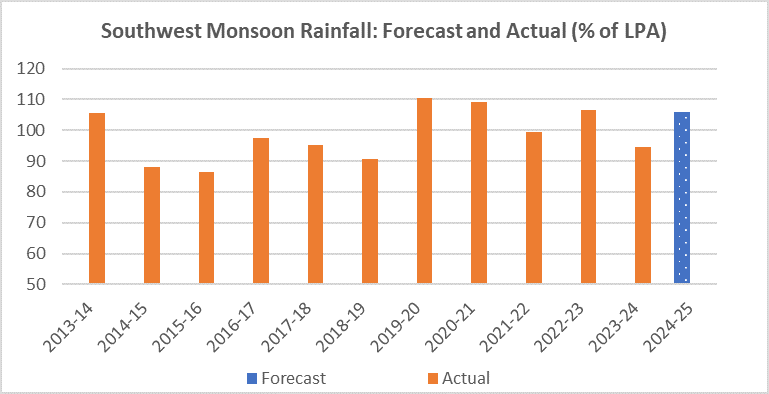

Forecasts of Above Normal Monsoon in 2024 Sparks Optimism

- The India Meteorological Department (IMD) predicts above-normal rainfall (106% of its LPA) for the 2024 southwest monsoon season.

- Normal and timely arrival of rains bode well for the agriculture sector, which was adversely affected by uneven rainfall in 2023.

- Higher agricultural output is crucial to manage food inflation, which has remained high at 8.7% in May 2024 (an average of 8.4% for the last 12 months).

- Higher farm production lowers food prices, leaving households with more disposable income which can be used for additional savings, pay-off loans, or discretionary spending.

Note: Current Long Period Average (LPA) of all India Southwest monsoon rainfall based on the average rainfall over the period 1971-2020 is 870mm.

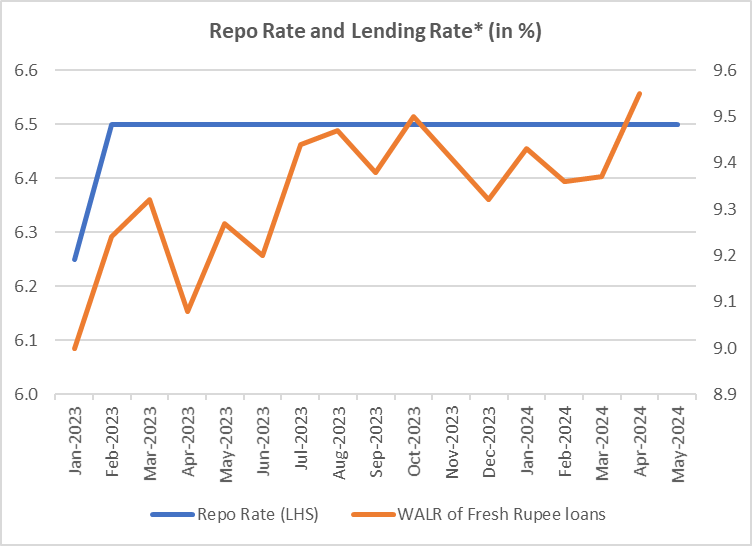

No Immediate Relief from High Borrowing Costs

- RBI has kept the repo rate unchanged at 6.5% in its June monetary policy meeting, signalling the continuation of the current high interest rate environment for an extended period.

- In May, lending rates moved slightly upwards anticipating delays in repo rate cuts.

- Higher borrowing costs mean additional EMIs for home loans; while returns on investments like fixed deposits increase.

- You can lock in higher FD rates to boost savings or pay off existing loans to reduce EMIs. For new loans, opt for a floating rate or wait for a potential rate cut by late 2024 or early 2025.

*: Weighted Average Lending Rates (WALR) of fresh rupee loans, LHS: Left Hand Side

Recommended for you

Readers also explored

India’s Growth Outlook Amid Global Uncertainty

World GDP Breakdown 2025: Who Powers the Global Economy?

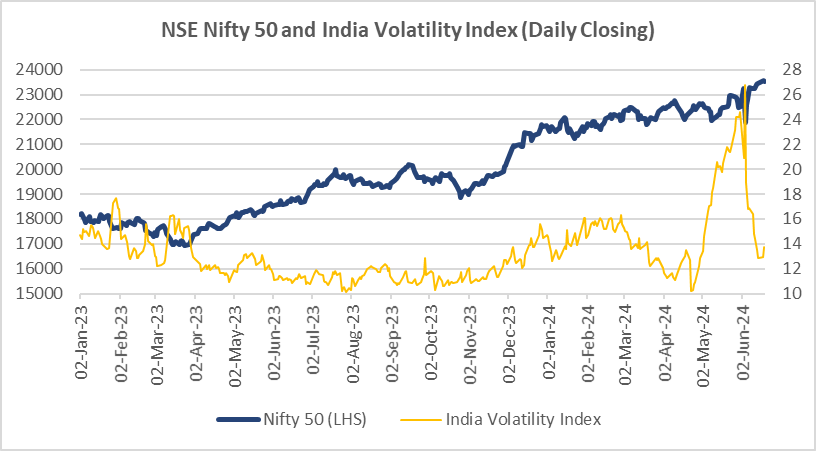

Elections Induced Market Volatility

- Equity markets experienced significant volatility in May and early June, with the NSE VIX hitting an intraday high of 31.7 on June 4, indicating uncertainty surrounding the Lok Sabha Election results.

- NSE Nifty 50 closed at 21,884.5 points on June 4, falling by 5.9% in a single day.

- By June 19, 2024, the NSE Nifty closed at 23,516.0 points, increasing by 7.5% from June 4 closing levels and by 25.4% higher from June 19, 2023 levels.

- This underscores the importance of maintaining a long-term investment horizon to avoid portfolio fluctuations and potential losses.

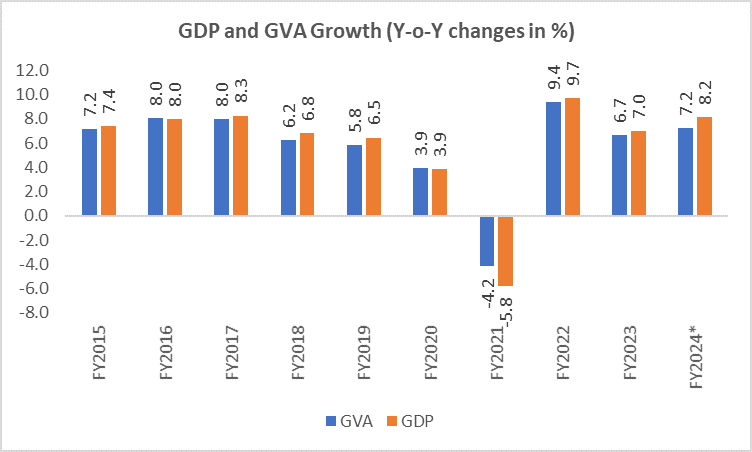

Rising GDP Growth Boosts Investor Confidence

- As per government estimates, India’s GDP growth accelerated to 8.2% in FY2024, surpassing the FY2023 growth of 7.0%.

- India’s strong growth fundamentals boost investor confidence, evident from rising DII investments in domestic equities (₹557.0 bn in May 2024).

- Foreign investments in the debt market amounted to $1.0 bn in May 2024, and AUMs of growth-oriented schemes increased by 53.3% in May compared to last year.

- Investing across different asset classes such as stocks, bonds, and real estate is advisable to capitalise on India's growth story, which will also help mitigate the impact of inflation.

Note: Data is provisional. * Provisional Estimates, GVA: Gross Value Added, GDP: Gross Domestic Product