This month’s update covers:

- RBI Cuts Rates Again

- Gold Hits New Highs

- Falling Inflation, Lowered Taxes

- Trump Tariffs: Global Volatility Spikes

- Recovery in Indian Stock Markets

We break down what these events mean for your money and outline clear action steps for your financial plan.

As an added bonus, we will give links to relevant research and tools on our website to help you make quality financial decisions in a shorter time.

RBI Cuts Rates Again

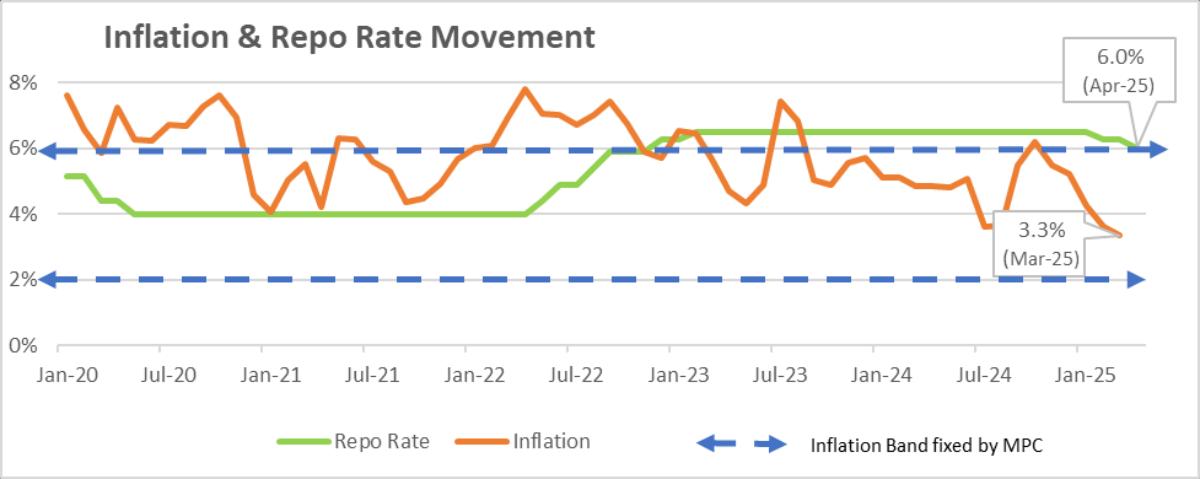

The RBI cut the repo rate by 25 bps each in February and April, bringing it down to 6%. The central bank also pumped ₹1 lakh crore of liquidity into the banking system to support growth. With inflation low and a good monsoon forecast, we expect more rate cuts of 50-75 bps by March 2026.

Action Plan

- Opt for or switch to floating-rate home loans to benefit from the current rate cut cycle. If you need help selecting a new lender, read our evaluation of home loan lenders.

- Keep an eye on emails from your home loan lender upon rate revisions for changing your tenure, EMI or both.

- For guidance on optimising your home loan, use our floating interest rate calculator to choose the most appropriate option for you.

Recommended for you

Readers also explored

August 2025 MPC Review: Calm Now, But Global Storms Brewing

Nifty 50 Companies List 2025 : Top 50 Stocks in India

Gold Hits New Highs

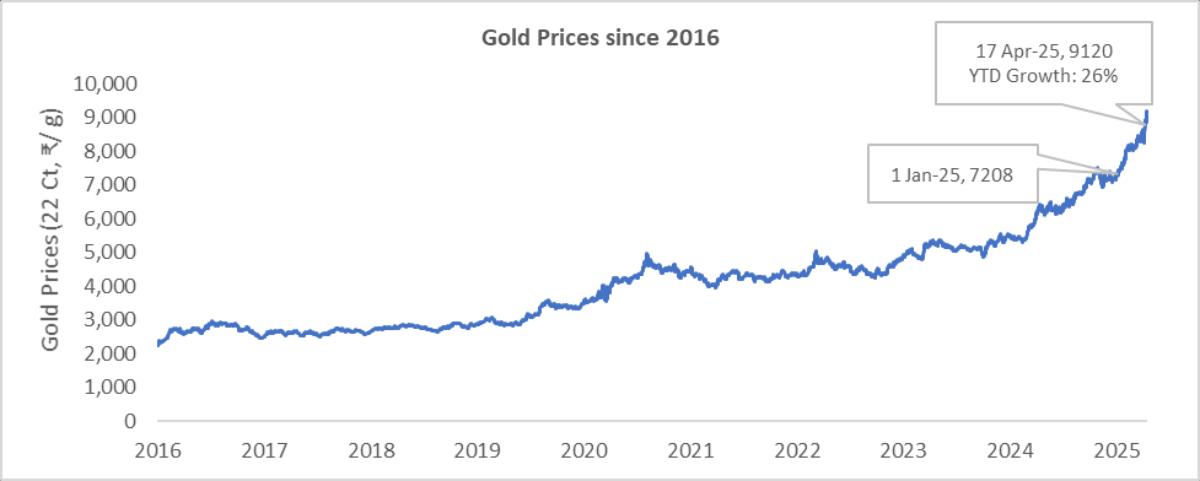

Gold prices have shot up 26% since 2025 beginning, driven by global uncertainty, trade tensions, and a shaky rupee. Investors worldwide are flocking to gold as a safe haven.

Central banks around the world have scooped up gold at an unprecedented pace in 2024 and continuing the same in 2025. Investors worldwide are also flocking to gold as a safe haven as US dollar weakens.

Action Plan

- Diversify your investment portfolio by allocating a small portion towards gold. It is an excellent hedge against inflation, stock market volatility and external shocks.

- Given high prices, avoid lump sum purchases and instead go for SIP or staggered buying.

- Hold onto your gold investments even though prices have increased significantly in the last few years.

Falling Inflation, Lowered Taxes

Retail inflation dropped to 3.34% in March, the lowest since 2019, thanks to bumper harvests and softening food and vegetable prices.

RBI has lowered inflation forecast for FY26 to 4% due to sharper than expected decline in food prices and easing global crude oil rates.

As the new income tax structure kicks in from April, it would result in more money in your hands for increased consumption and investments.

Action Plan

- Lower EMI’s (rate cuts) + lower inflation + lower tax outgo = Additional disposable income.

- Invest the increased disposable income wisely towards your financial goals.

- Proactively, review your tax plan early to maximise savings.

Trump Tariffs: Global Volatility Spikes

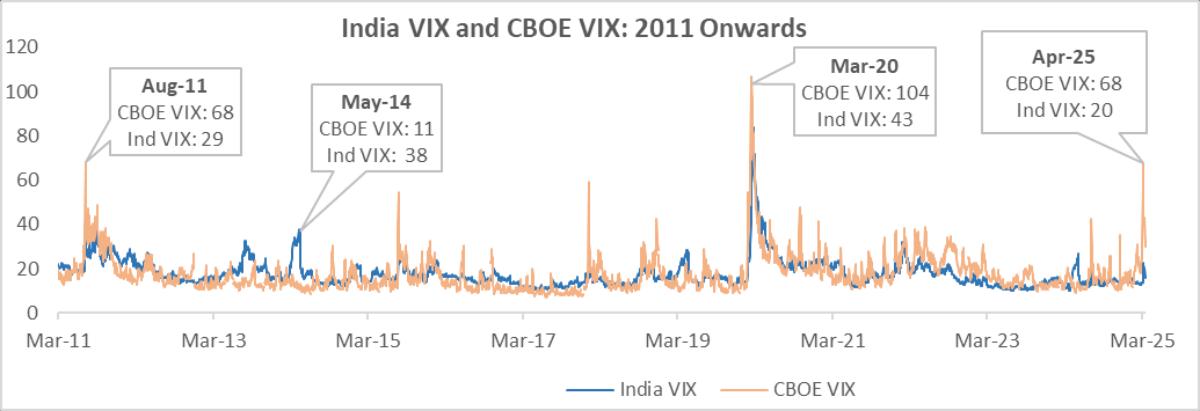

President Trump’s tariff announcements, including a 26% tariff on Indian goods, rattled markets before a 90-day pause was announced. The US volatility index soared, but India’s market volatility stayed relatively calm.

Action Plan

- Markets are likely to be volatile in the near term. Avoid over-investing in and panic withdrawals from the Indian stock market.

- Diversify across geographies with a long-term view to reduce portfolio risk.

- Invest in a phased manner in undervalued global markets.

Indian Markets Saw Some Recovery

Indian Markets Saw Some Recovery

After a sharp drop of 9% in Jan-Feb, the Indian equity market recovered 6% in March and 2% in April (after falling temporarily due to tariff drama), thanks to strong buying by domestic and foreign investors.

Action Plan

- Stay invested and continue SIP contributions to benefit from current market valuations.

- If your portfolio is low on fixed income allocation, diversify by adding debt mutual funds to create a more stable and steady portfolio.

- Given the high likelihood of further repo rate cuts, park large amounts (annual bonuses, etc) in debt mutual funds to benefit from price appreciation upon rate cuts.