February 2025 was anything but dull—Trump’s tariff blow, a market shake-up, RBI’s liquidity boost, and gold standing tall through it all.

On February 13, Trump escalated trade tensions, slapping fresh tariffs on nations with high trade barriers. India felt the heat, with steel, aluminum, and auto parts taking a direct hit. Markets reacted sharply, wiping out over $1 trillion in market cap, marking the longest monthly losing streak in nearly 30 years.

In response, the RBI announced a $10 billion dollar/rupee swap to steady the rupee and ease liquidity pressures. Meanwhile, gold-backed loans jumped 77% YoY, signaling households turning to their safest asset.

India’s Q3 GDP growth stood at 6.2% YoY, but softening private consumption and global volatility kept uncertainty alive. With inflation cooling to 3.6%, hopes for an RBI rate cut in April are rising—but is that enough for a turnaround, or should we prepare for more market swings?

Despite the uncertainty, here’s how investment planning can help you manage through the chaos:

Action Plan

1) Equities: Positioning for Trade Tensions & Rupee Risks

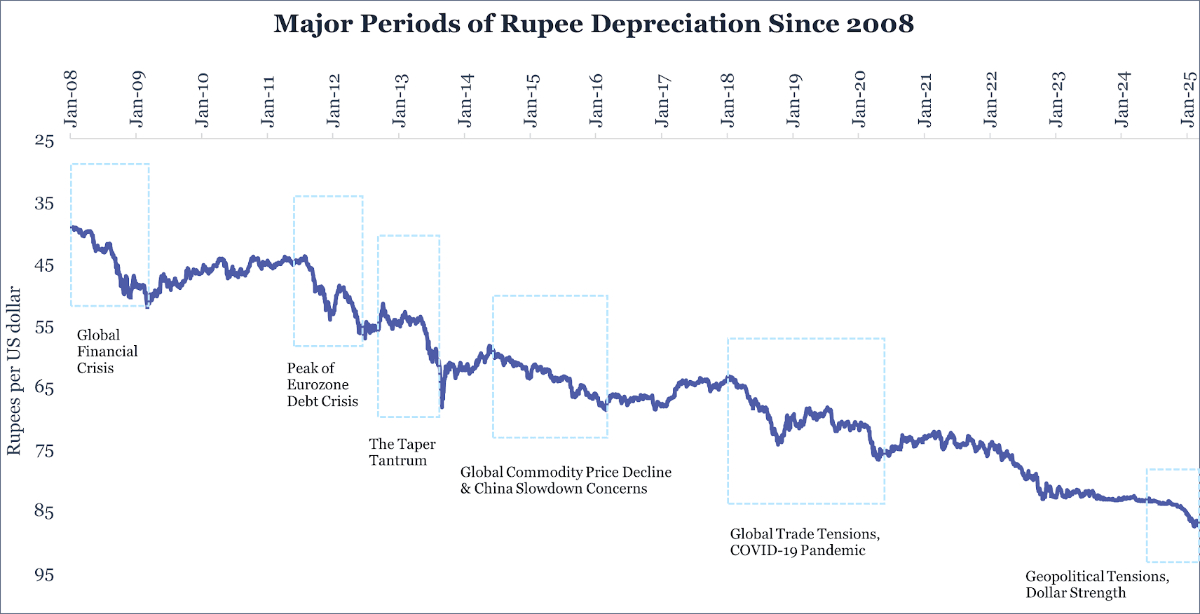

- Stay invested—historically, equity markets have performed well post-rupee depreciation, as a weaker rupee boosts export-driven sectors, driving earnings growth.

- Avoid excessive mutual fund diversification—limit holdings to 4-5 well-researched funds.

- Increase SIP contributions gradually to take advantage of lower market valuations.

| Start Date | End Date | Reason | Rupee Depreciation (%) | Subsequent Nifty 50 1- Year Returns |

| Jan-08 | Mar-09 | Global Financial Crisis | 29% | 74% |

| Aug-11 | Jun-12 | Eurozone Debt Crisis | 28% | 11% |

| Oct-12 | Aug-13 | The Taper Tantrum | 26% | 45% |

| May-14 | Feb-16 | Global Commodity Price Decline | 14% | 26% |

| Jan-18 | Apr-20 | Global Trade Tensions and Covid-19 Pandemic | 18% | 48% |

Recommended for you

Readers also explored

Risk Radar: India’s Economy Faces Crosswinds

India’s Unemployment Rate in 2025

2) Gold: A Time-Tested Safe Haven

- Maintain exposure to gold as a hedge against rupee depreciation and global uncertainties.

- You can get exposure to gold either physically or through an ETF for better liquidity.

- Avoid overexposure—gold should complement, not dominate, your portfolio.

[Use our Asset Allocator to select preferred portfolio allocation]

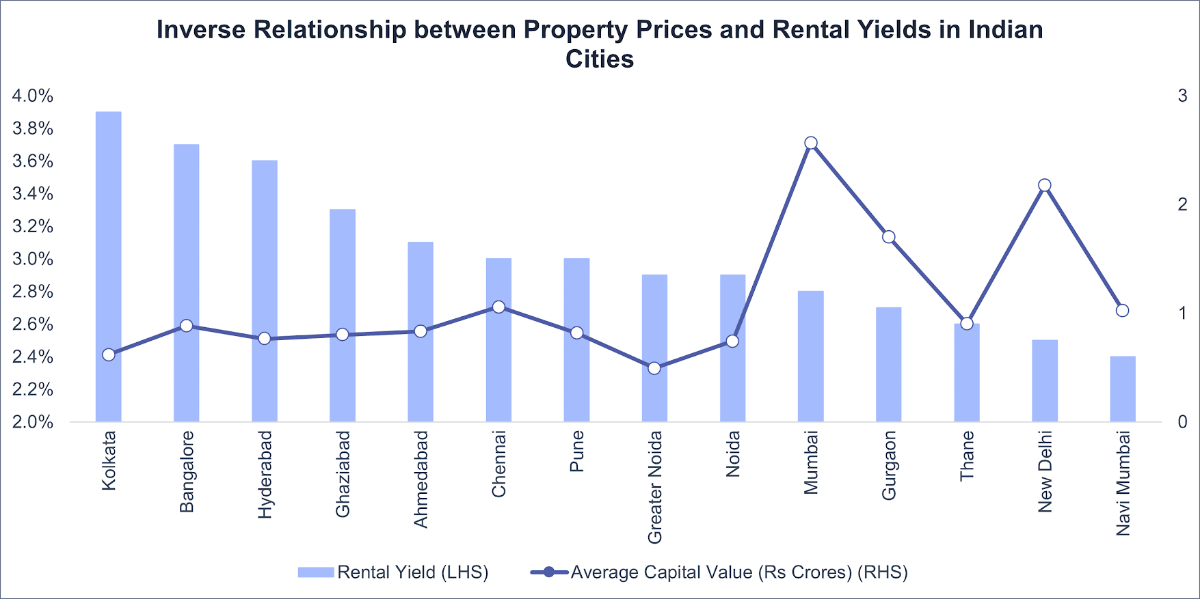

3) Real Estate: Leverage Cooling Inflation & Rental Yields

- Opt for a floating-rate loan to benefit from further potential rate cuts by RBI.

- Focus on high-yield rental markets—cheaper real estate often offers better rental returns. Look for well-connected areas with strong infrastructure growth.

- Focus on REITs with high occupancy rates and stable rental income.

Immediate Checklist: Key Events to Watch

✔ March 20, 2025 – US Fed FOMC Meeting

→ Any shift in the Fed’s stance on rate cuts will impact global markets and the rupee.

✔ March 24, 2025 – RBI Dollar/Rupee Swap Execution

→ The market's response will be crucial for currency valuation and export competitiveness.

✔ March 25, 2025 – India Q4 FY24 Current Account Deficit Data

→ A widening deficit could put pressure on the rupee, influencing foreign investment flows.

✔ April 1, 2025 – Start of New Financial Year (FY25-26)

→ New taxation rules and budget provisions kick in—review your tax-saving strategies.

March is shaping up to be a crucial month, with some uncertainty still ahead, staying diversified and prepared is key. Keep track of upcoming events and adjust your strategy as needed.