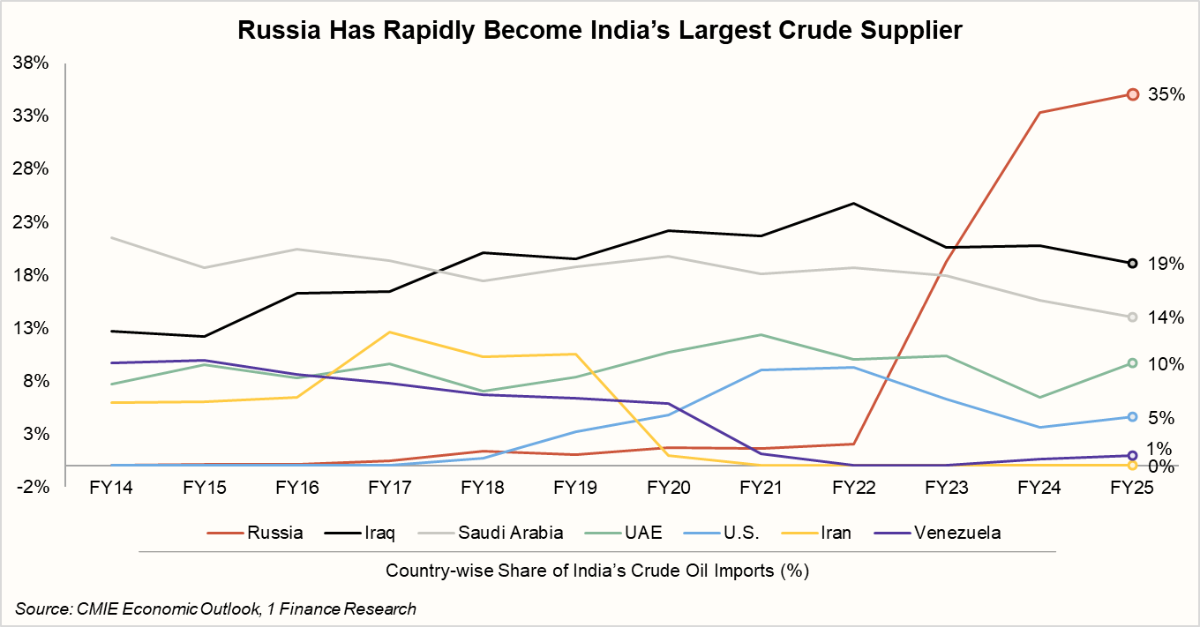

The alternative is to stop buying Russian oil. Today, Russia is India’s top oil supplier, providing 35% of our crude. This oil comes at a deep discount compared to Brent crude. If India stops these imports, the impact would be severe; our oil import bill could surge significantly.

The graph below clearly shows how heavily India relies on Russia to keep fuel prices stable:

Out of these two scenarios, India is more likely to reduce Russian imports and diversify elsewhere.

All eyes are now on the U.S. Supreme Court. They are expected to rule on whether President Trump exceeded his authority by imposing these emergency tariffs. If the Court rules against the President, tariffs could drop significantly. This would likely trigger a massive relief rally in the Indian Equity Markets.

For now, the best strategy is to watch closely and stay invested. Avoid over-concentration in sectors most vulnerable to these tariffs, like gems and textiles.

When Politics Knocks on the Fed’s Door

We have discussed the chaos of 500% tariffs and military interventions. But there is one more "anchor" of the global economy currently under attack: The independence of the U.S. Federal Reserve.

Recently, the U.S. Department of Justice (DOJ) launched an unprecedented criminal investigation into Fed Chair Jerome Powell. While the official reason involves "office renovation costs," the markets see it for what it really is: A pressure tactic to force interest rate cuts.

This is not the first time a U.S. President has tried to "bully" the Fed. To understand the danger, we have to look back at the Great Inflation era of the 1960s and 70s.

The Road to 14% Inflation in the U.S.

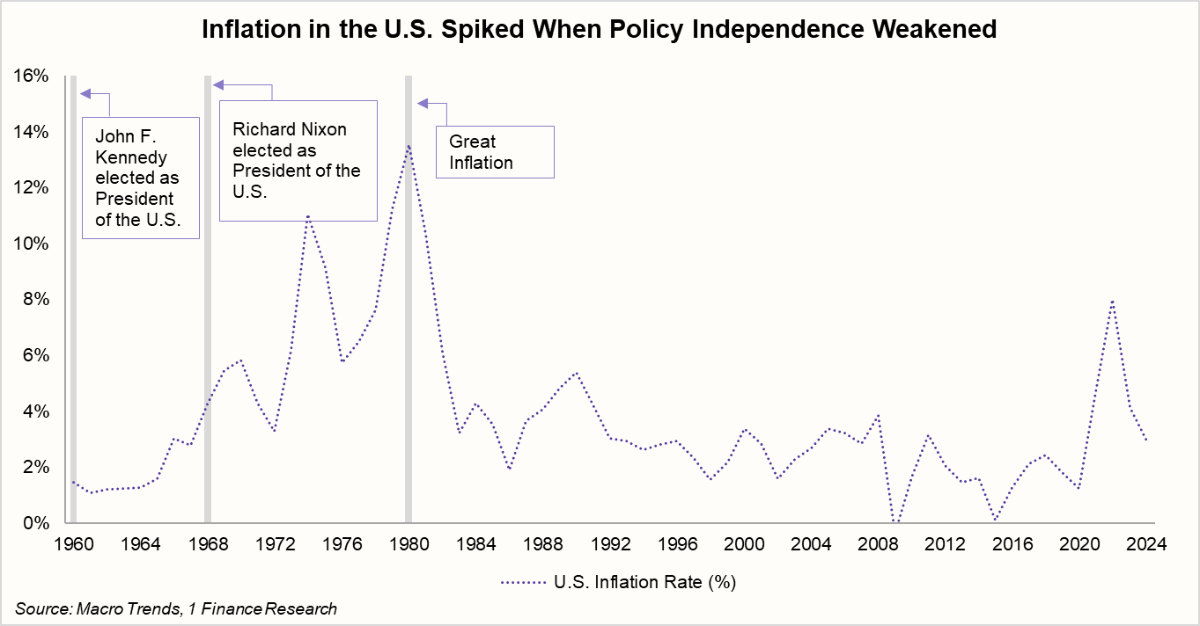

In the early 1960s, under John F. Kennedy, the Fed maintained a relatively professional distance. However, the tide turned with Richard Nixon (elected in 1968). Nixon was obsessed with growth ahead of his 1972 re-election. He famously pressured Fed Chair Arthur Burns to keep interest rates low, even as prices began to climb.

Burns succumbed to political loyalty. He pumped "easy money" into the system to help Nixon’s landslide victory.

While the Fed was keeping the printing presses running, two massive "shocks" hit the system:

- The End of Gold (1971): Nixon decoupled the dollar from gold, removing the final "anchor" on the money supply.

- The Oil Shocks (1973 & 1979): Tensions in the Middle East caused energy prices to quadruple. Because the Fed had already flooded the market with cash, there was nothing to "buffer" these costs.

The result? A decade-long economic nightmare. By 1980, U.S. inflation didn't just rise; it exploded to a staggering 14%. It took a "nuclear" response from the next Fed Chair, Paul Volcker, who raised rates to 20% and crushed the global economy just to fix Nixon’s mistake.

The graph below clearly shows the timeline from Kennedy to Nixon and the eventual 1980 inflation peak:

Why Does This Matter for India?

For Indian investors, this isn’t just a U.S. headline. It creates three clear risks for India.

- A politicised Fed means a volatile dollar, making it harder for the RBI to manage the rupee without dipping into forex reserves.

- Global investors dislike uncertainty. If trust in the Fed weakens, FII flows into emerging markets like India can turn erratic, while gold gains favour.

- Even if U.S. short-term rates fall, long-term yields may stay high due to inflation fears. This means the RBI may delay rate cuts to combat imported inflation and currency weakness.

Conclusion

Early 2026 has started on a volatile note, making global developments hard to ignore. For India, the key risk is rising U.S. pressure through tariffs and sanctions. Exports may be a small part of India's GDP, but sentiment and input costs matter. The real risk from 500% tariffs is a forced shift away from discounted Russian crude, which could lift inflation.

Venezuela could ease supply over time, but Iran remains the bigger concern, especially around Chabahar and the Strait of Hormuz. Add growing political pressure on the U.S. Fed, and global uncertainty rises. In this environment, some gold exposure makes sense, along with avoiding heavy concentration in sectors most exposed to global shocks.